Professional Documents

Culture Documents

Chapter 14: Money, Interest Rates, and Exchange Rates Multiple Choice Questions

Chapter 14: Money, Interest Rates, and Exchange Rates Multiple Choice Questions

Uploaded by

Bill BennttOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 14: Money, Interest Rates, and Exchange Rates Multiple Choice Questions

Chapter 14: Money, Interest Rates, and Exchange Rates Multiple Choice Questions

Uploaded by

Bill BennttCopyright:

Available Formats

Chapter 14: Money, Interest Rates, and Exchange Rates Multiple Choice Questions 1.

The exchange rate between currencies depends on A. the interest rate that can be earned on deposits of those currencies. B. the expected future exchange rate. C. the interest rate that can be earned on deposits of those currencies and the expected future exchange rate. D. national output. E. None of the above. Answer: B . !one" serves as A. a #ediu# of exchange. B. a unit of account. C. a store of value. D. All of the above. E. $nl" A and B Answer: D %. !one" includes A. currenc". B. ban& deposits on which chec& #a" be written. C. both A and B. D. travelers' chec&s. E. A( B and D. Answer: E ). *n the +nited ,tates at the end of ---( the total #one" suppl"( !1( a#ounted to approxi#atel" A. 1- percent of that "ear's .N/. B. - percent of that "ear's .N/. C. %- percent of that "ear's .N/. D. )- percent of that "ear's .N/. E. 0- percent of that "ear's .N/. Answer: A

112

0.

*ndividuals base their de#and for an asset on A. the expected return the asset offers co#pared with the returns offered b" other assets. B. the ris&iness of the asset's expected return. C. the asset's li3uidit". D. All of the above. E. $nl" A and B. Answer: D

4.

The fa#il" su##er house on Cape Code pa"s a return in the for# of A. interest rate. B. capital gains. C. the pleasure of vacations at the beach. D. A( B and C. E. B and C onl". Answer: E

5.

*n a world with #one" and bonds onl"( A. it is ris&" to hold #one". B. it is not ris&" to hold #one". C. ris& does affect the de#and for #one". D. there is no relationship between ris& and holding #one". E. None of the above. Answer: A

1.

6hich one of the following state#ents is the #ost accurate7 A. A rise in the average value of transactions carried out b" a household or a fir# causes its de#and for #one" to fall. B. A reduction in the average value of transactions carried out b" a household or a fir# causes its de#and for #one" to rise. C. A rise in the average value of transactions carried out b" a household or a fir# causes its de#and for #one" to rise. D. A rise in the average value of transactions carried out b" a household or a fir# causes its de#and for no#inal #one" to rise. E. A rise in the average value of transactions carried out b" a household or a fir# causes its de#and for real #one" to rise. Answer: E

12-

2.

The aggregate #one" de#and depends on A. the interest rate. B. the price level. C. real national inco#e. D. All of the above. E. $nl" A and C. Answer: D

1-.

The aggregate real #one" de#and schedule 89:(;< A. slopes upward because a fall in the interest rate raises the desired real #one" holdings of each household and fir# in the econo#". B. slopes downward because a fall in the interest rate reduces the desired real #one" holdings of each household and fir# in the econo#". C. has a =ero slope because a fall in the interest rate &eeps constant the desired real #one" holdings of each household and fir# in the econo#". D. slopes downward because a fall in the interest rate raises the desired real #one" holdings of each household and fir# in the econo#". E. None of the above. Answer: D

11.

>or a given level of A. no#inal .N/( changes in interest rates cause #ove#ents along the 89:(;< schedule. B. real .N/( changes in interest rates cause a decrease of the 89:(;< schedule. C. real .N/( changes in interest rates cause an increase of the 89:(;< schedule. D. no#inal .N/( changes in interest rates cause an increase in the 89:(;< schedule. E. real .N/( changes in interest rates cause #ove#ents along the 89:(;< schedule. Answer: E

121

1 .

A rise in A. real .N/ decreases aggregate real #one" de#and for a given interest rate( #oving the 89:(;< schedule to the right. B. real .N/ raises aggregate real #one" de#and for a given interest rate( #oving the 89:(;< schedule to the left. C. real .N/ raises aggregate real #one" de#and for a given interest rate( #oving the 89:(;< schedule to the right. D. no#inal .N/ raises aggregate real #one" de#and for a given interest rate( #oving the 89:(;< schedule to the right. E. real .N/ raises aggregate no#inal #one" de#and for a given interest rate( #oving the 89:(;< schedule to the right. Answer: C

1%.

The #one" suppl" schedule is A. hori=ontal because !, is set b" the central ban& while / is ta&en as given. B. vertical because !, is set b" the central ban&. C. vertical because !, is set b" the households and fir#s while / is ta&en as given. D. vertical because !, and / are set b" the central ban&. E. vertical because !, is set b" the central ban& while / is ta&en as given. Answer: E

1).

