Professional Documents

Culture Documents

TATA Motors Case Study

TATA Motors Case Study

Uploaded by

ramki073033Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TATA Motors Case Study

TATA Motors Case Study

Uploaded by

ramki073033Copyright:

Available Formats

TO

W

AR

D

S

A

N

E

W

D

A

W

N

EXPLO

RIN

G AVEN

U

ES O

F

F

U

TU

R

E

P

R

O

F

ITA

B

IL

ITY

1

Background of Tata Motors

Tata group of companies was founded by Jamsetji N Tata in the second half of the 19th century, when

India was still under British Rule. A visionary entrepreneur, an avowed nationalist and a committed

philanthropist, Jamsetji Tata helped pave the path of Indias industrialisation by seeding pioneering

businesses in sectors such as steel, energy, textiles and hospitality. The Tata group comprises over

100 operating companies in seven business sectors: communications and information technology,

engineering, materials, services, energy, consumer products and chemicals. The group has operations

in more than 80 countries across six continents, and its companies export products and services to

85 countries.

Tata Motors is Indias largest automobile company, with consolidated revenues of INR 1, 88,818

crores (USD 34.7 billion) in 2012-13. It is a Fortune 500 company, with presence both in India and

across the globe. Established in 1945, Tata Motors presence cuts across the length and breadth

of India. Today, over 7.5 million Tata vehicles ply on Indian roads, since the frst truck rolled out in

1954. The companys manufacturing base in India is spread across Jamshedpur (Jharkhand), Pune

(Maharashtra), Lucknow (Uttar Pradesh), Pantnagar (Uttarakhand), Sanand (Gujarat) and Dharwad

(Karnataka). It has also acquired Daewoo Commercial Vehicle Company (now Tata Daewoo) of South

Korea, Hispano Carrocera of Spain, and has a joint venture with Marcopolo of Brazil for manufacturing

fully built buses and coaches. In 2008 Tata Motors bought over marquee car brands Jaguar & Land

Rover from Ford. Tata Motors also has a majority stake in Italian design and engineering company

Trilix. It is the leader in commercial vehicles in almost all segments, and amongst the top 5 in

passenger vehicles with winning products in the compact, midsize car and utility vehicle segments.

It is also the worlds fourth largest truck and bus manufacturer. Tata Motors Groups over 60,000

employees are guided by the One Team One Vision philosophy - to be passionate in anticipating

and providing the best vehicles and experiences that excite our customers globally.

Evolution of Tata Motors Commercial

Vehicle (CV) Business

Tata Motors commenced production in 1954 with the manufacture of medium commercial vehicles

in collaboration with Mercedes Benz. The import content was slowly brought down over the years,

and by the year 1969 when the collaboration ended it was almost negligible. Tata Motors had by

then developed the knowhow to design its own vehicles. By the seventies the company broadened

its range to include Heavy commercial vehicles with products of its own design. It went on to lead

the M&HCV segment in India. Over the years Tata Motors has got into many new segments in the

commercial vehicle segment and also created segments of its own with innovative products like the

Tata Ace, Zip, Magic & Iris. It has gone on to be the market leader in almost all the segments that it

operates in the commercial vehicle space.

2

Global Commercial Vehicle Business

(in the last 5 years)

The commercial vehicle business around the world is cyclical in nature in terms of sales. Similar

pattern has been seen in the last 5 years. The period between FY 2008-09 was particularly severe

on the commercial vehicle industry with most Original Equipment Manufacturers (OEM) suffering

huge setback in terms of sales. OEMs from established markets continue to face a number of

challenges to maintain or grow their market position in their respective domestic markets. These

include increasingly stringent regulations, rising fuel prices and largely saturated markets.

The balance of power in the global commercial vehicle market has changed decisively over the past

fve years. Between 2006 and 2010 Western Europes share in commercial vehicle market fell from

10 to 7 percent & in North America it fell from 50 to 32 percent. Market share losses of the saturated

markets contrast with strong market share gains in the emerging markets. China sharply increased

its global market share in 2009 by about 10 percent to 28 percent, replacing the US as the largest

commercial vehicle market, largely due to governmental support initiatives. By 2010, Chinese global

market share had already grown to 30 percent. India enjoyed similar although less spectacular

growth. Asia is now by far the largest region for commercial vehicle sales, accounting for nearly one

in two commercial vehicles sold worldwide.

The commercial vehicle market will continue to grow over the coming years, with a fundamental

rebalancing of the global market. The worldwide distribution of power within the commercial vehicle

industry has shifted since 2006. Asian manufacturers have secured a stronger position at the expense

of global manufacturers, such as Daimler, Volvo Trucks and Paccar, which previously dominated the

heavy duty market.

Indian Commercial Vehicle business

(in the last 5 years)

Road has always been the dominant mode of transport in India, accounting for around 60% of the

total transport volume, in spite of them being narrow and congested with poor surface quality. Due

to the long-standing history of poor quality roads and low customer expectations, Indian trucks

have traditionally been technically unsophisticated and are mainly operated by owner-drivers who

typically take care of their trucks maintenance and repair themselves.

