Professional Documents

Culture Documents

"Form No. 15G: AO No. AO Type Range Code Area Code

Uploaded by

senkum812002Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"Form No. 15G: AO No. AO Type Range Code Area Code

Uploaded by

senkum812002Copyright:

Available Formats

No.

of

shares

Totalvalue

ofshares

Amountofsecurities

Amountof

sumsgiven

oninterest

Rateof

interest

Numberof

units

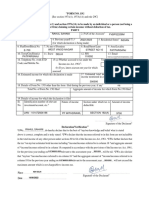

SCHEDULEII

(Detailsofthesecuritiesheldinthenameofdeclarantandbeneficiallyownedbyhim)

Descriptionof

securities

Numberofsecurities

Date(s)of

securities

(dd/mm/yyyy)

Date(s)onwhichthesecuritieswere

acquiredbythedeclarant(dd/mm/yyyy)

SCHEDULEIII

(Detailsofthesumsgivenbythedeclarantoninterest)

Nameandaddressofthe

persontowhomthesumsare

givenoninterest

Dateonwhichthesumsweregivenon

interest(dd/mm/yyyy)

Periodforwhichsumswere

givenoninterest

Incomeinrespectof

units

SCHEDULEIV

(Detailsofthemutualfundunitsheldinthenameofdeclarantandbeneficiallyownedbyhim)

SCHEDULEV

Nameandaddressofthe

mutualfund

Classofunitsandfacevalueofeach

unit

Distinctivenumberofunits

Theamountofwithdrawalreferredtoinsection80CCA(2)(a)fromNationalSavingsSchemereferredtoinScheduleV

InterestonsecuritiesreferredtoinScheduleII

IncomeformunitsreferredtoinScheduleIV

Classofshares&

facevalueofeach

share

Distinctivenumbersoftheshares

DividendfromsharesreferredtoinScheduleI

17.PresentWard/Circle

20.PresentAOCode(ifnotsameas

above)

18.ResidentialStatus(withinthe

meaningofSection6oftheIncomeTax

Act,1961)

15.Email

(Pleaseticktherelevantbox)

19.NameofBusiness/Occupation

16.TelephoneNo.(withSTDCode)andMobileNo.

21.JurisdictionalChiefCommissionerofIncometaxorCommissionerofIncometax(ifnotassessedto

Incometaxearlier)

AONo.

22.Estimatedtotalincomefromthesourcesmentionedbelow:

ParticularsofthePostOfficewheretheaccountundertheNationalSavingsScheme

ismaintainedandtheaccountnumber

Dateonwhichtheaccount

wasopened(dd/mm/yyyy)

Theamountof

withdrawalfromthe

account

24.Detailsofinvestmentsinrespectofwhichthedeclarationisbeingmade:

(DetailsofthewithdrawalmadefromNationalSavingsScheme)

AONo.

9.Area/Locality 8.Road/Street/Lane

11.Town/City/District 12.State

14.LastAssessmentYearinwhich

assessed

"FORMNO.15G

[Seesection197A(1),197A(1A)andrule29C]

PARTI

7.AssessedinwhichWard/Circle

Declarationundersection197A(1)andsection197A(1A)oftheIncometaxAct,1961tobemadebyanindividualoraperson(notbeingacompanyorfirm)claiming

certainreceiptswithoutdeductionoftax.

6.

#

Status 4.Flat/Door/BlockNo. 5.NameofPremises

23.EstimatedtotalincomeofthepreviousyearinwhichincomementionedinColumn22istobeincluded

SCHEDULEI

(Detailsofshares,whichstandinthenameofthedeclarantandbeneficiallyownedbyhim)

Date(s)onwhichtheshareswereacquiredbythe

declarant(dd/mm/yyyy)

2.PANoftheAssessee

3.AssessmentYear

(forwhichdeclarationisbeingmade)

13.PIN

InterestonsumsreferredtoinScheduleIII

AreaCode AOType RangeCode

AOType RangeCode

1.NameofAssessee(Declarant)

10.AOCode(underwhomassessedlast

time)

AreaCode

Place:

Date:

Place:

Date:

Notes:

1.

2.

3.

4.

