Professional Documents

Culture Documents

Que 01 12

Uploaded by

Cosovliu RamonaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Que 01 12

Uploaded by

Cosovliu RamonaCopyright:

Available Formats

P

a

p

e

r

1

.

1

(

I

N

T

)

Preparing

Financial

Statements

(International Stream)

QUESTION PAPER

Time allowed 3 hours

This paper is divided into two sections

Section A ALL 25 questions are compulsory and MUST be

answered

Section B ALL FIVE questions are compulsory and MUST be

answered

PART 1

THURSDAY 6 DECEMBER 2001

2

Section A ALL TWENTY-FIVE questions are compulsory and MUST be attempted

Please use the answer sheet provided to indicate your choice in each question

Each question within this section is worth 2 marks

1 The trial balance totals of Gamma at 30 September 2001 are:

Debit $992,640

Credit $1,026,480

Which TWO of the following possible errors could, when corrected, cause the trial balance to agree?

1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.

2. The balance on the motor expenses account $27,680 has incorrectly been listed in the trial balance as a credit.

3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.

4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.

A 1 and 2

B 2 and 3

C 2 and 4

D 3 and 4

2 The trial balance of Delta, a limited liability company, did not agree and a suspense account was opened for the

difference. The following errors were subsequently found:

1. A cash refund due to customer A was correctly treated in the cash book and then credited to the accounts receivable

ledger account of customer B.

2. The sale of goods to a director for $300 was recorded by debiting sales revenue account and crediting the directors

current account.

3. The total of the discount received column in the cash book had been credited in error to the discount allowed

account.

4. Some of the cash received from customers had been used to pay sundry expenses before banking the money.

5. $5,800 paid for plant repairs was correctly treated in the cash book and then credited to plant and equipment asset

account.

Which of the above errors would require an entry to the suspense account as part of the process of correcting them?

A 1, 3 and 5

B 1, 2 and 5

C 1 and 5

D 3 and 4

3 Beta purchased some plant and equipment on 1 July 2001 for $40,000. The estimated scrap value of the plant in ten

years time is estimated to be $4,000. Betas policy is to charge depreciation on the straight line basis, with a

proportionate charge in the period of acquisition.

What should the depreciation charge for the plant be in Betas accounting period of twelve months to

30 September 2001?

A $720

B $600

C $900

D $675

3 [P.T.O.

4 Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises

quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until

30 June 2000. It was increased from that date to $96,000 per year.

What rent expense and end of year prepayment should be included in the financial statements for the year ended 30

April 2001?

Expense Prepayment

A $93,000 $8,000

B $93,000 $16,000

C $94,000 $8,000

D $94,000 $16,000

5 At 30 September 2000, the following balances existed in the records of Lambda:

$

Plant and equipment: Cost 860,000

Accumulated depreciation 397,000

During the year ended 30 September 2001, plant with a written down value of $37,000 was sold for $49,000. The

plant had originally cost $80,000. Plant purchased during the year cost $180,000. It is the companys policy to charge

a full years depreciation in the year of acquisition of an asset and none in the year of sale, using a rate of 10% on the

straight line basis.

What net amount should appear in Lambdas balance sheet at 30 September 2001 for plant and equipment?

A $563,000

B $467,000

C $510,000

D $606,000

6 At 30 September 2000, Z Ltd had a provision for doubtful debts of $37,000. During the year ended 30 September

2001 the company wrote off debts totalling $18,000, and at the end of the year it is decided that the provision for

doubtful debts should be $20,000.

What should be included in the income statement for bad and doubtful debts?

A $35,000 debit

B $1,000 debit

C $38,000 debit

D $1,000 credit

7 Which of the following best explains the imprest system of petty cash control?

A Weekly expenditure cannot exceed a set amount.

B The exact amount of expenditure is reimbursed at intervals to maintain a fixed float.

C All expenditure out of the petty cash must be properly authorised.

D Regular equal amounts of cash are transferred into petty cash at intervals.

1

D

I

N

T

A

D

P

a

p

e

r

1

.

