Professional Documents

Culture Documents

Corporation Law After Midterms Reviewer

Corporation Law After Midterms Reviewer

Uploaded by

dennisgdagooc0 ratings0% found this document useful (0 votes)

30 views140 pagesdoc

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdoc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views140 pagesCorporation Law After Midterms Reviewer

Corporation Law After Midterms Reviewer

Uploaded by

dennisgdagoocdoc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 140

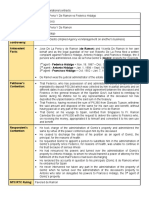

Revsed Bagtas Revewer by Ve and Ocfe 2A 125

XI. STOCKHOLDERS AND MEMBERS

Shares of stock n a corporaton consttute persona property of the stockhoder, whch he can

contract wth as n any other form of property. Shares of stock however do not represent propretary

rghts of stockhoders to the assets or propertes of the corporaton. Its hoder do not own any part of

the assets represented by the capta of the corporaton; nor are the stockhoders entted to the

possesson of any defnte porton of the corporatons assets or propertes.

POWERS OF CORPORATION WITH RESPECT

TO THE SHARES OF STOCK ALREADY ISSUED

POWERS WHICH CORPORATION DOES NOT

HAVE

(1) Sub|ect to any contrary stpuaton n the

subscrpton agreement, to ca for the

payment of the unpad subscrpton, together

wth nterest accrued, f any, on the date

specfed n the contract of subscrpton or on

the date stated n the ca made by the

board;

(1) Demand for the repurchase of ts shares

of stock uness the shares are cassfed as

redeemabe shares n the artces of

ncorporaton;

(2) To mpose nterest on the unpad

subscrptons from the date of subscrpton, f

so requred by, and at the rate of nterest

fxed n, the by-aws;

(2) Refuse to pay to the stockhoders

dvdends decared on shares whch have not

been decared denquent to appy them to

the payment of the unpad subscrpton, and

(3) To refuse to ssue to the subscrber the

certfcates of stock coverng shares where

the subscrpton has not been fuy pad;

(3) Bd denquent shares, and thereby obtan

for tsef proft, for vaue greater than the

baance due on the unpad subscrpton, pus

accrued nterest, cost of advertsement and

expenses of sae.

(4) To refuse to recognze and regster the

sae or assgnment of any share where the

subscrpton has not been fuy pad;

(5) To refuse to recognze a sae or

assgnment of shares of stock whch have

not been duy regstered n the stock and

transfer book.

1. Shareholders Not Corporate Creditors. aGarcia v. Lim Chu Sing, 59 Ph. 562 (1934).

GARCIA v. LIM CHU SING

FACTS:

Lm CUAN SY had an account wth the Mercante Bank of Chna (Pantff Bank) n the form of "trust

recepts" guaranteed by Lm CHU SING (defendant) as surety & wth chatte mortgage securtes. Lm

CUAN SY faed to compy wth hs obgatons. The Pantff Bank requred Lm CHU SING, as surety, to

devered a promssory note for P19,605.17 wth nterest thereon at 6% per annum, payabe monthy.

One of the condtons stpuated n the sad note s that n case of defendant's defaut n the payment

of any of the monthy nstaments the entre amount, together wth nterest thereon at 6% per

annum, sha become due & payabe on demand. The defendant had been makng parta payments

eavng an unpad baance of P9,105.17. However, he defauted n the payment of severa

nstaments by reason of whch the unpad baance on the promssory note had pso facto become

due & demandabe. The Mercante Bank of Chna, wthout the knowedge & consent of the

defendant, forecosed the chatte mortgage and prvatey sod the property covered thereby. The

defendant s the owner of shares of stock of the Pantff Bank of Chna amountng to P10,000. The

Pantff Bank was subsequenty paced under qudaton. The defendant fed a moton for the

ncuson of the prncpa debtor Lm Cuan Sy as party defendant wth the CFI-Mana so that he coud

ava hmsef of the beneft of the exhauston of the property of sad Lm Cuan Sy. The moton was

dened. The proceeds of the sae of the mortgaged chattes together wth other payments made were

apped to the amount of the promssory note n queston, eavng the baance whch the pantff now

seeks to coect.

ISSUE: W/N t s proper to COMPENSATE the defendant-appeant's ndebtedness of P9,105.17 wth

the sum of P10,000 representng the vaue of hs shares of stock wth the Mercante Bank of Chna.

HELD: NO. Accordng to the weght of authorty, a share of stock or the certfcate thereof s not an

ndebtedness to the owner nor evdence of ndebtedness and, therefore, t s not a credt.

Stockhoders, as such, are not credtors of the corporaton. It s the prevang doctrne of the

Amercan courts that the capta stock of a corporaton s a trust fund to be used more partcuary for

the securty of credtors of the corporaton, who presumaby dea wth t on the credt of ts capta

stock.

The shares of a bankng corporaton do not consttute an ndebtedness of the corporaton to

the stockhoder and, therefore, the atter s not a credtor of the former for such shares. The

ndebtedness of a sharehoder to a bankng corporaton cannot be compensated wth the amount of

hs shares theren, there beng no reaton of credtor & debtor wth respect to such shares.

Therefore, the defendant-appeant Lm CHU SING not beng a credtor of the Pantff Bank,

athough the atter s a credtor of the former, there s no suffcent ground to |ustfy a compensaton.

2. S!s"riptio# Co#tra"t (Sec. 60 & 72; Trillana v. Quezon Colegialla, 93 Ph. 383 |1953|).

Secton 60. Subscrpton contract. - Any contract for the acquston of unssued stock n an exstng

corporaton or a corporaton st to be formed sha be deemed a subscrpton wthn the meanng of

ths Tte, notwthstandng the fact that the partes refer to t as a purchase or some other contract.

Secton 72. Rghts of unpad shares. - Hoders of subscrbed shares not fuy pad whch are not

denquent sha have a the rghts of a stockhoder.

PURCHASE OF ISSUED SHARES SUBSCRIPTION OF UNISSUED SHARES

(1) TRADITION/DELIVERY - upon fu payment

of the prce; sae consttutes merey a tte

and not a mode by whch ownershp of the

sub|ect matter s transferred.

(1) UPON PERFECTION - ISSUANCE of shares

of stock even wthout fu payment; upon the

mere meetng of the mnds, the effects of a

rea contract take pace. Furthermore, the

regstraton of the subscrpton n the stock

and transfer book s not aso essenta to

consttute subscrpton and ssuance of the

shares. (Such s meant to govern the bndng

effects of sae and dspostons of shares as

far as thrd partes are concerned, but not

wth respect to the corporaton and

stockhoders.)

Such consttutes the very mode by whch the

covered shares are thereby ssued and then

owned by the subscrber.

(2) SUBSTANTIAL BREACH - remedes

rescsson or specfc performance

(2) Even n the case of breach, the

subscrber cannot rescnd

(3) Bankruptcy or nsovency of the

corporaton w termnate ts cam aganst

the purchaser on the theory that t can no

onger perform ts sde of an executory

contract by devery of a vad certfcate and

that the consderaton has faed.

