Professional Documents

Culture Documents

Working Capital Management Notes

Working Capital Management Notes

Uploaded by

Ramana VaitlaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Questionnaire On Work Life BalanceDocument5 pagesQuestionnaire On Work Life BalanceRamana Vaitla67% (3)

- Questionnaire On Work Life BalanceDocument5 pagesQuestionnaire On Work Life BalanceRamana Vaitla67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project ManagementDocument5 pagesProject ManagementRamana VaitlaNo ratings yet

- Kelas 2 - Latihan Soal PTS 2 MathDocument7 pagesKelas 2 - Latihan Soal PTS 2 MathShakti Mikayla Tsamara Karima100% (2)

- ReviewsDocument1 pageReviewsRamana VaitlaNo ratings yet

- Table 5.ANOVA AnalysisDocument53 pagesTable 5.ANOVA AnalysisRamana VaitlaNo ratings yet

- + (91) - 9533037888 House No 3-4-226/D, Kachiguda, Hyderabad - 500027, Opposite Jain Mandir, Near Venkata Ramana TheatreDocument1 page+ (91) - 9533037888 House No 3-4-226/D, Kachiguda, Hyderabad - 500027, Opposite Jain Mandir, Near Venkata Ramana TheatreRamana VaitlaNo ratings yet

- Financial AnalysisDocument69 pagesFinancial AnalysisRamana VaitlaNo ratings yet

- Azeem, A., Zia Ul Ha. (2012) : Farhan, M., Yousaf, A. (2016) D. S. Chaubey, D.S., Sharma, L.S., Pant, M. (2013)Document1 pageAzeem, A., Zia Ul Ha. (2012) : Farhan, M., Yousaf, A. (2016) D. S. Chaubey, D.S., Sharma, L.S., Pant, M. (2013)Ramana VaitlaNo ratings yet

- Postponement EOI 2012Document1 pagePostponement EOI 2012Ramana VaitlaNo ratings yet

- Management Faculty Courses Planned For The Year-2011-2012: Programme SummaryDocument6 pagesManagement Faculty Courses Planned For The Year-2011-2012: Programme SummaryRamana VaitlaNo ratings yet

- Captial Structure of UltratechDocument76 pagesCaptial Structure of UltratechRamana Vaitla0% (2)

- Porject Synopsis AirtelDocument7 pagesPorject Synopsis AirtelRamana VaitlaNo ratings yet

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDocument6 pagesKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaNo ratings yet

- Communication Limited, Hyderabad: Project SynopsisDocument4 pagesCommunication Limited, Hyderabad: Project SynopsisRamana VaitlaNo ratings yet

- Project Synopsis: Topic: Woriking of Housing Finance Companies - A Case Study ofDocument3 pagesProject Synopsis: Topic: Woriking of Housing Finance Companies - A Case Study ofRamana VaitlaNo ratings yet

- Sales Promotional Activities - Big Bazar-69-11Document76 pagesSales Promotional Activities - Big Bazar-69-11Ramana VaitlaNo ratings yet

- Sri Vajra Financial ReportsDocument7 pagesSri Vajra Financial ReportsRamana VaitlaNo ratings yet

- The Balanced ScorecardDocument6 pagesThe Balanced ScorecardRamana VaitlaNo ratings yet

- Department of Business Management M.B.A III Semester Internal Assessment Subject: Total Quality ManagementDocument2 pagesDepartment of Business Management M.B.A III Semester Internal Assessment Subject: Total Quality ManagementRamana VaitlaNo ratings yet

- Impact of Promotional ServicesDocument67 pagesImpact of Promotional ServicesRamana VaitlaNo ratings yet

- Xe Currency Rate 31032020 PDFDocument6 pagesXe Currency Rate 31032020 PDFKrishna KanojiaNo ratings yet

- Pagoda (Coin)Document3 pagesPagoda (Coin)Ardid LopezNo ratings yet

- Trading BalanceDocument4 pagesTrading BalanceShidiq WidiyantoNo ratings yet

- Math - COT Week 7Document4 pagesMath - COT Week 7Ella Maria de Asis - JaymeNo ratings yet

- Lesson 3 KanjiDocument16 pagesLesson 3 KanjiL SNo ratings yet

- Contoh Slip Gaji Karyawan Format Ms ExcelDocument2 pagesContoh Slip Gaji Karyawan Format Ms ExcelBahari Prabowo Aji100% (1)

- Transmittal Sheet: Administrative BLDG., Pho Compound, Old Municipal Road, Masbate CityDocument10 pagesTransmittal Sheet: Administrative BLDG., Pho Compound, Old Municipal Road, Masbate CityNigel Leigh Godfrey GutierrezNo ratings yet

- Countries Capitals and Currencies: The World Map Keeps Changing Due ToDocument7 pagesCountries Capitals and Currencies: The World Map Keeps Changing Due ToNavya BehlNo ratings yet

- 20190308191405-Berkas Persyaratan TAMTAMA BRIMOBDocument9 pages20190308191405-Berkas Persyaratan TAMTAMA BRIMOBHaifaNurfitrianiNo ratings yet

- Credit Note: Acct Number Acct Desc Line Descripion Amount 34207 DD Charges 600.00 Total 600.00Document28 pagesCredit Note: Acct Number Acct Desc Line Descripion Amount 34207 DD Charges 600.00 Total 600.00gurumurthy38No ratings yet

- Acces Miyajima EnglishDocument1 pageAcces Miyajima Englishbritties69No ratings yet

- !beretta Fiyat Listesi - v010721 - VFDocument5 pages!beretta Fiyat Listesi - v010721 - VFCabir ÇakmakNo ratings yet

- Country Capital Currancy PDFDocument3 pagesCountry Capital Currancy PDFSinghTarunNo ratings yet

- THS/TPHS/TGCHS/TNHS Grand Reunion Registration FormDocument1 pageTHS/TPHS/TGCHS/TNHS Grand Reunion Registration FormEmmanuel Aquino Batao-eyNo ratings yet

- CHALLANDocument1 pageCHALLANBalu VarreNo ratings yet

- Decimal Coinage: India-Republic 1091Document1 pageDecimal Coinage: India-Republic 1091Muthu KrishnanNo ratings yet

- FINANCIAL-STATEMENT-2021-2022 (Word)Document30 pagesFINANCIAL-STATEMENT-2021-2022 (Word)Dhave Guibone Dela CruzNo ratings yet

- Sri Shankara Matt: Cummulative Statement 2017Document28 pagesSri Shankara Matt: Cummulative Statement 2017Vijaya BhaskarNo ratings yet

- Damac Project AvailabilityDocument62 pagesDamac Project AvailabilityAnonymous 2rYmgRNo ratings yet

- CardTransactions191031160011576769402 PDFDocument3 pagesCardTransactions191031160011576769402 PDFWeng ShanNo ratings yet

- DBSDocument4 pagesDBSSilvia DewiyantiNo ratings yet

- Chandan Retail PVT LTD GRDocument2 pagesChandan Retail PVT LTD GRSontu Esperanza FreundNo ratings yet

- Imagens de Moedas FaoDocument210 pagesImagens de Moedas FaoIvanildo MedeirosNo ratings yet

- Memories Currencies of CountriesDocument13 pagesMemories Currencies of CountriesQIE PSNo ratings yet

- Fxrate 06 06 2023Document2 pagesFxrate 06 06 2023ShohanNo ratings yet

- Certificate of Employment (Tanod)Document20 pagesCertificate of Employment (Tanod)Barangay28 Zone04No ratings yet

- AUD USD Technical AnalysisDocument3 pagesAUD USD Technical AnalysisYudhishthir KumarNo ratings yet

- Short Memory Tricks To Remember The List of Important Countries Its CurrencyDocument2 pagesShort Memory Tricks To Remember The List of Important Countries Its CurrencyRaje VijiNo ratings yet

- Certificate of AcceptanceDocument30 pagesCertificate of AcceptanceJamielor BalmedianoNo ratings yet

Working Capital Management Notes

Working Capital Management Notes

Uploaded by

Ramana VaitlaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Management Notes

Working Capital Management Notes

Uploaded by

Ramana VaitlaCopyright:

Available Formats

WORKING

CAPITAL

MANAGEMENT

Introduction: Working capital is th circulation o! "lood is )orking capital is # r' li! "lood and n r# c ntr o! a "usin ss$ %ust as

ss ntial in th

hu&an "od' !or &aintaining li! ( s&ooth running o! a a&ount o!

ss ntial to &aintain th

"usin ss$ No "usin ss can run succ ss!ull' )ith out an ad *uat )orking capital$

Working capital r ! rs to that part o! !ir&+s capital )hich is r *uir d !or !inancing short t r& or curr nt ass ts such as cash( &ark ta"l d "tors( and in# ntori s$ In oth r )ords )orking capital is th !unds n c ssar' to co# r th cost o! op rating th nt rpris $ s curiti s( a&ount o!

