Professional Documents

Culture Documents

F7int 2013 Dec Q

F7int 2013 Dec Q

Uploaded by

トマッロ アルバートOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F7int 2013 Dec Q

F7int 2013 Dec Q

Uploaded by

トマッロ アルバートCopyright:

Available Formats

Fundamentals Level Skills Module

Time allowed

Reading and planning: 15 minutes

Writing: 3 hours

ALL FIVE questions are compulsory and MUST be attempted.

Do NOT open this paper until instructed by the supervisor.

During reading and planning time only the question paper may

be annotated. You must NOT write in your answer booklet until

instructed by the supervisor.

This question paper must not be removed from the examination hall.

P

a

p

e

r

F

7

(

I

N

T

)

Financial Reporting

(International)

Wednesday 4 December 2013

The Association of Chartered Certified Accountants

ALL FIVE questions are compulsory and MUST be attempted

1 On 1 April 2013, Polestar acquired 75% of the equity share capital of Southstar. Southstar had been experiencing

difficult trading conditions and making significant losses. In allowing for Southstars difficulties, Polestar made an

immediate cash payment of only $150 per share. In addition, Polestar will pay a further amount in cash on

30 September 2014 if Southstar returns to profitability by that date. The value of this contingent consideration at the

date of acquisition was estimated to be $18 million, but at 30 September 2013 in the light of continuing losses, its

value was estimated at only $15 million. The contingent consideration has not been recorded by Polestar. Overall,

the directors of Polestar expect the acquisition to be a bargain purchase leading to negative goodwill.

At the date of acquisition shares in Southstar had a listed market price of $120 each.

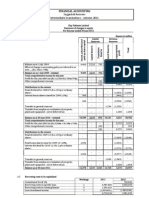

Below are the summarised draft financial statements of both companies.

Statements of profit or loss for the year ended 30 September 2013

Polestar Southstar

$000 $000

Revenue 110,000 66,000

Cost of sales (88,000) (67,200)

Gross profit (loss) 22,000 (1,200)

Distribution costs (3,000) (2,000)

Administrative expenses (5,250) (2,400)

Finance costs (250) nil

Profit (loss) before tax 13,500 (5,600)

Income tax (expense)/relief (3,500) 1,000

Profit (loss) for the year 10,000 (4,600)

Statements of financial position as at 30 September 2013

Assets

Non-current assets

Property, plant and equipment 41,000 21,000

Financial asset: equity investments (note (iii)) 16,000 nil

57,000 21,000

Current assets 16,500 4,800

Total assets 73,500 25,800

Equity and liabilities

Equity

Equity shares of 50 cents each 30,000 6,000

Retained earnings 28,500 12,000

58,500 18,000

Current liabilities 15,000 7,800

Total equity and liabilities 73,500 25,800

The following information is relevant:

(i) At the date of acquisition, the fair values of Southstars assets were equal to their carrying amounts with the

exception of a leased property. This had a fair value of $2 million above its carrying amount and a remaining

lease term of 10 years at that date. All depreciation is included in cost of sales.

(ii) Polestar transferred raw materials at their cost of $4 million to Southstar in June 2013. Southstar processed all

of these materials incurring additional direct costs of $14 million and sold them back to Polestar in August 2013

for $9 million. At 30 September 2013 Polestar had $15 million of these goods still in inventory. There were no

other intra-group sales.

2

(iii) Polestar has recorded its investment in Southstar at the cost of the immediate cash payment; other equity

investments are carried at fair value through profit or loss as at 1 October 2012. The other equity investments

have fallen in value by $200,000 during the year ended 30 September 2013.

(iv) Polestars policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose,

Southstars share price at that date can be deemed to be representative of the fair value of the shares held by the

non-controlling interest.

(v) All items in the above statements of profit or loss are deemed to accrue evenly over the year unless otherwise

indicated.

Required:

(a) Prepare the consolidated statement of profit or loss for Polestar for the year ended 30 September 2013.

(b) Prepare the consolidated statement of financial position for Polestar as at 30 September 2013.

