Professional Documents

Culture Documents

Testimony - Robert Rusten, CAO

Uploaded by

Philip Tortora0 ratings0% found this document useful (0 votes)

244 views18 pagesTestimony by Robert Rusten, Burlington’s chief administrative officer (CAO)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTestimony by Robert Rusten, Burlington’s chief administrative officer (CAO)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

244 views18 pagesTestimony - Robert Rusten, CAO

Uploaded by

Philip TortoraTestimony by Robert Rusten, Burlington’s chief administrative officer (CAO)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

STATE OF VERMONT

PUBLIC SERVICE BOARD

Petition of City of Burlington d/b/a Burlington

Telecom, for a certificate of public good to

operate a cable television system in the City of

Burlington, Vermont

)

)

)

)

Docket No. 7044

PREFILED TESTIMONY OF

ROBERT RUSTEN ON BEHALF OF

THE CITY OF BURLINGTON

March 28, 2014

Mr. Rusten is the City of Burlingtons Chief Administrative Officer. Mr. Rustens

testimony will describe the Citys current financial status relative to Burlington Telecom and its

plans for addressing Burlington Telecoms financial situation, the Citibank Settlement and the

importance of the Bridge Lease Financing. Mr. Rusten will also address the expected benefit to

Burlingtons credit rating of the settlement and resolution of the CPG violations in this

proceeding.

TABLE OF CONTENTS

1. Introduction ........................................................................................................................... 1

2. The Citys Current Financial Status Relative to Burlington Telecom ............................. 3

3. The Citibank Settlement and Bridge Lease Will Benefit the City and City Taxpayers . 9

EXHIBITS

Exhibit Petitioner RR-1 Citibank Settlement

Exhibit Petitioner RR-2 City Council Resolution Approving Citibank Settlement

Exhibit Petitioner RR-3 Citibank Complaint

Exhibit Petitioner RR-4 Moodys Rating Update (March 9, 2010)

Exhibit Petitioner RR-5 Moodys Rating Update (January 7, 2011)

Exhibit Petitioner RR-6 Moodys Rating Update (September 16, 2011)

Exhibit Petitioner RR-7 Moodys Rating Action (June 20, 2012)

Exhibit Petitioner RR-8 Chart of BT Borrowing Costs

Exhibit Petitioner RR-9 City Council Resolution Approving Bridge Financing

STATE OF VERMONT

PUBLIC SERVICE BOARD

Petition of City of Burlington d/b/a Burlington

Telecom, for a certificate of public good to

operate a cable television system in the City of

Burlington, Vermont

)

)

)

)

Docket No. 7044

PREFILED TESTIMONY OF

ROBERT RUSTEN ON BEHALF OF

THE CITY OF BURLINGTON

1. Introduction 1

Q1. Please state your name, occupation and business address. 2

A1. My name is Robert Rusten. In May, 2013 I was appointed Chief Administrative Officer 3

(CAO) of the City of Burlington, Vermont (Burlington or the City) by Mayor 4

Miro Weinberger. My business address is City Hall, 149 Church Street, Burlington, 5

Vermont 05401. Prior to becoming Burlingtons Chief Administrative Officer, I was the 6

deputy City Manager for the City of South Burlington. I also served for approximately 7

four years as the Town Manager for Wilmington, Vermont. Previously I served for 10 8

years in the Vermont House of Representatives, with the last six on the Ways and Means 9

Committee. One area of focus was in rewriting the States Education Finance Law, Act 10

60, the result of which was the enactment of Act 68. 11

12

Q2. Please describe the duties of the Chief Administrative Officer. 13

A2. The duties of the Chief Administrative Officer are set forth in the Charter for the City of 14

Burlington. As the Chief Administrative Officer, I am responsible for the same duties as 15

provided by state law for town clerks and for town treasurers. As part of my duties, I am 16