M aning: Working capital & ans th !unds ,i$ $- capital. a#aila"l and us d !or da'

to da' op rations ,i$ $- )orking. o! an

nt rpris $ It consists "roadl' o! us d in or r lat d to its us d during an accounting

that portion o! ass ts o! a "usin ss )hich ar curr nt op rations$ It r ! rs to !unds )hich ar p riod to g n rat &a/or purpos a curr nt inco& 0ist nc $ o! a t'p

)hich is consist nt )ith

o! a !ir&

O"/ cti# s o! )orking capital:

E# r' "usin ss n

ds so&

a&ount o! )orking capital$ It is n

d d !or

!ollo)ing purpos s1

2 3or th

purchas

o! ra) &at rials( co&pon nts and spar s$

2 To pa' )ag s and salari s$ 2 To incur da' to da' o!!ic 0p ns s tc$ 0p ns s and o# rh ad costs such as !u l( po) r( and

2 To pro#id

cr dit !aciliti s to custo& rs

tc$

3actors that d t r&in Th

)orking capital: nu&" r o!

)orking capital r *uir & nt o! a conc rn d p nd upon a larg

!actors such as 4 5i6 4 Natur o! "usin ss o! charact r o! "usin ss$

4 5 asonal #ariations )orking capital c'cl 4 Op rating !!ici nc'

4 Pro!it l # l$ 4 Oth r !actors$ 5ourc s o! )orking capital: Th )orking capital r *uir & nts should " & t "oth !ro& short t r& as ) ll

as long t r& sourc s o! !unds$

3inancing o! )orking capital through short t r& sourc s o! !unds has th " n !its o! lo) r cost and sta"lishing clos r lationship )ith "anks$

3inancing o! )orking capital through long t r& sourc s pro#id s th " n !its o! r duc s risk and incr as s li*uidit'

T'p s o! )orking capital:

Working capital an "

di#id d into t)o cat gori s1

P r&an nt )orking capital:

It r ! rs to that &ini&u& a&ount o! in# st& nt in all curr nt ass ts )hich is r *uir d at all ti& s to carr' out &ini&u& l # l o! "usin ss acti#iti s$

T &porar' )orking capital:

Th

a&ount o! such )orking capital k "asis o! "usin ss acti#iti s$

ps on !luctuating !ro& ti&

to ti&

on th

Ad#antag s o! )orking capital:

2 It h lps th 2 It can arrang 2 It

"usin ss conc rn in &aintaining th loans !ro& "anks and oth rs on "usin ss crisis in

good)ill$ as' and !a#ora"l t r&s$

na"l s a conc rn to !ac

& rg nci s such as

d pr ssion$ 2 It cr at s an n#iron& nt o! s curit'( con!id nc ( and o# r all

!!ici nc' in a "usin ss$ 2 It h lps in &aintaining sol# nc' o! th "usin ss$

7isad#antag s o! )orking capital:

2 Rat

o! r turn on in# st& nts also !all )ith th

shortag

o! )orking

capital$ 2 E0c ss )orking capital &a' r sult into o# r all in !!ici nc' in organi6ation$ 2 E0c ss )orking capital & ans idl 2 Inad *uat ti& $ !unds )hich arn no pro!its$

)orking capital can not pa' its short t r& lia"iliti s in

Manag & nt o! )orking capital:

A !ir& &ust ha# !ir&$ It should "

ad *uat n ith r

)orking capital( i$ $- as &uch as n 0c ssi#

d d th

nor inad *uat $ 8oth situations ar !ir& has idl !unds )hich

dang rous$ E0c ssi#

)orking capital & ans th

arn no pro!its !or th do s not ha#

!ir&$ Inad *uat

)orking capital & ans th

!ir&

su!!ici nt !unds !or running its op rations$ It )ill " r lationship " t) n )orking capital( risk

int r sting to und rstand th and r turn$ Th "asic o"/ cti#

o! )orking capital &anag & nt is to &anag

!ir&s curr nt ass ts and curr nt lia"iliti s in such a )a' that th satis!actor' l # l o! )orking capital is &aintain d( i$ $- n ith r inad *uat nor 0c ssi# $ Working capital so& can " ti& s is r ! rr d to as said to " t th h art o! th

9circulating capital:$ Op rating c'cl n d !or )orking capital$ Th

!lo) " gins )ith con# rsion o! cash into ra)

&at rials )hich ar ( in turn trans!or& d into )ork1in1progr ss and th n to !inish d goods$ With th pr su&ing goods ar th Th c'cl to cash$ n !! cti# in carr'ing )orking capital c'cl o"s r# d that th )ith lo) sal !inish d goods turn into accounts r c i#a"l (

sold as cr dit$ Coll ction o! r c i#a"l s "rings "ack

co&pan' has "

)orking capital li&its$ It &a' also " t r&s has " a"o# ta"l

P8T in a"solut s n !ro& th

n incr asing as a ' ar to ' ar "asis as could " although pro!it p rc ntag turno# r &a' "

lo) r "ut in pro!it

a"solut

t r&s it is incr asing$ In ord r to !urth r incr as th ir &argins "'

&argins( 55L can incr as

0t nding cr dit to good to g t " tt r rat s$

custo& rs and also "' pa'ing th

cr ditors in ad#anc

WORKING CAPITAL AN7 RATIO ANAL;5I5

Ratio Anal'sis is on th

o! th

i&portant t chni*u s that can "

us d to ch ck

!!ici nc' )ith )hich )orking capital is " ing &anag d "' a !ir&$ Th as !ollo)s

&ost i&portant ratios !or )orking capital &anag & nt ar

N t Working Capital:

Th r

ar

t)o conc pts o! )orking capital na& l' gross )orking capital and di!! r nc " t) n curr nt

n t )orking capital$ N t )orking capital is th

ass ts and curr nt lia"iliti s$ An anal'sis o! th " Th # r' h lp !ull !or kno)ing th !ollo)ing ta"l pro#id s th op rational

n t )orking capital )ill co&pan'$

!!ici nc' o! th

data r lating to th

n t )orking capital

o! 55L$

NET WORKING CAPITAL < C=RRENT A55ET51C=RRENT LIA8ILITI5

;EAR C=RRENT A55ET5 C=RRENT LIA8ILITIE5 NET WORKING CAPITAL >??@ >ABC@@D?E DEA@AD?BF B>>DA?A@ >??B >EGFGAADB DBGFA>B?F D>??@DEDF >??C FFCGE>>G? DECB?>ECC D@?FCGADF >??E FBFAA@@A >DCGCFBBD DA@ACDEGF

Graph

IN3ERENCE:

3ro& th

a"o#

ta"l

it can "

in! rr d that th

proportion o! n t )orking d in th ' ar

capital had incr as d !ro& th >??E co&par )ith >??C$

' ar >??@ to>??C and d cr

Working capital turno# r ratio:

This is also kno)n as sal s to )orking capital ratio and usuall' r pr s nt d in ti& s$ This sta"lish s th r lationship o! sal s to n t

)orking capital$ This ratio indicat s 1h ath r or not )orking capital has " n !! cti# l' utili6 d in &aking sal s$ In cas i! a co&pan' can achi #

high r #olu&

o! sal s )ith r lati# l' s&all a&ount o! )orking capital( it op rating !!ici nc' o! th co&pan'$ It is

is an indication o! th calculat d as !ollo)s1

;EAR NET 5ALE5,R5. WORKING CAPITAL,R5. RATIO >??@ A>GD>E>GB B>>DA?A@ B$EG >??B B>>DEDBD? D>??@DEDF @$> >??C BBE>D@CGD D@?FCGADF A$A >??E B@@>>GFDG DA@ACDEGF A$@

INTERPRETATION:

3ro& th

a"o#

ta"l

can conclud

that )orking capital ratio is

d cr asing$ In th th

' ar >??@ it is B$EG ti& s it d cr as d to A$A ti& s in ' ar >??E$

' ar >??C$ And it is incr asing A$@ ti& s in th

C=RRENT A55ET5 TO TOTAL A55ET5 RATIO:

Curr nt ass ts pla' an i&portant rol organi6ation$ 5o( to & t th

in da'1to1da' !unctioning o! an curr nt ass ts so as

# r' !ir& should &aintain ad *uat

dail' r *uir & nts o! "usin ss$ I! th 0c ds th n th

proportion o! curr nt )ill " so&

ass ts in total ass ts idl

r *uir d li&it( th r ti& ( th

in# st& nts on such ass ts$ At th

proportion o! curr nt # r' !ir& should situations

ass ts in total should not l ss than r *uir & nts$ 5o( &aintain th ad *uat

*uantit' o! curr nt ass ts$ 8ut during th &plo' &or curr nt ass ts and #ic 1# rsa$

o! p ak d &and( should Particularl' in cas to th th

o! production organi6ations( th r

is h a#' i&portanc na"l

curr nt ass ts than !i0 d ass ts$ This kind o! anal'sis )ill )orking capital position o! th

