Professional Documents

Culture Documents

Trusts Reviewer

Trusts Reviewer

Uploaded by

alfx216Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trusts Reviewer

Trusts Reviewer

Uploaded by

alfx216Copyright:

Available Formats

Roan Salanga Trusts Page 1 of 8

BUSINESS TRUSTS

Nature and Classification of Trusts

I. Definition and Essential Characteristic of Trust

1440. A person who establishes a trust is called the trustor; one in

whom confidence is reposed as regards property for the benefit of

another person is known as the trustee; and the person for whose

benefit the trust has been created is referred to as the beneficiary.

Trustlegal relationship between one person having an

equitable ownership in property and another person owing the

legal title to such property, the equitable ownership of the

former entitling him to the performance of certain duties and

the exercise of certain powers by the latter

Characteristics of a trust or express trust: (Morales v. CA)

a. It is a relationship

b. It is a relationship of a fiduciary character

c. It is a relationship with respect to property, not one involving

merely personal duties

d. It involves the existence of equitable duties imposed upon the

holder of the title to the property to deal with it for the benefit

of another

e. It arises as a result of a manifestation of intention to create the

relationship

1. Based on Equity

1442. The principles of the general law of trusts, insofar as they are

not in conflict with this Code, the Code of Commerce, the Rules of

Court and Special laws are hereby adopted.

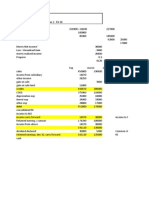

2. Distinguished from Agency

Agency Trust

Fiduciary in nature

Essentially revocable Essentially obligatory in its terms

and period and can only be

rescinded based on breach of trust

Agent possesses property

under agency for and in the

name of the owner

Trustee takes legal or naked title to

the subject matter of trust

Agent must act upon

instructions of the owner

Trustee acts on his own business

discretion

Agent enters into contract in

the name of the principal

Trustee enters into contracts in his

own name

Agent cannot be sued Trustee is liable directly and may be

sued in his trust capacity

II. Kinds of Trust

1441. Trusts are either express or implied. Express trusts are created

by the intention of the trustor or of the parties. Implied trusts come

into being by operation of law.

A. Express Trusts

1. Essence and Definition of Express Trusts

Express trustone created by the intention of the trustor or

of the parties (Art. 1441)

o Those created by direct and positive acts of the parties, by

some writing or deed or will or by words evidencing an

intention to create a trust

Essential Characteristics of Express Trusts

a. Nominate and Principalfor having been given particular

name and essentially defined by the Civil Code, and not

needing another contract to be valid and binding

b. Unilateralonly the trustee assumes obligations to carry

on the trust for the benefit of the beneficiary

c. Primarily gratuitoussupported by the consideration of

liberality, especially when Art. 1446 provides that

beneficiarys acceptance is presumed

d. Realan express trusts constitute a real contract, that is, it

is not merely perfected by a mere meeting of minds

between the trustor and trustee to constitute a trust.

Indeed, no trust relationship exists, until and unless, the

property constituting the res is conveyed to the trustee.

e. Preparatorynot constituted for its own sake in that the

trust relationship is essentially a medium established by

the trustor to allow full authority and discretion on the

party of the trustee to enter into various juridical acts on

Roan Salanga Trusts Page 2 of 8

the corpus to earn income or achieve other goals given for

the benefit of the beneficiary

o An express trust may create a form of contract pour atrui

f. Fiduciary

a) Essentially Contractual in Nature; Need No Particular

Wordings

1444. No particular words are required for the creation of an

express trust, it being sufficient that a trust is clearly intended.

What important is whether the trustor manifested an

intention to create the kind of relationship which in law is

known as trust. (Julio v. Dalandan)

A clear intention to create trust must be shown, and the

proof of fiduciary relationship must be clear and

convincing. (Canezo v. Rojas)

b) Based on Property Relationship

What distinguishes a trust from other relations is the

separation of legal title and equitable ownership of the

property. In a trust relation, legal title is vested in the

fiduciary while equitable ownership is vested in a cestui

que trust (Canezo)

Trust, in its technical sense, is a right of property, real or

personal, held by one party for the benefit of another. (Guy

v. CA)

c) Fiduciary

The juridical concept of a trust, which in a broad sense

involves, arises from, or is the result of, a fiduciary relation

between the trustee and the cestui que trust as regards

certain propertyreal, personal, funds or money, or

choses in actionmust not be confused with an action for

specific performance. A trustee cannot invoke the statute

of limitations to bar the action and defeat the rights of the

cestuis que trustent. (Pacheco v. Arro)

2. Express Trust must be Proven

An express trust cannot be proven by parol evidence.