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 2 of 16

responsible for making payments of City obligations, bonded indebtedness, payroll and 1

managing the retirement benefits of City employees. The City Charter also provides that 2

the Chief Administrative officer is responsible for pledging the credit of the City for 3

bonded indebtedness when authorized or directed by the City Council. 4

5

Q3. What is the purpose of your testimony? 6

A3. I describe the Citys current financial situation relative to Burlington Telecom, the 7

Mediated Settlement Agreement (the Citibank Settlement) executed in Citibank v. City 8

of Burlington et al., Docket No. 2:11-cv-214 (D. Vt.) (the Citibank Action) generally, 9

and the importance of the bridge lease financing with Raymond C. Pecor, III (the Bridge 10

Lease Financing) to accomplish the settlement and restructure Burlington Telecoms 11

debt, attract an investor, and maximize repayment of general fund monies to the City. A 12

copy of the Citibank Settlement Agreement is attached as Exhibit Pet. RR-1. A copy of 13

the City Council Resolution Approving the Citibank Settlement Agreement is attached as 14

Exhibit Pet. RR-2. A copy of the Complaint filed by Citibank in the Citibank Action is 15

attached as Exhibit Pet. RR-3. I also address the Citys credit rating, the risk posed by 16

not moving forward with the Citibank Settlement and Bridge Lease Financing, and the 17

expected benefit to Burlingtons credit rating of the settlement and resolution of the CPG 18

violations in this proceeding. 19

20

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 3 of 16

1

2. The Citys Current Financial Status Relative to Burlington Telecom 2

Q4. In your role as the Citys Chief Administrative Officer, do you participate in the issuance 3

of Burlingtons general obligation bonds and other forms of debt? 4

A4. Yes. Since becoming Burlingtons CAO, I, along with Assistant CAO for Finance 5

Richard Goodwin, have regularly worked on the issuance of Burlingtons general 6

obligations bonds, along with the issuance of bonds for the electric department, the 7

wastewater department, and the airport. I have also worked on the issuance of a number 8

of other short term borrowings. 9

10

Q5. Do you regularly review credit ratings assigned to Burlingtons general obligations bonds 11

and other forms of debt? 12

A5. Yes. 13

14

Q6. In your previous work, did you regularly get involved with the issuance of debt and the 15

credit ratings assigned to various obligations and bonds? 16

A6. Yes, in regards to the issuance of debt. As both the deputy City Manager for South 17

Burlington and the Town Manager for Wilmington, Vermont, I was regularly involved in 18

the issuance of debt. I am familiar with the process of bond ratings from Moodys 19

Investor Services Inc. and other credit rating firms. 20

21

Q7. What is the Citys current credit rating for its long term general obligation bonds? 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 4 of 16

A7. Currently, Moodys has assigned the City of Burlingtons long term general obligation 1

bonds a rating of Baa3 with a negative outlook. 2

3

Q8. How does Moodys rate Burlingtons bonds? 4

A8. At the request of, and upon application for, a rating of a general bond issuance, Moodys 5

will review financial information submitted by Burlington and develop a rating based on 6

Moodys standard rating system. Sometimes, representatives of Moodys may visit 7

Burlington. The financial information considered includes, among other things, tax rates, 8

property values, economic conditions, liquidity, budgets and the Citys financial 9

statements along with pending or potential litigation against Burlington. Moodys will 10

often follow an application for a rating with additional specific questions about the status 11

of an important litigation or ask a question about an issue arising from Burlingtons 12

financial statements. Once Moodys has the information it believes is sufficient, it will 13

issue a credit rating for a specific obligation. Moodys will also update that rating based 14

upon changes in facts and circumstances. 15

16

Q9. What does a rating of Baa3 mean? 17

A9. Moodys publishes its ratings criteria for both long-term and short-term scales. As stated 18

by Moodys, these are forward-looking opinions of the relative credit risks of financial 19

obligations. For outstanding long term obligation bonds, like the type Burlington 20

typically issues, Moodys has different rating levels on a scale with Aaa being the highest 21

quality credit and C being the lowest. Moodys may assign a numerical modifier 1, 2, or 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 5 of 16

