Professional Documents

Culture Documents

Letter To Meretec - MITL Creditors

Uploaded by

forespoke0 ratings0% found this document useful (0 votes)

1K views55 pagesApparently shareholders and investors into Meyado's associate company Meretec - MITL got back stabbed... After the company sales to CMA in Australia it does not look like they will see some cash back. But some did...

More details on Meyado's associate company poor governance on www.forespoke.com

Original Title

Letter to Meretec - MITL creditors

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentApparently shareholders and investors into Meyado's associate company Meretec - MITL got back stabbed... After the company sales to CMA in Australia it does not look like they will see some cash back. But some did...

More details on Meyado's associate company poor governance on www.forespoke.com

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views55 pagesLetter To Meretec - MITL Creditors

Uploaded by

forespokeApparently shareholders and investors into Meyado's associate company Meretec - MITL got back stabbed... After the company sales to CMA in Australia it does not look like they will see some cash back. But some did...

More details on Meyado's associate company poor governance on www.forespoke.com

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 55

SFP

semanaase hl.

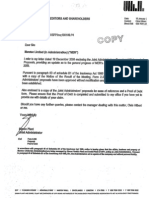

TO ALL KNOWN CREDITORS AND SHAREHOLDERS Date: 19 December 2008

Contact: Chis Hilbert

Direct Disk 020753 2362

OurRef: — MEROOO1/SFP/csh191208.P4

Dear Sirs

Meretec Limited {in Administration) (“MER”)

I refer to my letter dated 20 November 2008 which was provided to you with, inter aia, a brief explanation

of the effect/purpose of the Administration of MER and the next stage.

| have previously explained that, pursuant to Schedule 81, Paragraph 49 ofthe Insolvency Act 1986, the

‘Administrator is required, within 8 weeks of thelr appointment to provide creditors with a statement of

proposais for achieving the purpose or purposes specified.

To this end, | enclose a Report and Statement of Proposals, which provides an update as to general

progress of AL's Administration as at 18 December 2008, together with the Joint Administrators’

proposals.

Should you have any further queries, please contact the Manager dealing with this matter, Chris Hibert

tn cores wth pang 45 of Studd Bt fh elec At 8, not aay gna han, Bons ad papryo

rete Linited (n Adnistration) are being managed by inon Franklin Plant and Daniel Panto SFP, acting as Jone Administrators. Pursuant

topmiragh Sched of tie cohency Ret 1th Jot adnate pete cnpty an tet persoa ay.

SFP | PENSIGNHOUSE | ADMRALSWAY | MARSHWALL | DOCKLANDS 1 LONDON | E149Na 1 T c2075562272 | F 0m 75989922

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

Strictly Private and Confidential

Meretec Limited (In Administration)

Report to Creditors and

Statoment of Proposals

Pursuant to Paragraph 49(1) of

‘Schedule Bt to the Insolvency Act 1986

‘Simon Franklin Plant Daniel Plant

MIPA MABRP WIPA MABRP-

‘SFP

‘9 Ensign House

Admirals Way.

Marsh Wall

London

E14.9XQ

Tel: +44(207) 5382222

Fax: +44 207) 5369922

Email: simonp@sfplant.co.uk

danielp@stplant.co.uk

‘This report has been writen and presented forthe sole purpose of complying with the relevant provisions of the

Insolvency Act 1986 and the Enterprise Act 2002. It may not be deciosed, disseminated or copiod without our prior

wren permission, other than to those ented under statue or otherwise 2s ordered by the Court, and no laity wil

be accepted to any other person or party who acts of refrain from acting ons contents

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule B1 ofthe Insolvency Act 1986

Contents

4. Bxeeutve Summary

2 Intoducton

3. The Joint Administrators’ Appointment

4 Company History and Events Leasing othe Adninsration Order

5. The Pupose ofthe Administration

8, Evonts Fotowing the Joint Administrators’ Appointment Leading fo Inia Strategy

1. Gonorl Progress in Retain othe Adminstration

8, The'Staloment of Ass ar the Outcome for Crtors

8, Tho Joint Administrators! Costs

10, Adlon! Points Required tobe Mado Pursuant tothe Rules

11, The Dispensing of te Mootng of Credtors

12, The Joint Adminstrator Proposet

13, Anctay

‘Appendices

1 Statutory Information

| Estimated Stalenent of Aes as at 5 November 2008 / Creditors Deals /Dreclors Estimated Statement of Aas

Joint Administrators Receipts and Payments Accountto 18 December 2008

IV Breakdown of Adninisrators Fees

Breakdown of SFP Forensic Limited Feos

Vi_Breckdoun of SFP Datastoo Limited Fees

VIL SFP and Assoratd Enltos Charge Out Rates

Yl Proof of Dat Form

1K Gullo to Admbistetors and Liquidators Fees

x Form2216

Moretec Limited (In Administration)

Report to Creditors and Stat

ont of Proposals

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986,

4. Executive Summary

44. The Company was placed info Administration on 5 November 2008. The

purpose of rescuing the Company 2s a going conoem was not zchievable,

The primary purpose of the Administration was therefore to achieve @

botir result for the Company's creditors as a whole than would be Bkely if

the Company wore wound up (without fist being in Administration).

4.2. The Company traded as @ steel recycling company and developed a

niue process fo remove zine from galvanised steel. srgiteed ofce

‘was Grenville Court, Britwell Road, Bumham, Buckinghamshire, SL1 8DF.

Iti not occupy a physical eding adress in the UK, bututlised series

offices at 23 Berkeley Square, London,

13. The directors approached another firm of insolvency pracitioners in order

{to appoint Administrators as a result of the global credit aisis and the

share value In CMA Corporaton plummating. At the fime of the

‘Administration, ito longer had sutcient funds of assets to meet its dabis|

‘end was therefore unable to moet is liabilities 2s they fel due.

4144 The primary purpose of the Administration would be achieved by

investigating the potential of realising the Company's shareholding in CMA

‘Corporation for sufclent value. The Company had akeady sold its

‘business and asses prior tothe appointment ofthe Joint Administrators,

therefore confued trading of the business was not an option, The Joint

‘Administrators envisage implementing a statocic plan in which to ensure

‘maximum value is acquired from the shares in CMA Corporation,

4.5 The purpose of Administrafon is sil in the process of being achieved and

there is sila signifcant amount of work to be undertaken, This includes

liaising wih sofcitors conceming a strategy to maximise realisations and

confinued investigafons into the Company's affars. The Joint

‘Administrators’ consider thet it may be edviseble for the Company to

Confnve in Adminstration forthe time being. However, they requie the

option of placing it info Crediors’ Voluntary Liquidation for dstibuon

purposes inthe unlkely event tht there are sufficient realisations in the

‘Administration for a dividend to unsecured creditors. Alternatively, the

oint Administrators vil fle notice of dssoluton of the Company at

‘Companies House should they take the view thatthe Company has no

Property which might permit a dstrbution to is creditors, unless they

balieve that they should present a winding up petiion at cour, so that a

liquidator can be appointed to further invesigate the Companys aff. It

isnot proposed to convene a meeting of creditors.

1.6 There has been a limited response to the questionnaire that was sont fo

creditors. Responses may assist the Administrators with their general

investigation duties. Accordingly, those who have not repied are urged fo

dos0.

‘SECTION/APP. REFERENCE

Section §

Section 4

and Appendlx |

Section 4

‘And Appendic I

Section 6

Sections 7,14 and 12

Section 13

Moretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

2. Introduction

24 This Report and Statoment of Proposals (the Report’ is prepared pursuant fo Schedule B1, Paragraph

48 of the Insolvency Act 1986, (the Act) in relation to Meretec Limited (in Administration) (the

‘Company’, the purpose of wich isto provide creiors witha full update as to fhe present poston and

seek creditors approval of the next stage of proceedings.

2.2 The Report aio includes information required tb be provided to creditors pursuant to Rule 2.38 of the

Insolvency Rules 1986 (‘he Rules’). Al statutory information pertaining to the Company is set out in

‘Appendix

3. The Joint Administrators’ Appointment

31 On 5 November 2008 Notice of Appointment of an Administator by Holder of a Qualifying Floating

Charge (Notice of Appointment’) was fled inthe High Court of Justice by the Company's secur trustee

pursuant to a secufty rust and intr creitr deed, Zenith Trusts Limited (‘Zenit’).

32 On the same data, the No‘ce of Appointment was endorsed withthe No. 9603 of 2008. Both Simon

Franklin Plant and Daniel Piant of SFP, 9 Ensign House, Admirals Way, Marsh Wall, London E14 9XQ

were appointed Joint Administrators (the Joint Administrators’). Pursuant to Schedule Bt, Paragraph

100(2) ofthe Ac, the Joint Administrators actin and several.

