Professional Documents

Culture Documents

Rajat Gupta Case

Rajat Gupta Case

Uploaded by

Ja Se Em KvOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rajat Gupta Case

Rajat Gupta Case

Uploaded by

Ja Se Em KvCopyright:

Available Formats

Rajat Guptas case

&

Evils of Insider

trading

Rajat Gupta -First Indian-born CEO of a

global Western company

Name - Rajat Kumar Gupta

Birth date - December 1948 (age 63)

BirthPlace - Kolkata, West Bengal, India

Residence - Westport, CT, USA

Ethnicity - Indian American

Citizenship - United States

Education - Alma mater IIT Delhi

Harvard Business School

Occupation - Consultant, Management expert

Years active - 1973-2007

Employer - McKinsey & Company, Inc.

Net worth - $100 million

Rajat Gupta -First Indian-born CEO of a global

Western company

Corporate chairman, board director or strategic advisor

to a variety of large and notable organizations:

Goldman Sachs,

Procter and Gamble

American Airlines

non-profits including

The Gates Foundation,

The Global Fund and

the International Chamber of Commerce.

Rajat Gupta -First Indian-born CEO of a global

Western company

Rajat Gupta is additionally the co-founder of

four different organizations:

The Indian School of Business with Anil Kumar,

The American India Foundation with Victor

Menezes and Lata Krishnan,

New Silk Route with Parag Saxena and

Victor Menezes, and Scandent with Ramesh

Vangal.

Rajat Guptas Criminal Background

Criminal charge - Conspiracy, securities fraud

He was convicted in June 2012 on insider trading

charges stemming from the Raj Rajaratnam Galleon

Group case on four criminal felony counts of

conspiracy and securities fraud

Criminal penalty - Sentencing pending (Oct 17` 2012)

Criminal status - Convicted, appeal pending

Rajat Guptas Case

On March 1, 2011, the SEC filed an administrative civil

complaint against Gupta for insider trading with

billionaire and Galleon Group founder Raj Rajaratnam.

On October 26, 2011 the United States Attorney's Office

filed criminal charges against Gupta. He was arrested in

New York City by the FBI and pleaded not guilty. He was

released on $10 million bail on the same day

In April 2012, another charge relating to passing P&G

information was added by the prosecution

Rajat Gupta's trial began on May 21, 2012.[70]

On June 15, 2012, Gupta was found guilty on

three counts of securities fraud and one count

of conspiracy.He was found not guilty on two

other securities fraud charges.

Sentencing is scheduled for 17 Oct 2012 .

Rajat Guptas Case

Mr. Gupta was convicted on three counts of

securities fraud and one count of conspiracy

for passing along confidential boardroom

information about Goldman to a hedge fund

that earned millions of dollars trading on his

tips.

He was acquitted of two counts of securities

fraud, including the only one relating to P&G.

Rajat Guptas Case

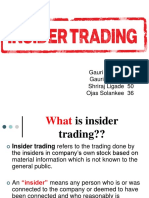

Insider trading and their evils

Insider trading

Insider information is information (about company strategy

and plans) that someone within a company has but that is

not available to those outside the company.

The moral problems connected with insider information

concern the use that individuals may make of such

information while they are still members of the firm.

Two aspect of the problem:

1. One is that of some one within the firm using information

for his or her private gain, at the expense of the firm.

This is called conflict of interest

2. The other is the use of insider information by someone

within a firm advantage over those not in the firm.

.

Insiders of the company

Insiders need not be the person who is

directly connected to the company because of

their position or otherwise.

SEBI has defined insider as a person

connected to or deemed to be connected and

has reasonable connection with unpublished

price sensitive data of the company.

