Professional Documents

Culture Documents

7 Adjustments To Final Accounts

Uploaded by

Ashleigh ThomasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Adjustments To Final Accounts

Uploaded by

Ashleigh ThomasCopyright:

Available Formats

Pg .

51

Chapter 8

Adjustments to Final Accounts

Adjustments Effect Upon

Trading and Profit and Loss Account Balance sheet

1. Closing Stock Trading Account = Opening Stock + Included as a

Net Purchases + Carriage In - Closing Current Asset.

Stock)

2. Expenses Due PLUS particular Expense in the Profit and Included as a Current

(Not paid) Loss Account. Liability.

3. Expenses MINUS particular Expense in the Profit Included as a

Prepaid (paid for and Loss Account. Current Asset.

next year)

4. Gain Due PLUS particular Gain in the Profit and Included as a

Loss Account. Current Asset.

5. Gain Prepaid MINUS particular Gain in the Profit and Included as a Current

Loss Account. Liability.

6. Depreciation Included as an Expense in the Profit and Subtracted from the

Loss Account. Cost of the Fixed

Asset.

7. Bad Debts Creation (full amount) and Increase (the Subtracted from

Provision difference only) included as an Expense. Debtors.

Decrease ( the difference only) included as Subtracted from

a Gain. Debtors.

8. Goods Taken MINUS from Purchases in the Trading PLUS Drawings.

by the owner. Account.

Pg . 52

Example:

The following Trial Balance has been extracted as at 30 June 2004:

Trial Balance Dr Cr

Lm Lm

Capital 36,175

Drawings 19,050

Purchases 105,240

Sales 168,432

Stock at 1 July 2003 9,427

Debtors 3,840

Creditors 5,294

VAT 1,492

Returns In and Out 975 1,237

Discount Allowed 127

Commission Received 243

Wages and Salaries 30,841

Vehicle Expenses 1,021

Rent and Rates 8,796

Heating and Lighting 1,840

Telephone 355

General Expenses 1,752

Bad Debts 85

Vehicles at cost 8,000

Depreciation Provision on Vehicles 3,500

Shop Fittings at cost 6,000

Depreciation Provision on Shop Fittings 2,400

Bad Debts Provision 150

Cash in hand 155

Cash at Bank 21,419

218,923 218,923

Adjustments as at 30 June 2004:

1. Stock at 30 June 2004 is valued at Lm11,517.

2. Vehicle Expenses owing Lm55.

3. Rent prepaid Lm275.

4. Depreciate Vehicles at 25% p.a. on the Net Book Value.

5. Depreciate Fittings at 10% p.a. on the cost.

6. The Provision for Bad Debts is to be equal to 2.5% of Debtors.

7. The owner took Lm240 goods for his own use.

8. Commission Received owing Lm57.

For the year ending 30 June 2004, you are asked to prepare:

a. The Trading Account and the Profit and Loss Account

b. The Balance Sheet.

Pg . 53

Trading Account and Profit and Loss account for the year ending 30 June 2004

Sales 168,432

less Returns Inwards (975) 167,457

Cost of Sales

Opening Stock 9,427

Purchases 105,240

Less Returns Outwards (1,237)

104,003

Less (7) Goods Taken (240)

Net Purchases 103,763

113,190

Less (1) Closing Stock (11,517) (101,673)

Gross Profit 65,784

Add (8) Commission Received (+57) 300

Add (6) Reduction in Bad Debts Provision (150-96) 54 354

66,138

Less Expenses

Discount Allowed 127

Wages and Salaries 30,841

(2) Vehicle Expenses (+55) 1,076

(3) Rent and Rates (-275) 8,521

Heating and Lighting 1,840

Telephone 355

General Expenses 1,752

Bad Debts 85

(4/5) Depreciation: Vehicles 1,125

Shop Fittings 600 1,725 (46,322)

Net Profit 19,816

Notes:

Pg . 54

Balance Sheet as at 30 June 2004

Fixed Assets

Cost Total Net Book

Deprc'n Value

Shop Fittings

6,000 3,000 3,000

Vehicle

8,000 4,625 3,375

14,000 7,625 6,375

Current Assets

Closing Stock

11,517

Debtors

3,840

Less Bad Debts Provision

96 3,744

Cash at Bank

21,419

Cash in Hand

155

Rent Prepaid

275

Commission Received Due

57

37,167

Current Liabilities

Creditors

5,294

VAT

1,492

Vehicle Expenses owing

55 6,841

Net Current Assets

30,326

Net Assets

36,701

Financed by

Capital at beginning

36,175

Net Profit

19,816

55,991

Drawings (+240)

19,290

Capital at end

36,701

Pg . 55

Exercises

1. Peter Sultana, a sole trader, prepared the following Trial Balance

as at 31 December 2001.