*f there is initiall" A. excess de#and for #one"( the interest rate falls( and if there is initiall" an excess suppl"( it rises. B. excess suppl" of #one"( the interest rate falls( and if there is initiall" an excess de#and( it rises. C. excess suppl" of #one"( the interest rate increases( and if there is initiall" an excess de#and( it falls. D. excess suppl" of #one"( the interest rate falls( and if there is initiall" an excess de#and( it further falls. E. None of the above. Answer: B

12

10.

6hich one of the following state#ents is the #ost accurate7 A. A decrease in the #one" suppl" lowers the interest rate( while an increase in the #one" suppl" raises the interest rate( given the price level and output. B. An increase in the #one" suppl" lowers the interest rate( while a fall in the #one" suppl" raises the interest rate( given the price level. C. An increase in the #one" suppl" lowers the interest rate( while a fall in the #one" suppl" raises the interest rate( given the output level. D. An increase in the #one" suppl" lowers the interest rate( while a fall in the #one" suppl" raises the interest rate( given the price level and output. E. None of the above. Answer: D

14.

An increase in A. no#inal output raises the interest rate( while a fall in real output lowers the interest rate( given the price level and the #one" suppl". B. real output decreases the interest rate( while a fall in real output increases the interest rate( given the price level. C. real output raises the interest rate( while a fall in real output lowers the interest rate( given the #one" suppl". D. no#inal output raises the interest rate( while a fall in real output lowers the interest rate( given the price level. E. real output raises the interest rate( while a fall in real output lowers the interest rate( given the price level and the #one" suppl". Answer: E

15.

An increase in a countr"'s #one" suppl" causes A. its currenc" to appreciate in the foreign exchange #ar&et( while a reduction in the #one" suppl" causes its currenc" to depreciate. B. its currenc" to depreciate in the foreign exchange #ar&et( while a reduction in the #one" suppl" causes its currenc" to appreciate. C. no effect on the values of its currenc" in international #ar&ets. D. its currenc" to depreciate in the foreign exchange #ar&et( while a reduction in the #one" suppl" causes its currenc" to further depreciate. E. None of the above. Answer: B

12%

11.

6hich one of the following state#ents is the #ost accurate7 A. .iven /+,( when the #one" suppl" rises( the dollar interest rate declines and the dollar depreciates against the euro. B. .iven ;+,( when the #one" suppl" rises( the dollar interest rate declines and the dollar depreciates against the euro. C. .iven /+, and ;+,( when the #one" suppl" decreases( the dollar interest rate declines and the dollar depreciates against the euro. D. .iven /+, and ;+,( when the #one" suppl" rises( the dollar interest rate declines and the dollar appreciates against the euro. E. .iven /+, and ;+,( when the #one" suppl" rises( the dollar interest rate declines and the dollar depreciates against the euro. Answer: E

12.

.iven /+, and ;+,( A. an increase in the European #one" suppl" causes the euro to appreciate against the dollar( but it does not disturb the +.,. #one" #ar&et e3uilibriu#. B. an increase in the European #one" suppl" causes the euro to appreciate against the dollar( and it creates excess de#and for dollars in the +.,. #one" #ar&et. C. an increase in the European #one" suppl" causes the euro to depreciate against the dollar( and it creates excess de#and for dollars in the +.,. #one" #ar&et. D. an increase in the European #one" suppl" causes the euro to depreciate against the dollar( but it does not disturb the +.,. #one" #ar&et e3uilibriu#. E. None of the above state#ents is true. Answer: D

-.

An econo#"'s long?run e3uilibriu# is A. the e3uilibriu# that would occur if prices were perfectl" flexible. B. the e3uilibriu# that would occur if prices were perfectl" flexible and alwa"s ad@usted i##ediatel". C. the e3uilibriu# that would occur if prices were perfectl" flexible and alwa"s ad@usted i##ediatel" to preserve full e#plo"#ent. D. the e3uilibriu# that would occur if prices were perfectl" fixed to preserve full e#plo"#ent. E. the e3uilibriu# that would occur if prices were perfectl" fixed at the full e#plo"#ent point. Answer: C

12)

1.

6hich one of the following state#ents is the #ost accurate7 A. $nl" the long?run e3uilibriu# price level is the value of / satisf"ing /A!,B89:(;<. B. $nl" the short?run e3uilibriu# price level is the value of / satisf"ing /A!,B89:(;<. C. The short and long?run e3uilibriu# price level is the value of / satisf"ing /A!,B89:(;<. D. The long?run e3uilibriu# price level is the value of / satisf"ing /A!DB89:(;<. E. None of the above. Answer: C

An increase in a countr"'s #one" suppl" A. causes a #ore than proportional increase in its price level. B. causes a less than proportional increase in its price level. C. causes a proportional increase in its price level. D. leaves its price level constant in long?run e3uilibriu#. E. None of the above. Answer: C

%.

A change in the level of the suppl" of #one" A. increases the long?run values of the interest rate and real output. B. decreases the long?run values of the interest rate and real output. C. has no effect on the long?run value of onl" the interest rate. D. has no effect on the long?run value of onl" real output. E. has no effect on the long?run values of the interest rate and real output. Answer: E

).

