Professional Documents

Culture Documents

Divided We Stand: Why Inequality Keeps Rising: Unequal? Showed That The Gap Between Rich and

Divided We Stand: Why Inequality Keeps Rising: Unequal? Showed That The Gap Between Rich and

Uploaded by

Eduardo PastorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Divided We Stand: Why Inequality Keeps Rising: Unequal? Showed That The Gap Between Rich and

Divided We Stand: Why Inequality Keeps Rising: Unequal? Showed That The Gap Between Rich and

Uploaded by

Eduardo PastorCopyright:

Available Formats

1

www.oecd.org/els/social/inequality

Divided We Stand:

Why Inequality Keeps Rising

The gap between rich and poor has widened in most OECD countries over the past 30 years. This

occurred when countries were going through a sustained period of economic growth, before the Great

Recession. What will happen now that 200 million people are out of work worldwide and prospects of

growth are weak? New OECD analysis says that the trend to greater inequality is not inevitable:

governments can and should act.

The landmark 2008 OECD report Growing

Unequal? showed that the gap between rich and

poor had been growing in most OECD countries.

Three years down the road, inequality has

become a universal concern, among both policy

makers and societies at large. The new OECD

study Divided we Stand: Why Inequality Keeps

Rising reveals that the gap between rich and poor

has widened even further in most countries.

Today in advanced economies, the average

income of the richest 10% of the population is

about nine times that of the poorest 10%. Even in

traditionally egalitarian countries such as

Germany, Denmark and Sweden the income gap

between rich and poor is expanding from 5 to 1

in the 1980s to 6 to 1 today. Its 10 to 1 in Italy,

Japan, Korea and the United Kingdom, rising to 14

to 1 in Israel, Turkey and the United States and

reaching more than 25 to 1 in Mexico and Chile.

The Gini coefficient, a standard measure of

inequality, where zero means everybody has the

same income and 1 means the richest person

has all the income, stood at an average of 0.29

for working-age persons in OECD countries in

the mid-1980s. By the late 2000s, it had

increased by almost 10% to 0.316.

Figure 1. Huge differences in income gaps between rich and poor across OECD countries

Levels of inequality in the latest year before the crisis and in the mid-1980s, working-age population

Note: The Gini coefficient ranges from 0 (perfect equality) to 1 (perfect inequality). Gaps between poorest and richest are the

ratio of average income of the bottom 10% to average income of the top 10%. Income refers to disposable income adjusted for

household size. * Information on data for Israel: http//dx.doi.org/10.1787/888932315602.

Source: OECD Income Distribution and Poverty Database (www.oecd.org/els/social/inequality).

Divided We Stand: Why Inequality Keeps Rising

www.oecd.org/els/social/inequality

2

Using this measure, inequality rose in 17 of

the 22 OECD countries for which long-term data

series back to the 1980s are available. It climbed

by more than 4 percentage points in Finland,

Germany, Israel, Luxembourg, New Zealand,

Sweden, and the United States. Inequality

remained relatively stable in France, Hungary,

and Belgium while there were declines in Greece

and Turkey and, more recently in Chile and

Mexico, but from very high levels.

A sustained period of strong economic

growth has allowed emerging economies to lift

millions of people out of absolute poverty. But

the benefits of strong economic growth have not

been evenly distributed and high levels of income

inequality have risen further. Among the BRICs,

only Brazil managed to strongly reduce inequality.

But the gap between rich and poor is still at 50

to 1, five times that in the OECD countries.

What is driving the increase of income inequality?

The OECDs new report Divided We Stand: Why

Inequality Keeps Rising is taking a fresh look at

these questions. The single most important

driver has been greater inequality in wages and

salaries. This is not surprising: earnings account

for about three-quarters of total household

incomes among the working-age population in

most OECD countries. The earnings of the

richest 10% of employees have taken off rapidly,

relative to the poorest 10% in most cases. And

those top earners have been moving away from

the middle earners faster than the lowest

earners, extending the gap between the top and

the increasingly squeezed middle-class.