Like most emerging markets, low-cost trucks dominate the Indian market. However, India has been

subject to slightly stronger fuctuations in terms of commercial vehicle development. One peculiarity

of the Indian market structure is the high percentage of light trucks. The Indian market is largely

consolidated, with a 90 percent market share split between the top 3 Indian manufacturers.

3

With the opening up of economy, India has been gradually reducing protectionist measures since

the early 1990s. The automobile industry has completely opened up to foreign investments. Import

regulations and customs duties no longer constitute a true barrier for completely knocked down

(CKD) and completely built up (CBU) production. Big global players like Daimler & Volvo have entered

into the Indian market taking advantage of this favourable investment environment. Daimler has

formed a subsidiary, Daimler India Commercial Vehicles, and recently announced its own brand

for the Indian market BharatBenz. Volvo entered the luxury bus segment in 2006 and is leading

player in this segment. In 2008, Volvo Trucks formed a Joint Venture (JV) with Eicher Volvo Eicher

Commercial Vehicles (VECV). Under this JV, Volvos heavy duty trucks are being offered in India in

addition to trucks and buses already provided by Eicher. These organizations have clearly given an

indication about their long term strategy for the Indian market.

Tata Motors Commercial Vehicle

Business

Medium & Heavy Commercial Vehicles (M&HCV)

Commercial vehicles are divided into various categories based on their usage, load capacity etc.

Figure 1 gives an illustration of the basic categorization of commercial vehicles. At Tata Motors, the

M&HCV product line is broadly divided under 2 categories, namely Cargo and ConsTruck

. While

Cargo line has normal load carrying trucks, ConsTruck

Range of trucks is engineered to meet the

demands of the construction and mining industry. The cargo product line is further bifurcated on

tonnage and has a range from 16 tons to 49 tons. Similarly the ConsTruck

range has trucks and

tippers with tonnage from 16 tons to 31 tons. The various product categories of Tata Motors in

M&HCV segment, with sample models is given in the Annexure I (Figure 2)

After experiencing a volume growth of over 30% during 2009-10 and 2010-11, the buoyancy in

domestic CV industry has been on a wane. The M&HCV industry bore the brunt of slowing industrial

activity, weak investment sentiment and the impact of signifcant feet capacity addition over the

past three years, especially in the heavy-duty categories of the trucking market. Within the M&HCV

segment, the contraction in demand for the higher tonnage category of trucks such as tippers,

tractor trailers and multi-axle vehicles (MAVs) has been the sharpest. These factors caused M&HCV

volumes to shrink by a sharp 29% Year-on-Year in FY 2012-13. From transporters viability standpoint,

the current phase is characterized by reduced cargo volumes, stiff competition owing to surplus

capacities (M&HCV sales doubled from the lows of FY 2008-09, bringing down the average age of

M&HCV population to a 10 year low) and rising operating costs, especially in wake of the recent hike

in diesel prices.

Competitive landscape in the M&HCV industry has been changing very fast. The industry which had

2-3 major players, mostly domestic before 2005, has today seen the entry of major global players

into it. Today the industry has more than 10 global and Indian OEMs fghting it out in the market.

The latest entrant into this feld is Diamler with its Indian subsidiary Daimler India Commercial Vehicle

4

(DICV). Like Tata Motors it is a full range player and is expected to compete with Tata Motors in almost

all segments. Globally, in all big CV markets with majority of the players competing in the market,

the market leaders command only a 20 25% market share. Tata Motors enjoys a unique position in

the M&HCV industry in this regard. It has a 62% market share in this segment. The challenge before

Tata Motors is to retain the same and further enhance it, thus reversing a global trend in the Indian

market.

Light & Intermediate Commercial vehicles (L&ICV)

In 1981 the Govt. allowed 4 Japanese frms Toyota, Mitsibushi, Mazda and Nissan, to enter the

Indian market for Light Commercial Vehicles through joint ventures with Indian companies and also

announced its policy of broad-banding of licenses, under which companies did not have to seek

licenses for every new vehicle they wanted to manufacture. Tata Motors used this opportunity to enter

into the LCV market by designing & developing its own LCV in a record 18 months, and launched the

Tata 407 in 1985. It was followed up with the launch of the Tata 608 & Tata 709 in 1987. By mid-90s

Tata Motors had beaten all competition to be the market leader in this segment. The vehicles made

by Tata Motors were sturdier and reliable and thus better suited for the rough Indian roads. In terms

of reach and spare parts availability also Tata Motors was way ahead of its competitors.

This segment is broadly classifed by Industry body Society of Indian Automotive Manufacturers

(SIAM) into 2 categories - the Light Commercial Vehicle (LCV) segment (which has a load bearing

capacity of 3.5 tons to 7.5 tons) and the Intermediate Commercial Vehicle (ICV) segment (with

capacity of more than 7.5 tons to 12 tons). Figure 3 in the annexure gives a detailed breakup of the

products that Tata Motors has in LCV & ICV segments.