3 to each generic rating classification from Aa through Caa. The modifier 1 indicates 1

that the obligation ranks in the higher end of its generic rating category; the modifier 2 2

indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of 3

that generic rating category. 4

5

On this scale Aaa to Baa3 are listed as investment grade. Baa3 is the lowest 6

investment grade rating. Moodys states that Baa3 ratings present a moderate long term 7

credit risk with certain speculative elements. Ratings below Baa3 are considered 8

speculative grade or junk bond status. 9

10

Q10. What does the negative assigned to the rating mean? 11

A10. Moodys may assign an outlook to a particular rating. There are four basic outlooks: 12

positive, negative, stable and developing. The Moodys outlook indicates the expected 13

direction of a credit rating in the medium term. A negative outlook indicates that 14

Moodys expects the credit rating to decline in the medium term. Burlingtons current 15

outlook is negative. If Moodys outlook were correct, Burlingtons credit rating would 16

decline into the speculative ratings. 17

18

Q11. How does the rating assigned by Moodys impact the Citys financial position? 19

A11. Our bond rating has serious implications beyond BT it impacts the entire City and City 20

Schools. The City of Burlington has current statutory authority, without the need for 21

additional voter approval, to issue $7,000,000 annually in long term general obligation 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 6 of 16

debt. Of that amount, $2,000,000 is for capital projects for the Citys schools, $3,000,000 1

is for the Burlington Electric Departments capital projects, and $2,000,000 is for 2

Burlington General Funds capital projects. Over the past few years, Burlington has 3

issued the maximum amount allowed by the City Charter. 4

5

When issuing debt obligations, generally speaking, an entity with a higher credit rating 6

will pay a lower rate of interest for a similar obligation with the same maturity, security 7

and terms than one with a lower credit rating. My experience in the last sale by 8

Burlington of general obligation bonds suggests that if Burlingtons bond rating were to 9

fall below investment grade, a large pool of potential institutional purchasers would be 10

prohibited from purchasing Burlingtons bonds based on the investment guidelines such 11

institutional investors are required to follow (i.e., they can only purchase investment 12

grade bonds). 13

14

Q12. What was the Citys credit rating before Citibank filed its lawsuit? 15

A12. In March of 2010, after Burlington indicated that it would not be making lease payments 16

to Citibank and was expected to not appropriate funds to make lease payments for fiscal 17

year 2011, Moodys downgraded Burlington from an Aa3 to an A2 rating. (Exhibit Pet. 18

RR-4). In January 2011, Moodys downgraded Burlington to an A3 rating, which 19

Moodys affirmed after Citibank filed suit in September 2011. (Exhibits Pet. RR-5, 6). 20

In 2012, Burlington was downgraded to the current Baa3 level. At that time, the outlook 21

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 7 of 16

was revised to negative based on uncertainty surrounding the outcome of the Citibank 1

Action and repayment of the loan to BT. (Exhibits Pet. RR-7). 2

3

Q13. What steps has Burlington taken since 2010 to ensure that City funds are not used to fund 4

Burlington Telecom? 5

A13. In the fall of 2010, the City opened a Burlington Telecom segregated depository account 6

into which all Burlington Telecom revenues are directly deposited. (Burlington Telecom 7

bills its customers on a monthly basis for all services.) The use of a depository account 8

for Burlington Telecom was a departure from past practice. Prior to establishing the 9

Burlington Telecom depository account, all revenues from Burlington Telecom were 10

deposited in the General Fund Main Operating Account. 11

12

It is now Burlingtons policy that all Enterprise Funds including the Airport, Water, 13

Wastewater, Burlington Electric, and Burlington Telecom have segregated depository 14

accounts. With the exception of Burlington Electric Department, Burlington currently 15

issues all checks for payroll, payables, and capital expenditures for Enterprise Funds such 16

as Burlington Telecom from the General Fund Main Operating Account. On a monthly 17

basis, Burlington then makes whole the General Fund Main Operating Account by 18

transferring from the segregated depository accounts the amount paid on their behalf 19

from the General Fund Main Operating Account. This process ensures that all expenses 20

incurred by Burlington Telecom, and paid by the Citys main operating account, are 21