&anag rs to und rstand th

!ir&$ 7ata

r lating to th as !ollo)s1

proportion o! )orking capital in total ass ts is d pict d

This ratio

sta"lish s th

r lationship " t)

n th

curr nt ass ts and

total ass ts$

;EAR C=RRENT A55ET5,R5. TOTAL A55ET5,R5. RATIO H >??@ >DCGCFBBD FG??D>CC? @@$EE >??B DECB?>ECC F>CBA?C?@ @C$>@ >??C DBGFA>B?F AC@GG@BBA F@$@C >??E DEA@AD?BF AGDGF@DED FC$@D

IN3ERENCE: 3ro& th a"o# ta"l it can " in! rr d that th proportion o! curr nt ' ar >??@$ In th ' ar

ass ts to total ass ts had d cr as d @@$EE in th >??@ it had incr as d to @C$>@( again in th F@$@CH( again in th ' ar >??E incr as

' ar >??C it has d cr as d

in FC$@D

Curr nt ass ts to sal s ratio: Th curr nt ass ts ar us d !or th purpos o! g n rating sal s$ A ratio o! ass ts ar appli d in

curr nt ass ts to sal s r # als that ho) " st th "usin ss !or turno# r$ As p r th a"o#

said ratio( a lo) proportion o!

curr nt ass ts in r lation to sal s indicat s " tt r turno# r o! th co&pan' and #ic 1# rsa( )hich )ill sho) positi# Th i&pact on pro!ita"ilit'$

data r lating to this asp ct is pro#id d as !ollo)s and it is

calculat d as !ollo)s$

;EAR C=RRENT A55ET5,R5. NET 5ALE5,R5. RATIO

H >??@ >ABC@@D?E A>GD>E>GB @C$@ >??B >EGFGAADB B>>DEDBD? AB$@ >??C FFCGE>>G? BBE>D@CGD @?$@ >??E FBFAA@@@A B@@>>GFDG @@$A

IN3ERENCE: 3ro& th a"o# ta"l it can " in! rr d that th proportion o! curr nt ' ar >??B

ass ts to sal s had incr as d to @C$@H in th it had d cr as d AB$@H$ In th th

' ar >??@$ In th

' ars >??C it had incr as d to @?$@H and in

' ar >??E had incr as d @@$AH$

Curr nt ass ts to !i0 d ass ts ratio:

Total ass ts in an' "usin ss contain "oth !i0 d and curr nt ass ts$ 3or prop rl' !unctioning o! th organi6ation in t r&s o! production and " t) n th &$ I! i&pact on

&ark ting it is n c ssar' to &aintain a prop rl' "alanc th th proportion o! !i0 d ass ts incr as s( it )ill "

a n gati#

!ir&+s li*uidit' and i! curr nt ass ts incr as ( production incr as s

and )hich caus s i&pact on th

d &and !or th

product$ In #i ) o!

!! cti#

&anag & nt o! !unds and to in# st on "oth !i0 d and curr nt ass ts( it is n c ssar' to tak ratio " t) th d cision as soon as possi"l $ 7ata r lating to th

n curr nt ass ts to !i0 d ass ts is d pict d as !ollo)s$

;EAR C=RRENT A55ET5,R5. 3IIE7 A55ET5,R5. RATIO H >??@ >ABC@@D?E DBCA@A>DG DA$DF >??B >EGFGAADB DEA@GC?@G D@$BC >??C FFCGE>>G? DFE?DFFCB >A$A >??E FBFAA@@@A >?>?EAC>@ DE$?

IN3ERENCE: 3ro& th a"o# ta"l it can " in! rr d that th proportion o! curr nt ' ar >??@$ In th ' ar

ass ts to !i0 d ass ts had d cr as d DA$DFH in th >??B it had incr as d to D@$BCH$ In th had d cr as in ' ar >??E in DE$?H$

' ar >??C it had incr as d >A$AHit

RATIO ANAL;5I5

INTRO7=CTION:

Ratio Anal'sis is a po) r!ul tool o !inancial anal'sis$ Al 0and r Jall !irst pr s nt d it in DGGD in 3 d ral R s r# proc ss o! co&parison o! on th appraisal o! th !igur 8ull tin$ Ratio Anal'sis is a

against oth r( )hich &ak s a ratio and ratios to &ak prop r anal'sis a"out th t r& ratio r ! rs to

ratios o! th

str ngths and ) akn ss o! th th nu& rical or *uantitati#

!ir&+s op rations$ Th r lationship " t)

n t)o accounting !igur s$ proc ss o!

Ratio anal'sis o! !inancial stat & nts stands !or th d t r&ining and pr s nting th th stat & nts$

r lationship o! it &s and group o! it &s in

Ratio anal'sis can " cr ditor )ould lik

us d "oth in tr nd anal'sis and static anal'sis$ A to kno) th a"ilit' o! th co&pan'( to & t its curr nt

o"ligation and th r !or tr nd o! r c i#a"l $

)ould think o! curr nt and li*uidit' ratio and

Ma/or tool o! !inancial ar

thus ratio anal'sis and 3unds 3lo) proc ss o! id nti!'ing th !inancial

anal'sis$3inancial anal'sis is th str ngth and ) akn ss o! th " t) n th it &s o! th

!ir& "' prop rl' sh t and th

sta"lishing r lationship pro!it account

"alanc

Th

!inancial anal'st &a' us

ratio in t)o )a's$ 3irst h

&a' co&par

pr s nt ratio )ith th

ratio o! th

past ! ) ' ars and pro/ ct ratio o! th th tr nd in r lation that particular

n 0t ' ar or so$ This )ill indicat !inancial asp ct o! th

nt rpris $ Anoth r & thod o! using ratios !or a !inancial ratio !or th co&pan' )ith !or

!inancial anal'sis is to co&par

industr' as a )hol ( or !or oth r( th o"ligation$ It & asur s th gr at r th

!ir&+s a"ilit' to & gr at r th

t its curr nt ratio( th

!ir&+s li*uidit'$ Th

!ir&s li*uidit' and #ic 1# rsa$

A ratio can "

d !in d as a nu& rical r lationship " t)

n t)o nu&" rs

0pr ss d in t r&s o! ,a. proportion ,". rat d !in as a !inancial tool to d t r&in

,c. p rc ntag $ It is also

an int rpr t nu& rical r lationship o! r lation

"as d on !inancial stat & nt 'ardstick that pro#id s a & asur ship " t) n t)o #aria"l or !igur s$

M aning and I&portanc :

Ratio anal'sis is conc rn d to " appraisal o! !inancial condition( J r

on

o! th

i&portant !inancial tools !or

!!ici nc' and pro!ita"ilit' o! "usin ss$

ratio anal'sis id us !ul !ro& !ollo)ing o"/ cts$

D$ 5hort t r& and long t r& planning >$ M asur & nt and #aluation o! !inancial p r!or&anc

F$ 5tud o! !inancial tr nds A$ 7 cision &aking !or in# st& nt and op rations @$ 7iagnosis o! !inancial ills B$ pro#iding #alua"l insight into !ir&s !inancial position or pictur

A7KANTAGE5L 7I5A7KANTAGE5 O3 RATIO ANAL;5I5

Ad#antag s: Th !ollo)ing ar th &ain ad#antag s d ri# d o! ratio anal'sis( )hich ar

o"tain d !ro& th

!inancial stat & nt #ia Pro!it L Loss Account and 8alanc

5h

t$ anal'sis h lps to grasp th r lationship " t) n #arious it &s in

a. Th th

!inancial stat & nts$ us !ul in pointing out th tr nds in i&portant it &s and thus

". Th ' ar h lp th

&anag & nt to !or cast h lp o! ratios( int r !ir& co&parison &ad to #ol# !utur

c. With th

&ark t strat gi s$ d. Out o! ratio anal'sis standard ratios ar actual )ith standards r # als th tak . Th ar corr cti# action$ n t)o accounting th dat s co&put d and co&parison o! &anag & nt to

#arianc s$ This h lps th

co&&unication o! that has happ n d " t) !! cti# action$

r # al d

!. 5i&pl th

ass ss& nts o! li*uidit'( sol# nc' pro!ita"ilit' indict d "' ratio anal'sis$ Ratios &

!!ici nc' o!