The largest gains were reaped by the top 1% and

in some countries by an even smaller group: the

top 0.1% of earners. New data for the United

States, for example, show that the share of after-

tax household income for the top 1% more than

doubled, from nearly 8% in 1979 to 17% in 2007.

Over the same period, the share of the bottom

20% of the population fell from 7% to 5%.

The study reveals a number of surprising findings:

First, globalisation had little impact on both

wage inequality and employment trends. Even

though trade flows between countries around

the world have been increasing rapidly,

companies have been investing more and

more directly in other countries, and imports

from emerging economies, such as China and

India, have surged, these trends were not

major drivers of inequality in OECD countries.

Second, technological progress has been more

beneficial for workers with higher skills. People

with much-demanded skills to deal with the

new information and communication

technologies or skills specific to the financial

sector, for instance, have enjoyed significant

earnings and income gains while workers with

low or no skills have been left behind. As a

result, the earnings gap between high- and

low-skilled workers has been growing.

Third, regulatory reforms and institutional

changes increased employment opportunities

but also contributed to greater wage inequality.

These reforms were carried out to strengthen

competition in the markets for goods and

services and to make labour markets more

adaptable. The good news is that more people,

and in particular many low-paid workers, were

brought into employment. But the logical

consequence of more low-paid people in work

is a widening distribution of wages.

Fourth, Part-time work increased, atypical labour

contracts became more common and the

coverage of collective-bargaining arrangements

declined in many countries. These changes in

working conditions also contributed to rising

earnings inequality.

Fifth, the rise in the supply of skilled workers

helped offset the increase in wage inequality

resulting from technological progress, regulatory

reforms and institutional changes. Raising the

skills level of the labour force also had a significant

positive impact on employment growth.

Sixth, changing family structures make

household incomes more diverse and reduce

economies of scale. There are more single-

headed households today than ever before; in

Divided We Stand: Why Inequality Keeps Rising

www.oecd.org/els/social/inequality

3

the mid-2000s, they accounted for 20% of all

working-age households, on average, in OECD

countries. In couple households, employment

rates of the wives of top earners increased the

most. And in all countries, marriage behaviour

has changed. People are now much more likely

to choose partners in the same earnings

bracket: so rather than marrying nurses,

doctors are now increasingly marrying other

doctors. Again, all of these factors contributed

to higher inequality but much less so than the

changes in the labour markets.

Seventh, the distribution of non-wage incomes

has generally also become more unequal. In

particular, capital income inequality increased

more than earnings inequality in two-thirds of

OECD countries. But at around 7%, the share of

capital income in total household income still

remains modest on average.

Last but not least, tax and benefit systems have

become less redistributive in many countries

since the mid-1990s. Currently, cash transfers

and income taxes reduce income inequality by

one quarter among the working-age population.

The main reasons for the decline in

redistributive capacity are found on the benefit

side: cuts to benefit levels, tightening of

eligibility rules to contain expenditures for social

protection and the failure of transfers to the

lowest income groups to keep pace with

earnings growth all contributed.

Many of the driving forces of income inequality

are the same in both emerging and OECD

economies. But the setting is not the same.

Emerging economies have large informal

sectors: workers who are outside of social-

protection systems and generally in low-paid,

low-productivity jobs. Informal employment

remains stubbornly high in many emerging

economies despite strong overall economic

growth. In these countries, disparities between

ethnic groups and regions, rural and urban

populations, and migrant and non-migrant

workers are also significant.

Figure 2. Market incomes are distributed more unequally than net incomes

Inequality (Gini coefficient) of market income and disposable (net) income in the OECD area,

working-age persons, 2008 (or closest)

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0.50

0.55

Inequality of market income () Inequality of disposable income

Note: Market incomes are all gross incomes from earnings, savings and capital.

* Information on data for Israel: http//dx.doi.org/10.1787/888932315602.