Though in FY 2012-13 there was a negative growth in this segment (vis--vis FY 2011-12), the

industry has seen a CAGR of 13.2% over the last 5 years. Tata Motors is the undisputed market

leader in the LCV segment with nearly 70% market share and has a market share of more than 42%

in ICV segment. A snapshot of market share and volume in these segments for the last 5 years is

given in Annexure-I (Figures 9 & 10).

There are various growth drivers for this segment, the major ones being the increased demand

for last mile connectivity which saw the phenomenal growth of the Tata 407 range. The improving

conditions of Indian roads due to implementation of various Government schemes like Pradhan

Mantri Gramin Sadak Yojna (PMGSY) has led to increased sales in this segment. Focus on improved

urban infrastructure and rapid industrialization also has been a major growth driver for this industry.

The competition is also growing in this segment with Indian players like Eicher, M&M, Force Motors

and global players like Daimler (Bharat Benz) entering the fray.

The customer preference in this segment has seen a marked shift from being a very price sensitive

market to a more performance oriented market. Factors like payload, mileage, overloading capacity

etc. which used to be drivers of customer preferences have given way to factors like engine

power, reliability, cabin comfort, safety etc. Increased vehicle complexities due to opening of niche

applications across the country are bringing in its own share of challenges. Having catered to the

5

mass market for long, Tata Motors now also faced the challenge of creating a brand image of a

premium manufacturer in the L&ICV segment. The task ahead of Tata Motors is to dominate LCV &

ICV truck segment across all tonnage points and maintain proftability by building a premium brand

image.

Buses

Tata Motors has for over ffty years, continued to redefne the ways in which people look at road

travel in India. From building the earliest trucks that acted as goods transportation vehicles to

manufacturing chassis for buses that virtually support the entire public transport network in the

country, Tata Motors has always enjoyed a strong presence on Indian roads.

Today Tata Motors is the worlds fourth largest bus manufacturer with the most complete range

of transit vehicles that meet every need that arises in our day-to-day travel. It has continued to

be the leader in this segment not just by setting technological benchmarks but also by adapting

innovations effectively to suit Indian travel conditions. It manufactures a variety of premium buses

and coaches that cater to the entire gamut of utility vehicles and applications, from luxurious inter-

city travel options to safe transport choices for school going children. While fully built buses come in

a wide range from 12 seaters to 67 seaters, Chassis options vary from 4 tonne Gross Vehicle Weight

(GVW) (5 meter length) to 16 tonne GVW (12m length). Figure 4 gives an illustration of the various

segments of the bus market and products of Tata Motors in these segments. Buses are typically

divided into four categories based on their application/usage. The customer segment for buses is

further divided into 3 distinct categories the STUs (State Transport Units), Private operators, and

contract operators. Figure 6 illustrates the preferences of the various customer segments mentioned

above and describes the implications of these on OEMs as per an internal study.

The major brands of Tata Motors are the Tata City Ride, Tata Starbus, Starbus Ultra and Tata Divo.

Tata Motors has put in place an elaborate product strategy to counter its competitors in the market.

The new product range has products both from Tata Motors and Marcopolo. The range of buses

from Marcopolo is specifcally benchmarked against the best products that are currently available in

the Indian market. It can offer competition to entrenched players like Volvo & Mercedes Benz in the

luxury segment.

Like all other areas in the commercial vehicle industry the people transport category has also moved

away from its oligopolistic nature. Today the industry is crowded with a number of players both

national and international. The performance of both Tata Motors and the competition (in terms of

vehicles sold) in the last 6 years are given in Annexure-I (Figures 11, 12, & 13).

With changing competitive landscape, Tata Motors will face competition from both national and

international players in high growth inter-urban and contract segments. In the segments of urban

and semi-urban transport, expansion of MNCs is diffcult due to tender-driven and regulated nature

of the segments. The inter-urban transport segment is where the competition is maximum due to

the high revenue, high visibility nature of the segment. This segment is most attractive for MNCs

as well. The contract transport segment is witnessing mixed competition with many domestic and

international players investing in this segment.

6

The luxury bus segment is also witnessing a lot of competition from European and Chinese

manufacturers and several new entrants are expected in the near future. Volvo is currently the market

leader in this segment and plans to continue its dominance by introducing contemporary products

in the future. Daimler has already launched 2 and 3 axle luxury coaches in India and its future plans

are centered on buses and luxury coach segments. Kinglong has tied up with JCBL to sell buses in

India. It has already launched its products in the urban transport market and plans to expand in India.

Turkish manufacturer Temsa and Japanese Hino have also lined up their entry in the near future.

The impact on Tata Motors has been manifold, due to the entry of new competitors. Tata Motors

earlier foray into the luxury bus segment through its Globus brand of buses was with mixed results.

Volvo continued to be the market leader in this segment. The entry of other European players like

Daimler and Temsa will result in products that rate high on parameters like safety, comfort, luxury

and performance. This will pose a challenge for many Indian manufacturers. On the other hand entry

of Chinese players like Kinglong will create pricing pressure for the existing players in the market

offering similar features.

To meet these challenges some domestic players have entered into collaboration with global

manufacturers, with an intention to expand into full range manufacturing. Some of the strategic

partnerships that have been forged are mentioned below. All these changes in the segment have

profound implications for Tata Motors as well.