(3) When the corporaton becomes nsovent,

the corporaton becomes mmedatey abe

to pay for the shares of stock subscrbed to.

IN RELATION TO LIMITED LIABILITY OF

STOCKHOLDERS - Stockhoders are abe to

the extent of how much they promsed to

subscrbe - ths s the prce the stockhoder

Revsed Bagtas Revewer by Ve and Ocfe 2A

pays for en|oyng mted abty.

(4) Can be sub|ect to a resoutory or

suspensve condton - non occurrence of

whch does not gve rse to the sae

(4) Can be sub|ect to terms and condtons

but such must not excuse buyer from payng.

Terms and condtons and stpuatons may

be agreed upon n a subscrpton agreement.

Such varyng terms are vad and effectve

between the partes for so ong as they do

not undermne the utmate obgaton of the

subscrber to pay the subscrpton n order to

protect the cams of the corporate credtors.

(5) Purchaser s not a debtor, and accordng

to some courts, the measure of abty of

the purchaser f he defauts, s n damages

for the dfference between the contract prce

and the market vaue of the shares

(5) The unpad subscrpton s a debt of

subscrber.

(6) The provson of the Corporaton Law

regardng cas for unpad subscrptons and

assessment of stock do not appy.

(7) The rue that the corporaton has no ega

capacty to reease an orgna subscrber to

ts captas stock from the obgaton to pay

for hs shares s nappcabe to a contract of

purchase of shares.

NOTE: CONSIDERATION for subscrpton s aways onerous for the protecton of the credtors. Ths s

another enforcement of the trust fund doctrne. ISSUANCE OF STOCK BELOW THE PAR VALUE s a

voaton of the trust fund doctrne. ISSUANCE OF STOCKS WITH NO PAR VALUE must be decared n

the books.

CLV: Subscrpton agreements are not covered by Statute of Frauds, and the corporaton has a rght

to enforce and coect, and to adduce ora evdence, upon an ora subscrpton agreement, on the

foowng grounds: (1) the speca treatment accorded to subscrpton agreement under Corporate

Law requres that subscrpton agreements, even when they have been entered nto oray, shoud be

aowed to be proved and enforced by ora evdence, n order to fuy protect corporate credtors

under the trust fund doctrne; and (2) even f subscrpton agreements are covered by the Statute of

Frauds, but by ther nature whch upon consent woud make the subscrber a stockhoder and owner

of the covered shares, whch woud consttute parta executon, they are deemed to be exempted

from the prohbton aganst the presentng of ora evdence to prove and enforce them.

CHARACTERISTICS:

1) Orgna ssuance from authorzed capta stock at the tme of ncorporaton;

2) The openng, durng the fe of the corporaton of the porton of the orgna authorzed capta

stock prevousy unssued;

3) The ncrease of authorzed capta stock acheved through a forma amendment of the artces

of ncorporaton and regstraton thereof wth SEC.

NOTE: Any transacton coverng ssued shares of stock s a not a subscrpton agreement, and

therefore s governed by the Law on Saes.

a$ Purchase Agreement. aBayla v. Silang Traffic Co., Inc., 73 Ph. 557 (1942).

BAYLA v SILANG TRAFFIC CO. INC.

FACTS:

Pettoners n G.R. No. 48195 nsttuted ths acton n the CFI of Cavte aganst the respondent Sang

12

7

Traffc Co., Inc. (cross-pettoner n G.R. No. 48196), to recover certan sums of money whch they

had pad severay to the corporaton on account of shares of stock they ndvduay agreed to take

and pay for under certan specfed terms and condtons:

"(1)That the subscrber promses to pay personay or by hs duy authorzed agent to the seer

at the Muncpaty of Sang, Provnce of Cavte, Phppne Isands, the sum of one thousand fve

hundred pesos (P1,500), Phppne currency, as purchase prce of FIFTEEN (15) shares of capta

stock, sad purchase prce to be pad as foows, to wt: fve (5%) per cent upon the executon of

the contract, the recept whereof s hereby acknowedged and confessed, and the remander n

nstaments of fve per cent, payabe wthn the frst month of each and every quarter

thereafter, commencng on the 1st day of |uy, 1935, wth nterest on deferred payments at the

rate of SIX (6%) per cent per annum unt pad.

(2)That the sad subscrber further agrees that f he fas to pay any of sad nstament when

due, or to perform any of the aforesad condtons, or f sad shares sha be attached or eved

upon by credtors of the sad subscrber, then the sad shares are to revert to the seer and the

payments aready made are to be forfeted n favor of sad seer, and the atter may then take

possesson, wthout resortng to court proceedngs.

(3)The sad seer upon recevng fu payment, at the tme and manner herenbefore specfed,

agrees to execute and dever to sad subscrber, or to hs hers and assgns, the certfcate of

tte of sad shares, free and cear of a encumbrances."

The pettoners agreed to purchase the foowng number of shares and, up to Apr 30, 1937, had

pad the foowng sums on account thereof:

Sofrono T.

Baya.......

8 shares P360

Venanco

Toedo........

8 shares 375

|osefa

Nava..............

15

shares

675

Paz

Toedo................

15

shares

675

Pettoners' acton for the recovery of the sums above mentoned s based on a resouton by the

board of drectors of the respondent corporaton on August 1, 1937.

The respondent corporaton set up the foowng defenses: (1) resouton s not appcabe to the

pettoners Baya, Nava, and Toedo because on the date thereof "ther subscrbed shares of stock

had aready automatcay reverted to the defendant, and the nstaments pad by them had aready

been forfeted"; and (2) resouton of August 1, 1937, was revoked and canceed by a subsequent

resouton of the board of drectors of the defendant corporaton dated August 22, 1937.

The tra court absoved the defendant from the compant and decared forfeted n favor of the

defendant the shares of stock n queston. It hed that the resouton of August 1, 1937, was nu and

vod, ctng Velasco vs. Poiza (37 Ph., 802), wheren ths Court hed that "a corporaton has no ega

capacty to reease an orgna subscrber to ts capta stock from the obgaton to pay for shares;

and any agreement to ths effect s nvad" CA modfed the decson of the tra court. It affrmed the

dsmssa of the pantffs companed part thereof decarng ther subscrpton canceed s reversed.

Defendant s drected to grant pantffs 30 days after fna |udgment wthn whch to pay the arrears

on ther subscrpton. Both partes appeaed to ths Court by petton and cross-petton for ceriorari.

