Professional Documents

Culture Documents

Bottlenecks and Problems Related To Financial Inclusion in Bottlenecks and Problems Related To Financial Inclusion in Madhya Pradesh. Bottlenecks and Problems Related To Financial Inclusion in

Bottlenecks and Problems Related To Financial Inclusion in Bottlenecks and Problems Related To Financial Inclusion in Madhya Pradesh. Bottlenecks and Problems Related To Financial Inclusion in

Uploaded by

Janice Cordeiro0 ratings0% found this document useful (0 votes)

3 views5 pagesall about madhya pradesh

Original Title

mp

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentall about madhya pradesh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views5 pagesBottlenecks and Problems Related To Financial Inclusion in Bottlenecks and Problems Related To Financial Inclusion in Madhya Pradesh. Bottlenecks and Problems Related To Financial Inclusion in

Bottlenecks and Problems Related To Financial Inclusion in Bottlenecks and Problems Related To Financial Inclusion in Madhya Pradesh. Bottlenecks and Problems Related To Financial Inclusion in

Uploaded by

Janice Cordeiroall about madhya pradesh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Journal of Economics and Sustainable Development

ISSN 2222-1700 (Paper ISSN 2222-2!"" (#nline

$ol%&' No%(' 2012

Bottlenecks and Problems Related to Financial Inclusion in

Nasser )*mad +at*er

Abstract.

,*e present -or. of t*e researc* paper is to identif/ t*e problems and bottlenec.s in relation to financial

inclusion usin0 t*e case of 1ad*/a Prades*' one of t*e poorest states in India% India does not appear to be

successful in promotin0 financial inclusion in 1ad*/a Prades* t*e main reason for t*is is t*e lac. of functional

autonom/% In t*e state of 1ad*/a Prades* lac. of a-areness' income and asset constraints' limited literac/ and

social e2clusion act as ma3or barriers to financial inclusion%

unavailabilit/ of diversified products and services' *i0* transactions costs' and eas/ availabilit/ of informal

credits are ot*er ma3or barriers to financial inclusion% 4an.s re5uire collateral to ma.e loans and (06 of

and ++4 borro-ers 0et up collateral% 7iven t*at land is t*e most important form of collateral in rural areas and

poor *ouse*old8s le0al documentation issues and si9eable proportion of poor is e2cluded%

Key words: :inancial inclusion' :inance' 4ottlen

1. Introduction

:inancial inclusion *erein refers to t*e timel/ deliver/ of financial services to disadvanta0ed sections of societ/%

+esearc* in t*e last decade leads us to believe t*at a -ell functionin0 and inclusive financial s/stem is li

faster and e5uitable 0ro-t* (;ono*an' Patric. 200<% :inancial inclusion is an eas/ access to safe savin0s'

appropriatel/ desi0ns loans for poor and lo- income *ouse*olds and for micro' small and medium si9ed

enterprises' and suitable insurance and

1.1. Financial inclusion and its related problems.

From demand side lac. of a-areness' income and asset constraints' limited literac/ especiall/ financial literac/

and social e2clusion act as ma3or barriers% :rom suppl/

unavailabilit/ of diversified products and services' *i0* transaction costs' and eas/ availabilit/ of informal

credits are ma3or barriers to ac*ieve financial inclusion (,*roat' 2007% #t*er factors li.e 0ender issu

occupation' social securit/ pa/ment s/stems are also pla/in0 vital roles in influencin0 access to financial

services% (=orld 4an.' 200!

Empirical evidence su00ests t*at access to financial services *elps t*e poor and *as positive impact on

nutrition and *ealt* outcomes' demand for education and t*e status of -omen -it*in a *ouse*old

(>ittlefied'200&% 1ad*/a Prades* is one of t*e India8s lar0est states' in -*ic* 7<6 of t*e population lives in

rural areas% #ver all' farmin0 supports about

of accessibilit/ is one of t*e bi00est bottlenec.s for 1:Is and N7#s t*at provide services in remote areas of

1ad*/a Prades* %1ost crops are *i0*l/ dependent upon -*et*er' -*ic* increases t*e

borro- to invest in a0riculture t*rou0* financial inclusion (Empo-erpoor' 2007% )lt*ou0* 1ad*/a Prades*

occupies (%76 of t*e countr/8s total land area' it comprises onl/ "%!6 of India8s population% >o-er? population

densit/ deters man/ ban.s and 1:Is from openin0 branc*es in sparsel/ in*abited re0ions of t*e state (Srinivasn'

2007

)ccordin0 to t*e interim report of t*e committee on financial inclusion' at least <%2@ million farmer

*ouse*olds in 1ad*/a Prades* are financiall/ e2cluded%

are not full/ coordinated% ,*is means t*at finance does not accompan/ 0overnment pro0rammes% #n t*e ot*er

*and' 0overnment pro0rammes are fre5uentl/ not available -*ere finance is bein0 provided% :urt*

of t*e poor are left out of covera0e b/ bot* sectors (Srinivasan' 2007% 1an/ S;7s -*ere formed and promoted

under pro0rammes in 1ad*/a Prades*% +e0ional office of t*e National 4an. for )0riculture and +ural

Development (N4)+D in 4*opal *as e

to an/ ban.s despite t*at fact some of t*ese 0roups are several /ears old%

4an.s do not understand *o- micro finance -or.s and create tedious and complicated procedures for

loanin0 to t*e or0ani9ations% In man/ areas ban.s do not cooperate -it* 1:Is% 1an/ -omen *esitate to start

savin0 in accounts because t*e/ do not trust an institution to .eep t*eir mone/ safe% SAS is ver/ successful at

scalin0 up financial inclusion in 1ad*/a Prades* but

4an.s *ave Bfor profit onl/C attitudes and e2pect to ma.e returns immediatel/ on all clients% Suc* e2pectations

Journal of Economics and Sustainable Development

!"" (#nline

21

Bottlenecks and Problems Related to Financial Inclusion in

Madhya Pradesh.