The following mark allocation is provided as guidance for this question:

(a) 14 marks

(b) 11 marks

(25 marks)

3 [P.T.O.

2 The following trial balance relates to Moby as at 30 September 2013:

$000 $000

Revenue 227,800

Cost of sales 164,500

Construction contract (note (i)) 4,000

Distribution costs 13,500

Administrative expenses (note (iii) 16,500

Bank interest 900

Lease rental paid on 30 September 2013 (note (ii)) 9,200

Land ($12 million) and building ($48 million) at cost (note (ii)) 60,000

Owned plant and equipment at cost (note (ii)) 65,700

Leased plant at initial carrying amount (note (ii)) 35,000

Accumulated depreciation at 1 October 2012:

building 10,000

owned plant and equipment 17,700

leased plant 7,000

Inventory at 30 September 2013 26,600

Trade receivables 38,500

Bank 7,300

Insurance provision (note (iii)) 150

Deferred tax (note (iv)) 8,000

Finance lease obligation at 1 October 2012 (note (ii)) 29,300

Trade payables 21,300

Current tax (note (iv)) 1,050

Equity shares of 20 cents each 45,000

Loan note (note (v)) 40,000

Retained earnings at 1 October 2012 19,800

434,400 434,400

The following notes are relevant:

(i) The balance on the construction contract is made up of the following items:

Cost incurred to date $14 million

Value of contract billed (work certified) $10 million

The contract commenced on 1 October 2012 and is for a fixed price of $25 million. The costs to complete the

contract at 30 September 2013 are estimated at $6 million. Mobys policy is to accrue profits on construction

contracts based on a stage of completion given by the work certified as a percentage of the contract price.

(ii) Non-current assets:

Moby decided to revalue its land and building, for the first time, on 1 October 2012. A qualified valuer

determined the relevant revalued amounts to be $16 million for the land and $384 million for the building. The

buildings remaining life at the date of the revaluation was 16 years. This revaluation has not yet been reflected

in the trial balance figures. Moby does not make a transfer from the revaluation reserve to retained earnings in

respect of the realisation of the revaluation surplus. Deferred tax is applicable to the revaluation surplus at 25%.

The leased plant was acquired on 1 October 2011 under a five-year finance lease which has an implicit interest

rate of 10% per annum. The rentals are $92 million per annum payable on 30 September each year.

Owned plant and equipment is depreciated at 125% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2013. All

depreciation is charged to cost of sales.

(iii) On 1 October 2012, Moby received a renewal quote of $400,000 from the companys property insurer. The

directors were surprised at how much it had increased and believed it would be less expensive for the company

to self-insure. Accordingly, they charged $400,000 to administrative expenses and credited the same amount

4

to the insurance provision. During the year, the company incurred $250,000 of expenses relating to previously

insured property damage which it has debited to the provision.

(iv) A provision for income tax for the year ended 30 September 2013 of $34 million is required. The balance on

current tax represents the under/over provision of the tax liability for the year ended 30 September 2012. At

30 September 2013, the tax base of Mobys net assets was $24 million less than their carrying amounts. This

does not include the effect of the revaluation in note (ii) above. The income tax rate of Moby is 25%.

(v) The $40 million loan note was issued at par on 1 October 2012. No interest will be paid on the loan; however,

it will be redeemed on 30 September 2015 for $53,240,000 which gives an effective finance cost of 10% per

annum.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Moby for the year ended

30 September 2013.

(b) Prepare the statement of financial position for Moby as at 30 September 2013.

Note: A statement of changes in equity and notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 12 marks

(b) 13 marks

(25 marks)

5 [P.T.O.

