Professional Documents

Culture Documents

Problems

Uploaded by

dandiaconeasa0 ratings0% found this document useful (0 votes)

2 views1 pageThis document summarizes four problems related to utility and risk aversion in international investments.

The first problem asks about how much an individual with different wealth levels ($5000 and $1,000,000) and utility functions (log and inverse) would pay to avoid a 50% chance of gaining or losing $2000.

The second problem asks how much an owner of a store valued at $1,000,000, who faces risks of hurricane damage, would pay for insurance that covers the difference to $1,000,000 if his utility is the log function.

The third problem asks whether purchasing both lottery tickets and property insurance represents rational behavior, and if so how it can be explained given the lottery

Original Description:

nnnnnnnnnnnnnnnnnnn

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes four problems related to utility and risk aversion in international investments.

The first problem asks about how much an individual with different wealth levels ($5000 and $1,000,000) and utility functions (log and inverse) would pay to avoid a 50% chance of gaining or losing $2000.

The second problem asks how much an owner of a store valued at $1,000,000, who faces risks of hurricane damage, would pay for insurance that covers the difference to $1,000,000 if his utility is the log function.

The third problem asks whether purchasing both lottery tickets and property insurance represents rational behavior, and if so how it can be explained given the lottery

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageProblems

Uploaded by

dandiaconeasaThis document summarizes four problems related to utility and risk aversion in international investments.

The first problem asks about how much an individual with different wealth levels ($5000 and $1,000,000) and utility functions (log and inverse) would pay to avoid a 50% chance of gaining or losing $2000.

The second problem asks how much an owner of a store valued at $1,000,000, who faces risks of hurricane damage, would pay for insurance that covers the difference to $1,000,000 if his utility is the log function.

The third problem asks whether purchasing both lottery tickets and property insurance represents rational behavior, and if so how it can be explained given the lottery

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

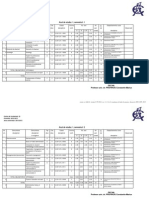

Seminar 5 International Investments

Utility and Risk Aversion

1. Suppose your utility function can be characterized by U(W) = lnW, and you are

facing a gamble in which you stand either to win or to lose $2000. Each outcome has

a probability of .5. How much would you be willing to pay to avoid this gamble if

your initial wealth were $5000? How much would you be willing to pay if your initial

wealth were $1,000,000? How would your answer dier if your utility function were

characterized instead by U(W) = 1/W?

2. A store-owner faces a probability of .02 that a hurricane will reduce the value of his

store to $1 during the next year. There is also a probability of .03 that a hurricane

will reduce the stores value to $500,000, and a probability of .95 that no hurricane

will occur, in which case the store is worth $1,000,000. An insurance company is

willing to insure the store at its current market value. That is, if a hurricane occurs,

the insurance company will pay the dierence between $1 million and the stores

value after the storm. If the store-owners utility function is U(W) = lnW, what is

the maximum amount he will be willing to pay to buy this insurance?

3. Many people purchase lottery tickets. This purchase represents an exchange of a

sure amount of wealth (the cost of the ticket) for an uncertain amount (that is, a

payo of either zero or the lottery jackpot. Moreover, the expected payo on the

lottery ticket is less than the cost of the ticket. Many of the same people purchase

property insurance. This purchase represents an exchange of an uncertain amount of

wealth (the value of the property uninsured) for a certain amount (the insured value

of the property). Does this purchase represent rational behavior? If so, how can it

be explained?

4. You are interested in buying a store with a value of $1,000,000. You have $1,500,000

and you decide to place the rest in a bank deposit with an interest rate of 10% per

year for 6 months. There is a probability of .001 that your store will burn to the

ground and its value will be reduced to zero. With a power utility (U(W) = 1/W)

of the wealth 6 months in the future, how much would you be willing to pay for

insurance (at the beginning)? Assume that if the house does not burn down, its

end-of-year value still will be $1,000,000.

