Professional Documents

Culture Documents

MF0017

MF0017

Uploaded by

kanchi880 ratings0% found this document useful (0 votes)

6 views9 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views9 pagesMF0017

MF0017

Uploaded by

kanchi88Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 9

Master of Business Administration- MBA Semester 4

MF0017-Merchant Banking and Financial Services

Q1 Explain the concept of book building and methods or guidelines of book building

with 75 and 100% of book building.

Ans.CONCEPT OF BOOK BUILDING:

Book building is the process through which the prices of IPOs (securities issued first time

for public) are obtained through the demand of market. Through the mechanism of book

building, companies can raise capital from the general public by offering Initial Public

Offers (IPOs) as well as by issuing Follow-on Public Offers (FPOs). In the process of book

building, the investors send their bids at the price which seems reasonable within a price

range.

GUIDELINES BY SEBI

On the recommendations of Malegam committee, the concept of Book Building

assumed significance in India as SEBI approved, with effect from November 1, 1995, the

use of the process in pricing new issues.

SEBI issued the guidelines under which the option of 100%book-building was

available to only those issuer companies which are to make an issue of capital of and above

Rs. 100crore.

These guidelines were modified in 1998-99.The ceiling of issue size was reduced to

Rs. 25crore.

SEBI modified book-building norms for public issues in 1999

and allowed the issuer to choose either the existing or the

modified mode of book building.

Modified Guidelines:-

Compulsory display of demand at the terminals was made optional.

The reservation of 15% of the issue size for individual investors could be

clubbed with fixed price offer.

The issuer was allowed to disclose either the issue size or the number of

securities being offered.

The allotment of the book built portion was required to be made in Demat mode

only.

Types of Book-Building:

The Companies are bound to adhere to the SEBIs guidelines for book building offers in the

following manner:

75% book building

100% book building

75 per cent Book-Building Process:

Under this process 25 per cent of the issue is to be sold at a fixed price and the balance of

75 per cent through the Book Building process.

2. Offer to Public through Book Building Process:

The process specifies that an issuer company may make an issue of securities to the public

through prospectus in the following manner:

A. 100 per cent of the net offer to the public through book building process, or

B. 75 per cent of the net offer to the public through book building process and 25 per cent

of the net offer to the public at a price determined through book building process.

100% book building

BOOK BUILDING

METHOD

FIXED PRICE

METHOD

75% OF THE PUBLIC ISSUE CAN

BE OFFERED TO INSTITUTIONAL

INVESTORS WHO HAVE

PARTICIPATED IN THE BIDDING

PROESS.

25% OF THE PUBLIC ISSUE CAN

BE OFFERED THROUGH

PROSPECTUS AND SHALL BE

RESERVED FOR ALLOCATION TO

INDIVIDUAL INVESTORS WHO

HAVE NOT PARTICIPATED IN

THE BIDDING PROCESS.

TOTAL PUBLIC ISSUE

(i.e. net offer to the public)

CHART 1

75% OF THE NET OFFER THROUGH BOOK BUILDING PROCESS

Q2. Issue management is one of the important functions of merchant bankers and lead

bankers. Explain the two types of activities pre issue obligation and post issue obligation.

Also write on the concept of Application Supported by Blocked Amount (ASBA).

Ans. Management of issues involves marketing of corporate securities equity shares,

preference shares and debentures by offering them to public.

Pre-issue activities:

They prepare copies of and send it to SEBI and then file them to Registrar of Companies

They conduct meetings with company representatives and advertising agencies to decide

upon the date of opening issue, closing issue, launching publicity campaign etc..

They help the companies in fixing up the prices for their issues

Documents to be submitted along with Offer Document by the Lead Manager

MOU

Inter-se Allocation of Responsibilities

Due-Diligence Certificate

Certificates signed by Company Secretary or Chartered Accountant

List of Promoters Group & other details

Promoter individual shareholding.

Stock exchanges on which securities proposed to be listed, Permanent A/c No.,

Bank A/c No. & passport No. of promoters.

Undertaking to SEBI

by promoter, promoter group & relatives of promoters

B/w date of filling offer documents & date of closure of issue.

Appointment of Intermediaries

Merchant Banker not lead manage issue:

If he is a promoter or a director of issuer company.

Can manage if securities listed/proposed to be listed on OTCEI.

Merchant Banker lead manage issue:

Associate of Issuer Company.

Involved in marketing of issue.