3 Kingdom is a public listed manufacturing company. Its draft summarised financial statements for the year ended

30 September 2013 (and 2012 comparatives) are:

Statements of profit or loss and other comprehensive income for the year ended 30 September:

2013 2012

$000 $000

Revenue 44,900 44,000

Cost of sales (31,300) (29,000)

Gross profit 13,600 15,000

Distribution costs (2,400) (2,100)

Administrative expenses (7,850) (5,900)

Investment properties rentals received 350 400

fair value changes (700) 500

Finance costs (600) (600)

Profit before taxation 2,400 7,300

Income tax (600) (1,700)

Profit for the year 1,800 5,600

Other comprehensive income (1,300) 1,000

Total comprehensive income 500 6,600

Statements of financial position as at 30 September:

2013 2012

$000 $000 $000 $000

Assets

Non-current assets

Property, plant and equipment 26,700 25,200

Investment properties 4,100 5,000

30,800 30,200

Current assets

Inventory 2,300 3,100

Trade receivables 3,000 3,400

Bank nil 5,300 300 6,800

Total assets 36,100 37,000

Equity and liabilities

Equity

Equity shares of $1 each 17,200 15,000

Revaluation reserve 1,200 2,500

Retained earnings 7,700 8,700

26,100 26,200

Non-current liabilities

12% loan notes 5,000 5,000

Current liabilities

Trade payables 4,200 3,900

Accrued finance costs 100 50

Bank 200 nil

Current tax payable 500 5,000 1,850 5,800

Total equity and liabilities 36,100 37,000

6

The following information is relevant:

On 1 July 2013, Kingdom acquired a new investment property at a cost of $14 million. On this date, it also

transferred one of its other investment properties to property, plant and equipment at its fair value of $16 million as

it became owner-occupied on that date. Kingdom adopts the fair value model for its investment properties.

Kingdom also has a policy of revaluing its other properties (included as property, plant and equipment) to market value

at the end of each year. Other comprehensive income and the revaluation reserve both relate to these properties.

Depreciation of property, plant and equipment during the year was $15 million. An item of plant with a carrying

amount of $23 million was sold for $18 million during September 2013.

Required:

(a) Prepare the statement of cash flows for Kingdom for the year ended 30 September 2013 in accordance with

IAS 7 Statement of Cash Flows using the indirect method. (14 marks)

(b) At a board meeting to consider the results shown by the draft financial statements, concern was expressed that,

although there had been a slight increase in revenue during the current year, the profit before tax had fallen

dramatically. The purchasing director commented that he was concerned about the impact of rising prices. During

the year to 30 September 2013, most of Kingdoms manufacturing and operating costs have risen by an

estimated 8% per annum.

Required:

(i) Explain the causes of the fall in Kingdoms profit before tax. (6 marks)

(ii) Describe the main effects which the rising prices may have on the interpretation of Kingdoms financial

statements. You are not required to quantify these effects. (5 marks)

(25 marks)

7 [P.T.O.

4 (a) The Conceptual Framework for Financial Reporting identifies faithful representation as a fundamental qualitative

characteristic of useful financial information.

Required:

Distinguish between fundamental and enhancing qualitative characteristics and explain why faithful

representation is important. (5 marks)

(b) Laidlaw has produced its draft financial statements for the year ended 30 September 2013 and two issues have

arisen:

(i) On 1 September 2013, Laidlaw factored (sold) $2 million of trade receivables to Finease. Laidlaw received

an immediate payment of $18 million and credited this amount to receivables and charged $200,000 to

administrative expenses. Laidlaw will receive further amounts from Finease depending on how quickly

Finease collects the receivables.

Finease will charge a monthly administration fee of $10,000 and 2% per month on its outstanding balance

with Laidlaw. Any receivables not collected after four months would be sold back to Laidlaw; however,

Laidlaw expects all customers to settle in full within this period. None of the receivables were due or had

been collected by 30 September 2013. (5 marks)

(ii) On 1 October 2012, Laidlaw sold a property which had a carrying amount of $35 million to a property

company for $5 million and recorded a profit of $15 million on the disposal. Part of the terms of the sale

are that Laidlaw will rent the property for a period of five years at an annual rental of $400,000. At the end

of this period, the property company will sell the property through a real estate company/property agent at

its fair value which is expected to be approximately $65 million. Laidlaw will be given the opportunity to

repurchase the property (at its fair value) before it is put on the open market.

