Professional Documents

Culture Documents

M A Strategy ArcelorMittal Part2

Uploaded by

Shresth KotishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M A Strategy ArcelorMittal Part2

Uploaded by

Shresth KotishCopyright:

Available Formats

M&A strategy seven elements

I Vision Vi i & Business strategy II Target and M&A master plan III Pre-deal

Deal

Strategic St t i fit

IV Post-deal

V Steady state

I Input t

1 2

M&A strategy t t

PMI

Leadership M&A process management

Who is leader of the M&A strategy and process? Who is control?

What are the key success drivers of the M&A strategy and how are we going to manage them?

Business

Transaction

Risk management

What do we want to achieve? Does it make sense? What is the game we want to play? How do we make it work?

What is the right price? What is the engineering? How do we manage escalating momentum? How do we close? Legal help?

How will we avoid premature death? Seize the moments? Avoid typical pitfalls and value erosion?

Stakeholders

Finance

Note: Here we define M&A strategy as the design and structure of all key aspects before and during the deal - a broader definition would also encompass the post-merger phase

Who do we need to involve, how, to which extent and when?

How will we fund it? How much debt/equity?

3

Source: icircle

What is your M&A stimuli?

What is driving your decision to buy/merge?

1. 2. 3. 4. 5. 6. 7. 8. 9 9. 10. 11. 12. 13 13. 14. Success Defeats Vulnerability Overwhelming change Beat/stop competitors Antecipating pain No pipeline Clients demand E Expansionism i i Capital markets Excess cash Vision about the future Wealth creation Legislation � Re-assurance we can lead; be bolder � Doubts about competitiveness; whats missing? � Holding fragile position, weak to respond/command � Unability to keep pace; losing ground � Feeling the threat � Sensing future trouble, obstacles � R&D, products � Protecting franchise � Growing G i the th franchise f hi � Whats next? � Shopping � Inspirational, entrepreneurial � Financial � Gaining edge over competition

Smart Stimuli

I our stimulus Is ti l really ll smart? t? Legitimate? L iti t ? Is M&A the best way to go? Defines mental model for strategic intent and M&A strategy

Source: icircle

You might also like

- Avoid The Noise: Five Key Concepts For Financial SuccessFrom EverandAvoid The Noise: Five Key Concepts For Financial SuccessRating: 1 out of 5 stars1/5 (1)

- M&A Strategy Lessons from the FieldDocument83 pagesM&A Strategy Lessons from the FieldСергей ЮшкинNo ratings yet

- The Astute Investor, 2nd ed: Moneymaking Stock Market Advice from the MastersFrom EverandThe Astute Investor, 2nd ed: Moneymaking Stock Market Advice from the MastersNo ratings yet

- Citigroup Practical Banking Pres 06Document30 pagesCitigroup Practical Banking Pres 06jwkNo ratings yet

- Buy and Hold Is Dead: How to Make Money and Control Risk in Any MarketFrom EverandBuy and Hold Is Dead: How to Make Money and Control Risk in Any MarketNo ratings yet

- GoldStar Policy Document 2015Document24 pagesGoldStar Policy Document 2015Nimish MistryNo ratings yet

- Elements of EntrepreneurshipDocument7 pagesElements of EntrepreneurshipcrimsengreenNo ratings yet

- What Are The Differences Between TradersDocument14 pagesWhat Are The Differences Between TradersAldo RaquitaNo ratings yet

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksFrom EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNo ratings yet

- To Sell or Not To Sell? That Is The Question On The Minds of Many Board Members, Executives and InvestorsDocument1 pageTo Sell or Not To Sell? That Is The Question On The Minds of Many Board Members, Executives and InvestorsStradlingNo ratings yet

- Guide To Writing A Business PlanDocument6 pagesGuide To Writing A Business PlanInnovation Nations75% (4)

- Business plan benefitsDocument4 pagesBusiness plan benefitsAshu AshwiniNo ratings yet

- Principles of Marketing Digital Assignment - I: When To Start A Company?Document5 pagesPrinciples of Marketing Digital Assignment - I: When To Start A Company?VINAYNo ratings yet

- Management Articles: Business, Finance and ManagementDocument6 pagesManagement Articles: Business, Finance and ManagementSivasankaran KannanNo ratings yet

- Functional Areas of ManagementDocument16 pagesFunctional Areas of Managementbaby winette vicerraNo ratings yet

- IITM Placement Guide 2015-16 PDFDocument352 pagesIITM Placement Guide 2015-16 PDFSudesh ChaudharyNo ratings yet