!ir& ar

t co&parisons &uch &or

#alid$

7isad#antag s:

Ratio anal'sis is to calculat

and

as' to und rstand and such statistical

calculation sti&ulation thinking and d # lop und rstanding$ 8ut th r i. Th r ar c rtain dra)"acks and dang rs th ' ar $ to ratio anal'sis pro!us l'$

is a tr nd' to us

ii. Accu&ulation o! &ass data o"scur d rath r than clari!i s r lationship$ iii. Wrong r lationship and calculation can l ad to )rong conclusion$ D$ In cas o! int r !ir& co&parison no t)o !ir& ar 0a&pl :on !ir& &a' purchas si&ilar in si6 ( ag th ass t at lo) r

and product unit$,3or

pric

)ith a high r r turn and anoth r !ir& )itch purchas )ill ha# a lo) r r turn.

th

ass t at

ass t at high r pric >$ 8oth th

int r p riod and int r !ir& co&parison ar in pric l # l can a!! ct th

a!! ct d "' pric #alidit' o! ratios

l # l chang s$ A chang

calculat d !or di!! r nt ti& F$ =nl ss #ari s t r&s lik

p riod$ group pro!it( op rating pro!it( n t pro!it( tc$( ar prop rl' d !in ( co&parison

curr nt ass t( curr nt lia"ilit' " t) n t)o #aria"l s " co& si&pl

& aningl ss$ as' to calculat $ Th d cision on a singl anal'st ratio$ J has

A$ Ratios ar should not tak to tak

to und rstand and

d cision should not tak

s # ral ratios into consid ration$

5TAN7AR75 O3 COMPARI5ION:

D$ Ratios calculat d !ro& th >$ Ratio d # lop d using th th sa& !ir&

past !inancial stat & nts o! th

sa&

!ir&$

pro/ ct d or p r!or& !inancial stat & nt o!

F$ Ratios o! so& succ ss!ul( at th A$ Ratios o! th

s l ct d !ir& sa&

sp ciall' th

&ost progr ssi#

and

point o! ti& $ !ir& " longs$

industr' to )hich th

IMPORTANCE O3 RATIO ANAL;5I5

In th

pr c ding discussion in th

!or&( )

ha#

illustrat d th

co&pulsion 8alanc

and i&plication o! i&portant ratios that can " 5h

calculat d !ro& th

t and Pro!it L Loss account o! a !ir&$ As a tool o! !inancial o! crucial signi!icanc $ Th !act and na"l s th i&portanc o! ratio

&anag & nt( th ' ar anal'sis li s in th

dra)ing o! in! r nc s r garding

th

p r!or&anc

o! a !ir&$ Ration anal'sis is a r l #ant in ass ssing th !ollo)ing asp ct$

p r!or&anc

o! a !ir& in r sp ct o! th

CA=5TION IN =5ING RATIO5:

D$ It is di!!icult to d cid >$ Th

on th

prop r "as s o! co&parison$ o! di!! r nc in situation o!

co&parison r nd r d di!!icult " caus

t)o co&pani s or o! on 1co&pan' !or di!! r nt ' ars$ F$ Th A$ Th pric l # l chang in th &ak th int rpr tation o! ratios in#alid "alanc sh t and

di!! r nc

d !inition o! it &s in th th

Pro!it L Loss stat & nt &ak @$ Th

int rpr tation o! ratios di!!icult$ ar l ss in!or&ati# and

ratios calculat d at a point o! ti&

d ! cti# B$ Th

as th ' su!! r !ro& sort t r& chang s$ g n rall' calculat d !ro& th past !inancial stat & nt

ratios ar

and thus ar

no indicators o! !utur $

LIM=T7IT; Ks PRO3ITA8ILIT;

INTRO7=CTION

3inancial anal'sis is th and ) akn ss o! th it &s o! th

proc ss o! id nti!'ing th

!inancial str ngths n th

!ir& "' prop rl' sh

sta"lishing r lationship " t)

"alanc

t and pro!it loss account$ Manag & nt should

particularl' int r st in kno)ing !inancial str ngths and ) akn ss o! th !ir& to &ak o! th th ir " st us !ir& to and to " tak a a"l to spot out !inancial ) akn ss corr cti# actions$ using an'

suita"l

3inancial anal'sis is th

starting point o! &aking plans( " !or

sophisticat d !or casting and planning proc dur s$

Ma/or

tools

o!

!inancial

anal'sis

ar

ratio

anal'sis

and

!unds

!lo)

anal'sis$ 3inancial anal'sis is th str ngths and ) akn ss o! th " t) n th it &s o! th

proc ss o! id nti!'ing th

!inancial

!ir& "' prop rl' sh t and th

sta"lishing r lationship pro!it and loss account$

"alanc

M aning and i&portanc

Ratio anal'sis is conc rn d to " appraisal o! !inancial condition( J r

on

o! th

i&portant !inancial tools !or

!!ici nc' and pro!ita"ilit' o! "usin ss$

ratio anal'sis is us !ul !ro& !ollo)ing o"/ cti# s$

D$ 5hort t r& and long t r& planning$ >$ M asur & nt and #aluation o! !inancial p r!or&anc $

F$ 5tud' o! !inancial tr nds$ A$ 7 cision &aking !or in# st& nt and op rations$ @$ 7iagnosis o! !inancial ills$ B$ Pro#iding #alua"l insight into !ir&+s !inancial position or pictur $

Ratio+s D$ Curr nt Ratio >$ Muick Ratio F$ A"solut Muick Ratio

A$ N t Pro!it Ratio @$ 7 "tors Turno# r Ratio B$ In# ntor' Turno# r Ratio

C=RRENT RATIO

Th

curr nt ratio is calculat d "' di#iding curr nt ass ts "'

curr nt

lia"iliti s$

Curr nt

ratio

<

curr nt

ass tsNcurr nt

lia"iliti s

Th

curr nt ratio is a & asur

o! th

!ir&+s short1t r& sol# nc'$ It s !or # r' on rup

indicat s th

a#aila"ilit' o! curr nt ass ts in rup

o! curr nt lia"iliti s$ A ratio o! gr at r than on &or curr nt ass ts than curr nt lia"iliti s

& ans that th clai&s against

!ir& has th &$ A

standard ratio " t) o! ANNAP=RNA

n th & is >:D$ Th EARCANAL LIMITE7

data r lationship th is d pict d

curr nt ratio as !ollo)s:

;EAR >??@ >??B >??C >??E

C=RRENT

A55ET5

C=RRENT

LIA8ILITIE5

Curr nt

Ratio

,H. D$FA D$CD D$E D$BC

>ABC@@D?E >EGFGAADB FFCGE>>G? FBFAA@@@A

DEA@AD?BF DBGFA>B?F DECB?>ECC >DCGCFBBD

Graph

In! r nc :

Th

standard nor& !or this ratio is >:D th

&pirical anal'sis o! th

data

r lating to th !ro& D$CD in

curr nt ratio o! Annapurna Ear canal Ltd$ Jas d cr as d th ' ar >??B to D$E in th ' ar >??C

M=ICK

RATIO:

This ratio

sta"lish s a r lationship " t)

n *uick o! li*uid ass ts and o! li*uidit' &anag & nt o! " con# rt d in to cash

curr nt lia"iliti s$ It is an a"solut th conc rn$ An ass t is li*uid i!

& asur it can

i&& diat l' or r asona"l' soon )ithout a loss o! #alu ( i! ignor s totall' th stocks$ 8 caus in# ntori s nor&all' r *uir so& ti& !or r ali6ing standard *uick D:D$

into cash: th ir #alu ratio

also has a t nd nc' to !luctuat $ Th is

Muick

Ratio

<

Muick

Ass tsNCurr nt

Lia"iliti s

;EAR >??@ >??B >??C

M=ICK

A55ET5

C=RRENT

LIA8ILITIE5 DEA@AD?BF DBGFA>B?F DECB?>ECC

M=ICK

RATIO,H. D$D D$A D$@E

>?FCAAB>F >AF?FG?D? >GBED@CE@

>??E

F>FAFCCDD

>DCGCFBBD

D$AE

M=ICK

RATIO

GRAPJ

In! r nc :

Th

standard nor& !or this ratio is D:D( & ans !or co&pan' &ust ha# D rup

# r' D rup o! *uick

o! curr nt ass ts$

lia"ilit'(

Th in

*uick ratio o! Annapurna >??C$ It ha# &or than

arcanal ltd$D$Din >??@( D$A in >??B andD$@E D rup o! *uick ass ts !or all A' ars$

A"solut

*uick

ratio:

5inc

cash is th

&ost li*uid ass ts n c ssar' to

0a&in

th

ratio o! cash

and its

*ui#al nt to curr nt lia"iliti s$ Trad

in# st& nt or &ark ta"l includ d in th

s curiti s ar

*ui#al nt o! cash$ Th r !or ( th ' &a' "

consu&ption

o!

a"solut

*uick

ratio$

A"solut

*uick

ratio

<

A"solut

Muick

Ass tsNCurr nt

Lia"iliti s

;EAR >??@ >??B >??C >??E

CA5JLEM=IKLENT

C=RRENT

LIA8ILITIE5

A85OL=TE

M=ICK

RATIO ?$?>A ?$?@@ ?$?EC ?$DDD

A@AEF>E G>C>G>G DB>GCEBG >AFFBGAB

DEA@AD?BF DBGFA>B?F DECB?>ECC >DCGCFBBD

A"solut

*uick

ratio

graph

In! r nc :

Th th

standard nor&s o! a"solut !ir& not &aintain th

*uick ratio is ?$@:D$3ro& th

a"o#

ta"l o! th

su!!ici nt l # l o! *uick ass ts " caus

da'1to1da'

0p ns s $It is !luctuating " t)