All of the above amounts are deemed to be at commercial values. (5 marks)

Required:

Explain, and quantify where appropriate, how Laidlaw should account for the above two issues in its financial

statements for the year ended 30 September 2013.

Note: The mark allocation is shown against each of the two issues above.

(15 marks)

8

5 Fundo entered into a 20-year operating lease for a property on 1 October 2000 which has a remaining life of

eight years at 1 October 2012. The rental payments are $23 million per annum.

Prior to 1 October 2012, Fundo obtained permission from the owner of the property to make some internal alterations

to the property so that it can be used for a new manufacturing process which Fundo is undertaking. The cost of these

alterations was $7 million and they were completed on 1 October 2012 (the time taken to complete the alterations

can be taken as being negligible). A condition of being granted permission was that Fundo would have to restore the

property to its original condition before handing back the property at the end of the lease. The estimated restoration

cost on 1 October 2012, discounted at 8% per annum to its present value, is $5 million.

Required:

(a) Explain how the lease, the alterations to the leased property and the restoration costs should be treated in

the financial statements of Fundo for the year ended 30 September 2013. (4 marks)

(b) Prepare extracts from the financial statements of Fundo for the year ended 30 September 2013 reflecting

your answer to (a) above. (6 marks)

(10 marks)

End of Question Paper

9

You might also like

- Consolidation Accounts QuestionsDocument43 pagesConsolidation Accounts QuestionsAli Sheikh93% (14)

- Tuition Mock D11 - F7 Questions FinalDocument11 pagesTuition Mock D11 - F7 Questions FinalRenato WilsonNo ratings yet

- Questions & Solutions ACCTDocument246 pagesQuestions & Solutions ACCTMel Lissa33% (3)

- Auditing Problem - Preweek: Cordillera Career Development College College of AccountancyDocument42 pagesAuditing Problem - Preweek: Cordillera Career Development College College of AccountancyGi Ne VaNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Introduction To Human Resources ManagementDocument23 pagesIntroduction To Human Resources ManagementashusinghputputNo ratings yet

- ACCA QuestionDocument9 pagesACCA QuestionAcca Fia TuitionNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- Afr Past Papers Upto June 2014 PDFDocument82 pagesAfr Past Papers Upto June 2014 PDFJaved IqbalNo ratings yet

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNo ratings yet

- Caf 7 Far2Document4 pagesCaf 7 Far2askermanNo ratings yet

- Ad 2013Document7 pagesAd 2013Gaurav AgarwalNo ratings yet

- ACC1006 EOY Essay DrillDocument13 pagesACC1006 EOY Essay DrillTiffany Tan Suet YiNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- F7int 2009 Dec QDocument9 pagesF7int 2009 Dec Qrajkrishna03No ratings yet

- F7INT 2014 Jun QDocument9 pagesF7INT 2014 Jun QBilal PashaNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAleenaSheikhNo ratings yet

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirNo ratings yet

- f7 2014 Dec QDocument13 pagesf7 2014 Dec QAshraf ValappilNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAsjad RehmanNo ratings yet

- Audit of Shareholders EquityDocument6 pagesAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- December 2003 ACCA Paper 2.5 QuestionsDocument10 pagesDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Assignment Questions Jan 2012 Non-BentleyDocument10 pagesAssignment Questions Jan 2012 Non-Bentleyvaisag_01No ratings yet

- P2int 2008 Dec QDocument8 pagesP2int 2008 Dec Qpkv12No ratings yet

- Appendix Scanner Gr. I GreenDocument25 pagesAppendix Scanner Gr. I GreenMayank GoyalNo ratings yet

- Professional MARCH... JULY 2020 #IfrsiseasyDocument172 pagesProfessional MARCH... JULY 2020 #IfrsiseasyJason Baba KwagheNo ratings yet

- Financial Reporting: March/June 2016 - Sample QuestionsDocument7 pagesFinancial Reporting: March/June 2016 - Sample QuestionsViet Nguyen QuocNo ratings yet