Changes in the #one" suppl" growth rate A. are neutral in the short run. B. need not be neutral in the short run. C. are neutral both in the short and long run. D. are neutral in the long run. E. need not be neutral in the long run. Answer: D

120

0.

A sustained change in the #onetar" growth rate will A. i##ediatel" affect e3uilibriu# real #one" balances b" raising the #one" interest rate. B. eventuall" affect e3uilibriu# no#inal #one" balances b" raising the #one" interest rate. C. eventuall" affect e3uilibriu# real #one" balances b" reducing the #one" interest rate. D. eventuall" affect e3uilibriu# real #one" balances b" raising the real interest rate. E. eventuall" affect e3uilibriu# real #one" balances b" raising the #one" interest rate. Answer: E

4.

!one" de#and behavior #a" A. change as a result of de#ographic trends or financial innovations such as electronic cash?transfer facilities. B. change onl" as a result of de#ographic trends. C. change onl" as a result of financial innovations such as electronic cash? transfer facilities. D. not change as a result of de#ographic trends or financial innovations such as electronic cash?transfer facilities. E. change as a result of de#ographic trends but not as a result of financial innovations such as electronic cash?transfer facilities. Answer: A

5.

6hich one of the following state#ents is the #ost accurate7 *n a A. cross?section of countries( long?ter# changes in #one" supplies and price levels show a clear negative correlation. B. ti#e series of countries( long?ter# changes in #one" supplies and price levels show a clear positive correlation. C. cross?section of countries( short?ter# changes in #one" supplies and price levels show a clear negative correlation. D. cross?section of countries( short?ter# changes in #one" supplies and price levels show a clear positive correlation. E. cross?section of countries( long?ter# changes in #one" supplies and price levels show no clear correlation. Answer: A

124

1.

>or .er#an"( long?ter# changes in #one" supplies and price levels A. do not show a clear positive correlation. B. show a clear positive correlation. C. do not show a clear negative correlation. D. do show a high and significant positive correlation. E. None of the above. Answer: A

2.

;ear?b"?"ear data fro# 1212 C --- show that A. there is a strong positive relationship between average 8atin A#erican #one"?suppl" growth and inflation. B. there is a strong negative relationship between average 8atin A#erican #one"?suppl" growth and inflation. C. there is a strong positive relationship between average 8atin A#erican #one"?suppl" growth and deflation. D. it is difficult to find a strong positive relationship between average 8atin A#erican #one"?suppl" growth and inflation. E. there is a wea& positive relationship between average 8atin A#erican #one"? suppl" growth and inflation. Answer: A

%-.

6hich one of the following state#ents is the #ost accurate7 A. A per#anent increase in a countr"'s #one" suppl" causes a proportional long? run depreciation of its currenc" against foreign currencies. B. A te#porar" increase in a countr"'s #one" suppl" causes a proportional long? run depreciation of its currenc" against foreign currencies. C. A per#anent increase in a countr"'s #one" suppl" causes a proportional long? run appreciation of its currenc" against foreign currencies. D. A per#anent increase in a countr"'s #one" suppl" causes a proportional short?run depreciation of its currenc" against foreign currencies. E. A per#anent increase in a countr"'s #one" suppl" causes a proportional short?run appreciation of its currenc" against foreign currencies. Answer: A

125

%1.

6ages A. enter indices of the price level directl". B. do not enter indices of the price level directl"( but the" #a&e up a s#all fraction of the cost of producing goods and services. C. do not enter indices of the price level directl"( but the" #a&e up a negligible fraction of the cost of producing goods and services. D. do not enter indices of the price level directl"( but the" #a&e up a large fraction of the cost of producing goods and services. E. None of the above. Answer: D

% .

>or all the #ain industrial countries in recent "ears( A. the exchange rate is #uch #ore variable than relative price levels. B. the exchange rate is #uch less variable than relative price levels. C. the exchange rate is as variable as the relative price levels. D. *t is hard to tell fro# the data whether the exchange rate is #uch #ore variable than relative price levels. E. None of the above. Answer: A

%%.

>or all the #ain industrial countries in recent "ears( A. there is #uch less #onth?to?#onth variabilit" of the exchange rate( suggesting that price levels are relativel" stic&" in the short run. B. there is #uch #ore #onth?to?#onth variabilit" of the exchange rate( suggesting that price levels are relativel" stic&" in the short run. C. there is al#ost the sa#e #onth?to?#onth variabilit" of the exchange rate and price levels. D. it is hard to tell whether #onth?to?#onth variabilit" of the exchange rate is si#ilar to changes in price levels. E. there is #uch #ore #onth?to?#onth variabilit" of the exchange rate( suggesting that price levels are relativel" stic&" in the long run. Answer: B

121

%).

