Professional Documents

Culture Documents

Inc Tax CIA-2

Inc Tax CIA-2

Uploaded by

jsrrohit0 ratings0% found this document useful (0 votes)

4 views5 pagesd

Original Title

Inc tax CIA-2

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentd

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesInc Tax CIA-2

Inc Tax CIA-2

Uploaded by

jsrrohitd

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 5

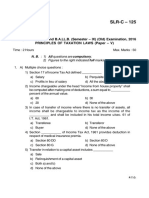

Match the following 5 Marks

Section Amount of exemption

1) 54 G a. Cost of bonds purchased

2) 54EC b. Capital gain x amt invested in Purch of new house

Net sale consideration

3) 54 B c. Cost of land or building acquired

4) 54 d. Cost of agricultural land

5 ) 54 F e. Cost of New residential house

1

Fill in the blanks 5 Marks

1) The cost inflation index for 81-82 and 08-09 is

____________ and _____________.

2) Under section 54 D __________ assessees can claim

exemption

3) Indexed cost of acquisition in case of bonus shares

is___________.

4) Depreciable assets is always treated as___________.

5) Capital gain on shifting of industrial undertaking from

urban to rural area is under sec__________.

True or false 5 Marks

1) Amount deposited in capital gain account scheme is exempt

from tax for a period of two years.

2) Indexed cost of acquisition for assets purchased before 1-4-

81. is cost of the asset of F.M.V which ever is lesser.

3) Transfer of capital assets under gift or will is considered as

transfer.

4) Capital assets should be used more than 36 months to be

treated as long term capital gain.

5) Expenses incurred on purchase is added to indexed cost of

acquisition

Multiple choice question 5 Marks

1)Specified investments means investment in

a. 6.5% Gold bonds c. NHAI and REC

b. National saving certificate d. None of the above

2)Indexed cost of acquisition is nil for

a. Equity shares c. Bonus shares

b. Right shares d. For c and d

3) Asseessee can claim exemption under section 54 F

a. land and building c. Residential house

b. bonds d. For a,b & c

4) Machinery purchased in 03-94 ( CII -244) for Rs. 50,000.

WD.V on 1-4-06 is Rs>35,000. Sold on 31 march 09 for Rs.6,000

The taxable gain is

a. 22,000 c. 30,000

b. 25,000 d. Nil

5)Agricultural land in Mysore situated away from city limits

purchased in 81-82 for Rs.20,000 .Sold on 1 April 09 Rs.3,60,000

The taxable gain is

a. 1,85,000 c. 1,85,400

b. 1,80,000 d. Nil

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Chapter 6 Plant Assets Exercises T3AY2021Document8 pagesChapter 6 Plant Assets Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- TFA - Chapter 36 - Property, Plant and EquipmentDocument9 pagesTFA - Chapter 36 - Property, Plant and EquipmentAsi Cas Jav0% (1)

- Capital Gain: Unit IIIDocument44 pagesCapital Gain: Unit IIIvikas_is_stupidNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 7-Direct TaxationvijaykumartaxNo ratings yet

- 4 Law of TaxationDocument21 pages4 Law of TaxationssNo ratings yet

- Bridge Course Unit 1 AssignmentDocument2 pagesBridge Course Unit 1 AssignmentSrinidhi SrinivasanNo ratings yet

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDocument8 pagesNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNo ratings yet

- Icai Study Material MCQS: Be Chargeable To TaxDocument19 pagesIcai Study Material MCQS: Be Chargeable To TaxMr. indigoNo ratings yet

- One Word NagaDocument10 pagesOne Word NagaWelcome 1995No ratings yet

- Pre TestDocument2 pagesPre TestLaisa BartoloNo ratings yet

- TRB MCQDocument6 pagesTRB MCQDurai ManiNo ratings yet

- P7 Syl2012Document14 pagesP7 Syl2012anjus5sudha5vinu5No ratings yet

- Pearsons Federal Taxation 2019 Comprehensive 32nd Edition Rupert Test BankDocument38 pagesPearsons Federal Taxation 2019 Comprehensive 32nd Edition Rupert Test Bankriaozgas3023100% (16)

- Questions Leb Grou2Document7 pagesQuestions Leb Grou2Rohit VermaNo ratings yet

- 1stF 2nd Yr Intermediate Accounting 1 VerifiedDocument33 pages1stF 2nd Yr Intermediate Accounting 1 VerifiedMika MolinaNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Income Tax - II (2022-23)Document69 pagesIncome Tax - II (2022-23)prasanthpraveen2318No ratings yet

- Tax Planning and Estate BuildingDocument5 pagesTax Planning and Estate BuildingRunita ShahNo ratings yet

- 1107695748model Question Paper (Paper I) by Gopakumar GDocument9 pages1107695748model Question Paper (Paper I) by Gopakumar GSivasankarNo ratings yet

