Professional Documents

Culture Documents

Indian Life Insurance Industry - The Changing Trends: Dr. Arnika Srivastava, Dr. Sarika Tripathi

Indian Life Insurance Industry - The Changing Trends: Dr. Arnika Srivastava, Dr. Sarika Tripathi

Uploaded by

Nithya GopinathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Life Insurance Industry - The Changing Trends: Dr. Arnika Srivastava, Dr. Sarika Tripathi

Indian Life Insurance Industry - The Changing Trends: Dr. Arnika Srivastava, Dr. Sarika Tripathi

Uploaded by

Nithya GopinathCopyright:

Available Formats

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [93]

INDIAN LIFE INSURANCE INDUSTRY

THE CHANGING TRENDS

Dr. Arnika Srivastava,

Assistant Professor

Faculty of Commerce,

Sunbeam College for Women, Varanasi, India

Dr. Sarika Tripathi,

Assistant Professor

Faculty of Commerce

Sunbeam College for Women, Varanasi, India

Dr. Amit Kumar,

Assistant Professor

Faculty of Commerce

Sunbeam College for Women, Varanasi, India

ABSTRACT

Insurance industry contributes to the financial sector of an economy and also provides an

important social security net in developing countries. The growth of the insurance sector in India

has been phenomenal. The insurance industry has undergone a massive change over the last few

years and the metamorphosis has been noteworthy. There are numerous private and government

insurance companies in India that have become synonymous with the term insurance over the

years. Offering a diversified product portfolio and excellent services the many insurance

companies in India have managed to make their way into almost every Indian household.

Keywords: Life Insurance, Substandard, Competitiveness, GDP, Indigenous, Aggressive

Marketing, ULIP, Penetration, Pushed Insurer, Gross Premium.

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [94]

INTRODUCTION:

According to Mr J. Hari Narayan, Chairman of insurance watchdog IRDA, Indian insurance industry in set for

some serious changes. Speaking to students of Institute of Insurance and Risk Management at their graduation

ceremony on Tuesday, Mr Narayan said the Indian insurance industry had matured from its state of childhood to

early adulthood. He said that in countries like UK, the agents have adopted themselves to latest form of

marketing and very soon such changes will also be introduced in India.With an annual growth rate of 15-20%

and the largest number of life insurance policies in force, the potential of the Indian insurance industry is huge.

Total value of the Indian insurance market (2004-05) is estimated at Rs. 450 billion (US$10 billion). According

to government sources, the insurance and banking services contribution to the country's gross domestic product

(GDP) is 7% out of which the gross premium collection forms a significant part. The funds available with the

state-owned Life Insurance Corporation (LIC) for investments are 8% of GDP.

A HISTORICAL REVIEW OF INDIAN INSURANCE INDUSTRY

In 1818, a British company called Oriental Life Insurance setup the first insurance firm in India followed by the

Bombay Assurance Company in 1823 and the Madras Equitable Life

Insurance Society in 1829. Though all this companies were operating in India but insuring the life of European

living in India only. Later some of the companies started providing insurance to Indians with approximately

20% higher premium than Europeans as Indians were treated as substandard. Substandard in insurance

parlance refers to lives with physical disability. Bombay Mutual Life Assurance Society was the first company

established in 1871 which started selling policies to Indians with fair value.

Insurance business was subjected to Indian company act1866, without any specific regulation. In 1905, the

slogan Be Indian-Buy Indian declared by Swadwshi Movement gave birth to dozens of indigenous life

insurance and provident fund companies.

In 1937, the Government of India setup a consultative committee and finally first comprehensive insurance act

was passed in 1938.

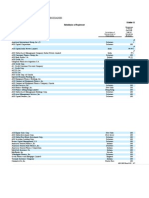

Figure-1

In oct.2000, IRDA (Insurance Regulatory and Development Authority) issued license paper to three companies,

which are HDFC Life Standard, Sundaram Royal Alliance Insurance Company and Reliance General Insurance.

