Professional Documents

Culture Documents

Chapter 13

Chapter 13

Uploaded by

AdarshYopaajiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 13

Chapter 13

Uploaded by

AdarshYopaajiCopyright:

Available Formats

Chapter 13

Capital Structure and Leverage

Learning Objectives

After reading this chapter, students should be able to:

Explain why capital structure policy involves a trade-of between risk and return, and list

the four primary factors that infuence capital structure decisions

!istinguish between a "rm#s business risk and its "nancial risk

Explain how operating leverage contributes to a "rm#s business risk and conduct a

breakeven analysis, complete with a breakeven chart

!e"ne "nancial leverage and explain its efect on expected $%E, expected E&', and the

risk borne by stockholders

(riefy explain what is meant by a "rm#s optimal capital structure

'pecify the efect of "nancial leverage on beta using the )amada e*uation, and transform

this e*uation to calculate a "rm#s unlevered beta, b+

,llustrate through a graph the premiums for "nancial risk and business risk at diferent

debt levels

-ist the assumptions under which .odigliani and .iller proved that a "rm#s value is

unafected by its capital structure, then explain trade-of theory, signaling theory, and the

efect of taxes and bankruptcy costs on capital structure

-ist a number of factors or practical considerations "rms generally consider when making

capital structure decisions

(riefy explain the extent that capital structure varies across industries, individual "rms in

each industry, and diferent countries

Chapter 13: Capital Structure and Leverage Learning Objectives 85

Lecture Suggestions

/his chapter is rather long, but it is also modular, hence sections can be omitted without loss

of continuity /herefore, if you are experiencing a time crunch, you could skip selected

sections

0hat we cover, and the way we cover it, can be seen by scanning the slides and

,ntegrated 1ase solution for 1hapter 23, which appears at the end of this chapter solution 4or

other suggestions about the lecture, please see the 5-ecture 'uggestions6 in 1hapter 7, where

we describe how we conduct our classes

DAYS O C!A"#$%: & O' 58 DAYS (5)*+inute periods,

8- Lecture Suggestions Chapter 13: Capital Structure and Leverage

Ans.ers to $nd*o/*Chapter 0uestions

13*1 %perating leverage is the extent to which "xed costs are used in a "rm#s operations ,f

operating leverage is increased 8"xed costs are high9, then even a small decline in

sales can lead to a large decline in pro"ts and in its $%E

13*1 a2 /he breakeven point will be lowered

b2 /he efect on the breakeven point is indeterminant An increase in "xed costs will

increase the breakeven point )owever, a lowering of the variable cost lowers the

breakeven point 'o it#s unclear which efect will have the greater impact

c2 /he breakeven point will be increased because "xed costs have increased

d2 /he breakeven point will be lowered

13*3 ,f sales tend to fuctuate widely, then cash fows and the ability to service "xed charges

will also vary 1onse*uently, there is a relatively large risk that the "rm will be unable

to meet its "xed charges As a result, "rms in unstable industries tend to use less debt

than those whose sales are sub:ect to only moderate fuctuations, or relatively stable

sales

13*& An increase in the personal tax rate makes both stocks and bonds less attractive to

investors because it raises the tax paid on dividend and interest income 1hanges in

personal tax rates will have difering efects, depending on what portion of an

investment#s total return is expected in the form of interest or dividends versus capital

gains 4or example, a high personal tax rate has a greater impact on bondholders

because more of their return will be taxed sooner at the new higher rate An increase

in the personal tax rate will cause some investors to shift from bonds to stocks because

of the attractiveness of capital gains tax deferrals /his raises the cost of debt relative

to e*uity ,n addition, a lower corporate tax rate reduces the advantage of debt by

reducing the bene"t of a corporation#s interest deduction that discourages the use of

debt 1onse*uently, the net result would be for "rms to use more e*uity and less debt

in their capital structures

13*5 a2 An increase in the corporate tax rate would encourage a "rm to increase the

amount of debt in its capital structure because a higher tax rate increases the

interest deductibility feature of debt

b2 An increase in the personal tax rate would cause investors to shift from bonds to

stocks due to the attractiveness of the deferral of capital gains taxes /his would

raise the cost of debt relative to e*uity; thus, "rms would be encouraged to use

less debt in their capital structures

c2 4irms whose assets are illi*uid and would have to be sold at 5"re sale6 prices

should limit their use of debt "nancing 1onse*uently, this would discourage the

"rm from increasing the amount of debt in its capital structure

d2 ,f changes to the bankruptcy code made bankruptcy less costly, then "rms would

tend to increase the amount of debt in their capital structures

Chapter 13: Capital Structure and Leverage Answers and Solutions 83

e2 4irms whose earnings are more volatile and thus have higher business risk, all else

e*ual, face a greater chance of bankruptcy and, therefore, should use less debt

than more stable "rms

13*- &harmaceutical companies use relatively little debt because their industries tend to be

cyclical, oriented toward research, or sub:ect to huge product liability suits +tility

companies, on the other hand, use debt relatively heavily because their "xed assets

make good security for mortgage bonds and also because their relatively stable sales

make it safe to carry more than average debt

13*3 E(,/ depends on sales and operating costs that generally are not afected by the "rm#s

use of "nancial leverage, because interest is deducted from E(,/ At high debt levels,

however, "rms lose business, employees worry, and operations are not continuous

because of "nancing di<culties /hus, "nancial leverage can infuence sales and cost,

hence E(,/, if excessive leverage causes investors, customers, and employees to be

concerned about the "rm#s future

13*8 Expected E&' is generally measured as E&' for the coming years, and we typically do

not refect in this calculation any bankruptcy-related costs Also, E&' does not refect

8in a ma:or way9 the increase in risk and rs that accompanies an increase in the debt

ratio, whereas &= does refect these factors /hus, the stock price will be maximi>ed at

a debt level that is lower than the E&'-maximi>ing debt level

13*4 /he tax bene"ts from debt increase linearly, which causes a continuous increase in the

"rm#s value and stock price )owever, bankruptcy-related costs begin to be felt after

some amount of debt has been employed, and these costs ofset the bene"ts of debt

'ee 4igure 23-? in the textbook

13*1) 0ith increased competition after the breakup of A/@/, the new A/@/ and the seven (ell

operating companies# business risk increased 0ith this component of total company

risk increasing, the new companies probably decided to reduce their "nancial risk, and

use less debt, to compensate 0ith increased competition the chance of bankruptcy

increases and lowering debt usage makes this less of a possibility ,f we consider the tax

issue alone, interest on debt is tax deductible; thus, the higher the "rm#s tax rate the

more bene"cial the deductibility of interest is )owever, competition and business risk

have tended to outweigh the tax aspect as we can see from the actual debt ratios of the

(ell companies

13*11 /he "rm may want to assess the asset investment and "nancing decisions :ointly 4or

instance, the highly automated process would re*uire fancy, new e*uipment 8capital

intensive9 so "xed costs would be high A less automated production process, on the

other hand, would be labor intensive, with high variable costs ,f sales fell, the process

that demands more "xed costs might be detrimental to the "rm if it has much debt

"nancing /he less automated process, however, would allow the "rm to lay of

workers and reduce variable costs if sales dropped; thus, debt "nancing would be more

attractive %perating leverage and "nancial leverage are interrelated /he highly

automated process would increase the "rm#s operating leverage; thus, its optimal

capital structure would call for less debt %n the other hand, the less automated

process would call for less operating leverage; thus, the "rm#s optimal capital structure

would call for more debt

88 Answers and Solutions Chapter 13: Capital Structure and Leverage

Solutions to $nd*o/*Chapter "roble+s

13*1 A(E B

C &

4

A(E B

== 3 D == E D

=== , F== D

A(E B F==,=== units

13*1 /he optimal capital structure is that capital structure where 0A11 is minimi>ed and

stock price is maximi>ed (ecause Gackson#s stock price is maximi>ed at a 3=H debt

ratio, the "rm#s optimal capital structure is 3=H debt and I=H e*uity /his is also the

debt level where the "rm#s 0A11 is minimi>ed

13*3 a2 Expected E&' for 4irm 1:

E8E&'19 B =28-D7E=9 J =78D23F9 J =E8DF2=9 J =78D??F9 J

=28D27K=9

B -D=7E J D=7I J D7=E J D2II J D27K B DF2=

8Lote that the table values and probabilities are dispersed in a symmetric manner

such that the answer to this problem could have been obtained by simple

inspection9

b2 According to the standard deviations of E&', 4irm ( is the least risky, while 1 is the

riskiest )owever, this analysis does not consider portfolio efectsMif 1#s earnings

increase when most other companies# decline 8that is, its beta is low9, its apparent

riskiness would be reduced Also, standard deviation is related to si>e, or scale,

and to correct for scale we could calculate a coe<cient of variation 8Nmean9:

E8E&'9 1C B NE8E&'9

A DF2= D3K2 =I2

( E7= 7OK =I=

1 F2= E22 =?2

(y this criterion, 1 is still the most risky

13*& 4rom the )amada e*uation, b B b+P2 J 82 Q /98!NE9R, we can calculate b+ as b+ B bNP2 J 82

Q /98!NE9R

b+ B 27NP2 J 82 Q =E98D7,===,===ND?,===,===9R

b+ B 27NP2 J =2FR

b+ B 2=E3F

Chapter 13: Capital Structure and Leverage Answers and Solutions 84

13*5 a2 --: !N/A B 3=H

E(,/ DE,===,===

,nterest 8DK,===,=== =2=9 K==,===

E(/ D3,E==,===

/ax 8E=H9 2,3K=,===

Let income D7,=E=,===

$eturn on e*uity B D7,=E=,===ND2E,===,=== B 2EKH

)-: !N/A B F=H

E(,/ DE,===,===

,nterest 8D2=,===,=== =279 2,7==,===

E(/ D7,?==,===

/ax 8E=H9 2,27=,===

Let income D2,K?=,===

$eturn on e*uity B D2,K?=,===ND2=,===,=== B 2K?H

b2 --: !N/A B K=H

E(,/ DE,===,===

,nterest 8D27,===,=== =2F9 2,?==,===

E(/ D7,7==,===

/ax 8E=H9 ??=,===

Let income D2,37=,===

$eturn on e*uity B D2,37=,===ND?,===,=== B 2KFH

Although --#s return on e*uity is higher than it was at the 3=H leverage ratio, it is

lower than the 2K?H return of )-

,nitially, as leverage is increased, the return on e*uity also increases (ut, the

interest rate rises when leverage is increased /herefore, the return on e*uity will

reach a maximum and then decline

13*- a2 ?,=== units 2?,=== units

'ales D7==,=== DEF=,===

4ixed costs 2E=,=== 2E=,===

Cariable costs 27=,=== 7I=,===

/otal costs D7K=,=== DE2=,===

Sain 8loss9 8D K=,===9 D E=,===

b2 A(E B

C &

4

B

D2=

D2E=,===

B 2E,=== units

'(E B A(E8&9 B 82E,===98D7F9 B D3F=,===

4) Answers and Solutions Chapter 13: Capital Structure and Leverage

c2 ,f the selling price rises to D32, while the variable cost per unit remains "xed, & Q C

rises to D2K /he end result is that the breakeven point is lowered

A(E B

C &

4

B

D2K

D2E=,===

B ?,IF= units

'(E B A(E8&9 B 8?,IF=98D329 B D7I2,7F=

/he breakeven point drops to ?,IF= units /he contribution margin per each unit

sold has been increased; thus the variability in the "rm#s pro"t stream has been

increased, but the opportunity for magni"ed pro"ts has also been increased

d2 ,f the selling price rises to D32 and the variable cost per unit rises to D73, & Q C falls to D?

/he end result is that the breakeven point increases

A(E B

C - &

4

B

D?

D2E=,===

B 2I,F== units

'(E B A(E8&9 B 82I,F==98D329 B DFE7,F==

/he breakeven point increases to 2I,F== units because the contribution margin per

each unit sold has decreased

Chapter 13: Capital Structure and Leverage Answers and Solutions 41

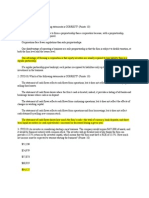

Sales

Costs

Dollars

Units of Output

(Thousands)

800,000

600,000

400,000

200,000

0 5 10 15 20

i!ed Costs

Sales

Costs

Dollars

Units of Output

(Thousands)

800,000

600,000

400,000

200,000

0 5 10 15 20

i!ed Costs

13*3 Lo leverage: !ebt B =; E*uity B D2E,===,===

'tat

e

&s E(,/ 8E(,/ Q rd!982 Q /9 $%E' &'8$%E9 &'8$%E' Q

$TE9

7

2 =7

DE,7==,==

=

D7,F7=,=== =2? ==3K ===223

7 =F 7,?==,=== 2,K?=,=== =27 ==K= ====22

3 =3 I==,=== E7=,=== ==3 ===O = ==2KO

$TE B =2=F

Cariance B ===7O3

'tandard deviation B ==FE

$TE B 2=FH

7

B ===7O3

B FEH

1C B N$TE B FEHN2=FH B =F2E

-everage ratio B 2=H: !ebt B D2,E==,===; E*uity B D27,K==,===; rd B OH

'tat

e

&s E(,/ 8E(,/ Q rd!982 Q /9 $%E' &'8$%E9 &'8$%E' Q

$TE9

7

2 =7

DE,7==,==

=

D7,EEE,E== =2OE ==3O ===23?

7 =F 7,?==,=== 2,K=E,E== =27I ==KE ====23

3 =3 I==,=== 3EE,E== ==7I ===? = ==727

$TE B =222

Cariance B ===3K3

'tandard deviation B ==K=

$TE B 222H

7

B ===3K3

41 Answers and Solutions Chapter 13: Capital Structure and Leverage

Sales

Costs

Dollars

Units of Output

(Thousands)

800,000

600,000

400,000

200,000

0 5 10 15 20

i!ed Costs

B KH

1C B KHN222H B =FE2

-everage ratio B F=H: !ebt B DI,===,===; E*uity B DI,===,===; rd B 22H

'tat

e

&s E(,/ 8E(,/ Q rd!982 Q /9 $%E' &'8$%E9 &'8$%E' Q

$TE9

7

2 =7

DE,7==,==

=

D7,=F?,=== =7OE ==FO ===EF=

7 =F 7,?==,=== 2,72?,=== =2IE ==?I ====EF

3 =3 I==,=== 8E7,===9 8===K9 8===79 = ==KIF

$TE B =2EE

Cariance B ==22I=

'tandard deviation B =2=?

$TE B 2EEH

7

B ==22I=

B 2=?H

1C B 2=?HN2EEH B =IF=

-everage ratio B K=H: ! B D?,E==,===; E B DF,K==,===; rd B 2EH

'tat

e

&s E(,/ 8E(,/ Q rd!982 Q /9 $%E' &'8$%E9 &'8$%E' Q

$TE9

7

2 =7

DE,7==,==

=

D2,?2E,E== =37E ==KF ===KOO

7 =F 7,?==,=== OIE,E== =2IE ==?I ====K?