Th

standard nor& !or this ratio is D:> & ans !or D rup

# r' > rup

s o! curr nt and

Lia"iliti s( Co&pan' &ust ha# &ark ta"l s curiti s$

o! cash and "ank "alanc

N t Pro!it Ratio:

As

# r' "usin ss is to

arn pro!it( this ratio is # r' i&portant " caus

it & asur s th inco&

pro!ita"ilit' o! sal s$ A "usin ss &a' 'i ld high gross " caus o! incr asing op rating and non1op rating d t ct d "' calculating this ratio$

"ut lo) n t inco&

0p ns s$ This situation can

asil' "

Th

pro!its us d !or this purpos !igur

&a' "

pro!its a!t rN" !or

ta0$ To

o"tain this ratio( th !igur

o! n t pro!its a!t r ta0 is di#id d "' th !igur o! sal s th ratio &argin

o! n t pro!its a!t r ta0 is di#id d "' th

is also kno)n as sal s &argin as ) )hich th sal s l a#

can asc rtain )ith its h lp th 0p ns s$ Th unit o!

lat r d ducting all th cas

0pr ssion is p rc ntag ( as is th

)ith pro!ita"ilit' ratios$

;EAR5 NET PRO3IT NET 5ALE5 RATIO H >??@ C?@@C>EB A>GD>E>EB D$BA >??B >AE@D>BB B>>DEDBD? F$GG >??C >>?C>C>A BBE>D@CGD F$FD >??E DA>F@@BB B@@>>GFDG >$DC

Graph

In! r nc : Jigh r th ratio " tt r is th pro!ita"ilit'$ 3ro& th ta"l in th th ratio is ' ar >??E

d clining !ro& >??@ to >??B is incr as $ Again d cr as

N t Pro!it Ratio is not control o# r th distri"ution 5o( !! cti#

!! cti#

o# r th

p riod o! stud'$ Co&pan' has not and

cost o! goods sold( s lling( ad&inistrati#

0p ns s$ st ps ar to " tak n to incr as th pro!its$

CA5J MANAGEMENT

Introduction: Cash &anag & nt is on is th o! th k ' ar as o! )orking capital &anag & nt$ Cash &ain dut' o! th !inanc &anag r is to

li*uid curr nt ass t$ Th

pro#id

ad *uat

cash to all s g& nts o! th

organi6ation$ Th

i&portant

r ason !or &aintaining cash "alanc s is th

transaction &oti# $ A !ir&

nt rs into #ari t' o! transactions to acco&plish its o"/ cti# s )hich ha# to " paid !or in th !or& o! cash$

M aning o! cash:

Th

t r& 9cash: )ith r ! r nc

to cash &anag & nt us d in t)o s ns s$ In a

narro) r s ns

it includ s coins( curr nc' not s( ch *u s( "ank dra!ts h ld it also includ s 9n ar1cash ass ts: such as d posits )ith "anks$

"' a !ir&$ n a "road r s ns &ark ta"l s curiti s and ti&

O"/ cti# s o! cash &anag & nt:

Th r

ar

t)o "asic o"/ cti# s o! cash &anag & nt$ Th ' ar 1

4 To &

t th

cash dis"urs & nt n th

ds as p r th

pa'& nt sch dul $

4 To &ini&i6

a&ount lock d up as cash "alanc s$

8asic pro"l &s in Cash Manag & nt: Cash &anag & nt in#ol# s th !ollo)ing !our "asic pro"l &s$

4 Controlling l # l o! cash 4 Controlling in!lo)s o! cash 4 Controlling out!lo)s o! cash and 4 Opti&u& in# st& nt o! surplus cash$

7 t r&ining sa! t' l # l !or cash:

Th th

!inanc

&anag r has to tak

into account th

&ini&u& cash "alanc

that

!ir& &ust k

p to a#oid risk or cost o! running out o! !unds$ 5uch t r& d as 9sa! t' l # l o! cash:$ Th !inanc &anag r

&ini&u& l # l &a' " d t r&in s th

sa! t' l # l o! cash s parat l' "oth !or nor&al p riods and d cid s a"out t)o "asic !actors$ Th '

p ak p riods$ =nd r "oth cas s h ar 1

7 sir d da's o! cash:

It & ans th

nu&" r o! da's !or )hich cash "alanc

should "

su!!ici nt to

co# r pa'& nts$

A# rag

dail' cash !lo)s:

This & ans a# rag dail'$

a&ount o! dis"urs & nts )hich )ill ha#

to "

&ad

Crit ria !or in# st& nt o! surplus cash:

In &ost o! th

co&pani s th r

ar

usuall' no !or&al )ritt n instructions discr tion and /udg& nt

!or in# sting th

surplus cash$ It is l !t to th

o! th

!inanc

&anag r$ Whil

0 rcising such /udg& nt( h

usuall' tak s

into consid ration th

!ollo)ing !actors1

5 curit':

This can " &or

nsur d "' in# sting &on ' in s curiti s )hos

pric

r &ains

or l ss sta"l $

Li*uidit':

This can "

nsur d "' in# sting &on ' in short t r& s curiti s including

shaOort t r& !i0 d d posits )ith "anks$

;i ld:

Most corporat

&anag rs gi#

l ss

&phasis to 'i ld as co&par d to s curit'

and li*uidit' o! in# st& nt$ 5o th ' pr ! r short t r& go# rn& nt s curiti s !or in# sting surplus cash$

Maturit':

It )ill " th !inanc

ad#isa"l

to s l ct s curiti s according to th ir &aturiti s so th 'i ld as ) ll as &aintain th

&anag r can &a0i&i6

li*uidit' o! in# st& nts$

Cash Manag & nt in 55L:

Th

cash &anag & nt is carri d out in s a)a's "' CTM ,Corporat in &ost o! th

Tr asur' co&pani s$

Manag & nt.$ CTM is a co&&onl' !ollo) d proc dur

Ratio Anal'sis is on th

o! th

i&portant t chni*u s that can "

us d to ch ck

!!ici nc' )ith )hich cash &anag & nt is " ing &anag d "' a !ir&$ Th as !ollo)s1

&ost i&portant ratios !or cash &anag & nt ar

Cash to curr nt ass ts ratio:

This ratio

sta"lish s th

r lationship " t)

n th

cash and th

curr nt

ass ts$ It is calculat d as !ollo)s

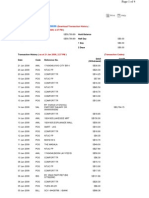

;EAR CA5J ,R5. C=RRENT A55ET5,R5. RATIO >??@ FAB?>?B >ABC@@D?E D$A >??B EDEAE?C >EGFGAADB >$E> >??C D@>?GCAC FFCGE>>G? A$@ >??E >FACBF>A FBFAA@@@A B$A@

Graph

IN3ERENCE:

3ro& th

a"o#

ta"l

it can "

in! rr d that th

cash to curr nt ass ts

Ratio is sho)n it is D$AH in th

' ar >??@ and incr as d till >??E$

CA5J TO C=RRENT LIA8ILITIE5 RATIO:

This ratio

sta"lish s th

r lationship " t)

n th

cash and curr nt

lia"iliti s$ It is calculat d as !ollo)s$

;EAR Cash ,Rs. C=RRENT LIA8ILITIE5,R5. Ratio >??@ FAB?>?B DEA@AD?BF D$EC >??B EDEAE?C DBGFA>B?F A$EF >??C D@>?GCAC DECB?>ECC E$D >??E >FACBF>A >DCGCFBBD D?$CC

Graph

INTERPRETATION:

3ro& th

a"o#

ta"l

it can "

in! rr d that th

proportion cash to curr nt ' ar >???1

lia"iliti s ratio is sho)n d cr asing tr nd$ It is DF$A?H in th ?D L d cr as d to ?$CAH in th ' ar >??@1?B$

RECEIKA8LE5 MANAGEMENT

Introduction: R c i#a"l s constitut a signi!icant portion o! th total ass ts o! th pa'& nts ar

"usin ss$ Wh n a !ir& s ll r goods or s r#ic s on cr dit( th postpon d to !utur dat s and r c i#a"l s ar

cr at d$ I! th ' s ll !or

cash no r c i#a"l s cr at d$

M aning:

R c i#a"l

ar

ass t accounts r pr s nting a&ounts o) d to th o! goods or s r#ic s in th ordinar' cours

!ir& as a

r sult o! sal

o! "usin ss$

Purpos

o! r c i#a"l s:

Accounts r c i#a"l s ar

cr at d " caus

o! cr dit sal s$ Th

purpos

o!

r c i#a"l s is dir ctl' conn ct d )ith th sal s$ Th o"/ cti# s o! cr dit sal s ar

o"/ cti# s o! &aking cr dit as !ollo)s1

4 Achi #ing gro)th in sal s$ 4 Incr asing pro!its$ 4 M ting co&p tition$

3actors a!! cting th

si6

o! R c i#a"l s:

Th

&ain !actors that a!! ct th

si6

o! th

r c i#a"l s ar 1

4 L # l o! sal s$ 4 Cr dit p riod$ 4 Cash discount$

Costs o! &aintaining r c i#a"l s:

Th

costs )ith r sp ct to &aint nanc

o! r c i#a"l s ar

as !ollo)s1

Capital costs:

This is " caus and th

th r

is a ti&

lag " t)

n th

sal

o! goods to custo& rs !or additional

pa'& nt "' th &$ Th

!ir& has( th r !or

to arrang

!unds to &

t its o"ligations$

Ad&inistrati#

costs:

3ir& incur this cost !or &anu!acturing accounts r c i#a"l s in th salari s to th custo& rs$

!or& o!

sta!! k pt !or &aintaining accounting r cords r lating to

Coll ction costs: Th !ir& has to incur costs !or coll cting th pa'& nts !ro& its cr dit

custo& rs$ 7 !aulting costs:

Th

!ir& &a' not a"l

to r co# r th

o# r du s " caus

o! th

ina"ilit' o!

custo& rs$ 5uch d "ts tr at d as "ad d "ts$

R c i#a"l s &anag & nt:

R c i#a"l s ar

dir ct r sult o! cr dit sal $ Th

&ain o"/ cti#

o!

r c i#a"l s &anag & nt is to pro&ot r ach d )h r th

sal s and pro!its until that point is

ROI in !urth r !unding o! r c i#a"l s is l ss than th that additional cr dit ,i$ $- cost o!

cost o! !unds rais d to !inanc capital.$ Incr as

in r c i#a"l s also incr as s chanc s o! "ad d "ts$

Thus( cr ation o! r c i#a"l s is " n !icial as ) ll as dang rous$ 3inall' &anag & nt o! accounts r c i#a"l & ans as th proc ss o! &aking d cisions

r lating to in# st& nt o! !unds in this ass t )hich r sult in &a0i&i6ing th o# r all r turn on th in# st& nt o! th !ir&$

R c i#a"l s &anag & nt and Ratio Anal'sis:

Ratio Anal'sis is on th

o! th

i&portant t chni*u s that can "

us d to ch ck

!!ici nc' )ith )hich r c i#a"l s &anag & nt is " ing &anag d "' a &ost i&portant ratios !or r c i#a"l s &anag & nt ar as !ollo)s1

!ir&$ Th

7E8TOR5 T=RNOKER RATIO: 1

7 "tors constitut th *ualit' o! th

an i&portant constitu nt o! curr nt ass ts and th r !or d "tors to a gr at 0t nt d t r&in s a !ir&+s li*uidit'$ con# rt d into cash$ In d "tors o! a !ir&$

It sho)s ho) *uickl' r c i#a"l s or d "tors ar oth r )ords( th Th 7TR is a t st o! th

li*uidit' o! th

li*uidit' o! !ir&+s r c i#a"l s can " Coll ction P riod$

0a&in d in t)o )a's th ' ar

7TR and A# rag

;EAR CRE7IT 5ALE5 ,R5. AKG 7E8TOR5 ,R5. RATIO >??@ A>GD>E>EB BGAFFGFB B$DE >??B B>>DEDBD? CCB>ABDB E$?D >??C BBE>D@CGD ECABAGEB C$BF >??E B@@>>GFDG DD@?EE@FB @$BG

INTERPRETATION:

3ro& th a# rag

a"o#

ta"l

it can "

in! rr d that th

proportion sal s to ' ar >??@ is B$DE$ It

d "tors is sho)ing !luctuating tr nd in th

incr as d to D$EF ti& s in >??B and incr as s r &aining t)o ' ars d cri s$

7E8TOR5 COLLECTION PERIO7: 7ata coll ction p riod is nothing "ut th &on ' !ro& th th custo& rs a!t r th p riod r *uir d to coll ct th d coll ction r duc s

cr dit sal s$ A sp # rsa

l ngth o! op rating c'cl

and #ic

;EAR5 AKG 7 "tors,in Rs. N t cr dit sal s ,in Rs. 7 "tors coll ction p riod ,in da's. >??@ BGAFFGFB A>GD>E>EB @G >??B CCB>ABDB B>>DEDBD? AB >??C ECABAGEB BBE>D@CGD AE >??E DD@?EE@B B@@>>GFDG BA

5ourc : data co&pil d !ro& th

annual r ports o! Annapurna

arcanal ltd$

IN3ERENCE5:

3ro& th

a"o#

ta"l

it can "

in! rr d that th

d "tors turn o# r ratios

sho)ing !luctuating tr nd$ In th is @G da's and r duc d in th up to >??E$

' ar >??@ it is d "tors coll ction p riod

' ar >??B to AB da's th n incr as d slightl'

INKENTOR; MANAGEMENT

Introduction:

In# ntori s ar

stock o! th

product a co&pan' is &anu!acturing !or sal products$ Th #arious !or&s in )hich

and co&pon nts$ That &ak up th in# ntori s

0ist in a &anu!acturing co&pan' ar : Ra)1&at rials( )ork1in1

proc ss( !inish d goods$

4 Ra)1Mat rials: 1 Ar products through th thos

thos

"asic inputs that ar

con# rt d into !inish d

&anu!acturing proc ss$ Ra)1&at rials in# ntori s ar " n purchas d and stor d !or !utur production$

units( )hich ha#

4 Work1In1Proc ss in# ntori s ar products that n d &or )ork " !or

s &i1&anu!actur d products$ Th th ' " co&

r pr s nt

!inish d products !or sal $

4 3inish d Goods in# ntori s ar )hich ar !acilitat

thos

co&pl t l' &anu!actur d products(

r ad' !or sal $ 5tocks o! ra)1&at rials and )ork1in1proc ss production )hich stock o! !inish d goods is r *uir d !or s&ooth in# ntori s s r# as a link " t) n production

&ark ting op rations$ Th s and consu&ption o! goods$

4 5tor s and spar s ar

also &aintain d "' so&

!ir&s$ This includ s o!!ic

and plant cl aning &at rials lik tc$ Th s

soaps( "roo&s( oil( !u l( light( "ul"s nt r in production$ 8ut ar n c ssar'

&at rials do not dir ctl'

!or production proc ss$

d to holding in# ntor'

Th

*u stion o! &anaging in# ntori s aris s onl' )h n th

co&pan' holds co&pan'Ps to thr

in# ntori s$ Maintaining in# ntori s in#ol# s t'ing up o! th !unds and incurr nc o! storag and handling cost$ It is

0p nsi# ar

&aintain in# ntori s( )h' do s co&pan' hold in# ntori s4 Th r g n ral &oti# s !or holding in# ntori s$ D$Transaction Moti# : 1 E&phasi6 s th !acilitat n

d to &aintain in# ntori s to

s&ooth production and sal s op rations$

>$Pr cautionar' &oti# : 1 N c ssitat s holding o! in# ntori s to guard against th risk o! unpr dicta"l chang s in d &and and suppl' !orc s and

oth r !actors$ F$5p culati# &oti# : 1 In!lu nc s th d cision to incr as in!lu nc s$ or r duc

in# ntor' l # ls to tak

ad#antag s o! pric

A co&pan' should &aintain ad *uat suppl' to th !actor' !or th

stock o! &at rials !or a continuous

unint rrupt d production$ It is not possi"l d d$ A ti& 0ists lag

!or a co&pan' to procur 0ists " t)

ra) &at rials )h n # r it is n

n d &and !or &at rials and its suppl'$ Also th r

unc rtaint' in procuring ra) &at rials in ti& procur & nt o! &at rials &a' " d la' d " caus

on &an' occasions$ Th o! such !actors as strik ( !ir& should &aintain

transport disruption or short suppl'$ Th r !or ( th su!!ici nt stock o! ra) &at rials at a gi# n ti& production$

to str a& lin

O"/ cti#

o! In# ntor' Manag & nt

In th o! &

cont 0t o! in# ntor' &anag & nt th ting t)o con!licting n si6 ds

!ir& is !ac d )ith th

pro"l &

4 To &aintain a larg

o! in# ntor' !or su!!ici nt and s&ooth

production and sal s op rations$ 4 To &aintain a &ini&u& in# st& nt in in# ntori s to &a0i&i6 pro!ita"ilit'$

8oth

0c ssi#

and inad *uat

in# ntori s ar

not d sira"l $ Th s o"/ cti#

ar o!

t)o

dang rous points )ithin )hich th in# ntor' &anag & nt should " in# ntor' in# st& nt$ Th t)o dang r points o!