A trust must be proven by clear, satisfactory, and convincing

evidence. It cannot rest on vague and uncertain evidence or

on loose, equivocal or indefinite declarations.

Rule: the burden of proving the existence of a trust is on the

party asserting its existence

The presence of the following elements must be proved:

a) a trustor or settler who executes the instrument creating

the trust

b) a trustee, who is the person expressly designated to carry

out the trust

c) the trust res, constituting of duly identified and definite

real properties

d) the cestui que trust, or beneficiaries whose identity must

be clear

3. Kinds of Express Trust

A. Express Trust involving Immovable

1443. No express trusts concerning an immovable or any

interest therein may be proved by parol evidence.

The existence of express trusts concerning real property

may not be established by parol evidence; thus, it must be

proven by some writing or deed

o However, if the parties to the action, during the trial,

make no objection to the admissibility of the oral

evidence to support the contract, there is deemed to be

a waiver

The requirement that express trust over immovable must

be in writing should be added as being governed by the

Statute of Frauds (Gamboa v. Gamboa)

B. Contractual/Inter vivos Trust

An inter vivos trusts are expressed trust pursued in the

form of donation, and which therefore become solemn

contracts which must comply with the solemnities

mandated by the Law on Donations

Roan Salanga Trusts Page 3 of 8

C. Testamentary Trust

When an express trust is created under the terms of the

last will and testament of the testator, it is a testamentary

trust and is governed by the Law on Succession

o Unless the will conforms with the solemnities and

conditions set by law, it will be void together with the

testamentary trust sought to be created therein

A testamentary trust was created by a provision in the will

whereby the testator proposed to create trust for the

benefit of a secondary school to be established in the town

of Tayabas, naming as trustee the ayutamiento of the town

or if there be none, then the civil governor of the Province

of Tayabas. (Govt of the Phil. Islands v. Abadilla)

D. Pension or Retirement Trusts

Publicly-regulated trusts would be those where the State

provides the vehicle by which institutions are allowed to

administer large funds for the benefit of the public. Among

such funds created under the law would be the pension

and benefits funds administered by the GSIS, the SSS and

the Pag-Ibig Fund. Tax laws provide for incentives to the

setting-up of retirement funds for employees. All such

funds are really being administered for the beneficiaries

thereof through the medium of trust.

E. Charitable Trusts

4. Parties to an Express Trust

a) Trustora person who establishes a trust (Art. 1440)

b) Trusteeone in whom confidence is reposed as regards

property for the benefit of another person (Art. 1440)

i. Trustee must have legal capacity to accept the trust

ii. Failure of Trustee to Assume the Position

1445. No trust shall fail because the trustee appointed declines

the designation, unless the contrary should appear in the

instrument constituting the trust.

In case of refusal to accept the trust by the trustee, the

court will appoint a trustee

But, if the appointment of the trustee is a material

provision, the trustor can provide that a refusal of the

trustee to accept the trust shall result in the failure or

nullification of the same

iii. Obligations of the Trustee (Rule 98 of Rules of Court)

Sec. 1. Where trustee appointed. - A trustee necessary to carry

into effect the provisions of a will or written instrument shall

be appointed by the Court of First Instance in which the will

was allowed if it be a will allowed in the Philippines, otherwise

by the Court of First Instance of the province in which the

property, or some portion thereof, affected by the trust is

situated.

Sec. 2. Appointment and powers of trustee under will;

Executor of former trustee need not administer trust. - If a

testator has omitted in his will to appoint a trustee in the

Philippines, and if such appointment is necessary to carry into

effect the provisions of the will, the proper Court of First

Instance may, after notice to all persons interested, appoint a

trustee who shall have the same rights, powers, and duties,

and in whom the estate shall vest, as if he had been appointed

by the testator. No person succeeding to a trust as executor or

administrator of a former trustee shall be required to accept

such trust.

Sec. 3. Appointment and powers of new trustee under written

instrument. - When a trustee under a written instrument

declines, resigns, dies, or is removed before the objects of the

trust are accomplished, and no adequate provision is made in

such instrument for supplying the vacancy, the proper Court

of First Instance may, after due notice to all persons

interested, appoint a new trustee to act alone or jointly with

the others, as the case may be. Such new trustee shall have

and exercise the same powers, rights, and duties as if he had

been originally appointed, and the trust estate shall vest in him

in like manner as it had vested or would have vested, in the

trustee in whose place he is substituted; and the court may

order such conveyance to be made by the former trustee or

his representatives, or by the other remaining trustees, as may

Roan Salanga Trusts Page 4 of 8

be necessary or proper to vest the trust estate in the new

trustee, either alone or jointly with the others.