Nasser )*mad +at*er

and Parva9e )*mad >one

D

S%S%> Jain P%7% Eolle0e $idis*a (1%P% India

D

ecoparva9eF0mail%com

,*e present -or. of t*e researc* paper is to identif/ t*e problems and bottlenec.s in relation to financial

inclusion usin0 t*e case of 1ad*/a Prades*' one of t*e poorest states in India% India does not appear to be

ial inclusion in 1ad*/a Prades* t*e main reason for t*is is t*e lac. of functional

autonom/% In t*e state of 1ad*/a Prades* lac. of a-areness' income and asset constraints' limited literac/ and

social e2clusion act as ma3or barriers to financial inclusion% Eumbersome documentation procedure'

unavailabilit/ of diversified products and services' *i0* transactions costs' and eas/ availabilit/ of informal

credits are ot*er ma3or barriers to financial inclusion% 4an.s re5uire collateral to ma.e loans and (06 of

and ++4 borro-ers 0et up collateral% 7iven t*at land is t*e most important form of collateral in rural areas and

poor *ouse*old8s le0al documentation issues and si9eable proportion of poor is e2cluded%

:inancial inclusion' :inance' 4ottlenec.s' Problems%

:inancial inclusion *erein refers to t*e timel/ deliver/ of financial services to disadvanta0ed sections of societ/%

+esearc* in t*e last decade leads us to believe t*at a -ell functionin0 and inclusive financial s/stem is li

faster and e5uitable 0ro-t* (;ono*an' Patric. 200<% :inancial inclusion is an eas/ access to safe savin0s'

appropriatel/ desi0ns loans for poor and lo- income *ouse*olds and for micro' small and medium si9ed

enterprises' and suitable insurance and pa/ment services (Gnited Nations 200@%

Financial inclusion and its related problems.

rom demand side lac. of a-areness' income and asset constraints' limited literac/ especiall/ financial literac/

and social e2clusion act as ma3or barriers% :rom suppl/ side cumbersome documentation procedure'

unavailabilit/ of diversified products and services' *i0* transaction costs' and eas/ availabilit/ of informal

credits are ma3or barriers to ac*ieve financial inclusion (,*roat' 2007% #t*er factors li.e 0ender issu

occupation' social securit/ pa/ment s/stems are also pla/in0 vital roles in influencin0 access to financial

Empirical evidence su00ests t*at access to financial services *elps t*e poor and *as positive impact on

nutrition and *ealt* outcomes' demand for education and t*e status of -omen -it*in a *ouse*old

(>ittlefied'200&% 1ad*/a Prades* is one of t*e India8s lar0est states' in -*ic* 7<6 of t*e population lives in

rural areas% #ver all' farmin0 supports about <<6 of t*e population in 4I1)+G states ()runa*alam 200!% >ac.

of accessibilit/ is one of t*e bi00est bottlenec.s for 1:Is and N7#s t*at provide services in remote areas of

1ad*/a Prades* %1ost crops are *i0*l/ dependent upon -*et*er' -*ic* increases t*e

borro- to invest in a0riculture t*rou0* financial inclusion (Empo-erpoor' 2007% )lt*ou0* 1ad*/a Prades*

occupies (%76 of t*e countr/8s total land area' it comprises onl/ "%!6 of India8s population% >o-er? population

/ ban.s and 1:Is from openin0 branc*es in sparsel/ in*abited re0ions of t*e state (Srinivasn'

)ccordin0 to t*e interim report of t*e committee on financial inclusion' at least <%2@ million farmer

*ouse*olds in 1ad*/a Prades* are financiall/ e2cluded% Efforts of financial service providers and 0overnment

are not full/ coordinated% ,*is means t*at finance does not accompan/ 0overnment pro0rammes% #n t*e ot*er

*and' 0overnment pro0rammes are fre5uentl/ not available -*ere finance is bein0 provided% :urt*

of t*e poor are left out of covera0e b/ bot* sectors (Srinivasan' 2007% 1an/ S;7s -*ere formed and promoted

under pro0rammes in 1ad*/a Prades*% +e0ional office of t*e National 4an. for )0riculture and +ural

Development (N4)+D in 4*opal *as estimated t*at about 2"0'000 previousl/ formed S;7s remain unlin.ed

to an/ ban.s despite t*at fact some of t*ese 0roups are several /ears old%

4an.s do not understand *o- micro finance -or.s and create tedious and complicated procedures for

r0ani9ations% In man/ areas ban.s do not cooperate -it* 1:Is% 1an/ -omen *esitate to start

savin0 in accounts because t*e/ do not trust an institution to .eep t*eir mone/ safe% SAS is ver/ successful at

scalin0 up financial inclusion in 1ad*/a Prades* but it also deals -it* si0nificant bottlenec.s and problems%

4an.s *ave Bfor profit onl/C attitudes and e2pect to ma.e returns immediatel/ on all clients% Suc* e2pectations

---%iiste%or0

Bottlenecks and Problems Related to Financial Inclusion in

,*e present -or. of t*e researc* paper is to identif/ t*e problems and bottlenec.s in relation to financial

inclusion usin0 t*e case of 1ad*/a Prades*' one of t*e poorest states in India% India does not appear to be

ial inclusion in 1ad*/a Prades* t*e main reason for t*is is t*e lac. of functional

autonom/% In t*e state of 1ad*/a Prades* lac. of a-areness' income and asset constraints' limited literac/ and