!ir& should op rat $ Th

to d t r&in

and &aintain opti&u& l # l o! " t) n th

opti&u& l # l o! in# ntor' )ill li and inad *uat in# ntori s$

0c ssi#

Th

!ir& should al)a's a#oid a situation o! o# r in# st& nt or und r &a/or dang rous o! o# r in# st& nt ar

in# st& nt in in# ntori s$ Th

4 =nn c ssar' ti 1up o! th 4 E0c ssi# carr'ing cost

!ir&s !unds loss s o! pro!it

4 Risk o! *ualit' Th ai& o! in# ntor' &anag & nt thus should " to a#oid 0c ssi# and

inad *uat

l # ls o! in# ntori s and to &aintain su!!ici nt in# ntor' !or &ad th to plac an

s&ooth production and sal s op rations$ E!!orts should " ord r at th at th 4 Ensur right ti& )ith th right sourc !! cti# to ac*uir

right *uantit'

right pric

and *ualit'$ An

in# ntor' &anag & nt should unint rrupt d

a continuous suppl' o! ra) &at rials to !acilitat

production$ 4 Maintain su!!ici nt stock o! ra) &at rials in p riods o! short suppl' and anticipat pric chang s$

4 Maintain su!!ici nt !inish d goods in# ntor' !or s&ooth sal s op rations and !!ici nt custo& r s r#ic $ th carr'ing cost and ti& $ p it at an opti&u& l # l$

4 Mini&i6

4 Control in# st& nt in in# ntori s and k

In# ntor' &anag & nt t chni*u s

In &anaging in# ntori s th

!ir& o"/ cti#

should "

in consonanc

)ith th

shar hold rsP ) alth &a0i&i6ation principl $ To achi # d t r&in th

this !ir& should

opti&u& l # l o! in# ntor'$ E!!ici ntl' controll d th !ir& !l 0i"l $ In !!ici nt in# ntor' control r sults !ir& &a so& ti& s run out o!

in# ntori s &ak

in un"alanc d in# ntor' and in!l 0i"ilit'1th

stock and so& ti& s &a' pil up unn c ssar' stocks$ This incr as s l # l o! in# st& nt and &ak s th !ir& unpro!ita"l $

To &anag

in# ntori s

!!ici nc'( ans) rs should "

sought to th

!ollo)ing

t)o *u stions$ D.Jo) &uch should " >.Wh n should it " ord r d4 ord r d4

Th

!irst *u stion ho) &uch to ord r( r lat s to th

pro"l & o! d t r&ining

cono&ic ord r *uantit' ,EOM.( and is ans) r d )ith an anal'sis o! costs o! &anu!acturing c rtain l # l o! in# ntori s$ Th ord r aris " caus o! d t r&ining th s cond *u stion )h n to

r ord r point$

EOM

On

o! th

&a/or in# ntor' pro"l &s to "

r sol# d is ho) &an' in# ntori s !ir& is "u'ing ra) purchas d on issu ach is ho) call d

should "

add d )h n in# ntor' is r pl nish d$ I! th lots in )hich it has to "

&at rials it has to d cid r pl nish& nt$ I! th

!ir& is planning a production run( th or ho) &uch to &ak $ Th s task o! th

&uch production to sch dul

pro"l &s ar th

ord r *uantit' pro"l &s and th opti&u& or

!ir& is to d t r&in

cono&ic ord r *uantit' ,or

cono&ic lot si6 . d t r&ining an

opti&u& in# ntor' l # l in#ol# s t)o t'p s o! costs$

D.Ord ring cost >. Carr'ing cost Th cono&ic ord r *uantit' is that in# ntor' l # l )hich &ini&i6 s th

total o! ord ring and carr'ing costs$

Ord ring cost

Th

t r& ord ring cost is us d in cas ntir

o! ra) &at rials ,or suppli s. and includ costs

includ s th

cost o! ac*uiring ra) &at rials$ Th

incurr d in !ollo)ing acti#iti s$ R *uisitioning purchas transporting( r c i#ing( insp cting and storing ,stor

ord ring(

plac & nt.$

Carr'ing cost

Cost incurr d !or &aintaining a gi# n l # l o! in# ntor' is call d carr'ing cost$ Th ' includ o"sol sc nc $ Econo&ic ord r *uantit' ,EOM. <#>ACNc storag ( ta0 s( insuranc s( d t rioration and

Wh r

A < annual r *uir & nt o! ra) &at rials

C<ord ring cost c<carr'ing cost

EOM Graphical Approach

Th !igur

cono&ic ord ring *uantit' can also " is as !ollo)s:

!ound out graphicall'$ Th

EOM

In th

a"o#

!igur

costs1carr'ing( ord ring and total ar ord r si6 $ W not

plott d on that total

# rtical a0is is us d to r pr s nt th carr'ing costs incr as s as th a# rag

ord r si6

incr as s( " caus ( on an

a larg r in# ntor' l # l " in ord r si6 " caus

&aintain d( and ord ring costs d clin larg ord r si6 is notic a"l & ans l ss nu&" r o! sinc it is a su& o! total

)ith incr as ord rs$ Th

" ha#ior o! total costs lin

t)o t'p s o! costs( )hich " ha# costs d clin

di!! r ntl' )ith ord r si6 $ Th

in th ir !irst instanc

"ut th ' start rising )h n th than o!!s t "' th incr as s

d cr as s in an a# rag in carr'ing costs$ Th th

ord ring costs is &or

cono&ic ord r *uantit' occurs at th

point M$ Wh r

total cost is &ini&u&$ Thus th

!ir&s op rating pro!it is &a0i&i6 d at

point$ R ord r Point ,ROP.

Th

pro"l & ho) &uch to ord r is sol# d d t r&ining th ans) r should th sought to th

cono&ic ord r

*uantit' ' t th

s cond pro"l &( )h n to

ord r this is a pro"l & o! d t r&ining th l # l at )hich an ord r should " d t r&in th

r ord r point is that in# ntor' in# ntor'$ To

plac d to r pl nish d th should kno)

r ord r point und r c rtaint'( )

a. L ad ti& ". A# rag usag

c. Econo&ic ord r *uantit'

L ad ti&

is th

ti&

nor&all' tak n is r pl nishing in# ntor' a!t r th & an th usag and l ad ti& do not

ord r has " !luctuat )ill "

n plac d "' c rtaint' )

und r such a situation ROP is si&pl' that in# ntor' l # l )hich &aintain d !or consu&ption during th l ad ti& $ i$ ( usag usag $

R ord r point ,und r c rtaint'. <l ad ti& R 1ord r Point ,und r c rtaint'. < L ad ti&

I A# rag I A# rag

In# ntor' &anag & nt at Annapurna Earcanal Ltd

Th

Annapurna Ear canal Ltd &anag & nt all th

unit and corporat

l # l

# r' &onth r #i )s in# ntor'$ All th &inut s and th in# ntor' holdings ar

!unctional h ad ar

call d !or & ting

discuss d in d tail at th

# r' &onth $A$E$Ltd purchas s th ord r( sinc th product o! ar

&at rial )h n th

custo& r plac s th

tailor1&ad

to custo& r+s r *uir & nts$ stock d

A!t r purchasing th at on plac

ra) &at rials( )hich is &ostl'( still )ill "

all oth r procur d against production ord rs ar

stor d$ ra)

7 p nding up on th

r *uir & nt in #arious production d part& nts th r sp cti# d part& nts or production shops$

&at rial is s nt to th

Wh n th

ord r is plac d !or ra) &at rial c rtain ra) &at rial is in

transit( such ra) &at rial is call d as ra) &at rial in transit$ E0a&pl QRa) &at rial on o# r s as$

Th

ra) &at rial can "

trans! r !ro& unit to anoth r unit or !ro& on

d part& nt to anoth r is call d trans! r1in Qtransist$It is nothing "ut to th trans! r o! ra) &at rial a&ong th int r !ir& units o! Annapurna

Earcanal Ltd$

Th Th

ra) &at rial( )hich is production proc ss( is call d )ork1in proc ss$ )ork in proc ss " co& s !inish d goods in# ntor'$ Th k pt !or a long r ti& $ Th ' should " !inish d should

not " ntir

sold o!! to cl ar o!! th !or

in# ntor'$ Jo) # r( !inish d goods in# ntor' is not th r production is &ainl' don

Annapurna Earcanal Li&it d( sinc ord r and sp ci!ications$ Th

on custo& r )hol

ra) &at rial is purchas d and th call it as in# ntor' c'cl $

proc ss is r p at d again )hich )

In# ntor' turno# r Ratio:1 In# ntor' turno# r ratio indicat s th !!ici nc' o! th !ir& in producing cost o! goods a# rag o! op n

and s lling its products$ It is calculat d "' di#iding th sold "' th a# rag in# ntor'$ Th a# rag in# ntor' is th

and closing "alanc

o! in# ntor'$

In# ntor' turno# r Ratio< Cost o! Goods 5old N A# rag

In# ntor'

; ars Cost o! goods sold A# rag >??@ F?CB@BFDD F>CC@?>A G$FE >??B B?BB?AEAA BAC@>FBC G$FB >??C FGG>GE??E BCFD@GC> @$G >??E FG?FEB?EF AFFFG>D@ G

in# ntor' ITR, in Ti& s.

