Professional Documents

Culture Documents

Sample Company Balance Sheet: Analtemplate

Uploaded by

Naoman Ch0 ratings0% found this document useful (0 votes)

11 views1 pageratio analysis

Original Title

Anal Template

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentratio analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageSample Company Balance Sheet: Analtemplate

Uploaded by

Naoman Chratio analysis

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

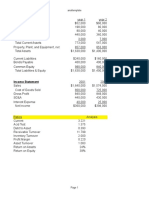

analtemplate

Ratio Analysis Template

Sample Company

Balance Sheet Dec 31 2001 Dec 31 2000

Cash $52,000 $60,000

Accounts Receivable 198,000 80,000

Marketable Securities 80,000 40,000

Inventories 440,000 360,000

Prepaids 3,000 7,000

Total Current Assets 773,000 547,000

Property, Plant, and Equipment, net 857,000 853,000

Total Assets $1,630,000 $1,400,000

=========== ===========

Current Liabilities $240,000 $160,000

Bonds Payable 400,000 400,000

Common Equity 990,000 840,000

Total Liabilities & Equity $1,630,000 $1,400,000

=========== ===========

Income Statement 2001 2000

Sales $1,640,000 $1,574,000

Cost of Goods Sold 800,000 725,000

Gross Profit 840,000 849,000

SG&A 440,000 430,000

Interest Expense 40,000 25,000

Net Income $360,000 $394,000

=========== ===========

Common Ratios 2001

Current 3.221

Acid Test 1.375

Debt to Asset 0.393

Receivable Turnover 11.799

Inventory Turnover 2.000

Profit Margin 0.220

Asset Turnover 1.083

Return on Assets 24%

Return on Equity 39%

This file contains a spreadsheet that can be used as a template for conducting ratio analysis. Using

the data below for Sample Company, several commonly used financial statement analysis ratios are

computed, using the data contained in the cells for the Balance Sheet and Income Statement for

Sample Company. Click on any of the cells containing a ratio to see how the ratios are computed

based on cell-referenced formulas.

To use this template for analysis of another company, copy this template to another spreadsheet

and substitute another company's financial statement data in place of the Sample Company data.

Additional ratios and analysis can be performed by inserting your own ratio formulas into the

spreadsheet and/or by incorporating additional information (e.g., free cash flow analysis or debt

coverage ratios).

Page 1

You might also like

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- Working Capital Management: Applications and Case StudiesFrom EverandWorking Capital Management: Applications and Case StudiesRating: 4.5 out of 5 stars4.5/5 (4)

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- Solution To Ch02 P14 Build A ModelDocument4 pagesSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Ch02 P14 Build A Model AnswerDocument4 pagesCh02 P14 Build A Model Answersiefbadawy1No ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- MME 3113 Assignment #2 Financial Ratios & Cash FlowDocument8 pagesMME 3113 Assignment #2 Financial Ratios & Cash FlowAnisha ShafikhaNo ratings yet

- Sample Company Balance SheetDocument1 pageSample Company Balance SheetStephen MagudhaNo ratings yet

- Analys TemplateDocument1 pageAnalys TemplateJack SanchezNo ratings yet

- Ratio Analysis ABC Company Balance Sheet: AnaltemplateDocument1 pageRatio Analysis ABC Company Balance Sheet: AnaltemplateselvamNo ratings yet

- CH 04Document27 pagesCH 04ClaraNo ratings yet

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- Chapter 4 Problem 32Document9 pagesChapter 4 Problem 32morgan.bertoneNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Sample Company Balance Sheet: AnaltemplateDocument4 pagesSample Company Balance Sheet: AnaltemplateSaidNawazNo ratings yet

- Sandra Company Financial Statement Analysis 2019 vs 2018Document4 pagesSandra Company Financial Statement Analysis 2019 vs 2018Jhazzie DolorNo ratings yet

- Ratio Analysis Template: AnaltemplateDocument1 pageRatio Analysis Template: AnaltemplatefaridaNo ratings yet

- CH 01Document5 pagesCH 01deelol99No ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Eliminating Unrealized Profit on Intercompany SalesDocument6 pagesEliminating Unrealized Profit on Intercompany SalesYuitaNo ratings yet

- Cash Flow Statement Illustration (IAS 7)Document2 pagesCash Flow Statement Illustration (IAS 7)amahaktNo ratings yet

- Module 3Document53 pagesModule 3prabhakarnandyNo ratings yet

- Financial AnalysisDocument8 pagesFinancial AnalysisAzrul KechikNo ratings yet

- section 4 (1)Document3 pagessection 4 (1)com01156499073No ratings yet

- Ch 02 Build Cumberland Industries Income Statement and Balance SheetDocument6 pagesCh 02 Build Cumberland Industries Income Statement and Balance SheetKhurram KhanNo ratings yet

- Financial Statement Analysis 1Document15 pagesFinancial Statement Analysis 1Ladymie MantoNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresNo ratings yet

- Student Ch03 FOF8eDocument131 pagesStudent Ch03 FOF8eRainey KamNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Complete Equity Method Workpaper Entries - Year 2010Document14 pagesComplete Equity Method Workpaper Entries - Year 2010jeankoplerNo ratings yet

- Preparing a Cash Flow StatementDocument7 pagesPreparing a Cash Flow StatementMiconNo ratings yet