The partes tgant, the tra court, and the Court of Appeas have nterpreted or consdered the sad

agreement as a contract of subscrpton to the capta stock of the respondent corporaton. It shoud

be noted, however, that sad agreement s entted "Agreement for Instament Sae of Shares n the

Sang Traffc Company, Inc.,"; that whe the purchaser s desgnated as "subscrber," the corporaton

Revsed Bagtas Revewer by Ve and Ocfe 2A

s descrbed as "seer"; that the agreement was entered nto on March 30, 1935, ong after the

ncorporaton and organzaton of the corporaton, whch took pace n 1927; and that the prce of the

stock was payabe n quartery nstaments spread over a perod of fve years. It aso appears that n

cv case No. 3125 of the Court of Frst Instance of Cavte mentoned n the resouton of August 1,

1937, the rght of the corporaton to se the shares of stock to the person named n sad resouton

(ncudng heren pettoners) was mpugned by the pantffs n sad case, who camed a preferred

rght to buy sad shares.

ISSUES: (1) W/N the contracts are subscrptons or saes of stock (2) W/N under the contract between

the partes, the faure of the purchaser to pay any of the quartery nstaments on the purchase

prce automatcay gave rse to the forfeture of the amounts aready pad and the reverson of the

shares to the corporaton.

HELD:

(1) They are contracts of sae and not of subscrpton. "A subscrpton, propery speakng, s the

mutua agreement of the subscrbers to take and pay for the stock of a corporaton, whe a purchase

s an ndependent agreement between the ndvdua and the corporaton to buy shares of stock from

t at stpuated prce."

(2) No. The contract provdes for nterest of the rate of sx per centum per annum on deferred

payments. The provson regardng nterest on deferred payments woud not have been nserted f t

had been the ntenton of the partes to provde for automatc forfeture and canceaton of the

contract. Moreover, the contract dd not expressy provde that the faure of the purchaser to pay

any nstament woud gve rse to forfeture and canceaton wthout the necessty of any demand

from the seer; and under artce 1100 of the Cv Code persons obged to dever or do somethng

are not n defaut unt the moment the credtor demands of them |udcay or extra-|udcay the

fufment of ther obgaton, uness (1) the obgaton or the aw expressy provdes that demand

sha not be necessary n order that defaut may arse, (2) by reason of the nature and crcumstances

of the obgaton t sha appear that the desgnaton of the tme at whch that thng was to be

devered or the servce rendered was the prncpa nducement to the creaton of the obgaton.

Is the resouton of August 1, 1937, vad? The contract n queston beng one of purchase and not

subscrpton as we have heretofore ponted out, we see no ega mpedment to ts rescsson by

agreement of the partes. Accordng to the resouton of August 1, 1937, the recsson was made for

the good of the corporaton and n order to termnate the then pendng cv case nvovng the

vadty of the sae of the shares n queston among others. To that rescsson the heren pettoners

apparenty agreed, as shown by ther demand for the refund of the amounts they had pad as

provded n sad resouton. It appears from the record that sad cv case was subsequenty

dsmssed, and that the purchasers of shares of stock, other than the heren pettoners, who were

mentoned n sad resouton were abe to beneft by sad resouton. It woud be an un|ust

dscrmnaton to deny the same beneft to the heren pettoners.

%!$ Pre-Incorporation Subscription (Sec. 61)

Secton 61. Pre-ncorporaton subscrpton. - A subscrpton for shares of stock of a corporaton st to

be formed sha be rrevocabe for a perod of at east sx (6) months from the date of subscrpton,

uness a of the other subscrbers consent to the revocaton, or uness the ncorporaton of sad

corporaton fas to materaze wthn sad perod or wthn a onger perod as may be stpuated n

the contract of subscrpton: Provded, That no pre-ncorporaton subscrpton may be revoked after

the submsson of the artces of ncorporaton to the Securtes and Exchange Commsson.

When propertes were assgned pursuant to a pre-ncorporaton subscrpton

agreement, but the corporaton fas to ssue the covered shares, the return of such

propertes to the subscrber s a drect consequence of rescsson and does not amount to

corporate dstrbuton of assets pror to dssouton. a!n "ong v. Tiu, 375 SCRA 614 (2002).

NOTE: The present Code recognzed that the subscrpton agreement s a contract between the

subscrber and the corporaton. Athough the corporaton s st non-exstent snce t s st n the

process of ncorporaton, t s st bound under the pre-ncorporaton agreement. The atter s

repaced by the promoters contract athough t s merey an expectancy. A subscrpton agreement

s n a sense a contract among severa subscrbers, and no one of the subscrbers can thus wthdraw

from the contract wthout the consent of a the others and thereby dmnsh, wthout the unversa

12

9

consent of a the others, the common fund n whch a have acqured an nterest.

%"$ Release from Subscription Obligation (a!ng "ong v. Tiu, 401 SCRA 1 (2003); Velasco

v. Poiza, 37 Ph. 802 |1918|; P#B v. Biulo$ Sa%mill, Inc., 23 SCRA 1968 |1968|; #aional

&'change Co. v. (e'er, 51 Ph. 601 |1928|)

The accepted rue n Ph. |ursdcton s that a corporaton can reease a subscrber from abty

on the subscrpton, n whoe or n part, ony wth the express or mped consent of a the

sharehoders and ony when there s no pre|udce to corporate credtors.

|ursprudence has aowed certan exceptons to ths rue: n the case of a bona fde compromse

or to set-off a debt due from the corporaton, a reease, supported by consderaton, whch w be

effectua as aganst dssentng stockhoders and subsequent and exstng credtors. NOTE: There

must st be vauabe consderaton.

ONG YONG v. TIU

Facts: In 1994, the constructon of the Masagana Ctma n Pasay Cty by Frst Landnk Asa

Deveopment Corporaton (FLADC) owned by the Tu famy was threatened by the forecosure by the

PNB for ther P 190 M debt. In order to stave off the threat the Tu famy together wth the Ong

famy agreed to restructure FLADC and created a pre-subscrpton agreement and each were to

mantan equa sharehodngs. The Ong famy nvested a tota sum of P 190 M to the corporaton

whe the Tu famy ncuded severa rea estate propertes as added capta for the restructured

corporaton. The Ong and Tu fames now owned 1,000,000 shares each of FLADC. After a the

debts were pad, the peace between Ong and Tu dd not ast. Tu camed rescsson based on

substanta breach by Ong upon the pre-subscrpton agreement. Ong, on the other hand mantaned

that t was Tu who commtted the breach because one of the propertes that they were supposed to

ncude n the agreement was n fact aready n the rea estate owned by FLADC. The SEC approved

the rescsson (both partes were return to status quo, P 190 M to the Ong famy and a the

remanng FLADC assets to the Tu famy, whch ncuded the now fnshed ma vaued at more than

P 1B) and the CA affrmed the decson wth sght modfcatons.

Hed:

1.) Is rescsson the proper remedy for an ntra-corporate dspute No, the Corporaton Code,

SEC rues and even the Rues of Court provde for approprate and adequate ntra-corporate

remedes, other than rescsson, n stuatons ke ths. Rescsson s certany not one of them,

specay f the party askng for t has no ega personaty to do so (because t s a corporaton,

Tu famy s not the corporaton) and the requrements of the aw therefore have not been

met. A contrary doctrne w tread on extremey dangerous ground because t w aow |ust

any stockhoder, for |ust about any rea or magned offense, to demand rescsson of hs

subscrpton and ca for the dstrbuton of some part of the corporate assets to hm wthout

compyng wth the requrements of the Corp. Code.