1

(

I

N

T

)

4

8 In reconciling a business cash book with the bank statement, which of the following items could require a

subsequent entry in the cash book?

1. Cheques presented after date.

2. A cheque from a customer which was dishonoured.

3. An error by the bank.

4. Bank charges.

5. Deposits credited after date.

6. Standing order entered in bank statement.

A 2, 3, 4 and 6

B 1, 2, 5 and 6

C 2, 4 and 6

D 1, 3 and 5

9 The following bank reconciliation statement has been prepared for Omega by a junior clerk:

$

Overdraft per bank statement 68,100

Add: Deposits not credited 141,200

209,300

Less outstanding cheques 41,800

Overdraft per cash book 167,500

Which of the following should be the correct balance per the cash book?

A $167,500 overdrawn as stated.

B $31,300 overdrawn

C $31,300 cash at bank

D $114,900 overdrawn

10 X and Y are in partnership, sharing profits equally and preparing their accounts to 31 December each year. On 1 July

2000, Z joined the partnership, and from that date profits are shared X 40%, Y 40% and Z 20%.

In the year ended 31 December 2000, profits were:

$

6 months to 31 June 2000 200,000

6 months to 31 December 2000 300,000

It was agreed that X and Y only should bear equally the expense for a bad debt of $40,000 written off in the six months

to 31 December 2000 in arriving at the $300,000 profit.

Which of the following correctly states Xs profit share for the year?

Profit share

X

$

A 216,000

B 200,000

C 220,000

D 224,000

1

D

I

N

T

A

H

P

a

p

e

r

1

.

1

(

I

N

T

)

5 [P.T.O.

11 S and T are in partnership and prepare their accounts to 31 December each year. On 1 July 2000, U joined the

partnership.

Profit sharing arrangements are:

6 months to 30 June 2000 6 months to 31December 2000

Salary S $15,000 $25,000

Share of balance of profit S 60% 40%

T 40% 40%

U 20%

The partnership profit for the year ended 31 December 2000 was $350,000 accruing evenly over the year.

What are the partners total profit shares for the year ended 31 December 2000?

S T U

$000 $000 $000

A 196 124 30

B 217 108 25

C 155 130 65

D 175 145 35

12 Which of the following four statements about accounting concepts or principles are correct?

1. The money measurement concept is that items in accounts are initially measured at their historical cost.

2. In order to achieve comparability it may sometimes be necessary to override the prudence concept.

3. To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are

disclosed.

4. To comply with the law, the legal form of a transaction must always be reflected in financial statements.

A 1 and 3

B 1 and 4

C 3 only

D 2 and 3

13 The closing inventory of Epsilon amounted to $284,000 at 30 September 2001, the balance sheet date. This total

includes two inventory lines about which the inventory taker is uncertain.

1. 500 items which had cost $15 each and which were included at $7,500. These items were found to have been

defective at the balance sheet date. Remedial work after the balance sheet date cost $1,800 and they were then

sold for $20 each. Selling expenses were $400.

2. 100 items which had cost $10 each. After the balance sheet date they were sold for $8 each, with selling

expenses of $150.

What figure should appear in Epsilons balance sheet for inventory?

A $283,650

B $283,800

C $292,150

D $283,950

6

14 Which of these statements about research and development expenditure are correct?

1. If certain conditions are satisfied, research and development expenditure must be capitalised.

2. One of the conditions to be satisfied if development expenditure is to be capitalised is that the technical feasibility

of the project is reasonably assured.

3. If capitalised, development expenditure must be amortised over a period not exceeding five years.

4. The amount of capitalised development expenditure for each project should be reviewed each year. If

circumstances no longer justify the capitalisation, the balance should be written off over a period not exceeding five

years.

5. Development expenditure may only be capitalised if it can be shown that adequate resources will be available to

finance the completion of the project.