Sec. 5. Trustee must file bond. Before entering on the duties

of his trust, a trustee shall file with the clerk of the court

having jurisdiction of the trust a bond in the amount fixed by

the judge of said court, payable to the Government of the

Philippines and sufficient and available for the protection of

any party in interest, and a trustee who neglects to file such

bond shall be considered to have declined or resigned the

trust; but the court may until further order exempt a trustee

under a will from giving a bond when the testator has directed

or requested such exemption, and may so exempt any trustee

when all persons beneficially interested in the trust, being of

full age, request the exemption. Such exemption may be

cancelled by the court at any time and the trustee required to

forthwith file a bond.

Sec. 6. Conditions included in bond. - The following

conditions shall be deemed to be a part of the bond whether

written therein or not:

(a) That the trustee will make and return to the court, at such

time as it may order, a true inventory of all the real and

personal estate belonging to him as trustee, which at the time

of the making of such inventory shall have come to his

possession or knowledge;

(b) That he will manage and dispose of all such estate, and

faithfully discharge his trust in relation thereto, according to

law and the will of the testator or the provisions of the

instrument or order under which he is appointed;

(c) That he will render upon oath at least once a year until his

trust is fulfilled, unless he is excused therefrom in any year by

the court, a true account of the property in his hands and of

the management and disposition thereof, and will render such

other accounts as the court may order;

(d) That at the expiration of his trust he will settle his accounts

in court and pay over and deliver all the estate remaining in

his hands, or due from him on such settlement, to the person

or persons entitled thereto.

But when the trustee is appointed as a successor to a prior

trustee, the court may dispense with the making and return of

an inventory, if one has already been filed, and in such case

the condition of the bond shall be deemed to be altered

accordingly.

iv. Generally, trustee does not assume personal liability on the

trust as to properties outside the trust estate

When the transaction at hand could have been entered

into by a trustee either as such or in its individual

capacity, then it must be clearly indicated that the

liabilities arising therefrom shall be chargeable to the

trust estate, otherwise they are due from the trustee in

his personal capacity (Senguan v. Phil. Trust Co.)

v. Trustee generally entitled to receive a fair compensation

for his services

Under Section 7 of Rule 98 of the Rules of Court, if the

compensation of the trustee is not determined in the

instrument creating the trust, his compensation shall be

fixed by the court that appointed him.

c) Beneficiarythe person for whose benefit the trust has been

created (Art. 1440)

In regard to private trusts, it is not always necessary that

the cestui que trust should be named, or even be in esse at

the time the trust is created in his favor (Abadilla)

Acceptance by beneficiary of gratuitous trust is not subject

to the rules for the formalities of donations

d) The Corpus or the Res

The subject matter of the trust

5. How Express Trust Terminated

A. Destruction of the Corpus

When the entire trust estate is loss or destroyed, the trust

is extinguished since the underlying proprietary basis no

longer exists to warrant any legal relationship between the

trustee and the beneficiary.

Roan Salanga Trusts Page 5 of 8

B. Revocation by the Trustor

In a revocable express trust, the trustee may simply invoke

the revocation or termination clause found in the deed of

trust thereby revoking the trust and conveying notice

thereof to the trustee. Unless there is reserved power to

revoke, the general rule is that an express trust is

irrevocable.

C. Achievement of Objective, or Happening of the Condition

Provided for in the Trust Instrument

When the trust instrument provides the objective or the

condition upon which the trust shall be extinguished, say

when the trust instrument provides that full ownership in

the trust properties shall be consolidated in the person of

the beneficiary once he reaches the age of majority, the

happening of the condition shall terminate the trust

D. Confusion or Merger of Legal Title and Beneficial Title in the

Same Person

When the trustee of an existing trust becomes the

beneficiary thereof, or vice versa, the trust relation is ipso

jure extinguished, for it is difficult to see how a person can

owe fiduciary duties to himself.

E. Breach of Trust

When a trustee breaches his duty of loyalty, it would

constitute legal basis by which to terminate the trust

o This operates as a renunciation of the trust and the

persons interested as beneficiaries in the property are

entitled to maintain an action to declare their right and

remove the unfaithful trustee.