4. Company History and Events Leading to the Administration Order

4.1 Albeit that statutoy information is contained in Appendix, this report provides brief deta in relaion to

‘he Company’s history.

42 The Company was incorporated on 26 October 1998 in order to buy and develop spectc technology rom

‘a US company known as Metals Investment Trust (‘MIT?. MIT had entered into Chapter 11 insolvency

proceedings in the US almost tn years previousy. ls crectr, Craig Siddell (Mr Sel” had developed

‘a unique process in which to remove Zinc ftom galvanized stl. was the frst type of lechnoogy of is

kind.

43. Atthe time of incorporation the Company's directors were Mr Siddell, Andrew Barker (‘Mr Barker), Mark

Evritt (Mr Evrt?), Gunnar Skoog (‘Mr Skoog’) and Marin Young (‘Mr Young"). The Company secretary

was ils bookkeeper, Eacotts Limited. Further details conceming previous directorships and company

‘secretaries can be found at Appendix

44 tis underetood that the Company operated its banking facies at all mes with HSBC and various other

international banks. The Company operated verious accounts and detals concerning this have been

provided by Mr Young, The Joint Administrators have contacted all the banks involved and the accounts

hhave been frazen. A small credit balance of cca £4,000 has subsequently been received.

45 191998, the value of zine was circa US$3,000 per tonne and a signif\cant income could be generated ‘rom

removing this element and shipping ito foundries around the world, A sigifcant amount of stee! noeded

‘tobe ‘armed in order to cove the costs involved in the process.

48 The Company acquired the business and asses (Inctuing patents) from MIT circa 10 years ago. At that

stage, it was clear thal acidtional funding was required in order to develop the protolypes through to @

‘workable plant. tis understood thatthe cost of this ran into cia US$25m and was pald over a period of

several years.

ar

48

49

440

an

442

443

444

445

Meretec Limited (In Administration)

Report to Creditors and Statoment of Proposals

raph 49(1) of Schedule Bf of the insolvency Act 1986

Por to the purchase of MIT, the crecors of the Company took ache as to how best deal with is

aoquisiton. An exising Meretec compeny was already setup in the US caled Meretec Corporation

MERC’). The Company is 100% shareholder of MERC. Its understood for reasons that are yet tobe

‘ascertained, thatthe Compeny was set up in order to aoquie the patents end assels rom MIT. Whereas,

[MERC was utilised to employ the staff ifended to werk onthe project, who effectively had the know how

inorder to operate the procedure.

Following the purchase of MIT's business and assets, a formal agreement was entered into between the

‘Company and MERC for the provision of services andthe spi ofthe assets between the two entities. This

left a complex sitvaion in terms of how fo apportion any income stream. At ratte, a firm of accountants

advised the Company's directors that any income should be split /3 as licence income payable to the

Company and 1/3 operating income payable to MERC.

{As the technology was developed inthe US, it was decided thet MERC bulld and operate from a plant in

‘Americe. The location desided upon was Chicago. In order to fund the operation and the development of

the system, the Company made several considerable inter-company loans to MERC fo the amount of

citca US$40m {these are reflected in the Company/s accounts). The loans were provided from loan note

holders (accounting for orca USE10m) and a sale of shares in the Company (accountng for circa

uss3tm).

The strategy docided upon was for the Company and MERC to foense the technology to various oer

‘companies around the world who would build their own recycling pants. The terms ofthe licence fee was

{oe calouated upon the amount of tonnes of see! manufactured by each pant.

‘The development process took the best part of seven years and the funds injected via the foan note

holders and shareholders was uflsed o perfect the process and testis capabilites. The idea was to sell

the technology onto large organisations tha utiised sigifcant quantiles of galvanised ste the primary

purchasers being the automobile indus.

‘CMA Corporation (Australia) History and Involvement

In 2005, one of Australia's largest recycting companies, Southem Recycing was acquired by CMA

Corporation (CMA, it is understood that CMA subsequently approached the Company in order to

‘acquire 2 licence to operate the recycling technology in Australia and buid its owm plant.

Negotiations between the Company and CMA commenced in Api! 2005 and completad in July 2005. This

provided for CMA to acquire a licence from the Company to operate the technology in Australia at an

‘greed price. in short, OMA would pay the Company US$10 per tonne of steel manufactured. A

‘guaranteed minimum of 100,000 tonnes was to be processed each yeer for a conract term of 10 years

‘extendable to 20 years. Ths effectively meant thatthe Company hed a guaranteed income steam of a

‘minimum of between USS10m wit the potential of generating upto USS20m.

Initial Public Offering and Intention to float the Company

Following completion ofthe agreement between the Company and CMA, the directors began looking for

‘opportunities to float the Company on the UK Stock Exchange. The directors approached several finenoe

houses for an Ital Pubic Ofering (1P0"), The Company wes looking for USS 10m investment to assist

With the Companys listing in late 2006 ! early 2007,

In order to assist wih the IPO and fo support the Company's application, i sought confirmed interest ftom

some ofthe largest car manufacturers in the world to gauge how many offers wouid be forfncoming for the

purchase of feences to consiruct plant. Its belaved thatthe Company secured signed letters for mull

plant deals from several blue chip car manufacturers.

416

4ar

438

419

420

424

423

424

Meretoc Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule B1 of the Insolvency Act 1986

‘Tne Company approached solictors in order to comple all he necessary documentation to proceed with

the [PO and caried out al the relevant due dligence required. The positon drastcally altered in 2007 with

1 downwerd trend in market condiions and uncertainty inthe steel industry, it was clear by Apri 2007 that

the IPO would nat be able to go aheed.

‘The downward trend had a dramatic impact upon the operation in Chicago and the directors of the

‘Company realised that stops needed to be taken to avoid the plant in Chicago from haemorrhaging

‘money. The plant presently had a burn rate of circa US$600,000 per month, being the minimum funds

required in order to keep it operational.

‘The Sale of the Company's and MERC’s Business and Assets to CMA

Given that the IPO was not vable, the directors looked to maximise the value in the Company and

MERC's business and assets, It appeared that the most viable way of achieving this would be to approach

CMA to se= if they would be intorested in acquiring it outright. Given that the Company held the patents

‘and MERC employed the staff withthe knowledge fo cary out the recycing procedure, it was necessary

{o deal wit both enifes in any sale agreement fo CMA.

In January 2008, the Company conducted a sale of the lent in Chicago for USS6.8m to CMA to avoid

incuing ongoing overheads in is operaton. The Company then looked to sel licence to CMA to

cperato the plant and benef from the technology. An agreement was reached along the similar nes of

the previous arrangement with CMA in relafon to its Austrian operation This completed in ly 2008.

[At this time, CMA started realising income from the Australian depot. The plant was not operating fo full,

‘capacty as the supply of steel did not reach the required targets. It is bafeved that CMA was generating

approximately US$88,000 per month from this plant,

At the me CMA was looking to acquire the Company's and MERC's business and assets those

‘companies combined approximate labililes were as follows:

‘+ rca USS412m in bonds; and

‘+ cca USS2m trade creditors (although this wes signicanly made up of professional costs in relation

to the attampled IPO and cue cigence)

‘An agreement was subsequently entered into on 25 July 2008 between the partes whereupon CMA

purchased the Company's and MERC’s business and asses in return for 37,500,000 of ts shares. At the

time, CMA was recorded as @ company with AUSS500m turnover, having a relatively stong share price

CCMEA's share price at tis time meant thatthe value atrbuted tothe share holding (which equated to 10%

‘ofCMA’s entre stock) resulted in the Company being soWent on a baance sheet basis.

‘An assot sale agreement was drawn up incorporating the Company and MERC. The direclors' took advice

fom their accountants as to the stucture of the agreement given that there may be certain tax

implications, [tis understood by the Joint Adminisvators that MERC had large tax losses and advice was

taken as tothe best method fo deal with this in respect ofthe sale

‘CMAs substantially larger than the Company and it was Ikely a tat tme that CMA would be taken over

by & competior via the acquisition of a majorly shareholding, Its share price at the ime of sale of the

‘Company and MERC to CMA was understood to be circa AUSSO.80.

Merotoc Limited (In Administration)

Roport to Creditors and Statement of Propos:

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

4.25 The prospects of CMA's share price holding ifs value or increasing were considered by the Company's

426

428

429

430

43t

432

433

434

directors to be high. It was anticipated that CMA shares would increase to cca AUSS 50 per share

‘making the Company's holding worth an estimated AUSS56,250,000,

Folloning the sale ofthe Company's and MERC’s business end assets fo CMA the 37,500,000 shares

‘hat were issued fo the Company and MERC are held in escrow for 12 months. The shares were alloceled

between the Company and MERC and the spt ofthese was agreed at relevant board meetings on 7

‘August 2008, Following the expr ofthe escrow period, the shares ate also subject toa company lock out

{ora further 12 months, meaning that they cannot be realised unt! 2010.