6hich one of the following state#ents is the #ost accurate7 A. There is a livel" acade#ic debate over the possibilit" that see#ingl" stic&" wages and prices are in realit" 3uite fixed. B. There is a livel" acade#ic debate over the possibilit" that see#ingl" stic&" wages and prices are in realit" #uch #ore stic&" than theor" assu#es. C. There is a livel" acade#ic debate over the possibilit" that see#ingl" stic&" wages and prices are in realit" 3uite flexible. D. There is no debate over the possibilit" that wages and prices are stic&" in the long run. E. There is no debate over the possibilit" that wages and prices are stic&" in the short run. Answer: C

%0.

During h"perinflation( exploding inflation causes real #one" de#and to A. fall over ti#e( and this additional #onetar" change #a&es #one" prices rise even #ore 3uic&l" than the #one" suppl" itself rises. B. increase over ti#e( and this additional #onetar" change #a&es #one" prices rise even #ore 3uic&l" than the #one" suppl" itself rises. C. fall over ti#e( and this additional #onetar" change #a&es #one" prices decrease even #ore 3uic&l" than the #one" suppl" itself rises. D. fall over ti#e( and this additional #onetar" change #a&es #one" prices rise even #ore 3uic&l" than the #one" suppl" itself rises. E. fall over ti#e( and this additional #onetar" change #a&es #one" prices decrease even less 3uic&l" than the #one" suppl" itself rises. Answer: A

%4.

*n a classic paper( Colu#bia +niversit" econo#ist /hillip Cagan drew the line between inflation and h"perinflation at an inflation rate of A. 0- percent per #onth. B. 1- percent per #onth. C. - percent per #onth. D. 0 percent per #onth. E. 0 percent per #onth. Answer: A

%5.

*n a classic paper( Colu#bia +niversit" econo#ist /hillip Cagan drew the line

122

between inflation and h"perinflation at an inflation rate of A. #ore than 1 - percent per "ear. B. #ore than 1-- percent per "ear. C. #ore than -- percent per "ear. D. #ore than 1 (--- percent per "ear. E. #ore than 1(--- percent per "ear. Answer: D %1. *n a world where the price level could ad@ust i##ediatel" to its new long?run level after a #one" suppl" increase( A. the dollar interest rate would increase because prices would ad@ust i##ediatel" and prevent the #one" suppl" fro# rising. B. the dollar interest rate would fall because prices would ad@ust i##ediatel" and prevent the #one" suppl" fro# rising. C. the dollar interest rate would fall because prices would ad@ust i##ediatel" and prevent the #one" suppl" fro# decreasing. D. the dollar interest rate would decrease because prices would ad@ust i##ediatel" and prevent the #one" suppl" fro# decreasing. E. None of the above. Answer: B %2. After a per#anent increase in the #one" suppl"( A. the exchange rate overshoots in the short run. B. the exchange rate overshoots in the long run. C. the exchange rate s#oothl" depreciates in the short run. D. the exchange rate s#oothl" appreciates in the short run. E. None of the above. Answer: A

--

Essay Questions 1. 6hat are the #ain functions of #one"7

Answer: !one" serves in general three i#portant functions: a #ediu# of exchangeD a unit of accountD and a store of value. As a #ediu# of exchange( #one" avoids going bac& to a barter econo#"( with the enor#ous search costs connected with it. As a unit of account( the use of #one" econo#i=es on the nu#ber of prices an individual faces. Consider an econo#" with N goods( then one needs onl" 9N? 1< prices. As a store of value( the use of #one" in general ensures that "ou can transfer wealth between periods. . 6hat are the factors that deter#ine the a#ount of #one" an individual desires to hold7

Answer: Three #ain factors: first( the expected return the asset offers co#pared with the returns offered b" other assetsD second( the ris&iness of the asset's expected returnD and third( the asset's li3uidit". %. 6hat are the #ain factors deter#ining the aggregate #one" de#and7

Answer: Three #ain factors: interest rate( the price level( and real national inco#e. A rise in the interest rate causes each individual in the econo#" to reduce her de#and for #one". *f the price level rises( individual households and fir#s will spend #ore #one" than before. 6hen real national inco#e 9.N/< rises( the de#and for #one" will rise. ). Explain wh" one can write the de#and for #one" as follows: !d A / 8 9:( ;<. Answer: The aggregate #one" de#and is proportional to the price level. *#agine that all prices in an econo#" doubled( but the interest rate and ever"one's real inco#es re#ained unchanged. Then( the #one" value of each individual's average dail" transactions would then si#pl" double( as would the a#ount of #one" each wishes to hold. 0. 6hat will be the effects of an increase in the #one" suppl" on the interest rate7

Answer: An increase in the #one" suppl" will cause the interest rate to decrease. This should increase invest#ent and possibl" consu#ption of durable goods. The reduction in the interest rate will cause a depreciation of the dollar.

-1

4.

6hat will be the effects of an increase in real national inco#e on the interest rate7

Answer: An increase in real national inco#e will increase the interest rate. *f invest#ent depends onl" on interest rate( this will cause invest#ent to go down. The increases interest rate will cause an appreciation of the dollar. 5. Anal"=e the effects of an increase in the European #one" suppl" on the dollarBeuro exchange rate.