At the same time Principal approval was given to Max New York Life, ICICI Prudential Life Insurance

Company and IFFCO Tokio General Insurance Company. Today total 22 life insurance companies including

one public sector are successfully operating in India. The growth of the sector can easily be judged through

figure-1. According to a study by McKinsey total life insurance market premiums in India is likely to more than

double from the current US$ 40 billion to US$ 80-US$100 billion by 2012.

CHANGING COMPETITIVE ENVIRONMENT:

With the opening of insurance sector in India, the share of private insurer was very less. As shown in table-1,

total share of private insurer was just 2% in 2001-02. It was because of any reason which includes credibility on

private players.

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [95]

TABLE-1: MARKET SHARE OF PUBLIC AND PRIVATE INSURANCE COMPANIES

Insurance sector 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08

Public(LIC) 98 94 87 78 73.66 65.28 59.65

Private 2 6 13 22 26.34 34.72 40.35

Source: Compiled from Insurance annual reports

Figure-2

Graphical representation of table-1

But soon because of innovative & customized products, novel distribution channels, aggressive marketing etc.

private players gave a tough competition to public sector company (LIC). Gradually, the market share of private

insurer went up and till financial year 2007-08, total share of private insurer reached as high as 40.35%.

The market share of LIC decreases after the entry of private insurer but it doesnt mean that the growth of LIC

got down. LIC continue its growth even after a cut throat completion from the private players.

TABLE-2: TOTAL LIFE INSURANCE PREMIUM

(RS. CRORE)

INSURER 2007-08 2006-07 2005-06 2004-05 2003-04 2002-03 2001-02

LIC

149789.99 127822.84 90792.22 75127.29 63533.43 54628.49 49821.91

(17.19) (40.79) (20.85) (18.25) (16.30) (9.65) (42.79)

Private Total

51561.42 28253.00 15083.54 7727.51 3120.33 1119.06 272.55

(82.50) (87.31) (95.19) (147.65) (178.83) (310.59) (4124.31)

Total

(LIC+Private)

201351.41 156075.84 105875.76 82854.80 66653.75 55747.55 50094.46

(29.01) (47.38) (27.78) (24.31) (19.56) (11.28) (43.54)

Note: Figure in bracket indicates the growth over the previous year in percent.

Source: Annual report 007-08 of IRDA

As shown in table-2, total revenue generated in 2007-08 by LIC is 149783.99 crore against just Rs.51561.42

crore, generated by all 21 private players. It shows that even after opening of insurance industry and heavy

competition from the new entrant, LIC observed a continuous growth in its revenue generation.

PRODUCT INNOVATIONS:

In fifties and sixties, the life insurance business was concentrated in urban areas and was confined only to the

higher class of the society. Through the LIC act 1956, the LIC was formed with the capital of 50 million. One of

the basic objectives of setting up the LIC was

to extend the reach of insurance cover and make it available to the lower segment of the society. LIC observed

minimum growth in 1960s and 1970s. This slow growth were caused by the factors like poor infrastructure, low

saving, low investment, high illiteracy etc. however the positive change in industrialization, infrastructure,

capital formation, saving rate resulted in tremendous growth of LIC. Still the penetration of insurance sector

was very low. A key catalyst in the Indian insurance market growth has been the entry of private players in

2000-01. With the entrance of private players and foreign collaborations, penetration of insurance sector in

India has gone up from 1.02% in 1999-00 to 4 % of GDP in 2007-08. Life insurance business in India grew by

14.2 per cent in US Dollar terms in 2007-08.

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [96]

Before entrance of private players, it was observed that only endowment and money back policies were popular

among consumers. But the new, private insurers focused on providing customized products, products that

contain innovative features to the customers created favorable demands for other type of policies like tern

insurance, child plan, pension plans and unit linked insurance policies (ULIPs).

TABLE-3

Years No. of New Products

1956-57 to 1969-70 57

1970-71 to 1979-80 16

1980-81 to 1989-90 22

1990-91 to 1999-00 29

Source: compiled from the annual reports of IRDA

As shown in table-3, total life insurance products introduced in initial 44 years i.e. since the formation of LIC

(1956-57) till the liberalization on life insurance industry, in 2000-01 are around 124 only. But the entry of

private players brought tough completion among insurer and forced all of them to search for customized

insurance products based on the needs of the customers.

