Professional Documents

Culture Documents

Bond Examples Fabozzi Part2

Uploaded by

Mauricio BedoyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Examples Fabozzi Part2

Uploaded by

Mauricio BedoyaCopyright:

Available Formats

Fixed Income Mathematics in Quantlib

Part II

Mauricio Bedoya

javierma36@gmail.com

February 2014

In this blog, we will replicate Exhibit 24.2 and create two additional classes: FixedPassThrough

and AccrualCMO. The FixedPassThrough class will create the cash ows that allow to make

payment in the AccrualCMO. In other words, FixedPassThrough works as the collateral of

AccrualCMO structure. Before we continue, I have to give some bad news. Exhibits 24.3 and

24.5 are wrong in the book. Contrast the last paragraph of page 447 with bond class A principal

payment.

Something that I forget to mentioned in the previous blogs, is that I didnt assert proper input

valuation. For example, if you provide a negative amount to class FixedRateMortgagePSA, the

program should prompt an error and this is not the case. I assume that you provide reasonable

inputs. At the same time, previous and current les arent part of QuantLib. Once I check that

everything works correctly, I will sent them to QuantLib to proper assessment.

1. Fixed Passthrough (page 474)

FixedPassThrough will be inherited from FixedRateMortgagePSA. The .hpp and .cpp les of

FixedPassThrowugh are:

1

1 / mode : c++; tabwi dth : 4; i ndent tabsmode : n i l ; cbas i c o f f s e t : 4 /

3 /

Copyri ght (C) 2014 Mauri ci o Bedoya

5

Thi s f i l e i s not yet part of QuantLib , a f r e e s of t war e /opens our ce l i br a r y

7 f or f i n a n c i a l quant i t at i ve anal ys t s and de ve l ope r s http : // quant l i b . org /

/

9

#i f nde f quant l i b f i xe dpas s t hr ough hpp

11 #de f i ne quant l i b f i xe dpas s t hr ough hpp

13 #i nc l ude f i xedratemortgagePSA . hpp

#i nc l ude <i ostream>

15 #i nc l ude <vector >

#i nc l ude <ql /ti me / daycounters / ac t ual ac t ual . hpp>

17 #i nc l ude <ql / i n t e r e s t r a t e . hpp>

19 namespace QuantLib{

21 c l a s s FixedPassThrough : publ i c FixedRateMortgagePSA{

publ i c :

23 FixedPassThrough ( cons t Date& i ssueDate , cons t Cal endar& cal endar , cons t

Real& amount , cons t I nt e r e s t Rat e& passthrowghRate , cons t I nt e r e s t Rat e& NetWAC

, cons t Real& WAM, Rate& f ee , cons t I nt e ge r& yearPayments , cons t Real& PSA,

cons t I nt e ge r& seasoned = 0) ;

v i r t ua l FixedPassThrough ( ) ;

25 //@{

/ Others /

27 Leg Ne t I nt e r e s t ( ) ;

29 //@}

pr i vat e :

31 Real term ;

I nt e ge r yearPayments , s eas oned ;

33 I nt e r e s t Rat e passthroughRate , NetWAC ;

/ Hel per s /

35 Time t = ( 1. 0/ yearPayments ) ;

Real compoundFactor = passthroughRate . compoundFactor ( t ) ;

37 I nt e ge r numberOfPayments = ( term yearPayments s eas oned ) ;

39 };

}

41

#e ndi f / def i ne d ( h h Fi l e ) /

2

/ mode : c++; tabwi dth : 4; i ndent tabsmode : n i l ; cbas i c o f f s e t : 4 /

2

/

4 Copyri ght (C) 2014 Mauri ci o Bedoya

6 Thi s f i l e i s not yet part of QuantLib , a f r e e s of t war e /opens our ce l i br a r y

f or f i n a n c i a l quant i t at i ve anal ys t s and de ve l ope r s http : // quant l i b . org /

8 /

10 #i nc l ude f i xedpas s t hr ough . hpp

12 namespace QuantLib {

14 FixedPassThrough : : FixedPassThrough ( cons t Date& i ssueDate , cons t Cal endar&

cal endar , cons t Real& amount , cons t I nt e r e s t Rat e& passthroughRate , cons t

I nt e r e s t Rat e& NetWAC, cons t Real& WAM, Rate& f ee , cons t I nt e ge r& yearPayments

, cons t Real& PSA, cons t I nt e ge r& seasoned ) : FixedRateMortgagePSA( i ssueDate ,

cal endar , amount , NetWAC, f ee , WAM, yearPayments , PSA, seasoned ) ,

passthroughRate ( passthroughRate ) , NetWAC (NetWAC) , yearPayments (

yearPayments ) , term (WAM) , s eas oned ( seasoned ) {}

16 FixedPassThrough : : FixedPassThrough ( ) {}

18 //@{

/ Others /

20

Leg FixedPassThrough : : Ne t I nt e r e s t ( )

22 {

Leg i n t e r e s t ;

24 f o r ( i nt i = 0; i < numberOfPayments ; i ++)

{

26 boost : : s har ed pt r <CashFlow> I ( new SimpleCashFlow( t hi s >

FixedRateMortgagePSA : : Begi ni ngBal ance ( ) [ i ]>amount ( ) ( compoundFactor 1)

, ( t hi s ) . FixedRateMortgagePSA : : Begi ni ngBal ance ( ) [ i ]>date ( ) ) ) ;

i n t e r e s t . push back ( I ) ;

28 }

30 r et ur n i n t e r e s t ;

}

32 }

The implementation in main, to replicar Exhibit 24.2:

3

/

2 Fi xed Income Mathematics Four Edi t i on

pag ( 474)

4 Anal yzi ng s e c ur i t i z e d products .

/

6 #i nc l ude <i ostream>

#i nc l ude <ql / quant l i b . hpp>

8 #i nc l ude <vector >

#i nc l ude <boost / as s i gn / st d/ vect or . hpp>

10 #i nc l ude <boost /f ormat . hpp>

#i nc l ude f i xedpas s t hr ough . hpp

12

us i ng namespace QuantLib ;

14 us i ng namespace std ;

us i ng namespace boost : : as s i gn ;

16

boost : : f ormat FORMATER1 ( %20d % 12.10d % 12.3d % 12.8d % 12.8d % 12.8d %

12s %12s %12s ) ;

18

i nt main ( )

20 {

t r y {

22 Rate BondRate = 0. 075;

Rate WAC = 0. 08125;

24 Rate f e e = 0 . 0 ;

DayCounter DC= Actual Actual ( Actual Actual : : ISDA) ;

26 Cal endar cal endar = Nul l Cal endar ( ) ;

Compounding compounded = Si mpl e ;

28 Frequency f r equency = Annual ;

30 I nt e r e s t Rat e bondRate ( BondRate , DC, compounded , f r equency ) ;

I nt e r e s t Rat e netWAC(WAC, DC, compounded , f r equency ) ;

32 Date i s s ue ( 1 , Jan , 2000) ;

i s s ue = cal endar . adj us t ( i s s ue ) ;

34 I nt e ge r YearPayments = 12;

I nt e ge r Seasoned = 3;