Source: OECD Database on Household Income Distribution and Poverty (www.oecd.org/els/social/inequality).

Divided We Stand: Why Inequality Keeps Rising

www.oecd.org/els/social/inequality

4

Why should policy makers worry?

The economic crisis has added urgency to the

debate. The social contract is starting to unravel in

many countries. Youths who see no future for

themselves feel increasingly disenfranchised. They

have now been joined by protesters who believe

that they are bearing the brunt of a crisis for

which they have no responsibility while people on

high incomes appear to have been spared.

Rising income inequality creates economic, social

and political challenges. It can jeopardise social

mobility: intergenerational earnings mobility is

low in countries with high inequality such as Italy,

the United Kingdom and the United States, and

higher in the Nordic countries, where income is

distributed more evenly. The resulting inequality

of opportunities will affect economic

performance as a whole. Inequality can also fuel

protectionist sentiments. People will no longer

support open trade and free markets if they feel

that they are losing out while a small group of

winners is getting richer and richer.

What can policy makers do?

The most promising way of tackling inequality is

through boosting employment. Fostering more

and better jobs, enabling people to escape poverty

and offering real career prospects, is the most

important challenge for policy makers to address.

Investing in human capital is key. This must

include the early childhood period and be

sustained through compulsory education. Once

the transition from school to work has been

accomplished successfully, there must be

sufficient incentives for workers and employers

to invest in skills throughout the working life.

Even though taxes play a lesser role for

redistribution, the growing share of income

going to top earners means that they now have

a greater capacity to pay taxes. Governments

may consider raising marginal tax rates on

income as a direct route to achieving this goal,

but this might not be the most effective

measure to raise tax revenues. Other measures

include improving tax compliance, eliminating

tax breaks; and reassessing the role of taxes on

all forms of property and wealth, including the

transfer of assets.

Providing freely accessible and high-quality public

services, such as education, health, and family

care is also important, especially for emerging

economies. On average, OECD governments

spend as much some 13% of GDP on public

social services as they do on all cash benefits

taken together, and this spending reduces

inequality by about one fifth on average.

Divided We Stand: Why Inequality Keeps Rising

shows that there is nothing inevitable about

growing inequalities. Globalisation and

technological changes offer opportunities but

also raise challenges that can be tackled with

effective and well-targeted policies. Any policy

strategy to reduce the growing divide between

rich and poor should rest on three main pillars:

more intensive human capital investment;

inclusive employment promotion; and well-

designed tax/transfer redistribution policies.

Divided We Stand: Why

Inequality Keeps Rising

E-book available online at:

www.oecd-ilibrary.org/

Printed version available

19 Dec 2011

Contact:

michael.forster@oecd.org Tel: +(33-1) 45249280

wen-hao.chen@oecd.org Tel: +(33-1) 45248959

ana.llenanozal@oecd.org Tel: +(33-1) 45248527

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Labor Relations Striking A Balance 4th Edition Budd Solutions ManualDocument21 pagesLabor Relations Striking A Balance 4th Edition Budd Solutions Manualdanielaidan4rf7100% (29)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Generational DifferencesDocument8 pagesGenerational DifferencesMehwish ShamsNo ratings yet

- Labor Law in China - Progress and Challenges (PDFDrive)Document164 pagesLabor Law in China - Progress and Challenges (PDFDrive)Azzam Fotocopy PrintNo ratings yet

- MWSS Privatization and Its ImplicationsDocument62 pagesMWSS Privatization and Its ImplicationsPoc Politi-ko ChannelNo ratings yet

- EBK and The Regulation of Engineering Profession in KenyaDocument12 pagesEBK and The Regulation of Engineering Profession in KenyaCharles Ondieki50% (4)

- Fallacy DetectiveDocument2 pagesFallacy DetectiveJohnoy Livingston0% (3)

- Feasibility StudyDocument67 pagesFeasibility StudyEmman Acosta Domingcil100% (5)

