Professional Documents

Culture Documents

2014-03 Club Performance

Uploaded by

api-238953710Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014-03 Club Performance

Uploaded by

api-238953710Copyright:

Available Formats

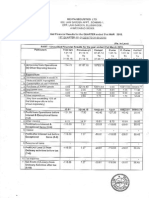

Liberty Investment Club Performance Report

As of 3/31/2014

Absolute Returns

Jan

Feb

Mar

Apr

May

June

July

Aug

Sept

Oct

Nov

Dec

2013

1.57%

2014 -1.44% 2.61% 0.17% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Relative Returns

Periodic Performance

Policy *

4.00%

Liberty

Mar-14

Equity

Policy 0.57%

0.70%

Port

Diff

0.13%

Ex Ret

2.00%

1.00%

Feb-14

Equity

Policy 5.20%

Port

4.93%

Diff

-0.28%

0.00%

-1.00%

Policy *

Liberty

Ex Ret

0.15%

0.17%

3 Mo

1.24%

1.31%

1 Yr

0.00%

0.00%

3 Yr

0.00%

0.00%

ITD

3.27%

2.89%

1.31%

-0.28% -0.06%

0.05%

Debt

0.19%

0.19%

0.00%

0.00%

Asset

4.80%

4.80%

0.00%

Asset

Policy -4.63% 1.54% -2.21%

Port -4.77% 1.50% -2.25%

Diff

-0.13% -0.04% -0.04%

Liberty

9%

10%

Asset

-0.33% -0.06%

Equity Debt

Characteristics

Policy

Debt

Jan-14

0.01% 0.06% 0.00% 0.00% -0.37%

44%

51%

39%

1.57%

Portfolio Asset Class Attribution

3.00%

1 Mo

Year

47%

Equity

Debt

Assets

Equity

Debt

Assets

* Policy portfolio is made up of 50% global equities (ACWI) and 40% US investment grade bonds (AGG) and 10% commodities (GSG)

Note: 2013 performance is from December 16, 2013 through year end

-na-

-na-

-na-

-na-

Liberty

-na-

3/31/2014

2/28/2014

1/31/2014

12/31/2013

12/16/2013

Growth of $100 Inception to Date

Policy

$105

$100

$95

$90

$85

$80

You might also like

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Case AnalysisDocument29 pagesCase AnalysisLiza NabiNo ratings yet

- Gold Market Update April - GSDocument16 pagesGold Market Update April - GSVictor KerezovNo ratings yet

- 2014-04 Club PerformanceDocument2 pages2014-04 Club Performanceapi-238953710No ratings yet

- 2014-02 Club PerformanceDocument2 pages2014-02 Club Performanceapi-238953710No ratings yet

- 2014-06 Club PerformanceDocument1 page2014-06 Club Performanceapi-238953710No ratings yet

- 2014-05 Club PerformanceDocument2 pages2014-05 Club Performanceapi-238953710No ratings yet

- 2014-01 Club PerformanceDocument2 pages2014-01 Club Performanceapi-238953710No ratings yet

- Flagship One Pager - All ReturnsDocument6 pagesFlagship One Pager - All ReturnsridnaniNo ratings yet

- Treasury Rates: Rates Monday, July 29th, 2013Document1 pageTreasury Rates: Rates Monday, July 29th, 2013Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 05.05.14Document1 pagePensford Rate Sheet - 05.05.14Pensford FinancialNo ratings yet

- 2022.07 Pavise Monthly Letter FlagshipDocument4 pages2022.07 Pavise Monthly Letter FlagshipKan ZhouNo ratings yet

- Roic Revenue Growth: Appendix 1: Key Business DriversDocument7 pagesRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiNo ratings yet

- Pensford Rate Sheet - 06.10.13Document1 pagePensford Rate Sheet - 06.10.13Pensford FinancialNo ratings yet

- Treasury Rates: Rates Monday, January 27th, 2014Document1 pageTreasury Rates: Rates Monday, January 27th, 2014Pensford FinancialNo ratings yet

- Full X-Ray Report - 20150313Document5 pagesFull X-Ray Report - 20150313Anand Mohan SinhaNo ratings yet

- 3rd Eye Capital - Exec SummaryDocument1 page3rd Eye Capital - Exec SummarygahtanNo ratings yet

- Pensford Rate Sheet - 07.07.14Document1 pagePensford Rate Sheet - 07.07.14Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 06.23.14Document1 pagePensford Rate Sheet - 06.23.14Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 09.15.2014Document1 pagePensford Rate Sheet - 09.15.2014Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 07.14.14Document1 pagePensford Rate Sheet - 07.14.14Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 06.02.14Document1 pagePensford Rate Sheet - 06.02.14Pensford FinancialNo ratings yet