36 Real Remai ningYears = 30;

FixedPassThrough FPT( i s s ue , cal endar , 400000000 , bondRate , netWAC,

RemainingYears , f ee , YearPayments , 1. 65 , Seasoned ) ;

38

cout << FORMATER1 % Date % BMB % SMM % MP % NI % SP % PREP

% TP % TCF << endl ;

40 Real BB, SMM, MP, NI , SP, PREP, TP, TCF;

f o r ( i nt i= 0; i <357; i ++) {

42 BB = FPT. FixedRateMortgagePSA : : Begi ni ngBal ance ( ) [ i ]>amount ( ) ;

SMM = FPT. FixedRateMortgagePSA : :SMM( ) [ i ]>amount ( ) ;

44 MP = FPT. FixedRateMortgagePSA : : Payment ( ) [ i ]>amount ( ) ;

NI = FPT. Ne t I nt e r e s t ( ) [ i ]>amount ( ) ;

46 SP = FPT. FixedRateMortgagePSA : : ProyectedPri nci pal Payment ( ) [ i ]>

amount ( ) ;

4

PREP = FPT. FixedRateMortgagePSA : : Pri nci pal Repayment ( ) [ i ]>amount ( ) ;

2 TP = SP + PREP;

TCF = NI + TP;

4

cout << FORMATER1 %FPT. FixedRateMortgagePSA : : Begi ni ngBal ance ( ) [ i ]>

date ( )

6 %BB %SMM %MP % NI %SP %PREP %TP %TCF << endl ;

}

8 }

10 catch ( st d : : except i on& e ) {

c e r r << e . what ( ) << endl ;

12 }

}

2. Accrual CMO structure (page 477)

AccrualCMO has dierent inspectors. You can retrieve Balance, Principal and Interest for each

bond in the structure.

1 / mode : c++; tabwi dth : 4; i ndent tabsmode : n i l ; cbas i c o f f s e t : 4 /

3 /

Copyri ght (C) 2014 Mauri ci o Bedoya

5

Thi s f i l e i s not yet part of QuantLib , a f r e e s of t war e /opens our ce l i br a r y

7 f or f i n a n c i a l quant i t at i ve anal ys t s and de ve l ope r s http : // quant l i b . org /

9 /

11 #i f nde f quantl i b accrual CMO hpp

#de f i ne quantl i b accrual CMO hpp

13

#i nc l ude FixedPassThrough . hpp

15

namespace QuantLib{

17 c l a s s AccrualCMO{

/ Types Names

19 Accrual Z

Normal A through X ( excl udi ng F, I , Q, R and S)

21 /

publ i c :

23 AccrualCMO( cons t std : : vector <Real>& ParAmount , cons t st d : : vector <

I nt er es t Rat e >& CouponRate , cons t std : : vector <st d : : s t r i ng >& type , cons t

FixedPassThrough& PassThrough ) ;

v i r t ua l AccrualCMO( ) ;

25 //@{

/ I ns pe c t or s /

27 st d : : vector <Real> parAmount ( ) cons t ;

st d : : vector <I nt er es t Rat e > couponRate ( ) cons t ;

5

st d : : vector <st d : : s t r i ng > type ( ) cons t ;

2 st d : : vector <st d : : vector <Real> > Bal ance ( ) cons t ;

st d : : vector <st d : : vector <Real> > Pr i nc i pal ( ) cons t ;

4 st d : : vector <st d : : vector <Real> > I nt e r e s t ( ) cons t ;

6 / Others /

Real WAM( ) cons t ;

8 st d : : vector <Real> VectorWAM( ) cons t ;

Real GrossWAC( ) cons t ;

10 Real Total Outstandi ng ( ) cons t ;

Real Ac c r ue I nt e r e s t ( ) ;

12 voi d ParAmountUpdate ( ) ;

voi d GenerateCashFlow ( ) ;

14

//@}

16 pr i vat e :

FixedPassThrough PassThrough ;

18 mutable std : : vector <Real> ParAmount ;

st d : : vector <Real> ParAmountCopy = ParAmount ;

20 st d : : vector <i nt > I nt er es t Rat eHel per ( ) ;

st d : : vector <I nt er es t Rat e > CouponRate ;

22 st d : : vector <st d : : s t r i ng > t ype ;

st d : : vector <I nt eger > Months ;

24 st d : : vector <st d : : vector <Real> > Bal ance , Pr i nc i pal , I n t e r e s t ;

26 };

28 / I nl i ne f unc t i ons /

i n l i n e Real Total Outstandi ng ( cons t st d : : vector <boost : : s har ed pt r <

FixedRateMortgagePSA> >& Mortgages )

30 {

Real Total = 0;

32 f o r ( i nt i = 0; i < Mortgages . s i z e ( ) ; i ++) {

Total += Mortgages [ i ]>amount ( ) ;

34 }

36 r et ur n Total ;

}

38

i n l i n e Real WAM( cons t std : : vector <boost : : s har ed pt r <FixedRateMortgagePSA> >&

Mortgages , boost : : s har ed pt r <AccrualCMO>& Tranches )

40 {

Real wam;

42 st d : : vector <st d : : vector <Real> > bal ance = Tranches>Bal ance ( ) ;

f o r ( i nt i = 0; i < Mortgages . s i z e ( ) ; i ++)

44 {

46 wam += ( Mortgages [ i ]>amount ( ) / Total Outstandi ng ( Mortgages ) ) (1 +

bal ance [ i ] . s i z e ( ) ) ;

}

48

r et ur n wam;

50 }

6

i n l i n e Real GrossWAC( cons t std : : vector <boost : : s har ed pt r <

FixedRateMortgagePSA> >& Mortgages )

2 {

Real wac ;

4 f o r ( i nt i = 0; i < Mortgages . s i z e ( ) ; i ++)

{

6 wac += ( Mortgages [ i ]>amount ( ) / Total Outstandi ng ( Mortgages ) )

Mortgages [ i ]>r at e ( ) ;

}

8

r et ur n wac ;

10 }

12 i n l i n e Real NetWAC( cons t std : : vector <boost : : s har ed pt r <FixedRateMortgagePSA>

>& Mortgages )

{

14 / f e e must i nc l ude : s e r v i c i ng f ee , t r us t e e f e e and payment f o r c r e di t

support /

Real netwac ;

16 f o r ( i nt i = 0; i < Mortgages . s i z e ( ) ; i ++)

{

18 netwac += ( Mortgages [ i ]>amount ( ) / Total Outstandi ng ( Mortgages ) ) (

Mortgages [ i ]>r at e ( ) Mortgages [ i ]>f e e ( ) ) ;

}

20

r et ur n netwac ;

22 }

24 }

#e ndi f / def i ne d ( hh Accrual CMO ) /

Im only going to concentrate in extension and contraction risk. As PSA increase, the average

life of each bond in the structure reduce, but no in equal proportion. Just play with the PSA

or create an additional Accrue type bond and evaluate the behaviour.

1 /

Fi xed Income Mathematics Four Edi t i on

3 pag ( 474)

Anal yzi ng s e c ur i t i z e d products .