- Financial Statement Analysis of Jenny CompanyDocument5 pagesFinancial Statement Analysis of Jenny CompanyAshley Rouge Capati QuirozNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Financial Statement AnalysisDocument48 pagesFinancial Statement AnalysisCheryl LowNo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJelwin Enchong BautistaNo ratings yet

- MAC 102 201905 Foundations of Accounting II.Document6 pagesMAC 102 201905 Foundations of Accounting II.Angellah Batiraishe MoyoNo ratings yet

- Assignment 6Document8 pagesAssignment 6Lara Lewis AchillesNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisEmmanuel PenullarNo ratings yet

- C5B Profitability AnalysisDocument6 pagesC5B Profitability AnalysisSteeeeeeeephNo ratings yet

- Technopreneurship PPT Presentation Group 1Document57 pagesTechnopreneurship PPT Presentation Group 1Mia ElizabethNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisbilalahmedbhuttoNo ratings yet

- Financial Statement Analysis Questions ExplainedDocument4 pagesFinancial Statement Analysis Questions ExplainedRisha OsfordNo ratings yet

- IA8 Spreadsheet 09-CDocument6 pagesIA8 Spreadsheet 09-CLayNo ratings yet

- Accounting-8264829Document6 pagesAccounting-8264829nathardeen2000100% (3)

- FS Analysis PT 2 - AssignmentDocument13 pagesFS Analysis PT 2 - AssignmentKim Patrick VictoriaNo ratings yet

- Nama: Theresia Tenera P NIM / Angkt: 01012681418029 / 38 Mata Kuliah: Manajemen Modal Kerja Magister ManajemenDocument6 pagesNama: Theresia Tenera P NIM / Angkt: 01012681418029 / 38 Mata Kuliah: Manajemen Modal Kerja Magister ManajemenTheresia Tenera Perangin-AnginNo ratings yet

- Chapter 5 - Financial Study 5%Document16 pagesChapter 5 - Financial Study 5%Louris NuquiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- P.O.M Final ResultDocument2 pagesP.O.M Final ResultNaoman ChNo ratings yet

- Family Business Succession Planning Managing The Family ComponentDocument1 pageFamily Business Succession Planning Managing The Family ComponentNaoman ChNo ratings yet

- TQM Group List MBA 3.5-4th SemesterDocument3 pagesTQM Group List MBA 3.5-4th SemesterNaoman ChNo ratings yet

- SBM Chapter-01Document46 pagesSBM Chapter-01Naoman ChNo ratings yet

- Price HondaDocument3 pagesPrice HondaNaoman ChNo ratings yet

- Pom Final SlidesDocument36 pagesPom Final SlidesNaoman ChNo ratings yet

- Mutual Fund Industry of PakistanDocument28 pagesMutual Fund Industry of Pakistanhammy86No ratings yet

- IntroductionDocument3 pagesIntroductionNaoman ChNo ratings yet

- RBVDocument7 pagesRBVNaoman Ch100% (1)

- Frichicks Swot and Case StudyDocument6 pagesFrichicks Swot and Case StudyNaoman ChNo ratings yet

- Presentation For Defense - FinalDocument45 pagesPresentation For Defense - FinalNaoman ChNo ratings yet

- CokeDocument26 pagesCokeWaqar MahmoodNo ratings yet

- SSRN Id2004508Document20 pagesSSRN Id2004508Naoman ChNo ratings yet

- Mutual Fund in Pakistan, Types and Performance EvaluationDocument7 pagesMutual Fund in Pakistan, Types and Performance Evaluationbonfument100% (2)

- Proposed Format For Research Proposal For MPhill and PHDDocument3 pagesProposed Format For Research Proposal For MPhill and PHDNaoman ChNo ratings yet

- Majid Hussain Internship LetterDocument1 pageMajid Hussain Internship LetterNaoman ChNo ratings yet

- Equivalence Degree Attestation RequirementsDocument1 pageEquivalence Degree Attestation RequirementsAmir MasoodNo ratings yet

- Human Capital ManagementDocument40 pagesHuman Capital ManagementNaoman Ch50% (2)

- Leadership Qualities Everyone Can UseDocument8 pagesLeadership Qualities Everyone Can UseNaoman ChNo ratings yet

- Jan2014 - Schedule of Charges (Jan - Jun 2014)Document41 pagesJan2014 - Schedule of Charges (Jan - Jun 2014)greatguy_07No ratings yet

- 301Document13 pages301Thu TrangNo ratings yet

- Proposed Format For Research Proposal For MPhill and PHDDocument3 pagesProposed Format For Research Proposal For MPhill and PHDNaoman ChNo ratings yet

- Kashmir Trip Declaration FormDocument1 pageKashmir Trip Declaration FormNaoman ChNo ratings yet

- Leadership Qualities Everyone Can UseDocument8 pagesLeadership Qualities Everyone Can UseNaoman ChNo ratings yet

- Muhammad Naoman RazzaqDocument2 pagesMuhammad Naoman RazzaqNaoman ChNo ratings yet

- Customer Satisfaction, Trust, and Loyalty in BankingDocument15 pagesCustomer Satisfaction, Trust, and Loyalty in BankingNaoman ChNo ratings yet

- VDocument23 pagesVNaoman ChNo ratings yet

- 2 Impact of Work LifeDocument8 pages2 Impact of Work LifeNaoman ChNo ratings yet

- AccountingDocument95 pagesAccountingNaoman ChNo ratings yet

- Letter of Offer of EmploymentDocument3 pagesLetter of Offer of EmploymentNaoman ChNo ratings yet