- What Are The Six Key Elements of Entrepreneurship and What Is The Importance of EachDocument8 pagesWhat Are The Six Key Elements of Entrepreneurship and What Is The Importance of EachtinieNo ratings yet

- Keys For An Effective Business Plan: Business Planning Workshop September 27, 2006Document61 pagesKeys For An Effective Business Plan: Business Planning Workshop September 27, 2006Tan Tok HoiNo ratings yet

- Selecting Shares eGuide: Your guide to choosing stocksDocument23 pagesSelecting Shares eGuide: Your guide to choosing stocksHermo Patacsil100% (1)

- How To Buy A Bank in Emerging MarketsDocument2 pagesHow To Buy A Bank in Emerging MarketskarishmaNo ratings yet

- Investment+Readiness+Checklist UpdatedDocument33 pagesInvestment+Readiness+Checklist UpdatedNorman RivasNo ratings yet

- Strategy Beyond The Hockey Stick: Chris Bradley, Martin Hirt, Sven Smit MckinseyDocument52 pagesStrategy Beyond The Hockey Stick: Chris Bradley, Martin Hirt, Sven Smit MckinseySerge75% (4)

- Final Exam Sa EntrepDocument3 pagesFinal Exam Sa EntrepMagella G. BrionesNo ratings yet

- Effective Decision MakingDocument3 pagesEffective Decision MakingDr-Rahat KhanNo ratings yet

- What's Changed About How Brands Contribute To Successful IPO's?Document6 pagesWhat's Changed About How Brands Contribute To Successful IPO's?Joe SmithNo ratings yet

- Hedge Fund Analyst Checklist PDFDocument4 pagesHedge Fund Analyst Checklist PDFsayuj83No ratings yet

- Principles of StrategyDocument15 pagesPrinciples of StrategysanazhNo ratings yet

- Finance Interview QuesDocument4 pagesFinance Interview QuesloyolaiteNo ratings yet

- Investment Banking - How To Become An Investment BankerDocument193 pagesInvestment Banking - How To Become An Investment BankerMichael Herlache MBA100% (4)

- 3 Secrets of Successful CompaniesDocument7 pages3 Secrets of Successful Companiesakiyama_ma83No ratings yet

- Challenges of Business OrganizationDocument3 pagesChallenges of Business OrganizationAqib ArshadNo ratings yet

- NurudeenDocument9 pagesNurudeenOkedara yunusNo ratings yet

- Unit 39 P4 - Studio Business Plan - Resource For StudentsDocument14 pagesUnit 39 P4 - Studio Business Plan - Resource For StudentsDan SmithNo ratings yet

- Ethiopian Entrepreneurship Success FactorsDocument13 pagesEthiopian Entrepreneurship Success FactorsBirukee Man50% (2)

- Investment Banking Valuation GuideDocument98 pagesInvestment Banking Valuation Guidesandeep chaurasiaNo ratings yet

- Trader Treatment Special ReportDocument14 pagesTrader Treatment Special ReportbergenglobalNo ratings yet

- Skills_for_Financial_Planning_Role_1698580141Document11 pagesSkills_for_Financial_Planning_Role_1698580141Md. Abdus samadNo ratings yet

- 3 s2.0 B9780750656757500165 MainDocument3 pages3 s2.0 B9780750656757500165 MainStephanie OleyNo ratings yet

- The Devil Is in The Details: Section NameDocument17 pagesThe Devil Is in The Details: Section NameOpalesque PublicationsNo ratings yet

- We LikeDocument58 pagesWe LikeShruti SharmaNo ratings yet

- Lean Fundly - Pitch Deck 02-11-13 V 0.3Document18 pagesLean Fundly - Pitch Deck 02-11-13 V 0.3analyticsvr100% (1)

- Financial ManagementDocument5 pagesFinancial ManagementarifzakirNo ratings yet

- Modelo Do LivroDocument16 pagesModelo Do Livrogebaima.ictNo ratings yet

- Trading As A Business - Chap 8Document10 pagesTrading As A Business - Chap 8DavidNo ratings yet

- Strategic Planning in Law Firms: Thinking Like Your ClientDocument36 pagesStrategic Planning in Law Firms: Thinking Like Your Clientapi-179708799No ratings yet

- Thesis On Indian Capital MarketDocument7 pagesThesis On Indian Capital MarketAsia Smith100% (1)

- Assignment No. 3 - A023-Entrep1aDocument2 pagesAssignment No. 3 - A023-Entrep1aDianna Lynn MolinaNo ratings yet