5 /

#i nc l ude <i ostream>

7 #i nc l ude <ql / quant l i b . hpp>

#i nc l ude <vector >

9 #i nc l ude <boost / as s i gn / st d/ vect or . hpp>

#i nc l ude <boost /f ormat . hpp>

11 #i nc l ude f i xedpas s t hr ough . hpp

#i nc l ude AccrualCMO. hpp

13

us i ng namespace QuantLib ;

15 us i ng namespace std ;

7

1 us i ng namespace boost : : as s i gn ;

3 boost : : f ormat FORMATER1 ( %20d % 12.10d % 12.3d % 12.8d % 12.8d % 12.8d %

12s %12s %12s ) ;

boost

5 : : f ormat FORMATER2 ( %10.4d % 10.4d % 10.4d % 10.4d % 10.4d ) ;

i nt main ( )

7 {

t r y {

9 Rate BondRate = 0. 075;

Rate WAC = 0. 08125;

11 Rate f e e = 0 . 0 ;

DayCounter DC= Actual Actual ( Actual Actual : : ISDA) ;

13 Cal endar cal endar = Nul l Cal endar ( ) ;

Compounding compounded = Si mpl e ;

15 Frequency f r equency = Annual ;

17 I nt e r e s t Rat e bondRate ( BondRate , DC, compounded , f r equency ) ;

I nt e r e s t Rat e netWAC(WAC, DC, compounded , f r equency ) ;

19 Date i s s ue ( 1 , Jan , 2000) ;

i s s ue = cal endar . adj us t ( i s s ue ) ;

21 I nt e ge r YearPayments = 12;

I nt e ge r Seasoned = 3;

23 vector <Rate> PSA;

PSA += 0 . 5 , 1 , 1 . 6 5 , 2 , 3 , 4 , 5;

25 Real RemainingYears = 30;

27 cout << FORMATER2 % PSA % A % B % C % Z << endl ;

st d : : vector <Real> ParAmount ;

29 ParAmount += 194500000 , 36000000 , 96500000 , 73000000;

st d : : vector <I nt er es t Rat e > CouponRate ;

31 f o r ( i nt i = 0; i < 4; i ++)

{

33 I nt e r e s t Rat e r ( 0. 075 ,DC, compounded , f r equency ) ;

CouponRate += r ;

35 }

st d : : vector <s t r i ng > type ;

37 type += A , B , C , Accrue ;

39 st d : : vector <Real> Vwam;

f o r ( i nt i = 0; i < PSA. s i z e ( ) ; i ++)

41 {

FixedPassThrough FPT( i s s ue , cal endar , 400000000 , bondRate , netWAC,

RemainingYears , f ee , YearPayments , PSA[ i ] , Seasoned ) ;

43 AccrualCMO CMO( ParAmount , CouponRate , type , FPT) ;

Vwam = CMO. VectorWAM( ) ;

45 cout << FORMATER2 %PSA[ i ] %Vwam[ 0 ] %Vwam[ 1 ] %Vwam[ 2 ] %Vwam[ 3 ]

<< endl ;

47 Vwam. c l e a r ( ) ;

}

49 }

8

1 catch ( st d : : except i on& e ) {

c e r r << e . what ( ) << endl ;

3 }

}

Its not possible to replicate Exhibit 24.3, because is wrong. Read last two paragraphs of page

477 for an explanation.

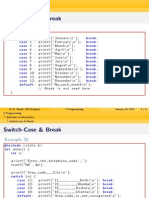

3. Prepayment Models (Chapter 23)

Now imagine that you want to consider any prepayment model, not only PSA. What you can

do is to create a class prepaymentxedratemortgage that accept as an input a vector of SMM

or CPR values. Im not going to publish this, but if you have diculties, comment this blog.

4. PAC bonds

Now, I will create a class PACBonds (FIM-3 in book), that allow to generate the corresponding

cashows and determinate the average life of the elements that integrate the structure. Before

we continue, I must say that Fabozzi book has another error in the table of page 489. For

dierent values of prepayment, is not possible to have the same average life for the support

bond. At the same time, for prepayment value 50, I get dierent (close) average life for PAC

and support bond.

/ mode : c++; tabwi dth : 4; i ndent tabsmode : n i l ; cbas i c o f f s e t : 4 /

2

/

4 Copyri ght (C) 2014 Mauri ci o Bedoya

6 Thi s f i l e i s not yet part of QuantLib , a f r e e s of t war e /opens our ce l i br a r y

f or f i n a n c i a l quant i t at i ve anal ys t s and de ve l ope r s http : // quant l i b . org /

8

QuantLib i s f r e e s of t war e : you can r e di s t r i but e i t and/ or modi fy i t

10 under the terms of the QuantLib l i c e n s e . You shoul d have r e c e i ve d a

copy of the l i c e n s e al ong wi th t hi s program ; i f not , pl e as e emai l

12 <quant l i bde v@l i s t s . s f . net >. The l i c e n s e i s al s o a va i l a bl e onl i ne at

<http : // quant l i b . org / l i c e n s e . shtml >.

14

Thi s program i s di s t r i but e d i n the hope that i t wi l l be us e f ul , but WITHOUT

16 ANY WARRANTY; wi thout even the i mpl i ed warranty of MERCHANTABILITY or FITNESS

FOR A PARTICULAR PURPOSE. See the l i c e n s e f o r more d e t a i l s .

18 /

20 #i f nde f quantlib PACBonds hpp

#de f i ne quantlib PACBonds hpp

9

1 #i nc l ude f i xedpas s t hr ough . hpp

3 namespace QuantLib {

5 c l a s s PacBonds{

publ i c :

7 PacBonds ( cons t st d : : vector <Real>& ParAmount , cons t st d : : vector <

I nt er es t Rat e >& CouponRate , cons t std : : vector <st d : : s t r i ng >& type , cons t Real&

capPSA, cons t Real& fl oorPSA , cons t FixedPassThrough& PassThrough ) ;

v i r t ua l PacBonds ( ) ;

9

//@{

11 / I ns pe c t or s /

st d : : vector <Real> ParAmount ( ) cons t ;

13 st d : : vector <I nt er es t Rat e > CouponRate ( ) cons t ;

st d : : vector <st d : : s t r i ng > Type ( ) cons t ;

15 st d : : vector <st d : : vector <Real> > Bal ance ( ) cons t ;

st d : : vector <st d : : vector <Real> > Pr i nc i pal ( ) cons t ;

17 st d : : vector <st d : : vector <Real> > I nt e r e s t ( ) cons t ;

19 / Others /

st d : : vector <Real> PAC AverageLife ( ) cons t ;

21 Real Support AverageLi f e ( ) cons t ;

Real GrossWAC( ) cons t ;

23 Real Total Outstandi ng ( ) cons t ;

25 //@}

27 pr i vat e :

//PAC I nf or mat i on

29 mutable std : : vector <Real> ParAmount ;

st d : : vector <Real> ParAmountCopy = ParAmount ;

31 st d : : vector <I nt er es t Rat e > CouponRate ;

st d : : vector <st d : : s t r i ng > t ype ;

33 Real capPSA , f l oorPSA ;

Real PSA ;

35 FixedPassThrough PassThrough ;

st d : : vector <st d : : vector <Real> > Bal ance , Pr i nc i pal , I n t e r e s t ;