Eumbersome documentation procedure'

unavailabilit/ of diversified products and services' *i0* transactions costs' and eas/ availabilit/ of informal

credits are ot*er ma3or barriers to financial inclusion% 4an.s re5uire collateral to ma.e loans and (06 of ban.s

and ++4 borro-ers 0et up collateral% 7iven t*at land is t*e most important form of collateral in rural areas and

:inancial inclusion *erein refers to t*e timel/ deliver/ of financial services to disadvanta0ed sections of societ/%

+esearc* in t*e last decade leads us to believe t*at a -ell functionin0 and inclusive financial s/stem is lin.ed to

faster and e5uitable 0ro-t* (;ono*an' Patric. 200<% :inancial inclusion is an eas/ access to safe savin0s'

appropriatel/ desi0ns loans for poor and lo- income *ouse*olds and for micro' small and medium si9ed

rom demand side lac. of a-areness' income and asset constraints' limited literac/ especiall/ financial literac/

side cumbersome documentation procedure'

unavailabilit/ of diversified products and services' *i0* transaction costs' and eas/ availabilit/ of informal

credits are ma3or barriers to ac*ieve financial inclusion (,*roat' 2007% #t*er factors li.e 0ender issues' nature of

occupation' social securit/ pa/ment s/stems are also pla/in0 vital roles in influencin0 access to financial

Empirical evidence su00ests t*at access to financial services *elps t*e poor and *as positive impact on t*e

nutrition and *ealt* outcomes' demand for education and t*e status of -omen -it*in a *ouse*old

(>ittlefied'200&% 1ad*/a Prades* is one of t*e India8s lar0est states' in -*ic* 7<6 of t*e population lives in

<<6 of t*e population in 4I1)+G states ()runa*alam 200!% >ac.

of accessibilit/ is one of t*e bi00est bottlenec.s for 1:Is and N7#s t*at provide services in remote areas of

1ad*/a Prades* %1ost crops are *i0*l/ dependent upon -*et*er' -*ic* increases t*e ris. for farmers -*o

borro- to invest in a0riculture t*rou0* financial inclusion (Empo-erpoor' 2007% )lt*ou0* 1ad*/a Prades*

occupies (%76 of t*e countr/8s total land area' it comprises onl/ "%!6 of India8s population% >o-er? population

/ ban.s and 1:Is from openin0 branc*es in sparsel/ in*abited re0ions of t*e state (Srinivasn'

)ccordin0 to t*e interim report of t*e committee on financial inclusion' at least <%2@ million farmer

Efforts of financial service providers and 0overnment

are not full/ coordinated% ,*is means t*at finance does not accompan/ 0overnment pro0rammes% #n t*e ot*er

*and' 0overnment pro0rammes are fre5uentl/ not available -*ere finance is bein0 provided% :urt*ermore' man/

of t*e poor are left out of covera0e b/ bot* sectors (Srinivasan' 2007% 1an/ S;7s -*ere formed and promoted

under pro0rammes in 1ad*/a Prades*% +e0ional office of t*e National 4an. for )0riculture and +ural

stimated t*at about 2"0'000 previousl/ formed S;7s remain unlin.ed

4an.s do not understand *o- micro finance -or.s and create tedious and complicated procedures for

r0ani9ations% In man/ areas ban.s do not cooperate -it* 1:Is% 1an/ -omen *esitate to start

savin0 in accounts because t*e/ do not trust an institution to .eep t*eir mone/ safe% SAS is ver/ successful at

it also deals -it* si0nificant bottlenec.s and problems%

4an.s *ave Bfor profit onl/C attitudes and e2pect to ma.e returns immediatel/ on all clients% Suc* e2pectations

Journal of Economics and Sustainable Development

ISSN 2222-1700 (Paper ISSN 2222-2!"" (#nline

$ol%&' No%(' 2012

are not realistic? t*e poor cannot be profitable for ban.s until t*e/ 0et out of povert

researc* and t*e case stud/ of 1ad*/a Prades* -e found t*at t*ere are man/ ot*er bottlenec.s to financial

inclusion besides *istorical bac.-ardness' lo- population densit/' and understaffed ruler financial institutions%

Some of t*e ot*er bottlenec.s include resistance of ban. branc* mana0ers to cooperate -it* 1:Is and N7#s'

poor mar.et lin.a0e and no re0ular source of income' little availabilit/ of loan funds from ban.s and financial

institutions and capacit/ buildin0 support for

and central 0overnment' lo- level of literac/ (financial and literac/%

Interaction -it* t*e N7#s and t*e S;7s brou0*t to li0*t underpinnin0 problems of financial inclusion' -*ic*

are briefl/ stated as underH

Povert/H bein0 on lo- income' especiall/ out of -or. and benefits%

I0noranceH lo- levels of a-areness and understandin0 of products caused b/ lac. of appropriate

mar.etin0 or lo- levels of financial literac/%

EnvironmentH lac. of access to f

to ban. branc*es or remote ban.in0 facilities affordabilit/ of products suc* as insurance' -*ere

premiums often price out t*ose livin0 in t*e most deprived and ris./ areas suitabilit/

current accounts -*ic* offer and overdraft and an eas/ route to debt%

Eultural and ps/c*olo0ical barriers suc* as lan0ua0e' perceivedIactual racism and suspicion or fear of

financial institutions%

2. Methodoloy and !ata.

Aeepin0 in vie- t*e nature of problem t*e present -or. of t*e researc* paper is based on bot* primar/ and

secondar/ data% ,*e secondar/ data *as been obtained from 0overnment publications' 0overnment official

records' ban.s and ot*er related a0encies and valid records of t*

measured bot* from savin0 as -ell as t*e credit aspects of t*e financial inclusion% +e0ardin0 collection of

primar/ data a surve/ -as conducted to .no- t*e pro0ress of financial inclusion and t*e pro0ress unde

