Professional Documents

Culture Documents

Bank Alfalah Deposits IFE Matrix of Bank Alfalah Deposits Weights Rates Weighted Scores

Bank Alfalah Deposits IFE Matrix of Bank Alfalah Deposits Weights Rates Weighted Scores

Uploaded by

zahranqv10 ratings0% found this document useful (0 votes)

9 views10 pagesIE

Original Title

IE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views10 pagesBank Alfalah Deposits IFE Matrix of Bank Alfalah Deposits Weights Rates Weighted Scores

Bank Alfalah Deposits IFE Matrix of Bank Alfalah Deposits Weights Rates Weighted Scores

Uploaded by

zahranqv1IE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

Bank Alfalah Deposits

IFE Matrix of Bank Alfalah Deposits

Weights Rates Weighted Scores

Strengths:

Financing facility up to 90% of the deposited amount 0.09 4

0.36

Customers Invest with a minimum deposit of Rs.

50,000 for1 year term deposit & Rs. 100,000 for 3

years term deposit

0.06

3

0.18

Attractive rate of 8.5%* on 1 year term deposit & 9%*

on 3 year term deposit

0.07 4

0.28

electronic transfers to move money in and out of the

account.

0.06 3

0.18

provide a very safe investment and guaranteed

returns/profit every month.

0.07 4

0.28

provides Customers to deposit cash in customers

account

0.06 3

0.18

The cash department is given special importance as

they have liquidity at all times.

0.06 3

0.18

Deposits structured for savings products, choose the

option that best suits customers needs and start

enjoying their daily banking services through vast

branch network and self service banking solutions.

0.07

4

0.28

Weaknesses:

Liquidity Risk.of security/asset cannot be traded in a quick time 0.09 1 0.09

frame in the market.

some of the funds that deposit into deposit account are not

immediately available.

0.07 1

0.07

Penalty on deposits that are withdraw prior to the maturity

date.

0.05 2

0.1

banks in particular offer lower rates of return on fixed deposits.

If interest rates go up, you may be locked in at a lower rate. The

funds are not at call, they are locked into a contract for a certain

term agreed by you and the bank.

0.06

1

0.06

Interest penalties will apply in emergency availability of

deposits.

0.06 2

0.12

Deduction of Zakat and withholding Tax @ 10%. 0.06 2

0.12

banks charge monthly service fees that you incur if your account

balance falls below a certain level.

0.07 1

0.07

TOTAL 1

2.55

EFE Matrix of Bank Alfalah Deposits

Weights Rates Weighted

Scores

Opportunities:

Customers can earn high rate of returns on your fixed deposits

with the benefit of monthly profits by Alfalah Mahana Amdan.

0.07 4

0.28

With a demand customers can withdraw all available funds at

any time.

0.06 3

0.18

Bank alfalah has numerous opportunities in future to increase

the volume of business

0.06 3

0.18

The money is not safe in corporate fixed deposits which earn a

higher interest rate as it would be in a bank

0.09 4

0.36

Bank Al-Falah Limited also issues Call Deposit Receipts (CDR). It

is an instrument like Cheque issued by the bank on account of a

customer & in favor of a person, to pay the specified amount.

0.06

3

0.18

The bank enjoys the benefit of keeping funds deposited until the

payment is not made.

0.06

3

0.18

Customers do not have to carry cash when they have a demand

deposit account because they use electronic transfers to move

money in and out of the account.

0.07

4

0.28

Threats:

if bank fall behind on deposits then depositor can go to court

and ask a judge to recover deposits.

0.07 2

0.14

some banks do offer a floating rate option. 0.06 2

0.12

Political situation in Pakistan is not good. Investors and

businessmen are shifting their assets outside Pakistan. Most

important of all is that the policies of Pakistani Government are

not consistent.

0.07

1

0.07

The privatization of other banks is thread fo bank alfalah 0.05 2 0.1

Reputation Risk of the bank loosing its repute among the

customers

0.07 1

0.07

systematic risk of bank deposits is often beyond the control due

to the macroeconomic factors

0.06 1

0.06

Credit Risk for the bank as he fails to repay the money to the

depositors.

