Professional Documents

Culture Documents

Liquidity Ratio of MTL

Uploaded by

Zahid Khalil0 ratings0% found this document useful (0 votes)

11 views7 pagesUniversity

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUniversity

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views7 pagesLiquidity Ratio of MTL

Uploaded by

Zahid KhalilUniversity

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

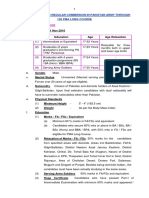

GOHER ALI MBO-FA13-008

MOHAMMAD ADIL MBO-FA13-

014

UMM-E-FARWAH MBO-FA13-020

MATEEN BUTT MBO-FA13-022

ZAHID KHALIL MBO-FA13-023

Group Members

Liquidity Ratio of MTL

Liquidity is a companys ability to

meet its maturing short term

obligations. Liquidity is essential to

conducting business activity,

particularly in times of adversity. The

Liquidity Ratio of Millat Tractor

Limited is given below:

Liquidity Ratio

Net Working Capital

Current Assets = 8732156 (Rs. in thousands)

Current Liabilities = 5331414 (Rs. in thousands)

Net Working capital of MTL = Current Assets

Current Liabilities

= 8732156 5331414

= 3400742 (Rs. in thousands)

The net working capital in 2012 was 3939598 (Rs. in

thousands) that shows in 2013 there is a decline in its

net working capital.

Liquidity Ratio

Current ratio

Current Ratio of MTL = Current Assets / Current

Liabilities

= 8732156 / 5331414

= 1.64

The current ratio of MTL shows that its current

assets are 1.63 times of its shot term liabilities,

which means that Current assets of MTL are 1.63

times can be converted into cash to pay its short

term obligations. The current ratio of MTL in 2012

was 1.77

Liquidity Ratio

Quick Ratio

Quick Assets = Cash + short term investment +

Accounts Receivables

Quick Assets of MTL = 2087580 + 551871 +

974158

= 3613609 (Rs. In thousands)

Quick Ratio of MTL = Quick Assets / Current

Liabilities

= 3613609 / 5331414

= 0.68

The quick ratio of MTL shows that its quick

assets are not enough to pay its short term

liabilities and this show less liquidity of the firm.

The Quick ratio in 2012 was 0.69

0.7

33

4.5

2

0.3

18

1

5.5

27

7

1.5

30

11

0.8

0.3

22

1

3.4

6

24

Current Assets of MTL in Percentage

2012 2013

2013

2012

Accumulated Compensated

absences

Trade and other Payables

Mark up accrued on short term

Borrowings

1.15

98.8

0.04

1.08

98.8

0.02

Current Liabilities of MTL in Percentage

2013 2012

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dr. Deema Dr. Maha 624 467 625 468 630 469 470 471 472 473Document1 pageDr. Deema Dr. Maha 624 467 625 468 630 469 470 471 472 473Zahid KhalilNo ratings yet

- ZakatDocument1 pageZakatZahid KhalilNo ratings yet

- Read MeDocument1 pageRead MeLuccas CastoriniNo ratings yet

- Accountant Resume TemplateDocument2 pagesAccountant Resume TemplateZahid KhalilNo ratings yet

- LCC 1Document4 pagesLCC 1nrmciit6753No ratings yet

- Eligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 138 Pma Long CourseDocument4 pagesEligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 138 Pma Long CourseZahid KhalilNo ratings yet

- Eligibility ConditionsDocument5 pagesEligibility ConditionsMuaz0% (4)

- Executive SummaryDocument20 pagesExecutive SummaryZahid KhalilNo ratings yet

- CV Templates Curriculum VitaeDocument6 pagesCV Templates Curriculum VitaeSingh ViratNo ratings yet

- Arsalan Hameed - CVDocument3 pagesArsalan Hameed - CVZahid KhalilNo ratings yet

- Graduate Lists D PSP 15Document8 pagesGraduate Lists D PSP 15Zahid KhalilNo ratings yet

- To Whom It May Concern: HR ManagerDocument1 pageTo Whom It May Concern: HR ManagerZahid KhalilNo ratings yet

- Graduate Lists D PSP 15Document8 pagesGraduate Lists D PSP 15Zahid KhalilNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummaryZahid KhalilNo ratings yet

- Adnan Ul HaqDocument89 pagesAdnan Ul HaqZahid KhalilNo ratings yet

- Newsletter Jun OldDocument20 pagesNewsletter Jun OldBabar Ali MisraniNo ratings yet

- Internship Report On Meezan Bank CompleteDocument86 pagesInternship Report On Meezan Bank CompleteArslan96% (27)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Farhan CVDocument1 pageFarhan CVZahid KhalilNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)