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 8 of 16

reimbursed within 60 days or less. This timely payment of expenses and reimbursement 1

to the City is in compliance with Condition 60. 2

3

As discussed in Mr. Dormans testimony, under the Bridge Lease Financing, a new 4

segregated operating account will be established at Merchants Bank. At that time, all 5

Burlington Telecom operating expenses will be paid directly from the Merchants Bank 6

Burlington Telecom operating account and will no longer be paid from the Citys General 7

Fund Main Operating Account. This is an important step towards Burlington Telecom 8

operating on as close to a stand-alone basis as possible. 9

10

Q14. Please confirm that since October 2010, BT has had sufficient revenue to cover all 11

operating expenses of the system. 12

A14. Yes, since October 2010, Burlington Telecom has had enough revenue to cover its 13

expenses. 14

15

Q15. Please confirm that since December 2010, Burlington Telecom has reimbursed the City 16

within two months of the Citys expenditure for any expenses incurred or payments made 17

by the City in support of services that Burlington Telecom provides to non-City entities. 18

A15. Yes, since at least December 2010, Burlington has complied with this requirement in 19

Condition 60 of the CPG by reimbursing the Citys General Fund Main Operating 20

Account for any expenses paid by the City since October 2010 in support of services that 21

BT provides to non-City entities. 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 9 of 16

1

Q16. Will any General Fund revenue be used in connection with the Citibank Settlement? 2

A16. It is likely that some General Fund revenue will be used to make certain payments in 3

connection with the Citibank Settlement. The use of such funds will not be for 4

Burlington Telecom operating expenses but will instead be for settlement purposes and 5

for minimizing the losses of, and consequences for, the City and its taxpayers related to 6

the past financial management of Burlington Telecom. (See Hearing Officers Report on 7

BTs Motion for Dec. Ruling Regarding Certain Payments, 7044 Nov. 8, 2011 and Board 8

Discussion and Order, Nov, 23, 2011). The City will supplement this testimony. 9

10

3. The Citibank Settlement and Bridge Lease Will Benefit the City and City 11

Taxpayers 12

Q17. Please explain how the Citibank Settlement and the bridge financing are expected to 13

impact the Citys bond rating and its short and long term financial situation. 14

A17. For the past three years, Burlington has worked diligently to restore Burlington Telecom 15

to a positive cash flow, restructure its financial position and locate potential investors and 16

resolve the outstanding Citibank Action and CPG violations found by the Board in this 17

docket. The Administrations long-stated BT goals have been to: 18

Protect taxpayers from further BT-related losses; 19

Maintain BT service for its more than 4,000 customers; 20

Preserve BT as a telecommunications competitor to maintain affordable Internet, 21

cable, and telephone services for Burlington residents, businesses, and most 22

importantly safety services provided by the police and fire departments; 23

Restore Burlingtons credit rating; and 24

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 10 of 16

Secure, if possible, the opportunity for recovery of a portion of the $16.9 million 1

spent by the City prior to 2010. 2

3

With the Citibank Settlement, the $33.5 million Citibank Action will be dismissed in 4

exchange for a $10.5 million settlement payment to Citibank. Of that amount, 5

$1,468,915 has been paid by McNeil, Leddy & Sheahan, the Citys co-defendant in the 6

Citibank Action, and/or its insurance carrier. Burlingtons share of the $10.5 million 7

settlement amount is $9,031,085 consisting of the $6 million Bridge Lease Financing, 8

$1.3 million of which may be in the form of a participation in the bridge financing or a 9

direct payment from Burlington, and other payments from BT revenue discussed in 10

paragraph 4 of the Citibank Settlement (Exhibit Pet. RR-1) and in detail in Mr. Dormans 11

testimony. A copy of the City Resolution Approving the Bridge Financing from 12

Raymond C. Pecor, III is attached as Exhibit Pet. RR-9. 13

14

The Citibank Settlement also contemplates that the $6 million bridge financing will be a 15

bridge to an eventual arms-length sale of Burlington Telecom to a private entity. 16