2.) Grantng rescsson s a proper remedy, does t voate the TFD Yes t w voate the TFD

and the procedures for vad dstrbuton of assets and property under the Corp. Code. The

TFD provdes that subscrpton to the capta stock of a corporaton consttute a fund to whch

the credtors have a rght to ook for the satsfacton of ther cams. The doctrne s the

underyng prncpe n the procedure for the dstrbuton of capta assets, n the Corp. Code

whch aows the dstrbuton of corporate capta ony n three nstances: (1) amendments of

the Artces of Incorporaton to reduce the authorzed capta stock (requres Board Resouton

and stockhoderss meetng) (2) purchase of redeemabe shares by the corporaton,

regardess of the exstence of unrestrcted retaned earnngs and (3) dssouton and eventua

qudaton of the corporaton. In the nstant case, the rescsson of the pre-subscrpton

agreement w effectvey resut n the unauthorzed dstrbuton of the capta assets and

property of the corporaton, thereby voaton the TFD and the Corp. Code, snce the rescsson

of a subscrpton agreement s not one of the nstances when dstrbuton of capta assets and

property of the corporaton s aowed.

%d$ When Condition of Payment Provided in y-la!s. (e Silva v. )boiiz * Co., 44 Ph.

755 (1923).

&. Co#sideratio# (Sec. 62).

Revsed Bagtas Revewer by Ve and Ocfe 2A

Secton 62. Consderaton for stocks. - Stocks sha not be ssued for a consderaton ess than the

par or ssued prce thereof. Consderaton for the ssuance of stock may be any or a combnaton of

any two or more of the foowng:

1. Actua cash pad to the corporaton;

2. Property, tangbe or ntangbe, actuay receved by the corporaton and necessary or

convenent for ts use and awfu purposes at a far vauaton equa to the par or ssued vaue

of the stock ssued;

3. Labor performed for or servces actuay rendered to the corporaton;

4. Prevousy ncurred ndebtedness of the corporaton;

5. Amounts transferred from unrestrcted retaned earnngs to stated capta; and

6. Outstandng shares exchanged for stocks n the event of recassfcaton or converson.

Where the consderaton s other than actua cash, or conssts of ntangbe property such as patents

of copyrghts, the vauaton thereof sha ntay be determned by the ncorporators or the board of

drectors, sub|ect to approva by the Securtes and Exchange Commsson.

Shares of stock sha not be ssued n exchange for promssory notes or future servce.

The same consderatons provded for n ths secton, nsofar as they may be appcabe, may be used

for the ssuance of bonds by the corporaton.

The ssued prce of no-par vaue shares may be fxed n the artces of ncorporaton or by the board

of drectors pursuant to authorty conferred upon t by the artces of ncorporaton or the by-aws, or

n the absence thereof, by the stockhoders representng at east a ma|orty of the outstandng

capta stock at a meetng duy caed for the purpose. (5 and 16)

%a$ Cash %"$ Ser'i"e %d$ Shares

%!$ (ropert) %d$ Retai#ed Ear#i#*s

CASH AND PROMISSORY NOTES FOR SUBSCRIPTION - WHY THE PROHIBITION

Two factors - (1) The underyng dfference n ega consequence between notes recevabe or

accounts recevabe and subscrpton recevabe on the other hand. If a not recevabe s accepted

as payment for subscrpton of shares of stock, the face vaue of the note woud appear as an

addton to the assets of the corporatons baance sheet, wthout correspondng deducton on the

capta stock of the equty porton. On the other hand, subscrpton recevabes are correcty

treated not as assets and are refected propery n the baance sheet of the corporaton as

deductons from stockhoders equty and the dfference shows the net amount of the

stockhoders equty whch s backed up by assets actuay receved by the corporaton (such as

cash or property) whch have vaues that do not depend on the credt standng of another person.

In short, the atter nforms the credtors of the actua net amount of capta stock whch s truy

backed-up by reazabe assets. (2) TFD - that the capta stock of the corporaton, especay the

pad-up porton thereof shoud be backed up by assets whch have ther own ntrnsc vaue other

than the promse of a person to pay n the future.

PROPERTY CONSIDERATION

The property to be accepted by the corporaton must be necessary or proper for t to own n

carryng on ts busness. (It cannot awfuy ssue stock for property whch ts charter does not

authorze t to acqure, or for property acqured for an unauthorzed purpose.) The property must

be of substanta nature, havng pecunary vaue capabe of beng ascertaned, and must be

somethng rea and tangbe as dstngushed from somethng specuatve. It must be devered to

the corporaton. It must be capabe of beng apped to the payment of debts and of dstrbuton

among the stockhoders.

EXAMPLE: Rea property may be accepted as payment on subscrpton to the capta stock ony

13

1

when the same can be used n the busness of the corporaton, as n rea estate deveopment,

subdvson, agro-ndustra busness, and the ke, as we as for the estabshment of offces.

SEC has rued that property as fnanca nstruments and recevabes may be egay accepted as

capta contrbutons sub|ect to the foowng condtons: (1) actuay receved by the corporaton

(2) necessary or convenent for the corporatons use and awfu purpose; and (3) at a far

vauaton equa to the par vaue of the stock to be approved by the SEC

DEBTS AND SERVICES AS CONSIDERATION

Labor performed or servces actuay rendered are aso consdered as consderatons, provded

that the transacton s n good fath and no fraud s perpetuated upon other stockhoders.

Prevousy-ncurred debts vauaton woud have been estabshed at arms-ength pror to even

negotatng on the subscrpton agreement, and they woud more often represent the true vaue

of servces whch the corporaton receved.

Future servces are not aowed as consderaton for subscrpton because the vaue of such

servce to the corporaton n exchange for shares of stock woud agan depend on the future

performance of the subscrber of the servces offered, and there woud be tendency to short-

change the corporaton.

SET-OFF OF CORPORATIONS INDEBTEDNESS

Prevousy-ncurred debts vauaton woud have been estabshed at arms-ength pror to even

negotatng on the subscrpton agreement, and they woud more often represent the true vaue

of servces whch the corporaton receved.

Snce these exsts n ts books, the corporaton woud have had to pay the same n cash to ts

credtor, and n turn the same cash s pad back by such credtor to the corporaton for

subscrpton of shares.

UNRESTRICTED RETAINED EARNINGS OR EXISTING CAPITAL AS CONSIDERATION

The amounts transferred from URE to stated capta covers the decaraton of stock dvdends,

whch has the net effect of captazng URE. Stock dvdends are n the nature of shares of stock,

where the consderaton s the amount of URE converted nto equty n the corporatons books.