Table-4

Company Total new PRODUCTS launched from 2000-to 2009-10

Life Insurance Corporation of India 64

HDFC Standard Life Insurance Co. Ltd. 57

Max New York Life Insurance Co. Ltd. 55

Birla Sun Life Insurance Co. Ltd. 58

Source: compiled from annual reports of IRDA

The result of the same can be seen in table-4, within just 10 years of liberalization of the sector, the insurer like

LIC also introduced 64 new policies in the market. Today a variety of products are available ranging from

traditional to Unit linked providing protection towards child, endowment, capital guarantee, pension and group

solutions.

CHANGING TRENDS IN LIFE INSURANCE POLICY:

Along with the other objectives of insurance like financial security, tax benefits etc. one of the major objectives

is saving and investment. Traditional life insurance policies like endowment were becoming unattractive and

not meeting the aspirations of the policyholders as the policyholder found that the sum assured guaranteed on

maturity had really depreciated in real value because of the depreciation in the value of money. The investor

was no longer content with the so called security of capital provided under a policy of life insurance and started

showing a preference for higher rate of return on his investments as also for capital appreciation. It was,

therefore found necessary for the insurance companies to think of a method whereby the expectation of the

policyholders could be satisfied. The objective of providing a hedge against the inflation through a contract of

insurance pushed insurer to link the insurance policy with market and thus the industry observed the beginning

of Unit linked insurance policy (ULIP).

UNIT LINKED VS NON LINKED INSURANCE PLANS:

There are so many advantages that ULIPs have over traditional policies. Some of them have been described in

table-5.

Table-5

Features ULIPs Traditional Policies

Description

Insurer allows policy holder to direct part

of their premiums into different type of

funds like equity, dept, money market,

hybrid etc. and risk of investment is

borne by policy holder

Insurer takes decision and

usually invests into low risk

return option. insurer also offers

guaranteed maturity proceeds

along with declared bonuses

Flexibility of

investment

Policy allowed choosing their investment

avenues as per their risk profile.

Policy holders are not allowed

to choose their investment

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [97]

avenues

Transparency

Policy holder can track their portfolio.

They are also informed about the value

and number of fund units they hold

Individual can not track their

portfolio.

Maturity benefit

payouts

At the time of maturity, policy holder

redeems the unit collected at the then

prevailing unit prices. Some plan also

offers royalty or additional units

annually or at the time of maturity.

At the time of maturity policy

holder get the sum assured plus

bonuses(if applicable)

Partial withdrawal

Subjected to some condition, policy

holders are allowed to withdraw from

their fund.

Policy holders are not allowed

to withdraw part of their funds.

Instead, some policy provides

facility of loan against the

investment.

Switching options Available(with some charges) Not available

Charges structures Charges are specified under various heads Charges are not specified

Single premium top up Allowed Not allowed

Source: Compiled from Various Sources

The flexibility, transparency, liquidity and fund options available with ULIPs made it the preferred choice of

customers and gradually it changed the trend of insurance policy. This fact can easily be seen in table -6

showing recent three years trends in sale of ULIPs and traditional policies.

Table-6

Unit Linked Business (%) Non-linked Business (%)

2005-06 2006-07 2007-08 2005-06 2006-07 2007-08

Private 82.3 88.75 90.33 17.7 11.25 9.67

LIC 29.76 46.31 62.31 70.24 53.69 37.69

Industry 41.77 56.91 70.3 58.23 43.09 29.7

Source: compiled from the annual reports of IRDA

Figure-3

Graphical representation of table-6

As shown in table-3, the share of ULIPs increased from 82.3 % in 2005-06 to 90.33% in 2007-08 as far as

private insurer are concern. LIC too showed a tactical shift towards promoting linked products and soon the

share of ULIPs rose from just 29.76% in 2005-06 to 62.37% in 2007-08

TABLE-7: ULIPS PLAN COMPARISON CHART

Company Plans Entry Age Term Maturity Age

Aviva Life Saver Plus Minimum- 0 years Maximum- 60 years 10-30 years 18-75 years

ICICI Prudential Life Stage RP Minimum- 0 years Maximum- 65 years 10-75 years 19-75 years