17

Q18. How is this settlement path expected to impact the Citys bond rating status? 18

A18. There are indications that a resolution of the Citibank lawsuit, and the development of a 19

path forward to resolve the issues pending before this Board, would be viewed favorably 20

by Moodys. In its March 9, 2010 Rating Update, Moodys noted that future rating 21

action will depend on the citys ability to produce a viable plan to place the 22

telecommunications system on a more sustainable path and provide additional detail on 23

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 11 of 16

the prospects for the system to meet its obligations, including repayment of the interfund 1

loan. (Exhibit Pet. RR-4 at 2). In its 2012 downgrade, Moodys listed the Citibank 2

lawsuit and the potential exposure to a judgment as a risk. 3

4

Specifically, in the downgrade to Baa3 Moodys wrote: 5

On September 2, 2011, Citibank filed a lawsuit against the city following the non- 6

appropriation and subsequent termination of the BT lease. While the impact of 7

this lawsuit on the citys General Fund is unclear, given the current regulatory 8

environment and city charter provisions, Moodys expects that any obligation 9

borne by the General Fund may adversely affect the citys credit profile. 10

Additionally, the lawsuit is likely to hamper any plans by the city to formulate a 11

viable long-term solution for the telecommunications and the repayment of funds 12

owed to its pooled cash account. 13

14

(Exhibit Pet. RR-7 at 1). 15

16

Moodys also listed three challenges facing Burlington: (1) potential exposure of the 17

general fund to any judgment or settlement resulting from the recent lawsuit (2) long- 18

term viability of BT which would ultimately result in the repayment of funds, and (3) 19

operating deficits in the Citys water and wastewater funds resulting on additional drains 20

on pooled cash. (Id.) It should be noted that the water and wastewater fund deficits were 21

eliminated as of June 30, 2013. 22

23

Moodys expressly stated that the credit rating would go up if Burlington (1) reduced or 24

eliminated the amount due from BT to the pooled cash account, (2) prevailed in the 25

Citibank lawsuit, (3) significantly reduced enterprise fund exposure to the General Fund 26

and reduced reliance on pooled cash, and (4) reduced reliance on short-term cash flow 27

instruments. (Id. at 4). 28

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 12 of 16

1

The implementation of the Citibank Settlement Agreement and the Bridge Lease 2

Financing effectively address the first two issues. Together, they present the only viable 3

plan available to reduce the amount due from to Burlington from BT by ensuring that BT 4

may be sold to a private entity. A future sale of BT will also preclude any future risk to 5

the taxpayers from BT. Furthermore, the Citibank Settlement eliminates the threat that 6

Burlington could be found liable and face a significant financial judgment in court. It 7

further ensures that BT will remain a viable entity and allow the City to recover some of 8

the money spent on BT. This has been an issue for Moodys as well. 9

10

I also note that Burlington has worked hard over the past few years to address the other 11

weaknesses cited by Moodys. As reflected in Mr. Barracloughs testimony, BT has been 12

managed to a positive cash flow position since October 2010. Moreover, the segregated 13

operating account that will be established under the new Bridge Lease Financing 14

eliminates the practice of Burlington making payments for BT out of its General Fund 15

Operating Account. Following the closing, all BT operating expenses will be paid 16

directly from a new segregated operating account at Merchants Bank. 17

18

Q19. Would an improved credit rating provide a financial benefit to Burlington? 19

A19: Yes. A stronger credit rating means that Burlington would have a lower rate of interest 20

when it issues general obligation bonds than it currently has. Given the capital needs of 21

the schools, the electric department, and other City departments, an improved credit 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 13 of 16

rating should result in lower borrowing costs to the City. For example, a change from a 1