F. Upon the Death of Trustee

Unless otherwise expressly stipulated in the trust

instrument, the death, civil interdiction, insanity or

insolvency of the trustee does not necessarily terminate

the trust but a new trustee will be appointed

o The reason why a trust does not fail for want of a trustee

is that to permit it to fail for this reason would be

contrary to the intention of the trustor in creating the

trust. The trustor is primarily interested in the disposition

of the beneficial interest in the property, and the matter

of its administration is a subsidiary consideration.

(Tolentino, at p. 676.)

A trust terminates upon the death of the trustee where the

trust is personal to the trustee in the sense that the trustor

intended no other person to administer it

o After Crispulos death, the respondent had no right to

retain possession of the property. At such point, a

constructive trust would be created over the property by

operation of law

o Where one mistakenly retains property which rightfully

belongs to another, a constructive trust is the proper

remedial devise to correct the situation

G. Generally Express Trusts Not Susceptible to Prescription

When there exists an express trust, prescription and laches

will run only from the time the express trust is repudiated

The rule requires a clear repudiation of the trust duly

communicated to the beneficiary

For acquisitive prescription to bar the action of the

beneficiary against the trustee, in an express trust, for the

recovery of the property, it must be shown that:

a) Trustee has performed unequivocal acts of repudiation

amounting to an ouster of the cestui que trust

b) Such positive acts of repudiation have been made known

to the cestui qui trust

c) Evidence thereon is clear and conclusive

III. Implied Trusts

1. Listing of Implied Trusts Not Exclusive; Founded on Equity

1447. The enumeration of the following cases of implied trust does

not exclude other established by the general law of trust, but the

limitation laid down in Art. 1442 shall be applicable.

Implied trustsfrom the facts and circumstances of a given

case, the existence of a trust relationship is inferred in order to

Roan Salanga Trusts Page 6 of 8

effect the presumed intention of the parties or to satisfy the

demands of justice or to protect against fraud

o Those which are deducible from the nature of the

transactions as matters of intent, or which are superinduced

on the transaction by operation of law as matters of equity,

independently of the particular intention of the parties

a) Resulting Trusts

A trust which is raised or created by the act or construction

of law

A trust raised by implication of law and presumed always to

have been contemplated by the parties, the intention as to

which is to be found in the nature of their transaction, but

not expressed in the deed or instrument of conveyance

Based on the equitable doctrine that valuable consideration

and not legal title determines the equitable title or interest

and are presumed always to have been contemplated by the

parties

b) Constructive Trusts

A trust raised by construction of law, or arising by operation

of law

A trust not created by any words, either expressly or

impliedly evincing a direct intention to create a trust, but by

the construction of equity in order to satisfy the demands of

justice

A constructive trust is not a trust in technical sense

There is neither promise nor fiduciary relations

o The so-called trustee does not recognize any trust and has

no intent to hold the property for the beneficiary

Otherwise known as a trust ex maleficio, a trust ex delicto, a

trust de son tort, an involuntary trust, or an implied trust

A trust by operation of law which arises contract to intention

and in invitum, against on who, by fraud, actual or

constructive, by duress or abuse of confidence, by

commission of wrong, or by any form of unconscionable

conduct, artifice, concealment, or questionable means, or

who in any way against equity and good conscience, either

has obtained or holds the legal right to property which he

ought not, in equity and good conscience, hold and enjoy

Constructive trusts are fictions of equity that the courts use

as devices to remedy any situation in which the holder of the

legal title may not, in good conscience, retain the beneficial

interest

c) Distinction between Resulting and Constructive Trust

Resulting Trust Constructive Trust

Based on equitable doctrine

that valuable consideration,

and not legal title, determines

the equitable title or interest

Created by the construction of

equity in order to satisfy the

demands of justice and

prevent unjust enrichment

Presumed always to have been

contemplated by the parties

Arise contrary to intention

against who [in bad faith]

ought to hold the legal right to

property

d) How to Prove Implied Trust

Must be proven by clear, satisfactory and convincing

evidence, and cannot rest on vague and uncertain evidence

or on loose, equivocal or indefinite declarations

May be proven by oral evidence, but the evidence must be

trustworthy and received by the courts with extreme

caution, and should not be made to rest on loose, equivocal

or indefinite declarations

e) Distinguished from Quasi-Contracts

Both embody the principle of equity above strict legalism

2. Purchase of Property where Beneficial Title in One Person, but

Price Paid by Another Person

1448. There is an implied trust when property is sold, and the legal

estate is granted to one party but the price is paid by another for the

purpose of having the beneficial interest of the property. The

former is the trustee, while the latter is the beneficiary. However, if

the person to whom the title is conveyed is a child, legitimate or

illegitimate, of the one paying the price of the sale, no trust is

Roan Salanga Trusts Page 7 of 8

implied by law, it being disputably presumed that there is a gift in

favor of the child.