CONSEOUENCES OF UNLAWFUL CONSIDERATION

Subscrpton contract s vad, but the consderaton s vod. It woud not be n consonance wth

the TFD nor to the best nterest of the corporaton and the subscrber, to consder the contract as

vod. The reasonabe nterpretaton s that the subscrpton contract woud be vad and bndng

on both the corporaton and the subscrber, but that the provson on such unawfu consderaton

s deemed vod, such that the subscrpton agreement woud be construed to be for cash and the

unpad amount be treated as part of subscrpton recevabes.

(OUESTION KO: So what do you for nstance wth accepted PNs refected as assets of the corporaton

- amend the records that contan them? Wont credtors be pre|udced because they were ed to

beeve that the assets are up to ths amount where they are not.)

Stock dvdends are n the nature of shares of stock, the consderaton for whch s the

amount of unrestrcted retaned earnngs converted nto equty n the corporatons books.

Lincoln Phil. Life v. Cour of )++eals, 293 SCRA 92 (1998).

1

+. ,atered Sto"-s (Sec. 65)

Secton 65. Labty of drectors for watered stocks. - Any drector or offcer of a corporaton

consentng to the ssuance of stocks for a consderaton ess than ts par or ssued vaue or for a

consderaton n any form other than cash, vaued n excess of ts far vaue, or who, havng

1The bass for determnng the documentary stamps due on stock dvdends decared woud be ther book vaue

as ndcated n the atest audted fnanca statements of the corporaton, and not the par vaue thereof.

Commissioner of Inernal ,evenue v. Lincoln Phil. Life Insurance Co., 379 SCRA 423 (2002).

Revsed Bagtas Revewer by Ve and Ocfe 2A

knowedge thereof, does not forthwth express hs ob|ecton n wrtng and fe the same wth the

corporate secretary, sha be sodary, abe wth the stockhoder concerned to the corporaton and

ts credtors for the dfference between the far vaue receved at the tme of ssuance of the stock

and the par or ssued vaue of the same.

NOTES:

Shares ssued as fuy pad when n truth the consderaton receved s known to be ess than the

par vaue or ssued vaue of the shares are caed WATERED STOCK.

Ths s prohbted because of the n|ures caused to: (1) CORPORATION whch s deprved of the

needed capta and the opportunty to market ts securtes to ts own advantage, thus hurtng ts

busness prospects and fnanca responsbty; (2) EXISTING AND FUTURE SHAREHOLDERS who

are aso n|ured by the duton of the proportonate nterests n the corporaton and who pay fu

vaue for ther shares; (3) PRESENT AND FUTURE CREDITORS who are n|ured as the corporaton

s deprved of the assets or capta requred by aw to be contrbuted by a sharehoders as

substtute for ndvdua abty for corporate debts; and (4) PERSONS WHO DEAL WITH IT OR

PURCHASE ITS SECURITIES WHO ARE DECEIVED because stock waterng s nvarabe

accompaned wth mseadng corporate accounts and fnanca statements, partcuary by an

overstatement of the vaue of assets receved for the shares to cover up a capta defct resutng

from overvauaton and underpayment of purported capta contrbutons.

.. (a)/e#t o0 Bala#"e o0 S!s"riptio# (Secs. 66 and 67; Lingayen Gulf &lecric Po%er Co. v.

Balazar, 93 Ph. 404 |1953|).

Secton 66. Interest on unpad subscrptons. - Subscrbers for stock sha pay to the corporaton

nterest on a unpad subscrptons from the date of subscrpton, f so requred by, and at the rate of

nterest fxed n the by-aws. If no rate of nterest s fxed n the by-aws, such rate sha be deemed to

be the ega rate.

Secton 67. Payment of baance of subscrpton. - Sub|ect to the provsons of the contract of

subscrpton, the board of drectors of any stock corporaton may at any tme decare due and

payabe to the corporaton unpad subscrptons to the capta stock and may coect the same or

such percentage thereof, n ether case wth accrued nterest, f any, as t may deem necessary.

Payment of any unpad subscrpton or any percentage thereof, together wth the nterest accrued, f

any, sha be made on the date specfed n the contract of subscrpton or on the date stated n the

ca made by the board. Faure to pay on such date sha render the entre baance due and payabe

and sha make the stockhoder abe for nterest at the ega rate on such baance, uness a dfferent

rate of nterest s provded n the by-aws, computed from such date unt fu payment. If wthn thrty

(30) days from the sad date no payment s made, a stocks covered by sad subscrpton sha

thereupon become denquent and sha be sub|ect to sae as herenafter provded, uness the board

of drectors orders otherwse.

NOTES:

The word ca s capabe of three meanngs namey (1) resouton of the board of drectors for the

payment of unpad subscrptons (2) notfcaton of such resouton made on the stockhoders (3)

the tme when the subscrptons become payabe.

A ca s usuay expressed n the form of a resouton adopted by the board of drectors,

specfyng the proporton of the unpad subscrpton whch t desred to ca n and the tme or

tmes when t s to be payabe. The entre amount of the unpad subscrpton may be caed at

once or t may be made payabe by nstaments, at stated ntervas or by successve cas.

A ca must be unform wth respect to a hoders of the cass of shares on whch t s made, who

have aready pad an equa amount on ther shares, and as a genera rue t must not exceed the

baance remanng unpad on ther shares.

WHEN CALL NOT NECESSARY (1) When, under the terms of the subscrpton contract, subscrpton

s payabe, not upon ca but mmedatey, or on a specfed day, or when t s payabe n

nstaments at specfed tmes; (2) If the corporaton becomes nsovent whch makes the abty

13

3

on the unpad subscrpton due and demandabe regardess of any stpuaton to the contrary n

the subscrpton agreement.

|ursprudence provdes that notce of ca for payment of unpad subscrbed stock must be

pubshed, except when the corporaton s nsovent.

A stockhoder who s empoyed wth the company, cannot sett-off hs unpad subscrpton

aganst hs awarded cams for wages, where there has been no ca for the payment of such

subscrpton. )+o-aca v. #L,C, 172 SCRA 442 (1989).

1. Deli#2e#") o# S!s"riptio# (Secs. 68, 69, 70 and 71; Phili++ine Trus Co. v. ,ivera, 44

Ph. 469 |1923|; .iran-a v. Tarlac ,ice .ill Co., 57 Ph. 619 |1932|)

Secton 68. Denquency sae. - The board of drectors may, by resouton, order the sae of

denquent stock and sha specfcay state the amount due on each subscrpton pus a accrued

nterest, and the date, tme and pace of the sae whch sha not be ess than thrty (30) days nor

more than sxty (60) days from the date the stocks become denquent.

Notce of sad sae, wth a copy of the resouton, sha be sent to every denquent stockhoder ether

personay or by regstered ma. The same sha furthermore be pubshed once a week for two (2)

consecutve weeks n a newspaper of genera crcuaton n the provnce or cty where the prncpa

offce of the corporaton s ocated.