Baa3 credit rating to an A credit rating would result in, under current estimates, a 1.7% in 2

lower interest rate. (Exhibit Pet. RR-8). 3

4

Q20. Can you quantify the savings to Burlington, in dollars, if Moodys were to upgrade 5

Burlingtons credit rating based upon resolution of the Citibank lawsuit and CPG 6

violations? 7

A20. Yes. As you can see from the chart created by Asstistnat CAO Goodwin and attached as 8

Exhibit Pet. RR-8 to my testimony, as the credit rating improves, the true interest cost on 9

the borrowing decreases. At a Baa3 with a negative outlook, debt is issued with a 10

5.7485% interest rate. The annual debt service on that debt is $608,731 and the total 11

interest cost is about $4.6MM. If the credit rating were to approve to A3, we estimate the 12

interest rate would drop to 4.0157% and Burlington would save over $1.5MM over the 13

course of the debt in true interest costs over the life of the financing. 14

15

Q21. Does the Baa3 credit rating affect other borrowings for the City? 16

A21. Yes, Burlington has had in the past annual short term borrowings for working capital. 17

Primarily, Burlington has borrowed money for working capital in advance of the 18

collection of tax revenues. Moodys credit ratings also affect the interest Burlington pays 19

on these short term borrowings in the same way it affects the long term borrowing 20

interest rates. So an improved credit rating could reduce the interest expense on short 21

term borrowing as well. 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 14 of 16

1

One short term borrowing mechanism the City uses is a line of credit (LOC). Our current 2

LOC for our tax anticipation borrowings calls for an increase of 4% as a default rate if 3

the Burlingtons credit rating were to fall below the Baa3 rating. That is, Burlington is to 4

maintain at least an investment grade rating. If Burlington drops below that rate, the 5

lender could declare Burlington to be in default. It should be noted that our current rate 6

on our LOC is less than 2.5%. 7

8

Q22. Would there be other savings to Burlington, in dollars, if Moodys were to upgrade 9

Burlingtons credit rating upon resolution of the Citibank lawsuit? 10

A22. Yes. Burlington has voter approval for approximately $6.05 million in borrowing for 11

waterfront north and bike path improvements as part of a Tax Increment Financing 12

Project along the Citys waterfront. Burlington has not yet issued such bonds. In 13

addition, the City voters recently voted to approve an addition $9.6 million in additional 14

bonded debt for waterfront improvements with the Burlington Tax Increment Financing 15

District. A stronger credit rating will result in lower interest rates when Burlington seeks 16

to incur such indebtedness. Furthermore, as a requirements of our bond covenants, we 17

must communicate to bond holders any change in our ratings made by our credit rating 18

agencies within 30 days. 19

20

Moreover, Burlington is analyzing its current outstanding bonds seeking ways to lower 21

our debt service. If the credit rating were to improve, Burlington may seek to refinance 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 15 of 16

some of its outstanding bonds to lower its debt service costs. Such a refinancing involves 1

issuing long term refunding bonds to pay off the higher interest rate bonds. The interest 2

rates that would be set for such refunding bonds are determined, among other things such 3

as market conditions, on the credit rating for the refunding bonds. A stronger credit 4

rating should equate to lower interest rates. These are all benefits that will flow to the 5

City and its taxpayers through the reduced debt service payments. An improved credit 6

rating is an important element to help achieve such savings. 7

8

Q23. Does Moodys indicate what would happen to Burlingtons credit rating if Burlington 9

were to face an adverse judgment in the Citibank lawsuit? 10

A23. Yes. Moodys reports are concerned about the impact an adverse judgment would have 11

on Burlingtons financial position. As Moodys previously explained any obligation 12

[related to BT] borne by the General Fund may adversely affect the citys credit profile. 13

Any monetary judgment against Burlington related to BT may have to be paid from the 14

general fund of Burlington. Thus, if Burlington were to receive an adverse judgment, 15