A 2 and 5

B 3, 4 and 5

C 2, 3 and 5

D 1, 2 and 3

15 On 30 September 2001 part of the inventory of a company was completely destroyed by fire.

The following information is available:

Inventory at 1 September 2001 at cost $49,800

Purchases for September 2001 $88,600

Sales for September 2001 $130,000

Inventory at 30 September 2001 undamaged items $32,000

Standard gross profit percentage on sales 30%

Based on this information, what is the cost of the inventory destroyed?

A $17,800

B $47,400

C $15,400

D $6,400

16 At 1 July 2000 the share capital and share premium account of a company were as follows:

$

Share capital 300,000 ordinary shares of 25c each 75,000

Share premium account 200,000

During the year ended 30 June 2001 the following events took place:

1. On 1 January 2001 the company made a rights issue of one share for every five held, at $120 per share.

2. On 1 April 2001 the company made a bonus (capitalisation) issue of one share for every three in issue at that time,

using the share premium account to do so.

What are the correct balances on the companys share capital and share premium accounts at 30 June 2001?

Share capital Share premium account

A $460,000 $287,000

B $480,000 $137,000

C $120,000 $137,000

D $120,000 $227,000

7 [P.T.O.

17 In relation to cash flow statements, which, if any, of the following are correct?

1. The direct method of calculating net cash from operating activities leads to a different figure from that produced by

the indirect method, but this is balanced elsewhere in the cash flow statement.

2. A company making high profits must necessarily have a net cash inflow from operating activities.

3. Profits and losses on disposals of non-current assets appear as items under cash flows from investing activities in

the cash flow statement or a note to it.

A Item 1 only

B Item 2 only

C Item 3 only

D None of the items.

18 A cash flow statement prepared in accordance with IAS7 Cash Flow Statements opens with the calculation of cash flows

from operating activities from the net profit before taxation.

Which of the following lists of items consists only of items that would be ADDED to net profit before taxation in that

calculation?

A Decrease in inventories, depreciation, profit on sale of non-current assets.

B Increase in trade payables, decrease in trade receivables, profit on sale of non-current assets.

C Loss on sale of non-current assets, depreciation, increase in trade receivables.

D Decrease in trade receivables, increase in trade payables, loss on sale of non-current assets.

19 IAS 10 Events after the Balance Sheet Date defines the extent to which events after the balance sheet date should be

reflected in financial statements. Five such events are listed below.

1 Merger with another company.

2 Insolvency of a customer.

3 Destruction of a major non-current asset.

4 Sale of inventory held at the balance sheet date for less than cost.

5 Discovery of fraud.

Which three of the listed items are, according to IAS 10, normally to be classified as adjusting?

A 1, 2 and 3

B 2, 4 and 5

C 1, 2 and 5

D 1, 4 and 5

20 In preparing the financial statements of a company, the following items have to be considered:

1. The company offers a one year warranty to purchasers, undertaking to replace an item if a defect occurs. Past

experience suggests that claims under the warranty will probably arise.

2. The company has an action pending against it for damages for wrongful dismissal of a director. The companys legal

advisor considers it improbable that the action will be successful.

3. The company has guaranteed the overdraft of a subsidiary. The subsidiary is trading profitably and the probability

of a liability arising is remote.

How should these items be reflected in the financial statements, if at all?

A All three should be disclosed by note.

B A provision should be created for the best estimate of the liability in 1, and items 2 and 3 should be disclosed

by note.

C A provision should be created for the best estimate of the liability in 1, item 2 should be disclosed by note and

item 3 not disclosed at all.

D A provision should be created for the best estimate of the liabilities in 1 and 2 and item 3 should be disclosed

by note.

8

21 The analysis of a companys financial statements revealed that the number of days sales in inventory was 80 days. The

average for companies in the same industry was 35 days.

Which one of the following is LEAST likely to account for the high level of 80 days?

A The companys trade is seasonal

B Poor inventory control

C A large purchase was made just before the balance sheet date

D An increase in the companys sales in the three months before the balance sheet date.

The following data relates to Questions 22 and 23.

Extracts from a companys financial statements for the year ended 30 September 2001 are given below.