- Diploma in International Financial Reporting: Thursday 9 December 2010Document11 pagesDiploma in International Financial Reporting: Thursday 9 December 2010Zain Rehman100% (1)

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- Rupees in 000: Page 1 of 6Document6 pagesRupees in 000: Page 1 of 6Royal XpreSsNo ratings yet

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- GCA Consultants: Financial Accounting and ReportingDocument261 pagesGCA Consultants: Financial Accounting and ReportingNguyễn Trung ThànhNo ratings yet

- ICMAP Past PaperDocument4 pagesICMAP Past PaperNoman Qureshi100% (2)

- Dipifr 2003 Dec QDocument10 pagesDipifr 2003 Dec QWesley JenkinsNo ratings yet

- Fidelity National Financial, Inc.: FORM 10-QDocument76 pagesFidelity National Financial, Inc.: FORM 10-Qrocky6182002No ratings yet

- P2int 2010 AnsDocument11 pagesP2int 2010 Anspkv12No ratings yet

- ZECO Audited Results For FY Ended 31 Dec 13Document1 pageZECO Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Summer 2010 QuestionsDocument5 pagesSummer 2010 QuestionstaubushNo ratings yet

- Ifrint 2012 Dec Q PDFDocument6 pagesIfrint 2012 Dec Q PDFPiyal HossainNo ratings yet

- F1 November 2010 AnswersDocument11 pagesF1 November 2010 AnswersmavkaziNo ratings yet

- L1 March 2014Document22 pagesL1 March 2014Metick MicaiahNo ratings yet

- F2 QP March 2014 Final For PrintDocument20 pagesF2 QP March 2014 Final For PrintwardahtNo ratings yet

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasNo ratings yet

- P1 FA April 2006Document17 pagesP1 FA April 2006IrfanNo ratings yet

- Breeze-Eastern Corporation: Securities and Exchange CommissionDocument31 pagesBreeze-Eastern Corporation: Securities and Exchange Commissionashish822No ratings yet

- Maynard: Financial Reporting, Chapter 1Document2 pagesMaynard: Financial Reporting, Chapter 1shah md musleminNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Preliminary Exam FIN 2 - SampleDocument3 pagesPreliminary Exam FIN 2 - SampleEumell Alexis PaleNo ratings yet

- 2012 Dec QCF QDocument3 pages2012 Dec QCF QMohamedNo ratings yet

- 3-6int 2002 Dec QDocument9 pages3-6int 2002 Dec Qadrianlee0107No ratings yet

- Consolidation 2Document5 pagesConsolidation 2Tay?No ratings yet

- j14 F7int AnsDocument10 pagesj14 F7int AnsSajidZiaNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- F7 June 2013 BPP Answers - LowresDocument16 pagesF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- ACCA F8 Audit Test - AnswersDocument4 pagesACCA F8 Audit Test - Answerskumassa kenyaNo ratings yet

- LSBF Big Book of ACCA Tips PDFDocument19 pagesLSBF Big Book of ACCA Tips PDFkumassa kenyaNo ratings yet

- ACCA Fundamentals Level Paper F6 (FA 2012) Taxation (UK) Final Mock ExaminationDocument0 pagesACCA Fundamentals Level Paper F6 (FA 2012) Taxation (UK) Final Mock Examinationkumassa kenyaNo ratings yet

- Acca Paper F5 Performance Management: Commentary, Marking Scheme and Suggested SolutionsDocument16 pagesAcca Paper F5 Performance Management: Commentary, Marking Scheme and Suggested Solutionskumassa kenyaNo ratings yet

- LR Questions PDFDocument10 pagesLR Questions PDFkumassa kenyaNo ratings yet

- F5 ATC Pass Card 2012 PDFDocument102 pagesF5 ATC Pass Card 2012 PDFsaeed_r2000422100% (1)

- Week 1-2Document13 pagesWeek 1-2Vincent Joshua DeNo ratings yet

- Pharmacrystal - GPAT NOTES 1Document10 pagesPharmacrystal - GPAT NOTES 1Pharmacrystal Gpatniper67% (3)

