Professional Documents

Culture Documents

Financial Management For Decision Makers

Financial Management For Decision Makers

Uploaded by

cutefrenzyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management For Decision Makers

Financial Management For Decision Makers

Uploaded by

cutefrenzyCopyright:

Available Formats

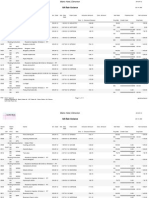

Chapter 7 240206521.xls.

ms_office

Atrill/Hurley

Financial Management for Decision Makers

Canadian Edition

Chapter 7

Problems and Cases

7.2

Year Machine 1 Machine 2 Machine 3

0 -200 -400 -600

1 150 150 140

2 125 140 130

3 130 120

4 120 120

5 110

6 100

7 90

8 70

Cost of capital 8%

Topic: Common-Period-of-Time and Equivalent-Annual-Annuity

Approaches

James Bay Geological Engineering Company (JBGEC) is considering buying

one of three earth-moving conveyors with the following investment

characteristics:

Project Cash Flows

($ thousands)

Copyright 2009 Pearson Education Canada Page 1 of 2

Chapter 7 240206521.xls.ms_office

Machine 1 NPV =

Machine 2 NPV =

Machine 3 NPV =

Machine 1 NPV =

Machine 2 NPV =

Machine 3 NPV =

Machine 1 NPV =

Machine 2 NPV =

Machine 3 NPV =

Machine 1 PMT =

Machine 2 PMT =

Machine 3 PMT =

Step 1: Calculate the NPV for each machine:

Step 2: Convert the NPV for each project into an annual annuity stream over

its expected life.

(a) Use the common-period-of-time approach to determine which machine, if

any, should be acquired.

Step 1: Calculate the NPV for each machine:

Step 2: Calculate the NPV arising for each machine, over the shortest-

common-period-of-time (using the reinvestment assumption).

(b) Use the equivalent-annual-annuity approach to determine which

machine, if any, should be acquired.

Copyright 2009 Pearson Education Canada Page 2 of 2

You might also like

- The Wealthy Barber - Everyone's Commonsense Guide To Becoming Financially IndependentDocument219 pagesThe Wealthy Barber - Everyone's Commonsense Guide To Becoming Financially IndependentcutefrenzyNo ratings yet

- Microsoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideFrom EverandMicrosoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideNo ratings yet

- Introduction To Management Science Hiller Hiller Chapter03Document57 pagesIntroduction To Management Science Hiller Hiller Chapter03alikaltayNo ratings yet

- Nozzle ProDocument185 pagesNozzle Progoodspeed_ph83% (6)

- Solution of Assignment 1Document3 pagesSolution of Assignment 1Anonymous 8O9X3QtR475% (4)

- Comparing Projects With Unequal LivesDocument3 pagesComparing Projects With Unequal LivesdzazeenNo ratings yet

- Practice Problems For The FinalDocument20 pagesPractice Problems For The FinalThanh Ngân0% (2)

- Catalyst Chage OperationDocument59 pagesCatalyst Chage OperationcutefrenzyNo ratings yet

- OM Numerical 2012Document27 pagesOM Numerical 2012Daneyal MirzaNo ratings yet

- Corporate Finance - Comparing Projects With Unequal Lives: ExampleDocument4 pagesCorporate Finance - Comparing Projects With Unequal Lives: Exampleanon_447537688No ratings yet

- Breakeven and Payback Analysis: Parameter or Decision VariableDocument5 pagesBreakeven and Payback Analysis: Parameter or Decision VariableZoloft Zithromax ProzacNo ratings yet

- Exercise 5 Goal ProgrammingDocument5 pagesExercise 5 Goal Programmingsiti nurmilaNo ratings yet

- Lecture 3 - Linear ProgrammingDocument14 pagesLecture 3 - Linear ProgrammingSakshi Khatri100% (1)

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Chapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesDocument7 pagesChapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesMishalNo ratings yet

- Question Bank or PutDocument5 pagesQuestion Bank or PutNITESH SONINo ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Capacity PlanningDocument17 pagesCapacity PlanningfuriousTaherNo ratings yet