Trial Balance as at 31 December 2001 Dr Cr

Lm Lm

Fixtures and Fittings 2,100

Purchases and Sales 25,160 39,210

Wages 8,140

Office Equipment 1,200

Capital 1 Jan 2001 44,260

Bad Debts written off 70

Rates and Insurance 1,090

Discount Allowed 420

Sales Returns and Purchases Returns 270 315

Carriage Inwards 720

Postage and Stationery 255

Stock 1 Jan 2001 3,160

Discount Received 290

Debtors and Creditors 3,620 1,750

Bad Debts Provision 150

Carriage Outwards 450

Drawings 1,800

Advertising 320

Cash at Bank 2,150

Cash in Hand 50

Premises 35,000

85,975 85,975

Adjustments:

i. Stock at 31 December 2001 was valued at cost Lm4,200.

ii. Wages accrued were Lm150.

iii. Rates prepaid Lm120.

iv. P. Sultana wishes to increase his Bad Debts Provision to Lm180.

v. Provide for depreciation as follows:

Fixtures and Fittings Lm200.

Office Equipment Lm80.

You are required to prepare:

a. Trading and Profit and Loss Account for the year ended 31

December 2001;

b. Balance Sheets as at 31 December 2001.

Pg . 56

2. Mario Zarb, a sole trader, prepared the following Trial Balance

as at 30 April 1999.

Trial Balance as at 30 April 1999 Dr Cr

Lm Lm

Capital 1 May 1998 11,100

Debtors and Creditors 3,460 2,090

Office Furniture 700

Discount Allowed and Received 680 280

Machinery 600

Purchases and Sales 9,450 16,330

Returns In and Out 760 410

Wages and Salaries 2,960

Bank 750

Cash 70

Bad Debts written off 190

Rates and Insurance 270

Premises 6,000

Carriage Outwards 520

Drawings 1,700

Sundry Expenses 120

Stock 1 May 1998 1,980

30,210 30,210

Adjustments :

i. Stock at 30 April 1999 Lm2050.

ii. Wages and Salaries owing Lm50.

iii. Provide for depreciation as follows:

a. Office Furniture Lm70

b. Machinery Lm20.

iv. Rates prepaid Lm70.

You are required to prepare:

i. Trading and Profit and Loss Account for the year ended 30

April 1999.

ii. Balance Sheet as at 30 April 1999.

Pg . 57

3. Raymond Abela, a sole trader prepared the following Trial Balance as

at 31 December 2000.

Trial Balance as at 31 December 2000 Dr (Lm) Cr (Lm)

Drawings 3,000

Purchases and Sales 71,059 92,100

Capital 1 Jan 2000 60,000

Loan 30,000

Stock 1 Jan 2000 10,000

Debtors and Creditors 16,100 10,000

Premises 75,000

Motor Van at cost 10,000

Provision for Depreciation of Motor Van 1 Jan 2000 1,000

Bank 3,000

Cash 1,562

Wages 2,000

Electricity 369

Advertising 510

Insurance 1,000

Provision for Bad Debts 500

193,600 193,600

Adjustments:

1. Stock at 31 December 2000 Lm13,000

2. Electricity Owing Lm150

3. Insurance prepaid Lm500

4. Increase Provision for Bad Debts to Lm750

5. Depreciate Motor Vans on a reducing Balance Basis at the rate of

10 per cent per annum.

You are required to prepare:

a. Trading and Profit and Loss Account for the year ended 31

December 2000.

b. Balance Sheet as at 31 December 2000.

Pg . 58

4. The following balances at 31 December 1997 have been extracted from

the books of K.Borg.