3 =3 I==,=== 87?F,K==9 8==F29 8==2F9 = =2=K=

$TE B =23I

Cariance B ==2?7I

'tandard deviation B =23F

$TE B 23IH

7

B ==2?7I

B 23FH

1C B 23FHN23IH B =O?F =OO

As leverage increases, the expected return on e*uity rises up to a point (ut as the risk

increases with increased leverage, the cost of debt rises 'o after the return on e*uity

peaks, it then begins to fall As leverage increases, the measures of risk 8both the

standard deviation and the coe<cient of variation of the return on e*uity9 rise with

each increase in leverage

Chapter 13: Capital Structure and Leverage Answers and Solutions 43

13*8 4acts as given: 1urrent capital structure: 7FH debt, IFH e*uity; r$4 B FH; r. Q r$4 B KH; /

B E=H;

rs B 2EH

'tep 2:!etermine the "rm#s current beta

rs B r$4 J 8r. Q r$49b

2EHB FH J 8KH9b

OH B KHb

2F B b

'tep 7:!etermine the "rm#s unlevered beta, b+

b+ B b-NP2 J 82 Q /98!NE9R

B 2FNP2 J 82 Q =E98=7FN=IF9R

B 2FN27=

B 27F

'tep 3:!etermine the "rm#s beta under the new capital structure

b- B b+P2 J 82 Q /98!NE9R

B 27FP2 J 82 Q =E98=FN=F9R

B 27F82K9

B 7

'tep E:!etermine the "rm#s new cost of e*uity under the changed capital structure

rs B r$4 J 8r. Q r$49b

B FH J 8KH97

B 2IH

13*4 a2 /he current dividend per share, !=, B DE==,===N7==,=== B D7== !2 B D7==82=F9 B

D72= /herefore, &= B !2N8rs Q g9 B D72=N8=23E Q ==F9 B D7F==

b2 'tep 2:1alculate E(,/ before the recapitali>ation:

E(,/ B D2,===,===N82 Q /9 B D2,===,===N=K B D2,KKK,KKI

Lote: /he "rm is 2==H e*uity "nanced, so there is no interest expense

'tep 7:1alculate net income after the recapitali>ation:

PD2,KKK,KKI Q =228D2,===,===9R=K B DO3E,===

'tep 3:1alculate the number of shares outstanding after the recapitali>ation:

7==,=== Q 8D2,===,===ND7F9 B 2K=,=== shares

'tep E:1alculate !2 after the recapitali>ation:

!= B =E8DO3E,===N2K=,===9 B D733F

!2 B D733F82=F9 B D7EF2IF

'tep F:1alculate &= after the recapitali>ation:

4& Answers and Solutions Chapter 13: Capital Structure and Leverage

&= B !2N8rs Q g9 B D7EF2IFN8=2EF Q ==F9 B D7F?=IO D7F?2

13*1) a2 4irm A

2 4ixed costs B D?=,===

7 Cariable costNunit B

units (reakeven

costs 4ixed sales (reakeven

B

Nunit DE?= B

7F,===

D27=,===

B

7F,===

D?=,=== D7==,===

3 'elling priceNunit B

Nunit D?== B

7F,===

D7==,===

B

units (reakeven

sales (reakeven

4irm (

2 4ixed costs B D27=,===

7 Cariable costNunit B

units (reakeven

costs 4ixed sales (reakeven

B

,=== 3=

=,=== 27 D =,=== E D7

B DE==Nunit

3 'elling priceNunit B

units (reakeven

sales (reakeven

B

3=,===

D7E=,===

B D?==Nunit

b2 4irm ( has the higher operating leverage due to its larger amount of "xed costs

c2 %perating pro"t B 8'elling price98+nits sold9 Q 4ixed costs Q 8Cariable costsNunit9

8+nits sold9

4irm A#s operating pro"t B D?U Q D?=,=== Q DE?=U

4irm (#s operating pro"t B D?U Q D27=,=== Q DE==U

'et the two e*uations e*ual to each other:

D?U Q D?=,=== Q DE?=U B D?U Q D27=,=== Q DE==U

-D=?U B -DE=,===

U B DE=,===ND=?= B F=,=== units

'ales level B 8'elling price98+nits9 B D?8F=,===9 B DE==,===

At this sales level, both "rms earn D?=,===:

&ro"tA B D?8F=,===9 Q D?=,=== Q DE?=8F=,===9

Chapter 13: Capital Structure and Leverage Answers and Solutions 45

B DE==,=== Q D?=,=== Q D7E=,=== B D?=,===

&ro"t( B D?8F=,===9 Q D27=,=== Q DE==8F=,===9

B DE==,=== Q D27=,=== Q D7==,=== B D?=,===

13*11 a2 +sing the standard formula for the weighted average cost of capital, we "nd:

0A11B wdrd82 Q /9 J wcrs

B 8=798?H982 Q =E9 J 8=?9827FH9

B 2=OKH

b2 /he "rmVs current levered beta at 7=H debt can be found using the 1A&. formula

rs B r$4 J 8r. Q r$49b

27FHB FH J 8KH9b

b B 27F

c2 /o 5unlever6 the "rmVs beta, the )amada e*uation is used

b- B b+P2 J 82 Q /98!NE9R

27FB b+P2 J 82 Q =E98=7N=?9R

27FB b+822F9

b+ B 2=?KOFI

d2 /o determine the "rm#s new cost of common e*uity, one must "nd the "rm#s new

beta under its new capital structure 1onse*uently, you must 5relever6 the "rmVs

beta using the )amada e*uation:

b-,E=H B b+P2 J 82 Q /98!NE9R

b-,E=H B 2=?KOFI P2 J 82 Q =E98=EN=K9R

b-,E=H B 2=?KOFI82E9

b+ B 2F72I3O

/he "rmVs cost of e*uity, as stated in the problem, is derived using the 1A&.

e*uation

rs B r$4 J 8r. Q r$49b

rs B FH J 8KH92F72I3O

rs B 2E23H

e2 Again, the standard formula for the weighted average cost of capital is used

$emember, the 0A11 is a marginal, after-tax cost of capital and hence the relevant

before-tax cost of debt is now OFH and the cost of e*uity is 2E23H

0A11B wdrd82 Q /9 J wcrs

B 8=E98OFH982 Q =E9 J 8=K982E23H9

B 2=IKH

/2 /he "rm should be advised to proceed with the recapitali>ation as it causes the

0A11 to decrease from 2=OKH to 2=IKH As a result, the recapitali>ation would

lead to an increase in "rm value

13*11 a2 0ithout new investment:

'ales D27,OK=,===

4- Answers and Solutions Chapter 13: Capital Structure and Leverage

C1 2=,7==,===

41 2,FK=,===

E(,/ D 2,7==,===

,nterest 3?E,===W

E(/ D ?2K,===

/ax 8E=H9 37K,E==

Let income D E?O,K==

W,nterest B ==?8DE,?==,===9 B D3?E,===

2 E&'%ld B DE?O,K==N7E=,=== B D7=E

0ith new investment:

!ebt 'tock

'ales D27,OK=,=== D27,OK=,===

C1 8=?98D2=,7==,===9 ?,2K=,=== ?,2K=,===

41 2,?==,=== 2,?==,===

E(,/ D 3,===,=== D 3,===,===

,nterest 2,2=E,===WW 3?E,===

E(/ D 2,?OK,=== D 7,K2K,===

/ax 8E=H9 IF?,E== 2,=EK,E==

Let income D 2,23I,K== D 2,FKO,K==

WW,nterest B ==?8DE,?==,===9 J =2=8DI,7==,===9 B D2,2=E,===

7 E&'! B D2,23I,K==N7E=,=== B DEIE

3 E&'' B D2,FKO,K==NE?=,=== B D37I

E&' should improve, but expected E&' is signi"cantly higher if "nancial leverage is

used

b2 E&' B

L

/9 ,982 4 C1 8'ales

B

L

/9 ,982 4 CA 8&A

E&'!ebtB

7E=,===

98=K9 D2,2=E,=== D2,?==,=== A D2?233 A 8D7??

B

7E=,===

98=K9 D7,O=E,=== A 8D2=KKI

E&''tock B

E?=,===

98=K9 D7,2?E,=== A 8D2=KKI

/herefore,

E?=,===

98=K9 D7,2?E,=== A 8D2=KKI

B

7E=,===

98=K9 D7,O=E,=== A 82=KKI

D2=KKIA B D3,K7E,===

Chapter 13: Capital Structure and Leverage Answers and Solutions 43

A B 33O,IF= units

/his is the 5indiference6 sales level, where E&'debt B E&'stock

c2 E&'%ld B

7E=,===

=K9 D3?E,===98 D2,FK=,=== A D77KKI A 8D7??

B =

DK233A B D2,OEE,===

A B 32K,OFI units

/his is the A(E considering interest charges

E&'Lew,!ebt B

7E=,===

,===98=K9 O=E , 7 D A 233 2? D A 8D7??