Moodys would likely downgrade Burlingtons credit from investment grade to 16

speculative. 17

18

Q24. Please explain the significance of the Citys request that the Board find that Burlington 19

has cured all past CPG violations. 20

A24. It is the Citys position that a finding that it has cured all past CPG violations is critical to 21

its ability to direct a sale of the system. There is a significant risk that potential buyers 22

Docket No. 7044

Prefiled Testimony of Robert Rusten

March 28, 2014

Page 16 of 16

will be reluctant to purchase a system with ongoing CPG violations. Furthermore, it is 1

important that the City be able to report to potential lenders for other City borrowings 2

that there are no ongoing violations of any permits within the City. 3

4

Both the Citys credit rating and lenders analysis of the Citys financial stability will 5

impact the interest rates the City is offered. If Moodys and lenders believe that not all 6

past CPG violations have been cured this will likely either increase the interest rates 7

being offered and/or limit the number of lenders making such offers. Additionally, due to 8

the Citys past financial history any indication that we are still in violation will likely 9

impact the Citys economic development potential, lessen our ability to attract capital, 10

and impact our ability to attract high quality employees. 11

You might also like

- Woolf: Vermont Median Family Income Jan 2016Document1 pageWoolf: Vermont Median Family Income Jan 2016Philip TortoraNo ratings yet

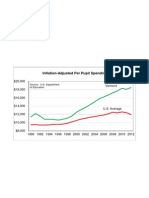

- Woolf: Inflation-Adjusted Spending Per Vermont PupilDocument1 pageWoolf: Inflation-Adjusted Spending Per Vermont PupilPhilip TortoraNo ratings yet

- Woolf: Vermont Gasoline and Fuel Oil PricesDocument1 pageWoolf: Vermont Gasoline and Fuel Oil PricesPhilip TortoraNo ratings yet

- Affidavit: United States vs. Mark McLoudDocument9 pagesAffidavit: United States vs. Mark McLoudPhilip TortoraNo ratings yet

- Woolf: Initial Claims For Unemployment InsuranceDocument1 pageWoolf: Initial Claims For Unemployment InsurancePhilip TortoraNo ratings yet

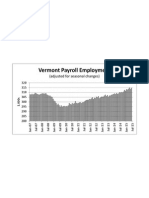

- Art Woolf: Vermont Payroll EmploymentDocument1 pageArt Woolf: Vermont Payroll EmploymentPhilip TortoraNo ratings yet

- Art Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedDocument1 pageArt Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedPhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Randy Quaid CaseDocument18 pagesPDF: Court Papers Filed in Randy Quaid CasePhilip TortoraNo ratings yet

- Art Woolf: Vermont Construction EmploymentDocument1 pageArt Woolf: Vermont Construction EmploymentPhilip TortoraNo ratings yet

- Art Woolf: Vermont Percent of Under 65 Population Without Health InsuranceDocument1 pageArt Woolf: Vermont Percent of Under 65 Population Without Health InsurancePhilip TortoraNo ratings yet

- Affidavit: State of Vermont Vs Jody HerringDocument14 pagesAffidavit: State of Vermont Vs Jody HerringPhilip TortoraNo ratings yet

- PDF: Court Papers Filed in Evi Quaid CaseDocument23 pagesPDF: Court Papers Filed in Evi Quaid CasePhilip TortoraNo ratings yet

- Art Woolf: Inflation-Adjusted Per Pupil SpendingDocument1 pageArt Woolf: Inflation-Adjusted Per Pupil SpendingPhilip TortoraNo ratings yet

- Art Woolf: Vermont Payroll EmploymentDocument1 pageArt Woolf: Vermont Payroll EmploymentPhilip TortoraNo ratings yet

- Woolf: Vermont Social Security RecipientsDocument1 pageWoolf: Vermont Social Security RecipientsPhilip TortoraNo ratings yet

- PDF: State of Vermont vs. Jody Herring Affidavit (Redacted)Document26 pagesPDF: State of Vermont vs. Jody Herring Affidavit (Redacted)Philip TortoraNo ratings yet