Conf. dr. Radu Lupu

Asist. dr. Sorin Dumitrescu, CFA

1

You might also like

- What are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceFrom EverandWhat are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceNo ratings yet

- Real Estate RichesDocument10 pagesReal Estate RichesPJJ SmitNo ratings yet

- Derivatives Future & OptionsDocument6 pagesDerivatives Future & OptionsNiraj Kumar SahNo ratings yet

- Ch. 2. Asset Pricing Theory (721383S) : Juha Joenväärä University of Oulu March 2014Document31 pagesCh. 2. Asset Pricing Theory (721383S) : Juha Joenväärä University of Oulu March 2014Asma DahmenNo ratings yet

- Risk ManagementDocument165 pagesRisk ManagementAvesh Saiyad100% (2)

- Notes On UncertaintyDocument8 pagesNotes On UncertaintySameen SakeebNo ratings yet

- Topic 1-Expected Utility TheoryDocument3 pagesTopic 1-Expected Utility TheoryMIRADOR ACCOUNTANTS KENYANo ratings yet

- Financial Markets and Instruments 9Document17 pagesFinancial Markets and Instruments 9Zhichang ZhangNo ratings yet

- The Demand and Supply of Health InsuranceDocument6 pagesThe Demand and Supply of Health Insuranceannie:XNo ratings yet

- A Short Essay On The Inconcistency of Insurance and GamblingDocument7 pagesA Short Essay On The Inconcistency of Insurance and GamblingZakaria CassimNo ratings yet

- 3 Risk-and-Risk-Aversion-part-1Document9 pages3 Risk-and-Risk-Aversion-part-1richard.hugsNo ratings yet

- Chapter1 Decision Theory Under UncertaintyDocument27 pagesChapter1 Decision Theory Under UncertaintydianazokhrabekovaNo ratings yet

- The Basic Tools of Finance CH 14Document45 pagesThe Basic Tools of Finance CH 14Abdul Qadeer ZawriNo ratings yet

- Homework 5 AnswersDocument5 pagesHomework 5 AnswersSophia SeoNo ratings yet

- Module II Risk and UncertainityDocument11 pagesModule II Risk and UncertainityJebin JamesNo ratings yet

- Choice Under Uncertainty: Review QuestionsDocument7 pagesChoice Under Uncertainty: Review Questions1111111111111-859751No ratings yet

- Tools FinanceDocument40 pagesTools FinanceHasnatNo ratings yet

- Atom and Molecules PDFDocument4 pagesAtom and Molecules PDFSusmitaMandalNo ratings yet

- Unit 21Document20 pagesUnit 21Mais OmerNo ratings yet

- Health Economics - Lecture Ch08Document64 pagesHealth Economics - Lecture Ch08Katherine SauerNo ratings yet

- Uncertainty and Consumer Behavior: Questions For ReviewDocument11 pagesUncertainty and Consumer Behavior: Questions For ReviewAudy syadzaNo ratings yet

- Actuarial Two. Unit 1Document50 pagesActuarial Two. Unit 1Mohamedi ZuberiNo ratings yet

- PS 2 Fall2022Document4 pagesPS 2 Fall20221227352812No ratings yet

- Health Insurance L3-2Document39 pagesHealth Insurance L3-2aochu111No ratings yet

- CH 05Document11 pagesCH 05tayakabhaiNo ratings yet

- The Basic Tools of FinanceDocument42 pagesThe Basic Tools of FinanceSandra Hanania PasaribuNo ratings yet

- Insurance Approach: Mortality Models and Credit Risk +Document6 pagesInsurance Approach: Mortality Models and Credit Risk +Madhusudan RaoNo ratings yet

- Econ3007 ForexriskDocument32 pagesEcon3007 ForexriskSta KerNo ratings yet

- SEC17 - Section 17 Pricing DerivativesDocument26 pagesSEC17 - Section 17 Pricing DerivativesLooseNo ratings yet

- 4 Uncertainty and InformationDocument40 pages4 Uncertainty and InformationJames GreenNo ratings yet

- L13 SensitivityDocument217 pagesL13 Sensitivityo3283No ratings yet

- Week 3 EconDocument11 pagesWeek 3 EconAndrew FergusonNo ratings yet

- October University For Modern Sciences & Arts Model Answer For Mid Term ExamDocument10 pagesOctober University For Modern Sciences & Arts Model Answer For Mid Term ExamkoftaNo ratings yet