Balance sheet Income statement

$000 $000

Issued share capital 500 Operating profit 300

Reserves 200 Finance cost 100

Accumulated profit 800 Profit before tax 200

Non-current liabilities:

10% loan notes 1,000

22 What is the return on shareholders equity as a percentage, based on these figures?

A 40%

B 20%

C 133%

D 12%

23 What is the return on total capital employed as a percentage, based on these figures?

A 12%

B 8%

C 133%

D 20%

24 Which of the following correctly states items which should be disclosed in the statement of changes in equity

required by IAS 1 Presentation of Financial Statements?

A Net profit for the period, surplus on revaluation of non-current assets, dividends paid, proceeds of issue of

shares.

B Proceeds of issue of shares, loan notes issued or repaid, retained profit for the period, surplus on revaluation of

non-current assets.

C Profit on ordinary activities, income tax expense, extraordinary items.

D Accumulated profits, reserves, issued share capital.

1

D

I

N

T

A

U

P

a

p

e

r

1

.

1

(

I

N

T

)

9 [P.T.O.

25 Which of the following statements about financial statements are in accordance with IAS 1?

1. Extraordinary items must be disclosed on the face of the income statement as additions to or deductions from profit

before tax.

2. The authorised share capital of the company must be disclosed by note or on the face of the balance sheet.

3. The total of staff costs for the period must be disclosed by note or on the face of the income statement.

4. The accounting policies adopted by the company must be disclosed but only if they do not comply with accounting

standards.

5. Proposed ordinary dividends should not be recognised as liabilities unless they have been proposed or declared

before the balance sheet date.

A 1, 2, 3 and 4

B 1, 2, 3 and 5

C 2, 3 and 5

D 1, 4 and 5

(50 marks)

10

Section B ALL FIVE questions are compulsory and MUST be attempted

1 The following is an extract from the trial balance of Tafford, a limited liability company, at 30 September 2001:

$000 $000

Warehouse machinery:

Cost: 3,000

Accumulated depreciation at 1 October 2000 1,700

Motor vehicles:

Cost 1,180

Accumulated depreciation at 1 October 2000 500

Inventory at 1 October 2000 13,000

Sales revenue 41,600

Purchases 22,600

Distribution costs 6,000

Administrative expenses 5,000

Allowance for doubtful debts, 1 October 2000 1,300

Bad debts written off 600

10% loan notes (issued 1999) 10,000

Interest paid on loan notes 500

Suspense account 100

Notes:

(1) Closing inventory at 30 September 2001 was $15,600,000.

(2) Bad debts written off and the movement on the allowance for doubtful debts are to be included in administrative

costs. The allowance for doubtful debts is to be reduced to $500,000.

(3) The balance on the suspense account is the proceeds of sale of motor vehicles, entered to the suspense account

pending correct treatment in the records.

The vehicles sold had cost $180,000 and had a written down value at 1 October 2000 of $60,000. It is the

companys policy to provide for a full years depreciation in the year of purchase of vehicles and none in the year of

sale. The vehicles sold were all used in the distribution of the companys sales.

(4) Depreciation is to be provided for on the straight line basis as follows:

Warehouse machinery 10 per cent

Motor vehicles 25 per cent

Depreciation of motor vehicles is to be divided equally between distribution costs and administrative expenses, and

depreciation of warehouse machinery charged wholly to distribution costs.

(5) Prepayments and accruals at 30 September 2001 were:

Prepayments Accruals

$000 $000

Distribution costs 200 100

Administrative expenses 100 60

(6) The estimated income tax expense for the year is $3,000,000.

Required:

Prepare Taffords income statement, complying as far as possible with the requirements of IAS 1 Presentation of

Financial Statements.

(10 marks)

11 [P.T.O.

2 You are preparing an income statement and balance sheet for Lamorgan, a sole trader who does not keep adequate

accounting records.