- Midterm (ONLINE) Autumn 2020 - Tayabur - RahmanDocument9 pagesMidterm (ONLINE) Autumn 2020 - Tayabur - RahmanTayabur RahmanNo ratings yet

- Chapter 31Document14 pagesChapter 31Labley100% (2)

- TFA - Chapter 39 - Land, Building and MachineryDocument7 pagesTFA - Chapter 39 - Land, Building and MachineryAsi Cas JavNo ratings yet

- Test 7 Capital GainDocument11 pagesTest 7 Capital GainA & A AssociatesNo ratings yet

- UFRS CH-21-25 ProblemSetDocument30 pagesUFRS CH-21-25 ProblemSetGioNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- BC0044 Accounting and Financial ManagementDocument12 pagesBC0044 Accounting and Financial ManagementSeekEducationNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaNo ratings yet

- اسئلة اقتصادية باللغة الانجليزيةDocument5 pagesاسئلة اقتصادية باللغة الانجليزيةMoun DirNo ratings yet

- Accounts Paper Fy Bcom BAF BMS BBIDocument2 pagesAccounts Paper Fy Bcom BAF BMS BBIAkki GalaNo ratings yet

- Paper7 Set1 AnsDocument21 pagesPaper7 Set1 AnsPranjal BariNo ratings yet

- Chap 010Document9 pagesChap 010Anonymous 7CxwuBUJz3No ratings yet

- Sybcom-Afm MCQDocument20 pagesSybcom-Afm MCQSiddharth VoraNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- 10 Long Lived AssetsDocument7 pages10 Long Lived AssetsPratheep GsNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- Income From Capital GainsDocument13 pagesIncome From Capital GainsPrince RaichandNo ratings yet

- ACC211 Mock Examination1Document11 pagesACC211 Mock Examination1jenayybangNo ratings yet

- Form Vat - IiiDocument4 pagesForm Vat - IiihrsolutionNo ratings yet

- Income Tax Assignment-3Document9 pagesIncome Tax Assignment-3Erohsik KrishNo ratings yet

- Special Order: Quiz 1 Chapter 18Document12 pagesSpecial Order: Quiz 1 Chapter 18Iyang LopezNo ratings yet

- AAOIFI FAS 26 - Quiz (MBL To BIBF)Document3 pagesAAOIFI FAS 26 - Quiz (MBL To BIBF)AL-HAMD GROUP100% (1)

- Homework IIIDocument3 pagesHomework IIIjavesharoraNo ratings yet

- Practice Exam For Final Exam Acct301 With AnswersDocument9 pagesPractice Exam For Final Exam Acct301 With Answersalleighawilliams123No ratings yet

- MQ3 Spr08gDocument10 pagesMQ3 Spr08gjhouvanNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Paper7 Syl22 Dec23 Set2 SolDocument20 pagesPaper7 Syl22 Dec23 Set2 SolAkash AgarwalNo ratings yet

- CH 13Document175 pagesCH 13Love FreddyNo ratings yet

- Answers To Important Questions-Ccs-Mid TermDocument3 pagesAnswers To Important Questions-Ccs-Mid TermDeependra NigamNo ratings yet

- PM Quiz PDFDocument35 pagesPM Quiz PDFChrissieNo ratings yet

- TFA COMPILED (AutoRecovered)Document147 pagesTFA COMPILED (AutoRecovered)Asi Cas JavNo ratings yet

- Finance Management Consolidated MCQsDocument6 pagesFinance Management Consolidated MCQsVikesh MojeedraNo ratings yet

- Accoutancy Sample Paper 2023Document44 pagesAccoutancy Sample Paper 2023Yashabh JosephNo ratings yet

- Practice QuestionsDocument13 pagesPractice Questions925ff2a357No ratings yet

- Acc 603 Test 2 Fall 2011Document7 pagesAcc 603 Test 2 Fall 2011Steph Stevens0% (1)

- HSC SP Paper 2023 MarchDocument4 pagesHSC SP Paper 2023 Marchshaikhjuned1030No ratings yet

- Class-TYBAF Semester - V Subject: Financial Accounting Sem - I (Atkt)Document37 pagesClass-TYBAF Semester - V Subject: Financial Accounting Sem - I (Atkt)Durvank PatilNo ratings yet

- 324 PDFDocument20 pages324 PDFhemaNo ratings yet

- Ifa-I AssDocument3 pagesIfa-I Assnatiman090909No ratings yet

- Networks That Consists of Millions of Private, Public, Academic, Business, and GovernmentDocument2 pagesNetworks That Consists of Millions of Private, Public, Academic, Business, and GovernmentjsrrohitNo ratings yet

- Hank KolbDocument1 pageHank KolbjsrrohitNo ratings yet

- 7 Financial MarketsDocument140 pages7 Financial MarketsLe Thuy Dung100% (1)

- Tire ManufacturingDocument5 pagesTire ManufacturingKaushal SinghNo ratings yet