0.07 1

0.07

All the banks are providing deposits facility so the competition

is high.

0.08 2

0.16

TOTAL 1 2.43

Bank Alfalah Loans

IFE Matrix of Bank Alfalah Loans

weight Rate Weighted

Score

Strength

1.Speedy loan approval process 0.05 4 0.2

2.Affordable tailor-made financing option 0.06 3 0.18

3.Flexibility to choice the repayment plans 0.05 4 0.2

4.Long tenure system 0.04 3 0.12

5.Modernization banking system(online)for loan customers 0.08 3 0.24

6.No hidden charges 0.07 3 0.21

7. Minimum down payments complete payment at any point of

time.

0.09 4 0.36

8. Loans can be obtained in U.S dollar, pound sterling Euro

Japanese.

0.06 3 0.18

Weaknesses

1.Do not announced a loan scheme for all talented individuals

and upcoming talent

0.07 1 0.07

2.It provides loans to already successful business .It does not

help

In minimizing the ever growing gap between rich and under-

privileged.

0.08 1 0.08

3. Do not play an active role in prime minister youth loan. 0.06 2 0.12

4. Bank ignores the public sector. 0.06 2 0.12

5. Business loans are not given to middle and lower class as

compares to upper level class.

0.09 1 0.09

6. Market department is not doing well performing poorly in

impressing or even reaching the target audience.

0.07 1 0.07

7. Banking language is not convenient so ordinary citizen could

not conveniently understand how their bank is performing.

Most of the form of loan also difficult to understand for

common people.

0.07 2 0.14

TOTAL 1 2.38

EFE Matrix of Bank Alfalah Loans

weight Rate Weighted

Score

Opportunities

1.High velocity of people growth 0.09 4 0.36

2.Information technology 0.07 3 0.21

3.Local setup expansion 0.05 2 0.10

4.Increasing scope of small and medium enterprise 0.06 3 0.18

5.Small farmers need loan or finance for latest purchase of

equipments and fertilizers

0.09 4 0.36

6.Business class need loan for business expansion 0.07 3 0.21

7. Less cost and harsh policies. 0.08 3 0.24

Threats

1. When loan is given to any customer there is always include

of defaulting.

0.09 3 0.27

2.Uncertain economic condition 0.08 4 0.32

3. Competition in banking sector. 0.09 3 0.27

4. Government policies pose unpleasant role. 0.10 2 0.20

5.Some banks offers a floating rates 0.06 2 0.12

6. Increasing SBP regulation in the banking industry. 0.07 3 0.21

TOTAL 1 3.05

Lending to Financial Institutions of Bank Alfalah

IFE Matrix of Bank Alfalahs Lending to Financial Institutions

Weights Rates Weighted

Scores

STRENGTH

Up to 90% financing against security deposit. 0.10 4 0.4

The amount of financing under Alfalah Quick Finance ranges

from Rs. 50,000 to Rs. 75,000,000 and up to Rs. 100,000,000

for corporate.

0.08 3 0.24

Affordable markup rates.

0.07 3 0.21

Offer a wide range of trade services designed to meet a range

of our corporate clients needs.

0.12 4 0.48

Business loans and solutions to meet your specific short-term

or long-term funding and business expansion requirements.

0.05 3 0.15

Financing facility up to 70% of assessed market value of

mortgaged property; 35% of sales turnover or 40% of the

projected cash flows over the period of finance.

0.08 3

0.24

Weakness

1) Penalty on late payment of the loans.

0.08 2 0.16

2) Bank charge extra charges for deductions. 0.10 .2 0.2

3)Bank favors the old clients and gives fewer opportunities.

0.07 2 0.14

4) Bank offered suitable rates other than banks but not on

flexible conditions.

0.12 1 0.12

5)Large business parties have fewer attractions in being

a client of BAL-IBD, mainly because of excessive amount of

documentation.

0.05 1 0.12

6) Business loans are not given to lower class as compared to

upper class.