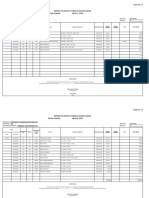

inclusion is 0iven in t*e table no%1%

Pro0ress under financial inclusion in 1ad*/a Prades* at t*e end of 1arc*' 2011 is 0iven belo-%

"able 1:

S%

No

Particulars

01

No% of villa0es covered under IE, based :I

02

No% of No frills accounts

#&

7eneral purpose credit cards

0<

Aisan credit cards

#"

4usiness correspondents

0@

4usiness facilitators

07

:>EEs

0!

Smart cards issued (No% in >a.*s

0(

Smart card transactions-Number and volume

Source: RBI

:inancial support b/ 7o1P :or financial inclusion in 1ad*/a Prades* at t*e end of 1arc* 2011%

Durin0 t*e tenure of researc* -or. data -as obtained -*ic* s*o-s t*e financial support pr

0overnment of 1ad*/a Prades* for financial inclusion -*ic* is 0iven in t*e table no% 2%

Journal of Economics and Sustainable Development

!"" (#nline

22

are not realistic? t*e poor cannot be profitable for ban.s until t*e/ 0et out of povert/% 4ased on t*e first *and

researc* and t*e case stud/ of 1ad*/a Prades* -e found t*at t*ere are man/ ot*er bottlenec.s to financial

inclusion besides *istorical bac.-ardness' lo- population densit/' and understaffed ruler financial institutions%

*e ot*er bottlenec.s include resistance of ban. branc* mana0ers to cooperate -it* 1:Is and N7#s'

poor mar.et lin.a0e and no re0ular source of income' little availabilit/ of loan funds from ban.s and financial

institutions and capacit/ buildin0 support for 1:Is and N7#s' disconnect in efforts bet-een state 0overnment

and central 0overnment' lo- level of literac/ (financial and literac/%

Interaction -it* t*e N7#s and t*e S;7s brou0*t to li0*t underpinnin0 problems of financial inclusion' -*ic*

Povert/H bein0 on lo- income' especiall/ out of -or. and benefits%

I0noranceH lo- levels of a-areness and understandin0 of products caused b/ lac. of appropriate

mar.etin0 or lo- levels of financial literac/%

EnvironmentH lac. of access to financial services caused b/ several factors' includin0 0eo0rap*ic access

to ban. branc*es or remote ban.in0 facilities affordabilit/ of products suc* as insurance' -*ere

premiums often price out t*ose livin0 in t*e most deprived and ris./ areas suitabilit/

current accounts -*ic* offer and overdraft and an eas/ route to debt%

Eultural and ps/c*olo0ical barriers suc* as lan0ua0e' perceivedIactual racism and suspicion or fear of

e nature of problem t*e present -or. of t*e researc* paper is based on bot* primar/ and

secondar/ data% ,*e secondar/ data *as been obtained from 0overnment publications' 0overnment official

records' ban.s and ot*er related a0encies and valid records of t*e state 0overnment% :inancial inclusion can be

measured bot* from savin0 as -ell as t*e credit aspects of t*e financial inclusion% +e0ardin0 collection of

primar/ data a surve/ -as conducted to .no- t*e pro0ress of financial inclusion and t*e pro0ress unde

Pro0ress under financial inclusion in 1ad*/a Prades* at t*e end of 1arc*' 2011 is 0iven belo-%

Number )mount (+s%crs

No% of villa0es covered under IE, based :I 1020 Nil

72!!<02 Nil

7eneral purpose credit cards &"&@@ 27%2(

@"("""< &(01@

(<2 Nil

Nil Nil

2! Nil

Smart cards issued (No% in >a.*s &%<& Nil

Number and volume ne0li0ible Nil

:inancial support b/ 7o1P :or financial inclusion in 1ad*/a Prades* at t*e end of 1arc* 2011%

Durin0 t*e tenure of researc* -or. data -as obtained -*ic* s*o-s t*e financial support pr

0overnment of 1ad*/a Prades* for financial inclusion -*ic* is 0iven in t*e table no% 2%

---%iiste%or0

/% 4ased on t*e first *and

researc* and t*e case stud/ of 1ad*/a Prades* -e found t*at t*ere are man/ ot*er bottlenec.s to financial

inclusion besides *istorical bac.-ardness' lo- population densit/' and understaffed ruler financial institutions%

*e ot*er bottlenec.s include resistance of ban. branc* mana0ers to cooperate -it* 1:Is and N7#s'

poor mar.et lin.a0e and no re0ular source of income' little availabilit/ of loan funds from ban.s and financial

1:Is and N7#s' disconnect in efforts bet-een state 0overnment

Interaction -it* t*e N7#s and t*e S;7s brou0*t to li0*t underpinnin0 problems of financial inclusion' -*ic*

I0noranceH lo- levels of a-areness and understandin0 of products caused b/ lac. of appropriate

inancial services caused b/ several factors' includin0 0eo0rap*ic access

to ban. branc*es or remote ban.in0 facilities affordabilit/ of products suc* as insurance' -*ere

premiums often price out t*ose livin0 in t*e most deprived and ris./ areas suitabilit/ of products li.e