Lm

Premises at Cost 70,000

Wages and Salaries 21,000

Rates 1,500

Electricity 520

Purchases 49,000

Stock at 1 January 1997 2,600

Carriage Outwards 96

Sales 84,690

Returns Inwards 71

Motor Van at cost 5,000

Provision for depreciation on

Motor Van at 1 Jan 1997 3,000

Loan from B.Caruana 20,000

Administration Expenses 11,200

Creditors 2,690

Insurance 240

Debtors 3,140

Cash in Hand 526

Bank Overdraft 1,400

Capital at 1 Jan 1997 66,226

Drawings 13,113

The following additional information dates to the year ended 31

December 1997:

a. Electricity accrued Lm300.

b. Insurance prepaid Lm120.

c. Motor Van to be depreciated by Lm1000.

d. A Provision for Bad Debts is to be created on Debtors at the rate of

5%.

e. Stock at 31 December 1997 is valued at Lm3,200.

You are required to prepare:

i. A Trial Balance as at 31 December 1997;

ii. A Trading and Profit and Loss Account for the year

ended 31 December 1997;

iii. A Balance Sheet as at 31 December 1997.

Pg . 59

5. The Trial Balance of S Abela at 31 March 2001 was as follows:

Dr Cr

Lm Lm

Stock at 1 April 2000 18,400

Purchases 60,080

Purchases Returns 240

Cash in hand 340

Cash at bank 10,084

Premises at cost 15,440

Lighting and Heating 836

Printing, and Stationery 112

Accountancy charges 656

Provision for doubtful debts 1,400

Sundry Debtors 14,400

Sundry Creditors 11,868

Wages 10,700

Salaries 3,500

Bad Debts 900

Capital 45,860

Drawings 3,000

Discount Allowed 2,520

Discount Received 1,840

Sales 83,580

Office Furniture at cost 2,500

Provision for Depreciation : Office Furniture 500

Rent and rates 1,600

Sales Returns 220

145,288 145,288

The following matters are to be taken into account:

1. Stock at 31 March 2001, Lm20,800.

2. Provision for doubtful debts is to be increased to Lm1,600.

3. Rent accrued due Lm200.

4. Light and Heat paid in advance Lm80.

5. Provide for depreciation on office furniture at 5% on cost.

You are required to prepare:

a. Trading and Profit and Loss Accounts for the year ended 31

March 2001;

b. Balance Sheet as at 31 March 2001.

Pg . 60

6. P.Abela owns a retail business, which sells curtain fabrics and

accessories.

On 31 December 1998 the balances of the accounts in his books were

extracted and the following Trial Balance was drawn up.

Trial Balance at 31 December 1998 Dr Cr

Lm Lm

Capital at 1 Jan 1998 16,770

Stock of Materials and accessories at 1 Jan 1998 12,300

Purchases and Sales 125,000 158,300

Commission Received 2,450

Rent 7,000

Fixtures and Fittings at cost 3,500

Motor Van at cost 10,500

Advertising 1,960

Motor Van Expenses 1,120

Heat and Light 790

Wages for assistant 6,800

Accountants fees 1,200

Insurance 700

Debtors and Creditors 3,100 2,700

Cash 250

Bank Overdraft 3,840

Bank charges and interest 270

Drawings 9,200

General Expenses 1,770

Provision for Depreciation : Fixtures and Fittings 1,400

185,460 185,460

Additional Information :

1. At 31 December 1998:

a. Stocks of Materials and accessories were valued at

Lm10,500.

b. Rent paid in advance Lm1000.

c. Wages owing to assistant were Lm300.

2. Pietru Abela depreciates the fixtures and fittings at 10% p.a. on

cost.

3. The Motor Vehicle was purchased on 1 January 1998. Pietru

Abela decides to create a provision for depreciation on the

Motor Vehicle of 20% p.a. on cost.

Pg . 61

4. Pietru Abela had taken materials that cost Lm500 for his own

use during the year. This amount had not been recorded in the

accounts.