B =

D2=KKIA B D7,O=E,===

A B 7I7,7F= units

E&'Lew,'tock B

=,=== ? E

K9 ?E,===98= 2 D7, A KKI 2= 8D

B =

D2=KKIA B D7,2?E,===

A B 7=E,IF= units

d2 At the expected sales level, EF=,=== units, we have these E&' values:

E&'%ld 'etup B D7=E E&'Lew,!ebt B DEIE E&'Lew,'tock B D37I

0e are given that operating leverage is lower under the new setup Accordingly,

this suggests that the new production setup is less risky than the old oneMvariable

costs drop very sharply, while "xed costs rise less, so the "rm has lower costs at

5reasonable6 sales levels

,n view of both risk and pro"t considerations, the new production setup seems

better /herefore, the *uestion that remains is how to "nance the investment

/he indiference sales level, where E&'debt B E&'stock, is 33O,IF= units /his is well

below the EF=,=== expected sales level ,f sales fall as low as 7F=,=== units, these

E&' "gures would result:

E&'!ebt B

7E=,===

R8=K9 D7,O=E,=== ,===9 = D2?23387F ,===9 = PD7??87F

B -D=FO

E&''tock B

E?=,===

R8=K9 D7,2?E,=== ,===9 = D2?23387F ,===9 = PD7??87F

B D=K=

/hese calculations assume that & and C remain constant, and that the company

can obtain tax credits on losses %f course, if sales rose above the expected

EF=,=== level, E&' would soar if the "rm used debt "nancing

,n the 5real world6 we would have more information on which to base the decisionM

coverage ratios of other companies in the industry and better estimates of the

likely range of unit sales %n the basis of the information at hand, we would

probably use e*uity "nancing, but the decision is really not obvious

48 Answers and Solutions Chapter 13: Capital Structure and Leverage

Chapter 13: Capital Structure and Leverage Answers and Solutions 44

13*13 +se of debt 8millions of dollars9:

&robability =3 =E =3

'ales D7,7F== D7,I=== D3,2F==

E(,/ 82=H9 77F= 7I== 32F=

,nterestW II E II E II E

E(/ D 2EIK D 2O7K D 73IK

/axes 8E=H9 FO = II = OF =

Let income D ?? K D 22F K D 2E7 K

Earnings per share 87= million shares9 DE E3 DF I? DI 23

W,nterest on debt B 8D7I= =279 J 1urrent interest expense

B D37E J DEF B DIIE

Expected E&' B 8=3=98DEE39 J 8=E=98DFI?9 J 8=3=98DI239

B DFI? if debt is used

7

!ebt B 8=3=98DEE3 Q DFI?9

7

J 8=E=98DFI? Q DFI?9

7

J 8=3=98DI23 Q DFI?9

7

B

2=OE

'tandard deviation of E&' if debt "nancing is used:

!ebt B =OE 2 B D2=F

1C B

DFI?

D2=F

B =2?

E8/,E!ebt9 B

,

E8E(,/9

B

DIIE

D7I=

B 3EO

!ebtNAssets B 8DKF7F= J D3== J D7I=9N8D2,3F= J D7I=9 B IFFH

+se of stock 8millions of dollars9:

&robability =3 =E =3

'ales D7,7F== D7,I=== D3,2F==

E(,/ 77F= 7I== 32F=

,nterest EF = EF = EF =

E(/ D 2?== D 77F= D 7I==

/axes 8E=H9 I7 = O= = 2=? =

Let income D 2=? = D 23F = D 2K7 =

Earnings per share 87EF million shares9W DE E2 DF F2 DK K2

WLumber of shares B 8D7I= millionNDK=9 J 7= million

B EF million J 7= million B 7EF million

E&'E*uity B 8=3=98DEE29 J 8=E=98DFF29 J 8=3=98DKK29 B DFF2

7

E*uity B 8=3=98DEE2 Q DFF29

7

J 8=E=98DFF2 Q DFF29

7

J 8=3=98DKK2 Q DFF29

7

B

=I7K=

E*uity B I7K= = B D=?F

1)) Answers and Solutions Chapter 13: Capital Structure and Leverage

1C B

DFF2

D=?F

B =2F

E8/,E'tock9 B

DEF

D7I=

B K==

Assets

!ebt

B

D7I= J D2,3F=

D3== J DKF7F=

B F??H

+nder debt "nancing the expected E&' is DFI?, the standard deviation is D2=F, the

1C is =2?, and the debt ratio increases to IFFH 8/he debt ratio had been I=KH9

+nder e*uity "nancing the expected E&' is DFF2, the standard deviation is D=?F, the

1C is =2F, and the debt ratio decreases to F??H At this interest rate, debt "nancing

provides a higher expected E&' than e*uity "nancing; however, the debt ratio is

signi"cantly higher under the debt "nancing situation as compared with the e*uity

"nancing situation (ecause E&' is not signi"cantly greater under debt "nancing

compared to e*uity "nancing, while the risk is noticeably greater, e*uity "nancing

should be recommended

Chapter 13: Capital Structure and Leverage Answers and Solutions 1)1

Co+prehensive5Spreadsheet "roble+

Note to Instructors:

#he solution to this proble+ is not provided to students at the bac6 o/ their te7t2

8nstructors can access the Excel 9le on the te7tboo6:s ;eb site or the 8nstructor:s

%esource CD2

13*1& /ax rate B E=H; r$4 B F=H; b+ B 27; r. Q r$4 B K=H

4rom data given in the problem and table we can develop the following table:

-everaged

!NA ENA !NE rd rd82 Q /9 beta

a

rs

b

0A11

c

=== 2== ===== I==H E7=H 27= 277=H 277=H

=7= =?= =7F== ?== E?= 23? 237? 22F?

=E= =K= =KKKI 2=== K== 2K? 2F=? 22EF

=K= =E= 2F=== 27== I7= 77? 2?K? 22IO

=?= =7= E==== 2F== O== E=? 7OE? 232=

Lotes:

a

/hese beta estimates were calculated using the )amada e*uation, b- B b+P2 J 82 Q /9

8!NE9R

b

/hese rs estimates were calculated using the 1A&., rs B r$4 J 8r. Q r$49b

c

/hese 0A11 estimates were calculated with the following e*uation: 0A11 B wd8rd982 Q

/9 J 8wc98rs9

a2 /he "rm#s optimal capital structure is that capital structure which minimi>es the

"rm#s 0A11 Elliott#s 0A11 is minimi>ed at a capital structure consisting of E=H

debt and K=H e*uity At that capital structure, the "rm#s 0A11 is 22EFH

b2 ,f the "rm#s business risk increased, the "rm#s target capital structure would consist

of less debt and more e*uity

c2 ,f 1ongress dramatically increases the corporate tax rate, then the tax deductibility

of interest would be greater /his should lead to an increase in the "rm#s use of

debt in its capital structure

d2

1)1 ComprehensiveSpreadsheet !roblem Chapter 13: Capital Structure and

Leverage

/he top graph is like the one in the textbook, because it uses the !NA ratio on the

hori>ontal axis /he bottom graph is a bit like .. showed in their original article in

that the cost of e*uity is linear and the 0A11 does not turn up sharply ,t is not

exactly like .. because it uses !NA rather than !NC, and also because ..

assumed that rd is constant whereas we assume the cost of debt rises with

leverage

Lote too that the minimum 0A11 is at the !NA and !NE levels indicated in the

table, and also that the 0A11 curve is very fat over a broad range of debt ratios,

indicating that 0A11 is not sensitive to debt over a broad range /his is important,

as it demonstrates that management can use a lot of discretion as to its capital

structure, and that it is %X to alter the debt ratio to take advantage of market

conditions in the debt and e*uity markets, and to increase the debt ratio if many

good investment opportunities are available

Chapter 13: Capital Structure and LeverageComprehensiveSpreadsheet !roblem

1)3

8ntegrated Case

13*15

Campus Deli Inc.