Directors/CEOs/Large shareholders/managers/workers

Independent non-executive directors, It includes a

person who is a connected person six months prior to

an act of insider trading

Share Transfer Agents/registrar to an issue,

Investment company/trustee company,

Subsidiary of a company and relatives of connected

persons,

Asset management company,

Merchant banker/debenture trustee/ broker/sub-

broker,

Portfolio manager/investment adviser/analysts

Accountancy firms, law firms/consultants Or an

employee thereof

Evils of Insider Trading

Few examples of Insiders Information

Periodical financial results

Intended declaration of dividends

Issue of securities by way of public/right/bonus etc

Major expansion plan or execution of new project

Amalgamation/merger or takeover,

Disposal of whole or substantial part of undertaking,

Any significant change in policies, plans or operations

of the company.

Example

Insider trading where a company director knows that the

company is in a bad financial state and sells his shares in it

knowing that in a few days time this news will be made

public together with an announcement of a cut in dividend

payment.

Likewise, the director would be insider dealing if, on being

informed before it was generally known by the public, that

the company has discovered oil or gold on its own land, he

bought more shares in the company in the not unrealistic

expectation of an increase in their market value as a result

of the subsequent public announcement.

The Sebi Act

Insider trading is an evil by which any stock market is

infected to cause grave damage to the common investor.

It erodes the confidence of the investor and undermines its

credibility. It is often said that insider trading is not as

rampant in any other stock market in the world as in the

Indian market. By the promulgation of the Securities and

Exchange Board of India (Insider Trading) Regulations, 1992

("the Regulations"), Sebi attempted to give a concrete

shape, by a legislative measure, to one of the specific

functions which s.11 of the Securities and Exchange Board

of India Act, 1992 ("the Sebi Act") requires Sebi to

discharge. The object of this measure is to prevent and curb

the menace of insider trading in shares.

Who Is Affected by Insider Trading?

Insiders - officers, directors, and other key

employees of a firm

Market professionals - informed non insiders,

including securities analysts, brokers, or

arbitrageurs,

liquidity traders - sometimes referred to as

noise traders, are short-term stock market

participants

Investors - small or large shareholders

You might also like

- A Value Based Approach To Candidate Selection in LinkedInDocument5 pagesA Value Based Approach To Candidate Selection in LinkedInVeronika SinghNo ratings yet

- Case Solution Iggy's Bread of WorldDocument8 pagesCase Solution Iggy's Bread of WorldMathan Anto MarshineNo ratings yet

- Rajat Gupta Case IssuesDocument8 pagesRajat Gupta Case IssuesGoutham Babu100% (1)

- SATYAM - Case Study of Corporate GovernanceDocument7 pagesSATYAM - Case Study of Corporate Governanceapi-2601086467% (3)

- Pallavi - Intel Tetra Threat FrameworkDocument7 pagesPallavi - Intel Tetra Threat FrameworkkynthaNo ratings yet

- 1 ADocument2 pages1 ASaqib KhanNo ratings yet

- Engstrom Auto Mirror Plant Case AnalysisDocument10 pagesEngstrom Auto Mirror Plant Case AnalysisAvinashSinghNo ratings yet

- Satyam ScamDocument4 pagesSatyam ScamNitin Kumar100% (3)

- Jane Doe v. Trump & EpsteinDocument15 pagesJane Doe v. Trump & Epsteinmary eng88% (8)

- Case Analysis Sheet Rajat GuptaDocument4 pagesCase Analysis Sheet Rajat GuptapriyanshaNo ratings yet

- SatYam Case StudyDocument9 pagesSatYam Case Studyrockers_86100% (1)

- The Satyam CaseDocument40 pagesThe Satyam CaseManinder SinghNo ratings yet

- Tata Sons Vs Cyrus MistryDocument12 pagesTata Sons Vs Cyrus MistryRahul Dinesh Kekane100% (1)

- When The Tail Wags The Dog: 1) Delineate The Role of Power and Politics in This CaseDocument2 pagesWhen The Tail Wags The Dog: 1) Delineate The Role of Power and Politics in This CaseNIHAR RANJAN MishraNo ratings yet