5. Commission Received was owing at 31 December 1998 Lm950.

You are required to prepare for Pietru Abela:

a. Trading and Profit and Loss Account for the year ending 31

December 1992;

b. A Balance Sheet as at 31 December 1992.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- 13 Single Entry and Incomplete Records - Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- Final AccountsDocument12 pagesFinal Accountsanandm1986100% (1)

- Review Questions Final Accounts For A Sole TraderDocument3 pagesReview Questions Final Accounts For A Sole TraderdhanyasugukumarNo ratings yet

- Seminar Solutions - Term 2Document36 pagesSeminar Solutions - Term 2bontom333No ratings yet

- 01 Company Final Accounts QuestionsDocument10 pages01 Company Final Accounts QuestionsMd. Iqbal Hasan0% (1)

- Exercise (Final Accounts)Document14 pagesExercise (Final Accounts)Abhishek Bansal100% (1)

- Financial Accounting Atc 1Document3 pagesFinancial Accounting Atc 1hshing02No ratings yet

- Final AccountsDocument12 pagesFinal AccountsHarish SinghNo ratings yet

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Hi-Aims College of Commerce and Management Sargodha: ST TH ST ST STDocument6 pagesHi-Aims College of Commerce and Management Sargodha: ST TH ST ST STMozam MushtaqNo ratings yet

- Documents Subject Accounts Form4 9PartnershipAccountsDocument16 pagesDocuments Subject Accounts Form4 9PartnershipAccountsCartello008No ratings yet

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Accounts Assignment 2Document12 pagesAccounts Assignment 2shoaiba167% (3)

- Department of Business AdministrationDocument9 pagesDepartment of Business AdministrationKannan NagaNo ratings yet

- Tax IllustrationsDocument7 pagesTax IllustrationsMsema KweliNo ratings yet

- Accounting 1 FinalDocument2 pagesAccounting 1 FinalchiknaaaNo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Final Account HWDocument5 pagesFinal Account HWniks4585No ratings yet

- 1 Fafn: Financial Accounting FundamentalsDocument12 pages1 Fafn: Financial Accounting Fundamentalsguanggao0No ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Financial Accounting Sample Paper 21Document31 pagesFinancial Accounting Sample Paper 21Jayasankar SankarNo ratings yet

- Scan 0001Document10 pagesScan 0001Ian InandanNo ratings yet

- Final Exam Revision Questions 1-5Document7 pagesFinal Exam Revision Questions 1-5Ken ChenNo ratings yet

- RESA Final Preboard P1Document10 pagesRESA Final Preboard P1rjn191% (11)

- CAT-CB Questionnaires (Encoded)Document13 pagesCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- AccountingDocument8 pagesAccountingBasil Babym50% (2)

- YuyutuDocument15 pagesYuyutuDeepak R GoradNo ratings yet

- Solution:: Profit and Loss Account and Balance Sheet On 31st December, 1991Document5 pagesSolution:: Profit and Loss Account and Balance Sheet On 31st December, 1991suhel3No ratings yet

- ACT 501 - AssignmentDocument6 pagesACT 501 - AssignmentShariful Islam ShaheenNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- Final AcctsDocument7 pagesFinal AcctsSyed ShabirNo ratings yet

- f3 Multiple Choice QuestionDocument3 pagesf3 Multiple Choice QuestionsfipakistanNo ratings yet

- Numerical SDocument11 pagesNumerical Sbarnwal_bikashNo ratings yet

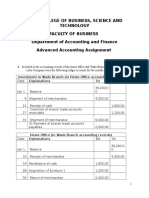

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- QuestionsDocument7 pagesQuestionsMyra RidNo ratings yet

- Balance SheetDocument16 pagesBalance SheetFam Sin YunNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Auditing PracticeDocument14 pagesAuditing PracticeshudayeNo ratings yet

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- Final Acc-Numerical 1Document10 pagesFinal Acc-Numerical 1Rajshree BhardwajNo ratings yet

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Mock Test Paper 6Document5 pagesMock Test Paper 6FarrukhsgNo ratings yet

- Practical Accounting 1 First Pre-Board ExaminationDocument14 pagesPractical Accounting 1 First Pre-Board ExaminationKaren EloisseNo ratings yet

- 1 Fafn: Financial Accounting FundamentalsDocument12 pages1 Fafn: Financial Accounting FundamentalsAltaf HussainNo ratings yet

- Cash Flow Exercises Set 1Document3 pagesCash Flow Exercises Set 1chiong0% (1)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationRena Rose Malunes11% (9)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosNo ratings yet

- Homework For Next ClassDocument3 pagesHomework For Next ClassSimo El Kettani20% (5)

- P1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011Document93 pagesP1-Q and As-Advanced Financial Accounting and Reporting - June 2010 Dec 2010 and June 2011HAbbuno100% (1)