Answer: The #ain points are: An increase in the European #one" suppl" will reduce the interest rate on the euro( and thus causes the euro to depreciates against the dollar. The +.,. #one" de#and and #one" suppl" are not going to be affected( and thus the interest rate in the +.,. will re#ain the sa#e. 1. Explain how the #one" #ar&ets of two countries are lin&ed through the foreign exchange #ar&et.

Answer: The #onetar" polic" actions b" the >ed affect the +.,. interest rate( changing the dollarBeuro exchange rate that clears the foreign exchange #ar&et. The European ,"ste# of Central Ban&s 9E,CB< can affect the exchange rate b" changing the European #one" suppl" and interest rate. 2. EAlthough the price levels appear to displa" short?run stic&iness in #an" countries( a change in the #one" suppl" creates i##ediate de#and and cost pressures that eventuall" lead to future increase in the price level.F Discuss.

Answer: 9,ee pages %)52 C %1-<. The state#ent is true. The pressures co#e fro# three #ain sources: excess de#and for output and laborD inflationar" expectationsD and raw #aterial prices. 1-. Explain the effects of a per#anent increase in the +.,. #one" suppl" in the short run and in the long run. Assu#e that the +.,. real national inco#e is constant.

An increase in the no#inal #one" suppl" raises the real #one" suppl"( lowering the interest rate in the short run. The #one" suppl" increase is considered to continue in the futureD thus( it will affect the exchange rate expectations. This will #a&e the expected return on the euro #ore desirable and thus the dollar depreciates. *n the case of a per#anent increase in the +.,. #one" suppl"( the dollar depreciates #ore than under a te#porar" increase in the #one" suppl". Now( in the long run( prices will rise until the real #one" balances are the sa#e as before the per#anent increase in the #one" suppl". ,ince the output level is given( the +.,. interest rate( which decreased before( will start to increase( until it will #ove bac& to its original level. The e3uilibriu# interest rate #ust be the sa#e as its original long ?run value. This increase in the interest rate #ust cause the dollar to appreciate against the euro after its sharp depreciation as a result of the per#anent increase in the #one" suppl". ,o a large

depreciation is followed b" an appreciation of the dollar. Eventuall"( the dollar depreciates in proportion to the increase in the price level( which in turn increases b" the sa#e proportion as the per#anent increase in the #one" suppl". Thus( #one" is neutral( in the sense that it cannot affect in the long run real variables( such as output( invest#ent( etc.

-%

Quantitative/Graphing ro!le"s 1. +sing a figure describing both the +.,. #one" #ar&et and the foreign exchange #ar&et( anal"=e the effects of a te#porar" increase in the European #one" suppl" on the dollarBeuro exchange rate.

Answer: An increase in the European #one" suppl" will reduce the interest rate on the euro and thus will cause the schedule of the expected euro return expressed in dollars to shift down( causing a reduction in the dollarBeuro exchange rate( that is( an appreciation of the +.,. Dollar. The euro depreciates against the dollar. The +.,. #one" de#and and #one" suppl" are not going to be affected( and thus the interest rate in the +.,. will re#ain the sa#e.

-)

+sing a figure describing both the +.,. #one" #ar&et and the foreign exchange #ar&et( anal"=e the effects of an increase in the +.,. #one" suppl" on the dollarBeuro exchange rate.

Answer: An increase in the +.,. #one" suppl" will cause the interest rate to decrease. This should increase invest#ent and possibl" consu#ption of durable goods. The reduction in the interest rate will cause a #ove#ent to the left along the schedule depicting the expected euro return expressed in dollars. The result is an increase in E or a depreciation of the dollar.

-0

%.

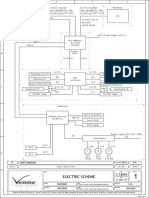

Explain the following figure:

Answer: The figure explains how the #one" #ar&ets of two countries are lin&ed through the foreign exchange #ar&et. The #onetar" polic" actions b" the >ed affect the +.,. interest rate( changing the dollarBeuro exchange rate that clears the foreign exchange #ar&et. The European ,"ste# of Central Ban&s 9E,CB< can affect the exchange rate b" changing the European #one" suppl" and interest rate.

-4

).

+sing figures for both the short run and the long run( show the effects of a per#anent increase in the +.,. #one" suppl". Tr" to line up "our figures to the short and long run e3uilibria side b" side. Assu#e that the +.,. real national inco#e is constant.