The following information is available to you to compute the figures for inclusion in the accounts for sales revenue,

purchases and closing inventory for the year ended 30 June 2001:

(a) Sales revenue

$

Cash received from credit customers 218,500

Cash sales receipts paid into bank 114,700

Expenses paid out of cash sales before banking 9,600

Trade receivables: 30 June 2000 41,600

30 June 2001 44,200

Refunds to customers 800

Discounts allowed 2,600

Bad debts written off 1,500

Amount due from credit customer deducted by Lamorgan in paying

suppliers account 700

Required:

Compute the sales revenue figure from this information. (5 marks)

(b) Purchases

$

Payments to suppliers 114,400

Trade payables: 30 June 2000 22,900

30 June 2001 24,800

Cost of items taken from inventory by Lamorgan for personal use 400

Amount due from credit customer deducted by Lamorgan in settling

suppliers account 700

Required:

Compute the purchases figure from this information. (3 marks)

(c) Closing inventory

$

Cost of inventory obtained from physical count on 30 June 2001 77,700

This figure does NOT include any amounts for the two items below.

(i) An inventory line which had cost $1,800 was found to be damaged. Remedial work costing $300 is needed

to enable the items to be sold for $1,700. Selling expenses of $100 would also be incurred in selling these

items.

(ii) Goods sent to a customer on approval in May 2001 were not included in the inventory. The sale price of the

goods was $4,000 and the cost $3,000. The customer notified his acceptance of the goods in July 2001.

Note: No adjustment to the sales figure in (a) above is required for this item.

Required:

Compute the adjusted closing inventory figure from this information. (2 marks)

(10 marks)

12

3 On 1 April 1998, Evon Limited acquired 75% of the ordinary share capital of Orset Limited for $180,000. At that date

the balance sheet of Orset Limited was as follows:

$

Sundry net assets 160,000

Share capital

100,000 Ordinary shares of $1 each 100,000

Accumulated profit 60,000

160,000

At 31 March 2001, the balance sheets of the two companies were as follows:

Evon Ltd Orset Ltd

$ $

Sundry net assets 560,000 230,000

Investment in Orset 180,000

740,000 230,000

Share capital

Shares of $1 each 500,000 100,000

Accumulated profit 240,000 130,000

740,000 230,000

Goodwill arising on consolidation is to be amortised over five years.

Required:

Prepare the consolidated balance sheet of Evon Limited and its subsidiary as at 31 March 2001.

(10 marks)

4 The IASCs Framework for the Preparation and Presentation of Financial Statements, and IAS 1 Presentation of Financial

Statements, together present concepts important in the preparation of financial statements, including materiality,

prudence and comparability among others.

Required:

(a) Explain the meaning of the following terms, giving one example of the application of each of them:

(i) Materiality;

(ii) Prudence. (6 marks)

(b) Explain how international accounting standards and the Framework promote comparability. (4 marks)

(10 marks)

13

5 The term overtrading is used to describe the condition of an enterprise which is increasing its sales revenue with

insufficient working capital to support the increase.

Required:

(a) State FOUR movements in items in financial statements or in accounting ratios that could indicate overtrading.

(4 marks)

(b) State THREE actions a company suffering from overtrading could take to rectify its position, and explain the

likely effect of the actions you propose. (6 marks)

(10 marks)

End of Question Paper

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Preparing Financial Statements: (International Stream)Document13 pagesPreparing Financial Statements: (International Stream)Jerahmeel JalalNo ratings yet

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Fa2 Specimen j14Document16 pagesFa2 Specimen j14Shohin100% (1)

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- F3 - Mock B - QuestionsDocument15 pagesF3 - Mock B - QuestionsabasNo ratings yet

- S17 FA2 Specimen Clean ProofDocument16 pagesS17 FA2 Specimen Clean Proofdaniel.maina2005No ratings yet

- Fa2 Specimen j14 PDFDocument16 pagesFa2 Specimen j14 PDFShahiman MahdzirNo ratings yet

- 1 Accounting-Week-2assignmentsDocument4 pages1 Accounting-Week-2assignmentsTim Thiru0% (1)

- Auditing Problems and SolutionsDocument10 pagesAuditing Problems and SolutionsLouie De La TorreNo ratings yet