- Final Accounts QuestionDocument12 pagesFinal Accounts QuestionIndu Gupta33% (3)

- Final AccDocument13 pagesFinal Accmdr32000No ratings yet

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Assignment 2 MBA 502 Econ Analysis - 2014Document4 pagesAssignment 2 MBA 502 Econ Analysis - 2014Thushan AmarasenaNo ratings yet

- Problems Chapter 6-7 International Parity ConditionsDocument12 pagesProblems Chapter 6-7 International Parity Conditionsarmando.chappell1005No ratings yet

- Ugba 101b Test 2 2008Document12 pagesUgba 101b Test 2 2008Minji KimNo ratings yet

- Final Word-Over The Counter Exchange of IndiaDocument14 pagesFinal Word-Over The Counter Exchange of IndiaVidita VanageNo ratings yet

- Pertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanDocument20 pagesPertemuan 6 - Disposisi Properti, Pabrik Dan PeralatanTawang Deni WijayaNo ratings yet

- Century Paper and Board Mills Limited - Case StudyDocument23 pagesCentury Paper and Board Mills Limited - Case StudyJuvairiaNo ratings yet

- Finanacial Performance Analysis of HDFC BankDocument54 pagesFinanacial Performance Analysis of HDFC BankSharuk KhanNo ratings yet

- Group 8 - Final Report - Mutual Funds in VietnamDocument18 pagesGroup 8 - Final Report - Mutual Funds in VietnamNguyễn Thuỳ DungNo ratings yet

- Submitted By: Anmol Hindwani (Pgsf1907) : Bank Performance AnalysisDocument20 pagesSubmitted By: Anmol Hindwani (Pgsf1907) : Bank Performance AnalysisSurbhî GuptaNo ratings yet

- Guidelines On Securitisation of Standard AssetsDocument14 pagesGuidelines On Securitisation of Standard AssetsPrianca GalaNo ratings yet

- Control AccountingDocument7 pagesControl AccountingAmir RuplalNo ratings yet

- FXOM Definitions EN PDFDocument10 pagesFXOM Definitions EN PDFDenni SeptianNo ratings yet

- DHL Delivery ReceiptDocument2 pagesDHL Delivery ReceiptsignulitraNo ratings yet

- CH 18 AnsDocument3 pagesCH 18 AnsUsama SaleemNo ratings yet

- Preparation of Financial Statements-PartnershipsDocument7 pagesPreparation of Financial Statements-PartnershipsHeavens MupedzisaNo ratings yet

- Lai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationDocument1 pageLai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationMiroslav GegoskiNo ratings yet

- Overpriced Jeans, Inc. - Transactions - Additional InformationDocument11 pagesOverpriced Jeans, Inc. - Transactions - Additional InformationKeshav TayalNo ratings yet

- Sample of Bank Comfort LetterDocument2 pagesSample of Bank Comfort LetterShakeshakes89% (9)

- Literature ReviewDocument3 pagesLiterature Reviewkalaswami50% (2)

- Currency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, ToDocument3 pagesCurrency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, Tovivekananda RoyNo ratings yet

- 4th Accounts Dec 2021Document2 pages4th Accounts Dec 2021KillingNo ratings yet

- Application For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFDocument6 pagesApplication For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFdasuyaNo ratings yet

- Bahria Town Karachi (PVT LTD.) Maintenance Bill: BTKH-MWG2292Document1 pageBahria Town Karachi (PVT LTD.) Maintenance Bill: BTKH-MWG2292Rana qasim 123No ratings yet

- Sneha Burud ASWDocument7 pagesSneha Burud ASWPrathmesh KulkarniNo ratings yet

- CH 16Document102 pagesCH 161asdfghjkl3No ratings yet

- The Structure of Financial System of BangladeshDocument8 pagesThe Structure of Financial System of Bangladeshmoaz_tareq1622No ratings yet

- Mendoza 1 1 ProbSet5Document8 pagesMendoza 1 1 ProbSet5Marilyn M. MendozaNo ratings yet

- MNC Valuation MefDocument9 pagesMNC Valuation MefKabulNo ratings yet

- Bop in IndiaDocument54 pagesBop in IndiaChintakunta PreethiNo ratings yet

- SOLENNE Temporary Sales InvoiceDocument1 pageSOLENNE Temporary Sales InvoiceMark Anthony CasupangNo ratings yet