Kotak Smart Advantage Minimum- 0 years Maximum- 65 years 10-30 years NA

LIC Money Plus Minimum- 0 years Maximum- 65 years 05-30 years 18-75 years

Max New York Life Life Maker Platinum Minimum- 12 years Maximum- 60 years 10-58 years 70 years

Met Life Met Smart Premier-RP Minimum- 91 Days Maximum- 70 years NA 100 years

Source:http:///www.bimadeals.com/life-insurance-india

-Journal of Arts, Science & Commerce E-ISSN 2229-4686 ISSN 2231-4172

International Refereed Research Journal w ww ww w. .r re es se ea ar rc ch he er rs sw wo or rl ld d. .c co om m Vol. III, Issue 2(3), April 2012 [98]

In order to encash the favorable environment for ULIPs, All the players in the industry are offering innovative

and customized ULIPs with respect to entry age of the customer, term of the policy, maturity age etc. to get

edge over others. Table -7 depicts the comparison chart of ULIPs plan launched by some major player of the

industry.

CONCLUSION:

Where almost all the industries in the world trying hard for survival due to the major economic meltdown,

Indian life insurance industry is one of the sectors that is still observing good growth. It is the changing trends

of Indian insurance industry only that has made it to cope with the changing economic environment. Indian

insurance industry has modified itself with the passage of time by introducing customized products based on

customers need, through innovative distribution channels, Indian life insurance industry searched its path to

grow. Changing government policy and guideline of the regulatory authority, IRDA have also played a very

vital role in the growth of the sector. Move from non-linked to unit liked insurance policies is one of the major

positive changes in Indian life insurance sector. Similarly, opening on the sector for private insurer broke the

monopoly of LIC and bring in a tough competition among the players. This completion resulted into

innovations in products, pricing, distribution channels, and marketing in the industry. Though the sector is

growing fast, the industry has not yet insured even 50% of insurable population of India. Thus the sector has a

great potential to grow. To achieve this objective, this sector requires more improvement in the insurance

density and insurance penetration. Development of products including special group policies to cater to

different categories should be a priority, especially in rural areas. The life insurers should conduct more

extensive market research before introducing insurance products targeted at specific segments of the population

so that insurance can become more meaningful and affordable. By adopting appropriate strategy along with

proper government support and able guidance of IRDA, India will certainly become the new insurance giant in

near future.

REFERENCE:

[1] Annual report of IRDA, 2003-04, 2004-05, 2005-06, 2006-07, 2007-08.

[2] Annual report of LIC, 2003-04, 2004-05, 2005-06, 2006-07, 2007-08.

[3] Article, An Analysis of the Evolution of Insurance in India by Tapen Sinha, ING Chair Professor,

Instituto Tecnologico Autonomo de Mexico and Special Professor, University of Nottingham.

[4] Bimaquest- Vol VIII, Issue I, pages 51-55

[5] Insurance bill-2000, Govt. of India, October 2000.p.26

[6] N JANARDHAN RAO, INDIA An emerging superpower house, published by ICFAI Press.

[7] www.irdaindia.org

[8] www.bimadeals.com/life-insurance-india

[9] www.insuringindia.com

[10] www.nasscom.in

[11] www.economictimes.com

[12] www.irdaindia.org

[13] www.indiatoday.com

----

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chartered Accountancy Scheme SyllabusDocument105 pagesChartered Accountancy Scheme SyllabusSaket SwarnkarNo ratings yet

- UPSC Civil Services Exam SyllabusDocument231 pagesUPSC Civil Services Exam Syllabusvssridhar99100% (1)

- Samsung Work SheetDocument4 pagesSamsung Work SheetSaket SwarnkarNo ratings yet

- Global Insurance TrendsDocument32 pagesGlobal Insurance TrendsDemian DanielNo ratings yet