37 st d : : vector <Real> SupportBal ance , Suppor t Pr i nci pal , Suppor t I nt e r e s t ;

39 //@{

// Hel per s

41 voi d SupportBal anceUpdate ( cons t Real& amount ) ;

Real SupportBal ance ( ) ;

43 st d : : vector <i nt > I nt er es t Rat eHel per ( ) ;

voi d GenerateCashFlow ( ) ;

45 //@}

};

47 }

49 #e ndi f / def i ne d ( quantlib PACBonds hpp ) /

10

1 / mode : c++; tabwi dth : 4; i ndent tabsmode : n i l ; cbas i c o f f s e t : 4 /

3 /

Copyri ght (C) 2014 Mauri ci o Bedoya

5

Thi s f i l e i s not yet part of QuantLib , a f r e e s of t war e /opens our ce l i br a r y

7 f or f i n a n c i a l quant i t at i ve anal ys t s and de ve l ope r s http : // quant l i b . org /

9 QuantLib i s f r e e s of t war e : you can r e di s t r i but e i t and/ or modi fy i t

under the terms of the QuantLib l i c e n s e . You shoul d have r e c e i ve d a

11 copy of the l i c e n s e al ong wi th t hi s program ; i f not , pl e as e emai l

<quant l i bde v@l i s t s . s f . net >. The l i c e n s e i s al s o a va i l a bl e onl i ne at

13 <http : // quant l i b . org / l i c e n s e . shtml >.

15 Thi s program i s di s t r i but e d i n the hope that i t wi l l be us e f ul , but WITHOUT

ANY WARRANTY; wi thout even the i mpl i ed warranty of MERCHANTABILITY or FITNESS

17 FOR A PARTICULAR PURPOSE. See the l i c e n s e f o r more d e t a i l s .

/

19

#i nc l ude PACBonds . hpp

21

namespace QuantLib {

23 PacBonds : : PacBonds ( cons t std : : vector <Real>& ParAmount , cons t st d : : vector <

I nt er es t Rat e >& CouponRate , cons t std : : vector <st d : : s t r i ng >& type , cons t Real&

capPSA, cons t Real& fl oorPSA , cons t FixedPassThrough& PassThrough ) : ParAmount

( ParAmount ) , CouponRate ( CouponRate ) , t ype ( type ) , capPSA ( capPSA) , f l oorPSA

( f l oorPSA) , PassThrough ( PassThrough )

{

25 QL REQUIRE( ( PassThrough . FixedRateMortgagePSA : : amount ( ) ==

Total Outstandi ng ( ) ) , Error : ParAmount and PassThrough amount d i f f e r . ) ;

QL REQUIRE( ( capPSA >= 0 | | f l oorPSA >= 0 | | capPSA > f l oorPSA) , Error :

PSA val ues must be po s i t i v e . ) ;

27

GenerateCashFlow ( ) ;

29 }

31 PacBonds : : PacBonds ( ) {}

33 //@{

/ I ns pe c t or s /

35 st d : : vector <Real> PacBonds : : ParAmount ( ) cons t { r et ur n ParAmountCopy ; }

st d : : vector <I nt er es t Rat e > PacBonds : : CouponRate ( ) cons t { r et ur n CouponRate ; }

37 st d : : vector <st d : : s t r i ng > PacBonds : : Type ( ) cons t { r et ur n t ype ; }

st d : : vector <st d : : vector <Real> > PacBonds : : Bal ance ( ) cons t { r et ur n Bal ance ; }

39 st d : : vector <st d : : vector <Real> > PacBonds : : Pr i nc i pal ( ) cons t { r et ur n

Pr i nc i pa l ; }

st d : : vector <st d : : vector <Real> > PacBonds : : I nt e r e s t ( ) cons t { r et ur n I n t e r e s t

; }

11

/ Others /

2 st d : : vector <Real> PacBonds : : PAC AverageLife ( ) cons t

{

4 st d : : vector <Real> l i f e ;

6 f o r ( i nt i = 0; i < Pr i nc i pa l . s i z e ( ) ; i ++)

{

8 Real M = 0;

f o r ( i nt j = 0; j < Pr i nc i pa l [ i ] . s i z e ( ) ; j ++)

10 {

M += ( ( j + 1) Pr i nc i pa l [ i ] [ j ] ) / 12;

12 }

14 l i f e . push back (M / ParAmountCopy [ i ] ) ;

}

16

r et ur n l i f e ;

18 }

20 Real PacBonds : : Support AverageLi f e ( ) cons t

{

22 i nt support = ParAmountCopy . s i z e ( ) 1;

Real M = 0;

24 f o r ( i nt j = 0; j < Suppor t Pr i nci pal . s i z e ( ) ; j ++)

{

26 M += ( ( j + 1) Suppor t Pr i nci pal [ j ] ) / 12;

}

28

r et ur n (M / ParAmountCopy [ support ] ) ;

30 }

32 Real PacBonds : : GrossWAC( ) cons t

{

34 Real wac = 0;

Real Total = Total Outstandi ng ( ) ;

36 f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

{

38 wac += ( ParAmount [ i ] / Total ) CouponRate [ i ] ;

}

40

r et ur n wac ;

42 }

44 Real PacBonds : : Total Outstandi ng ( ) cons t

{

46 Real Total = 0;

f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

48 {

Total += ParAmount [ i ] ;

50 }

52 r et ur n Total ;

}

12

1 Real PacBonds : : SupportBal ance ( )

{

3 Real t o t a l = 0;

f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

5 {

t o t a l += I nt er es t Rat eHel per ( ) [ i ] ParAmount [ i ] ;

7 }

9 r et ur n t o t a l ;

}

11

voi d PacBonds : : SupportBal anceUpdate ( cons t Real& amount )

13 {

f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

15 {

ParAmount [ i ] = I nt er es t Rat eHel per ( ) [ i ] amount ;

17 }

}

19 //@}

21 //@{ Hel per s de f i ne d pr i vat e

st d : : vector <i nt > PacBonds : : I nt er es t Rat eHel per ( )

23 {

st d : : vector <i nt > he l pe r ;

25 f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

{

27 i f ( t ype [ i ]==Support )

{

29 he l pe r . push back ( 1) ;

}

31 e l s e

{

33 he l pe r . push back ( 0) ;

}

35 }

37 r et ur n he l pe r ;

}

39

voi d PacBonds : : GenerateCashFlow ( )

41 {

i nt N = PassThrough . FixedRateMortgagePSA : : ProyectedPri nci pal Payment ( ) .

s i z e ( ) ;

43 // Set vector s s i z e

st d : : vector <Real> begi ni ngbal ance (N) , pr i nc i pa l (N) , i n t e r e s t (N) ;

45 Suppor t Pr i nci pal . r e s i z e (N) , SupportBal ance . r e s i z e (N) , Suppor t I nt e r e s t

. r e s i z e (N) ;

47 Real e xc e s s ; // Excess amount over PAC /

Support bal ance

i nt j = 0; // St ar t Counter

49 i nt support = ParAmount . s i z e ( ) 1; // I de nt i f y Support vect or

ONLY.