1. Ashok Leyland-Nissan They plan to enter the light bus segment through this JV. It has

already developed complete range of engine power points in heavy buses. This will be a

big challenge for the existing full range players in India.

2. Volvo-Eicher This JV is currently strong in the light bus segment, looking to expand

to full range. They are moving from franchised to captive body building. Their value for

money proposition is going to increase pressure on other players in the market.

3. Isuzu-Swaraj Mazda Traditionally this JV is strong in light buses. Their JV for luxury bus

segment has not had successes. This will remain a relevant competitor in light buses.

4. Volvo It is the most strongly placed OEM currently. It is the market leader in the inter-

urban luxury segment. It is introducing price competitive products specifc to Indian

market for this segment.

5. Daimler Daimler is making investments in Pune for captive bodybuilding of urban buses.

It plans eventual transfer of bus business under Bharat Benz. Tata Motors is not the

leader in inter-urban luxury segment. Its new products will target matching quality and

performance of Volvo. The potential full range offering and aggressive pricing by these

players is going to be challenge for existing players in India.

There are still many challenges for the growth of the bus business in India. At a macro level, the

growing penetration of other mass scale public transportation (like metros, mono rails etc.) are a

threat to the bus business. Entry of foreign full range players poses a big risk for domestic incumbents

as they look to capture a slice of the pie of bus market share. The frequently changing regulatory

7

environment also poses a risk for this business. Maintaining a dominant market share in these

market conditions remained a challenge for the bus business.

Small Commercial Vehicles (SCV) and Pick-up segment

Small commercial vehicle is the latest addition to the various segments of the commercial vehicle

industry in India. This segment and its evolution is a perfect example of the Blue Ocean Strategy

as enunciated by W. Chan Kim and Renee Mauborgne. This segment was completely dominated

by large 3-wheeler load carriers from Bajaj, Ape, Piaggio, Force Motors etc. In 2005 Tata Motors

launched the Tata Ace, a product which created an entirely new segment - the Mini Truck segment.

It wiped out the large three wheeler category within a span of three years. It spawned a new segment

which many followers tried to emulate including 3 wheeler makers such as Piaggio, Force, Mahindra

etc. Tata Motors was able to retain its market share in this segment against competing products like

Mahindra Maxximo, Piaggio Porter 1000 and many more.

Tata Motors was also the pioneer of the large pickup segment in India. In the mid 1990s Tata Motors

launched Tatamobile which later was rechristened Tata 207. The main competitor in this segment

was Mahindra & Mahindra with its Maxx pickup. The product has subsequently seen substantial

refnement since its launch. In 2012, Tata Motors launched a new pickup the Tata Xenon. This

product was well received by the market with rapid increase in sales and market share in many

geographies where Tata Motors had lower share of market. The various product categories in the

SCV segment (cargo & passenger) are given in Annexure I (Figure 5).

Most of the customers in these segments are frst time users / individual buyers unlike the heavier

trucks which are dominated by feet owners. These products are mostly used for last mile delivery

of goods. These products are more dependent on the consumption of goods and services and

therefore have a lesser cyclical nature in comparison to heavier trucks. The key customer buying

parameters for these products include - product performance, operating economics, and availability

of vehicle fnancing arrangements (loans).

The CV market is set to experience signifcant changes primarily with the use of hub and spoke

model. By hub and spoke model, it is meant that the freight is generated from certain regional

cluster which is then transported to various trucking centers or hubs spread across the country.

These goods are further segregated and transported across the various spokes and fnally through

these spokes the goods are delivered to the end consumers.

Future competition in this segment is expected from Chinese & Japanese automakers. The growth

in this segment depends on the ease of vehicle fnancing - loans being available to all potential

customers at low rate of interest. With various products commanding different spots in the market

share ladder the challenges for every different product was unique. While for some product lines the

challenge was to maintain the market share for others the challenge was to fght off competition and

reach the top spot. Tata Motors being a player in almost all segments has the challenge of keeping

competition at bay in all the segments and look to further grow at a faster rate and expand the

market as well.

8

Small Commercial Vehicle Passenger

In last few years, India has seen a spurt in passenger transportation with improvement in road

infrastructure, rural to urban connectivity, urbanization, industrialization, increase in disposable

income, increase in population etc. Till July 2007, only 3 Wheelers were used in Last Mile Public

Transport (LMPT) movement for inter & intra city movement.

In July 2007, Tata Magic Indias frst 4 wheeled commercial passenger vehicle was launched & it

changed the whole landscape of LMPT by assuring its passengers & operator better safety, better

comfort, better technology, higher proftability & higher status to its owner. Tata Motors has been a

pioneer in creating and growing the small commercial 4 wheeler passenger market in India.

LMPT industry is segmented based on a) Geography, b) Type of Usage. The segmentation as per

geography is either for intra or intercity uses. Type of usage can be shared and non shared application.

Tata Motors offers two products in Small Commercial Passenger Industry Tata Magic (seating

capacity 6-7 passengers) & Tata Magic Iris (seating capacity 3-4 passengers). Tata Magic & Tata

Magic Iris are used majorly for Shared Application (both within and outside city). Tata Motors has

been a pioneer in creating and growing the small commercial passenger vehicle market in India.

