Professional Documents

Culture Documents

Sales Mix

Sales Mix

Uploaded by

Utsav Choudhury0 ratings0% found this document useful (0 votes)

19 views24 pagesSales Mix

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSales Mix

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views24 pagesSales Mix

Sales Mix

Uploaded by

Utsav ChoudhurySales Mix

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

Sales Mix

Effect of sales mix on CVP

analysis.

Unit contribution margin is replaced

with contribution margin for a

composite unit.

A composite unit is composed of

specific numbers of each product in

proportion to the product sales mix.

Sales mix is the ratio of the volumes of

the various products.

The resulting break-even formula

for composite unit sales is:

Break-even point

in composite units

Fixed costs

Contribution margin

per composite unit

=

Computing Multiproduct

Break-Even Point

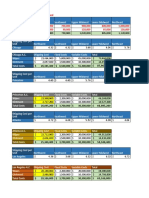

Windows Doors

Selling Price $200 $500

Variable Cost 125 350

Unit Contribution 75 $ 150 $

Sales Mix Ratio 4 1

Computing Multiproduct

Break-Even Point

A company sells windows and doors. They sell

4 windows for every door.

Step 1: Compute contribution margin per

composite unit.

Computing Multiproduct

Break-Even Point

Windows Doors

Selling Price $200 $500

Variable Cost 125 350

Unit Contribution 75 $ 150 $

Sales Mix Ratio 4 1

Composite C/M $300 $150

Break-even point

in composite units

Fixed costs

Contribution margin

per composite unit

=

Step 2: Compute break-even point in

composite units.

Computing Multiproduct

Break-Even Point

Break-even point

in composite units

Fixed costs

Contribution margin

per composite unit

=

Break-even point

in composite units

Rs.900,000

Rs.450 per

composite unit

=

Step 2: Compute break-even point in

composite units.

Computing Multiproduct

Break-Even Point

Break-even point

in composite units

= 2,000 composite units

Sales Composite

Product Mix Units Units

Window 4 2,000 = 8,000

Door 1 2,000 = 2,000

Step 3: Determine the number of windows and

doors that must be sold to break even.

Computing Multiproduct

Break-Even Point

Windows Doors Combined

Selling Price $200 $500

Variable Cost 125.00 350.00

Unit Contribution 75.00 $ 150.00 $

Sales Volume 8,000 2,000

Total Contribution 600,000 $ 300,000 $ 900,000 $

Fixed Costs 900,000

Income $ 0

Step 4: Verify the results.

Multiproduct Break-Even

Income Statement

Case Study

Multi products Company has a sales ratio of 2:3:5 for

models X, Y and Z respectively. Total fixed cost for

the year are Rs 200000.The sale price, variable cost

and contribution margin associated with each product

are as follows:

M-X M-Y M-Z

Sales Price 50 25 10

Variable Cost 30 15 8

Contribution 20 10 2

Find out composited BEP and the no. of individual

product required at B.E.P is then determined.

Case the no. of individual product required at

B.E.P is then determined.

M-X M-Y M-Z

Sales Price 50 25 10

Variable Cost 30 15 8

Contribution 20 10 2

Sales Mix 2 3 5

Total contribution 40 30 10 80

Break-even point

in composite units

Fixed costs

Contribution margin

per composite unit

=

Break-even point

in composite units

Rs200,000

Rs.80 per composite

unit

=

Step 2: Compute break-even point in

composite units.

Computing Multiproduct

Break-Even Point

Break-even point

in composite units

= 2500 composite units

the no. of individual product required at

B.E.P is then determined.

In order to fill 2500 baskets, it will take the following Units for

each model.

Model X =2500 x 2=5000 units

Model Y = 2500 x 3 = 7500 units

Model Z = 2500 x 5 = 12500 units

Limiting of key factor

A limiting or key factor may be defined as the factor

in the activities of an undertaking, which at a

particular point in time or over a period will limit the

volume of output. Examples of limiting factors are:

Sales

Materials

Labour

Production capacity/machine hours

Financial resources

Example:-

Product A B

Contribution per unit Rs.15 Rs.20

Which Product will be more profitable

A or B??