0.08 1 0.08

TOTAL 1 2.52

EFE Matrix of Bank Alfalahs Lending to Financial Institutions

weight Rate Weighted

Score

OPPORTUNITY

Increasing scope of small and medium enterprise

0.09

3

0.27

Peace and security conditions if favorable.

0.07 4

0.28

The bank enjoys the benefit of keeping funds deposited until

the payment is not made.

0.09

3

0.27

Bank Alfallah has numerous opportunities in future to

increase the volume of business.

0.08

4

0.32

local set up expansion

0.07

4

0.28

High population growth rate

0.08

3

0.24

THREATS

Some banks do offer a floating rate option.

0.07

2

0.14

If bank fails to provides the finance , shares and trade finance

illegal then debtor can go to court .

0.08

1

0.08

Economic condition is not good in Pakistan for business thats

why difficult for bank to charge high rates of return.

0.08

2 0.16

Systematic risk of bank loans is often beyond the control due

to the currency fluctuations and economic factors.

0.09

2

0.18

All the banks are providing loan at flexible rates so the

competition is high.

0.12

1

0.12

Debit Risk for the bank as he fails to repay the money back to

bank.

0.08

1

0.08

TOTAL 1 2.42

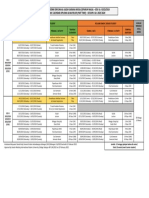

Product

Division

Products of Alfalah

Bank

Sales(in 000)

Profits % IFE EFE

1 Deposits 525525770

50% 2.55 2.43

2 Loans 260779850

38% 2.38 3.05

3 Lending to Financial

Institutions

2522022

12% 2.52 2.42

Deposits

IFE= 2.55

EFE= 2.43

Loans

IFE= 2.38

EFE= 3.05

Lending to Financial

Institutions

IFE= 2.52

EFE= 2.42

IE Matrix

I II

III

IV

V

IV

VI

VII XI

Strong Average Weak

3.0-4.0 2.0-2.99 1.0-1.99

4.0 3.0 2.0 1.0

High

3.0-4.0

3.0

Medium

2.0-2.99

2.0

Low

1.0-1.99

1.0

The EFE

Total

Weighted

Score

The IFE Total Weighted

Score

Grow and Build

Backward, Forward and Horizontal

Integration.

Market Penetration

Market Development

Product Development

L.F.I

IFE= 2.52

EFE= 2.42

Deposits

IFE= 2.55

EFE= 2.43

Loans

IFE= 2.38

EFE= 3.05

Quadrants I, II and IV

Grow and build

Backward, Forward and Horizontal Integration.

Market Penetration

Market Development

Product Development

Quadrants III, V and VII

Hold and maintain

Market Penetration

Product Development

Quadrants VI, VIII and IX

Harvest or divest

Retrenchment

Divestiture

Strategy Recommended:

Bank Alfalah position lies in Sector-II for Loans and lies in Section v for deposits & lending to

financial institutions and it have strong IFE as well as High EFE score. Therefore bank should

apply the Grow and Build for loans and Hold and Maintain for lending to financial

institutions

Hold and Maintain

Market Penetration

Product Development

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Job Order Pure ProblemsDocument19 pagesJob Order Pure ProblemsolafedNo ratings yet

- SWOT Analysis of DepositsDocument3 pagesSWOT Analysis of Depositszahranqv1No ratings yet

- Golden ABCDocument2 pagesGolden ABCSumin SeongNo ratings yet

- Employee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanDocument1 pageEmployee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanXiao Minn NeohNo ratings yet

- Medical Rep QuestionsDocument14 pagesMedical Rep Questionshina100% (1)

- Business Policy and StrategyDocument38 pagesBusiness Policy and Strategyzahranqv1No ratings yet

- SwotDocument5 pagesSwotzahranqv1No ratings yet

- BCG MATRIX of Bank Alfalah:: Banking Industry Growth in 2013 Is 9%Document3 pagesBCG MATRIX of Bank Alfalah:: Banking Industry Growth in 2013 Is 9%zahranqv1No ratings yet