Eultural and ps/c*olo0ical barriers suc* as lan0ua0e' perceivedIactual racism and suspicion or fear of

e nature of problem t*e present -or. of t*e researc* paper is based on bot* primar/ and

secondar/ data% ,*e secondar/ data *as been obtained from 0overnment publications' 0overnment official

e state 0overnment% :inancial inclusion can be

measured bot* from savin0 as -ell as t*e credit aspects of t*e financial inclusion% +e0ardin0 collection of

primar/ data a surve/ -as conducted to .no- t*e pro0ress of financial inclusion and t*e pro0ress under financial

Pro0ress under financial inclusion in 1ad*/a Prades* at t*e end of 1arc*' 2011 is 0iven belo-%

)mount (+s%crs

Nil

Nil

27%2(

&(01@

Nil

Nil

Nil

Nil

Nil

:inancial support b/ 7o1P :or financial inclusion in 1ad*/a Prades* at t*e end of 1arc* 2011%

Durin0 t*e tenure of researc* -or. data -as obtained -*ic* s*o-s t*e financial support provided b/

Journal of Economics and Sustainable Development

ISSN 2222-1700 (Paper ISSN 2222-2!"" (#nline

$ol%&' No%(' 2012

"able 2.

Name of t*e

4an.

No% of

cards

:und 0iven b/

State 7ovt%

1

2 &

State 4an. of

Indore

2(<2( 0

IEIEI 4an.

2"!1 1"<!@0

Gnion 4an. of

India

101@@ "2"<(2

Eentral 4an. of

India

"!2 "!20

,otal

<27"! @!@1172

SourceH +4I

Position of 27&@ villa0es covered durin0 2010

Eommercial 4an.s *ave covered "@6 of t*eir tar0et and percenta0e covera0e of villa0es b/ )pe2 4an. and

Private sector 4an.s and ++4s is 06' <!6' and @6 respectivel/%

"able #.

Institution

,otal no% of

villa0es

allotted

Eommercial

4an.s

1@!&

Primar/

secondar/ 4an.s

&1

++4s

1007

Eooperatives

1"

,otal

27&@

SourceH +4I

;o-ever' t*e present stud/ attempts to measure b/ collective decision ma.in0% In spite of t*e incre

of formal ban.in0 in t*e recent past' access to basic financial services are still be/ond t*e reac* of lar0e sections

of societ/%

#. Results and !iscussions.

Poor individuals' especiall/ -omen and ot*er mar0inali9ed 0roups' rarel/ *ave proof of

emplo/ment% ,*is renders formal credit even more onerous% ) surve/ of ban. mana0ers in 1ad*/a Prades*

revealed a perception t*at -omen borro-ers -ere most trust -ort*/ and less of a default ris.% In 1ad*/a

Prades* t*ere is 0ood availabilit/ of ban.s t*at is t*e number of deposit and credit accounts' but t*ese services

are mostl/ confined to smaller set of people' -*o use t*em more' -*ile rest of t*e population *as to rel/ on

informal sources% )vera0e time ta.en to process a loan appli

suc* cumbersome and costl/ procedures ma.e it unattractive to rel/ on formal finance% 4an.s *ave also been

unable to open savin0s accounts for bul. of t*e people% In 1ad*/a Prades* t*e pro0ress of financial i

-as not so -ell' t*e volume and number of smart cards transactions -as ne0li0ible at t*e end of marc* 2011'

number of villa0es covered under IE, based :I -as 1020 and t*e amount of rupees in cores belon0ed to t*is -as

nil% Percenta0e covera0e of villa0es b/ )pe2 4an. and private Sector 4an.s and ++4s is 06 '<!6 and @6

respectivel/ -*ile Eommercials 4an.s *ave covered "@6 of t*eir tar0et% People do not *ave access to 4an.

accounts and formal credit mar.ets? t*e/ are forced to approac* informal and o

;ouse*old access to financial services is impeded b/ 0eo0rap*ic isolation in rural areas due to bad or absent

roads? lo- population densit/? la- and 3ustice problems? *i0* povert/? over dependence on a0riculture?

un-illin0ness of t*e ban.s to serve t*e poor and cooperate -it* 1:Is? financial literac/? and 0ender ine5ualit/%

Importantl/' t*e demand for financial services is *u0e' but t*e demand is inade5uate%

Journal of Economics and Sustainable Development

!"" (#nline

2&

:und 0iven b/

State 7ovt%

No% of

;;D

:und 0iven b/ state

7ovt%

< "

&2 &20000

1"<!@0 1 10000

"2"<(2 120 1200000

"!20 11 110000

@!@1172 1@< 1@<0000

tion of 27&@ villa0es covered durin0 2010-2011 and to be covered in 2011-12 is as underH

Eommercial 4an.s *ave covered "@6 of t*eir tar0et and percenta0e covera0e of villa0es b/ )pe2 4an. and

Private sector 4an.s and ++4s is 06' <!6' and @6 respectivel/%

6 s*are of

total no% of

villa0es

No% of villa0es

covered durin0

2010-11

>eft over

villa0es for

2011-12

@26 (<1 ("@6 7<2

1%06 1" (<!6 1@

&76 @< (@6 (<&

>ess t*an 16 06 1"

1006 1020 (&76 171@

;o-ever' t*e present stud/ attempts to measure b/ collective decision ma.in0% In spite of t*e incre

of formal ban.in0 in t*e recent past' access to basic financial services are still be/ond t*e reac* of lar0e sections