Rationale: one who pays for something usually does so for his

own benefit

3. Purchase of Property where Title is Placed in the Name of Person

who Loaned the Purchase Price

1450. if the price of a sale of property is loaned or paid by one

person for the benefit of another and the conveyance is made to the

lender or payor to secure the payment of the debt, a trust arises by

operation of law in favor of the person to whom the money is

loaned or for whom it is paid. The latter may redeem the property

and compel a conveyance thereof to him.

It is only after the beneficiary reimburses the trustee of the

purchase price that the former can compel conveyance of the

property from the latter

4. When Absolute Conveyance of Property Effected only as Means

to Secure Performance of Obligation of the GrantorEquitable

Mortgage

1454. If an absolute conveyance of property is made in order to

secure the performance of an obligation of the grantor toward the

grantee, a trust by virtue of law is established. If the fulfillment of

the obligation is offered by the grantor when it becomes due, he

may demand the reconveyance of the property to him.

5. Two or More Persons Purchase Property Jointly, but Places Title

in One of Them

1452. If two or more persons agree to purchase property and by

common consent the legal title is taken in the name of one of them

for the benefit of all, a trust is created by force of law in favor of the

others in proportion to the interest of each.

6. Property Conveyed to Person Merely as Holder thereof

1453. When property is conveyed to a person in reliance upon his

declared intention to hold it for, or transfer it to another or the

grantor; there is an implied trust in favor of the person whose

benefit is contemplated.

Under this, the implied trust is enforceable even when the

agreement is not in writing

This article applies if the person conveying the property did not

expressly state that he was establishing the trust but such is

the intention

7. Donation of Property to a Donee who shall have No Beneficial

Title

1449. There is also an implied trust when a donation is made to a

person but it appears that although the legal estate is transmitted to

the donee, he nevertheless is either to have no beneficial interest or

only a part thereof.

8. Land Passes by Succession but Heir Places Title in a Trustee

1451. When land passes by succession to any person and he causes

the legal title to be put in the name of another, a trust is established

by implication of law for the benefit of the true owner.

9. When Trust Fund Used to Purchase Property which is Registered

in Trustees Name

1455. When any trustee, guardian or other person holding a

fiduciary relationship uses trust funds for the purchase of property

and causes the conveyance to be made to him or to a third person, a

trust is established by operation of law in favor of the person to

whom the funds belong.

10. When Property is Acquired through Mistake or Fraud

1456. If property is acquired through mistake or fraud, the person

obtaining it is, by force of law, considered a trustee of an implied

trust for the benefit of the person from whom the property comes.

When a person through fraud succeeds in registering the

property in his name, the law creates what is called a

constructive or implied trust in favor of the defrauded party

and grants the latter the right to recover the property

fraudulently registered within a period of 10 years (Heirs of

Patiwayon v. Martinez)

o The period reckoned from the issuance of the adverse title to

the property which operates as a constructive notice

Public policy demands that a person guilty of fraud or, at least,

of breach of trust, should not be allowed to use a Torrens title

as a shield against the consequences of his wrongdoing

Roan Salanga Trusts Page 8 of 8

11. Does Implied Trust Prescribe or may it be Defeated by Laches

The prescriptive period of 10 years for an action of

reconveyance applies only if there is an actual need to

reconvey the property as when the plaintiff is not in possession

thereof

o Point of reference is the date of registration of the deed or

the date of the issuance of the certificate of title of the

property provided that the property has not been acquired

by an innocent purchaser for value

When plaintiff is in possession of the subject property, the

action, being in effect that of quieting of title to the property,

does not prescribe

Prescription cannot apply when title of Trustee is Void due to

Forgery

In constructive trusts, prescription may supervene even if the

trustee does not repudiate the relationship

o Repudiation of the said trust is not a condition precedent to

the running of the prescriptive period

Close relationship and Continued recognition of Trust

relationship

o The doctrine of laches is not to be applied mechanically as

between the near relatives which would tend to excuse what

otherwise may be considered a long delay in taking action

o Moreover, continued recognition of the existence of the

trust precludes the defense of laches

Though the Statute of Limitations does not run between the

trustee and cestui que trust as long as the trust relations

subsist, it does run between the trust and third persons

Prescription cannot apply against a Minor Beneficiary in

Implied Trust

You might also like

- Partnership Agency and Trust Reviewer AKDDocument69 pagesPartnership Agency and Trust Reviewer AKDKringle Lim - Dansal94% (35)