Uness the denquent stockhoder pays to the corporaton, on or before the date specfed for the

sae of the denquent stock, the baance due on hs subscrpton, pus accrued nterest, costs of

advertsement and expenses of sae, or uness the board of drectors otherwse orders, sad

denquent stock sha be sod at pubc aucton to such bdder who sha offer to pay the fu amount

of the baance on the subscrpton together wth accrued nterest, costs of advertsement and

expenses of sae, for the smaest number of shares or fracton of a share. The stock so purchased

sha be transferred to such purchaser n the books of the corporaton and a certfcate for such stock

sha be ssued n hs favor. The remanng shares, f any, sha be credted n favor of the denquent

stockhoder who sha kewse be entted to the ssuance of a certfcate of stock coverng such

shares.

Shoud there be no bdder at the pubc aucton who offers to pay the fu amount of the baance on

the subscrpton together wth accrued nterest, costs of advertsement and expenses of sae, for the

smaest number of shares or fracton of a share, the corporaton may, sub|ect to the provsons of

ths Code, bd for the same, and the tota amount due sha be credted as pad n fu n the books of

the corporaton. Tte to a the shares of stock covered by the subscrpton sha be vested n the

corporaton as treasury shares and may be dsposed of by sad corporaton n accordance wth the

provsons of ths Code.

Secton 69. When sae may be questoned. - No acton to recover denquent stock sod can be

sustaned upon the ground of rreguarty or defect n the notce of sae, or n the sae tsef of the

denquent stock, uness the party seekng to mantan such acton frst pays or tenders to the party

hodng the stock the sum for whch the same was sod, wth nterest from the date of sae at the

ega rate; and no such acton sha be mantaned uness t s commenced by the fng of a compant

wthn sx (6) months from the date of sae.

Secton 70. Court acton to recover unpad subscrpton. - Nothng n ths Code sha prevent the

corporaton from coectng by acton n a court of proper |ursdcton the amount due on any unpad

subscrpton, wth accrued nterest, costs and expenses.

Secton 71. Effect of denquency. - No denquent stock sha be voted for or be entted to vote or to

representaton at any stockhoder's meetng, nor sha the hoder thereof be entted to any of the

rghts of a stockhoder except the rght to dvdends n accordance wth the provsons of ths Code,

unt and uness he pays the amount due on hs subscrpton wth accrued nterest, and the costs and

expenses of advertsement, f any.

The prescrptve perod to recover on unpad subscrpton does not commence from the

Revsed Bagtas Revewer by Ve and Ocfe 2A

tme of subscrpton but from the tme of demand by Board of Drectors to pay the baance

of subscrpton. Garcia v. Suarez, 67 Ph. 441 (1939).

NOTES:

The SEC has rued that the use of the word SHALL shows that a pror ca or board resouton

demandng payment s not necessary f a specfc date of payment s specfed n the subscrpton

contract; and nether s there a need of a forma decaraton of the board for an unpad

subscrpton to become denquent n the event of faure to pay the unpad subscrpton wthn

the prescrbed 30 day perod from the date specfed n the subscrpton contract.

WHO IS THE HIGHEST BIDDER

Such bdder who sha offer to pay the fu amount of the baance on the subscrpton together

wth accrued nterests, costs of advertsements and expenses of sae for the smaest number of

shares or fracton of a share.

If there s no bdder, the corporaton may bd for the same, wth such shares to be vested n the

corporaton as treasury shares.

(DISCLAIMER: I am not sure f ths s correct but ths s how I understood the expanaton.) For

exampe stockhoder X owes the corporaton Php 3M (ncusve of costs, etc.) for 3000 shares.

Durng the bd, what the bdders do ets say bdders A, B and C s to bd for a certan number of

shares n exchange for a fxed prce whch w cover the baance on the subscrpton together

wth accrued nterests, costs of advertsement and expenses of sae. Whoever bds for the

smaest number of shares sha be consdered as the hghest bdder, and the remanng shares

not covered by the bd s reverted to ts denquent owner. In ths case, et us say for Php 3M, A

expressed the ntenton to pay 3M for 1000 shares whe B for 2000 shares and C for 3000 shares,

the hghest bdder s A. The 1000 shares sha be paced under the name of A, whe the 2000

shares whch were not covered sha be deemed as fuy pad by denquent stockhoder X (who s

no onger denquent by ths tme).

CLV tes us that durng ths bddngs, bdders do not ncude the amount they wsh to bd for the

shares of stock, as what the corporaton deems mportant s that the denquent amount pus

costs of the sae be pad, no more, no ess. What they ony ncude n ther bd s the number of

shares they wsh to purchase. That s why the rue s the hghest bdder sha be the one who

purchases the east number of shares for a fxed prce. CLV aso tes us that the corporaton

generay does not desre to proft from ths endeavor but ony to dscharge such denquency.

However, nothng precudes the corporaton from earnng profts n ths case provded they

structure the bd n such a way as to accommodate such endeavor. However CLV tes us that ths

s qute dffcut.

OTHER REMEDIES AVAILABLE TO THE CORPORATION

The Board of Drectors has absoute dscreton to choose whch remedy t deems proper n order

to coect on the unpad subscrptons. If t does not know whch remedy t w make use of, t may

put up the unpad stock for sae as provded n Sectons 38 to 48 of the Code, or by acton n

court.

EFFECTS OF DELINOUENCY

DELINOUENCY MAY BE ACHIEVED IN TWO WAYS: (1) faure to pay the subscrpton on the date

mentoned n the ca or (2) faure to pay the subscrpton on the date specfed on the contract of

subscrpton. THESE ARE ITS EFFECTS: (1) t dsquafes the stockhoders to be voted for or be

entted to vote or to representaton at any stockhoders meetng; (2) t dsquafes the

stockhoder to exercse any rghts of a stockhoder except the rght to dvdends unt and uness

he pays the amount due on hs subscrpton wth accrued nterest and the costs and expenses of

13

5

advertsement f any.

They sha not be entted to notce on meetngs, and they are not ncuded n the determnaton

of the quorum. The ony rght remanng to them s the rght to receve dvdends but the cash

dvdends sha frst be apped to the unpad baance, whe the stock dvdend sha be wthhed

unt payment of unpad baance.

PRESCRIPTION ON DEMAND FOR PAYMENT OF SUBSCRIPTION

The perod begns to run from the tme the payment becomes demandabe, whch n the case of

subscrpton of shares begns to run ony from the tme the board of drector decares that

baance are due and demandabe. The perod does not run from the date of subscrpton.

%a$ Who "ay #uestion a $elin%uency Sale (Sec. 68 and 69).

Secton 68. Denquency sae. - The board of drectors may, by resouton, order the sae of

denquent stock and sha specfcay state the amount due on each subscrpton pus a accrued

nterest, and the date, tme and pace of the sae whch sha not be ess than thrty (30) days nor

more than sxty (60) days from the date the stocks become denquent.