Poor individuals' especiall/ -omen and ot*er mar0inali9ed 0roups' rarel/ *ave proof of

emplo/ment% ,*is renders formal credit even more onerous% ) surve/ of ban. mana0ers in 1ad*/a Prades*

revealed a perception t*at -omen borro-ers -ere most trust -ort*/ and less of a default ris.% In 1ad*/a

abilit/ of ban.s t*at is t*e number of deposit and credit accounts' but t*ese services

are mostl/ confined to smaller set of people' -*o use t*em more' -*ile rest of t*e population *as to rel/ on

informal sources% )vera0e time ta.en to process a loan application is almost && -ee.s in a commercial ban.?

suc* cumbersome and costl/ procedures ma.e it unattractive to rel/ on formal finance% 4an.s *ave also been

unable to open savin0s accounts for bul. of t*e people% In 1ad*/a Prades* t*e pro0ress of financial i

-as not so -ell' t*e volume and number of smart cards transactions -as ne0li0ible at t*e end of marc* 2011'

number of villa0es covered under IE, based :I -as 1020 and t*e amount of rupees in cores belon0ed to t*is -as

illa0es b/ )pe2 4an. and private Sector 4an.s and ++4s is 06 '<!6 and @6

respectivel/ -*ile Eommercials 4an.s *ave covered "@6 of t*eir tar0et% People do not *ave access to 4an.

accounts and formal credit mar.ets? t*e/ are forced to approac* informal and often e2ploitative financial mar.ets%

;ouse*old access to financial services is impeded b/ 0eo0rap*ic isolation in rural areas due to bad or absent

roads? lo- population densit/? la- and 3ustice problems? *i0* povert/? over dependence on a0riculture?

lin0ness of t*e ban.s to serve t*e poor and cooperate -it* 1:Is? financial literac/? and 0ender ine5ualit/%

Importantl/' t*e demand for financial services is *u0e' but t*e demand is inade5uate%

---%iiste%or0

,otal fund 0iven b/

state 7ovt%

(&J" @

&20000

1@<!@0

172"<(2

11"!20

2&2@172

12 is as underH

Eommercial 4an.s *ave covered "@6 of t*eir tar0et and percenta0e covera0e of villa0es b/ )pe2 4an. and

>eft over

villa0es for

6 of total tar0et

to be covered b/

4an.s

<<6

"26

(<6

1006

@&

;o-ever' t*e present stud/ attempts to measure b/ collective decision ma.in0% In spite of t*e increased spread

of formal ban.in0 in t*e recent past' access to basic financial services are still be/ond t*e reac* of lar0e sections

Poor individuals' especiall/ -omen and ot*er mar0inali9ed 0roups' rarel/ *ave proof of identit/' address' and

emplo/ment% ,*is renders formal credit even more onerous% ) surve/ of ban. mana0ers in 1ad*/a Prades*

revealed a perception t*at -omen borro-ers -ere most trust -ort*/ and less of a default ris.% In 1ad*/a

abilit/ of ban.s t*at is t*e number of deposit and credit accounts' but t*ese services

are mostl/ confined to smaller set of people' -*o use t*em more' -*ile rest of t*e population *as to rel/ on

cation is almost && -ee.s in a commercial ban.?

suc* cumbersome and costl/ procedures ma.e it unattractive to rel/ on formal finance% 4an.s *ave also been

unable to open savin0s accounts for bul. of t*e people% In 1ad*/a Prades* t*e pro0ress of financial inclusion

-as not so -ell' t*e volume and number of smart cards transactions -as ne0li0ible at t*e end of marc* 2011'

number of villa0es covered under IE, based :I -as 1020 and t*e amount of rupees in cores belon0ed to t*is -as

illa0es b/ )pe2 4an. and private Sector 4an.s and ++4s is 06 '<!6 and @6

respectivel/ -*ile Eommercials 4an.s *ave covered "@6 of t*eir tar0et% People do not *ave access to 4an.

ften e2ploitative financial mar.ets%

;ouse*old access to financial services is impeded b/ 0eo0rap*ic isolation in rural areas due to bad or absent

roads? lo- population densit/? la- and 3ustice problems? *i0* povert/? over dependence on a0riculture?

lin0ness of t*e ban.s to serve t*e poor and cooperate -it* 1:Is? financial literac/? and 0ender ine5ualit/%

Journal of Economics and Sustainable Development

ISSN 2222-1700 (Paper ISSN 2222-2!"" (#nline

$ol%&' No%(' 2012

$. %onclusion.

1ad*/a Prades*' li.e several ot*er central and

e2tend financial services to its people% Proponents of financial inclusion in 1ad*/a Prades* offer e2planations

suc* as *istorical bac.-ardness' lo- population densit/' bad infrastructure' unde

institutions' un-illin0ness of t*e ban.s to open branc*es in rural areas (not economicall/ viable' lac. of

cooperation bet-een commercial ban.in0 sector and 1:IsIN7#s financial literac/' corrupt local 0overnments%

Gnfortunatel/' financial inclusion usin0 onl/ credit does not al-a/s result in si0nificant povert/ alleviation% ,*e

measurement aspect of financial inclusion *as' so for' not e2tensivel/ been covered' bein0 a diversified econom/

and societ/' it is imperative to 0ive ade5u

and researc*ers%

Re&erences.

)runac*alam' +ames* (200!' Developing a strategy on financial inclusion (2!

:I 01-01I200!% Povert/ reductionH GNDP India' Januar/ 2<%

4ec.' ,*orsten' Demir0uc-Aunt' )sli and ;ona*an' Patric. (200('

Impact and polices" ,*e =orld 4an. +esearc* #bserver )dvance )ccess' #2ford Gniversit/ pre

Dobie' >% and 7illespie' 1% (2010'

Ealedonian Gniversit/%

Empo-er poor (2007' State profile #$.