13

1 f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; ++i )

{

3 st d : : f i l l ( begi ni ngbal ance . begi n ( ) , begi ni ngbal ance . end ( ) , 0) ;

st d : : f i l l ( pr i nc i pa l . begi n ( ) , pr i nc i pa l . end ( ) , 0) ;

5 st d : : f i l l ( i n t e r e s t . begi n ( ) , i n t e r e s t . end ( ) , 0) ;

7 whi l e ( ParAmount [ i ] > 0. 0001)

{

9 //PSA Value

PassThrough . setPSA( PassThrough . getPSA( ) ) ;

11 Real PSA Pri nci pal Payment = PassThrough . FixedRateMortgagePSA : :

ProyectedPri nci pal Payment ( ) [ j ]>amount ( ) +

PassThrough . FixedRateMortgagePSA : : Pri nci pal Repayment ( ) [ j ]>

amount ( ) ;

13 // Fl oor Value

PassThrough . setPSA( f l oorPSA ) ;

15 Real Fl oor Pr i nc i pal = PassThrough . FixedRateMortgagePSA : :

ProyectedPri nci pal Payment ( ) [ j ]>amount ( ) +

PassThrough . FixedRateMortgagePSA : : Pri nci pal Repayment ( ) [ j ]>

amount ( ) ;

17 //Cap Value

PassThrough . setPSA( capPSA ) ;

19 Real Cap Pr i nci pal = PassThrough . FixedRateMortgagePSA : :

ProyectedPri nci pal Payment ( ) [ j ]>amount ( ) +PassThrough . FixedRateMortgagePSA : :

Pri nci pal Repayment ( ) [ j ]>amount ( ) ;

21 Real Pri nci pal Payment = 0;

Real Absorb = 0;

23

/

25 Support Sect i on

/

27 //

i f ( SupportBal ance ( ) > 0)

29 {

i f ( PassThrough . getPSA( ) < f l oorPSA )

31 {

Pri nci pal Payment = PSA Pri nci pal Payment ;

33 }

e l s e

35 {

Pri nci pal Payment = ( Cap Pr i nci pal >= Fl oor Pr i nc i pal ) ?

Fl oor Pr i nc i pal : Cap Pr i nci pal ;

37 }

39 i f ( i < support )

{

41 // To absorb

Absorb = PSA Pri nci pal Payment Pri nci pal Payment +

e xc e s s ;

43 }

14

1 e l s e

{

3 // To absorb

Absorb = PSA Pri nci pal Payment + e xc e s s ;

5 }

e xc e s s = 0;

7

i f ( SupportBal ance ( ) > Absorb )

9 {

// Update support

11 SupportBal ance [ j ] = ParAmount [ support ] ;

Suppor t Pr i nci pal [ j ] = Absorb ;

13 Suppor t I nt e r e s t [ j ] = ParAmount [ support ] ( CouponRate

[ support ] . compoundFactor ( 1. 0/12) 1) ;

SupportBal anceUpdate ( Absorb ) ;

15 }

e l s e

17 {

// Absorb support bal ance

19 Absorb = SupportBal ance ( ) ;

SupportBal ance [ j ] = ParAmount [ support ] ;

21 Suppor t Pr i nci pal [ j ] = Absorb ;

Suppor t I nt e r e s t [ j ] = ParAmount [ support ] ( CouponRate

[ support ] . compoundFactor ( 1. 0/12) 1) ;

23 e xc e s s = PSA Pri nci pal Payment Pri nci pal Payment

SupportBal ance ( ) ;

SupportBal anceUpdate ( Absorb ) ;

25 }

}

27

/

29 PAC s e c t i on

/

31 e l s e

{

33 Pri nci pal Payment = PSA Pri nci pal Payment ;

}

35

i f ( i < support )

37 {

// Pac i nf or mat i on

39 begi ni ngbal ance [ j ] = ParAmount [ i ] ;

i n t e r e s t [ j ] = ParAmount [ i ] ( CouponRate [ i ] . compoundFactor

( 1. 0/12) 1) ;

41

i f ( ParAmount [ i ] > Pri nci pal Payment )

43 {

// Update PAC

45 pr i nc i pa l [ j ] = Pri nci pal Payment + e xc e s s ;

ParAmount [ i ] = ( Pri nci pal Payment + e xc e s s ) ;

47 e xc e s s = 0;

}

15

e l s e

2 {

// Absorb PAC bal ance

4 pr i nc i pa l [ j ] = ParAmount [ i ] ;

e xc e s s = Pri nci pal Payment ParAmount [ i ] ;

6 ParAmount [ i ] = ParAmount [ i ] ;

}

8 }

j ++;

10 }

/

12 Pac bal ance , pr i nc i pa l and i n t e r e s t

/

14 i f ( i < support )

{

16 Bal ance . push back ( begi ni ngbal ance ) ;

Pr i nc i pa l . push back ( pr i nc i pa l ) ;

18 I n t e r e s t . push back ( i n t e r e s t ) ;

}

20

}

22 }

//@}

24 }

Code to replicate table in page 489.

/

2 Fi xed Income Mathematics Four Edi t i on

pag ( 489)

4 Anal yzi ng s e c ur i t i z e d products .

/

6 #i nc l ude <i ostream>

#i nc l ude <al gori thm>

8 #i nc l ude <ql / quant l i b . hpp>

#i nc l ude <vector >

10 #i nc l ude <boost / as s i gn / st d/ vect or . hpp>

#i nc l ude <boost /f ormat . hpp>

12 #i nc l ude f i xedpas s t hr ough . hpp

#i nc l ude AccrualCMO. hpp

14 #i nc l ude PACBonds . hpp

16 us i ng namespace QuantLib ;

us i ng namespace std ;

18 us i ng namespace boost : : as s i gn ;

20 boost : : f ormat FORMATER2 ( %10.4d % 10.4d % 10.4d ) ;

16

i nt main ( )

2 {

t r y {

4 Rate BondRate = 0. 075;

Rate WAC = 0. 08125;

6 Rate f e e = 0 . 0 ;

DayCounter DC= Actual Actual ( Actual Actual : : ISDA) ;

8 Cal endar cal endar = Nul l Cal endar ( ) ;

Compounding compounded = Si mpl e ;

10 Frequency f r equency = Annual ;

12 I nt e r e s t Rat e bondRate ( BondRate , DC, compounded , f r equency ) ;

I nt e r e s t Rat e netWAC(WAC, DC, compounded , f r equency ) ;

14 Date i s s ue ( 1 , Jan , 2000) ;

i s s ue = cal endar . adj us t ( i s s ue ) ;

16 I nt e ge r YearPayments = 12;

I nt e ge r Seasoned = 3;

18 Real RemainingYears = 30;

20 st d : : vector <Real> ParAmount ;

ParAmount += 243800000 , 156200000;

22 st d : : vector <I nt er es t Rat e > CouponRate ;

f o r ( i nt i = 0; i < ParAmount . s i z e ( ) ; i ++)

24 {

I nt e r e s t Rat e r ( 0. 075 ,DC, compounded , f r equency ) ;

26 CouponRate += r ;

}

28 st d : : vector <s t r i ng > type ;

type += PAC1 , Support ;