- IQA Audit ChecklistDocument26 pagesIQA Audit ChecklistnorlieNo ratings yet

- United Nations Trade and Environment Review 2013Document341 pagesUnited Nations Trade and Environment Review 2013HeathwoodPressNo ratings yet

- DAP Separate Opinion SAJ Antonio T. CarpioDocument27 pagesDAP Separate Opinion SAJ Antonio T. CarpioHornbook RuleNo ratings yet

- DAP Declared Unconstitutional by The Supreme Court of The PhilippinesDocument92 pagesDAP Declared Unconstitutional by The Supreme Court of The PhilippinesMalou TiquiaNo ratings yet

- China's Maritime Territorial Claims: Implications For U.S. Interests.Document46 pagesChina's Maritime Territorial Claims: Implications For U.S. Interests.Steve B. SalongaNo ratings yet

- Small Wind GuideDocument27 pagesSmall Wind GuideSteve B. SalongaNo ratings yet

- Preparing To Build A Masonry OvenDocument28 pagesPreparing To Build A Masonry OvenSteve B. SalongaNo ratings yet

- Christian Monsod: The 2010 Automated Elections - An AssessmentDocument14 pagesChristian Monsod: The 2010 Automated Elections - An AssessmentNational Citizens' Movement for Free Elections (NAMFREL)No ratings yet

- Budget Basics For UP Students by Leonor M. BrionesDocument9 pagesBudget Basics For UP Students by Leonor M. BrionesSteve B. SalongaNo ratings yet

- How It WorksDocument6 pagesHow It WorksFaizal IsmailNo ratings yet

- Annex A: Privilege Speech of Senator Lorenzo Sumulong On Philippines' North Borneo (Sabah) Claim at The Philippine Senate, March 25, 1963.Document6 pagesAnnex A: Privilege Speech of Senator Lorenzo Sumulong On Philippines' North Borneo (Sabah) Claim at The Philippine Senate, March 25, 1963.Steve B. SalongaNo ratings yet

- The Facts and The Law of The Marcos Wealth by Jovito R. SalongaDocument7 pagesThe Facts and The Law of The Marcos Wealth by Jovito R. SalongaSteve B. Salonga100% (1)

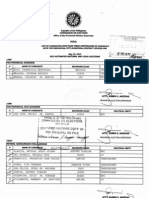

- Misamis Oriental Quickstat: Indicator Reference Period and DataDocument4 pagesMisamis Oriental Quickstat: Indicator Reference Period and DataSheena Mae SieterealesNo ratings yet

- Belgica Et Al vs. ES 2013 Part 2: LEGAL DISCUSSION.Document31 pagesBelgica Et Al vs. ES 2013 Part 2: LEGAL DISCUSSION.Steve B. SalongaNo ratings yet

- List of Provincial Candidates For Province of RizalDocument2 pagesList of Provincial Candidates For Province of RizalSteve B. SalongaNo ratings yet

- Steve Salonga's Professional Resume / BiodataDocument3 pagesSteve Salonga's Professional Resume / BiodataSteve B. SalongaNo ratings yet

- Residential Free Patent Act RA10023 IrrDocument9 pagesResidential Free Patent Act RA10023 IrrSteve B. Salonga100% (1)

- List of Candidates, 1st District, Province of RizalDocument6 pagesList of Candidates, 1st District, Province of RizalSteve B. SalongaNo ratings yet

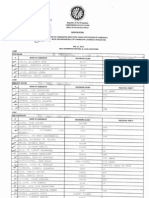

- Province of Rizal, 2010 Election ResultsDocument6 pagesProvince of Rizal, 2010 Election ResultsSteve B. SalongaNo ratings yet

- The Chicago Plan RevisitedDocument71 pagesThe Chicago Plan RevisitedYannis KoutsomitisNo ratings yet

- The Permaculture Path: April Sampson-Kelly PDC ADPA BCA MCA GRD DipDocument62 pagesThe Permaculture Path: April Sampson-Kelly PDC ADPA BCA MCA GRD DipRamón OrtegaNo ratings yet