Between the years 2007 to 2011, Large 3 Wheeler (Seating Capacity 6 Passengers) sales dropped

drastically as operators and passengers preferred 4 wheeler vehicles. Mahindra & Force Motors

have signifcantly scaled down manufacturing of large 3 wheelers & the market is now predominantly

for 4 wheeler vehicles. However, there was still a big opportunity available within small 3-wheeler

diesel market space having size of approx. 2.1 Lac units per annum which was not addressed by

large 4 wheelers. To cater to this market, Tata Motors launched Tata Magic Iris in 2011 and in just one

and a half years of its launch Tata Iris has received good response with volumes growing quarter by

quarter across all the states with more than 40,000 Iris successfully running on roads.

Indian LMPT scenario is changing rapidly with improvement in road infrastructure, urbanization,

higher disposable income, industrialization, population growth etc. resulting in increase in passenger

travel in intra & intercity movement. 4 wheeled vehicles are being preferred by the customers

and passengers as they provide better safety to passengers/owners over 3 Wheelers. Even state

transport authorities are endorsing the advantage of 4 wheelers leading to increase in the share of

4 wheelers, in a space traditionally dominated by 3 wheelers. Many 3 wheeler manufacturers have

either launched their 4 wheelers or are planning to bring 4 wheelers as they see the transition from 3

to 4 wheels in future as inevitable. Going forward, majority of cities/towns are expected to allow only

clean fuels like CNG/LPG vehicles for intra-city public movement.

Future offerings in this segment will be from existing 3 wheeler manufacturers like Piaggio which is

coming with Ape Mini passenger version, Bajaj Auto which will bring RE60 on Quadri-Cycle norms

(yet not approved/implemented in India), Ashok Leyland which is coming with passenger vehicle

version on their existing DOST platform. This market also has the maximum potential of growth in

the near future. Can Tata Motors bring in pioneering products to further expand this market from

which the whole industry would beneft?

9

Dealership Network

Over the years Tata Motors has established the largest network of sales, services and spare parts

centre for commercial vehicles in India. This network has over 200 dealers, more than 500 full range

dealerships and close to 1800 touch points. One added dynamic has been the growing product

line in small commercial vehicle business and therefore the need to increase the reach of the dealer

network. Setting up of a full range dealer network requires a large amount of capital investment. To

take products like the Tata Ace and Tata Ace Zip to their intended market Tata Motors has set up a

large number of sales outlets in areas where there is no presence of full range dealerships. Over the

years Tata Motors has been able to steadily increase the number of dealerships but in the present

scenario there are various questions that the organisation is grappling with. With the steady increase

in product line, product focus is slowly going down. How does Tata Motors counter this? Should

the organisation continue adding full range dealerships or should it move on to a business unit wise

dealership model?

Viability of dealerships is extremely important to keep the network healthy. The company is also

faced with the challenge of increasing the revenue per outlet which is under tremendous pressure

with competitors playing with the price structure of product lines. The challenge facing Tata Motors

is what would be the ideal network size and structure which will help it retain its hold over the market.

Service network and its importance

In the commercial vehicle industry service network plays a great role when the customer is making

a buying decision. Tata Motors has had an initial advantage as far as the reach and spread of the

network is concerned. But with new players with advanced infrastructure entering the market and

local players fooding the market with low cost options Tata Motors faces a tough challenge to

ward of competition and improve the proftability of its channel partners. Tata Motors has already

implemented a lot of innovative schemes in Annual Maintenance Contract (AMC) and Extended

Warranty to keep their service advantage intact. Today customers are increasingly moving towards

a total life cost of ownership (TCO) approach while deciding to buy a vehicle. Therefore the service

advantage will play a greater role in pre sales.

Over the years Tata Motors has ingeniously brought in various product & process innovations that

has helped it stay ahead of the Indian commercial vehicle market. Even after opening up of the

market and a lot of foreign players entering the fray Tata Motors has still held on to its position as

the market leader. In addition to the constant product innovation a lot of other initiatives have helped

Tata Motors get ahead of competition.

10

Special Initiatives by Tata Motors

Project Neev

Commercial Vehicle Business Unit (CVBU) has initiated and established their rural presence in a big

way through Project Neev. Neev is currently present in the 6 states of Rajasthan, Uttar Pradesh,

Bihar, Andhra, Maharashtra and Madhya Pradesh and has footprints in 238 districts, 1,798 tehsils,

covering more than 150,000 villages. Approach to rural market is on the plank of self employment.

Through a rigorous skill building exercise, local, unemployed rural youth have been inducted and

trained to work as promoters of Tata Motors commercial vehicles, who work in their own habitations.