30

st d : : vector <Real> PSA;

32 Real Cap , Fl oor ;

PSA += 0. 0 , 0. 5 , 0. 9 , 1. 0 , 1. 5 , 1. 65 , 2. 0 , 2. 5 , 3. 0 , 3. 5 , 4. 0 , 4. 5 , 5. 0 ,

7 . 0 ;

34 Cap = 3 . 0 ;

Fl oor = 0 . 9 ;

36

cout << Average Li f e or I nstruments i ns i de the s t r uc t ur e << endl ;

38 cout << FORMATER2 % PSA % PAC1 % Support << endl ;

40 f o r ( i nt i = 0; i < PSA. s i z e ( ) ; i ++)

{

42 // PassThrough

FixedPassThrough FPT( i s s ue , cal endar , 400000000 , bondRate , netWAC,

RemainingYears , f ee , YearPayments , PSA[ i ] , Seasoned ) ;

44 // PAC

PacBonds PAC( ParAmount , CouponRate , type , Cap , Fl oor , FPT) ;

46

// Average l i f e i nf or mat i on

48 st d : : vector <Real> PAC aver agel i f e = PAC. PAC AverageLife ( ) ;

Real Suppor t ave r age l i f e = PAC. Suppor t AverageLi f e ( ) ;

17

1 cout << FORMATER2 %FPT. getPSA( ) % PAC aver agel i f e [ 0 ] %

Suppor t ave r age l i f e << endl ;

}

3

}

5

catch ( st d : : except i on& e ) {

7 c e r r << e . what ( ) << endl ;

}

9 }

5. Agency Mortgage Strips

In FixedPassThrough class, you can nd NetInterest and TotalPrincipal inspectors (inherited

from FixedPassThroughPSA). These are the Legs (cashow) that you need.

6. Pricing

Once you have the corresponding Leg (cash ow), what is left to determinate the price of an

instrument (bonds from the structure), is the corresponding yield curve. In previous blogs I

show how to set a at yield curve (atforward class). Next, Im going to determinate the price

of the pass-through found in exhibit 22.8 (page 437), and the IO and PO bond class. The results

should correspond to those found in illustration 25.7 (page 501). Results dier because in the

book, they use approximate data.

/

2 Fi xed Income Mathematics Four Edi t i on

pag ( 489)

4 Anal yzi ng s e c ur i t i z e d products .

/

6 #i nc l ude <i ostream>

#i nc l ude <al gori thm>

8 #i nc l ude <ql / quant l i b . hpp>

#i nc l ude <vector >

10 #i nc l ude <boost / as s i gn / st d/ vect or . hpp>

#i nc l ude <boost /f ormat . hpp>

12 #i nc l ude f i xedpas s t hr ough . hpp

14 us i ng namespace QuantLib ;

us i ng namespace std ;

16 us i ng namespace boost : : as s i gn ;

18 boost : : f ormat FORMATER ( %12.7d % 10.7d ) ;

i nt main ( )

20 {

18

t r y {

2 Rate BondRate = 0. 075;

Rate WAC = 0. 0 95;

4 Rate f e e = 0. 005 ;

DayCounter DC= Actual Actual ( Actual Actual : : ISDA) ;

6 Cal endar cal endar = Nul l Cal endar ( ) ;

Compounding compounded = Si mpl e ;

8 Frequency f r equency = Annual ;

10 I nt e r e s t Rat e bondRate ( BondRate , DC, compounded , f r equency ) ;

I nt e r e s t Rat e netWAC(WAC, DC, compounded , f r equency ) ;

12 Date i s s ue ( 1 , Jan , 2000) ;

i s s ue = cal endar . adj us t ( i s s ue ) ;

14 I nt e ge r YearPayments = 12;

I nt e ge r Seasoned = 0;

16 Real RemainingYears = 30;

18 // PassThrough

FixedPassThrough FPT( i s s ue , cal endar , 100000 , bondRate , netWAC,

RemainingYears , f ee , YearPayments , 1. 0 , Seasoned ) ;

20 // Yi el dCurve

Rate yi e l d= 0. 0989564;

22 I nt e r e s t Rat e Yi el d ( yi el d , DC, compounded , f r equency ) ;

24 Real NPV Passthrough = CashFlows : : npv(FPT. TotalCashFlow ( ) , Yi el d , true ,

i s s ue , i s s ue ) ; // Passthrough

Real NPV IO = CashFlows : : npv(FPT. FixedRateMortgagePSA : : Ne t I nt e r e s t ( ) ,

Yi el d , true , i s s ue , i s s ue ) ; //IO

26 Real NPV PO = CashFlows : : npv(FPT. FixedRateMortgagePSA : : Tot al Pr i nc i pal ( ) ,

Yi el d , true , i s s ue , i s s ue ) ; //PO

28 cout << Pr i ce << endl ;

cout << FORMATER % PassThrough : % NPV Passthrough << endl ;

30 cout << FORMATER % IO: %NPV IO << endl ;

cout << FORMATER % PO: %NPV PO << endl ;

32

cout << \n ;

34 cout << FORMATER % TIR: %FPT. CashFl owYi el d ( NPV Passthrough ) << endl ;

cout << FORMATER % BEY: %FPT.BEY( Yi el d ) <<endl ;

36

cout << FORMATER % Durati on : %FPT. Ef f e c t i ve Dur at i on ( NPV Passthrough

, 0 . 7 5 , 1 . 0 ) << endl ;

38 cout << FORMATER % Convexi ty : %FPT. Ef f ect i veConvexi t y (

NPV Passthrough , 0 . 7 5 , 1 . 0 ) << endl ;

}

40

catch ( st d : : except i on& e ) {

42 c e r r << e . what ( ) << endl ;

}

44 }

19

In this case, duration and convexity approach diers from book. To estimate eective convexity

and duration, FixedPassThrough class increase (reduce) the yield

1

.

Clases may have suer changes, during the development. You can found them in the blog as

c++ les. I will send these to QuantLib in June 2014. Next blog will implement option pricing

examples and exercises found in Jhon C. Hull book: Option, Futures and Other Derivatives

sixth edition.

1

In the book, they increase (reduce) BEY.