- The Customer S Revenge FINALDocument16 pagesThe Customer S Revenge FINALRuchi Gupta50% (2)

- Maruti Suzuki's Manesar Plant - Brief Write-UpDocument2 pagesMaruti Suzuki's Manesar Plant - Brief Write-UpNEERAJ KUMAR KESHARBANINo ratings yet

- Bajaj Lockout Case StudyDocument4 pagesBajaj Lockout Case StudyJayesh RuchandaniNo ratings yet

- Tata Agency ProblemDocument2 pagesTata Agency ProblemShreya Karn 2027446100% (1)

- BajajDocument4 pagesBajajSugandha BhatiaNo ratings yet

- Case Study: Leadership in Client Service and Employee EducationDocument1 pageCase Study: Leadership in Client Service and Employee EducationKumaresh Deenadayalan100% (2)

- Labour Unrest at Honda MotorcyclesDocument7 pagesLabour Unrest at Honda MotorcyclesMayuri Das0% (1)

- Maruti Manesar-Violence July 2012Document33 pagesMaruti Manesar-Violence July 2012Pratik D. Patel100% (6)

- L&T Group 3 Rahul SarkarDocument8 pagesL&T Group 3 Rahul SarkarSenthil S. VelNo ratings yet

- Regency CeramicsDocument2 pagesRegency CeramicsSoumya ShankarNo ratings yet

- Case Study On Strike at Maruti Suzuki IndiaDocument13 pagesCase Study On Strike at Maruti Suzuki IndiaAnkit Ranjan50% (2)

- Harshad Mehta ScamDocument20 pagesHarshad Mehta ScamVinay Singh0% (1)

- Agri-Input Marketing Case Study Analysis: Vanraj Mini Tractors: Is Small Beautiful?Document3 pagesAgri-Input Marketing Case Study Analysis: Vanraj Mini Tractors: Is Small Beautiful?Praharsh Shah100% (1)

- Rose Valley Scam: Presented BY Minal PawarDocument7 pagesRose Valley Scam: Presented BY Minal PawarMinal Sunil PawarNo ratings yet

- Honda CaseDocument8 pagesHonda CaseSamikshyaNo ratings yet

- Tata CommunicationsDocument19 pagesTata CommunicationsSumit Kapoor100% (1)

- HR As Tranformation Partner in Maruti SuzukiDocument6 pagesHR As Tranformation Partner in Maruti SuzukiManju Mahara100% (1)

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- Dashman Company Case Solution.Document2 pagesDashman Company Case Solution.KathanShahNo ratings yet

- Promoters Influence On Corporate Governance: A Case Study of Tata GroupDocument9 pagesPromoters Influence On Corporate Governance: A Case Study of Tata GroupAaronNo ratings yet

- Rajat GuptaDocument8 pagesRajat GuptaNatarajan Murugan100% (1)

- SATYAM SCANDAL A Case Study PDFDocument11 pagesSATYAM SCANDAL A Case Study PDFNishant Navneet SorenNo ratings yet

- Conflict Management & Negotiation Skills: Individual Assignment - 3Document4 pagesConflict Management & Negotiation Skills: Individual Assignment - 3Tanya MahajanNo ratings yet

- Written Analysis & Communication: Case Analysis Ramesh Patel at Aragon Entertainment LimitedDocument6 pagesWritten Analysis & Communication: Case Analysis Ramesh Patel at Aragon Entertainment LimitedAmandeep DahiyaNo ratings yet

- Akash (Marketing Management)Document23 pagesAkash (Marketing Management)MY COMPUTERNo ratings yet

- Chapter 4Document29 pagesChapter 4Akshay BaidNo ratings yet

- Ethical Issues in 2G ScamDocument3 pagesEthical Issues in 2G Scamreenakeni44280% (1)

- Case Study - Tata Steel DelayeringDocument12 pagesCase Study - Tata Steel DelayeringSharad Aggarwal100% (1)