- LP Formulation SheetDocument5 pagesLP Formulation Sheetmohamed hossamNo ratings yet

- End Term Examination: Fifth Semester (Mca) December-2009Document4 pagesEnd Term Examination: Fifth Semester (Mca) December-2009Pratiksha TiwariNo ratings yet

- Or AssignmentDocument6 pagesOr Assignmentmalede gashawNo ratings yet

- Capacity Problem1Document3 pagesCapacity Problem1Ahmed ZamanNo ratings yet

- Assignment Operations Management II 2019Document4 pagesAssignment Operations Management II 2019Indah Widoningtyas100% (1)

- 73 220 Lecture16Document9 pages73 220 Lecture16api-26315128No ratings yet

- Lecture 7 NotesDocument6 pagesLecture 7 NotesAna-Maria GhNo ratings yet

- 1Document5 pages1EndayenewMolla88% (16)

- Problem Solution Capital BudgetingDocument5 pagesProblem Solution Capital BudgetingAaryaAust50% (2)

- Tybms - orDocument6 pagesTybms - orSahil ChaudhariNo ratings yet

- (N D Vohra Unsolved Q-4 Page-594) (Solution: 6 Years)Document15 pages(N D Vohra Unsolved Q-4 Page-594) (Solution: 6 Years)Lokesh GagnaniNo ratings yet

- Assignment (40%) : A) Formulate The Problem As LPM B) Solve The LPM Using Simplex AlgorithmDocument5 pagesAssignment (40%) : A) Formulate The Problem As LPM B) Solve The LPM Using Simplex Algorithmet100% (1)

- Test+Full+O R +++ABC+++Service+SectorDocument4 pagesTest+Full+O R +++ABC+++Service+SectorSameer AhmedNo ratings yet

- WwpsDocument13 pagesWwpsKenVictorinoNo ratings yet

- TP & AP-QP ProblemsDocument15 pagesTP & AP-QP ProblemsSidharth DaveNo ratings yet

- Topic 9Document18 pagesTopic 9SUREINTHARAAN A/L NATHAN / UPMNo ratings yet

- Appendix 11B: Using Excel SolverDocument5 pagesAppendix 11B: Using Excel SolverHassleBustNo ratings yet

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhNo ratings yet

- MBA22 - Production & Operations ManagementDocument2 pagesMBA22 - Production & Operations ManagementNayan KanthNo ratings yet

- 2017 Final ExamDocument24 pages2017 Final ExamBi11y 1eeNo ratings yet

- Operation Costs Are Divided Into 2 Main Groups: - Fixed Costs - Variable CostsDocument24 pagesOperation Costs Are Divided Into 2 Main Groups: - Fixed Costs - Variable CostsPadmaja TripathyNo ratings yet

- Chapter 6 - Strategic Capacity PlanningDocument16 pagesChapter 6 - Strategic Capacity PlanningJahirul Islam ShovonNo ratings yet

- Captial Budgeting ExcercisesDocument3 pagesCaptial Budgeting ExcercisesPak CareerNo ratings yet

- Capacity PlanningDocument12 pagesCapacity PlanningHafiz AbirNo ratings yet

- Practice Problems 2Document7 pagesPractice Problems 2Emily Simpson0% (1)

- Idoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Document6 pagesIdoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Tural RamazanovNo ratings yet

- CMA Final Paper-9 Study Note 4 & 6: Operations ResearchDocument35 pagesCMA Final Paper-9 Study Note 4 & 6: Operations ResearchSaksham KhuranaNo ratings yet

- LP-Application Operations PDFDocument14 pagesLP-Application Operations PDFAnand DharunNo ratings yet

- Or Individual Assignment For Queens MBA FINALDocument7 pagesOr Individual Assignment For Queens MBA FINALAster GebreNo ratings yet

- Chapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesDocument2 pagesChapter 25 - Weygandt Financial and Managerial Accounting, 3e Challenge ExercisesTien Thanh DangNo ratings yet