Underwriting

The lead merchant banker shall satisfy themselves about the ability of the

underwriters to discharge their underwriting obligations. The lead merchant banker

shall:

Post-issue activities:

It includes collection of application forms, screening of applications, deciding allotment

procedure, mailing of allotment letters, share certificates and refund orders

Post issue monitoring reports

The post issue lead merchant banker shall ensure the submission of the post issue

monitoring reports

Due diligence certificate to be submitted with the final post issue monitoring report. The

post issue lead merchant banker shall file a due diligence certificate in the format specified

along with the final post issue monitoring report. Redressal of the investor grievances. The

post-issue lead merchant banker shall actively associate himself with post-issue activities

namely allotment, refund and dispatch and shall regularly monitor redressal of investor.

Applications Supported by Blocked Amount (ASBA):

SEBI vide its circular no. SEBI/CFD/DIL/DIP/31/2008/30/7 July 30, 2008 introduced a

supplementary process of applying in public issues, viz., and the Applications Supported

by Blocked Amount (ASBA) process. The ASBA process shall be available in all public

issues made through the book building route.

The main features of ASBA process are as follows:

Meaning of ASBA: ASBA is an application for subscribing to an issue,

containing an authorization to block the application money in a bank account.

2. Self-Certified Syndicate Bank (SCSB): SCSB is a bank which offers the

facility of applying through the ASBA process.

Q3. Write short notes on:

a) Foreign Direct Investment (FDI) and its role

b) Foreign Currency Convertible Bonds (FCCB)

Ans. a) Foreign Direct Investment (FDI):

Foreign direct investment (FDI) in its classic form is defined as a company from one

country making a physical investment into building a factory in another country.

Include investments made to acquire lasting interest in enterprises operating outside of

the economy of the investor.

Generally speaking FDI refers to capital inflows from abroad that invest in the production

capacity of the economy and are:

Usually preferred over other forms of external finance because they are

Non-debt creating, non-volatile and their returns depend on the performance of the

projects financed by the investors.

FDI also facilitates international trade and transfer of knowledge, skills and

technology.

The FDI relationship consists of a parent enterprise and a foreign affiliate which together

form a multinational corporation (MNC).

In order to qualify as FDI the investment must afford the parent enterprise control over its

foreign affiliate.

The IMF defines control in this case as owning 10% or more of the ordinary shares or

voting power of an incorporated firm or its equivalent for an unincorporated firm.

Foreign Direct Investment (FDI) is permitted as under the following forms of investments-

Through financial collaborations.

Through joint ventures and technical collaborations.

Through capital markets via Euro issues.

Through private placements or preferential allotments.

b) Foreign Currency Convertible Bond (FCCB):

A Foreign Currency Convertible Bond (FCCB) is a type of convertible bond issued in a

currency different than the issuer's domestic currency.

In other words, the money being raised by the issuing company is in the form of a foreign

Currency. It gives two options. One is, to get the regular interest and principal and the other

is to convert the bond into equities. It is a hybrid between bond and stock.

Benefits to companies

Some companies, banks, governments, and other sovereign entities may decide to issue

bonds in foreign currencies because:

gives issuers the ability to access investment capital available in foreign markets.

coupon

and principal payments, but these bonds also give the bondholder the option to convert the

bond into stock.

-50 percent

lower than the market rate because of its equity component.

Q4 Depository helps in the transfer of securities from one investor to another in an

electronic form. Write the differences between Bank and Depository. Explain the

functions performed by Depository.

Ans. Bank vs. Depository:

A depository functions like a bank. As banks deal with the funds of the clients and depository

deals with the holding of the security accounts. Both maintain their respective accounts in

obedience with the prevailing rules and by-laws.

DIFFERENCE BETWEEN BANK AND DEPOSITORY

BANK DEPOSITORY

Allocates account number.

Holds funds in accounts

Minimum balance required.

Functions through branches.

Issues account statement &

pass book.

Charges commission/ service

charges.

Provides interest to the

account holders.

Allocates client ID number.

Holds securities in accounts.

Normally no minimum balance

required.

Functions through depository

participants.

Issues account statement i.e.

statement of holding and statement

of transactions.

Depository Participant charges:

o Account opening and closing

fee

o Demat and Remat fee

o Transaction fee (buy, sell,

off market)

o Custody charges

In future, through stock lending, it

will be possible to earn income on

Depository Account.

Functions of Depository:

Dematerialization: One of the primary functions of depository is to eliminate or minimize the

movement of physical securities in the market. This is achieved through dematerialization of

securities. Dematerialization is the process of converting securities held in physical form into

holdings in book entry form.

Account Transfer: The depository gives effects to all transfers resulting from the settlement

of trades and other transactions between various beneficial owners by recording entries in the

accounts of such beneficial owners.