- Agency ReviewerDocument20 pagesAgency ReviewerJingJing Romero92% (74)

- Election Law Reviewer (Exam)Document17 pagesElection Law Reviewer (Exam)roansalanga100% (11)

- UST Golden Notes 2011 - Partnership and Agency PDFDocument42 pagesUST Golden Notes 2011 - Partnership and Agency PDFVenus Leilani Villanueva-Granado100% (11)

- CLV - Law On TrustsDocument52 pagesCLV - Law On TrustsBless Carpena100% (6)

- San Beda PartnershipDocument32 pagesSan Beda PartnershipLenard Trinidad79% (14)

- Contemporary ConstructionDocument1 pageContemporary Constructionroansalanga100% (2)

- De Leon ReviewerDocument6 pagesDe Leon ReviewerRom56% (9)

- AgPart 925 - Trust DigestDocument40 pagesAgPart 925 - Trust Digestcezar delailani89% (9)

- Agency, Trust and Partnership Green NotesDocument50 pagesAgency, Trust and Partnership Green NotesNewCovenantChurch96% (26)

- Partnership Agency TrustDocument58 pagesPartnership Agency TrustThea Baltazar100% (6)

- Agency Reviewer (Villanueva)Document73 pagesAgency Reviewer (Villanueva)iam560100% (2)

- Atp ReviewerDocument56 pagesAtp ReviewerJohnCarrasco100% (2)

- Bar Exam Questions For Trust and AgencyDocument8 pagesBar Exam Questions For Trust and AgencyMoon BeamsNo ratings yet

- Bill of Rights Reviewer FullDocument31 pagesBill of Rights Reviewer Fullroansalanga100% (22)

- Guaranty and SuretyshipDocument14 pagesGuaranty and Suretyshiproansalanga100% (1)

- Preaching For Piketty: Taxing The Wealthy in The Aftermath of Tax AmnestyDocument27 pagesPreaching For Piketty: Taxing The Wealthy in The Aftermath of Tax AmnestyAndreas Rossi DewantaraNo ratings yet

- Reviewer TrustDocument4 pagesReviewer TrustJoshuaGomez100% (4)

- Principles Law On TrustsDocument3 pagesPrinciples Law On TrustsAnthony Yap100% (1)

- TrustsDocument7 pagesTrustsredenbidedNo ratings yet

- Trust Reviewer 2Document14 pagesTrust Reviewer 2Alfred IlaganNo ratings yet

- Law On Trust - Notes-LectureDocument17 pagesLaw On Trust - Notes-LectureAmicus Curiae100% (1)

- Trusts ARTICLE 1440Document15 pagesTrusts ARTICLE 1440Jv Fermin100% (1)

- Trust Memory AidDocument8 pagesTrust Memory AidCeCe EmNo ratings yet

- TRUSTS PresentationDocument47 pagesTRUSTS Presentationnegotiator100% (1)

- TrustDocument8 pagesTrustelmersgluethebombNo ratings yet

- Law On Trust ReviewerDocument7 pagesLaw On Trust ReviewerMigoy DA100% (2)

- Trusts ReviewerDocument6 pagesTrusts ReviewerRuth Hazel Galang100% (1)

- ATP - Art. 1404-1457Document7 pagesATP - Art. 1404-1457Migoy DANo ratings yet

- Trust NotesDocument3 pagesTrust NotesEunice Nicee100% (1)

- Roa, Jr. vs. Court of AppealsDocument1 pageRoa, Jr. vs. Court of AppealsPio Guieb AguilarNo ratings yet

- Agency ReviewerDocument20 pagesAgency ReviewerDiannee Romano100% (1)

- Agency v. TrustDocument1 pageAgency v. Trustaudy33% (3)

- Philippine Law On TrustsDocument3 pagesPhilippine Law On TrustsKayeNo ratings yet

- Agency and Trust ReviewerDocument66 pagesAgency and Trust ReviewerWaldemar Johasan100% (3)

- Notes On Partnership and AgencyDocument148 pagesNotes On Partnership and Agencyonlineonrandomdays100% (5)

- Agency Bar Reviewer 2019 by Atty. Jose Cochingyan, IIIDocument34 pagesAgency Bar Reviewer 2019 by Atty. Jose Cochingyan, III刘王钟100% (2)

- Agency, Trust and Partnership ReviewerDocument14 pagesAgency, Trust and Partnership ReviewerMhai NievesNo ratings yet