- Part - A:: COURSE: B. Tech. YEAR: IV Year - Mechanical Engineering SUBJECT NAME: Resource ManagementDocument6 pagesPart - A:: COURSE: B. Tech. YEAR: IV Year - Mechanical Engineering SUBJECT NAME: Resource ManagementNat RatnamNo ratings yet

- Chapter 2 - Tutorial - W.R. Economy Management (2017-2018)Document4 pagesChapter 2 - Tutorial - W.R. Economy Management (2017-2018)Pesar BawaniNo ratings yet

- Learn Assignment 1 Draw-And-Determine A VSM Swim Lane - and - OEE 22-23 QS 1-And-2Document9 pagesLearn Assignment 1 Draw-And-Determine A VSM Swim Lane - and - OEE 22-23 QS 1-And-2Adam KučeraNo ratings yet

- Revision Sem 1 2017-18Document55 pagesRevision Sem 1 2017-18Farhan Amira100% (2)

- Chapter 6Document54 pagesChapter 6Shankaranarayanan GopalNo ratings yet

- Ice Cream Truck Project: Engineering Economy (IE255)Document8 pagesIce Cream Truck Project: Engineering Economy (IE255)Mohammad KashifNo ratings yet

- Chap 5Document8 pagesChap 5Aman Kumar SaranNo ratings yet

- Problems: Section Assigned Problems 8.1 8-1 To 8-11 8.2.1 8-12 To 8-21 8.2.2 8-22 To 8-25Document5 pagesProblems: Section Assigned Problems 8.1 8-1 To 8-11 8.2.1 8-12 To 8-21 8.2.2 8-22 To 8-25siti nurmilaNo ratings yet

- Student Sol 064 eDocument98 pagesStudent Sol 064 eMinh NguyễnNo ratings yet

- Capacity Planning: Supplement 7Document20 pagesCapacity Planning: Supplement 7Kylie TarnateNo ratings yet

- 6.1 Present Worth AnalysisDocument26 pages6.1 Present Worth AnalysisNur Aniem0% (2)

- Paper 17Document6 pagesPaper 17avdesh7777No ratings yet

- YEP121 Yacht Manufacturing Management Main 11-12Document6 pagesYEP121 Yacht Manufacturing Management Main 11-12Leo@spNo ratings yet

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Genralized Corrosion Cost AnalysisDocument34 pagesGenralized Corrosion Cost AnalysiscutefrenzyNo ratings yet

- RDC Product CatalogDocument4 pagesRDC Product CatalogcutefrenzyNo ratings yet

- Mine Development: Surface WaterDocument10 pagesMine Development: Surface WatercutefrenzyNo ratings yet

- Effect of Welding On Microstructure and Mechanical Properties of An Industrial Low Carbon SteelDocument5 pagesEffect of Welding On Microstructure and Mechanical Properties of An Industrial Low Carbon Steelmalika_00No ratings yet

- Tempil-Iron Carbon DiagramDocument1 pageTempil-Iron Carbon DiagramcutefrenzyNo ratings yet

- Mek4450 Ife Day1 Lesson2Document32 pagesMek4450 Ife Day1 Lesson2cutefrenzyNo ratings yet

- ReadmeDocument1 pageReadmecutefrenzyNo ratings yet

- Hfss 2way Thermal DimensionsDocument34 pagesHfss 2way Thermal DimensionscutefrenzyNo ratings yet

- Oil & Gas Downstream - EN-weldingDocument22 pagesOil & Gas Downstream - EN-weldingcutefrenzyNo ratings yet

- Corrdata Step GuideDocument8 pagesCorrdata Step GuidecutefrenzyNo ratings yet

- Figure 12.7: Equivalent Annual Costs As A Function of Miles DrivenDocument3 pagesFigure 12.7: Equivalent Annual Costs As A Function of Miles DrivencutefrenzyNo ratings yet

- Rate VarianceDocument11 pagesRate VariancecutefrenzyNo ratings yet

- 64610Document11 pages64610cutefrenzyNo ratings yet