Inter-company loan between the Company and MERC

‘According to the Company's and MERC’s accounts forthe year ended 31 December 2005, MERC owes it

224,759,018 by way of an intercompany loan. It's understood that a supplemental agreement was

‘entered into between the paras (agread by the board of directors on 7 August 2008) providing that the

‘Company held MERC's entitlement to a proportion ofthe CMA shares as nominee.

Itis understood that it was subsequently agreed at a futher board meeting that in setlement ofthe inter-

‘company loan, MERC allotted its share eniitement tothe Company. This requires futher investigation by

the Joint Administrators,

‘The Onset of Insolvency Procedures

Following the sale o CMA, the creciors were required to look at methods in which fo dea wth he airs

‘ofthe Company given thatthe bonds issued were due to expire on 31 October 2008. Accordingly, the

CCompary approached finance brokers inorder to put together arenancing re-structuring deal inorder

{omeetits commitments.

In August 2006, heads of terms were drawn up for a refinancing deal. The idea was forthe Company to

raise funds off he back of the value ofthe shares in CMA to settle the Companys unsecured credtors

Some creditors advised the Company that thy would be wing fo accept a debt for equily swep,

However, in September 2008 it is understood thatthe value of CMA's shares fel to below AUSSO.34

hich effactvaly made a resnancing package untenable. As a result, the directors of the Company

sought insolvency advice and approached another firm of insolvency practitioners to look to place the

company into Administration,

Inorder to place the Company into Administration, the dirctors were required to serve Note of intention

‘to Appoint an Administrator, Zenith, Upon receipt of his, Zenith approached insolvency practitoners SFP

toreview the position. The decision was taken to appoint the partners of SFP as Joint Administrators.

‘On & November 2008 a Notice of Appointment of Administrators was fled atthe High Court of Justice and

‘endorsed with number 9603 of 2008, appointing both Simon Frankin Plant and Daniel Pant 2s Joint

Administrators,

At Appendix Il is an Esimated Statement of Alfars as at the data that the Company was placed into

Administration ("he Statement of Afar). The Statement of Aas indicates that the Company was

insolvent ona balance sheet basis with a deficiency to creditors of £12,023,636,

5, The Purpose of the Administration

5A.

‘The purposes of an Adminstration are set out in Schedule B1, Paragraph 3(1) of the Act. In short, this

provides that an Administrator ofa company must perform his functions with the objective of:

52

53

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule B4 ofthe Insolvency Act 1966

54.1 rescuing the company 2s a going concern, or

5.2 achieving a better result for the creditors as a whole than would be likely to be achioved f the

‘company were wound up (without frst being in Administration), or

5.4.3 realising propery in order to make a distribution to one or more secured or preferential

creditors.

‘The purposes are therefore a hierecchy of objectives. The rescue of a company isthe priority. Nextis to

instead achiove a better return tothe creditors as a whole. in the event that this cannot be achieved then

the Administrator is permited to realise assets forthe benefit ofthe preferential or seoured creditors,

In the light of the insolvency ofthe Company, the ital purpose relating to is rescue could only be

achieved through a company voluntary arrangement. This was not considered tobe achievable, although

‘appeared thatthe second purpose was a viable opfon. Full details concering progress in respect of

this purpose are set outin Section 7

Events Following the Joint Administrators’ Appointment Leading to Ital Strategy

co

62

63

64

65

66

‘Asa roseue of the Company was not possible, the primary purpose of the Administration was fo obtain a

better result forthe creditors as a whole than woud be achieved if the Company was simply wound up

{without frst being in Administration). This would potentally be achieved with the assistance of

sfalutory moratorium which protects @ company when i is placed into Administration, The moratorium

eflectively prevents all creditors’ actions being taken or progressed without leave of the Coutt or the

‘Adminstratr’s consent, thereby proving @ company wih a breathing space in which a strategy can be

invoked to maximise realisations.

On the day of appointment, the Joint Administrators attempted to contact the Company's rectors in

‘order to advise them that Simon Franklin Plant and Daniel Pient of SFP had been appointed os Joint

Adrninistrators.

‘The Joint Administrators attempted to call Mr Young and Mr Evrit, the two UK based directors. it was

understood that the other direciors were spread between the US and United Arab Emirates. Mr Evritt

relumed the Joint Administrators call on the evening of § November 2008 and i was explained to him the

‘events of the day and the present postion concerning the Administration,

Mr Evrtt was advised that it was imperative thatthe Joint Admiistraters meet with him and Mr Young in

‘order to ciscuss the ramifications ofthe appointment together with obtaining @ detailed history conceming

the events leading to the sale of the Company's business and assets. Mr Evritt advised that he would

‘contact Mr Young and revert back to the Joint Administrators with some proposed times.

It was subsequently understood that Mr Young was not in the UK and the earliest time he would be

avalable for a meeting would be Monday, 17 November 2008. The Joint Administrators explained that

this would cause potential issues given thatthe Joint Administrators have to discharge certain dutes

ihn a very stict imetfame and information would be needed before this time in order to carry these ou.

{twas agreed that Mr Young would provide details to the Joint Administrators via ema ofa bret history of

the Company, its banking detals, profesional acvisors and any other relevant information to assist

‘Additionally, a meeting was arranged for Mr Evrt and Mr Young to attend SFP's offices on Monday, 17

November 2008 at {1am in order raise eny adktonal queries and to give the Joint Administrators forensic

department, SFP Forensic Limited (‘SFP Forensic’) an opportuni to obtain some initial information.

Further detalsconcering the outcome of tre meeting can be found at Section 7

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule Bt of the insolvency Act 1986

7. General Progress In Relation to the Administration

TA

72

73

14

18

76

a

78

79

140

‘The Meeting with Mr Young and bir Evritt

On 17 November 2008, Mr Young and Mr Evrit attended the Joint Administrators offoes. A ful history of

the Company and MERC was oblained. Further Mr Young advised thatthe Company's accountants were

holding books and records al relevant to the Company and that these could be collected at any time,

Mr Young further confirmed that there were two potential assets that could be realised in the next 7 to 10,

days, One was a VAT refund from HM Revenue and Customs of citca £162,000, The other was @

«dividend declared by CMA to its shereholders, of which the Company was due to receive circa £80,000,

‘At the meeting Mr Young and Mr Evit were also provided with te standard pack issued to decors

‘sling out ther duies and the ramifications of the appointment. Mr Young advised that given the other

directors were not based in the UK, he would contact them to explain the importance of reviewing these

and suggested that in the meantime they be sent fo them in te post.

‘The Company's Shareholding in MERC

Mr Young advised thatthe Company is 100% shareholder in MERC. Andrew Barker, wha is one ofthe

Company's drectors, is also the Chief Executve Offcer of MERC and is based in the US. Further, Mr

‘Young advised that MERC has no assots as these had al been sold to CMA. However, tha it curently

has labilies of circa US$150 000.

‘The Joint Administrators shall be taking advice in respect oftheir duties in relation fo MERC from a US

based fim of solicitors.

Pre-Appointment VAT refund

‘The VAT refund of £162,231.75 has now been received into the Joint Administrators estate aocount

‘There are no furherrealisaons to be made ftom this source.

(CMA Dividend

‘Me Young has confirmed that te application for the payment ofthe CMA dividend was mede prior to the

‘Joint Administrators appointment and that it was expected imminenty.

Mr Young however, advised that there may be a set off claim. Given that the dividend payments yet to

be received, itis uncertain as to whether or not payment ofthis has been withheld pending resolution of

this,

‘The Joint Administrators have consulted wih the solicitors instucted in this matier, Nabarto LLP

((Nabarre?) to determine whether or not CMA is entitled to set off payment of the dividend to the

‘Company. decision as fo how best to proceed wil be made dependant upon Nabarro's advice

Realisation of the Company's shareholding in CMA

At this present time, the only oer known significant esset in the Company's Administration is the

37,500,000 shares held in CMA,

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule B1 of the Insolvency Act 1986

7.41. The Joint Administrators are present investigating the sale agreement and te agreed lock cu period in

order to formulate a strategy conceming the realisation of these shares forthe benefit of the Company's

creditors,

7.42 The Joint Adrinistators shall fxmulale a strategy in which fo ascertain the best course of action, This wil

_uncoubtedy involve the instuction of Australian soiciors to advise upon the best method of realising the

shares.