5ourc : 7ata co&pil d !ro& th annual r port o! Annapurna Earcanal Ltd$

In! r nc s:

3ro& th to a# rag

a"o#

ta"l

it can in! rr d that th

proportion cost o! good sold ' ar>??@ and again ' ar

stock it is incr as d to G$FEti& s in th

d cr as d @$G ti& s in th >??E$

' ar >??Cand again incr as d G ti& s in th

In# ntor' holding p riod:1

In# ntor' holding p riod is th This can " & asur

r ciprocal o! in# ntor' turn o# r ratio$

in t r&s o! nu&" r o! da's$

In# ntor' holding p riod< A# rag Cost o! goods o! sold

in# ntor' 0FB@da's

; ars AKG INKENTOR; CG5 ,In Rs$. INKENTOR; JOL7ING PERIO7,In da's. >??@ F>CC@?>A F?CB@BFDD FG >??B BAC@>FBC B?BB?AEAA A? >??C BCFD@GC> FGG>GE??E B> >??E AFFFG>D@ FG?FEB?EF AD

Graph

In! r nc s:

3ro& th

a"o#

ta"l

it can in! r that th

proportion o! a# rag

in# ntor'

to cost o! goods sold had FG da's in >??@$ In th incr as d that is B> da's and again d cri s$

' ar >??C it can "

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Questionnaire On Work Life BalanceDocument5 pagesQuestionnaire On Work Life BalanceRamana Vaitla67% (3)

- Questionnaire On Work Life BalanceDocument5 pagesQuestionnaire On Work Life BalanceRamana Vaitla67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project ManagementDocument5 pagesProject ManagementRamana VaitlaNo ratings yet

- Kelas 2 - Latihan Soal PTS 2 MathDocument7 pagesKelas 2 - Latihan Soal PTS 2 MathShakti Mikayla Tsamara Karima100% (2)

- ReviewsDocument1 pageReviewsRamana VaitlaNo ratings yet

- Table 5.ANOVA AnalysisDocument53 pagesTable 5.ANOVA AnalysisRamana VaitlaNo ratings yet

- + (91) - 9533037888 House No 3-4-226/D, Kachiguda, Hyderabad - 500027, Opposite Jain Mandir, Near Venkata Ramana TheatreDocument1 page+ (91) - 9533037888 House No 3-4-226/D, Kachiguda, Hyderabad - 500027, Opposite Jain Mandir, Near Venkata Ramana TheatreRamana VaitlaNo ratings yet

- Financial AnalysisDocument69 pagesFinancial AnalysisRamana VaitlaNo ratings yet

- Azeem, A., Zia Ul Ha. (2012) : Farhan, M., Yousaf, A. (2016) D. S. Chaubey, D.S., Sharma, L.S., Pant, M. (2013)Document1 pageAzeem, A., Zia Ul Ha. (2012) : Farhan, M., Yousaf, A. (2016) D. S. Chaubey, D.S., Sharma, L.S., Pant, M. (2013)Ramana VaitlaNo ratings yet

- Postponement EOI 2012Document1 pagePostponement EOI 2012Ramana VaitlaNo ratings yet

- Management Faculty Courses Planned For The Year-2011-2012: Programme SummaryDocument6 pagesManagement Faculty Courses Planned For The Year-2011-2012: Programme SummaryRamana VaitlaNo ratings yet

- Captial Structure of UltratechDocument76 pagesCaptial Structure of UltratechRamana Vaitla0% (2)

- Porject Synopsis AirtelDocument7 pagesPorject Synopsis AirtelRamana VaitlaNo ratings yet

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDocument6 pagesKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaNo ratings yet

- Communication Limited, Hyderabad: Project SynopsisDocument4 pagesCommunication Limited, Hyderabad: Project SynopsisRamana VaitlaNo ratings yet

- Project Synopsis: Topic: Woriking of Housing Finance Companies - A Case Study ofDocument3 pagesProject Synopsis: Topic: Woriking of Housing Finance Companies - A Case Study ofRamana VaitlaNo ratings yet

- Sales Promotional Activities - Big Bazar-69-11Document76 pagesSales Promotional Activities - Big Bazar-69-11Ramana VaitlaNo ratings yet

- Sri Vajra Financial ReportsDocument7 pagesSri Vajra Financial ReportsRamana VaitlaNo ratings yet

- The Balanced ScorecardDocument6 pagesThe Balanced ScorecardRamana VaitlaNo ratings yet

- Department of Business Management M.B.A III Semester Internal Assessment Subject: Total Quality ManagementDocument2 pagesDepartment of Business Management M.B.A III Semester Internal Assessment Subject: Total Quality ManagementRamana VaitlaNo ratings yet

- Impact of Promotional ServicesDocument67 pagesImpact of Promotional ServicesRamana VaitlaNo ratings yet

- Xe Currency Rate 31032020 PDFDocument6 pagesXe Currency Rate 31032020 PDFKrishna KanojiaNo ratings yet

- Pagoda (Coin)Document3 pagesPagoda (Coin)Ardid LopezNo ratings yet

- Trading BalanceDocument4 pagesTrading BalanceShidiq WidiyantoNo ratings yet

- Math - COT Week 7Document4 pagesMath - COT Week 7Ella Maria de Asis - JaymeNo ratings yet

- Lesson 3 KanjiDocument16 pagesLesson 3 KanjiL SNo ratings yet

- Contoh Slip Gaji Karyawan Format Ms ExcelDocument2 pagesContoh Slip Gaji Karyawan Format Ms ExcelBahari Prabowo Aji100% (1)

- Transmittal Sheet: Administrative BLDG., Pho Compound, Old Municipal Road, Masbate CityDocument10 pagesTransmittal Sheet: Administrative BLDG., Pho Compound, Old Municipal Road, Masbate CityNigel Leigh Godfrey GutierrezNo ratings yet

- Countries Capitals and Currencies: The World Map Keeps Changing Due ToDocument7 pagesCountries Capitals and Currencies: The World Map Keeps Changing Due ToNavya BehlNo ratings yet

- 20190308191405-Berkas Persyaratan TAMTAMA BRIMOBDocument9 pages20190308191405-Berkas Persyaratan TAMTAMA BRIMOBHaifaNurfitrianiNo ratings yet

- Credit Note: Acct Number Acct Desc Line Descripion Amount 34207 DD Charges 600.00 Total 600.00Document28 pagesCredit Note: Acct Number Acct Desc Line Descripion Amount 34207 DD Charges 600.00 Total 600.00gurumurthy38No ratings yet

- Acces Miyajima EnglishDocument1 pageAcces Miyajima Englishbritties69No ratings yet

- !beretta Fiyat Listesi - v010721 - VFDocument5 pages!beretta Fiyat Listesi - v010721 - VFCabir ÇakmakNo ratings yet

- Country Capital Currancy PDFDocument3 pagesCountry Capital Currancy PDFSinghTarunNo ratings yet

- THS/TPHS/TGCHS/TNHS Grand Reunion Registration FormDocument1 pageTHS/TPHS/TGCHS/TNHS Grand Reunion Registration FormEmmanuel Aquino Batao-eyNo ratings yet

- CHALLANDocument1 pageCHALLANBalu VarreNo ratings yet

- Decimal Coinage: India-Republic 1091Document1 pageDecimal Coinage: India-Republic 1091Muthu KrishnanNo ratings yet

- FINANCIAL-STATEMENT-2021-2022 (Word)Document30 pagesFINANCIAL-STATEMENT-2021-2022 (Word)Dhave Guibone Dela CruzNo ratings yet

- Sri Shankara Matt: Cummulative Statement 2017Document28 pagesSri Shankara Matt: Cummulative Statement 2017Vijaya BhaskarNo ratings yet

- Damac Project AvailabilityDocument62 pagesDamac Project AvailabilityAnonymous 2rYmgRNo ratings yet

- CardTransactions191031160011576769402 PDFDocument3 pagesCardTransactions191031160011576769402 PDFWeng ShanNo ratings yet

- DBSDocument4 pagesDBSSilvia DewiyantiNo ratings yet

- Chandan Retail PVT LTD GRDocument2 pagesChandan Retail PVT LTD GRSontu Esperanza FreundNo ratings yet

- Imagens de Moedas FaoDocument210 pagesImagens de Moedas FaoIvanildo MedeirosNo ratings yet

- Memories Currencies of CountriesDocument13 pagesMemories Currencies of CountriesQIE PSNo ratings yet

- Fxrate 06 06 2023Document2 pagesFxrate 06 06 2023ShohanNo ratings yet

- Certificate of Employment (Tanod)Document20 pagesCertificate of Employment (Tanod)Barangay28 Zone04No ratings yet

- AUD USD Technical AnalysisDocument3 pagesAUD USD Technical AnalysisYudhishthir KumarNo ratings yet

- Short Memory Tricks To Remember The List of Important Countries Its CurrencyDocument2 pagesShort Memory Tricks To Remember The List of Important Countries Its CurrencyRaje VijiNo ratings yet

- Certificate of AcceptanceDocument30 pagesCertificate of AcceptanceJamielor BalmedianoNo ratings yet