- Internal Factor Evaluation Matrix 2Document4 pagesInternal Factor Evaluation Matrix 2zahranqv1100% (1)

- IFE Matrix of Bank Alfalah Deposits: Weights Rates Weighted Scores StrengthsDocument4 pagesIFE Matrix of Bank Alfalah Deposits: Weights Rates Weighted Scores Strengthszahranqv1No ratings yet

- PAK Suzuki Case StudyDocument15 pagesPAK Suzuki Case Studyzahranqv1No ratings yet

- Final Paper of Group 3-K31Document43 pagesFinal Paper of Group 3-K31Maureen MenorNo ratings yet

- AiaDocument38 pagesAiaharrydrivesucrazyNo ratings yet

- A Glossary of Lean TermsDocument5 pagesA Glossary of Lean TermsDipak Kumar PatelNo ratings yet

- Chapter 9 Summary: For Asset Disposal Through Discarding or SellingDocument2 pagesChapter 9 Summary: For Asset Disposal Through Discarding or SellingAreeba QureshiNo ratings yet

- Annual Report 2014 2015 0Document61 pagesAnnual Report 2014 2015 0SmollettesNo ratings yet

- (Intro Entrepreneurship) (G) Business Plan Group 7Document64 pages(Intro Entrepreneurship) (G) Business Plan Group 7Farrah SharaniNo ratings yet

- Company LawDocument111 pagesCompany LawVaibhav ArwadeNo ratings yet

- R2003D10581013 Assignment 1 - Finance & Strategic ManagementDocument10 pagesR2003D10581013 Assignment 1 - Finance & Strategic ManagementMandy Nyaradzo MangomaNo ratings yet

- Optimal ScamDocument2 pagesOptimal ScamMuaaz ButtNo ratings yet

- Nota StrategicDocument2 pagesNota StrategicFakhruddin FakarNo ratings yet

- Programme: Bachelor of Business Administration (Bba) (Updated:24/7/2018)Document4 pagesProgramme: Bachelor of Business Administration (Bba) (Updated:24/7/2018)ashraf95No ratings yet

- V.balamurugan and M.manoharanDocument10 pagesV.balamurugan and M.manoharanAmritansh ChoubeyNo ratings yet

- Retail Marketing ManagerDocument2 pagesRetail Marketing ManagerRoscoeNo ratings yet

- Takwim Akademik Diploma Ism PT 2023 2024 Pindaan 1Document1 pageTakwim Akademik Diploma Ism PT 2023 2024 Pindaan 1Raihana AzmanNo ratings yet

- Marketing 3.0: Dr. (Prof.) Philip KotlerDocument9 pagesMarketing 3.0: Dr. (Prof.) Philip KotleroutkastedNo ratings yet

- Chapter 1 The Nature of Strategic ManagementDocument10 pagesChapter 1 The Nature of Strategic ManagementDalia ElarabyNo ratings yet

- Ross 12e PPT Ch27Document20 pagesRoss 12e PPT Ch27jl123123No ratings yet

- Coby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDocument46 pagesCoby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDeeb. DeebNo ratings yet

- Import-Export: A Proposal ONDocument10 pagesImport-Export: A Proposal ONrahulvaliya100% (1)

- CVDocument2 pagesCVSumit DasNo ratings yet

- Mis S2Document25 pagesMis S2Abin AntonyNo ratings yet

- Employee Attrition Rate Employee Absenteeism RateDocument1 pageEmployee Attrition Rate Employee Absenteeism Ratelokesh godaraNo ratings yet

- Accounting Standard 6Document208 pagesAccounting Standard 6aanu1234No ratings yet

- Example 15 - If FunctionDocument2 pagesExample 15 - If FunctionArthur PedrotiNo ratings yet

- CapbudprobsolDocument8 pagesCapbudprobsolAlicia May Castro LapuzNo ratings yet

- Hein+Fricke Company ProfileDocument10 pagesHein+Fricke Company ProfileRama Nambi RajanNo ratings yet