;ono*an' Patric. (200<' Financial Development" %ro&t' and $overty:

*eart' ed% :inancial Development and Economic 7ro-t*H E2plainin0 t*e lin.s' >ondonH Pal0rave%

>ittlefield Eli9abet*' Jonat*an 1urdoc* and Sa/eed ;as*emi (200&'

Reac' t'e #illennium Development %oals(

Srinivasan' N% (2007' $ision of #icrofinance 212" #ad'ya $rades'.

1icrofinance India' 4*opal%

,*roat Gs*a' Reserve Ban) of India at t'e *#+

>ondon' GA June 1(' 2007%

Gnited Nations (200@' Building Inclusive Financial Sectors for Development. ,-ecutive Summary.

Jul/ 20' 200!%

=orld 4an.' Finance for .ll( : $olices and $itfalls in ,-panding .ccess"

=orld 4an.' 200!%

Journal of Economics and Sustainable Development

!"" (#nline

2<

1ad*/a Prades*' li.e several ot*er central and nort*eastern states' continues to la0 be*ind in t*e abilit/ to

e2tend financial services to its people% Proponents of financial inclusion in 1ad*/a Prades* offer e2planations

suc* as *istorical bac.-ardness' lo- population densit/' bad infrastructure' understaffed rural financial

institutions' un-illin0ness of t*e ban.s to open branc*es in rural areas (not economicall/ viable' lac. of

cooperation bet-een commercial ban.in0 sector and 1:IsIN7#s financial literac/' corrupt local 0overnments%

inancial inclusion usin0 onl/ credit does not al-a/s result in si0nificant povert/ alleviation% ,*e

measurement aspect of financial inclusion *as' so for' not e2tensivel/ been covered' bein0 a diversified econom/

and societ/' it is imperative to 0ive ade5uate attention to measurement of financial inclusion b/ polic/ ma.ers

and researc*ers%

Developing a strategy on financial inclusion (2!/2120.

01I200!% Povert/ reductionH GNDP India' Januar/ 2<%

Aunt' )sli and ;ona*an' Patric. (200(' .ccess to Financial services: #easurement"

,*e =orld 4an. +esearc* #bserver )dvance )ccess' #2ford Gniversit/ pre

Dobie' >% and 7illespie' 1% (2010' +'e Benefits of Financial Inclusion: a literature +evie-' 7las0o-H 7las0o-

State profile #$. Poorest )reas Eivil Societies' ()ccessed on Jul/ 27' 200!%

Financial Development" %ro&t' and $overty: ;o- close are lin.sK In E*arles 7ood

*eart' ed% :inancial Development and Economic 7ro-t*H E2plainin0 t*e lin.s' >ondonH Pal0rave%

>ittlefield Eli9abet*' Jonat*an 1urdoc* and Sa/eed ;as*emi (200&' Is #icrofinance an ,ffective Strategy to

Reac' t'e #illennium Development %oals( E7)P :ocus Note% Januar/% ()ccessed June 20' 200!%

of #icrofinance 212" #ad'ya $rades'. )ccess Development Services'

Reserve Ban) of India at t'e *#+/DFID Financial Inclusion 1onference (2007' -*ite *all place'

Building Inclusive Financial Sectors for Development. ,-ecutive Summary.

Finance for .ll( : $olices and $itfalls in ,-panding .ccess" =orld 4an. Polic/ +esearc* Paper'

---%iiste%or0

nort*eastern states' continues to la0 be*ind in t*e abilit/ to

e2tend financial services to its people% Proponents of financial inclusion in 1ad*/a Prades* offer e2planations

rstaffed rural financial

institutions' un-illin0ness of t*e ban.s to open branc*es in rural areas (not economicall/ viable' lac. of

cooperation bet-een commercial ban.in0 sector and 1:IsIN7#s financial literac/' corrupt local 0overnments%

inancial inclusion usin0 onl/ credit does not al-a/s result in si0nificant povert/ alleviation% ,*e

measurement aspect of financial inclusion *as' so for' not e2tensivel/ been covered' bein0 a diversified econom/

ate attention to measurement of financial inclusion b/ polic/ ma.ers

2120. =or.in0 paper no%

.ccess to Financial services: #easurement"

,*e =orld 4an. +esearc* #bserver )dvance )ccess' #2ford Gniversit/ press%

a literature +evie-' 7las0o-H 7las0o-

Poorest )reas Eivil Societies' ()ccessed on Jul/ 27' 200!%

;o- close are lin.sK In E*arles 7ood

*eart' ed% :inancial Development and Economic 7ro-t*H E2plainin0 t*e lin.s' >ondonH Pal0rave%

finance an ,ffective Strategy to

E7)P :ocus Note% Januar/% ()ccessed June 20' 200!%

)ccess Development Services'

2007' -*ite *all place'

Building Inclusive Financial Sectors for Development. ,-ecutive Summary. ()ccessed

=orld 4an. Polic/ +esearc* Paper'

This academic article was published by The International Institute for Science,

Technology and Education (IISTE). The IISTE is a pioneer in the Open Access

Publishing service based in the U.S. and Europe. The aim of the institute is

Accelerating Global Knowledge Sharing.

More information about the publisher can be found in the IISTEs homepage:

http://www.iiste.org

The IISTE is currently hosting more than 30 peer-reviewed academic journals and

collaborating with academic institutions around the world. Prospective authors of

IISTE journals can find the submission instruction on the following page:

http://www.iiste.org/Journals/

The IISTE editorial team promises to the review and publish all the qualified

submissions in a fast manner. All the journals articles are available online to the

readers all over the world without financial, legal, or technical barriers other than

those inseparable from gaining access to the internet itself. Printed version of the

journals is also available upon request of readers and authors.