- FA2 Revision Question 3Document8 pagesFA2 Revision Question 3miss ainaNo ratings yet

- Aau ModelDocument34 pagesAau ModelTayech TayuNo ratings yet

- J G S M: Sample Accounting Exemption Exam QuestionsDocument7 pagesJ G S M: Sample Accounting Exemption Exam QuestionsShiloh JinNo ratings yet

- Rental Income CalculationDocument8 pagesRental Income CalculationAliRazaSattarNo ratings yet

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyNo ratings yet

- Preparing Financial StatementsDocument18 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- FSA-Tutorial 1-Fall 2022Document4 pagesFSA-Tutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Receivables Ledger & Partnership AccountsDocument6 pagesReceivables Ledger & Partnership AccountsAbdul Gaffar0% (1)

- F3 Mock Questions 201603 PDFDocument14 pagesF3 Mock Questions 201603 PDFMD.Rakibul HasanNo ratings yet

- ACCA Paper F3 Financial Accounting Mock Exam QuestionsDocument23 pagesACCA Paper F3 Financial Accounting Mock Exam QuestionsOrion0088No ratings yet

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocument17 pagesDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNo ratings yet

- Intermediate Accounting 1 Trial Balance ErrorsDocument14 pagesIntermediate Accounting 1 Trial Balance Errorscpacpacpa100% (1)

- Fa2 PilotDocument16 pagesFa2 PilotBhuiyan Mohammad IftekharNo ratings yet

- F3Document17 pagesF3Irfan Khan100% (1)

- ACCT101 Sample Paper - With SolutionDocument24 pagesACCT101 Sample Paper - With SolutionBryan Seow100% (1)

- Midterm Exam ReviewDocument12 pagesMidterm Exam ReviewAllison0% (1)

- ACCA F3-FFA LRP Revision Mock - Questions S15Document18 pagesACCA F3-FFA LRP Revision Mock - Questions S15Kiri chrisNo ratings yet

- Practice Questions A1Document11 pagesPractice Questions A1rishalNo ratings yet

- Poa May 2001 Paper 2Document10 pagesPoa May 2001 Paper 2Jerilee SoCute WattsNo ratings yet

- Acc 01Document10 pagesAcc 01NothingNo ratings yet

- MCQ For Practise (Pre-Mids Topics) PDFDocument6 pagesMCQ For Practise (Pre-Mids Topics) PDFAliNo ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- Wiley - Practice Exam 2 With SolutionsDocument11 pagesWiley - Practice Exam 2 With SolutionsIvan BliminseNo ratings yet

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QMuhammad SaadNo ratings yet

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasNo ratings yet

- FA2 TEST 1 REVIEWDocument15 pagesFA2 TEST 1 REVIEWVinh Ngo Nhu75% (4)

- Poa May 2002 Paper 2Document12 pagesPoa May 2002 Paper 2Jerilee SoCute Watts50% (4)

- 1.pilot Paper 1Document21 pages1.pilot Paper 1Eugene MischenkoNo ratings yet

- IFRS 15 Revenue Recognition ExamplesDocument4 pagesIFRS 15 Revenue Recognition ExamplesFeruz Sha RakinNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsFrom EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

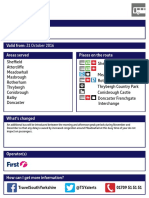

- X78 Sheffield Valid From 31 October 2016 PDFDocument8 pagesX78 Sheffield Valid From 31 October 2016 PDFCosovliu RamonaNo ratings yet

- CPJ Ten Most Censored 5 2 12 PDFDocument13 pagesCPJ Ten Most Censored 5 2 12 PDFCosovliu RamonaNo ratings yet

- Herbert Plutschow - An Anthropological Perspective On The Japanese Tea CeremonyDocument22 pagesHerbert Plutschow - An Anthropological Perspective On The Japanese Tea CeremonyCosovliu RamonaNo ratings yet

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Lecture Notes IIIDocument19 pagesLecture Notes IIICosovliu RamonaNo ratings yet