Optimal Capital Structure

Assu+e that <ou have just been hired as business +anager o/

Ca+pus Deli (CD,= .hich is located adjacent to the ca+pus2 Sales

.ere >1=1))=))) last <ear? variable costs .ere -)@ o/ sales? and

97ed costs .ere >&)=)))2 #here/ore= $A8# totaled >&))=)))2

Aecause the universit<:s enroll+ent is capped= $A8# is e7pected to be

constant over ti+e2 Aecause no e7pansion capital is reBuired= CD

pa<s out all earnings as dividends2 Assets are >1 +illion= and 8)=)))

shares are outstanding2 #he +anage+ent group o.ns about 5)@ o/

the stoc6= .hich is traded in the over*the*counter +ar6et2

CD currentl< has no debtCit is an all*eBuit< 9r+Cand its 8)=)))

shares outstanding sell at a price o/ >15 per share= .hich is also the

boo6 value2 #he 9r+:s /ederal*plus*state ta7 rate is &)@2 On the

basis o/ state+ents +ade in <our 9nance te7t= <ou believe that CD:s

shareholders .ould be better oD i/ so+e debt 9nancing .ere used2

;hen <ou suggested this to <our ne. boss= she encouraged <ou to

pursue the idea= but to provide support /or the suggestion2

8n toda<:s +ar6et= the ris6*/ree rate= r

%'

= is -@ and the +ar6et

ris6 pre+iu+= r

E

F r

%'

= is -@2 CD:s unlevered beta= b

G

= is 12)2 CD

currentl< has no debt= so its cost o/ eBuit< (and ;ACC, is 11@2

8/ the 9r+ .ere recapitaliHed= debt .ould be issued= and the

borro.ed /unds .ould be used to repurchase stoc62 Stoc6holders= in

turn= .ould use /unds provided b< the repurchase to bu< eBuities in

other /ast*/ood co+panies si+ilar to CD2 You plan to co+plete <our

report b< as6ing and then ans.ering the /ollo.ing Buestions2

1)& Integrated Case Chapter 13: Capital Structure and Leverage

A2 (1, ;hat is business ris6I ;hat /actors inJuence a 9r+:s

business ris6I

Ans.er: KSho. S13*1 through S13*3 here2L Ausiness ris6 is the

ris6iness inherent in the 9r+:s operations i/ it uses no debt2

A 9r+:s business ris6 is aDected b< +an< /actors= including

these: (1, variabilit< in the de+and /or its output= (1,

variabilit< in the price at .hich its output can be sold= (3,

variabilit< in the prices o/ its inputs= (&, the 9r+:s abilit< to

adjust output prices as input prices change= (5, the a+ount

o/ operating leverage used b< the 9r+= and (-, special ris6

/actors (such as potential product liabilit< /or a drug

co+pan< or the potential cost o/ a nuclear accident /or a

utilit< .ith nuclear plants,2

A2 (1, ;hat is operating leverage= and ho. does it aDect a 9r+:s

business ris6I

Ans.er: KSho. S13*& through S13*- here2L Operating leverage is

the e7tent to .hich 97ed costs are used in a 9r+:s

operations2 8/ a high percentage o/ the 9r+:s total costs are

97ed= and hence do not decline .hen de+and /alls= then

the 9r+ is said to have high operating leverage2 Other

things held constant= the greater a 9r+:s operating

leverage= the greater its business ris62

A2 (1, ;hat is +eant b< the ter+s M9nancial leverageN and

M9nancial ris6NI

Ans.er: KSho. S13*3 here2L 'inancial leverage re/ers to the 9r+:s

decision to 9nance .ith 97ed*inco+e securities= such as

Chapter 13: Capital Structure and Leverage Integrated Case 1)5

debt and pre/erred stoc62 'inancial ris6 is the additional

ris6= over and above the co+pan<:s inherent business ris6=

borne b< the stoc6holders as a result o/ the 9r+:s decision

to 9nance .ith debt2

A2 (1, !o. does 9nancial ris6 diDer /ro+ business ris6I

Ans.er: KSho. S13*8 here2L As .e discussed above= business ris6

depends on a nu+ber o/ /actors such as sales and cost

variabilit<= and operating leverage2 'inancial ris6= on the

other hand= depends on onl< one /actorCthe a+ount o/

97ed*inco+e capital the co+pan< uses2

C2 o.= to develop an e7a+ple that can be presented to CD:s

+anage+ent as an illustration= consider t.o h<pothetical

9r+s= 'ir+ G= .ith Hero debt 9nancing= and 'ir+ L= .ith

>1)=))) o/ 11@ debt2 Aoth 9r+s have >1)=))) in total

assets and a &)@ /ederal*plus*state ta7 rate= and the< have

the /ollo.ing $A8# probabilit< distribution /or ne7t <ear:

"robabilit< $A8#

)215 >1=)))

)25) 3=)))

)215 &=)))

(1, Co+plete the partial inco+e state+ents and the 9r+s:

ratios in #able 8C 13*12

1)- Integrated Case Chapter 13: Capital Structure and Leverage

#able 8C 13*12 8nco+e State+ents and %atios

'ir+ G 'ir+ L

Assets >1)=))) >1)=))) >1)=))) >1)=))) >1)=))) >1)=)))

$Buit< >1)=))) >1)=))) >1)=))) >1)=))) >1)=))) >1)=)))

"robabilit< )215 )25) )215 )215 )25) )215

Sales > -=))) > 4=))) >11=))) > -=))) > 4=))) >11=)))

Oper2 costs &=))) -=))) 8=))) &=))) -=))) 8=)))

$A8# > 1=))) > 3=))) > &=))) > 1=))) > 3=))) > &=)))

8nt2 (11@, ) ) ) 1=1))

1=1))

$A# > 1=))) > 3=))) > &=))) > 8)) > > 1=8))

#a7es (&)@, 8)) 1=1)) 1=-)) 31)

1=11)

et inco+e > 1=1)) > 1=8)) > 1=&)) > &8) >

> 1=-8)

A$" 1)2)@ 152)@ 1)2)@ 1)2)@ @ 1)2)@

%O$ -2)@ 42)@ 112)@ &28@ @ 1-28@

#8$ 123

323

$(A$", 152)@ @

$(%O$, 42)@ 1)28@

$(#8$, 125

A$"

325@ @

%O$

121@ &21@

#8$

) )2-

Chapter 13: Capital Structure and Leverage Integrated Case 1)3

Ans.er: KSho. S13*4 through S13*11 here2L !ere are the /ull<

co+pleted state+ents:

'ir+ G 'ir+ L

Assets >1)=))) >1)=))) >1)=))) >1)=))) >1)=))) >1)=)))

$Buit< >1)=))) >1)=))) >1)=))) >1)=))) >1)=))) >1)=)))

"robabilit< )215 )25) )215 )215 )25) )215

$A8# > 1=))) > 3=))) > &=))) > 1=))) > 3=))) > &=)))

8nt2 (11@, ) ) ) 1=1)) 1=1))

1=1))

$A# > 1=))) > 3=))) > &=))) > 8)) > 1=8))

> 1=8))

#a7es (&)@, 8)) 1=1)) 1=-)) 31) 31) 1=11)

et inco+e > 1=1)) > 1=8)) > 1=&)) > &8) > 1=)8)

> 1=-8)

A$" 1)2)@ 152)@ 1)2)@ 1)2)@

1)2)@

%O$ -2)@ 42)@ 112)@ &28@

1-28@

#8$ 123

323

$(A$", 152)@ 152)@

$(%O$, 42)@ 1)28@

$(#8$, 125

A$"

325@ 325@

%O$

121@ &21@

#8$

) )2-

C2 (1, Ae prepared to discuss each entr< in the table and to

e7plain ho. this e7a+ple illustrates the eDect o/ 9nancial

leverage on e7pected rate o/ return and ris62

Ans.er: KSho. S13*13 through S13*15 here2L Conclusions /ro+ the

anal<sis:

12 #he 9r+:s basic earning po.er= A$" O $A8#5#otal assets=

is unaDected b< 9nancial leverage2

1)8 Integrated Case Chapter 13: Capital Structure and Leverage

12 'ir+ L has the higher e7pected %O$:

$(%O$

G

, O )215(-2)@, P )25)(42)@, P )215(112)@, O

42)@2

$(%O$

L

, O )215(&28@, P )25)(1)28@, P )215(1-28@, O

1)28@2

#here/ore= the use o/ 9nancial leverage has increased

the e7pected pro9tabilit< to shareholders2 #a7 savings

cause the higher e7pected %O$

L

2 (8/ the 9r+ uses debt=

the stoc6 is ris6ier= .hich then causes r

d

and r

s

to

increase2 ;ith a higher r

d

= interest increases= so the

interest ta7 savings increases2,

32 'ir+ L has a .ider range o/ %O$s= and a higher

standard deviation o/ %O$= indicating that its higher

e7pected return is acco+panied b< higher ris62 #o be

precise:

%O$ (Gnlevered,

O 1211@= and CQ O )21&2

%O$ (Levered,

O &21&@= and CQ O )2342

#hus= in a stand*alone ris6 sense= 'ir+ L is t.ice as

ris6< as 'ir+ GCits business ris6 is 1211@= but its

stand*alone ris6 is &21&@= so its 9nancial ris6 is &21&@ F

1211@ O 1211@2

&2 ;hen $A8# O >1=)))= %O$

G

R %O$

L

= and leverage has a

negative i+pact on pro9tabilit<2 !o.ever= at the

e7pected level o/ $A8#= %O$

L

R %O$

G

2

52 Leverage .ill al.a<s boost e7pected %O$ i/ the

e7pected unlevered %OA e7ceeds the a/ter*ta7 cost o/

Chapter 13: Capital Structure and Leverage Integrated Case 1)4

debt2 !ere $(%OA, O $(Gnlevered %O$, O 42)@ R r

d

(1 F

#, O 11@()2-, O 321@= so the use o/ debt raises

e7pected %O$2

-2 'inall<= note that the #8$ ratio is huge (unde9ned= or

in9nitel< large, i/ no debt is used= but it is relativel< lo.

i/ 5)@ debt is used2 #he e7pected #8$ .ould be larger

than 125 i/ less debt .ere used= but s+aller i/ leverage

.ere increased2

D2 A/ter spea6ing .ith a local invest+ent ban6er= <ou obtain

the /ollo.ing esti+ates o/ the cost o/ debt at diDerent debt

levels (in thousands o/ dollars,:

A+ount Debt5Assets Debt5$Buit< Aond

Aorro.ed %atio %atio %ating r

d

> ) )2))) )2)))) C C

15) )2115 )21&14 AA 82)@

5)) )215) )23333 A 42)

35) )2335 )2-))) AAA 1125

1=))) )25)) 12)))) AA 1&2)

o. consider the opti+al capital structure /or CD2

(1, #o begin= de9ne the ter+s Mopti+al capital structureN and

Mtarget capital structure2N

Ans.er: KSho. S13*1- here2L #he opti+al capital structure is the

capital structure at .hich the ta7*related bene9ts o/

leverage are e7actl< oDset b< debt:s ris6*related costs2 At

the opti+al capital structure= (1, the total value o/ the 9r+

is +a7i+iHed= (1, the ;ACC is +ini+iHed= and the price per

share is +a7i+iHed2 #he target capital structure is the +i7

o/ debt= pre/erred stoc6= and co++on eBuit< .ith .hich the

9r+ plans to raise capital2

11) Integrated Case Chapter 13: Capital Structure and Leverage

D2 (1, ;h< does CD:s bond rating and cost o/ debt depend on the

a+ount o/ +one< borro.edI

Ans.er: 'inancial ris6 is the additional ris6 placed on the co++on

stoc6holders as a result o/ the decision to 9nance .ith debt2

Conceptuall<= stoc6holders /ace a certain a+ount o/ ris6 that

is inherent in a 9r+:s operations2 8/ a 9r+ uses debt (9nancial

leverage,= this concentrates the business ris6 on co++on

stoc6holders2

'inancing .ith debt increases the e7pected rate o/

return /or an invest+ent= but leverage also increases the

probabilit< o/ a large loss= thus increasing the ris6 borne b<

stoc6holders2 As the a+ount o/ +one< borro.ed increases=

the 9r+ increases its ris6 so the 9r+:s bond rating

decreases and its cost o/ debt increases2

D2 (3, Assu+e that shares could be repurchased at the current

+ar6et price o/ >15 per share2 Calculate CD:s e7pected $"S

and #8$ at debt levels o/ >)= >15)=)))= >5))=)))= >35)=)))=

and >1=)))=)))2 !o. +an< shares .ould re+ain a/ter

recapitaliHation under each scenarioI

Ans.er: KSho. S13*13 through S13*15 here2L #he anal<sis /or the

debt levels being considered (in thousands o/ dollars and

shares, is sho.n belo.:

At D O >):

$"S O

g outstandin Shares

, # 1 ,L( D ( r $A8# K

d

O

)=))) 8

, ))=)))()2- & >

O >32))2

#8$ O

8nterest

$A8#

O 2

Chapter 13: Capital Structure and Leverage Integrated Case 111

At D O >15)=))):

Shares repurchased O >15)=)))5>15 O 1)=)))2

%e+aining shares outstanding O 8)=))) F 1)=))) O 3)=)))2

(ote: $"S and #8$ calculations are in thousands o/

dollars2,

$"S O

) 3

-, (>15),L()2 )8 )2 )) & K>

O >321-2

#8$ O

) >1

)) & >

O 1)2

At D O >5))=))):

Shares repurchased O >5))=)))5>15 O 1)=)))2

%e+aining shares outstanding O 8)=))) F 1)=))) O -)=)))2

(ote: $"S and #8$ calculations are in thousands o/

dollars2,

$"S O

-)

-, (>5)),L()2 )4 )2 )) & K>

O >32552

#8$ O

5 & >

)) & >

O 8242

At D O >35)=))):

Shares repurchased O >35)=)))5>15 O 3)=)))2

%e+aining shares outstanding O 8)=))) F 3)=))) O 5)=)))2

(ote: $"S and #8$ calculations are in thousands o/

dollars2,

$"S O

) 5

-), (>35),L()2 15 )21 )) & K>

O >32332

111 Integrated Case Chapter 13: Capital Structure and Leverage

#ie O

5 1 2 8- >

)) & >

O &2-2

At D O >1=)))=))):

Shares repurchased O >1=)))=)))5>15 O &)=)))2

%e+aining shares outstanding O 8)=))) F &)=))) O &)=)))2

(ote: $"S and #8$ calculations are in thousands o/

dollars2,

$"S O

) &

)2-), (>1=))),L( & )21 )) & K>

O >324)2

#8$ O

) & >1

)) & >

O 1242

D2 (&, Gsing the !a+ada eBuation= .hat is the cost o/ eBuit< i/ CD

recapitaliHes .ith >15)=))) o/ debtI >5))=)))I >35)=)))I

>1=)))=)))I

Ans.er: KSho. S13*1- through S13*3) here2L

r

%'

O -2)@ r

E

F r

%'

O -2)@

b

G

O 12) #otal assets O >1=)))

#a7 rate O &)2)@

A+ount Debt5Assets Debt5$Buit< Levered

Aorro.ed

a

%atio

b

%atio

c

Aeta

d

r

s

e

> ) )2))@ )2))@ 12)) 112))@

15) 1125) 1&214 12)4 11251

5)) 152)) 33233 121) 1321)

35) 3325) -)2)) 123- 1&21-

1=))) 5)2)) 1))2)) 12-) 152-)

otes:

a

Data given in proble+2

b

Calculated as a+ount borro.ed divided b< total assets2

Chapter 13: Capital Structure and Leverage Integrated Case 113

c

Calculated as a+ount borro.ed divided b< eBuit< (total

assets less a+ount borro.ed,2

d

Calculated using the !a+ada eBuation= b

L

O b

G

K1 P (1 F #,

(D5$,L2

e

Calculated using the CA"E= r

s

O r

%'

P (r

E

F r

%'

,b= given the

ris6*/ree rate= the +ar6et ris6 pre+iu+= and using the

levered beta as calculated .ith the !a+ada eBuation2

D2 (5, Considering onl< the levels o/ debt discussed= .hat is the

capital structure that +ini+iHes CD:s ;ACCI

Ans.er: KSho. S13*31 and S13*31 here2L

r

%'

O -2)@ r

E

F r

%'

O -2)@

b

G

O 12) #otal assets O >1=)))

#a7 rate O &)2)@

A+ount

Aorro.e

d

a

Debt5Asse

ts

%atio

b

$Buit<5Asse

ts

%atio

c

Debt5$Buit

<

%atio

d

Levered

Aeta

e

rs

/

rd

a

rd(1 F

#,

;ACC

g

>

)