Contribution per unit of key factor

Product A B

Contribution per unit Rs.15 Rs.20

Product B , will be more profitable

Contribution per unit of key factor

Product A B

Contribution per unit Rs.15 Rs.20

Material required per unit 3kg 5kg

Contr. per kg of material Rs.5 Rs.4

Product A, will be more profitable

Limiting Key Factor-Material

Lets take an example that the material

available is only 15000 kg

A B

No. of units that 5000 3000

can be produced

Contribution 65000 60000

Product A, is more profitable

Problem:-

The following particulars are extracted from

the records of a company

A B

Selling Price (per unit) 100 120

Consumption of material p.u 2kg 3Kg

Material Cost Rs. 10 Rs. 15

Direct Wages Rs. 15 Rs.10

Problem:-

A B

Direct Expenses 5 6

Machine hours used p.u 3 2

Overhead expenses p.u:

Fixed Rs. 5 Rs. 10

Variable Rs. 15 Rs. 20

Direct wages per hour is Rs.5

Problem

a) Comment on the profitability of each product (both

use the same raw material) when:

1. Total Sales potential in units is limited

2. Total Sales Potential in value is limited

3. Raw material is in short supply and

4. Production capacity in terms of machine hours) is

the limiting factor.

b) Assuming raw material as the key factor, availability

of which is 10000 kg and maximum sales potential

of each product being 3,500 units, find out the

product mix which will yield the maximum profit

Solution

Statement of Marginal Cost and Contribution

A B

Sales Rs.100 Rs.120

Less:- Marginal Cost

Direct Material 10 15

Direct Wages 15 10

Direct Expenses 5 6

Variable OHD 15 20

45 51

Contribution 55 69

P/V Ratio 55% 57.5%

Contribn per kg of material 27.5 23

Contribn per machine hour 18.3 34.5

Comments

1. B is more profitable as its making a larger

contribution per unit as compared to A

2. B is more profitable as its P/V ratio is more

3. A is more profitable as its contribution per

kg of material is more

4. B is more profitable as it makes larger

contribution per machine hour

Solution

b) When Raw material is key factor.

A is more profitable to produce as its

contribution per kg of material is higher than

B.

For 3500 units of A-material consumed will be

3500 x 2 kg=7000 Kg. The balance 3000 kg

can be used to produce 1000 units(3000kg/3)

of B.

Thus the product mix is 3500 units of A and

1000 units of B

You might also like

- NYSF Leveraged Buyout Model TemplateDocument20 pagesNYSF Leveraged Buyout Model TemplateBenNo ratings yet

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- Ac102 Rev04-06Document25 pagesAc102 Rev04-06Eric KnoflerNo ratings yet

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocument26 pagesWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- Absorption and Marginal Costing 1Document59 pagesAbsorption and Marginal Costing 1Rocky SaahilNo ratings yet

- Target Cost TasksDocument5 pagesTarget Cost TaskskaterinayasinskyNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Absorption and Marginal CostingDocument61 pagesAbsorption and Marginal Costinghwagdare100% (1)

- Math Accounting by AtaurDocument28 pagesMath Accounting by AtaurShajib KhanNo ratings yet

- Day 3Document33 pagesDay 3Leo ApilanNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- CVP AnalysisDocument25 pagesCVP AnalysisMahediNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisSubrahmanya Sringeri100% (1)

- Introduction To Marginal CostingDocument29 pagesIntroduction To Marginal CostingUdaya ChoudaryNo ratings yet

- Relevant Costs (Part 2) : F. M. KapepisoDocument21 pagesRelevant Costs (Part 2) : F. M. KapepisosimsonNo ratings yet

- Material CostingDocument23 pagesMaterial CostingGanesh somvanshiNo ratings yet

- Revision 2Document37 pagesRevision 2percy mapetereNo ratings yet

- Unit 1 - Capital Budgeting PDFDocument48 pagesUnit 1 - Capital Budgeting PDFDharaneeshwar SKNo ratings yet

- CVP Analysis F5 NotesDocument7 pagesCVP Analysis F5 NotesSiddiqua Kashif100% (1)

- Absorption and Marginal CostingDocument58 pagesAbsorption and Marginal CostingtokyadaluNo ratings yet