- Ciena Thompson Hold+Document6 pagesCiena Thompson Hold+sinnlosNo ratings yet

- Pensford Rate Sheet - 05.28.13Document1 pagePensford Rate Sheet - 05.28.13Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 05.28.13Document1 pagePensford Rate Sheet - 05.28.13Pensford FinancialNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Pensford Rate Sheet - 07.08.13Document1 pagePensford Rate Sheet - 07.08.13Pensford FinancialNo ratings yet

- 36ONE Fact Sheets SeptemberDocument3 pages36ONE Fact Sheets Septemberrdixit2No ratings yet

- Pensford Rate Sheet - 08.18.14Document1 pagePensford Rate Sheet - 08.18.14Pensford FinancialNo ratings yet

- IQS Report July2010Document8 pagesIQS Report July2010ZerohedgeNo ratings yet

- Pensford Rate Sheet - 01.13.14Document1 pagePensford Rate Sheet - 01.13.14Pensford FinancialNo ratings yet

- Net Long Short Net Long Short Exposure P&L YTD: June Exposure & Performance PerformanceDocument1 pageNet Long Short Net Long Short Exposure P&L YTD: June Exposure & Performance PerformancenabsNo ratings yet

- Pensford Rate Sheet - 10.07.13Document1 pagePensford Rate Sheet - 10.07.13Pensford FinancialNo ratings yet

- Particulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012Document4 pagesParticulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012saboorakheeNo ratings yet

- Oward Imons B R: OnnectionsDocument4 pagesOward Imons B R: Onnectionsapi-245850635No ratings yet

- Pensford Rate Sheet - 06.09.14Document1 pagePensford Rate Sheet - 06.09.14Pensford FinancialNo ratings yet

- B&I DBBL PRSNDocument42 pagesB&I DBBL PRSNMahirNo ratings yet

- ML Stragegic Balance INDEX - FACT SHEETDocument3 pagesML Stragegic Balance INDEX - FACT SHEETRaj JarNo ratings yet

- UnciaSmartPremia Weekly22072016Document2 pagesUnciaSmartPremia Weekly22072016julienmessias2No ratings yet

- Pensford Rate Sheet - 09.02.2014Document1 pagePensford Rate Sheet - 09.02.2014Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 07.09.12Document1 pagePensford Rate Sheet - 07.09.12Pensford FinancialNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Woof JunctionDocument13 pagesWoof JunctionUzma KhanNo ratings yet

- Attrition Dashboard - May 31stDocument12 pagesAttrition Dashboard - May 31st32587412369No ratings yet

- Name: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialDocument8 pagesName: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialAkash MehtaNo ratings yet

- 2013 6 June Monthly Report TPOUDocument1 page2013 6 June Monthly Report TPOUSharonWaxmanNo ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Time Technoplast LTD TIMETECHNODocument4 pagesTime Technoplast LTD TIMETECHNOsm255No ratings yet

- Pensford Rate Sheet - 10.22.12Document1 pagePensford Rate Sheet - 10.22.12Pensford FinancialNo ratings yet

- EDHEC-Risk Alternative Indexes - Overview February 2011Document1 pageEDHEC-Risk Alternative Indexes - Overview February 2011chris_clair9652No ratings yet

- Morningstar® Portfolio X-Ray: H R T y UDocument5 pagesMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNo ratings yet

- Pensford Rate Sheet - 07.23.12Document1 pagePensford Rate Sheet - 07.23.12Pensford FinancialNo ratings yet

- Treasury Rates: Rates Monday, June 24th, 2013Document1 pageTreasury Rates: Rates Monday, June 24th, 2013Pensford FinancialNo ratings yet

- Pensford Rate Sheet - 02.18.14Document1 pagePensford Rate Sheet - 02.18.14Pensford FinancialNo ratings yet

- Derivatives Report 21st March 2012Document3 pagesDerivatives Report 21st March 2012Angel BrokingNo ratings yet

- Derivatives Report 25th April 2012Document3 pagesDerivatives Report 25th April 2012Angel BrokingNo ratings yet

- BT - Flexible Backtesting For Python - BT 0.2.10 DocumentationDocument9 pagesBT - Flexible Backtesting For Python - BT 0.2.10 DocumentationSomeoneNo ratings yet

- Gds Two Pager 2011 DecDocument2 pagesGds Two Pager 2011 DecridnaniNo ratings yet