Transfer and Registration: A transfer is the legal change of ownership of a security in the

records of the issuer. For affecting a transfer, certain legal steps have to be taken like

endorsement, execution of a transfer instrument and payment of stamp duty. The depository

accelerates the transfer process by registering the ownership of shares in the name of the

depository.

Corporate Actions: A depository may handle corporate actions in two ways. In the first case,

it merely provides information to the issuer about the persons entitled to receive corporate

benefits. In the other case, depository itself takes the responsibility of distribution of corporate

benefits.

Pledge and Hypothecation: The securities held with NSDL may be used as collateral to

secure loans and other credits by the clients. In a manual environment, borrowers are required

to deliver pledged securities in physical form to the lender or its custodian. These securities

are verified for authenticity and often need to be transferred in the name of lender. This has a

time and money cost by way of transfer fees or stamp duty.

Q5. Every investor has his own risk perceptions and objectives of investment. Write

about Mutual funds also write down about the benefits and disadvantages of Mutual

funds which is very essential for all the investors to know.

Ans. Mutual Funds:

A mutual fund is an investment company which pools together the funds of investors

having a common objective. The funds collected under one common objective are invested

in various investment avenues (equity, bond, preference shares, real estate, gold, off shore

funds etc.) and managed by professional fund managers. The whole investment in a mutual

fund is divided into various units and each investor is known as a unit holder.

Advantages of Investing Mutual Funds:

1. Professional Management - The basic advantage of funds is that, they are professional

managed, by well qualified professional. Investors purchase funds because they do not

have the time or the expertise to manage their own portfolio.

2. Diversification - Purchasing units in a mutual fund instead of buying individual stocks

or bonds, the investors risk is spread out and minimized up to certain extent. The idea

behind diversification is to invest in a large number of assets so that a loss in any

particular investment is minimized by gains in others.

3. Economies of Scale - Mutual fund buy and sell large amounts of securities at a time,

thus help to reducing transaction costs, and help to bring down the average cost of the

unit for their investors.

4. Liquidity - Just like an individual stock, mutual fund also allows investors to liquidate

their holdings as and when they want.

Disadvantages of Investing Mutual Funds:

1. Professional Management- Some funds doesnt perform in neither the market, as their

management is not dynamic enough to explore the available opportunity in the market,

thus many investors debate over whether or not the so-called professionals are any better

than mutual fund or investor himself, for picking up stocks.

2. Costs The biggest source of AMC income is generally from the entry & exit load

which they charge from investors, at the time of purchase. The mutual fund industries

are thus charging extra cost under layers of jargon.

3. Dilution - Because funds have small holdings across different companies, high returns

from a few investments often don't make much difference on the overall return. Dilution

is also the result of a successful fund getting too big.

4. Taxes - when making decisions about your money, fund managers don't consider your

personal tax situation. For example, when a fund manager sells a security, a capital-gain

tax is triggered, which affects how profitable the individual is from the sale.

Q6 Rating methodology is used by the major Indian credit rating agencies. Explain on

the main factors that are analyzed in credit rating agencies and also on the limitations

on the limitations of credit rating.

Ans. Factors analyzed in credit rating agencies:

A Credit Rating issued by a credit rating agency is an assessment of the credit

worthiness of individual financial securities (For example, a bond) and debt issued by

corporations, government issued securities or even a countrys ability to repay debt.

Credit Ratings are assigned by rating agencies to companies and debt instruments, are

designed to gauge the likelihood that a company will default on its obligations to creditors.

Thus, they give investors a rough idea of the risk associated with loaning money to the

entity being rated.

Credit ratings are forward-looking opinions about credit risk. It expresses the agencys

opinion about the ability and willingness of an issuer, such as a corporation or state or city

government, to meet its financial obligations in full and on time.

Credit ratings provide individual and institutional investors with information that

assists them in determining whether issuers of debt obligations and fixed-income

securities will be able to meet their obligations with respect to those securities.

Credit rating agencies provide investors with objective analyses and independent

assessments of companies and countries that issue such securities. Globalization in the

investment market, coupled with diversification in the types and quantities of securities

issued, presents a challenge to institutional and individual investors who must analyze risks

DISADVANTAGES OF CREDIT RATING:

1. Biased rating and misrepresentations: It is very important that credit rating agencies

function independently and are objective in their assessment of companys financial position

and its ability to meet its obligations on time.

2. Static study: Rating is done on the basis of present and past historical data of the

company and this is only a static study.

3. Concealment of material information: The issuer company might conceal vital

information from the investigation team of the agency.

4. No guarantee for soundness of company: Independent views should be formed by the

user public in general of the rating symbol.

5. Human bias: Human bias may adversely affect the credit rating.

6. Subsequent downgrading: credit rating agencies would review the grade and downgrade

the rating resulting into impairing the image of the company.