‘The Company's Trading Premises

713 The Company cid not occupy a trading premises. in order to deal with any UK operations it ulised a

serviced office address at 23 Berkeley Square, London, There is no agreement in place in relation to this

and they were ceased fo be used some me prior fo the Joint Administrators appointment. There is,

‘therefore no property fo deal with.

Investigation into the Company's Affairs Prior to the Administration

7.44 Investigations into the Company's affairs prior tit being placed into Adinistation ave being undertaken

by SFP Forensic and are presenty ongoing,

7.45 SFP Forensic has ideniifed various areas of concer in relafon to the Company's trading actives prior

to it being placed into Administration, These are currenty being investigated. However, the Joint

‘Administrators do not wish to divulge any futher information in relaton to this at this stage since it may

hamper enquires future recoveries.

‘Additional Issues and Realisations

7.48 The Company's books and records have been recovered from the Company's accountants by an ently

associated wit the Joint Administrators fm, SFP Datastore Limited (‘SFP Datastore’). An inventory has

‘been prepared and the books and records wil continue fo be stored by them.

‘The Statement of Affairs and the Outcome for Creditors / Joint Administrators Receipts and Payments

8.41 Based upon current information, it is presently unclear whether or not there wil be dividend to

Unsecured crediors. At Appendix Il is an Estimated Statement of Afars as at the date that the

Company was piaced into Administration, completed by the Joint Administatos, Further, attached is an

Estimated Outoome Statement provided by the directors of the Company.

82 In addon to this isa st of creditors whose details have been obtained from the Company/s records and

‘whose claims have been lodged. Piease note that the £0.00 balances denote claims that are yet to be

lodged onto the Joint Administrators system and does not mean that the claim has been rejected or

agreed.

83 Attached et Appendix Ill is tho Joint Administrators Receipts and Payments Account for the period §

November 2008 to 18 December 2006.

The Joint Administrators’ Costs

9.4 Given itis presently uncertain as to whether or not thee will be a surplus avaiable to the unsecured

creditors, itlooks to be the case that he thid purpose only ofthe Adminstration (at paragraph 5.1.3) wil

be achieved. From the outset the Jcint Administrators arrenged for members of ther team to be present

atthe Company's trading premises in order to react to any immediate issues.

Merotoc Limited (In Administration)

Report to Creditors and Statement of Proposals

ursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

92. Todate, the Joint Administrators have undertaken, inter ea, the folowing actions:

924

ial review ofthe positon and ascertaining the trading posiion of the Company;

9.2.2 _lissing withthe directors in order to deal with immediate issues;

923 lieising with the drectors concerning the sale of the Company's assets prior to the Joint

Administrators appointment;

924 attending meetings with Mr Young end Mr Et conceming the Company's affairs;

92.5 dealing with shareholders queries concerning ther investments in the Company;

19.26 reviewing the Company/s books and records for creditor information and any employee detalls;

9.27 liaising with SFP Datastore concerning rebieval ofthe Company's books and records;

9.28 _lcising wth SFP Forensics regarding invesigatin into the affats ofthe Company;

9.29 escottaining the postion of MERC and the Joint Administrators obigations concerning tis,

92.10 fzising with solicitors concerning various aspects of the Administration and the Company's

affiars; and

9.211 undertaking all statutory measures including updating creditors, advertising end fling requisite

sdecuments and forms at Companies House.

193 At Appendix IV isa breakdown of the ime that hes been incurred by SFP to date. At Appondix IX is @

Guide to Administrators and Liquidators Fees, being Statement of Insobvency Practice 9.

94 AtAppendix Vis2 breakdown of the time that has been Incurred by SFP Forensic to date,

97 AtAppendix Vis a breakdown of the fe that has been incurred by SFP Datastore to date.

98 At Appendl Vilis.a guide fo SFP and its associated entities charge out rates and disbursement rates.

189 Section 12 sats out the Joint Administrators proposals. The Joint Administrators are presenty uncertain

28 to whother or not there will be a distrbution fo unsecured creditors, alhough it fS noted that this is

dependent upon the value of the shares in CMA. On this basis, the Rules provide that the secured

creditors (and preferential creditors f they receive a dividend) are to agroe the Joint Administrators fees.

‘Albeit unikely that tere wil be a distibuion to unsecured creditors, for the sake of good order, the Joint

‘Administrators are seeking authorisation from them oftheir remuneraion on a time cost basis, being the

time properly given by the Joint Administrators and their staff in attending to matters arising in the

‘Administration under rue 2.106(2) of the Ruies.

98.10 Disbursements and specific expenditure relaing to the administration ofan insolvent estate and payable

to an independent third party are recoverable without creditor approval. Such expenciture is made, if

funds are avaiable from the insolvent estate. If funds are not avaiable the payment is made fom this

fim’ offce account and this frm is rembursed from the insolent estate if and when funds become

availabe.

9.41 Payments made out of a fims office account and recharged to an insolvent estate are defined as

‘Galogory 1 Disbursements. This disbursement is explained further under the expenses and

942

913

944

Meretec Limited {In Administration)

Report to Creditors and Statement of Proposals.

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

Disbursements heading in the Guide to Administrators and Liquidators fees at Appendix IX The

following Category 1 disbursements have been incurred to date:

Bordereau 2 12500

Malrediecton £ — 49.80

Expenditure incidental tothe adminisraion ofthe insolvent case, which by its nature includes an element

of shared oF allocated costs are recoverable with creditor approval. These payments are defined as

‘Category 2 Disbursements’ and, once again, this disbursement is explained futher in the Guide to

‘Administrators and Liquidators fees at Appendix IX. There have been the folowing Category 2

disbursements incurred to date:

Postage £ 68A5

‘The fees incurred by Nebarro and SFP Forensic are on a time cost basis. SFP Datastore’s fees are

calculated on a fixed fee basis for storage end retrieval of Books and records and an hourly rate for any

further work carried out

‘SFP Forensic and SFP Datastoe are ents which are associated with the Joint Administrators frm, SFP.

Cine Associated Entties"). Pursuant to SIP 9 payments made to outside parties in which the office holder

or his fim or any associate has an inferest should be treated 2s a Category 2 Disbursement In

‘accordance with SIP 9 the folowing information is provided conceming the Associated Enites:

94a the Associated Entities have been established by SFP to perform functions to which

either the office holder or outside agencies could undertake. It is considered that by

Vue oftheir specialist nature and close proximity to SFP they wil achieve better resus

than the office holder, his team or any outside agencies would be able to accomplish.

9462 the Associated Entiies remuneration is on an hourly time cost basis, divided into 6

‘minute units and calculated as follows:

Entity Basis of Remuneration ‘Siaff Charge Out Rates

‘SFP Forensic, Tine Cost £75 - 2450"

[SFP Datasiore Fixed Fee and Time Cost £25875"

‘The charge out rates detal the bands that wil be applied dependent upon the grading of staff

requited to deal with any one spectc assignment. Please note that these may fuctuatfater

during the course ofthe Administration or the placing ofthe Company into a subsequent insoWency

regime.

9443 the proposals to creditors seek the approval of the payment of SIP 9 Category 2

Disbursements. Approval wil enile the offce holder to settle these as and when

deemed necessary wihout the need for any futher authorisation.

410, Additional Points Required to Be Made Pursuant to the Rules

404

102

For creditors’ general information, the EC Regulations on insolvency proceedings do apply in tis case,

and these proceedings are the main proceedings.

Pursuant to Schedule B1, Paragraph 47(1) ofthe Ac, he Joint Adinistators may request one or more

relevant persons to provide a Statement of Afar of te Company. Cerzn ofthe Doctors have provided

a completed statement of affairs. Acopy can be found at Appendix I

1.

103

Moretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule 61 of the Insolvency Act 1985

“The Joint Administrators donot consider thatthe prescribed pat defned under secon 176A ofthe Act

wil be payable and therefoe donot intend to make an appcation to Court pusuant to section 176A(6) of

the Act

‘The Dispensing Of A Meeting of Creditors

11d

12

113

114

15

Pursuant to Schedule B1, Paragraph 61(1) a copy ofthe Administrato’s statement of proposals must be

‘accompanied by an invitation to a creditors meeting, However, his requirement may be dispensed with in

circumstances where there i likely to be noting of substance thatthe creditors meeting could decide

‘These circumstances are set out in Paragragh 52(1) which provides thatthe need to convene a meeting

shall not apply where the statement of proposals slates thatthe Administrator thinks that:

41.24 the company hes sufcient property to enable each creditor ofthe company to be paid in full

11.22 the company has insufficient property to enable a distribution to be made to unsecured creditors

‘other than by virtue of payment through the prescribed element of floating charge realisations,

or

4.23 the only objective of the Administration which the Administrator thinks is capable of

achievement is realising property in order to make a distibuion to one or more secured or

preferential creditors.