- COMELEC List of Candidates For Antipolo CityDocument4 pagesCOMELEC List of Candidates For Antipolo CitySteve B. SalongaNo ratings yet

- A Message of Hope To Filipinos Who CareDocument16 pagesA Message of Hope To Filipinos Who CareSteve B. SalongaNo ratings yet

- Icar-Indian Institute of Pulses Research Kalyanpur, Kanpur - 208 024Document10 pagesIcar-Indian Institute of Pulses Research Kalyanpur, Kanpur - 208 024JeshiNo ratings yet

- Articles Group 2 The Right To Work and Rights at Work Child Labour and The Institutional Treatment of Hiv Aids Indias Laws As Briefly ComparDocument32 pagesArticles Group 2 The Right To Work and Rights at Work Child Labour and The Institutional Treatment of Hiv Aids Indias Laws As Briefly ComparvigilindiaNo ratings yet

- A Case Study (Airsoft Company)Document3 pagesA Case Study (Airsoft Company)diana jane torcuatoNo ratings yet

- Hbo PowerpointDocument252 pagesHbo PowerpointMarvin GabilleteNo ratings yet

- Relevant Contracts TaxDocument11 pagesRelevant Contracts TaxTe KruNo ratings yet

- Teaching CouncilDocument9 pagesTeaching Councilbrod337No ratings yet

- Far Eastern University: MGT 1106 Final Assessment SY 2019-2020 1 Semester HR Manpower PlanDocument38 pagesFar Eastern University: MGT 1106 Final Assessment SY 2019-2020 1 Semester HR Manpower Planmark Galapon100% (1)

- G.R. No. 138051 June 10, 2004 JOSE Y. SONZA, Petitioner, Abs-Cbn Broadcasting Corporation, RespondentDocument10 pagesG.R. No. 138051 June 10, 2004 JOSE Y. SONZA, Petitioner, Abs-Cbn Broadcasting Corporation, RespondentDexter LingbananNo ratings yet

- Resignation Termination RetirementDocument5 pagesResignation Termination RetirementMary Grace Ramos BalbonaNo ratings yet

- Question Bank - SHRMDocument3 pagesQuestion Bank - SHRMDeepa RNo ratings yet

- Cases On ODDocument4 pagesCases On ODAditya Rahmaniac0% (1)

- Government of India Department of Atomic Energy Nuclear Fuel Complex ECIL Post, Hyderabad - 500 062. Advertisement No. Nfc/02/2012Document7 pagesGovernment of India Department of Atomic Energy Nuclear Fuel Complex ECIL Post, Hyderabad - 500 062. Advertisement No. Nfc/02/2012Rama KrishnaNo ratings yet

- HRM Lopez LA4Document20 pagesHRM Lopez LA4Levi MadaraNo ratings yet

- TCO Company ProfileDocument10 pagesTCO Company ProfileZeeshan Ul HaqNo ratings yet

- Verified Complaint: Jury Trial DemandedDocument60 pagesVerified Complaint: Jury Trial Demandedingrid8775No ratings yet

- Economic Analysis PDFDocument495 pagesEconomic Analysis PDFRonnie50% (2)

- Job Description and Job Specification A Study ofDocument7 pagesJob Description and Job Specification A Study ofdianafauziyyahNo ratings yet

- Secured SecurityDocument3 pagesSecured SecurityIroko Adeola FunmilayoNo ratings yet

- ACIDocument11 pagesACIShahriar Khan TusharNo ratings yet

- Transformational Leadership in Nursing PracticeDocument17 pagesTransformational Leadership in Nursing Practicexr4dm100% (1)

- Noe 4th Ed Chap005Document39 pagesNoe 4th Ed Chap005vikram622No ratings yet

- Bsci Manual 2.0Document4 pagesBsci Manual 2.0NafizAlamNo ratings yet

- Private Employers - DehradunDocument9 pagesPrivate Employers - DehradunHunnuNo ratings yet