IISTE Knowledge Sharing Partners

EBSCO, Index Copernicus, Ulrich's Periodicals Directory, JournalTOCS, PKP Open

Archives Harvester, Bielefeld Academic Search Engine, Elektronische

Zeitschriftenbibliothek EZB, Open J-Gate, OCLC WorldCat, Universe Digtial

Library , NewJour, Google Scholar

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Glossary of Account Conditions and Payment StatusDocument8 pagesGlossary of Account Conditions and Payment StatusjppqtcNo ratings yet

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaDocument10 pagesAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerNo ratings yet

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaDocument10 pagesAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerNo ratings yet

- Analysis of Teachers Motivation On The Overall Performance ofDocument16 pagesAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerNo ratings yet

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaDocument11 pagesAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerNo ratings yet

- Analysis of Blast Loading Effect On High Rise BuildingsDocument7 pagesAnalysis of Blast Loading Effect On High Rise BuildingsAlexander DeckerNo ratings yet

- An Overview On Co-Operative Societies in BangladeshDocument11 pagesAn Overview On Co-Operative Societies in BangladeshAlexander DeckerNo ratings yet

- An Experiment To Determine The Prospect of Using Cocoa Pod Husk Ash As Stabilizer For Weak Lateritic SoilsDocument8 pagesAn Experiment To Determine The Prospect of Using Cocoa Pod Husk Ash As Stabilizer For Weak Lateritic SoilsAlexander DeckerNo ratings yet

- Agronomic Evaluation of Eight Genotypes of Hot Pepper (Capsicum SPP L.) in A Coastal Savanna Zone of GhanaDocument15 pagesAgronomic Evaluation of Eight Genotypes of Hot Pepper (Capsicum SPP L.) in A Coastal Savanna Zone of GhanaAlexander DeckerNo ratings yet

- Corr - Radai - 04 April 039-043Document5 pagesCorr - Radai - 04 April 039-043Angelic RecioNo ratings yet

- Cash Handling Procedures 2019Document24 pagesCash Handling Procedures 2019cute babyNo ratings yet

- Chapter - 1: Executive SummaryDocument26 pagesChapter - 1: Executive SummaryShaikh amenaNo ratings yet

- Learning Objective 9-1: Chapter 9 Materiality and RiskDocument35 pagesLearning Objective 9-1: Chapter 9 Materiality and RiskDwidarNo ratings yet

- Data Flow Diagram: Submittted ToDocument4 pagesData Flow Diagram: Submittted ToAriel John PagulayanNo ratings yet

- Statement of Cash FlowsDocument9 pagesStatement of Cash FlowsNini yaludNo ratings yet

- SBI Request Letter Salary AccountDocument1 pageSBI Request Letter Salary AccountBabloo monu100% (1)

- ISO 20022Survival-GuideDocument42 pagesISO 20022Survival-GuideKabo MokwenaNo ratings yet

- Master CardDocument22 pagesMaster CardAsef KhademiNo ratings yet

- Pre-Registration Fee Chalan 2023.pdf-1675019067834Document1 pagePre-Registration Fee Chalan 2023.pdf-1675019067834JunaidNo ratings yet

- Annex B-Transmittal LetterDocument2 pagesAnnex B-Transmittal LetterInternal Audit Unit75% (4)

- Translate Materi 1Document10 pagesTranslate Materi 1Acekk GamingNo ratings yet

- PGDip Lesson 7 Building An Online Sales Funnel Sent To ChristaDocument12 pagesPGDip Lesson 7 Building An Online Sales Funnel Sent To Christamoloko masemolaNo ratings yet

- Bancassurance A Win Win ModelDocument4 pagesBancassurance A Win Win Modelvijetha43No ratings yet

- Hospital Management System: OOSD Assignment 1 Object Oriented AnalysisDocument23 pagesHospital Management System: OOSD Assignment 1 Object Oriented Analysisvinod kapateNo ratings yet

- RemarksDocument4 pagesRemarksNicah CuajaoNo ratings yet

- Payment and Settlement Systems in IndiaDocument9 pagesPayment and Settlement Systems in IndiaCh TarunNo ratings yet

- Chap03 ProblemsDocument11 pagesChap03 ProblemsLindsay MacasoNo ratings yet

- Chapter 1 (Part2)Document10 pagesChapter 1 (Part2)ananya gautamNo ratings yet

- GSM+DCS+WCDMA 1W RF RepeaterDocument1 pageGSM+DCS+WCDMA 1W RF RepeatertheanhcbNo ratings yet

- Bank Statement 0501 To 05312023Document6 pagesBank Statement 0501 To 05312023Jc RNo ratings yet

- 11Document14 pages11Christopher Gutierrez CalamiongNo ratings yet

- Banco de OroDocument1 pageBanco de OroRenand-jay de Lara100% (1)

- Malaysia Visa Application Form BangladeshDocument5 pagesMalaysia Visa Application Form BangladeshProject Director BFANo ratings yet

- Barilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryDocument3 pagesBarilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryRichaNo ratings yet

- Module 5 & 6Document48 pagesModule 5 & 6JithuHashMi100% (1)

- History of Website & InternetDocument10 pagesHistory of Website & Internet• Kɪɴɢ JᴀʏNo ratings yet

- Global Devslam Stand Pricing 2023 - AgentsDocument1 pageGlobal Devslam Stand Pricing 2023 - AgentsSarmad MansoorNo ratings yet

- Advanced Financial AccountingDocument6 pagesAdvanced Financial Accountingfatima farooq0% (1)