Professional Documents

Culture Documents

7 Reasons A Credit Card Is Blocked

Uploaded by

Paduraru Liviu Robert0 ratings0% found this document useful (0 votes)

99 views2 pagesCredit card companies are beefing up their anti-fraud measures to stem the tide of fraud. What looks like a red flag to a computer may just be you trying to make a mundane purchase. If the analysis doesn't add up, your c ard will be blocked and your next purchase declined.

Original Description:

Original Title

7 Reasons a Credit Card is Blocked

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCredit card companies are beefing up their anti-fraud measures to stem the tide of fraud. What looks like a red flag to a computer may just be you trying to make a mundane purchase. If the analysis doesn't add up, your c ard will be blocked and your next purchase declined.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

99 views2 pages7 Reasons A Credit Card Is Blocked

Uploaded by

Paduraru Liviu RobertCredit card companies are beefing up their anti-fraud measures to stem the tide of fraud. What looks like a red flag to a computer may just be you trying to make a mundane purchase. If the analysis doesn't add up, your c ard will be blocked and your next purchase declined.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 2

7 reasons your credit card gets blocked

Plus: 7 tips for handling it when it happens to you

When your credit card company stops a thief from charging fraudulent expenses to

your card, you're thrilled. But what happens when they mistake you for the thie

f?

7 reasons your credit card gets blockedWith $6.89 billion in fraud losses in 200

9, credit card companies eager to stem the tide are continually beefing up their

anti-fraud measures, relying on sophisticated computer software to flag suspici

ous transactions. Trouble is, what looks like a red flag to a computer may just

be you trying to make a mundane purchase. Then, all of a sudden, your card's dec

lined, leaving you red-faced and frustrated.

So what looks bad to your card company? Anything out of the ordinary. "The credi

t card companies -- Visa, MasterCard, American Express, Discover -- all have the

ir own proprietary technologies that look for anomalies in your spending habits,

" says Robert Siciliano, a McAfee consultant and identity theft expert based in

Boston. Siciliano suggests that each transaction is automatically analyzed for u

p to 200 different data points, everything from where you live to what you norma

lly buy to how much you're spending, to determine the likelihood that you're the

one actually making a particular charge. If the analysis doesn't add up, your c

ard will be blocked and your next purchase declined.

What triggers a block

Card issuers won't go on the record about specific red flags -- as Siciliano poi

nts out, "That'll only give the bad guys an edge." But according to experts and

hapless cardholders who have experienced a block, these shopping habits may lead

to hassles:

Shopping where you've never shopped before. "I've had calls from my card com

pany saying, We've detected unusual activity.' It wasn't unusual, but it was a di

fferent pharmacy than the one I normally went to," says Denise Richardson, a cer

tified identity theft risk management specialist and author of "Give Me Back My

Credit!"

Making several purchases quickly. Janis Badarau, of Lavonia, Ga., sometimes

hits three grocery stores in a row to find what she needs and take advantage of

sales. But a few months ago, she was so speedy that by the time she swiped her c

ard at the third store, it was declined. "I called the bank when I got home, and

they told me that shopping at three supermarkets within an hour or so was consi

dered 'unusual activity,'" Badarau says.

Charging something small, then something big. Criminals sometimes test the w

aters with a stolen card by charging a tiny amount -- say, a song on iTunes -- b

efore moving on to a triple-digit purchase. That small-big pattern in your own b

uying habits may result in a declined card.

Shopping away from your home base. That's especially common when you're movi

ng. "If my billing address is Massachusetts and I'm buying a washer and dryer in

Idaho, that's an anomaly, because why would I buy a washer and dryer in Idaho i

f I live in Massachusetts?" says Siciliano.

Charging travel expenses. On the road, any purchase from gas to restaurant m

eals can trigger a block. While that's long been true for travelers abroad, it n

ow happens domestically, too. "Once my travel to L.A. flagged it and I spent 20

minutes verifying transactions," says Traci Coulter, of New York City. When she

asked what caused the card to be declined, she was told, "a taxi, a charge at th

e airport, in-air Wi-Fi and a rental car hold" -- all standard travel expenses.

Buying things in different geographic regions on the same day. During a crui

se, Janet Gillis, of Tampa, Fla., used a card to get money from an ATM on the sh

ip, then she later made a purchase on-shore in Belize. For the rest of the trip,

her card was declined. "Apparently, the ATM on board the ship is registered to

a Miami location, and several hours later, I was purchasing something in Belize.

To them, it looked suspicious because the transactions happened so close togeth

er," says Gillis. Online purchases to merchants in different parts of the world

can trigger the same flag.

Dealing with billing issues. When Siciliano wanted to make an addition to an

online purchase, he contacted the company, but the second transaction they trie

d to process was declined. The card issuer "thought that the merchant was taking

advantage of my card number."