- Vermont Housing Affordability IndexDocument1 pageVermont Housing Affordability IndexPhilip TortoraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CH 02Document24 pagesCH 02Dima100% (2)

- Enron Company Reaction PaperDocument7 pagesEnron Company Reaction PaperJames Lorenz FelizarteNo ratings yet

- Franchise BrochureDocument3 pagesFranchise BrochurePari SavlaNo ratings yet

- E TaxDocument1 pageE TaxTemesgenNo ratings yet

- INCOTERMS 2010 Chart (ALFA SP) PDFDocument1 pageINCOTERMS 2010 Chart (ALFA SP) PDFNilesh JoshiNo ratings yet

- PMBOK (Project Management Body of Knowledge)Document8 pagesPMBOK (Project Management Body of Knowledge)Hari Purwadi0% (1)

- Retail Turnover Rent Model: Units of Projection 1,000Document26 pagesRetail Turnover Rent Model: Units of Projection 1,000tudormunteanNo ratings yet

- Template Tripartite AgreementDocument4 pagesTemplate Tripartite AgreementRami Reddy100% (1)

- AAO Promotion Exam NewSyllabus ItDocument35 pagesAAO Promotion Exam NewSyllabus ItSRanizaiNo ratings yet

- Managerial RemunerationDocument18 pagesManagerial RemunerationIshita GoyalNo ratings yet

- 2Document14 pages2romeoremo13No ratings yet

- Call Front Spread - Call Ratio Vertical Spread - The Options PlaybookDocument3 pagesCall Front Spread - Call Ratio Vertical Spread - The Options PlaybookdanNo ratings yet

- Nigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDocument3 pagesNigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDung Rwang PamNo ratings yet

- All India Council For Technical Education: Scheme OF Industry Institute Partnership Cell (IIPC)Document31 pagesAll India Council For Technical Education: Scheme OF Industry Institute Partnership Cell (IIPC)anuj_agrawalNo ratings yet

- Translation and Globalization-Routledge (2003)Document209 pagesTranslation and Globalization-Routledge (2003)mmaissNo ratings yet

- Marketing Plan of Indigo AirlinesDocument14 pagesMarketing Plan of Indigo AirlinesShrey Chaurasia100% (4)

- Vietnam Tax Legal HandbookDocument52 pagesVietnam Tax Legal HandbookaNo ratings yet

- Finweek English Edition - March 7 2019Document48 pagesFinweek English Edition - March 7 2019fun timeNo ratings yet

- L4DB - Y12 - UBO Assignment - Sep - 2020 PDFDocument4 pagesL4DB - Y12 - UBO Assignment - Sep - 2020 PDFsnapNo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- BCOM PM Unit 3Document11 pagesBCOM PM Unit 3Anujyadav MonuyadavNo ratings yet

- Naik Divides L&T To Rule The Future: Companies EngineeringDocument5 pagesNaik Divides L&T To Rule The Future: Companies EngineeringAnupamaa SinghNo ratings yet

- Chapter 7: Internal Controls I: True/FalseDocument10 pagesChapter 7: Internal Controls I: True/FalseThảo NhiNo ratings yet

- Backflush Accounting FM May06 p43-44Document2 pagesBackflush Accounting FM May06 p43-44khengmaiNo ratings yet

- Btled He 221 Lesson 1Document18 pagesBtled He 221 Lesson 1DEOGRACIAS GERARDO100% (1)

- Chapter 2 - Investment Appraisal - Introduction Nature and Stages of Investment Appraisal NatureDocument5 pagesChapter 2 - Investment Appraisal - Introduction Nature and Stages of Investment Appraisal NatureTeresaBachmannNo ratings yet

- CN WWF 20191021Document14 pagesCN WWF 20191021Maria Fernanda ZuluagaNo ratings yet

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- Value Added TaxDocument46 pagesValue Added TaxBoss NikNo ratings yet

- Stakeholder Theory - PresentationDocument12 pagesStakeholder Theory - PresentationMuhammad Khurram Shabbir100% (1)