- More On MargoDocument2 pagesMore On MargoSuchitra RaviNo ratings yet

- Rakish Iron Works - HRM Case StudyDocument17 pagesRakish Iron Works - HRM Case StudyAnkitNo ratings yet

- Case 1-Accounting EthicsDocument14 pagesCase 1-Accounting Ethicsprathmesh kajale50% (2)

- SRM Cases - 34rd BatchDocument17 pagesSRM Cases - 34rd Batchishrat mirzaNo ratings yet

- Satyam Scam Case StudyDocument18 pagesSatyam Scam Case StudyPritish Das100% (1)

- EDP Descriptive & Case StudyDocument2 pagesEDP Descriptive & Case StudyNithyananda PatelNo ratings yet

- Marketing of Services Assignment Dated 04-06-2020Document2 pagesMarketing of Services Assignment Dated 04-06-2020RICHARD BAGENo ratings yet

- Case AnalysisDocument3 pagesCase AnalysissrirockNo ratings yet

- Organisations Success BHARTI AIRTELDocument6 pagesOrganisations Success BHARTI AIRTELdukedhakaNo ratings yet

- Role of Gatekeepers On The Effectiveness of Corporate GovernanceDocument5 pagesRole of Gatekeepers On The Effectiveness of Corporate GovernancePrasad Parab100% (1)

- Satyam Fraud Failure of Corporate GovernanceDocument12 pagesSatyam Fraud Failure of Corporate GovernanceOm Prakash Yadav100% (8)

- Reliance Jio - DiversificationDocument1 pageReliance Jio - DiversificationManas KapoorNo ratings yet

- Icici Scam CGDocument6 pagesIcici Scam CG201812058 imtnagNo ratings yet

- An Evil of Insider Trading - RAJAT GUPTADocument16 pagesAn Evil of Insider Trading - RAJAT GUPTATarun Chawla100% (1)

- Insider TradingDocument10 pagesInsider TradingSHRIRAJ LIGADENo ratings yet

- The Rajat Gupta CaseDocument3 pagesThe Rajat Gupta CaseHIMANSHI GUPTANo ratings yet

- Chapter 5 Regulatory MechanismDocument37 pagesChapter 5 Regulatory MechanismGowtham SrinivasNo ratings yet

- Chapter 5 Regulatory MechanismDocument47 pagesChapter 5 Regulatory Mechanismnithinnick66No ratings yet

- Submission - Law ColumnDocument11 pagesSubmission - Law ColumnAbhishek RudraNo ratings yet

- Just For Example: 1. Certifications/AcknowledgmentDocument21 pagesJust For Example: 1. Certifications/AcknowledgmentGanesh SurveNo ratings yet

- IM Maggi Final PPT 07092013Document20 pagesIM Maggi Final PPT 07092013Ganesh SurveNo ratings yet

- Just For Example: 1. Certifications/AcknowledgmentDocument20 pagesJust For Example: 1. Certifications/AcknowledgmentGanesh SurveNo ratings yet

- Reference Group Influenec On Consumer BehaviourDocument9 pagesReference Group Influenec On Consumer BehaviourGanesh Surve100% (1)

- Disini vs. Sec. of JusticeDocument34 pagesDisini vs. Sec. of JusticeDom Robinson BaggayanNo ratings yet

- Northern Islands Vs GarciaDocument7 pagesNorthern Islands Vs GarciaDenzel Edward CariagaNo ratings yet

- United States v. Angela Simpson, 4th Cir. (2015)Document4 pagesUnited States v. Angela Simpson, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Morgan v. Bihailo Et Al - Document No. 5Document3 pagesMorgan v. Bihailo Et Al - Document No. 5Justia.comNo ratings yet