This has become a successful inclusive growth program for the rural geographies. This program has

been appreciated and recognized in various forums for innovation in rural marketing, noteworthy

being recognition received from the Honorable Minister of Youth and Sports in the Conference of

Ministers of States for Youth 12-13

Value Added Services

For close to 60 years now, Tata Motors has been a step ahead in offering new technologies, products

and value added services (VAS). Several industry frsts have been introduced by the company. Some

of the latest innovations on VAS are - the 4-year warranty (partnering the customer through the

lifecycle of the product). This has been designed based on the lifecycle cost study of over 15 lakh

Tata trucks & tippers operating all over the country, in varied terrain and loading conditions. Another

innovation on VAS front is the new premium Triple Beneft Insurance across its range of M&HCV,

ICV & LCV Trucks and Tippers. This is yet another frst from Tata Motors in the Indian commercial

vehicle space designed in partnership with Iffco-Tokio General Insurance Company.

Key Account Management Program

Tata Motors was also a pioneer in launching the Key Account Management program in commercial

vehicle space. Even today, it is the only manufacturer in Indian CV space that has a Key Account Portal.

Key account customers have multi-location branches and site offces which make it diffcult to share

product and service related information to their workshop managers, drivers, operations managers

etc. The key account portal offers customers several benefts. Some of these are enumerated below:

Customers can view resolution status of registered complaints through online tracking

system.

Various analysis reports are also available for making better decisions.

Also the portal helps to be aware of customers older feet and thus TML is aware & takes

action for replacement with new vehicles.

Customers can make online payment through portal for various services used in

workshops.

11

They also can contact various Key contact persons whose details are uploaded on the

portal.

Road Ahead

Tata Motors has led the Indian commercial vehicle industry for almost 6 decades now. It is a major

player in almost all the segments of the industry. For the organization, every market segment brings its

own set of challenges, with its unique set of customers and competitors. For example the challenges

faced by M&HCV segment are completely different from those faced by SCV segment. The price

points, customer profle, customer expectations etc. are completely different in each segment. Being

a player which has a presence in almost all the segments of commercial vehicles, Tata Motors is thus

faced with multifarious challenges (as well as opportunities). With the incoming challenge from major

global players the challenges have only increased for Tata Motors.

What strategy should Tata Motors adopt to garner the best profts

and market share in all segments of commercial vehicles?

ANNEXURE-I

CV

Passenger

Based on

no. of

passengers

Rigid

< 3.5T SCV

3.5 to

7.5

LCV

7.5T-

16.2T

ICV

12T-

16.2T

MCV

(2 Axles)

25-37

T

MAVs

35 T

40 T

Tractor

Trailor

49 T

Tractor

Trailor

Goods

Figure 1- Basic Vehicle Categorization for Commercial Vehicles

Figure 2 Product Categories in Medium & Heavy Commercial Vehicles

Rigid Truck

LPT 1613 LPT 2518 LPT 3118

Tractor Trailer

LPS 3518 Prima 4028 Prima 4923 Prima 4928

Tipper

LPK 1613 LPK 2518 LPK 3118 Prima 3138

12

Figure 3 Products categories in Light & Intermediate Commercial Vehicles

Figure 4 Product Categories in Bus Segment

LCV - 4 Ton

LCV

SFC 407

Starbus 16-24s

LPT 407

Starbus 28-36s

SK 407

Cityride 12-20s

LCV - 7 Ton

ICV

SFC 709

Starbus 36-42s

LPT 709

Tata Skoolbus

LPT 709 HEx2

LPK 407

Tata Skoolbus

ICV - 9 Ton

MCV

ICV - 11 Ton

SFC 909

1512 TC

LPT 1109

LPK 909

1618 TC Bus

LPT 1109 HEx2

LPT 909 HEx2

Starbus 53-64s

LPK 909

Divo bus

13

Category Kay Purchase Criteria Relative Performance

Operator

Requirements

Acquisition Cost

Reliability

Resale Value

Fuel Effciency

Performance

Low cost of ownership

Passenger

Requirements

Safety

Ride comfort

Convenience

Figure 5 Product Categories in SCV Segment (Cargo & Passenger)

Figure 6 - Customer Segments in Bus Industry, their Preferences &

Implications of those on Customer Segments

Micro Trucks

<1500 kg GVW

Mini Trucks

1500-1990 kg GVW

Small pickups

2000-2500 kg GVW

Large Pickups

> 2500 kg GVW

Mini Vans

Micro Vans

Tata Ace Zip

Tata Ace

Tata Super Ace

Xenon Tata Magic

Tata Magic Iris

Tata RX pickup Tata Venture

STU Private Operators Contract Operators

Customer Preferences

There are 3 distinct customer segments STUs, Private Operators and Contract Operators