In this instance the Joint Administrators are of that the view that 11.2.3 wil apply in relaton to the

Company.

Notwithstanding ti, the Joint Administrators shall be required to summon a meoing of creditors if iis

requested by the Companys creditors whose debts amount fo at least 10% of te total debis of the

‘Company, by way of service of a Form 2.21B, within 12 days from the date on which the proposals are

sent out

Hf such meeting is requested it must be held within 28 days of the request being received by the Joint

‘Administrators. Security must be given forthe expenses of summoning and holding the meeting. At

‘Appendix X isa copy ofthe Form 2.21B should any ceditor wish fo request a meetrg, Ifo meeting is

requested the proposals wil be deemed fo be accepted pursuant to Rule 2.346) of he Rules.

‘The Joint Administrators’ Proposal

A

122

123

24

‘The Administration has enabled the Company to have a breathing space In which to asoertain the present

postion concering the sale ofits business and assets fo CMA and the circumstances leading tits

insolvency.

Whilst investigations are ongoing, the protection of the Adminisvation is sill in order to finalise all

cutstending matters. The presccibed timo mit for an Administration is 12 months, In the event that an

‘Administration lasts in excess of 12 months, the Joint Administrators have to obtain creditors approval or

‘make an application to Court to extend its length,

It is a requirement, notwithstanding the fact that a company is ffl in Adminisaion for the Joint

‘Administetors to investigate the company's atfars and submit the appropriate D form to the Deperment of

Business Enterprise and Regulatory Reform concerning the directors conduct

In the event that there are or may be further realisations that result in a dividend to unsecured creditors the

Joint Administrators shall seek fo place the Company into Creditors Voluntary Liquidation in order to effect

125

126

Merotec Limited (In Administration)

Report to Croditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule Bt of the Insolvency Act 1986

fa distibuton. In such circumstances they will be looking to take the appointment as Liquidators. in

‘accordance with Schedule B1, Paragraph 83(7} ofthe Act and Rule 2.117(3), cediors are able to nominate

2 diferent person or persons as proposed Liquidtor or Liquidators, provided tha the nomination is made

afer the receipt ofthe proposas and before they are approved. AAs an alternative, and should there be no

Ikoly funds to distibule to unsecured credilors, thatthe Joint Administrators may seek to place the

Company info Compulsory Liquidation In oder to bring proceedings that only Liquidator may commence

‘or the benefitof the estate

Iti proposed thatthe Creitors’ Voluntary Liquidation would commence from the date of acknoweedgement

by the Regstrar of Companies that the relevant notice has been filed at Companies House. This

procedure, wnich is permited by the Act would crcurnvent the need for an addtional creditors meeting and

oop costs to a minimum.

Inlightof the above, and in accordance with Schedule B1, Paragraph 49(1) ofthe Act it's proposed by the

saint Administrators that:

4261 the Administration of the Company continue in order to further investigate the circumstances:

Teading to the Company’s falure and finalise any addtional matters which requir the assistance

‘of the moratorium;

12.6.2 the Joint Administrators’ remuneration be fixed by the time properly spent by them and their staff

in attending to matters arising out of the Adiinistaion in accordance with Stalement of

Insolvency Practce @ and thatthe Joint Administrators be authorised to draw remuneration 2s

‘and when funds become availabe;

4263 the Joint Administrators be authorised to recover all disbursements including category 2

cisbursements as dened by the Statement of Insolvency Practice &;

42.84 in the event hat the Joint Administrators think that the Company hes no property which might

permit a distribution to is creditors, they shall be authorised fo file @ noice of dissolution of the

‘Company pursuant to paragraph 84 of Schedule BI tothe Act,

4285 in the event of a potential distribution being avalable to unsecured crecitors, the Jolt

‘Administrators be eppcinted Joint Liquidators of the Company pursuant to paragraph 83 of

‘Schedule B1 to the Act without further recourse to the creditors with the purpose of making a

distribution to unsecured creditors and to continue investigation into the Company's afairs;

1266 es an alternative to paragraphs 12.64 and 12.65 the Joint Adminsrators be able lo seek to

place the Company info Compulsory Liquidation in order to pursue such actions and bring

proceedings that ony aLiguidatoris permite to bring pursuant fo the Act

42.87 upon the placing of the Company into Liquidation under paragraph 126.5 or 12.8.6 or the

necessary form being fled for the Company to be dissolved, the Joint Administrators be

discharged from liabliy in respect of any action undertaken by them pursuant to Schedule B1,

paragraph 98 of the Act; and

12.8.8 upon the placing ofthe Company into Liquidation, the Joint Liquidators’ by authorsad to ac in &

Joint and several capacity

Meretec Limited (In Administration)

Report to Creditors and Statement of Proposals

Pursuant to Paragraph 49(1) of Schedule B1 of the Insolvency Act 1988

43, Ancillary

Croditors Questionnaires

434 The response that has been forlncoming from the questionnaire provided to creditors has proved to be

helpful in relation to the events that Wanspired up to the date that the Company was piaced into

Administration.

132 As previously stated in the first circular to the Company's creditors, responses that are received may

prove integral to assist with investigatons into the Company's affas. Accordingly, if you have not

previously provided a completed questionnaire, please do so, at your earliest onvenience.

Directors Conduct

433. Pursuent to the Company Directors Disqualification Act 1986, itis the Joint Administrators and eny

subsequently appointed Liquidators duty to submit a requisite reportform to the Department of Business

Enterprise and Regulaory Reform concerning the directors’ conduct.

41346 The reportform must address all person holding the positon as director during the three years upto the

date ofthe onset of insolvency. Please note tha this isa standerd requirement, Responses to creditors’

‘questionnaires may prove extremely helpful concering this.

If any creditor has any queries in relation to the above, please do not hesitate to contact ether the Joint

‘Administrators or the Manager dealing wth this matter, Chris Hirt on 020 7538 2222.

18th December 2008 7

ant

(dministrator

Moretec Limited (in Administration)

Report to Creditors & Statement of Proposals

APPENDIX |

‘© Statutory Information

Meretec Limited ~ in Administration

Statutory Information As Reflected At Companies House

Company Number: 03659285

Date of Incorporation: 26/10/1998

Previous Names: Metal Investment Trust Limited

Nature of Business: 2710 - Manufacture of basic Iron and steel including ferro

alloys

Issued Share Capital: 127,278,578 Ordinary A shares have been issued according to

‘the last filed annual retum as at 26 October 2007. An accurate

‘share register is not yet available and the Joint Administrators

shall compile this information as soon as it is readily available,

Name ‘Appointed Resigned

Director(s): Mark Evi 19/03/2008 :

Andrew Willam Barker 2201112007 7

Craig Steven Sidell 08/02/2006 i

Martin Edward Young 271022001 -

Gunnar Skoog 26/10/1998 -

Robert Bolier 1022007 47/10/2007

Robert Coxon 20/04/2006 01/09/2007

David John Downes o1mtoro08 17/10/2007

Andrew Henry Simon 2004/2006 17/10/2007

Timothy Peach 7/0/2002 28/02/2005

Dr Milton Sanders 28/02/2005 31/42/2005

Wiliam A Morgan 4721999 15/11/2000

Martin Edward Young 2eroriges 23/06/1969

Company Secretary: Eacotts Limited 27/2007 7

Julian David Hillman 17101/2003 04/1/2005

Mark Gerald Paine zejoeriges 17/04/2003

Thames Valley Services ow/t1v20008 02/07/2007

Martin Edward Young 2610/1998 9/04/1999

Current Registered Office: 9 Ensign House

Admirals Way

Marsh Wall

Docklands

London E14 9X

Previous Registered Office: Grenville Court

Britwell Road

Burnham

Bucks

‘SL18DF

Serviced Office Address: 23 Berkeley Square

London

wi

Accountants: Eacotts

Grenville Court

Britwell Road

Bumham

Bucks

‘SL18DF

Schedule of Outstanding Mortgages or Charges:

Please see attached

800z/60!90

9002/60!90

8002/60/90

8002/60!90

8002/60!90

8002/60!90

8002/60!90

pousnes

‘Guy eanpay pue juewealBy Aunoeg ‘ebeByoyy

waweeiBy Aunoag

‘S8u80"] pue Stuajed UL se1e}U| AuNoNS Jo WELD pue ueweaLby weuUBISSY fea

qunogde yueq Jeno aBiey9

jueweeiby uowusissy

quawiseiBy eBpeig

SenUnoes J2K0 abe }0y4

Sapuoag JaN0 abeB Loy

‘emueqeg

adh,

snowe,

snowe,

snoye,

aywr seqysni, yyuez

oy] seaysn1y yuOZ

oyun] seaysnay wuz,

oye] soaysnay yUOZ

boyy] saeisnuy yyUEZ

Paywiry sosysnay yqusz

‘owen

ih)