Answer:

An increase in the no#inal #one" suppl" raises the real #one" suppl"( lowering the interest rate in the short run 9the #ove#ent fro# 1 to on the lower left figure<. The #one" suppl" increase is considered to continue in the future( and thus it will affect the exchange rate expectations. This will #a&e the expected return on the euro #ore desirable and thus the dollar depreciates. *n the case of a per#anent increase in the +.,. #one" suppl"( the dollar depreciates #ore than under a te#porar" increase in the #one" suppl" 9fro# point 1' to point ' in the upper left figure<. *n the long run( 9the right hand side figure<( prices will rise until the real #one" balances are the sa#e as before the per#anent increase in the #one" suppl" 9fro# point to point )( in the lower right figure<. ,ince the output level is given( the +.,. interest rate( which decreased before( will start to increase( until it will #ove bac& to its original level 9fro#

-5

/oint to ) in the lower left figure<. The e3uilibriu# interest rate #ust be the sa#e as its original long?run value 9at point ) in the lower right figure<. This increase in the interest rate #ust cause the dollar to appreciate against the euro after its sharp depreciation as a result of the per#anent increase in the #one" suppl" 9this process is depicted in the upper right figure fro# point ' to )'<. ,o a large depreciation 9fro# point 1' in the left upper figure to pint ' in both the left and right upper figures< is followed b" an appreciation of the dollar 9the #ove#ent fro# ' to point )' in the upper right hand side figure<. Eventuall"( the dollar depreciates in proportion to the increase in the price level( which in turn increases b" the sa#e proportion as the per#anent increase in the #one" suppl". Thus( #one" is neutral( in the sense that it cannot affect in the long?run real variables( such as output( invest#ent( etc. Note that points %' and )' represent the sa#e exchange rate.

-1

0.

+sing ) different figures( plot the ti#e paths showing the effects of a per#anent increase in the +nited ,tates #one" suppl" on: A. +.,. #one" suppl". B. the dollar interest rate. C. the +.,. price level. D. the dollarBeuro exchange rate.

Answer: ,ee below.

-2

You might also like

- Abel & Bernanke Macroeconomics Study Guide QuestionsDocument13 pagesAbel & Bernanke Macroeconomics Study Guide Questionskranium2391% (11)

- Statement of Purpose For PHDDocument2 pagesStatement of Purpose For PHDShamsuddeen Nalakath50% (2)

- TBCH 15Document29 pagesTBCH 15Bill Benntt100% (1)

- TBCH 07Document14 pagesTBCH 07Bill BennttNo ratings yet

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttNo ratings yet

- Krugman TB ch01Document10 pagesKrugman TB ch01b4rfb4rf100% (2)

- Chapter 8 MishkinDocument20 pagesChapter 8 MishkinLejla HodzicNo ratings yet

- Untitled13 PDFDocument22 pagesUntitled13 PDFErsin TukenmezNo ratings yet

- Perloff Tb06 Ec300Document24 pagesPerloff Tb06 Ec300shahid_hussain_41No ratings yet

- Ec305 1Document120 pagesEc305 1sahmed7060% (1)

- Chapter 05 Risk and Return: Past and PrologueDocument30 pagesChapter 05 Risk and Return: Past and Prologuesaud141192% (13)

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttNo ratings yet

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttNo ratings yet

- TBCH 15Document29 pagesTBCH 15Bill Benntt100% (1)

- TBCH 07Document14 pagesTBCH 07Bill BennttNo ratings yet

- HowTo Downloading Genomic DataDocument2 pagesHowTo Downloading Genomic DataJack SimNo ratings yet

- PytonCode-PSSE FULLTEXT01Document105 pagesPytonCode-PSSE FULLTEXT01fpttmm100% (1)

- Section 11B Gas Tanker Operating ManualDocument117 pagesSection 11B Gas Tanker Operating Manualeuro707No ratings yet

- TBCH 16Document19 pagesTBCH 16Bill Benntt100% (1)

- TBCH 12Document18 pagesTBCH 12Bill BennttNo ratings yet

- TBCH 17Document23 pagesTBCH 17Bill Benntt100% (3)

- TBCH 19Document22 pagesTBCH 19Bill BennttNo ratings yet

- TBCH 18Document24 pagesTBCH 18Bill BennttNo ratings yet

- TBCH 11Document13 pagesTBCH 11Bill BennttNo ratings yet

- TBCH 02Document14 pagesTBCH 02Bill Benntt100% (3)

- TBCH 13Document25 pagesTBCH 13Bill BennttNo ratings yet

- TBCH 05Document14 pagesTBCH 05Bill Benntt100% (1)

- TBCH 01Document13 pagesTBCH 01Bill BennttNo ratings yet

- TBCH 10Document12 pagesTBCH 10Bill BennttNo ratings yet

- Krugman TB ch08Document11 pagesKrugman TB ch08Teresita Tan ContrerasNo ratings yet

- TBCH 08Document12 pagesTBCH 08Bill BennttNo ratings yet

- Krugman TB Ch07 With AnswersDocument340 pagesKrugman TB Ch07 With AnswersJean ChanNo ratings yet

- International EconomicsDocument25 pagesInternational EconomicsBill BennttNo ratings yet

- StudentDocument31 pagesStudentKevin CheNo ratings yet

- 13.1 Exchange Rates and International TransactionsDocument27 pages13.1 Exchange Rates and International Transactionsjandihuyen83% (6)

