Professional Documents

Culture Documents

Sa Sept11 Bonds

Sa Sept11 Bonds

Uploaded by

Suniel Jamil0 ratings0% found this document useful (0 votes)

5 views7 pagesbond valuation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbond valuation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views7 pagesSa Sept11 Bonds

Sa Sept11 Bonds

Uploaded by

Suniel Jamilbond valuation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

RELEVANT TO ACCA QUALIFICATION PAPER P4 AND

PERFORMANCE OBJECTIVES 15 AND 16

2011 ACCA

Bond valuation and bond yields

Bonds and their variants such as loan notes, debentures and loan stock, are

IOUs issued by governments and corporations as a means of raising finance.

They are often referred to as fixed income or fixed interest securities, to

distinguish them from equities, in that they often (but not always) make known

returns for the investors (the bond holders) at regular intervals. These interest

payments, paid as bond coupons, are fixed, unlike dividends paid on equities,

which can be variable. Most corporate bonds are redeemable after a specified

period of time. Thus, a plain vanilla bond will make regular interest payments

to the investors and pay the capital to buy back the bond on the redemption

date when it reaches maturity.

This article, the first of two related articles, will consider how bonds are valued

and the relationship between the bond value or price, the yield to maturity and

the spot yield curve. It addresses, in part, the learning required in Sections

C3a and C3d of the Paper P4 Syllabus and Study Guide.

Bond value or price

Example 1

How much would an investor pay to purchase a bond today, which is

redeemable in four years for its par value or face value of $100 and pays an

annual coupon of 5% on the par value? The required rate of return (or yield) for

a bond in this risk class is 4%.

As with any asset valuation, the investor would be willing to pay, at the most,

the present value of the future income stream discounted at the required rate

of return (or yield). Thus, the value of the bond can be determined as follows:

Year Year 1 Year 2 Year 3 Year 4

Cash flows $5 $5 $5 $105

PV (4%) 5 x 1.04

-1

=

4.81

5 x 1.04

-2

=

4.62

5 x 1.04

-3

=

4.44

105 x 1.04

-4

=

89.75

Value/price (sum of the PV of flows) = $103.62

Note: Mathematically, for year one, 5 / 1.04

1

is the same as 5 x 1.04

-1

, and similarly

for all the years

If the required rate of return (or yield) was 6%, then using the same calculation

method, the price of the bond would be $96.53. And where the required rate of

2

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

return (or yield) is equal to the coupon 5% in this case the current price of

the bond will be equal to the par value of $100.

Thus, there is an inverse relationship between the yield of a bond and its price

or value. The higher rate of return (or yield) required, the lower the price of the

bond, and vice versa. However, it should be noted that this relationship is not

linear, but convex to the origin.

Bond price

Yield (or required return)

The plain vanilla bond with annual coupon payments in the above example is

the simpler type of bond. In addition to the plain vanilla bond, candidates as

part of their Paper P4 studies and exam are required to have knowledge of,

and be able to deal with, more complicated bonds such as: bonds with coupon

payments occurring more frequently than once a year; convertible bonds and

bonds with warrants which contain option features; and more complicated

payment features such as repayment mortgage or annuity type payment

structures.

Yield to maturity (YTM) (also known as the [Gross] Redemption Yield (GRY))

If the current price of a bond is given, together with details of coupons and

redemption date, then this information can be used to compute the required

rate of return or yield to maturity of the bond.

Example 2

A bond paying a coupon of 7% is redeemable in five years at par ($100) and is

currently trading at $106.62. Estimate its yield (required rate of return).

$106.62 = $7 x (1+r)

-1

+ $7 x (1+r)

-2

+ + $107 x (1+r)

-5

The internal rate of return approach can be used to obtain r. Since the current

price is higher than $100, r must be lower than 7%.

Initially, try 5% as r:

$7 x 4.3295 [5%, five-year annuity] + $100 x 0.7835 [PV 5%, five-year] =

$30.31 + $78.35 = $108.66

3

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

Try 6% as r:

$7 x 4.2124 [6%, five-year annuity] + $100 x 0.7473 [PV 6%, five-year] =

$29.49 + $74.73 = $104.22

Yield = 5% + (108.66 106.62 / 108.66 104.22) x 1% = 5.46%

The 5.46% is the yield to maturity (YTM) (or redemption yield) of the bond.