- Cost II Individual Assignment On CH 1 CVP Analysis-5Document3 pagesCost II Individual Assignment On CH 1 CVP Analysis-5kalina.sintayehuNo ratings yet

- MA 13.2 (No Solutions)Document2 pagesMA 13.2 (No Solutions)Michael ComunelloNo ratings yet

- Example 3 On Joint CostDocument9 pagesExample 3 On Joint CostJessicaTheLazy PlayerNo ratings yet

- Financial and Cost Volume Profit Models ShareDocument4 pagesFinancial and Cost Volume Profit Models ShareCahyo PriyatnoNo ratings yet

- 3.7.3 Principal Budget FactorDocument4 pages3.7.3 Principal Budget Factorericmhike8No ratings yet

- Chapter 3: Analysis of Changes in Sales, Cost of Sales, and Gross Margin Analysis of Variation in Gross Profit Gross Profit Variance AnalysisDocument3 pagesChapter 3: Analysis of Changes in Sales, Cost of Sales, and Gross Margin Analysis of Variation in Gross Profit Gross Profit Variance AnalysisAngelica MagdaraogNo ratings yet

- Class Note - Chpt12 Decision MakingDocument19 pagesClass Note - Chpt12 Decision MakingNicole LinNo ratings yet

- Mas 04 - CVP AnalysisDocument7 pagesMas 04 - CVP AnalysisCarl Angelo LopezNo ratings yet

- Group 2 CVP RelationDocument40 pagesGroup 2 CVP RelationJeejohn Sodusta0% (1)

- Relevant CostingDocument58 pagesRelevant CostingAlexanderJacobVielMartinezNo ratings yet

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiNo ratings yet

- Practice of Cost Volume Profit Breakeven AnalysisDocument4 pagesPractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- Maf Mock 01 Q& ADocument31 pagesMaf Mock 01 Q& ASahan Randheera Perera100% (1)

- Chap-10-Relevant CostingDocument6 pagesChap-10-Relevant CostingMd. Mostafijur RahmanNo ratings yet

- Unit-5 Cost Volume Profit AnalysisDocument44 pagesUnit-5 Cost Volume Profit AnalysisAnonymous dfy2iDZNo ratings yet

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanNo ratings yet

- Marginal CostingDocument30 pagesMarginal Costinganon_3722476140% (1)

- Management AccountingDocument68 pagesManagement AccountingNekibur DeepNo ratings yet

- Chapter 6:part Two Cost-Volume-ProfitDocument44 pagesChapter 6:part Two Cost-Volume-ProfitFidelina CastroNo ratings yet

- MAS 03 CVP AnalysisDocument4 pagesMAS 03 CVP AnalysisJoelyn Grace MontajesNo ratings yet

- Cost-Volume-Profit Analysis and Relevant CostingDocument39 pagesCost-Volume-Profit Analysis and Relevant CostingJai AceNo ratings yet

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- SESSION 6 Cost-Volume-Profit AnalysisDocument21 pagesSESSION 6 Cost-Volume-Profit Analysisnikhil srivastavaNo ratings yet

- Session 12 CVP AnalysisDocument52 pagesSession 12 CVP Analysismuskan mittalNo ratings yet

- Chapter 10Document13 pagesChapter 10Tran Huong GiangNo ratings yet

- Acn 3Document5 pagesAcn 3Navidul IslamNo ratings yet

- ACCTG 42 Module 3Document5 pagesACCTG 42 Module 3Hazel Grace PaguiaNo ratings yet

- CVP AnalysisDocument3 pagesCVP AnalysisshielamaelbaisacNo ratings yet

- Ch.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)Document15 pagesCh.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)Winter SummerNo ratings yet

- Cost - Direct Costing, CVP AnalysisDocument7 pagesCost - Direct Costing, CVP AnalysisAriMurdiyantoNo ratings yet

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- PVC Analysis QNDocument14 pagesPVC Analysis QNAnipa HubertNo ratings yet

- Lanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesDocument12 pagesLanen 3e, Chapter 17 Additional Topics in Variance Analysis: Learning ObjectivesPhuong TaNo ratings yet