)2))@ 1))2))@ )2))@ 12)) 112))@ )2)@ )2)@ 112))@

15) 1125) 8325) 1&214 12)4 11251 82) &28 11255

5)) 152)) 352)) 33233 121) 1321) 42) 52& 11215

35) 3325) -125) -)2)) 123- 1&21- 1125 -24 112&&

1=))) 5)2)) 5)2)) 1))2)) 12-) 152-) 1&2) 82& 112))

otes:

a

Data given in proble+2

b

Calculated as a+ount borro.ed divided b< total assets2

c

Calculated as 1 F D5A2

d

Calculated as a+ount borro.ed divided b< eBuit< (total

assets less a+ount borro.ed,2

e

Calculated using the !a+ada eBuation= b

L

O b

G

K1 P (1 F #,

(D5$,L2

11& Integrated Case Chapter 13: Capital Structure and Leverage

/

Calculated using the CA"E= r

s

O r

%'

P (r

E

F r

%'

,b= given the

ris6*/ree rate= the +ar6et ris6 pre+iu+= and using the

levered beta as calculated .ith the !a+ada eBuation2

g

Calculated using the ;ACC eBuation= ;ACC O .

d

r

d

(1 F #, P

.

c

r

s

2

CD:s ;ACC is +ini+iHed at a capital structure that consists o/

15@ debt and 35@ eBuit<= or a ;ACC o/ 11215@2

D2 (-, ;hat .ould be the ne. stoc6 price i/ CD recapitaliHes .ith

>15)=))) o/ debtI >5))=)))I >35)=)))I >1=)))=)))I

%ecall that the pa<out ratio is 1))@= so g O )2

Ans.er: KSho. S13*33 here2L ;e can calculate the price o/ a

constant gro.th stoc6 as D"S divided b< r

s

+inus g= .here

g is the e7pected gro.th rate in dividends: "

)

O D

1

5(r

s

F g,2

Since in this case all earnings are paid out to the

stoc6holders= D"S O $"S2 'urther= because no earnings are

plo.ed bac6= the 9r+:s $A8# is not e7pected to gro.= so g O

)2

!ere are the results:

Debt Level D"S r

s

Stoc6 "rice

> ) >32)) 112))@ >152))

15)=))) 321- 11251 1-2)3

5))=))) 3255 1321) 1-284S

35)=))) 3233 1&21- 1-254

1=)))=))) 324) 152-) 152))

SEa7i+u+

D2 (3, 8s $"S +a7i+iHed at the debt level that +a7i+iHes share

priceI ;h< or .h< notI

Chapter 13: Capital Structure and Leverage Integrated Case 115

Ans.er: KSho. S13*3& here2L ;e have seen that $"S continues to

increase be<ond the >5))=))) opti+al level o/ debt2

#here/ore= /ocusing on $"S .hen +a6ing capital structure

decisions is not correctC.hile the $"S does ta6e account o/

the diDerential cost o/ debt= it does not account /or the

increasing ris6 that +ust be borne b< the eBuit< holders2

D2 (8, Considering onl< the levels o/ debt discussed= .hat is CD:s

opti+al capital structureI

Ans.er: KSho. S13*35 here2L A capital structure .ith >5))=))) o/

debt produces the highest stoc6 price= >1-284? hence= it is

the best o/ those considered2

D2 (4, ;hat is the ;ACC at the opti+al capital structureI

Ans.er: 8nitial debt level:

Debt5#otal assets O )@= so #otal assets O 8nitial eBuit< O

>15 8)=))) shares O >1=)))=)))2

;ACCO

))) = ))) = 1 >

))) = 5)) >

(4@,()2-), P

))) = ))) = 1 >

))) = 5)) = 1 >

(1321@,

O 1235@ P 424)@ O 11215@2

ote: 8/ .e had (1, used the eBuilibriu+ price /or

repurchasing shares and (1, used +ar6et value .eights to

calculate ;ACC= then .e could be sure that the ;ACC at

the price*+a7i+iHing capital structure .ould be the

+ini+u+2 Gsing a constant >15 purchase price= and boo6

value .eights= inconsistencies +a< creep in2

11- Integrated Case Chapter 13: Capital Structure and Leverage

$2 Suppose <ou discovered that CD had +ore business ris6

than <ou originall< esti+ated2 Describe ho. this .ould

aDect the anal<sis2 ;hat i/ the 9r+ had less business ris6

than originall< esti+atedI

Ans.er: KSho. S13*3- here2L 8/ the 9r+ had higher business ris6= then=

at an< debt level= its probabilit< o/ 9nancial distress .ould be

higher2 8nvestors .ould recogniHe this= and both r

d

and r

s

.ould

be higher than originall< esti+ated2 8t is not sho.n in this

anal<sis= but the end result .ould be an opti+al capital

structure .ith less debt2 Conversel<= lo.er business ris6 .ould

lead to an opti+al capital structure that included +ore debt2

'2 ;hat are so+e /actors a +anager should consider .hen

establishing his or her 9r+:s target capital structureI

Ans.er: KSho. S13*33 and S13*38 here2L Since it is diTcult to

Buanti/< the capital structure decision= +anagers consider

the /ollo.ing judg+ental /actors .hen +a6ing capital

structure decisions:

12 #he average debt ratio /or 9r+s in their industr<2

12 "ro /or+a #8$ ratios at diDerent capital structures

under diDerent scenarios2

32 Lender5rating agenc< attitudes2

&2 %eserve borro.ing capacit<2

52 $Dects o/ 9nancing on control2

-2 Asset structure2

32 $7pected ta7 rate2

Chapter 13: Capital Structure and Leverage Integrated Case 113

82 Eanage+ent attitudes2

42 Ear6et conditions2

1)2 'ir+:s internal conditions2

112 'ir+:s operating leverage2

112 'ir+:s gro.th rate2

132 'ir+:s pro9tabilit<2

Optional 0uestion

Eodigliani and Eiller proved= under a ver< restrictive set o/

assu+ptions= that the value o/ a 9r+ .ill be +a7i+iHed b< 9nancing

al+ost entirel< .ith debt2 ;h<= according to EE= is debt bene9cialI

Ans.er: EE argued that using debt increases the value o/ the 9r+

because interest is ta7 deductible2 #he govern+ent= in

eDect= pa<s part o/ the interest= and this lo.ers the cost o/

debt relative to the cost o/ eBuit<= +a6ing debt 9nancing

+ore attractive than eBuit< 9nancing2 "ut another .a<=

since interest is deductible= the +ore debt a co+pan< uses=

the lo.er its ta7 bill= and the +ore o/ its operating inco+e

Jo.s through to investors= so the greater its value2

Optional 0uestion

;hat assu+ptions underlie the EE theor<I Are these assu+ptions

realisticI

Ans.er: EE:s 6e< assu+ptions are as /ollo.s:

12 #here are no bro6erage costs2

12 #here are no ta7es2

118 Integrated Case Chapter 13: Capital Structure and Leverage

32 8nvestors can borro. at the sa+e rate as corporations2

&2 8nvestors have the sa+e in/or+ation as +anagers

about the 9r+:s /uture invest+ent opportunities2

52 All o/ the 9r+:s debt is ris6less= regardless o/ ho. +uch

it uses2 (#here are no ban6ruptc< costs2,

-2 $A8# is not aDected b< the use o/ debt2

#hese assu+ptions are obviousl< unrealisticCinvestors do

incur bro6erage /ees and personal inco+e ta7es? the<

cannot borro. at the sa+e rate as corporations? and the<

do not have the sa+e in/or+ation as the 9r+:s +anagers

regarding /uture invest+ent opportunities2 Also= corporate

debt is ris6<= especiall< i/ a 9r+ uses lots o/ debt= and the

interest rate .ill rise as the debt level increases2

Chapter 13: Capital Structure and Leverage Integrated Case 114

'igure 8C 13*12 %elationship bet.een Capital Structure and Stoc6

"rice

U2 "ut labels on 'igure 8C 13*1= and then discuss the graph as

<ou +ight use it to e7plain to <our boss .h< CD +ight .ant

to use so+e debt2

Ans.er: KSho. S13*34 and S13*&) here2L #he use o/ debt per+its a

9r+ to obtain ta7 savings /ro+ the deductibilit< o/ interest2

So the use o/ so+e debt is good? ho.ever= the possibilit< o/

ban6ruptc< increases the cost o/ using debt2 At higher and

higher levels o/ debt= the ris6 o/ ban6ruptc< increases=

bringing .ith it costs associated .ith potential 9nancial

distress2 Custo+ers reduce purchases= 6e< e+plo<ees

leave= and so on2 #here is so+e point= generall< .ell belo.

a debt ratio o/ 1))@= at .hich proble+s associated .ith

potential ban6ruptc< +ore than oDset the ta7 savings /ro+

debt2

#heoreticall<= the opti+al capital structure is /ound at

the point .here the +arginal ta7 savings just eBual the

11) Integrated Case Chapter 13: Capital Structure and Leverage

Value of Firms

Stock

0 D1 Leverage, D/

D!