- de Leon ReviewerDocument6 pagesde Leon ReviewerJelay QuilatanNo ratings yet

- Modes of Extinguishment of AgencyDocument6 pagesModes of Extinguishment of AgencyDan Abania100% (2)

- Review Notes For Law On AgencyDocument11 pagesReview Notes For Law On AgencyJanetGraceDalisayFabreroNo ratings yet

- Partnership, Agency and TrustDocument33 pagesPartnership, Agency and TrustMitch Rapp100% (5)

- Agency ReviewerDocument25 pagesAgency ReviewerJacob Go100% (3)

- Salao v. Salao, G.R. No. L-26699Document3 pagesSalao v. Salao, G.R. No. L-26699amareia yapNo ratings yet

- Partnership Case Digest Compilation PDFDocument12 pagesPartnership Case Digest Compilation PDFTonifranz Sareno0% (1)

- Litton Vs Hill and Ceron (DIGEST)Document2 pagesLitton Vs Hill and Ceron (DIGEST)ckarla80100% (1)

- Reviewer AgencyDocument16 pagesReviewer Agencyfermo ii ramos100% (3)

- Aguila V Ca DigestDocument1 pageAguila V Ca Digestralph louie salanoNo ratings yet

- Trust ReviewerDocument5 pagesTrust ReviewerJaime Alfonso AloriaNo ratings yet

- All About TrustsDocument8 pagesAll About TrustsJaysonmaleroNo ratings yet

- Notes On TrustDocument12 pagesNotes On TrustRoy Samuel HalasanNo ratings yet

- Pat Reviewer4Document7 pagesPat Reviewer4Princess Montañano SantiagoNo ratings yet

- TRUSTEEDocument11 pagesTRUSTEEHermay BanarioNo ratings yet

- Partnership Report On Trust Final (Written Report)Document13 pagesPartnership Report On Trust Final (Written Report)Carlo AlvarezNo ratings yet

- Trustees 1Document10 pagesTrustees 1Anonymous NDFncPENo ratings yet

- Trust Cases DigestDocument17 pagesTrust Cases DigestJasmine Rey QuintoNo ratings yet

- TrustDocument4 pagesTrusteldene tampicoNo ratings yet

- Report On TrustDocument16 pagesReport On TrustMarianne SerranoNo ratings yet

- Trusts Review NotesDocument2 pagesTrusts Review NotesignorantlaineyNo ratings yet

- Trust ReviewerDocument4 pagesTrust ReviewerFaustine Mata100% (1)

- Cases Doctrines AgencyDocument6 pagesCases Doctrines AgencyShery Ann ContadoNo ratings yet

- Trusts FinalDocument64 pagesTrusts FinalJCapskyNo ratings yet

- Chapter 2 Express TrustsDocument9 pagesChapter 2 Express TrustsAj0% (1)

- Of The Trust: Express TrustsDocument6 pagesOf The Trust: Express TrustsJoyce Fe Egsaen MagannonNo ratings yet

- Report On TrustDocument18 pagesReport On TrustReyrey DalisayNo ratings yet

- Public OfficersDocument37 pagesPublic Officersroansalanga100% (2)

- Election Law (Recit Reviewer)Document53 pagesElection Law (Recit Reviewer)roansalangaNo ratings yet

- Civil ProcedureDocument59 pagesCivil ProcedureroansalangaNo ratings yet

- Bernas PIL Ch1-9Document20 pagesBernas PIL Ch1-9roansalanga100% (1)

- Bernas PIL Ch1-9Document20 pagesBernas PIL Ch1-9roansalanga100% (1)

- Chapter 5-7 PIL Bernas BookDocument7 pagesChapter 5-7 PIL Bernas BookroansalangaNo ratings yet

- Classification of PropertyDocument6 pagesClassification of Propertyroansalanga100% (1)

- PIL Chapters 1-4Document5 pagesPIL Chapters 1-4roansalangaNo ratings yet

- Island of Palmas Case Facts:: Public International Law Page - 1Document11 pagesIsland of Palmas Case Facts:: Public International Law Page - 1roansalangaNo ratings yet

- Mcrae TreatyDocument3 pagesMcrae TreatyroansalangaNo ratings yet

- Family Code ReviewerDocument65 pagesFamily Code Reviewerroansalanga96% (23)

- PrescriptionDocument11 pagesPrescriptionroansalanga100% (3)

- Preliminary Title Date of Effectiveness and Application: CulpaDocument50 pagesPreliminary Title Date of Effectiveness and Application: Culparoansalanga100% (1)