PoC Ty

dds

Meretec Limited (in Administration)

Report to Creditors & Statement of Proposals

‘APPENDIX

‘© Estimated Statement of Affairs as at § November 2008 / Creditors Details

MERETEC LIMITED (N ADMINISTRATION)

ESTIMATED STATEMENT OF AFFAIRS AS AT'S NOVEMBER 2008

Notes Book Value Estimated

torvalso

‘ rn

Assos (specifically plodged)

CMA snares 4 uncertain uncertain

Less; Lean Note Holders 119,000,000, 10,000,000

‘Supuus donc ett 900,000 10,000,000,

-Assote (nat specifically pledged)

‘VAT Refine 2 so2282 6282

(sth et Bank 3 “4.000 4216

Estimated deft to Floating Charge Creditor agar 768 08.448

LiasiLies

Floating Charge Creditor

Loan Note Heer 40,000,000,

‘UNSECURED CREDITORS

‘Trade & expense 4 32003698,

Estimated deficiency as regards creditors es

‘Siete cons and openes oe Aainraton

‘The Estate Sater feta dev ot rlod amount ated sharhcdet Saad pte rotons

es unto ew be any eo shel.

Meretec Limited (in Administration) (“the Company")

Notes To Estimated Statement of Affairs as at 5 November 2008

‘The value in the CMA shares is presently uncertain given thatthe share price continues to fluctuate

‘and any realisation of the shares is subject to the hares being held in escrow for 12 months followed

by an additional 12 month company lock out agreement. This effectively means the Joint

‘Administrators are unable to place a value on the value ofthe shares.

‘The Company had submitted its pre-appointment VAT retum prior to the appointment of the Joint

Administrators. The retum indicated a refund of circa £162,000. The Joint Administrators have since

received the VAT refund in the amount of £162,232.

‘The Company banked with HSBC Bank plc in the UK. At the date of the Joint Administrators

appointment the business current had a small credit balance of circa £4,000. The balance of funds

‘on the account has now been received and the Joint Administrators estate account has been

credited with the amount of £4,216.

This figure is reflected by the level of claims received to date by the Joint Administrators.

5. 18a Wms eo pe aS 2a eae,

Horn eon oN am anes

‘INS WOH ARO WIEN

Fras 10 0 wes 20 99 Ue EA

0 ae wu et yyy bs fg ong

‘vee vo tsa eng rg BB

Fg wou 7

abe el

on mena ening UHI SEH GOMFON ZAIN HUES

Loe ny oH foayoa9

Sez ng 4 ono nF emp UREaLeG

SEs ‘esa tag We pny fave‘ RED

0 )75'seng wen Foy oe Pg AD

“Wee0H ump sseeu toms ons YE ED

NE SIN HOLE es OIG RO

wa pT eg PON EO

fer neces en HEAT} NOL HEN ODE

sosrenize voc m0 os Os

od

ssp furéwe

(oommneunupy upon,

as

Form2.143,

Rule 229

Statement of affairs

‘Name of Company ‘Company number

MERETEC LIMITED (IN ADMINISTRATION) 03659285

inthe ‘Court ease number

HIGH COURT OF JUSTICE 9603 ne Loos

mewdaduessof Statement as tothe altars of (8) MERETEC LIMITED of Greenville Court, Britwell Road,

mpry Burnham, Buckinghamshire, SL1 8DF

on the (b) 5 November 2008, the date that the company entered administration,

een ce

Statement of Truth

(ser date

1 believe thatthe facts stated inthis statement of affairs are a fll, true and complete statement oft

affairs ofthe above named company a3 at (0) the date thatthe compeny ent

administration.

Full name a:

‘Signed

Dated Wop Noasubee. 008

‘Statement of Affairs for Meretoc Limited (In Administration)

Prepared by Martin Young, Director of Meretoc Limited for the board of Directors of Motetec

Limited (In administration)

Company Number 03659285,

WITHOUT PREDUJICE,

Please accept this Statement of Affairs for Meretec Limited (In Administration) as a full, true

and complete statement of the above named company as at the 5" of November 2008

Full Name: Meytin Egward Young

Signed .cssaMt

Dated: 16th of

INFORMATION O1

Background

On the 12" of August the company sod the business of Meretec Corp and Meretec Limited inctusing

tho name, intellectual property rights and employees "The Business" to CMA Corp en Ausiraan

‘Company in return for 37-5 milion shares in CMA Corp which were subject to an irevocable Escrow

‘Agreement until August 2009 and @ company Look Up agreement unt August 2070. At the time that

ths transaction completed the company was solvent withthe shares in CMA werth substantially more

than the outstanding bonds and unseevred creditor positions

Ih September and October 2008 the share price of CMA Corp moved down substantial in tne wth

Global markets effected by he cred ers, addtonally the Australian Dolr in which the company

Feld assets moved dovn substantial ageinst the USD in which the company held secured and

Uncecured debt Although the company had tentatively agroed re-fnancing in Australia in August and

Sopiember it was unable to complate this financing due tothe decrease in the value ofthe avaiable

colateral inthe CMA shares. z

‘When it became clear that the share values in CMA and the currency movements which the company

had experienced were not returning swifly back to their previous positions the company took

specialized insolvency advice from Davenport Lyons and Smith Wiliemson which led on to today’s

position.

‘The company is currently siting on less than $10,000 in cash. The company's only assets are

‘37,500,000 shares in CMA Corp which are held in Escrow plus accounts receivable of about

‘$500,000 in dividends and VAT returns from HMRC. We believe that since writing the above

‘statement the Company has received in approximately £160,000 from HMRC in respect to the VAT

‘claim but that the dividend payment from CMA Corporation has been requested but is stil

outstanding.

‘CORPORATE

1.1 The Company was incorporated under the Companies Act 1985 (the Aci") on 26 October

41998 e9 a private company imitod by shares with the name of Metals investment, Trust

Limited end registered in England and Wales with number 3659285. On 6 March 2008 the

‘Company changed its name to Meretec Limited.

12 The Directors of the Company are Martin Young, Gunnar Skoog and Craig Sidell, Mark Everitt

and Andrew Barker

1.3 The registered office of the Company is at Grenville Court, Britwell Road, Burnham,

Buckinghamshire SL1 eDF.

14

15

16

“The eccounting reference date of the Company is 31 December. The accounts for the year

aided 31 December 2006 are overdue for filing et Companies House although they have

been completed by Grant Thornton but not signed off

‘Shareholders

‘The largest shareholder of the Company is Meyado Private Wealth Management (MPWM), @

Company incorporated in England and Weles. MPWNM is a subsiciary of Meyado Group

Holdings (MGH), a company incorporated in the Bahame.

Meretec arranged a series of private placements for the Company via MPWN and MPWNM

Mote shares both for is parent MGH and on behalf of various other persons (both natural and

fogal), including MGH. This {s reflected in the latest financial statements for the Company

URe2). disclose that MPWM interest is a nominee hoiding and that the shares are held for the

penefit of a number of private investors.

Private Placement risk factors wore signed by all private Investors in Mereteo Limited which

were provided tc all placees.

“The Ditectors of the company believe that the company has approximately 197,773.87)

Millon shares outstanding but requires work with the company secretary in the coming days

qaieolablsh the currant up to date number. The board can repor that the company has mace

Te econ significant issuance of shares and that the last transaction was Just prior to the sale

Of the company to CMA Corporation in August ofthis year.

Please see the attached:

Meretec Shares on Issue

[though Moyedo Private Wealth Management has previously acted as nominee for many of

fhe private investors ft is understood that they are unuiling to continue this @ ts paren!

‘ompany is 2 significant shareholder, unsecured creditor and loan note holder and iis May

aaraee conficts of interest, MWVPM wil provide a lis ofall neminees to the Administrator within

arnumber of days.

‘The Company has the folowing subsidiary undertakings:

Name: Meretec Corporation, a"C" company

incorporated in tho State of Delaware

Issued Share Capital: US$1000 [divided nto 1000 ordinary shares

of USSt each}

Certificate of incorporation: ‘Tho Company was incorporated on May 9,

2000.