How to handle a block

When your card company suspects suspicious activity, sometimes you'll get an ema

il or a phone call asking you to verify a purchase. Other times your card is sim

ply declined, with no advance warning and no information why, and it's up to you

to call your issuer and sort out the problem. Follow these tips to minimize the

hassle (and humiliation) of a blocked card:

Carry backup credit cards. You'll be able to offer another working card whil

e you sort out the problems with the first.

Keep your card's contact info handy. "Have your credit card company's toll-f

ree number as one of your phone numbers in your mobile," recommends Siciliano. "

If a card is declined, you know who to call."

Tell your card company when you're traveling. Advance notice doesn't always

keep your travel purchases off the "suspicious activities" list, but card compan

ies recommend it. In the same vein, "Give your creditor your cell phone number,"

says Richardson. "If they only have your home number on file, that can be a pro

blem, too."

Use a prepaid card. When you travel, a preloaded card gives you the convenie

nce of credit without the hassles. (You do lose the protection, however, so that

convenience comes with a price.)

Get texts. According to Chase representative Gail Hurdis, customers can sign

up to receive a text message within minutes of a flagged transaction and can in

dicate by text whether they recognize it. If they do, the account is updated and

the transaction cleared instantly.

Provide a new address. When you move, quickly update your billing address so

your card company recognizes your new home base.

Ask for compensation. When Linsey Knerl's card was erroneously declined, the

store cashier refused to accept any other card, forcing Knerl to abandon a cart

full of stuff. The Tekamah, Neb., woman wrote a letter to her issuer expressing

her disappointment. "The credit card company actually gave me a rewards points

bonus for my troubles -- enough to buy a plane ticket the next time I traveled!"

she says.

Annoying as it can be to get blocked by mistake, remind yourself that it's a sig

n that your credit card company's got your back.

You might also like

- 7 Reasons Your CC Gets BlockedDocument2 pages7 Reasons Your CC Gets BlockedPriscilla JohnsonNo ratings yet

- Types of Credit/debit Card Fraud Educate YourselfDocument13 pagesTypes of Credit/debit Card Fraud Educate YourselfAmita RahiNo ratings yet

- How to Survive Identity Theft: Regain Your Money, Credit, and ReputationFrom EverandHow to Survive Identity Theft: Regain Your Money, Credit, and ReputationNo ratings yet

- Assignment of Management of Financial Services: Submitted To: Submitted byDocument9 pagesAssignment of Management of Financial Services: Submitted To: Submitted bygautam_gt2No ratings yet

- Research PaperDocument9 pagesResearch Papermark07rimkeviciusNo ratings yet

- Credit Card Fraud PDFDocument10 pagesCredit Card Fraud PDFjack meoff100% (1)

- Assignment On Credit Card FraudDocument9 pagesAssignment On Credit Card FraudMitesh JainNo ratings yet

- What To Do If Credit Cards Are Lost or StolenDocument2 pagesWhat To Do If Credit Cards Are Lost or StolenFlaviub23No ratings yet

- CRATMCARDSDocument2 pagesCRATMCARDSFlaviub23100% (1)

- 5 Laws Thatll Help The How To Get A Credit Card Number Industrywyfam PDFDocument2 pages5 Laws Thatll Help The How To Get A Credit Card Number Industrywyfam PDFovalhelmet22No ratings yet

- Identuty Theft StoryDocument3 pagesIdentuty Theft StoryaleNo ratings yet

- Debit Card SkimmingDocument2 pagesDebit Card SkimmingBeldon GonsalvesNo ratings yet

- Continue QuicktourDocument5 pagesContinue QuicktourbharakhadavaishaliNo ratings yet

- Online Payment Fraud144745Document10 pagesOnline Payment Fraud144745MikiNo ratings yet

- Name: Dhiram Kotadia Year: Tybcom Division: C Roll No.: 345 Subject: Computer Systems and Application Topic: Working of Credit CardDocument5 pagesName: Dhiram Kotadia Year: Tybcom Division: C Roll No.: 345 Subject: Computer Systems and Application Topic: Working of Credit Carddhiram_luckystar_903No ratings yet

- 5 Tips For Identity Theft ProtectionDocument2 pages5 Tips For Identity Theft ProtectionPratyoosh DwivediNo ratings yet

- Lost or Stolen Wallet? No Problem! Your Easy Step-by-Step Peace of Mind To Identity Theft Recovery & AvoidanceDocument6 pagesLost or Stolen Wallet? No Problem! Your Easy Step-by-Step Peace of Mind To Identity Theft Recovery & AvoidanceGina P.No ratings yet

- Equifax (Nyse:: EFX News PeopleDocument4 pagesEquifax (Nyse:: EFX News PeopleMahesh Kumar SomalingaNo ratings yet