7. Reflection of temporary adverse conditions: it might get low rating which might

adversely affect companys interest.

8. Difference in rating of two agencies: Rating done by two different credit rating for the

same instrument of the same issuer company in many cases can be different.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Synarchy ShambhalaDocument0 pagesSynarchy ShambhalaLucianDanNo ratings yet

- The Union LegislatureDocument4 pagesThe Union LegislatureSukti Basu PaulNo ratings yet

- (Contemporary Social Theory) Anthony Giddens (Auth.) - Central Problems in Social Theory - Action, Structure and Contradiction in Social Analysis-Macmillan Education UK (1979) PDFDocument301 pages(Contemporary Social Theory) Anthony Giddens (Auth.) - Central Problems in Social Theory - Action, Structure and Contradiction in Social Analysis-Macmillan Education UK (1979) PDFtotallylegal100% (3)

- Rochdale PioneersDocument2 pagesRochdale PioneersDiarmuid McDonnellNo ratings yet

- Board Reso For ClientDocument2 pagesBoard Reso For ClientRowel MagarceNo ratings yet

- Political Corruption Before and After ApartheidDocument18 pagesPolitical Corruption Before and After ApartheidLuke GarciaNo ratings yet

- FrekanslarDocument1 pageFrekanslarBatuhan AkgünNo ratings yet

- Banu MusaDocument1 pageBanu Musaari sudrajatNo ratings yet

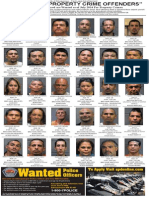

- Most Wanted Property Crime Offenders, July 2014Document1 pageMost Wanted Property Crime Offenders, July 2014Albuquerque JournalNo ratings yet

- Galloway Civil LawsuitDocument25 pagesGalloway Civil LawsuitAsbury Park PressNo ratings yet

- Comparitive Report: Sir Mackenzie Bowell vs. Dr. Roberta Bondar For Greatest CanadianDocument5 pagesComparitive Report: Sir Mackenzie Bowell vs. Dr. Roberta Bondar For Greatest Canadianapi-295732141No ratings yet

- Sociology EntDocument7 pagesSociology EntLAKSHMAN DASNo ratings yet

- Faiz Ul Bari Tarjuma Fathul Bari para 25,26,27Document858 pagesFaiz Ul Bari Tarjuma Fathul Bari para 25,26,27Islamic Reserch Center (IRC)No ratings yet

- Cultural Analysis PaperDocument4 pagesCultural Analysis Papertanu96tp5952No ratings yet

- Essay On The Importance of National Solidarity and Its ImprovementDocument2 pagesEssay On The Importance of National Solidarity and Its ImprovementANas Ali50% (2)

- Human Geography - CH 4 - Study GuideDocument6 pagesHuman Geography - CH 4 - Study GuideZzimmer34No ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document3 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)MarifeNo ratings yet

- ReviewerDocument47 pagesReviewerNYLIRPA CUTIENo ratings yet

- 6 Metropolitan PlanningDocument16 pages6 Metropolitan PlanningMohammad WasequzzamanNo ratings yet

- The American Dream in Huck FinnDocument16 pagesThe American Dream in Huck FinnTômLốcNo ratings yet

- Renaissance - Reformation QuestionsDocument2 pagesRenaissance - Reformation Questionsswyde13100% (1)

- Class 9 - Subject Specific Worksheets - Hindi MediumDocument25 pagesClass 9 - Subject Specific Worksheets - Hindi MediumNavi phogatNo ratings yet

- ICTimes September 2007Document24 pagesICTimes September 2007api-3805821No ratings yet

- AP U.S. Government & Politics Practice Exam: Section I (Multiple-Choice Questions)Document47 pagesAP U.S. Government & Politics Practice Exam: Section I (Multiple-Choice Questions)ttran963No ratings yet

- In Memory of Andrew McNaughtanDocument2 pagesIn Memory of Andrew McNaughtanJude ConwayNo ratings yet

- ABSL Paper Eng-InsideDocument5 pagesABSL Paper Eng-Insideအာ ကာNo ratings yet

- 2010migration and The GulfDocument93 pages2010migration and The GulfAsinitas OnlusNo ratings yet

- Text CH 8 RevolutionsDocument23 pagesText CH 8 Revolutionsapi-234531449No ratings yet

- Oaths Act: Revised Laws of MauritiusDocument4 pagesOaths Act: Revised Laws of MauritiusCorine EmilienNo ratings yet

- BE Bofors ScamDocument20 pagesBE Bofors Scampriyanka281291No ratings yet