- Chapter 5 Choice Under Uncertainty: Review QuestionsDocument8 pagesChapter 5 Choice Under Uncertainty: Review QuestionsYanee ReeNo ratings yet

- ACST152 2015 Week 9 Utility TheoryACST152 2015 Week 9 LeverageDocument15 pagesACST152 2015 Week 9 Utility TheoryACST152 2015 Week 9 LeveragenigerianhacksNo ratings yet

- Uncertainty and InformationDocument56 pagesUncertainty and Informationvedicagupta2405No ratings yet

- Exercises For RevisionDocument3 pagesExercises For Revisiontrinhmyngoc.uebNo ratings yet

- bt lỗ lãi bảo hiểmDocument3 pagesbt lỗ lãi bảo hiểmnguyenphuonganh07102002No ratings yet

- Handout 1 Choice Under UncertaintyDocument2 pagesHandout 1 Choice Under Uncertaintytaruna64ssaNo ratings yet

- Yale University - Financial Market CourseDocument26 pagesYale University - Financial Market CourseNitendo CubeNo ratings yet

- 4 05 Section Risk2Document3 pages4 05 Section Risk2lolforme14No ratings yet

- Info Lec 3Document2 pagesInfo Lec 3mostafa abdoNo ratings yet

- Gobble de La Gobble: An American Thanksgiving - 2011 Tangible Primary Market & Intangible Secondary MarketDocument5 pagesGobble de La Gobble: An American Thanksgiving - 2011 Tangible Primary Market & Intangible Secondary MarketA. CampbellNo ratings yet

- Exercises For Revision With SolutionDocument4 pagesExercises For Revision With SolutionThùy LinhhNo ratings yet

- Class Activity - UncertaintyDocument3 pagesClass Activity - UncertaintyCarine TeeNo ratings yet

- Exercise 6 UncertaintyDocument3 pagesExercise 6 UncertaintyChuang VisoldilokNo ratings yet

- Underatanding Risk & Attitudes Towards Risk Together With A Comparative Perspective Between Expected Utility Maximization & Prospect TheoriesDocument32 pagesUnderatanding Risk & Attitudes Towards Risk Together With A Comparative Perspective Between Expected Utility Maximization & Prospect TheoriesAbhishek YadavNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Hedge (Finance) : What Does Hedge Mean?Document4 pagesHedge (Finance) : What Does Hedge Mean?kkrathodNo ratings yet

- Full Download Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions ManualDocument36 pagesFull Download Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions Manualtapergodildqvfd100% (40)

- Dwnload Full Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions Manual PDFDocument36 pagesDwnload Full Fundamentals of Investments Valuation and Management 8th Edition Jordan Solutions Manual PDFvadhkhrig100% (13)

- Handout 9: Choice Under UncertaintyDocument6 pagesHandout 9: Choice Under UncertaintyRaulNo ratings yet

- Introduction To Risk Premium and Markowitz-BBDocument22 pagesIntroduction To Risk Premium and Markowitz-BBCarla SolerNo ratings yet

- Disprob PDFCKFCFKCDocument2 pagesDisprob PDFCKFCFKCFranco VillaromanNo ratings yet

- Forward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S UniversityDocument9 pagesForward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S UniversityMamoon RashidNo ratings yet

- Micro-Economics Q&ADocument8 pagesMicro-Economics Q&AAdnan Mohamed AhmedNo ratings yet

- Risk Management PDFDocument165 pagesRisk Management PDFPALADUGU MOUNIKANo ratings yet

- Chapter 3: Choice Under Uncertainty: Learning ObjectivesDocument5 pagesChapter 3: Choice Under Uncertainty: Learning ObjectivesRizza MendozaNo ratings yet

- Anul de Studiu: 1, Semestrul: 1: VăswăpkqăDocument2 pagesAnul de Studiu: 1, Semestrul: 1: VăswăpkqădandiaconeasaNo ratings yet

- Trade Policy in The EUDocument2 pagesTrade Policy in The EUdandiaconeasaNo ratings yet

- Why AmericaDocument3 pagesWhy AmericadandiaconeasaNo ratings yet

- African Trade: More Blocks Than RoadsDocument2 pagesAfrican Trade: More Blocks Than RoadsdandiaconeasaNo ratings yet