- Fueling The FireDocument9 pagesFueling The Firegmmartin42No ratings yet

- Famous Debit and Credit Fraud CasesDocument7 pagesFamous Debit and Credit Fraud CasesAmy Jones100% (1)

- Bulletin 12 Card Cloning Final 30.01.2018Document15 pagesBulletin 12 Card Cloning Final 30.01.2018Nicolas Azevedo SouzaNo ratings yet

- Fake Credit Card StatementDocument17 pagesFake Credit Card Statementvishal sharmaNo ratings yet

- SynopsisDocument13 pagesSynopsisVinay Sharma100% (1)

- 6.1. Credit Card FraudDocument2 pages6.1. Credit Card FraudAbdel Rahman Osamh AhmedNo ratings yet

- 7 Tips For Preventing Identity TheftDocument1 page7 Tips For Preventing Identity Theftnewsusa_01No ratings yet

- A Guide To Use Credit CardsDocument4 pagesA Guide To Use Credit CardsMuhammad UsmanNo ratings yet

- Spring 13 ColorDocument8 pagesSpring 13 Colorapi-309082881No ratings yet

- 03 ITF Interactive Session Organizations How Much Do Credit Card Companies Know About You PDFDocument2 pages03 ITF Interactive Session Organizations How Much Do Credit Card Companies Know About You PDFWahyu Jogedd100% (1)

- Understanding Carding A Closer Look at Card FraudDocument3 pagesUnderstanding Carding A Closer Look at Card FraudjcouninfoNo ratings yet

- Identity Theft & Common Fraud 101Document13 pagesIdentity Theft & Common Fraud 1011derek0No ratings yet

- Cardholder AgreementDocument10 pagesCardholder Agreementkaplanallen57No ratings yet

- Visa - Business BreakdownsDocument22 pagesVisa - Business Breakdownsyashvi.a.shahNo ratings yet

- CashappmethoDocument2 pagesCashappmethod86% (21)

- The Most Common Types of Consumer FraudDocument9 pagesThe Most Common Types of Consumer FraudJeffreyNo ratings yet

- Hacking Retail Gift Cards Remains Scarily Easy - WIREDDocument6 pagesHacking Retail Gift Cards Remains Scarily Easy - WIREDMichelle Brown100% (1)

- Identity TheftDocument5 pagesIdentity TheftBwallace12No ratings yet

- FraudDocument35 pagesFraudparkerroach21No ratings yet

- Plastic MoneyDocument8 pagesPlastic MoneySagar PentiNo ratings yet

- Discard - Credit Card Generator With BIN and WithDocument1 pageDiscard - Credit Card Generator With BIN and WithibrahimlukmanademolaNo ratings yet

- Chargeback 3Document3 pagesChargeback 3Jay DiadoraNo ratings yet

- Credit Card FraudDocument13 pagesCredit Card Frauda2zconsultantsjprNo ratings yet

- Identity Theft in PennsylvaniaDocument2 pagesIdentity Theft in PennsylvaniaJesse WhiteNo ratings yet

- Attorney's Advice-No ChargeDocument2 pagesAttorney's Advice-No Chargeemaq211100% (1)

- What Is Credit Card FraudDocument2 pagesWhat Is Credit Card FraudDavid OjoNo ratings yet

- Id Crises 9Document2 pagesId Crises 9Flaviub23No ratings yet

- Identity Theft PaperDocument10 pagesIdentity Theft PaperRohit Singh100% (1)

- Credit Card FraudDocument13 pagesCredit Card Fraudharshita patni100% (1)

- A Research Study of Plastic Money Among HousewivesDocument34 pagesA Research Study of Plastic Money Among HousewivesNainaNo ratings yet

- Credit Card FraudsDocument8 pagesCredit Card Fraudsalfregian11074819No ratings yet

- Debit VCRDocument2 pagesDebit VCRFlaviub23No ratings yet

- Fourteen Key Types of Banking Fraud PDFDocument5 pagesFourteen Key Types of Banking Fraud PDFLORIDELLE ABONALESNo ratings yet

- Thieves Using 'White Card' Fraud to Steal Money from ATMsDocument1 pageThieves Using 'White Card' Fraud to Steal Money from ATMsFlávio SantosNo ratings yet

- Creditcard SurveyDocument8 pagesCreditcard SurveyManmeet SinghNo ratings yet

- Credit Card FraudDocument16 pagesCredit Card Frauda2zconsultantsjpr100% (1)

- Credit Card Fraud Detection: Dept. of Cse, Vvit 2019-2020Document6 pagesCredit Card Fraud Detection: Dept. of Cse, Vvit 2019-2020Harsha GuptaNo ratings yet