The YTM is the rate of return at which the sum of the present values of all

future income streams of the bond (interest coupons and redemption amount)

is equal to the current bond price. It is the average annual rate of return the

bond investors expect to receive from the bond till its redemption. YTMs for

bonds are normally quoted in the financial press, based on the closing price of

the bond. For example, a yield often quoted in the financial press is the bid

yield. The bid yield is the YTM for the current bid price (the price at which

bonds can be purchased) of a bond.

Term structure of interest rates and the yield curve

The yield to maturity is calculated implicitly based on the current market price,

the term to maturity of the bond and amount (and frequency) of coupon

payments. However, if a corporate bond is being issued for the first time, its

price and/or coupon payments need to be determined based on the required

yield. The required yield is based on the term structure of interest rates and

this needs to be discussed before considering how the price of a bond may be

determined.

It is incorrect to assume that bonds of the same risk class, which are

redeemed on different dates, would have the same required rate of return or

yield. In fact, it is evident that the markets demand different annual returns or

yields on bonds with differing lengths of time before their redemption (or

maturity), even where the bonds are of the same risk class. This is known as

the term structure of interest rates and is represented by the spot yield curve

or simply the yield curve.

For example, a company may find that if it wants to issue a one-year bond, it

may need to pay interest at 3% for the year, if it wants to issue a two-year

bond, the markets may demand an annual interest rate of 3.5%, and for a

three-year bond the annual yield required may be 4.2%. Hence, the company

would need to pay interest at 3% for one year; 3.5% each year, for two years, if

it wants to borrow funds for two years; and 4.2% each year, for three years, if

it wants to borrow funds for three years. In this case, the term structure of

interest rates is represented by an upward sloping yield curve.

4

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

The normal expectation would be of an upward sloping yield curve on the basis

that bonds with a longer period of maturity would require a higher interest rate

as compensation for risk. Note here that the bonds considered may be of the

same risk class but the longer time period to maturity still adds to higher

uncertainty.

However, it is entirely normal for yield curves to be of many different shapes

dependent on the perceptions of the markets on how interest rates may change

in the future. Three main theories have been advanced to explain the term

structure of interest rates or the yield curve: expectations hypothesis, liquidity-

preference hypothesis and market-segmentation hypothesis. Although it is

beyond the remit of this article to explain these theories, many textbooks on

investments and financial management cover these in detail.

Valuing bonds based on the yield curve

Annual spot yield curves are often published by the financial press or by

central banks (for example, the Bank of England regularly publishes UK

government bond yield curves on its website). The spot yield curve can be used

to estimate the price or value of a bond.

Example 3

A company wants to issue a bond that is redeemable in four years for its par

value or face value of $100, and wants to pay an annual coupon of 5% on the

par value. Estimate the price at which the bond should be issued.

The annual spot yield curve for a bond of this risk class is as follows:

One-year 3.5%

Two-year 4.0%

Three-year 4.7%

Four-year 5.5%

The four-year bond pays the following stream of income:

Year 1 2 3 4

Payments $5 $5 $5 $105

This can be simplified into four separate bonds with the following payment

structure:

Year 1 2 3 4

Bond 1 $5

Bond 2 $5

Bond 3 $5

Bond 4 $105

5

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

Each annual payment is a single payment in that particular year, much like a

zero-coupon bond, and its present value can be determined by discounting

each cash flow by the relevant yield curve rate, as follows:

Bond 1 $5 x 1.035

-1

= $4.83

Bond 2 $5 x 1.04

-2

= $4.62

Bond 3 $5 x 1.047

-3

= $4.36

Bond 4 $105 x 1.055

-4

= $84.76

The sum of these flows is the price at which the bond can be issued, $98.57.

The yield to maturity of the bond is estimated at 5.41% using the same

methodology as example 2.

Some important points can be noted from the above calculation; firstly, the

5.41% is lower than 5.5% because some of the returns from the bond come in

earlier years, when the interest rates on the yield curve are lower, but the

largest proportion comes in Year 4. Secondly, the yield to maturity is a

weighted average of the term structure of interest rates. Thirdly, the yield to

maturity is calculated after the price of the bond has been calculated or

observed in the markets, but theoretically it is term structure of interest rates

that determines the price or value of the bond.