5.

i)

ii)

6.

**SignatureoftheDeclarant

12.Dateofdeclaration,distributionorpaymentofdividend/withdrawalunderthe

NationalSavingsScheme(dd/mm/yyyy)

13.AccountNumberofNationalSavingSchemefromwhichwithdrawalhas

beenmade

8.DateonwhichDeclarationisFurnished

(dd/mm/yyyy)

9.Periodinrespectofwhichthedividendhasbeen

declaredortheincomehasbeenpaid/credited

10.Amountofincomepaid 11.Dateonwhichtheincome

hasbeenpaid/

credited(dd/mm/yyyy)

1.NameofthepersonresponsibleforpayingtheincomereferredtoinColumn22ofPartI

3.CompleteAddress

.

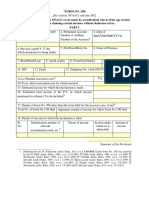

Declaration/Verification

*I/Wedoherebydeclarethattothebestof*my/ourknowledgeandbeliefwhatisstatedaboveiscorrect,completeandistrulystated.*I/We

declarethattheincomesreferredtointhisformarenotincludibleinthetotalincomeofanyotherpersonu/s60to64oftheIncometaxAct,1961.*I/Wefurther,

declarethatthetax*onmy/ourestimatedtotalincome,including*income/incomesreferredtoinColumn22above,computedinaccordancewiththeprovisions

oftheIncometaxAct,1961,forthepreviousyearendingon....................relevanttotheassessmentyear..................willbenil.*I/Wealso,declarethat*my/our

*income/incomesreferredtoinColumn22forthepreviousyearendingon....................relevanttotheassessmentyear..................willnotexceedthemaximum

amountwhichisnotchargeabletoincometax.

SignatureoftheDeclarant

..

..

.

Signatureofthepersonresponsiblefor

payingtheincomereferredtoin

Column22ofPartI

.

6.TelephoneNo.(withSTDCode)andMobileNo.

7.Status

Thedeclarationshouldbefurnishedinduplicate.

Beforesigningthedeclaration/verification,thedeclarantshouldsatisfyhimselfthattheinformationfurnishedinthisformistrue,correctandcompleteinall

respects.Anypersonmakingafalsestatementinthedeclarationshallbeliabletoprosecutionunder277oftheIncometaxAct,1961andonconvictionbe

punishable

[Forusebythepersontowhomthedeclarationisfurnished]

*Deletewhicheverisnotapplicable.

#

Declarationcanbefurnishedbyanindividualundersection197A(1)andaperson(otherthanacompanyorafirm)undersection197A(1A).

Thepersonresponsibleforpayingtheincomereferredtoincolumn22ofPartIshallnotacceptthedeclarationwheretheamountofincomeofthenaturereferred

toinsubsection(1)orsubsection(1A)ofsection197Aortheaggregateoftheamountsofsuchincomecreditedorpaidorlikelytobecreditedorpaidduringthe

previousyearinwhichsuchincomeistobeincludedexceedsthemaximumamountwhichisnotchargeabletotax.";

Inacasewheretaxsoughttobeevadedexceedstwentyfivelakhrupees,withrigorousimprisonmentwhichshallnotbelessthan6monthsbutwhich

mayextendtosevenyearsandwithfine;

Inanyothercase,withrigorousimprisonmentwhichshallnotbelessthan3monthsbutwhichmayextendtotwoyearsandwithfine.

PARTII

2.PANofthepersonindicatedinColumn1ofPartII

4.TANofthepersonindicatedinColumn1ofPartII

ForwardedtotheChiefCommissionerorCommissionerofIncometax

..