Directors: Gunnar Skoog,

Company Treasurer: Mark Everitt

Accounting Reference Date: December 31

Shareholders: Meretec Limited

Meretec Shares on Issue

Meyado Group Holdings 109,994,506

¥MRTI 14,105,630

‘Alan Polivnick 93,750

‘Atkoxander Grant 62,475

‘Alonso 62,500

Anthony Pralte 493,260

‘Antonio Harrison 93,750

B Morgan 287,500

Butter Smith 12,500

Charles Pinnell 374,969

Chitine 62,481

Contro! Masters Ine 375,000

David Fuller 187,465

David Wall 74,950

Gonzalez De Diego Miter 62,448

Gouge & Schitter 31,250

H Watson 87,456

lan Barber 27,998

Maw 62,454

Michael Curry 93,750

Milleran Marketing 200,013

NWay 62,466

Neil Dickson 61,260

P Coubrough 93,750

P Henshaw 156,225

P Radford 424,975

Peter Leuner 31,250

Pralte!| 902,315

Shaun Cerroll 100,000

Sikich Coperation 5,580,000

Tedjini "328,154

V Lopes Rocha 156,250

William Fiint Smith 125,000

MYoung 3,206,241

total shares in issue: TRS TO

Banking Relationships & Balances as of November 6° 2008

Meretec Limited

Bank: HSBC, NY

‘ABA: 021007088

‘Addross: Park Avenue Office 250 Park Avenue New York, NY10

Fel: 1 212 983 8859 Relationship Manager Margret Harvey:

margrat harvey@us.hsbe.com

‘Aceount No.: 006045359

Balance: $6,154.04

Bank: HSBC, Slough

4128 High Street, Slough, Borks, SL1 1UF Tet: 08457 606060

Sort Code: 404208.

‘Acoourt No. 61866070

Relationship Managar Randeep Budyat:

randeep badyel@hsbe.com

Balance: £225.97

‘Bank: HSBC, UK

Sort Code: 400515

‘Account No.: 68191682

Balance: $292.10

Meretec Corporation

Bank: HSBC, NY

‘ABA: 021001088

‘Account No.006053106

Balance: $406.95

Bank: Harris NA

ABA: 071025661

‘Account No. 4339120481

Belanco: $478

BANKING ARRANGEMENTS:

Neither the Limited nor Corp has any banking facilites.

DIRECTORS, SECRETARY AND ADVISERS

Directors ‘Martin Young (Chairman)

Mark Evertt (Non-Executive)

‘Gunnar Skoog (Non-Executis

Craig Siddell (Non-Executive

Andrew Barker (Managing Di

‘Company secretary ‘Thames Valley Business Ser

Registered office Grenville Court

Britwell Road

Burnham

Buckinghamshire

SL180F

Company Bookkeepers UK ‘Company Bockkeapers USA

Eacots ‘Sikich Corporation LLC

Grenville Court ‘298 Corporate Blvd,

Britwell Road Aurora,

Burnham IL 60502-9102

Bucks United States

‘SL1 80F

FTAO Montha Bunthon and Martin Gatehouse FTAO of George Melina

‘Tel: 01628 665432

Legal advisers to as to English law Legal advisers to the Compa

Davenport Lyons ‘Akerman, Senterfit & Eidson

30 Burlington Street Las Olas Centre Il

London 360 East Las Olas Boulevarc

Wis 3NL. Ft Lauderdale

FL33301-2229

USA

‘Auditors and reporting accountants

Grant Thorton UK LLP

Grant Thomton House

Molton Street

London

NW1 2EP

United Kingdom FTA Segio Cardosa

Creditors

The company entered into a lo

‘Absolute Capital and Meyada Group Holdings as well as some private Clients of Meyedo; Galapagos

Trust, Lind Domecq, John Pinnell and Antonio Hertison in August 2006 in preparation for IPO funding

[The funding wafer $10 milion repayable by December 2007 and an acmission was antipated

fore this tine.

{n Spring 2007 the company was forced to abandon the planed IPO because of market conditions and

docidod to sell the physical plant in East Chicago to CMA Corporation as wall as sell an additional

license to CMA, this strategy was successful and the sale of the plant and land to CMA cooperation

‘completed in January 2008. One of the Loan Note holders agreed to increase is lone note Instrument

by $1.5 million at this time.

In February 08 tne company was epproached by CMA Corporation to buy “the business” of Meretec

hich consisted of primarily the two income producing licenses and the intellectual property rights to

the Meretec process for @ sum of $30 milan. The board of Directors consulted and agreed the sale;

during the negotiations and drafting of the contracts the agreed sum modified to 37.5 milion shares of

‘CMA Corporation, the loan note holders of Mereiec approved the deal and changed the security to

the CMA shares from the IPR and the deal closed on August the 12" 2008. As part of the completion

of the deal all of the note holders received early repayment on some of their oan-notes plus a 10%

penalty for changing the security, this reduced the amount of capital owed by the company but re-

iterated a maturity date of October 31* 2008.

‘The instrument is subject toa equitable charge.

‘The Amounts sti owing to the note holder may require some further calculations due to interest but

the following table was produced by Eacotts for the board in Eerly August breaking down the amounts

‘owing and to which parties:

Please See the Note holders Schedule Attached

‘Meretec — Additional Creditors

‘Breakdown in original currency

MGH uss cept

Loan due to MGH - balance Carried Forward $136,595.00

‘Add: Payments made by Meyado on behalf of Merete

‘th Aug Loan to Meretec $60,000 ‘$60,000.00

22th Aug Loan to Meretec $9,980°2 $19,960.00

‘Gunnar Skoog salary £20,693 wk36 £20,693.00

Gurrer August salary £20,693 plus expenses claim £1,656 tote £22,049 n weok 37, £22,360 00

Davenport Lyons Payment £25,000 wi40 ££25,000.00

Evolution Securities payment £10,000 wk 42 £10,000.00

Pay down part of Chris Payandee loan Euro40,000 w42

Davenport Lyons payment £25,000 wka2 +£25,000.00

Davenport Lyons payment £25,000 wha ££25,000.00

Davenport Lyons payment £40,000 wk44 '240,000.00

tion Securities payment £10,000 and Eacotts £20,000 wk4+ +£30,000.00

Palladia payment £124.23 wk45 81,224.23

CMA Overpayment of License fee in August 2008 $120,000.00

Meyado Private Wealth Management invoice

“August invoice £104,635 88 (24,961.93 plus £100,274.5 Davenpor Jul & Aug bls) £420 33

Sept invoice £1252.56 81,262.56

(Oct invoice £1889.68 £1,889.68

Davenport Lyons bils charge Meyado paid on behatf of Meretec £100,274.50

Less: Davenport £2,757.59 Balance of week 42 payment £25k £2,751.59

Davenport £25k week43 -£25,000.00

Davenport £40k weekts -£40,000.00

‘Loan from Chris Payandee due August 2007 e

Loan Interest

Unpaid Salaries

‘Gunnar Skoog from 2007 241,386.00

‘Andy Baker June and July 2007 18,745.06

Unpaid Exponses Ct

Martin Young expenses claim - Invoice 77 £31,051.66

‘Andrew Barker Expenses Claim £23,759.96

Other Creditors

Akerman Senterfitt $135,037.06

Evolution ££30,000.00

Grant Thornton $2,477.51

Henry Davis York $15,426.44

Jones Day 244,549.12

North Bridge $400,000.00

Sikich LLP $2,039.38

Zenith Trust 27,446.52

Inland revenue (PAYE & NI) (epproxnate calciaton no errands received) ££265,594.74

UKIR (Withhold tax) £924.00

‘Meretec Corp.

‘Advanced Waste Service $17,038.40

Burke Costanza & Cuppy LLP 316,840.91

Lake County Treasurer $10,841.32

Meade Electric Company $14,218.25

Praxalr-95023241 $9,726.09

Sikich LLP $146,176.01

Superior Engineering $12,079.17

‘Treasurer Lake County - Property tax $10,051.57

Grand total {$4,429,207.11 £699,743.77 € 271,672.32

‘Addross Uist of Creditors,

Supplier Address

Meretec Limited

‘Akerman Senierfitt Post Office Box 4906 Orlando, FL32802

‘Andrew Barker

Evolution Securities Limited 9th Floor, 100 Wood Street, London EC2V 7AN

Grant Thorton LLP. 4175 West Jackeon Blvd., Chicago. IL 60604

Henry Davis York 144 Martin Place Sydney NSW 2000 Australia

Inlend revenue (PAVE & NI) Cumbernauld Glasgow G67 1¥2.

Jones Day 21 Tudor Street London EC4T ODJ X67 London’ Chancery

Martin Young Martin Young's Private Office, PO Box 43659, Union House, Sth Floor, Port Sayeed Roar

North Bridge Capital Partners

Limited +14 Buckingham Gate, London SW1E 6LB

‘Sikich LLP ‘998 Corporate Bivd, Aurora, Il 60502-9102

UKIR (withhold tax) ‘Tex on CP loan interest 0802

oath Trust Company Limited PO Box 460, Waterloo House, Don Stroat, St Heller Jersey JE4 SRS

Meretec Corp.