- Test 2 Sample MCQ (4-8)Document13 pagesTest 2 Sample MCQ (4-8)gg ggNo ratings yet

- Chapter 14Document33 pagesChapter 14Tugay Elbeller67% (3)

- Chapter 12 Pricing and Advertising: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)Document13 pagesChapter 12 Pricing and Advertising: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)kangNo ratings yet

- Chapter 13 National Income Accounting and The Balance of PaymentsDocument51 pagesChapter 13 National Income Accounting and The Balance of PaymentsBill BennttNo ratings yet

- Chapter 11Document15 pagesChapter 11kangNo ratings yet

- Krugman TB Ch09Document12 pagesKrugman TB Ch09vermanerds100% (1)

- 203 Sample Midterm2Document16 pages203 Sample Midterm2Annas GhafoorNo ratings yet

- Chapter 10 MishkinDocument22 pagesChapter 10 MishkinLejla HodzicNo ratings yet

- Chapter 13 Game Theory: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)Document12 pagesChapter 13 Game Theory: Microeconomics: Theory and Applications With Calculus, 4e, Global Edition (Perloff)kangNo ratings yet

- More Multiple Choice Questions With AnswersDocument14 pagesMore Multiple Choice Questions With AnswersJudz Sawadjaan100% (2)

- Econ 201 Mid Term ReviewDocument7 pagesEcon 201 Mid Term ReviewGeorge DhimaNo ratings yet

- Chapter 14Document10 pagesChapter 14kang100% (1)

- Chap24 Production and GrowthDocument82 pagesChap24 Production and GrowthThanh ThưNo ratings yet

- 1010 CHP 20Document40 pages1010 CHP 20haaaNo ratings yet

- Chapter 10Document10 pagesChapter 10kangNo ratings yet

- Applying The Competitive Model: Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument24 pagesApplying The Competitive Model: Choose The One Alternative That Best Completes The Statement or Answers The QuestionMirzaNo ratings yet

- TBCH 06Document12 pagesTBCH 06Bill BennttNo ratings yet

- Quiz 523Document17 pagesQuiz 523Haris NoonNo ratings yet

- Chapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8eDocument31 pagesChapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8ePranta SahaNo ratings yet

- Chapter 4: (Market Forces of Supply and Demand) Section ADocument11 pagesChapter 4: (Market Forces of Supply and Demand) Section APhạm HuyNo ratings yet

- 201 Final Winter 2013 V1aDocument11 pages201 Final Winter 2013 V1aKhalil Ben JemiaNo ratings yet

- Capital Structure and Leverage: Multiple Choice: ConceptualDocument56 pagesCapital Structure and Leverage: Multiple Choice: ConceptualEngr Fizza AkbarNo ratings yet

- Chapter 23aDocument7 pagesChapter 23amas_999No ratings yet

- Chapter 25aDocument7 pagesChapter 25amas_999No ratings yet

- Chapter 7: Inflation: Multiple Choice QuestionsDocument29 pagesChapter 7: Inflation: Multiple Choice QuestionsAliya JamesNo ratings yet

- Chapter 08aDocument7 pagesChapter 08amas_999No ratings yet

- Chapter 22aDocument7 pagesChapter 22amas_999No ratings yet

- Chapter 25bDocument7 pagesChapter 25bmas_999No ratings yet

- The ISLM World: D1 FactualDocument20 pagesThe ISLM World: D1 FactualNora RadNo ratings yet

- Finman Chap7Document80 pagesFinman Chap7Jollybelleann MarcosNo ratings yet

- Rational Expectations: Theory and Policy Implications: D1 FactualDocument11 pagesRational Expectations: Theory and Policy Implications: D1 FactualNora RadNo ratings yet

- Bonds and ValuationDocument83 pagesBonds and ValuationraetohjrNo ratings yet

- Tutorial 3 Answer EconomicsDocument9 pagesTutorial 3 Answer EconomicsDanial IswandiNo ratings yet

- PS4Document11 pagesPS4Rashid AyubiNo ratings yet

- International EconomicsDocument25 pagesInternational EconomicsBill BennttNo ratings yet

- 392Document14 pages392Bill Benntt100% (1)

- International EconomicsDocument25 pagesInternational EconomicsBill BennttNo ratings yet

- Chapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachDocument61 pagesChapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachBill BennttNo ratings yet

- Chapter 13 National Income Accounting and The Balance of PaymentsDocument51 pagesChapter 13 National Income Accounting and The Balance of PaymentsBill BennttNo ratings yet

- TBCH 21Document24 pagesTBCH 21Bill BennttNo ratings yet

- TBCH 22Document27 pagesTBCH 22Bill BennttNo ratings yet

- TBCH 08Document12 pagesTBCH 08Bill BennttNo ratings yet

- TBCH 13Document25 pagesTBCH 13Bill BennttNo ratings yet

- TBCH 06Document12 pagesTBCH 06Bill BennttNo ratings yet

- TBCH 10Document12 pagesTBCH 10Bill BennttNo ratings yet

- TBCH 11Document13 pagesTBCH 11Bill BennttNo ratings yet

- TBCH 02Document14 pagesTBCH 02Bill Benntt100% (3)