- Cancer Prevention and ControlDocument25 pagesCancer Prevention and ControlRiyaz AhamedNo ratings yet

- Report Settings: SEL-400 Series Relays Instruction ManualDocument4 pagesReport Settings: SEL-400 Series Relays Instruction ManualHenrique Pereira MachadoNo ratings yet

- Question # 01:: MTH301 Final Term Solved SubjectiveDocument25 pagesQuestion # 01:: MTH301 Final Term Solved SubjectiveMuhammad RazaNo ratings yet

- NOTES The Living World L4 - 2023-MinDocument2 pagesNOTES The Living World L4 - 2023-Minnandukr.8083No ratings yet

- PEC L5 Review - U1-3 - BasicDocument9 pagesPEC L5 Review - U1-3 - BasicDesNo ratings yet

- OHS in Front Office ServicingDocument46 pagesOHS in Front Office ServicingEdwin Soriano87% (15)

- Biomechanics of Stair Climbing PDFDocument10 pagesBiomechanics of Stair Climbing PDFdani.adrianNo ratings yet

- SRF060424 03Document18 pagesSRF060424 03nailgrpNo ratings yet

- Interpipe CatalogDocument3 pagesInterpipe CatalogUmmes AhmedNo ratings yet

- Job Application Email PracticeDocument1 pageJob Application Email PracticeGilda MoNo ratings yet

- PC F ResultsDocument70 pagesPC F ResultsAyan NadeemNo ratings yet

- Net SAML2 Service Provider FrameworkDocument43 pagesNet SAML2 Service Provider FrameworkojmojnovNo ratings yet

- Agas - Case No4 - Sec18Document2 pagesAgas - Case No4 - Sec18Maxine AgasNo ratings yet

- HDI3000 FieldServiceManual 3639 2613 PDFDocument752 pagesHDI3000 FieldServiceManual 3639 2613 PDFFrancisth ZeusNo ratings yet

- (Studies of Organized Crime 8) Carlo Morselli (Auth.) - Inside Criminal Networks-Springer-Verlag New York (2009)Document207 pages(Studies of Organized Crime 8) Carlo Morselli (Auth.) - Inside Criminal Networks-Springer-Verlag New York (2009)HUGO GUSTAVO FLOREZ ALATANo ratings yet

- DLL Biology FinalDocument11 pagesDLL Biology FinalAcza Jaimee C. Kalaw100% (5)

- Article 7 TG October December 2020 Ms ChitraSharma DR Shaifali Full1036Document5 pagesArticle 7 TG October December 2020 Ms ChitraSharma DR Shaifali Full1036Putri Azzahra Salsabila putriazzahra.2019No ratings yet

- Thaumaturgy-DdDocument43 pagesThaumaturgy-DdRaven Wu100% (1)

- 001 Bizgram Daily DIY PricelistDocument14 pages001 Bizgram Daily DIY PricelistFrederico WernerNo ratings yet

- Bank Charter of The Development Bank of MongoliaDocument7 pagesBank Charter of The Development Bank of MongoliakhishigbaatarNo ratings yet

- Josh Magazine CBSE Class 10th English Communication Sample Paper 2013Document24 pagesJosh Magazine CBSE Class 10th English Communication Sample Paper 2013Sunil Abdul SalamNo ratings yet

- Lecture Five 2 Per PageDocument30 pagesLecture Five 2 Per PagewardraNo ratings yet

- Jazz - Installing LED DRLsDocument16 pagesJazz - Installing LED DRLsKrishnaNo ratings yet

- AnswersDocument21 pagesAnswersinaya aggarwalNo ratings yet

- Samsung (UH5003-SEA) BN68-06750E-01ENG-0812Document2 pagesSamsung (UH5003-SEA) BN68-06750E-01ENG-0812asohas77No ratings yet

- Soal GrammarDocument27 pagesSoal GrammarZhanny SunNo ratings yet

- QRF PC18MR-3 LRDocument2 pagesQRF PC18MR-3 LRRalf MaurerNo ratings yet