Lower Higher

Implications

STUs and Municipal Corporations

Urban and sub-urban segment

Tender driven purchase process

Acquisition cost is the biggest purchase

driver

Private Operators

Inter-urban segment

Passenger comfort, safety and reliability

are the key purchase drivers

Contract Operators

Higher Re-sale Value, Lower Operating

Economics (mileage, maintenance cost

etc.) are the key purchase drivers

Fleet owner catering to the premium

segment also value passenger comfort,

reliability and safety

14

Year Tata Motors Hindustan

Motors

Ashok

Leyland

Force

Motors

Mahindra &

Mahindra

Piaggio TOTAL

2007-08 101847 3 0 5483 44976 4945 157254

2008-09 89150 50 0 1981 47277 9012 147470

2009-10 121403 281 0 3678 76487 11094 212943

2010-11 152201 312 0 6726 105588 9124 273951

2011-12 209895 157 7593 5862 127029 10579 361115

2012-13 254257

214

34794 3335 142796 2469 437865

Figure 7 - No. of vehicles sold by Tata Motors and competitors in SCV Cargo

Segment in last 6 Years

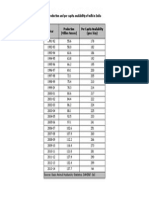

Figure 9 - No. of vehicles sold by Tata Motors and competitors in LCV Trucks

Segment in last 6 Years

Figure 8 - No. of vehicles sold by Tata Motors and competitors in SCV

Passenger Segment in last 6 Years

Year Tata Motors Force Motors Mahindra &

Mahindra

TOTAL

2007-08 11136 0 0 11136

2008-09 28659 0 0 28659

2009-10 48931 0 0 48931

2010-11 51051 237 0 51288

2011-12 60203 147 25434 85784

2012-13 94376 11 22313 116700

Year Tata Motors Ashok

Leyland

Mahindra &

Mahindra

Force

Motors

Eicher Swaraj

Mazda

TOTAL

2007-08 19009 0 4830 902 3288 2610 30639

2008-09 17078 3 3486 1757 2404 1495 26223

2009-10 26997 0 4804 1886 3844 1802 39333

2010-11 30693 1 5449 1416 5287 1189 44035

2011-12 35293 0 5872 1464 6291 1348 50268

2012-13 26654 0 4344 1294 5082 1517 38891

15

Figure 11 - No. of vehicles sold by Tata Motors and competitors in LCV Buses

Segment in last 6 Years

Figure 12 - No. of vehicles sold by Tata Motors and competitors in ICV Buses

Segment in last 6 Years

Year Tata Motors Ashok

Leyland

Eicher Mahindra &

Mahindra

Force

Motors

Swaraj

Mazda

TOTAL

2007-08 13317 616 1509 5284 5360 2234 28320

2008-09 11789 523 1022 2613 4027 1944 21918

2009-10 15382 812 1407 2813 5779 1835 28028

2010-11 20706 699 2484 4785 8321 3031 40026

2011-12 20976 398 3319 4456 11093 3189 43431

2012-13 20499 328 4040 2315 10926 2321 40429

Year Tata Motors Ashok

Leyland

Eicher JCBL Mahindra &

Mahindra

Swaraj

Mazda

TOTAL

2007-08 1417 765 1317 0 0 2090 5589

2008-09 3239 682 1225 0 0 1605 6751

2009-10 5251 1107 1726 1 0 1821 9906

2010-11 5684 1588 2318 0 0 3276 12866

2011-12 6066 2487 3091 0 84 3303 15031

2012-13 6611 3058 3253 0 79 3913 16914

Figure 10 - No. of vehicles sold by Tata Motors and competitors in ICV Truck

Segment in last 6 Years

Year Tata Motors Ashok

Leyland

Eicher Swaraj

Mazda

TOTAL

2007-08 19138 1774 16274 3663 40849

2008-09 13527 1271 10587 2331 27716

2009-10 21214 1502 17099 3864 43679

2010-11 25489 2810 22583 4529 55411

2011-12 32326 4169 25734 4875 67104

2012-13 24262 6477 22910 3767 57416

16

Figure 13 - No. of vehicles sold by Tata Motors and competitors in MCV

Buses Segment in last 6 Years

Figure 14 - No. of vehicles sold by Tata Motors and competitors in M&HCV

Trucks in last 6 Years

Year Tata Motors Ashok

Leyland

Eicher JCBL Swaraj

Mazda

Volvo

(incl. VBIPL)

TOTAL

2007-08 15522 16809 487 0 0 240 33058

2008-09 12203 15344 110 0 0 484 28141

2009-10 16850 15298 202 178 42 607 33177

2010-11 15014 18837 157 0 76 568 34652

2011-12 14650 18262 856 0 95 677 34540

2012-13 11315 15584 1371 0 18 601 28889

Year Tata

Motors

Ashok

Leyland

AMW Eicher Volvo MB India Mahindra &

Mahindra

Swaraj

Mazda

TOTAL

2007-08 129961 56061 3611 4392 823 206 32 0 195086

2008-09 84705 29796 3623 1625 913 219 6 0 120887

2009-10 111822 39228 3792 2119 1006 215 0 0 158182

2010-11 145943 59863 6792 5165 1000 103 843 2 219711

2011-12 153972 56345 10021 7719 595 85 3490 3 232230

2012-13 101194 45437 6533 7517 616 0 2977 21 164295

17

Source: SIAM (Society of Indian Automobile Manufacturers)

You might also like

- Milk Production and Per Capita Availability of Milk in IndiaDocument1 pageMilk Production and Per Capita Availability of Milk in IndiaArpita MukherjeeNo ratings yet

- Aquafeed July August 2015 FULL EDITIONDocument68 pagesAquafeed July August 2015 FULL EDITIONArpita MukherjeeNo ratings yet

