Professional Documents

Culture Documents

Questions For Walmart

Uploaded by

sagsachdev0 ratings0% found this document useful (0 votes)

8 views1 pagea

Original Title

Questions for Walmart

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageQuestions For Walmart

Uploaded by

sagsachdeva

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Develop a pro forms P&L and Balance Sheet for fiscal year ending 31 Jan 2006.

Additional

assumption:

SG& A 17.3% of anticipated nett sales

Interest on debt 4%

Similar prep aids, other assets, accrued liabilities, deferred tax and minority interest as in 2005.

Determine the intrinsic value of Wal-Mart using the DDM. Assess the value based on three

forms of DDM: the constant growth version, an assessment based on three years of projected

dividend and a projected future stock price, and the three-stage DDM.

Determine the intrinsic value using the P/E approach.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Investment Analysis and Portfolio Management - FinalDocument2 pagesInvestment Analysis and Portfolio Management - FinalsagsachdevNo ratings yet

- Solutions To Discussion Questions and ProblemsDocument39 pagesSolutions To Discussion Questions and Problemssagsachdev80% (10)

- Golaka C Nath FIM Class Schedule Term-IVDocument2 pagesGolaka C Nath FIM Class Schedule Term-IVsagsachdevNo ratings yet

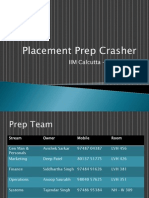

- Prep Crasher 2013Document33 pagesPrep Crasher 2013sagsachdev100% (1)

- QM TutorsDocument1 pageQM TutorssagsachdevNo ratings yet

- B3 BlockDocument41 pagesB3 BlocksagsachdevNo ratings yet

- Time TableDocument3 pagesTime TablesagsachdevNo ratings yet

- RM Quiz E AnsDocument1 pageRM Quiz E AnssagsachdevNo ratings yet

- Education Quality Vs NumbersDocument1 pageEducation Quality Vs NumberssagsachdevNo ratings yet

- Page 29 Solution PDFDocument5 pagesPage 29 Solution PDFsagsachdevNo ratings yet

- Reg No Name Old Total New Total Old Grade New GradeDocument1 pageReg No Name Old Total New Total Old Grade New GradesagsachdevNo ratings yet

- Sample QuestionsDocument2 pagesSample QuestionssagsachdevNo ratings yet

- TG Hermy Adventures PDFDocument3 pagesTG Hermy Adventures PDFsagsachdevNo ratings yet

- Sample Question 2Document1 pageSample Question 2sagsachdevNo ratings yet

- Exam Schedule Term IIDocument1 pageExam Schedule Term IIsagsachdevNo ratings yet

- Strategy Intro PGP 2013 Ses1 2Document0 pagesStrategy Intro PGP 2013 Ses1 2sagsachdevNo ratings yet

- Exam Schedule Term IIDocument1 pageExam Schedule Term IIsagsachdevNo ratings yet

- AEJ - Nomura Fact Sheet 2013Document2 pagesAEJ - Nomura Fact Sheet 2013sagsachdevNo ratings yet

- Guidelines For Mess Bill PaymentDocument2 pagesGuidelines For Mess Bill PaymentsagsachdevNo ratings yet

- Sbi Login Dup PWDDocument2 pagesSbi Login Dup PWDapi-3792961No ratings yet