- Unit - 4 Marginal CostingDocument27 pagesUnit - 4 Marginal CostingShreyash PardeshiNo ratings yet

- CH 05Document28 pagesCH 05Rommel CruzNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- CVP Analysis Final 1Document92 pagesCVP Analysis Final 1Utsav ChoudhuryNo ratings yet

- Solution Relevant CostingDocument9 pagesSolution Relevant CostingUtsav ChoudhuryNo ratings yet

- Relevant Costing-MBADocument33 pagesRelevant Costing-MBAUtsav ChoudhuryNo ratings yet

- Relevant CostingDocument40 pagesRelevant CostingUtsav ChoudhuryNo ratings yet

- Financial Accounting 3BDocument10 pagesFinancial Accounting 3BPRECIOUSNo ratings yet

- Minicase 3.2Document17 pagesMinicase 3.2OPS PMLCNo ratings yet

- P1 1a.31fcd1d NotesDocument220 pagesP1 1a.31fcd1d Notesshambhavishukla.mba21No ratings yet

- IntroductionDocument85 pagesIntroductionRitika MittalNo ratings yet

- Chapter 06 Testbank: StudentDocument55 pagesChapter 06 Testbank: StudentTu Nhi PhamNo ratings yet

- Solution of Amalgamation - Home AssignmentDocument32 pagesSolution of Amalgamation - Home Assignmentlucky_mugal786No ratings yet

- FSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)Document2 pagesFSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)sandeep mishraNo ratings yet

- Accountancy Online Test Answer KeyDocument5 pagesAccountancy Online Test Answer KeyAppan HaNo ratings yet

- Applied Auditing: Chapter 5 Cash and Accrual BasisDocument5 pagesApplied Auditing: Chapter 5 Cash and Accrual BasisDarlene SarcinoNo ratings yet

- B02037 - Ex - Financial AnalysisDocument6 pagesB02037 - Ex - Financial AnalysisNguyen Minh QuanNo ratings yet

- FAR Review MaterialDocument22 pagesFAR Review MaterialAntonette Eve CelomineNo ratings yet

- You Have Been Given Responsibility For Overseeing A Bank S SmallDocument1 pageYou Have Been Given Responsibility For Overseeing A Bank S SmallHassan JanNo ratings yet

- Chapter 22 - Retained EarningsDocument8 pagesChapter 22 - Retained EarningsOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Solution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Document4 pagesSolution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Kim JuanNo ratings yet

- Accounts Half YearlyDocument4 pagesAccounts Half YearlyTeena AroraNo ratings yet

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- Revenue CycleDocument3 pagesRevenue CycleAireyNo ratings yet

- Management InformationDocument25 pagesManagement InformationsamiNo ratings yet

- Chap 016Document65 pagesChap 016tranhanhatmai2011155310No ratings yet

- Temporal Rate Method Balance Sheet AssetsDocument3 pagesTemporal Rate Method Balance Sheet Assetslinda daibesNo ratings yet

- Corporate Liquidation Quiz 5docxDocument5 pagesCorporate Liquidation Quiz 5docxAngelica Duarte33% (6)

- Thu Cs CostDocument31 pagesThu Cs CostthulasikNo ratings yet

- Ambit - Strategy - Err Group - Delivering Alpha in India PDFDocument24 pagesAmbit - Strategy - Err Group - Delivering Alpha in India PDFshahavNo ratings yet

- IAS 20 Accounting For Government Grant and Disclosure of Govt AssistanceDocument3 pagesIAS 20 Accounting For Government Grant and Disclosure of Govt AssistanceYogesh BhattaraiNo ratings yet

- Feasibility Study Financial StatementsDocument9 pagesFeasibility Study Financial StatementsMarjorie L. DueñasNo ratings yet

- FA2Document77 pagesFA2shahreen arshad0% (1)

- Accounting Summary Session 7 - Tilburg University (Entrepreneurship and Business Innovation)Document4 pagesAccounting Summary Session 7 - Tilburg University (Entrepreneurship and Business Innovation)harald d'oultremontNo ratings yet

- Intangible AssetsDocument28 pagesIntangible AssetsHAKUNA MATATANo ratings yet