- Vodafone Brand ManagementDocument17 pagesVodafone Brand ManagementArpita MukherjeeNo ratings yet

- Spicejet Brand ManagementDocument18 pagesSpicejet Brand ManagementArpita MukherjeeNo ratings yet

- Trident Campus Mba PresentationDocument36 pagesTrident Campus Mba PresentationArpita MukherjeeNo ratings yet

- Cash Flow Statement Analysis For Grasim Industries LTDDocument3 pagesCash Flow Statement Analysis For Grasim Industries LTDArpita MukherjeeNo ratings yet

- Financial Statement Analysis and Research: Submitted To: Dr. Pawan JainDocument3 pagesFinancial Statement Analysis and Research: Submitted To: Dr. Pawan JainArpita MukherjeeNo ratings yet

- "Scope of Tourism Industry in Brazil": Business EnvironmentDocument3 pages"Scope of Tourism Industry in Brazil": Business EnvironmentArpita MukherjeeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- ComunicationDocument220 pagesComunicationmathivananNo ratings yet

- Car EbookDocument144 pagesCar Ebookm_i_c_k100% (2)

- Maruti Auto ExpoDocument28 pagesMaruti Auto Exposaifeez18No ratings yet

- Analysis of Virgin Australia.Document12 pagesAnalysis of Virgin Australia.Assign UsNo ratings yet

- 2011 03 23 Oa Fea Farrington Highway Nanakuli CiaDocument109 pages2011 03 23 Oa Fea Farrington Highway Nanakuli Ciaapi-289052060No ratings yet

- Assignment Air Asia Report ODC FullDocument16 pagesAssignment Air Asia Report ODC FullThiviyaa DarshiniNo ratings yet

- Ford Focus MK3-3.5 Auto HeadlightsDocument11 pagesFord Focus MK3-3.5 Auto HeadlightsOleksandr MasovetsNo ratings yet

- Uttar Pradesh Transport Department DLDocument3 pagesUttar Pradesh Transport Department DLNutan SharmaNo ratings yet

- Family Overview PDFDocument11 pagesFamily Overview PDFmalikscribdNo ratings yet

- Four-Wheel Steering ReportDocument21 pagesFour-Wheel Steering ReportMuralee Dharan PillaiNo ratings yet

- NTB02 082aDocument2 pagesNTB02 082aPMNo ratings yet

- Trenching, Backfilling & Compacting OPSS - Muni 401 Nov15Document10 pagesTrenching, Backfilling & Compacting OPSS - Muni 401 Nov15mmkamran1017No ratings yet

- JH Academy Notes ENVIRONMENTAL ENGINEERINGDocument53 pagesJH Academy Notes ENVIRONMENTAL ENGINEERINGKarnalPreeth100% (2)

- Marine Insurance Final ITL & PSMDocument31 pagesMarine Insurance Final ITL & PSMaeeeNo ratings yet

- C-857-14 Minimum Design Loading PDFDocument6 pagesC-857-14 Minimum Design Loading PDFMichael VanWagenenNo ratings yet

- 721Document8 pages721Didier Van Der LeeNo ratings yet

- Unit 2 The Three Levels of Supply Chain ManagementDocument11 pagesUnit 2 The Three Levels of Supply Chain ManagementSheela AngelNo ratings yet

- Toyota Corporate Communication CaseDocument6 pagesToyota Corporate Communication CaseAdriano PistolaNo ratings yet

- Results Seeding Run RDC Schladming 2023Document9 pagesResults Seeding Run RDC Schladming 2023racementNo ratings yet

- Product Catalogue 2006 / 2007: Systems and Components For Modern Commercial VehiclesDocument155 pagesProduct Catalogue 2006 / 2007: Systems and Components For Modern Commercial Vehiclesiry23muNo ratings yet

- Lilliput Lane Katalog 2013 SommerDocument12 pagesLilliput Lane Katalog 2013 SommerAnthony SaidNo ratings yet

- 1338 4654 1 PBDocument22 pages1338 4654 1 PBMoatassim CarNo ratings yet

- PagesDocument92 pagesPagesAhmed Samir We ShreenNo ratings yet

- 2012 SportsterDocument53 pages2012 SportstermonzainvespaNo ratings yet

- Maritime DisasterDocument16 pagesMaritime DisasterAzureen MurshidiNo ratings yet

- Comprehensive Preliminary Sizing and Resizing For A Fixed WingDocument29 pagesComprehensive Preliminary Sizing and Resizing For A Fixed WingNguyen Thanh DatNo ratings yet

- Brochure - Tipper - 3520 - 8X4 - TS-1Document2 pagesBrochure - Tipper - 3520 - 8X4 - TS-1Nitesh JangirNo ratings yet

- Woehwa Loading Chute Type 17 1Document2 pagesWoehwa Loading Chute Type 17 1Kroya HunNo ratings yet

- PA-28-161 WARRIOR III Operation Book PDFDocument190 pagesPA-28-161 WARRIOR III Operation Book PDFJody SudiroNo ratings yet

- TB153FR Operators ManualDocument239 pagesTB153FR Operators Manualthor013No ratings yet