- Credit Card Q&A: Build Credit With Secured & Student OptionsDocument15 pagesCredit Card Q&A: Build Credit With Secured & Student OptionsShekar KurakulaNo ratings yet

- Epayments: Is The Credit Card System Failing Ecommerce? Is A Solution in Sight?Document12 pagesEpayments: Is The Credit Card System Failing Ecommerce? Is A Solution in Sight?Flaviub23No ratings yet

- Green Dot FraudDocument16 pagesGreen Dot FraudJabeer75% (4)

- The Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsFrom EverandThe Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsRating: 3.5 out of 5 stars3.5/5 (3)

- The Book of Shadows: Discover the Power of the Ancient Wiccan Religion. Learn Forbidden Black Magic Spells and Rituals.From EverandThe Book of Shadows: Discover the Power of the Ancient Wiccan Religion. Learn Forbidden Black Magic Spells and Rituals.Rating: 4 out of 5 stars4/5 (1)

- My Spiritual Journey: Personal Reflections, Teachings, and TalksFrom EverandMy Spiritual Journey: Personal Reflections, Teachings, and TalksRating: 3.5 out of 5 stars3.5/5 (26)

- Becoming Supernatural: How Common People Are Doing The UncommonFrom EverandBecoming Supernatural: How Common People Are Doing The UncommonRating: 5 out of 5 stars5/5 (1478)

- Between Death & Life: Conversations with a SpiritFrom EverandBetween Death & Life: Conversations with a SpiritRating: 5 out of 5 stars5/5 (179)

- The Wim Hof Method: Activate Your Full Human PotentialFrom EverandThe Wim Hof Method: Activate Your Full Human PotentialRating: 5 out of 5 stars5/5 (1)

- The Three Waves of Volunteers & The New EarthFrom EverandThe Three Waves of Volunteers & The New EarthRating: 5 out of 5 stars5/5 (179)

- Conversations with God: An Uncommon Dialogue, Book 1From EverandConversations with God: An Uncommon Dialogue, Book 1Rating: 5 out of 5 stars5/5 (66)

- Adventures Beyond the Body: How to Experience Out-of-Body TravelFrom EverandAdventures Beyond the Body: How to Experience Out-of-Body TravelRating: 4.5 out of 5 stars4.5/5 (19)

- Good Without God: What a Billion Nonreligious People Do BelieveFrom EverandGood Without God: What a Billion Nonreligious People Do BelieveRating: 4 out of 5 stars4/5 (66)

- A New Science of the Afterlife: Space, Time, and the Consciousness CodeFrom EverandA New Science of the Afterlife: Space, Time, and the Consciousness CodeRating: 4.5 out of 5 stars4.5/5 (5)

- Notes from the Universe: New Perspectives from an Old FriendFrom EverandNotes from the Universe: New Perspectives from an Old FriendRating: 4.5 out of 5 stars4.5/5 (53)

- The Essence of the Bhagavad Gita: Explained by Paramhansa Yogananda as remembered by his disciple, Swami KriyanandaFrom EverandThe Essence of the Bhagavad Gita: Explained by Paramhansa Yogananda as remembered by his disciple, Swami KriyanandaRating: 4.5 out of 5 stars4.5/5 (40)

- The Four-Fold Way: Walking the Paths of the Warrior, Teacher, Healer and VisionaryFrom EverandThe Four-Fold Way: Walking the Paths of the Warrior, Teacher, Healer and VisionaryNo ratings yet

- The Happy Medium: Life Lessons from the Other SideFrom EverandThe Happy Medium: Life Lessons from the Other SideRating: 2.5 out of 5 stars2.5/5 (2)

- It's Easier Than You Think: The Buddhist Way to HappinessFrom EverandIt's Easier Than You Think: The Buddhist Way to HappinessRating: 4 out of 5 stars4/5 (60)

- The Art of Happiness: A Handbook for LivingFrom EverandThe Art of Happiness: A Handbook for LivingRating: 4 out of 5 stars4/5 (1205)

- Seven Sermons to the Dead: Septem Sermones ad MortuosFrom EverandSeven Sermons to the Dead: Septem Sermones ad MortuosRating: 4.5 out of 5 stars4.5/5 (31)

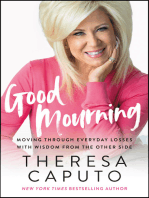

- Good Mourning: Moving Through Everyday Losses with Wisdom from the Other SideFrom EverandGood Mourning: Moving Through Everyday Losses with Wisdom from the Other SideRating: 3.5 out of 5 stars3.5/5 (2)

- Wisdom Distilled from the Daily: Living the Rule of St. Benedict TodayFrom EverandWisdom Distilled from the Daily: Living the Rule of St. Benedict TodayRating: 4 out of 5 stars4/5 (25)