5.Email

**IndicatethecapacityinwhichthedeclarationisfurnishedonbehalfofaHUF,AOP,etc.

You might also like

- GST Return Business Process For GSTDocument72 pagesGST Return Business Process For GSTAccounting & Taxation100% (1)

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocument2 pagesArea Code AO Type Range Code AO No.: Signature of The DeclarantRakesh DuttaNo ratings yet

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Document2 pages"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouNo ratings yet

- Form 15g TaxguruDocument3 pagesForm 15g Taxguruulhas_nakasheNo ratings yet

- TAX SAVING Form 15g Revised1 SBTDocument2 pagesTAX SAVING Form 15g Revised1 SBTrkssNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Form 15GDocument3 pagesForm 15Gsriramdutta9No ratings yet

- Icici Form 15GDocument2 pagesIcici Form 15Grajanikant_singhNo ratings yet

- FORM-15G: (Please Tick The Relevant Box)Document4 pagesFORM-15G: (Please Tick The Relevant Box)Kayam BalajiNo ratings yet

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocument3 pages"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanNo ratings yet

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- Form 15G WordDocument2 pagesForm 15G WordAsif NadeemNo ratings yet

- Bonds Form 15gDocument3 pagesBonds Form 15gRishi TNo ratings yet

- "Form No. 15GDocument2 pages"Form No. 15GJayvin ShiluNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Adobe Scan 13 Mar 2021Document1 pageAdobe Scan 13 Mar 2021Pankaj BhamareNo ratings yet

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Document4 pagesIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- New Form 15H For Fixed Deposits Editable in PDFDocument2 pagesNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- 103120000000007845Document3 pages103120000000007845arjunv_14100% (1)

- Form 15H Format 1Document4 pagesForm 15H Format 1ASHISH KININo ratings yet

- Form 15G WordDocument2 pagesForm 15G Wordsagar computerNo ratings yet

- Form 15gDocument4 pagesForm 15gcontactus kannanNo ratings yet

- TourDocument4 pagesTourAnup SahNo ratings yet

- PPC 1H667511110 2018-19 12042019Document3 pagesPPC 1H667511110 2018-19 12042019P PalNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- Form 15 HDocument2 pagesForm 15 Hsingh ramanpreetNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- PF Form 15G PDFDocument1 pagePF Form 15G PDFSorabh BhargavNo ratings yet

- PF Form 15GDocument1 pagePF Form 15GSorabh BhargavNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- Form 15HDocument2 pagesForm 15HNithya SathyaprasathNo ratings yet

- Form 15GDocument3 pagesForm 15GRahul DattoNo ratings yet

- Form 15GDocument4 pagesForm 15GRavi SainiNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- 26q DetailsDocument3 pages26q DetailsAmit TiwariNo ratings yet

- Form 27CDocument2 pagesForm 27Ctulsi22187No ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- Form15g GH02596993Document3 pagesForm15g GH02596993Dhana LakshmiNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- PDFDocument4 pagesPDFushapadminivadivelswamyNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Form Vat-01Document6 pagesForm Vat-01Manish MahajanNo ratings yet

- GST Rate Schedule For Certain Goods 3 June 17Document26 pagesGST Rate Schedule For Certain Goods 3 June 17CharteredAdda.comNo ratings yet

- GST Chapter Wise RateDocument213 pagesGST Chapter Wise RateMoneycontrol News92% (280)

- GST Chapter Wise RateDocument213 pagesGST Chapter Wise RateMoneycontrol News92% (280)

- Eco-System For GST and GST Suvidha ProvidersDocument31 pagesEco-System For GST and GST Suvidha ProvidersAccounting & Taxation76% (17)

- Form ITR-6Document35 pagesForm ITR-6Accounting & TaxationNo ratings yet

- Form Itr-4 SugamDocument9 pagesForm Itr-4 SugamAccounting & TaxationNo ratings yet

- Form ITR-3Document32 pagesForm ITR-3Accounting & Taxation100% (1)

- Jobs Cma Ca MbaDocument5 pagesJobs Cma Ca MbaAccounting & TaxationNo ratings yet

- Rbi Bulletin August 2015Document74 pagesRbi Bulletin August 2015Accounting & Taxation100% (1)

- IMPS FAQsBankers PDFDocument5 pagesIMPS FAQsBankers PDFAccounting & TaxationNo ratings yet

- Tax Liability For The Assessment Years 2014-15 and 2015-16Document11 pagesTax Liability For The Assessment Years 2014-15 and 2015-16Accounting & TaxationNo ratings yet

- Statistical Tables Relating To Banks in India PDFDocument372 pagesStatistical Tables Relating To Banks in India PDFAccounting & TaxationNo ratings yet