20

You might also like

- Termstructure Spread Functions in Quantlib 1.4: Mauricio Bedoya February 2014Document4 pagesTermstructure Spread Functions in Quantlib 1.4: Mauricio Bedoya February 2014Mauricio BedoyaNo ratings yet

- Bond Examples FabozziDocument36 pagesBond Examples FabozziMauricio Bedoya100% (1)

- Bond Examples FabozziDocument36 pagesBond Examples FabozziHkn YılmazNo ratings yet

- 21sc1101 Test 1 KeyDocument12 pages21sc1101 Test 1 Keyunique engineerNo ratings yet

- 7 WwwserveurDocument2 pages7 WwwserveurMouad JaouhariNo ratings yet

- 10 SQL Script Deep Dive and OIADocument6 pages10 SQL Script Deep Dive and OIArameshnaiduNo ratings yet

- First Project Report Algorithmic Trading StrategyDocument7 pagesFirst Project Report Algorithmic Trading Strategyjuans_502No ratings yet

- Practical File CSEDocument57 pagesPractical File CSEYASH MAKADIYANo ratings yet

- Plan Dsu (G)Document9 pagesPlan Dsu (G)Dhiraj Chaudhari CO-137No ratings yet

- C Programming Practical's (Basic Level Training Programs) SolvedDocument25 pagesC Programming Practical's (Basic Level Training Programs) SolvedAdvance TechnologyNo ratings yet

- 4 piserveurTCPDocument2 pages4 piserveurTCPMouad JaouhariNo ratings yet

- Project 6: Test Search Engine Cloud Computing Spring 2017: Professor Judy QiuDocument3 pagesProject 6: Test Search Engine Cloud Computing Spring 2017: Professor Judy Qiufuncart ghhhNo ratings yet

- Source CodeDocument7 pagesSource CodeKaustubhNo ratings yet

- Slide 08b - Control Structure - LoopDocument36 pagesSlide 08b - Control Structure - LoopEffendyFooadNo ratings yet

- Package BDocument8 pagesPackage BVan Tam PhamNo ratings yet

- Create or Replace Function Fact (N Number) Return Number Is I NUMBER (10) F Number: 1 Begin For I in 1.. N Loop F: F I End Loop Return F EndDocument5 pagesCreate or Replace Function Fact (N Number) Return Number Is I NUMBER (10) F Number: 1 Begin For I in 1.. N Loop F: F I End Loop Return F EndjyothimidhunaNo ratings yet

- C Programming Complete Lab 1-17Document41 pagesC Programming Complete Lab 1-17MURALI KARTHIK REDDYNo ratings yet

- CH 3 ReviewDocument8 pagesCH 3 ReviewJoe BlackNo ratings yet

- Raydium CLMM DevDocument11 pagesRaydium CLMM Devayman.marzoukkNo ratings yet

- PM G1&G2Document54 pagesPM G1&G2ivanaru404No ratings yet

- 8 LotoserveurDocument2 pages8 LotoserveurMouad JaouhariNo ratings yet

- 5 piserveurUDPDocument2 pages5 piserveurUDPMouad JaouhariNo ratings yet

- C Programing Basic Notes With ProgramDocument54 pagesC Programing Basic Notes With ProgramYogesh KatreNo ratings yet

- WWW Programming9 Com Programs C Programs 114 C Program To Design Lexical AnalyzeDocument32 pagesWWW Programming9 Com Programs C Programs 114 C Program To Design Lexical AnalyzePlanetNo ratings yet

- A Simple Color Balance AlgorithmDocument10 pagesA Simple Color Balance Algorithmpi194043100% (1)

- Code Ver4Document11 pagesCode Ver4Hoàng Long Nguyễn BùiNo ratings yet

- Control Flow - LoopingDocument18 pagesControl Flow - LoopingNur SyazlianaNo ratings yet

- AssignmentDocument1 pageAssignmentbhavikparmar2006No ratings yet

- Laboratory Exercises #3 - IFDocument12 pagesLaboratory Exercises #3 - IFCharisma ManansalaNo ratings yet

- Practical File For CDocument68 pagesPractical File For CNarayan VermaNo ratings yet

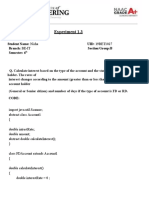

- Experiment 1.3: Student Name: Nisha UID: 19BET1027 Branch: BE-IT Section/Group:B Semester: 6Document13 pagesExperiment 1.3: Student Name: Nisha UID: 19BET1027 Branch: BE-IT Section/Group:B Semester: 6Nisha ChandNo ratings yet

- Helloworld CDocument4 pagesHelloworld Ckhin600No ratings yet

- Cap Riot TiDocument5 pagesCap Riot Tiadamquestion5941No ratings yet

- C Programming ExercisesDocument26 pagesC Programming Exercisestanjim1100% (2)

- Capstone Report: FIRST NAME: Gopalakrishnan LAST NAME: Kalarikovilagam Subramanian M12821535Document17 pagesCapstone Report: FIRST NAME: Gopalakrishnan LAST NAME: Kalarikovilagam Subramanian M12821535UdupiSri groupNo ratings yet

- Calculating Interest Based Problem in JavaDocument9 pagesCalculating Interest Based Problem in Javaarjun singhNo ratings yet

- C ProgramDocument13 pagesC Programsamuthiram771198No ratings yet

- Review Quiz: ©niit SEM Q/CPR/CR/SESSION 4/1/VER06/95Document30 pagesReview Quiz: ©niit SEM Q/CPR/CR/SESSION 4/1/VER06/95Ashish SrivastavaNo ratings yet

- Slides C PDFDocument21 pagesSlides C PDFRhil ColeNo ratings yet

- 3G QueryDocument8 pages3G QueryMarcos DominguezNo ratings yet

- Term Paper of Foundations of Computing Fast Food Automation SystemDocument22 pagesTerm Paper of Foundations of Computing Fast Food Automation Systemsharma_jalNo ratings yet

- Amandeep Singh (20BCS5399) PBLJ Worksheet 1.3Document10 pagesAmandeep Singh (20BCS5399) PBLJ Worksheet 1.3Amandeep SinghNo ratings yet

- ClosestPairProblem Lab03 ADADocument10 pagesClosestPairProblem Lab03 ADAArmando Lopez EspinozaNo ratings yet

- NthRoot Lab01 ADADocument12 pagesNthRoot Lab01 ADAArmando Lopez EspinozaNo ratings yet

- Assignment 1: Bangalore Institute of TechnologyDocument115 pagesAssignment 1: Bangalore Institute of TechnologyShantanu PrasharNo ratings yet

- How To Export HDL Simulation Data To ?: Verilog MatlabDocument7 pagesHow To Export HDL Simulation Data To ?: Verilog Matlabbebeto90No ratings yet

- Digital Assignment-6: Name: Bejugam Shiva Suprith REG NO: 18BCE0427 Faculty: Narayanamoorthi M SLOT: L59+L60Document14 pagesDigital Assignment-6: Name: Bejugam Shiva Suprith REG NO: 18BCE0427 Faculty: Narayanamoorthi M SLOT: L59+L60shivaNo ratings yet

- Simultaneous Equations Modelling in PythonDocument24 pagesSimultaneous Equations Modelling in PythonFernando Perez SavadorNo ratings yet

- C Programming Lab (JNTUK)Document40 pagesC Programming Lab (JNTUK)Saiindra ReddyNo ratings yet

- HK202 Lab 5 SynchronizationDocument14 pagesHK202 Lab 5 SynchronizationHiếu Nguyễn MinhNo ratings yet

- MathWorks Nordic - Counterparty Credit Risk and CVA - MATLAB & SimulinkDocument14 pagesMathWorks Nordic - Counterparty Credit Risk and CVA - MATLAB & SimulinkpaaatrikNo ratings yet

- Procedure Lee BLOB Pagos CXCDocument2 pagesProcedure Lee BLOB Pagos CXCIvan Fernando HurtadoNo ratings yet

- QR Code GeneratorDocument9 pagesQR Code GeneratorOlowookere JohnNo ratings yet

- C ProgramsDocument133 pagesC ProgramssandeshcvNo ratings yet

- Data Types: JAVA For BeginnersDocument12 pagesData Types: JAVA For BeginnersshekharcNo ratings yet