- On Target !: What Motivates Winning Salespeople? It's More Than Money! Six Sales MotivatorsDocument5 pagesOn Target !: What Motivates Winning Salespeople? It's More Than Money! Six Sales MotivatorsRuss WatsonNo ratings yet

- Esbe Material Unit 2Document15 pagesEsbe Material Unit 2NIMMANAGANTI RAMAKRISHNANo ratings yet

- 3 CettDocument37 pages3 Cettsanjana13No ratings yet

- ExamDocument31 pagesExamJuliana CabreraNo ratings yet

- Corporate Restructuring and M&A StrategiesDocument15 pagesCorporate Restructuring and M&A StrategiesJay BhattNo ratings yet

- Viva For HPGD Jl14 3635Document56 pagesViva For HPGD Jl14 3635Chawla HarsimarNo ratings yet

- Crafting A Winning Business PlanDocument25 pagesCrafting A Winning Business Planrishigautam86No ratings yet

- Best Practice in Corporate Venture Capital - The BlueprintDocument3 pagesBest Practice in Corporate Venture Capital - The BlueprintJing GaoNo ratings yet

- Key Steps Before Talking To Venture Capitalists - Intel Capital PDFDocument7 pagesKey Steps Before Talking To Venture Capitalists - Intel Capital PDFSam100% (1)

- How To Choose An Exit StrategyDocument5 pagesHow To Choose An Exit StrategySayaga GlobalindoNo ratings yet

- What Is Business Life CycleDocument9 pagesWhat Is Business Life Cyclebijal dedhiaNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptShresth KotishNo ratings yet

- Aiats Jeemain Test-6Document18 pagesAiats Jeemain Test-6Shivendra AgarwalNo ratings yet

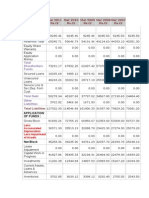

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Event Planning Business Plan SampleDocument19 pagesEvent Planning Business Plan Samplerajdanish88% (17)

- ReportDocument47 pagesReportShresth KotishNo ratings yet

- (224888313) Financial-Plan AnupamDocument23 pages(224888313) Financial-Plan AnupamShresth KotishNo ratings yet

- NHPC BSDocument2 pagesNHPC BSShresth KotishNo ratings yet

- M A Strategy ArcelorMittal Part5Document2 pagesM A Strategy ArcelorMittal Part5Shresth KotishNo ratings yet

- Financial Performance of Company Over Six YearsDocument2 pagesFinancial Performance of Company Over Six YearsShresth KotishNo ratings yet

- History NTPCDocument2 pagesHistory NTPCShresth KotishNo ratings yet

- A Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsDocument8 pagesA Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsShresth KotishNo ratings yet

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Sample Financial PlanDocument34 pagesSample Financial PlanShresth KotishNo ratings yet

- Aakash Malhotra Model Financial Planning ReportsDocument18 pagesAakash Malhotra Model Financial Planning Reportssayedmaruf7866807No ratings yet

- Sample Family Financial Plan: Prepared ForDocument22 pagesSample Family Financial Plan: Prepared ForShresth KotishNo ratings yet

- Prepared For: Mr. Mahendra DixitDocument31 pagesPrepared For: Mr. Mahendra DixitShresth KotishNo ratings yet

- Financial PlanniingDocument14 pagesFinancial PlanniingShresth KotishNo ratings yet

- Artha ShastraDocument1 pageArtha ShastraShresth KotishNo ratings yet

- Artha ShastraDocument1 pageArtha ShastraShresth KotishNo ratings yet

- Invicuts '14 CricketDocument1 pageInvicuts '14 CricketShresth KotishNo ratings yet

- History NTPCDocument2 pagesHistory NTPCShresth KotishNo ratings yet

- Investment Planning For Retired PeopleDocument30 pagesInvestment Planning For Retired Peoplemoli21No ratings yet

- Pgcil Sip Report JhaDocument72 pagesPgcil Sip Report JhaShresth KotishNo ratings yet

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocument1 pageYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishNo ratings yet

- Dividends DeclaredDocument1 pageDividends DeclaredShresth KotishNo ratings yet

- Bfs Roundup Flip 87Document3 pagesBfs Roundup Flip 87Shresth KotishNo ratings yet

- Shareholders ReportDocument37 pagesShareholders ReportShresth KotishNo ratings yet

- Vishleshan CaseDocument3 pagesVishleshan CaseHarish SatyaNo ratings yet

- Letter of AuthorizationDocument1 pageLetter of AuthorizationRamanuja SuriNo ratings yet