Professional Documents

Culture Documents

Estimate - Formation of Comapny - 1 Lac Capital

Estimate - Formation of Comapny - 1 Lac Capital

Uploaded by

Dhananjay KulkarniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimate - Formation of Comapny - 1 Lac Capital

Estimate - Formation of Comapny - 1 Lac Capital

Uploaded by

Dhananjay KulkarniCopyright:

Available Formats

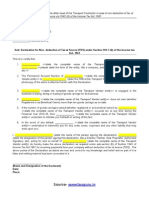

Sr. No.

Particulars

1 Fees payable for Availability of Name (One Time)

2 Fees payable for Registration of the Company

3 Stamp duty payable - Articles of Association

4 Stamp duty payable - Memorandum of Association

5 Stamp duty payable - Power of Attorney / Form 1

6

Incidental and stationery , postage , xeroxing, printing, scanning expenses & miscellaneous expenses

etc.

7 Professional Fees payable for Drafting of Memorandum and Articles of Association

preparing and filing of forms, obtaining Incorporation Certificate etc.

8 Fees for processing DIN Applications - 5 Directors

Total estimated for the formation of the Company:

Note: Amount does not include expenses for the following viz.:

a. Digital Signature Certificate with one years validity

b. Common Seal

c. Share Certificates printing and its stamping

d. Creating records for the Company after Incorporation upto 1st Board Meeting

Total estimated for the post incorporation expenses:

Total estimated expenses:

Estimate of expenses for formation of a Private Limited Company with capital of Rs. 1 Lac

Amount Rs.

(Estimated)

1,000

5,000

1,000

200

500

5,350

10,000

5,000

28,050

7,000

1,250

1,000

1,000

10,250

38,300

Estimate of expenses for formation of a Private Limited Company with capital of Rs. 1 Lac

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HR PolicyDocument30 pagesHR PolicyDhananjay Kulkarni50% (2)

- How GST Work in IndiaDocument25 pagesHow GST Work in IndiaDhananjay KulkarniNo ratings yet

- Letter of Appointment SampleDocument3 pagesLetter of Appointment SampleDhananjay KulkarniNo ratings yet

- Aapaduddharaka Batuk Bhairava Stotra Almira 26 SHLF 2 5841 1382 Ka DevanagaDocument25 pagesAapaduddharaka Batuk Bhairava Stotra Almira 26 SHLF 2 5841 1382 Ka DevanagaDhananjay KulkarniNo ratings yet

- 27 Net Worth CertificateDocument2 pages27 Net Worth CertificateDhananjay Kulkarni100% (3)

- Template-Of-TDS-Declaration For Transporter Wef 1.6.15Document1 pageTemplate-Of-TDS-Declaration For Transporter Wef 1.6.15Dhananjay KulkarniNo ratings yet

- 715 CircularDocument4 pages715 CircularDhananjay KulkarniNo ratings yet

- (Ebook) Robert Jordan - Wheel of Time (Historical) - The Strike at Shayol GhulDocument5 pages(Ebook) Robert Jordan - Wheel of Time (Historical) - The Strike at Shayol GhulDhananjay KulkarniNo ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Moa 2013Document9 pagesMoa 2013Dhananjay KulkarniNo ratings yet

- Accounting Manual For ......... School: Index ReciptsDocument1 pageAccounting Manual For ......... School: Index ReciptsDhananjay KulkarniNo ratings yet

- Steps To Incorporate LLPDocument2 pagesSteps To Incorporate LLPDhananjay KulkarniNo ratings yet

- Bio Coal EstimateDocument1 pageBio Coal EstimateDhananjay KulkarniNo ratings yet

- Fresher Finance Resume Format - 4Document2 pagesFresher Finance Resume Format - 4Dhananjay KulkarniNo ratings yet

- Fresher Finance Resume Format - 3Document2 pagesFresher Finance Resume Format - 3Dhananjay KulkarniNo ratings yet

- Fresher Finance Resume Format - 1Document4 pagesFresher Finance Resume Format - 1Dhananjay KulkarniNo ratings yet

- KPMG - Change in Tax Audit ReportDocument5 pagesKPMG - Change in Tax Audit ReportDhananjay KulkarniNo ratings yet