Mathematically:

Bond price =

Coupon x (1+r

1

)

-1

+ coupon x (1+r

2

)

-2

+ + coupon x (1+r

n

)

-n

+ redemption

value x (1+r

n

)

-n

Where r

1

, r

2

, etc are spot interest rates based on the yield curve and n is the

number of time periods in which an amount of the coupon is paid and, finally,

the value when the bond is redeemed.

In this article it is assumed that coupons are paid annually, but it is common

practice to pay coupons more frequently than once a year. In these

circumstances, the coupon payments need to be reduced and the time period

frequency needs to be increased.

Estimating the yield curve

There are different methods used to estimate a spot yield curve, and the

iterative process based on bootstrapping coupon paying bonds is perhaps the

simplest to understand. The following example demonstrates how the process

works.

6

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

Example 4

A government has three bonds in issue that all have a face or par value of $100

and are redeemable in one year, two years and three years respectively. Since

the bonds are all government bonds, lets assume that they are of the same

risk class. Lets also assume that coupons are payable on an annual basis.

Bond A, which is redeemable in a years time, has a coupon rate of 7% and is

trading at $103. Bond B, which is redeemable in two years, has a coupon rate

of 6% and is trading at $102. Bond C, which is redeemable in three years, has

a coupon rate of 5% and is trading at $98.

To determine the yield curve, each bonds cash flows are discounted in turn to

determine the annual spot rates for the three years, as follows:

Bond A: $103 = $107 x (1+r

1

)

-1

r

1

= 107/103 1 = 0.0388 or 3.88%

Bond B: $102 = $6 x 1.0388

-1

+ 106 x (1+r

2

)

-2

r

2

= [106 / (102 5.78)]

1/2

- 1= 0.0496 or 4.96%

Bond C: $98 = $5 x 1.0388

-1

+ $5 x 1.0496

-2

+ 105 x (1+r

3

)

-3

r

3

= [105 / (98 4.81 4.54)]

1/3

1 = 0.0580 or 5.80%

The annual spot yield curve is therefore:

Year

1 3.88%

2 4.96%

3 5.80%

Discussion of other methods of estimating the spot yield curve, such as using

multiple regression techniques and observation of spot rates of zero coupon

bonds, is beyond the scope of the Paper P4 syllabus.

As stated in the previous section, often the financial press and central banks

will publish estimated spot yield curves based on government issued bonds.

Yield curves for individual corporate bonds can be estimated from these by

adding the relevant spread to the bonds. For example, the following table of

spreads (in basis points) is given for the retail sector.

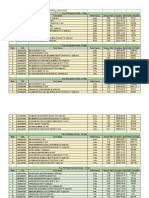

Rating 1 year 2 year 3 year

AAA 14 25 38

AA 29 41 55

A 46 60 76

7

BOND VALUATION AND BOND YIELDS

SEPTEMBER 2011

2011 ACCA

Example 5

Mason Retail Co has a credit rating of AA, then its individual yield curve

based on the government bond yield curve and the spread table above may

be estimated as:

Year 1 Year 2 Year 3

4.17% 5.37% 6.35%

These would be the rates of return an investor buying bonds issued by Mason

Retail Co would expect, and therefore Mason Retail Co would use these rates

as discount rates to estimate the price or value of coupons when it issues new

bonds. And Mason Retail Cos existing bonds market price would reflect its

individual yield curve.

Conclusion

This article considered the relationship between bond prices, the yield curve

and the yield to maturity. It demonstrated how bonds can be valued and how a

yield curve may be derived using bonds of the same risk class but of different

maturities. Finally it showed how individual company yield curves may be

estimated.

A following article will discuss how forward interest rates are determined from

the spot yield curve and how they may be useful in determining the value of an

interest rate swap. It will address the learning required in Sections F1 and F3

of the Paper P4 Syllabus and Study Guide.