Notce of sad sae, wth a copy of the resouton, sha be sent to every denquent stockhoder ether

personay or by regstered ma. The same sha furthermore be pubshed once a week for two (2)

consecutve weeks n a newspaper of genera crcuaton n the provnce or cty where the prncpa

offce of the corporaton s ocated.

Uness the denquent stockhoder pays to the corporaton, on or before the date specfed for the

sae of the denquent stock, the baance due on hs subscrpton, pus accrued nterest, costs of

advertsement and expenses of sae, or uness the board of drectors otherwse orders, sad

denquent stock sha be sod at pubc aucton to such bdder who sha offer to pay the fu amount

of the baance on the subscrpton together wth accrued nterest, costs of advertsement and

expenses of sae, for the smaest number of shares or fracton of a share. The stock so purchased

sha be transferred to such purchaser n the books of the corporaton and a certfcate for such stock

sha be ssued n hs favor. The remanng shares, f any, sha be credted n favor of the denquent

stockhoder who sha kewse be entted to the ssuance of a certfcate of stock coverng such

shares.

Shoud there be no bdder at the pubc aucton who offers to pay the fu amount of the baance on

the subscrpton together wth accrued nterest, costs of advertsement and expenses of sae, for the

smaest number of shares or fracton of a share, the corporaton may, sub|ect to the provsons of

ths Code, bd for the same, and the tota amount due sha be credted as pad n fu n the books of

the corporaton. Tte to a the shares of stock covered by the subscrpton sha be vested n the

corporaton as treasury shares and may be dsposed of by sad corporaton n accordance wth the

provsons of ths Code.

Secton 69. When sae may be questoned. - No acton to recover denquent stock sod can be

sustaned upon the ground of rreguarty or defect n the notce of sae, or n the sae tsef of the

denquent stock, uness the party seekng to mantan such acton frst pays or tenders to the party

hodng the stock the sum for whch the same was sod, wth nterest from the date of sae at the

ega rate; and no such acton sha be mantaned uness t s commenced by the fng of a compant

wthn sx (6) months from the date of sae.

3. Certi0i"ate o0 Sto"- (Sec. 63)

Secton 63. Certfcate of stock and transfer of shares. - The capta stock of stock corporatons sha

be dvded nto shares for whch certfcates sgned by the presdent or vce presdent, countersgned

by the secretary or assstant secretary, and seaed wth the sea of the corporaton sha be ssued n

accordance wth the by-aws. Shares of stock so ssued are persona property and may be transferred

by devery of the certfcate or certfcates ndorsed by the owner or hs attorney-n-fact or other

person egay authorzed to make the transfer. No transfer, however, sha be vad, except as

between the partes, unt the transfer s recorded n the books of the corporaton showng the names

of the partes to the transacton, the date of the transfer, the number of the certfcate or certfcates

Revsed Bagtas Revewer by Ve and Ocfe 2A

and the number of shares transferred.

No shares of stock aganst whch the corporaton hods any unpad cam sha be transferabe n the

books of the corporaton.

NOTES:

Certfcate sha ony be ssued upon fu payment - the ratonae for ths s to prevent parta

dsposton of a subscrpton whch s not fuy pad, because f t s permtted and the subscrber

subsequenty becomes denquent n the payment of hs subscrpton, the corporaton may not be

abe to se as many of hs subscrbed shares as woud be necessary to cover the tota amount

due from hm.

In the absence of the provson of the by-aws to the contrary, a corporaton may appy payments

made by subscrbers on account of ther subscrptons ether as: (1) fu payment for the

correspondng number of shares, the par vaue of whch s covered by such payment; or (2)

payment pro rata to each and a the entre number of shares subscrbed for.

The SEC may by specfc rue or reguaton, aow corporatons to provde n ther artces of

ncorporaton and by-aws for the use of uncertfed securty - securty evdenced by eectronc or

smar records.

%a$ &ature of Certificate' aTan v. S&C, 206 SCRA 740 (1992); a(e los Sanos v. ,e+ublic, 96

Ph. 577 (1955); aPonce v. )lsons Cemen Cor+., 393 SCRA 602 (2002); C.#. /o-ges v.

Lezama, 14 SCRA 1030 (1965).

TAN v. SEC

FACTS:

Respondent Vsayan Corp. was regstered on October 1, 1979. As ncorporator, pettoner had four

hundred (400) shares of the capta stock standng n hs name at the par vaue of P100.00 per share,

evdenced by Certfcate of Stock No. 2. He was eected as Presdent and subsequenty reeected,

hodng the poston as such unt 1982 but remaned n the Board of Drectors unt Apr 19, 1983 as

drector.

On |anuary 31, 1981, whe pettoner was st the presdent of the respondent corporaton, two other

ncorporators, namey, Antona Y. Young and Teresta Y. Ong, assgned to the corporaton ther

shares, represented by certfcate of stock No. 4 and 5 after whch, they were pad the correspondng

40% corporate stock-n-trade.

Pettoner's certfcate of stock No. 2 was canceed by the corporate secretary and respondent

Patrca Aguar by vrtue of Resouton No. 1981 (b), whch was passed and approved whe pettoner

was st a member of the Board of Drectors of the respondent corporaton. Due to the wthdrawa of

the aforesad ncorporators and n order to compete the membershp of the fve (5) drectors of the

board, pettoner sod ffty (50) shares out of hs 400 shares of capta stock to hs brother Ange S.

Tan. Another ncorporator, Afredo B. Uy, aso sod ffty (50) of hs 400 shares of capta stock to

Teodora S. Tan and both new stockhoders attended the speca meetng, Ange Tan was eected

drector and on March 27, 1981, the mnutes of sad meetng was fed wth the SEC.

Accordngy, as a resut of the sae by pettoner of hs ffty (50) shares of stock to Ange S. Tan on

Apr 16, 1981, Certfcate of Stock No. 2 was canceed and the correspondng Certfcates Nos. 6 and

8 were ssued, sgned by the newy eected ffth member of the Board, Ange S. Tan as Vce-

presdent, upon nstructon of Afonso S. Tan who was then the presdent of the Corporaton.

Mr. Buzon, submtted an Affdavt aegng that he was personay requested by Mr. Tan Su Chng to

request Mr. Afonso Tan to make proper endorsement n the canceed Certfcate of Stock No. 2 and

Certfcate No. 8, but he dd not endorse, nstead he kept the canceed (1981) Certfcate of Stock

No. 2 and returned ony to me Certfcate of Stock No. 8, whch he devered to Tan Su Chng.

When pettoner was dsodged from hs poston as presdent, he wthdrew from the corporaton on

February 27, 1983, on condton that he be pad wth stocks-n-trade equvaent to 33.3% n eu of

the stock vaue of hs shares n the amount of P35,000.00. After the wthdrawa of the stocks, the

13

7

board of the respondent corporaton hed a meetng on Apr 19, 1983, effectng the canceaton of

Stock Certfcate Nos. 2 and 8 n the corporate stock and transfer book 1 and submtted the mnutes

thereof to the SEC on May 18, 1983.