- BootsDocument8 pagesBootsSaket SwarnkarNo ratings yet

- Channel ManagementDocument6 pagesChannel ManagementSaket SwarnkarNo ratings yet

- Walmart Case Study - TYDocument8 pagesWalmart Case Study - TYSaket SwarnkarNo ratings yet

- Corporation Digested Cases 1-18Document29 pagesCorporation Digested Cases 1-18Roli Sitjar ArangoteNo ratings yet

- Claim FormDocument4 pagesClaim Formdharani633No ratings yet

- Premier: A Medical Insurance Plan For Senior CitizensDocument8 pagesPremier: A Medical Insurance Plan For Senior CitizensStefNo ratings yet

- Original 1489564280 Chapter 6 Quota Share TreatiesDocument12 pagesOriginal 1489564280 Chapter 6 Quota Share TreatiesmakeshwaranNo ratings yet

- Annx-1 Colly - 30-03-2015Document320 pagesAnnx-1 Colly - 30-03-2015Neeraj JhaNo ratings yet

- STAR HEALTH - Senior-Citizen-Red-Carpet-BrochureDocument7 pagesSTAR HEALTH - Senior-Citizen-Red-Carpet-BrochureTam AwNo ratings yet

- Ethiopian Maritime Code PDFDocument95 pagesEthiopian Maritime Code PDFYared AbebeNo ratings yet

- United States - Industry Reports (NAICS)Document13 pagesUnited States - Industry Reports (NAICS)Amir JungkookNo ratings yet

- SMChap 006Document66 pagesSMChap 006testbank100% (1)

- View LetterDocument5 pagesView LetterAaróm KumNo ratings yet

- American International Group Inc and SubsidiariesDocument14 pagesAmerican International Group Inc and SubsidiariesFOXBusiness.com50% (2)

- Health Insurance COMPANYDocument6 pagesHealth Insurance COMPANYWajid MalikNo ratings yet

- Statements of Estimated Annual Operating Results ExampleDocument9 pagesStatements of Estimated Annual Operating Results ExampleAnna Bella SatyaNo ratings yet

- 2014 The Institutes Full CatalogDocument36 pages2014 The Institutes Full CatalogbbarooahNo ratings yet

- Life Insurance Corporation of IndiaDocument10 pagesLife Insurance Corporation of IndiaroyjohnnyNo ratings yet

- Sale Agreement Between City of Kalamazoo and Developers For Lot 2Document29 pagesSale Agreement Between City of Kalamazoo and Developers For Lot 2Malachi BarrettNo ratings yet

- 95 Teses de LuteroDocument236 pages95 Teses de LuteroRoney RondonNo ratings yet

- ICAG Paper 3 - Advance AuditingDocument57 pagesICAG Paper 3 - Advance AuditingScott MensahNo ratings yet

- University of The CordillerasDocument6 pagesUniversity of The CordillerasBrix Chags100% (1)

- IC - 67 Marine InsuranceDocument23 pagesIC - 67 Marine InsuranceMahendra Kumar YogiNo ratings yet

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Document4 pagesBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988aldinNo ratings yet

- GIM RulesDocument15 pagesGIM RulesvithaninNo ratings yet

- QC-3654 Guaranteed Wealth Plan Brochure - V5a - 1Document19 pagesQC-3654 Guaranteed Wealth Plan Brochure - V5a - 1202032053 imtnagNo ratings yet

- Case Study Double Banking Operation: Shipping Operations CourseDocument69 pagesCase Study Double Banking Operation: Shipping Operations CoursePapitas Fritas100% (1)

- Chapter 2 NotesDocument10 pagesChapter 2 Notesthete.ashishNo ratings yet

- Final - Bad Faith SurveyDocument134 pagesFinal - Bad Faith SurveyJohnNo ratings yet

- Distribution Strategies in Rural MarketsDocument7 pagesDistribution Strategies in Rural Marketsmadhuri_amol75% (4)

- Discount BrandsDocument12 pagesDiscount BrandsMirela IancuNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument10 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- STO Ship Management CaseDocument20 pagesSTO Ship Management Casepradyum kumarNo ratings yet