- Oblicon ReviewerDocument90 pagesOblicon Reviewerroansalanga100% (2)

- Pledge and AntichresisDocument6 pagesPledge and AntichresisroansalangaNo ratings yet

- Sales ReviewerDocument53 pagesSales ReviewerroansalangaNo ratings yet

- Criminal Law II NotesDocument75 pagesCriminal Law II NotesroansalangaNo ratings yet

- Citizenship ReviewerDocument4 pagesCitizenship Reviewerroansalanga100% (2)

- Republic Act No. 386 An Act To Ordain and Institute The Civil Code of The Philippines Preliminary Title Effect and Application of LawsDocument142 pagesRepublic Act No. 386 An Act To Ordain and Institute The Civil Code of The Philippines Preliminary Title Effect and Application of LawsroansalangaNo ratings yet

- Power: Case Concerning The Barcelona Traction, Light and Company, Limited (Second Phase)Document3 pagesPower: Case Concerning The Barcelona Traction, Light and Company, Limited (Second Phase)KIMMYNo ratings yet

- Tugasl Akl 6-36Document13 pagesTugasl Akl 6-36Nabilla SekarsariNo ratings yet

- Topic 1.1 Nature and Necessity of FinanceDocument2 pagesTopic 1.1 Nature and Necessity of Financedhon lloyd albia100% (1)

- By RpadDocument2 pagesBy RpadManjunath Boppineni100% (1)

- Aksharam Educational Foundation - Brochure 2010 v2Document2 pagesAksharam Educational Foundation - Brochure 2010 v2R Praveen KumarNo ratings yet

- Agency ReviewerDocument21 pagesAgency ReviewerJon Jamora100% (3)

- Salary & Employment Forecast: Opinions You Can Count OnDocument21 pagesSalary & Employment Forecast: Opinions You Can Count OnArjun SharmaNo ratings yet

- Question (Apr 2012)Document49 pagesQuestion (Apr 2012)Monirul IslamNo ratings yet

- Lim vs. Florencio SabanDocument2 pagesLim vs. Florencio SabanRoche Dale100% (2)

- Mortgage AccountsDocument16 pagesMortgage Accountsvasanth kumarNo ratings yet

- Ratio Analysis of Fauji FertilizerDocument6 pagesRatio Analysis of Fauji FertilizersharonulyssesNo ratings yet

- Business Loan AgreementDocument4 pagesBusiness Loan Agreementel Capitan2606100% (1)

- Local Government UnitsDocument14 pagesLocal Government UnitsJennybabe PetaNo ratings yet

- OroquietaCityWD2015 Audit ReportDocument70 pagesOroquietaCityWD2015 Audit ReportVoltaire M. BernalNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIRamzan AliNo ratings yet

- Land TutorialDocument11 pagesLand TutorialChaw Zen0% (1)

- MCQ Banking and InsuranceDocument36 pagesMCQ Banking and InsuranceDeepa BhatiaNo ratings yet

- Basic Orientation On CBTAPDocument41 pagesBasic Orientation On CBTAPJoy villeranNo ratings yet

- 2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169Document5 pages2pagsibigan v. CA 221 SCRA 202 GR 90169 04071993 G.R. No. 90169sensya na pogi langNo ratings yet

- Accounting 2Document4 pagesAccounting 2Jocelyn Delacruz50% (2)

- CBLM Prepare Trial BalanceDocument17 pagesCBLM Prepare Trial BalanceBranny Ortega60% (5)

- DBP v. Guarina Corp.Document18 pagesDBP v. Guarina Corp.Juris FormaranNo ratings yet

- Credit Card Enrollment FormDocument2 pagesCredit Card Enrollment FormcenonNo ratings yet

- Chapter 5 - Simple InterestDocument34 pagesChapter 5 - Simple InterestKian GaboroNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesFinancial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsArpit BhawsarNo ratings yet

- FX Declaration Format From BorrowerDocument3 pagesFX Declaration Format From BorrowerJanani Parameswaran67% (3)

- The Uniform Chart of AccountsDocument137 pagesThe Uniform Chart of AccountsElzein Amir ElzeinNo ratings yet

- State V Nationwide Title Clearing No 12CH03602 02 Feb 2012Document29 pagesState V Nationwide Title Clearing No 12CH03602 02 Feb 2012William A. Roper Jr.No ratings yet

- Azeem 1Document67 pagesAzeem 1TanveerNo ratings yet

- Ranka RespondentDocument29 pagesRanka RespondentAnonymous 1m3YOSIA3lNo ratings yet