- Prac 19 - Equally Likely or Laplace CriterionDocument2 pagesPrac 19 - Equally Likely or Laplace CriterionvirusyadavNo ratings yet

- BCA Sem I 2010 JournalDocument26 pagesBCA Sem I 2010 JournalPrashant TandaleNo ratings yet

- C++ Proposed Exercises (Chapter 9: The C++ Programing Language, Fourth Edition)Document2 pagesC++ Proposed Exercises (Chapter 9: The C++ Programing Language, Fourth Edition)Mauricio Bedoya100% (1)

- C++ Proposed Exercises (Chapter 8: The C++ Programing Language, Fourth Edition)Document3 pagesC++ Proposed Exercises (Chapter 8: The C++ Programing Language, Fourth Edition)Mauricio BedoyaNo ratings yet

- LatexC++ Proposed Exercises (Chapter 7: The C++ Programing Language, Fourth Edition) - SolutionDocument7 pagesLatexC++ Proposed Exercises (Chapter 7: The C++ Programing Language, Fourth Edition) - SolutionMauricio BedoyaNo ratings yet

- C++ Proposed Exercises (Chapter 8: The C++ Programing Language, Fourth Edition) - SolutionDocument6 pagesC++ Proposed Exercises (Chapter 8: The C++ Programing Language, Fourth Edition) - SolutionMauricio Bedoya25% (4)

- C++ Proposed Exercises (Chapter 7: The C++ Programing Language, Fourth Edition)Document7 pagesC++ Proposed Exercises (Chapter 7: The C++ Programing Language, Fourth Edition)Mauricio BedoyaNo ratings yet

- C++ Proposed Exercises (Chapter 6: The C++ Programing Language, Fourth Edition) - SolutionDocument7 pagesC++ Proposed Exercises (Chapter 6: The C++ Programing Language, Fourth Edition) - SolutionMauricio Bedoya100% (1)

- C++ Exercises Chapter 2 (Solution)Document11 pagesC++ Exercises Chapter 2 (Solution)Mauricio BedoyaNo ratings yet

- EuropeanCall Diff AmericanCall PDFDocument2 pagesEuropeanCall Diff AmericanCall PDFMauricio BedoyaNo ratings yet

- EuropeanCall AmericanCall PDFDocument2 pagesEuropeanCall AmericanCall PDFMauricio BedoyaNo ratings yet

- C++ Exercises Chapter 2 (Proposed)Document3 pagesC++ Exercises Chapter 2 (Proposed)Mauricio BedoyaNo ratings yet

- Optimization For DummiesDocument5 pagesOptimization For DummiesMauricio BedoyaNo ratings yet

- Quantlib ExercisesDocument71 pagesQuantlib ExercisesMauricio BedoyaNo ratings yet

- QuantLib 1.4 + Xcode 4.5.2Document4 pagesQuantLib 1.4 + Xcode 4.5.2Mauricio BedoyaNo ratings yet

- Assignment MBADocument7 pagesAssignment MBAascom asNo ratings yet

- Econ CH 14Document12 pagesEcon CH 14BradNo ratings yet

- ACC 206 Week 3 Assignment Chapter Four and Five ProblemsDocument5 pagesACC 206 Week 3 Assignment Chapter Four and Five Problemshomeworktab0% (1)

- An Economic Analysis of Dhaka - Chittagon PDFDocument24 pagesAn Economic Analysis of Dhaka - Chittagon PDFshivu khatriNo ratings yet

- 20090531143401953Document26 pages20090531143401953kalechiru0% (2)

- SKLT Annual Report 2018 PDFDocument100 pagesSKLT Annual Report 2018 PDFnisaa12No ratings yet

- Business Simulation ReportDocument12 pagesBusiness Simulation ReportTanika Agarwal100% (1)

- Rbi 1Document27 pagesRbi 1Nishant ShahNo ratings yet

- Braeutigam Ronald - Optimal Policies For Natural MonopoliesDocument58 pagesBraeutigam Ronald - Optimal Policies For Natural MonopoliesMaximiliano FerrarisNo ratings yet

- Chapter 10Document32 pagesChapter 10REEMA BNo ratings yet

- Agbemabiesse, Gloria Eyram - 2011 ThesisDocument77 pagesAgbemabiesse, Gloria Eyram - 2011 ThesisTyusDeryNo ratings yet

- Consumer MathematicsDocument35 pagesConsumer MathematicsAlthea Noelfei QuisaganNo ratings yet

- Unit 1.ppt MisDocument22 pagesUnit 1.ppt MisAbdul KadharNo ratings yet

- Admas University: Answer SheetDocument6 pagesAdmas University: Answer SheetSamuel100% (2)

- BBA Thesis BENEA Ioana PDFDocument56 pagesBBA Thesis BENEA Ioana PDFSanti Gopal TolaniNo ratings yet

- FinalDocument1,200 pagesFinalRahulNo ratings yet

- Mathematics: Dispersion Trading Based On The Explanatory Power of S&P 500 Stock ReturnsDocument22 pagesMathematics: Dispersion Trading Based On The Explanatory Power of S&P 500 Stock ReturnsArnaud FreycenetNo ratings yet

- Chapter 7: Interest Rates and Bond ValuationDocument36 pagesChapter 7: Interest Rates and Bond ValuationHins LeeNo ratings yet

- International Arbitrage and Interest Rate Parity: From International Finance by Jeff MaduraDocument49 pagesInternational Arbitrage and Interest Rate Parity: From International Finance by Jeff Maduraabdullah.zhayatNo ratings yet

- Budget 2018-19: L'intégralité Des MesuresDocument145 pagesBudget 2018-19: L'intégralité Des MesuresL'express Maurice100% (1)

- Ebony Oil & Gas Limitedcls - ProfileDocument6 pagesEbony Oil & Gas Limitedcls - Profileaddo.terrenceNo ratings yet

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- FBP - Policy DocumentDocument60 pagesFBP - Policy DocumentDiwanDipesh SunilNo ratings yet

- Commerce ProjectDocument15 pagesCommerce ProjectSahil Chanda67% (3)

- GEM3 Empirical NotesDocument60 pagesGEM3 Empirical Notesxy053333No ratings yet

- La Liste Noire Des Sites Darnaques de lADC France Au 14.10.2023Document109 pagesLa Liste Noire Des Sites Darnaques de lADC France Au 14.10.2023Michael CollinsNo ratings yet

- Stakeholder Relations Guideline 2012 en (FMGT)Document4 pagesStakeholder Relations Guideline 2012 en (FMGT)SalmaAlnofaliNo ratings yet

- Comparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleDocument24 pagesComparison and Usage of The Boston Consulting Portfolio and The McKinsey Portfolio Maximilian BäuerleEd NjorogeNo ratings yet

- (Compare Us) Reverse Piercing of The Corporate Veil - A Straightforward Path To Justice by Nicholas AllenDocument16 pages(Compare Us) Reverse Piercing of The Corporate Veil - A Straightforward Path To Justice by Nicholas AllenNicole LimNo ratings yet

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderNo ratings yet