- TBCH 09Document13 pagesTBCH 09Bill BennttNo ratings yet

- TBCH 01Document13 pagesTBCH 01Bill BennttNo ratings yet

- TBCH 03Document13 pagesTBCH 03Bill BennttNo ratings yet

- TBCH 05Document14 pagesTBCH 05Bill Benntt100% (1)

- TBCH 04Document15 pagesTBCH 04Bill BennttNo ratings yet

- TBCH 22Document27 pagesTBCH 22Bill BennttNo ratings yet

- SERVICE AGREEMENT CONTRACT (AutoRecovered)Document3 pagesSERVICE AGREEMENT CONTRACT (AutoRecovered)Ivan KendrikNo ratings yet

- Lecture 1Document42 pagesLecture 1Tania Khan75% (4)

- Coaching, Counseling, and Supportive CommunicationDocument31 pagesCoaching, Counseling, and Supportive CommunicationMd SelimNo ratings yet

- HOMEROOM GUIDANCE MONITORING TOOL School LevelDocument2 pagesHOMEROOM GUIDANCE MONITORING TOOL School LevelCarla Mae MadlaoNo ratings yet

- E-Commerce Product Quick View - OdooDocument5 pagesE-Commerce Product Quick View - OdooKeluarga GadjahNo ratings yet

- Principles OF Sterile Technique: Prepared By: Mrs. R. M. Dimalibot RM, RN ManDocument36 pagesPrinciples OF Sterile Technique: Prepared By: Mrs. R. M. Dimalibot RM, RN ManCerisse RemoNo ratings yet

- Rockwell Automation Library of Process Objects: Central Reset (P - Reset)Document20 pagesRockwell Automation Library of Process Objects: Central Reset (P - Reset)NelsonNo ratings yet

- Government of Assam: State Level Police Recruitment Board, Assam Rehabari::: GuwahatiDocument1 pageGovernment of Assam: State Level Police Recruitment Board, Assam Rehabari::: GuwahatiMatibar RahmanNo ratings yet

- Office of Alumni Relations (SMU) Annual ReportDocument56 pagesOffice of Alumni Relations (SMU) Annual ReportTheingiZawNo ratings yet

- VodafoneDocument12 pagesVodafonedipanparmarNo ratings yet

- Secondary Data: References Saunders Et Al., Chapter 7Document6 pagesSecondary Data: References Saunders Et Al., Chapter 7Vivek Singh RanaNo ratings yet

- CRM in The Automobile Industry: Submitted By: Jatin Patel (75) Dhaval Goriya (29) Neha Shinde (103) Gumansinh RajputDocument7 pagesCRM in The Automobile Industry: Submitted By: Jatin Patel (75) Dhaval Goriya (29) Neha Shinde (103) Gumansinh RajputGumansinh RajputNo ratings yet

- Chapter 4 111Document8 pagesChapter 4 111angelyn.ardenoNo ratings yet

- MSDS Coloured Methylated SpiritsDocument10 pagesMSDS Coloured Methylated SpiritsThatoNo ratings yet

- A General Systems Theory of ProductivityDocument15 pagesA General Systems Theory of ProductivityAngela CastilloNo ratings yet

- Advanced 640 X 600 Pixel, Backside Illuminated Global Shutter, Ultra Compact Sensor, With High QE, High MTF, Excellent PLS, and Full-FeaturesDocument3 pagesAdvanced 640 X 600 Pixel, Backside Illuminated Global Shutter, Ultra Compact Sensor, With High QE, High MTF, Excellent PLS, and Full-FeaturesbananNo ratings yet

- Annex05 Electric SchemeDocument1 pageAnnex05 Electric SchemeRobertoNo ratings yet

- Config FileDocument51 pagesConfig FileNASSERNo ratings yet

- Final Project Report - Keiretsu: Topic Page NoDocument10 pagesFinal Project Report - Keiretsu: Topic Page NoRevatiNo ratings yet

- CIVIL AVIATION REQUIREMENTS FullDocument30 pagesCIVIL AVIATION REQUIREMENTS FullNambi RajanNo ratings yet

- Radiotelephony Basics: 1. General Operating ProceduresDocument10 pagesRadiotelephony Basics: 1. General Operating ProceduresArunNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Credit Risk Estimation TechniquesDocument31 pagesCredit Risk Estimation TechniquesHanumantha Rao Turlapati0% (1)

- XML DITA Authoring Training - TechTotalDocument4 pagesXML DITA Authoring Training - TechTotalTechTotalNo ratings yet

- NEC Express5800/R120f-1E System Configuration GuideDocument34 pagesNEC Express5800/R120f-1E System Configuration GuideBrucelee LeebouapaoNo ratings yet

- Networks Attack AssignmentDocument8 pagesNetworks Attack Assignmentg.d.s.bedi70No ratings yet