Shishir Malde is the examiner for Paper P4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Seagate Technology BuyoutDocument7 pagesSeagate Technology BuyoutTarun Gupta100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Angel Fund ChartDocument1 pageAngel Fund ChartRob PortNo ratings yet

- Accounting MergedDocument63 pagesAccounting MergedAnnika TrishaNo ratings yet

- Berkshire Hathaway: A High-Quality, Growing, 84-Cent Dollar: Whitney Tilson Kase Capital May 4, 2013Document29 pagesBerkshire Hathaway: A High-Quality, Growing, 84-Cent Dollar: Whitney Tilson Kase Capital May 4, 2013Arandhawa23No ratings yet

- Stock Statement Format For Bank LoanDocument8 pagesStock Statement Format For Bank LoanAnkit SoniNo ratings yet

- Corporate Purchasing Cardmember Report: For Your Records Only - Do Not Pay. Call Customer Service at 1-800-492-4920Document2 pagesCorporate Purchasing Cardmember Report: For Your Records Only - Do Not Pay. Call Customer Service at 1-800-492-4920gglionhartNo ratings yet

- Original For Buyer: Email Id-Corporatecare@timesinternet - inDocument1 pageOriginal For Buyer: Email Id-Corporatecare@timesinternet - inANKUR SARKARNo ratings yet

- Credit Assessment PresentationDocument12 pagesCredit Assessment PresentationMelvern SalimNo ratings yet

- Chapter 3 - Investment Banking: StudentDocument10 pagesChapter 3 - Investment Banking: StudentDyenNo ratings yet

- To Enroll A Merchant Via BPI Online, Please Follow The Procedure BelowDocument7 pagesTo Enroll A Merchant Via BPI Online, Please Follow The Procedure BelowLeoncio LibuitNo ratings yet

- Portfolio Investment ManagementDocument242 pagesPortfolio Investment ManagementWWZNo ratings yet

- Determine The Working Required To Finance A Level of Activity of 1,80,000/-Units of OutputDocument2 pagesDetermine The Working Required To Finance A Level of Activity of 1,80,000/-Units of OutputAkash KumarNo ratings yet

- Auto Debit Form (60801026)Document2 pagesAuto Debit Form (60801026)Hanafi AminNo ratings yet

- Fund Performance 31 Aug 21Document6 pagesFund Performance 31 Aug 21Al SharifNo ratings yet

- ImpDocument6 pagesImpChandra SekaranNo ratings yet

- V3 Bachelor of Law and Sharia KUCCPS4Document1 pageV3 Bachelor of Law and Sharia KUCCPS4AllanNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- Maybank 2 eDocument6 pagesMaybank 2 eNurshafira Mohd NorNo ratings yet

- Equity Futu Res: Mechanics of Trading (KLCI Futures)Document25 pagesEquity Futu Res: Mechanics of Trading (KLCI Futures)NOR IZZATI BINTI SAZALINo ratings yet

- Ifm Gretz Tool CompanyDocument9 pagesIfm Gretz Tool CompanyNodiey YanaNo ratings yet

- CorporationDocument16 pagesCorporationBrian Daniel BayotNo ratings yet

- CH 12 Hull Fundamentals 8 The DDocument25 pagesCH 12 Hull Fundamentals 8 The DjlosamNo ratings yet

- Đề thi thử KPMG TaxDocument53 pagesĐề thi thử KPMG TaxĐặng Trần Huyền TrâmNo ratings yet

- FSD CH0497631082 SWC CH enDocument6 pagesFSD CH0497631082 SWC CH enshuzefaNo ratings yet

- Exploratory Data Analysis On Mutual Funds Dataset 1707637258Document21 pagesExploratory Data Analysis On Mutual Funds Dataset 1707637258akashabimanuNo ratings yet

- If 3Document4 pagesIf 3Abdul Aziz WadiwalaNo ratings yet

- Financial Theory and Corporate Policy - Copeland.449-493Document45 pagesFinancial Theory and Corporate Policy - Copeland.449-493Claire Marie ThomasNo ratings yet

- Vendor Data To Be Completed by Requestor (TNB Department/Subsidiary)Document4 pagesVendor Data To Be Completed by Requestor (TNB Department/Subsidiary)Mohd Kahirol NizamNo ratings yet

- Basics of Financial Market: Report By: Rahul SinghDocument47 pagesBasics of Financial Market: Report By: Rahul Singhrrajpoot_1No ratings yet

- Tyco ScandalDocument2 pagesTyco ScandalKimberly GosselinNo ratings yet