- (1868) Aetna Insurance Co. v. Hallock, 73 U.S. 556 18 L. Ed. 948 - Lack of Official Court Seal Voids ProcessDocument3 pages(1868) Aetna Insurance Co. v. Hallock, 73 U.S. 556 18 L. Ed. 948 - Lack of Official Court Seal Voids ProcessJoshua of courseNo ratings yet

- FIR Enough To Award Compensation To Accident Victim or The Family, Says Supreme CourtDocument18 pagesFIR Enough To Award Compensation To Accident Victim or The Family, Says Supreme CourtLatest Laws TeamNo ratings yet

- 575 Publicly Funded GAL's, But Parents Can't See Their Invoices. Is This Safe?Document29 pages575 Publicly Funded GAL's, But Parents Can't See Their Invoices. Is This Safe?JournalistABC100% (2)

- BRP ReportDocument249 pagesBRP ReportMissionLocalNo ratings yet

- Css Criminology Notes PDFDocument5 pagesCss Criminology Notes PDFAar Tech Care0% (2)

- People Vs Teehankee JRDocument1 pagePeople Vs Teehankee JRRene GomezNo ratings yet

- Crim 1Document12 pagesCrim 1Kayre IrbengNo ratings yet

- United States v. Gaither, 10th Cir. (2005)Document4 pagesUnited States v. Gaither, 10th Cir. (2005)Scribd Government DocsNo ratings yet

- Eso 1 2 Ready To Go March Issue - PDF Format PDFDocument11 pagesEso 1 2 Ready To Go March Issue - PDF Format PDFHari SeldonNo ratings yet

- Lor Productions, Inc., A Corporation v. Valley Music Hall, Inc., A Corporation, Dba VMH, Inc. International, 447 F.2d 1010, 10th Cir. (1971)Document5 pagesLor Productions, Inc., A Corporation v. Valley Music Hall, Inc., A Corporation, Dba VMH, Inc. International, 447 F.2d 1010, 10th Cir. (1971)Scribd Government DocsNo ratings yet

- Italian EssayDocument8 pagesItalian EssayAngelo de MeloNo ratings yet

- Marilao Water Consumer vs. IAC DigestDocument8 pagesMarilao Water Consumer vs. IAC DigestYsabelleNo ratings yet

- NS Offences - BNS & IPCDocument4 pagesNS Offences - BNS & IPCAyesha SharifNo ratings yet

- Dutchman EssayDocument6 pagesDutchman Essayapi-285540046100% (2)

- Pakistan RailwaysDocument7 pagesPakistan Railwaysapi-3745637No ratings yet

- United States v. Albert Spenard, 438 F.2d 717, 2d Cir. (1971)Document5 pagesUnited States v. Albert Spenard, 438 F.2d 717, 2d Cir. (1971)Scribd Government DocsNo ratings yet

- Vehicle Use POlicyDocument5 pagesVehicle Use POlicyAndrew James ParkerNo ratings yet

- Sample JudafDocument5 pagesSample JudafnathNo ratings yet

- BUGNOSEN - People vs. GesmundoDocument3 pagesBUGNOSEN - People vs. Gesmundolleiryc7No ratings yet

- Law On Evidence: Diagnostic QuizDocument2 pagesLaw On Evidence: Diagnostic QuizAnne chuiNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument3 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Zamora V Multi WoodDocument8 pagesZamora V Multi Woodfjl_302711No ratings yet

- CRC Rule 10.603 Authority and Duties of Presiding Judge - Judicial Council of California - California Rules of Court Rule 10.603 Authority and Duties of Presiding JudgeDocument5 pagesCRC Rule 10.603 Authority and Duties of Presiding Judge - Judicial Council of California - California Rules of Court Rule 10.603 Authority and Duties of Presiding JudgeCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNo ratings yet

- Martin Geddes On QDocument40 pagesMartin Geddes On QGreg Parks100% (2)

- The Wrongful Conviction of Arthur Andersen LLCDocument18 pagesThe Wrongful Conviction of Arthur Andersen LLCMichael E. Marotta100% (1)