Advanced Waste Service 1126 South 70th Street Suite N408B West Allis WI 53214

Burke Costanza & Cuppy LLP 9191 Broadway Merrillvile, IN 46410

Lake Counly Government Genter 2293 North Main Street Grown Point,

Lake County Treasurer Indiana 46307-1696,

Meade Electric Company

Praxair Distribution Ine Dept CH 10660 Palatine IL 60055-0660

‘Sikich Corp LLP 998 Corporate BWvd. Aurora, IL 60502-9102

‘Superior Engineering

Other Loan

Meyado Group Holdings '50 Shirley Street, PO Box N-624, Nassau, Bahamas

Meyado Private Weaith

Management ‘clo Meyade Group Holdings Limited as above

cma, Melbourne, Australia

Chris Payandee Madrid, Spain

Capital Structure

‘The company currently has epproximatoly 140 million shares on issue and Meyado Private Wealth

‘Management Limited is currently the largest shareholdor with epproximatsly 90% of the shares being

held in its nominee. I can confirm that Meyaco Private Wealth Management Limited is only a nominee

‘and has no beneficial interest in the company whatsoaver. Meyado Private Wealth Management is

required to resign as nominee for the beneficial shareholders due to administration,

‘There are approximately 380 nominee shareholders within the company with the largest nominee

being Meyado Group Holdings with the majority of rest ofthe investors private investors who are

resident in Europe, America and the Far East

Other details

‘The company has no Insurances, Pension schemes or landlords. The company has no other

employees other than the Directors all of whom are unpaid. Andrew Barker was the Managing

Director of Meretec Limited until the Asset Sale on August the 12th where he was also sold with the

‘company and he wes issued a new contract with CMA. He was never removed as a Director of

Meretec prior to this edministration order hence the aberration.

‘Summary

‘The Directors are aware that the assets in Meretec which are shares in CMA Corporation are

potentially undervalued on a temporary basis and that the realization of these shares now or in

the near future could be prejudicial to the intorests of all of the creditors equally. Furthermore

the Directors are aware that the company CMA corporation has within the last two wooks

received an all share offer for the company which was rejected as well as receiving a

Substantial new strategic shareholder all of which point to there being substantiated interest

within the primary assets that Meretec hold a strategic stake in CMA Corporation. The

Directors are concerned that if realization of the assets is forced now that it would be

prejudicial to the interests of the unsecured creditors and the company which could result in

Unfair economic advantage being g attributed to the secured creditors for sums far in excess,

of the sums owing to them under contract. This concerns the Directors and they wish to

officially bring this to the attention of the Administrators and the court.

Meretec Limited (in Administration)

Reportto Creditors & Statement of Proposals.

‘APPENDIX tl

© Joint Administrators Reooipts and Payments Account to 18 December 2008

Meretec Limited

(In Administration)

JOINT ADMINISTRATORS' INCOME AND EXPENDITURE ACCOUNT

Statement From 05/11/2008 From 05/11/2008

of affairs To 18/12/2008, To 18/12/2008

7 £ £

RECEIPTS

CMA Shares Uncertain 0.00 0.09

VAT Refund 163,000.00 162,231.75 162,231.75

Bank Interest Gross 218.88 218.88

Cash at Bank 2,000.00 421597 421597

168,666.60 168,666.60

PAYMENTS:

‘Statutory Advertising 169.92

Vat Receivable 25.49

195.41 195.61

BALANCE - 18 Decomber 2008 166,471.19

Merotec Limited (in Administration)

Reportto Crouitors & Statement of Proposals

‘APPENDIX IV

‘¢ Breakdown of Administrators Fees / Activity Codes

‘seis po aBreyo ty u s92L0Ueh J} NEE POM YoY pese—.U! BNE sje HDR. OY AK HAUT Sa JO oRNOD a NINO aN

{98 J0) eae no Bul Awning 20) xpUedEy 205

— 1unos0e uo user uopeieunogs

LER ORO oveadT — ooare —ag0SE GORE —aTORFET ‘39800 OL,

wee 008 vam cos UNUSED OR nou sod 3 os oBeiony

oor; orthoses cove ‘mou won,

oree ge ovst oo ‘sowwa9

009 Supe

os ot oro. ose ‘siosse o vonesntoy

oz oz ‘vonesiisenuy

ori =o hae oss ‘Surwueig pue uoneasiujUpY

sountea

We, wunssy —oeRSIMUpY —_smERSMMUPY OWES ss6e009 sobeuny 210s souea Sugeuen NOWLONn >R0M JO NOUYOIISEYTO

‘00 4313030 9} OL 8002 ABEWAAON 9 GoRzd 3HL YOd S3LVA LNO OUVHO GNY BNL 4O ANVMINS

(ouvensiaway ND cauMroaLHaN

‘SIP 9 STANDARD ACTIVITY SUMMARIES:

Standard Activity Examples of Work

‘Administration and Planning Case Planning

Administrative set up

Appointment and noffication

Maintenance of records

Statutory reporting

Estate accounting

Schedule company books and records

Investigation SiP2

CDDA report

Investigating antecedent transactions

Realisation of assets, Identifying, securing, insuring assets

Retention of title

Debt collection - pre and post appointment

Property, business and asset sales

Communication and negotiations with secured

creditors

Trading Planning

Management of operation

Communication/negotition with suppliers

Communication/negotiation with landlord

Communicatton/negotiation wit third parties

Monitor goods outward/inwards

Stock take

On-going employee issues

Travel

Creditors Communication with creditors

Creditor claims (including employees and other

preferential creditors

Meretec Limited (in Administration)

Report to Creditors & Statement of Proposals

APPENDIX V

‘© Breakdown of SFP Forensic Limited Fees

“sete po eetp ou) secuauen.0} yun pom rN pesBe!oU aNDY See! Gojoe sg 209K BUN Sua Jo Ws aN BANG ‘EN

{Weis 10} seu INO aBsaYD Aiming 40} mpueddy 995

‘une22e wo uneyp uopesounIeS

CSTE wort seI809 ea,

vem ost voor oo'00z ove coos nou 20d 3592 Bes0ny

oe hae ont : oe. oe sunou reo.

oreo es os oe. oe. uopeBneeny

soweng

MeL wesssy —soensupy —_seyeastuMPY OWS, 26eu0N, seBeuew ones —— Sulbouey,

NOWONn OM 40 NOLLYOHISSYTO

‘8002 HaENaOO 91 O1 9907 WABNAAON s GORA ZH Yo S21VE.LNO BORVHO ONY BW 40 ANVANNS

Lh

(iowmunsiniway ND aaLWn Sau

SISNEHO

coke

das

Meretec Limited (in Administration)

Report to Creditors & Statement of Proposals

‘APPENDIX VI

‘© Breakdown of SFP Datastore Limited Fees

wee

swowssingsig mo.

onuad F139

‘soma 5216

eunou suowesingsa

ase

ur=.0; 0984 I oBue4 faewuns 20} ypueUty 20g

wnop0e Uo une vontiountiey

¥ seso0 0

cose sno a goes a6 e0y

ee i ‘nou 90

ve sple2eu jo Bnepoqueaiy wong dh Beno,

sropums — siso0unS

Suysuewenny syse1 seg NoWoNna ION Jo WOMLYOIAIESY.O

‘02 waaneto3a 9} 01 soee EAANAAON 8 GONSd BH Nod SLY AND AORN GAY aM. 4O ALYHNS

(vouvanseunay wi oaumn oaizuaN

suoswiva

Th HH es

Morotec Limited {in Administration)

Report to Creditors & Statement of Proposals

‘APPENDIX Vil

‘+ Charge out Rates for SFP main practice and associated entities

(sysop ay sed 0913 S021 0} oe)

coses sow Aveda ohne

se i809 EIS

(sus 040 dr maa fog Ns

(su94 01 «16 Aanpa fac ewes euomppy pur Bursuowonyy

ys wo ee

swe sue, sz 800 JIS

w (won201109

80mg x08 ue leneiney) syse1 eBei01g

EE ERS TRE aes

POUT SOE das

se se ou

oor 06 oo

ost ou ost

02 cel oz.

sz ost see

osz Su ose.

su oz, zuebouen | | siz

oe sz Lssbeveyy owes | | ooe

see ose. Zsa6evey souues | | seo

osy. soeeia Buyseuen | | suz soanq Buibeuen | | Osh sopeg Bubevey)

TTS oes | | may pe RTS, Spe

OVP] SOSROTSY dS amar Ruedaag das eva] SISUBIe SIS