+arginal ban6ruptc<*related costs2 !o.ever= anal<sts

cannot identi/< this point .ith precision /or an< given 9r+=

or /or 9r+s in general2 Anal<sts can help +anagers

deter+ine an opti+al range /or their 9r+:s debt ratios= but

the capital structure decision is still +ore judg+ental than

based on precise calculations2

!2 !o. does the e7istence o/ as<++etric in/or+ation and

signaling aDect capital structureI

Ans.er: KSho. S13*&1 through S13*&& here2L #he as<++etric

in/or+ation concept is based on the pre+ise that

+anage+ent:s choice o/ 9nancing gives signals to

investors2 'ir+s .ith good invest+ent opportunities .ill

not .ant to share the bene9ts .ith ne. stoc6holders= so

the< .ill tend to 9nance .ith debt2 'ir+s .ith poor

prospects= on the other hand= .ill .ant to 9nance .ith

stoc62 8nvestors 6no. this= so .hen a large= +ature 9r+

announces a stoc6 oDering= investors ta6e this as a signal

o/ bad ne.s= and the stoc6 price declines2 'ir+s 6no. this=

so the< tr< to avoid having to sell ne. co++on stoc62 #his

+eans +aintaining a reserve o/ borro.ing capacit< so that

.hen good invest+ents co+e along= the< can be 9nanced

.ith debt2

Chapter 13: Capital Structure and Leverage Integrated Case 111

Optional 0uestion

You +ight e7pect the price o/ a +ature 9r+:s stoc6 to decline i/ it

announces a stoc6 oDering2 ;ould <ou e7pect the sa+e reaction i/

the issuing 9r+ .ere a <oung= rapidl< gro.ing co+pan<I

Ans.er: 8/ a +ature 9r+ sells stoc6= the price o/ its stoc6 .ould

probabl< decline2 A +ature 9r+ should have other

9nancing alternatives= so a stoc6 issue .ould signal that its

earnings potential is not good2 A <oung= rapidl< gro.ing

9r+= ho.ever= +a< have so +an< good invest+ent

opportunities that it si+pl< cannot raise all the eBuit< it

needs as retained earnings= and investors 6no. this2

#here/ore= the stoc6 price o/ a <oung= rapidl< gro.ing 9r+

.ould probabl< not /all because o/ a ne. stoc6 issue=

especiall< i/ the 9r+:s +anagers announce that the< are

not selling an< o/ their o.n shares in the oDering2

111 Integrated Case Chapter 13: Capital Structure and Leverage

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Catalog of Ideas - KUKA Robotics PDFDocument74 pagesCatalog of Ideas - KUKA Robotics PDFAugustino Nguyen Cao ThangNo ratings yet

- Treasury Alliance Cash Pooling White PaperDocument16 pagesTreasury Alliance Cash Pooling White PaperShilpa KogantiNo ratings yet

- Expense Report/Travel Expense Statement (Simulation) : ItineraryDocument1 pageExpense Report/Travel Expense Statement (Simulation) : ItineraryAlvin AgullanaNo ratings yet

- User Guide - Service Entry Sheet - October 2021 - v1.0Document17 pagesUser Guide - Service Entry Sheet - October 2021 - v1.0Alvin AgullanaNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument10 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityAlvin AgullanaNo ratings yet

- RR 18-12 Regulations - in - The - Processing - of - Authority - To - PrintDocument5 pagesRR 18-12 Regulations - in - The - Processing - of - Authority - To - PrintAlvin AgullanaNo ratings yet

- Rmo 53 98Document25 pagesRmo 53 98Alvin AgullanaNo ratings yet

- Program FlowDocument1 pageProgram FlowAlvin AgullanaNo ratings yet

- Overall ScoresheetDocument1 pageOverall ScoresheetAlvin AgullanaNo ratings yet

- Mas 1405Document12 pagesMas 1405Alvin AgullanaNo ratings yet

- Case Number: 1 G.R. Number: Case Title: Heirs of San Andres vs. Rodriguez DateDocument2 pagesCase Number: 1 G.R. Number: Case Title: Heirs of San Andres vs. Rodriguez DateAlvin AgullanaNo ratings yet

- Chap2 As 1 Disclosure of Accounting PoliciesDocument3 pagesChap2 As 1 Disclosure of Accounting PoliciesAashutosh PatodiaNo ratings yet

- BD ppt19Document84 pagesBD ppt19Steven GalfordNo ratings yet

- 1feb 9feb DataDocument2 pages1feb 9feb DataPaul YangNo ratings yet

- Varroc Final ReportDocument43 pagesVarroc Final ReportKamlakar AvhadNo ratings yet

- In Witness WhereofDocument4 pagesIn Witness WhereofRAtu SYuhadahNo ratings yet

- Accounting For CorporationsDocument7 pagesAccounting For CorporationsXYRELLENo ratings yet

- Limitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Document9 pagesLimitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Taxpert Professionals Private LimitedNo ratings yet

- Infosys Chairman Nandan Nilekani's StatementDocument2 pagesInfosys Chairman Nandan Nilekani's StatementNDTVNo ratings yet

- Flores Vs Drilon 223 Scra 568 (1993)Document1 pageFlores Vs Drilon 223 Scra 568 (1993)Maica MahusayNo ratings yet

- Recent Trends of PE Funding in IndiaDocument38 pagesRecent Trends of PE Funding in IndiaProf Dr Chowdari PrasadNo ratings yet

- CSR Proposal FormatsDocument14 pagesCSR Proposal FormatsVEEERYNo ratings yet

- Meaning of NBFCDocument30 pagesMeaning of NBFCRaj SakpalNo ratings yet

- Fi515 Test 2Document4 pagesFi515 Test 2joannapsmith33No ratings yet

- UNVRDocument4 pagesUNVRFaizal WihudaNo ratings yet

- Gamuda BerhadDocument2 pagesGamuda BerhadHui EnNo ratings yet

- Urdaneta City University: College of Accountancy and Business AdministrationDocument46 pagesUrdaneta City University: College of Accountancy and Business Administrationmara maurilloNo ratings yet

- Mergers and Acquisitions-Atty EspedidoDocument9 pagesMergers and Acquisitions-Atty EspedidoKvyn Honoridez100% (1)

- PTI vs. GarciaDocument1 pagePTI vs. GarciaAngie DouglasNo ratings yet

- India Consumer: Wallet Watch - Vol 1/12Document6 pagesIndia Consumer: Wallet Watch - Vol 1/12Rahul GanapathyNo ratings yet

- Psa 210 RedraftedDocument40 pagesPsa 210 RedraftedRarajNo ratings yet

- The Screening of Stocks For Shariah ComplianceDocument7 pagesThe Screening of Stocks For Shariah Compliancehabeebbhai110No ratings yet

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Document21 pagesMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoNo ratings yet

- Women Business Incubation Centre, QuettaDocument31 pagesWomen Business Incubation Centre, Quettabaloch75100% (3)

- CSR AssignmentDocument10 pagesCSR AssignmentMukesh ManwaniNo ratings yet

- Strategic Analysis of Investment Banking in IndiaDocument19 pagesStrategic Analysis of Investment Banking in Indiaanuradha100% (7)

- Chapter 18 Issues in INternational AccountingDocument3 pagesChapter 18 Issues in INternational AccountingindraakhriaNo ratings yet

- Risk Management Through Derivative in Indian Stock MarketDocument29 pagesRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiNo ratings yet

- DISNEYDocument1 pageDISNEYGerald Jason AxellinoNo ratings yet