Fve (5) years and nne (9) months after the transfer of 50 shares to Ange S. Tan and three (3) years

and seven (7) months after effectng the transfer of Stock Certfcate Nos. 2 and 8 from the orgna

owner n the stock and transfer book of the corporaton, the atter fed the case before the Cebu SEC

Extenson Offce questonng for the frst tme, the canceaton of hs aforesad Stock Certfcates Nos.

2 and 8. SEC Extenson Offce Hearng Offcer rued n favor of pettoner. Prvate respondent n the

orgna compant went to the SEC on appea. The commsson en banc unanmousy overturned the

Decson of the Hearng Offcer.

ISSUES:

(1) W/N the meanng of shares of stock are persona property and may be transferred by devery of

the certfcate or certfcates ndorsed by the owner or hs attorney-n-fact or other person egay

authorzed to make the transfer (2) W/N Secton 63 of the Corporaton Code of the Phppnes s

"mandatory n nature", meanng that wthout the actua devery and endorsement of the certfcate

n queston, there can be no transfer, or that such transfer s nu and vod.

HELD:

(1) There s no doubt that there was devery of Stock Certfcate No. 2 made by the pettoner to the

Corporaton before ts repacement wth the Stock Certfcate No. 6 for ffty (50) shares to Ange S.

Tan and Stock Certfcate No. 8 for 350 shares to the pettoner, on March 16, 1981. The probem

arose when pettoner was gven back Stock Certfcate No. 2 for hm to endorse and he deberatey

wthed t for reasons of hs own. That the Stock Certfcate n queston was returned to hm for hs

purpose was attested to by Mr. Buzon n hs Affdavt.

The proof that Stock Certfcate No. 2 was spt nto two (2) consstng of Stock Certfcate No. 6 for

ffty (50) shares and Stock Certfcate No. 8 for 350 shares, s the fact that pettoner surrendered the

atter stock (No. 8) n eu of P2 mon pesos worth of stocks, whch the board passed n a resouton

n ts meetng on Apr 19, 1983. Thus, on February 27, 1983, pettoner ndcated he was wthdrawng

from the corporaton on condton that he be pad wth stock-n-trade correspondng to 33.3%, whch

had ony a par vaue of P35,000.00. In ths same meetng, the transfer of Stock Certfcate Nos. 2 and

8 from the orgna owner, Afonso S. Tan was ordered to be recorded n the corporate stock and

transfer book thereafter submttng the mnutes of sad meetng to the SEC on May 18, 1983.

It s aso doubtess that Stock Certfcate No. 8 was exchanged by pettoner for stocks-n-trade snce

he was operatng hs own enterprse engaged n the same busness, otherwse, why woud a

busnessman be nterested n acqurng P2,000,000.00 worth of goods whch coud possby at that

tme, f up warehouse? In fact, he even padocked the warehouse of the respondent corporaton,

after wthdrawng the thrty-three and one-thrd (33 1/3%) percent stocks. Accordngy, the

Memorandum of Agreement prepared by the respondents' counse, Atty. Ramrez evdencng the

transacton, was aso presented to pettoner for hs sgnature, however, ths document was never

returned by hm to the corporate offcer for the sgnature of the other offcers concerned.

(2) No. To foow the argument put up by pettoner whch was uphed by the Cebu SEC Extenson

Offce Hearng Offcer, Fex Chan, that the canceaton of Stock Certfcate Nos. 2 and 8 was nu and

vod for ack of devery of the canceed "mother" Certfcate No. 2 whose endorsement was

deberatey wthhed by pettoner, s to prescrbe certan restrctons on the transfer of stock n

voaton of the corporaton aw tsef as the ony aw governng transfer of stocks. Whe Secton 47(s)

grants a stock corporatons the authorty to determne n the by-aws "the manner of ssung

certfcates" of shares of stock, however, the +o%er o regulae is no he +o%er o +rohibi, or o

im+ose unreasonable resricions of he righ of soc$hol-ers o ransfer heir shares. (Emphass

supped)

Moreover, t s safe to nfer from the facts deduced n the nstant case that, there was aready

devery of the unendorsed Stock Certfcate No. 2, whch s essenta to the ssuance of Stock

Certfcate Nos. 6 and 8 to ange S. Tan and pettoner Afonso S. Tan, respectvey. What ed to the

probem was the return of the canceed certfcate (No. 2) to Afonso S. Tan for hs endorsement and

hs deberate non-endorsement.

Revsed Bagtas Revewer by Ve and Ocfe 2A

For a ntents and purposes, however, snce ths was aready canceed whch canceaton was

aso reported to the respondent Commsson, there was no necessty for the same certfcate to be

endorsed by the pettoner. A the acts requred for the transferee to exercse ts rghts over the

acqured stocks were attendant and even the corporaton was protected from other partes,

consderng that sad transfer was earer recorded or regstered n the corporate stock and transfer

book.

Tuazon v. La Provisora 0ili+ina: But devery s not essenta where t appears that the persons sought

to be hed as stockhoders are offcers of the corporaton, and have the custody of the stock book

A certfcate of stock s not necessary to render one a stockhoder n corporaton. Nevertheess, a

certfcate of stock s the paper representatve or tangbe evdence of the stock tsef and of the

varous nterests theren. The certfcate s not stock n the corporaton but s merey evdence of the

hoder's nterest and status n the corporaton, hs ownershp of the share represented thereby, but s

not n aw the equvaent of such ownershp.

Under the nstant case, the fact of the matter s, the new hoder, Ange S. Tan has aready exercsed

hs rghts and prerogatves as stockhoder and was even eected as member of the board of drectors

n the respondent corporaton wth the fu knowedge and acquescence of pettoner. Due to the

transfer of ffty (50) shares, Ange S. Tan was cothed wth rghts and responsbtes n the board of

the respondent corporaton when he was eected as offcer thereof.

NOTE: Pettoner even attempted to msead the Court by erroneousy quotng the rung of the Court

n C. N. Hodges v. Lezama, whch has some paraesm wth the nstant case was the partes nvoved

theren were aso cose reatves as n ths case. The quoted porton appearng on p. 11 of the

petton, was cut short n such a way that reevant portons thereof were purposey eft out n order to

mpress upon the Court that the unendorsed and uncanceed stock certfcate No. 17, was

uncondtonay decared nu and vod, fagranty omttng the |ustfyng crcumstances regardng ts

acquston and the reason gven by the Court why t was decared so.

NOTE: Ths case hed that the ack of endorsement of a certfcate of a stock whch had been

prevousy devered to the corporaton by the regstered stockhoder for canceaton woud not

prevent the corporaton from canceng n the books of the corporaton, such certfcate and ssuance

of a new certfcate n favor of the new owner of the shares. The statement n Tan that the certfcate

of stock does not represent ownershp of the shares covered theren shoud be understood n the

ght than Tan essentay nvoved ssues between ntra-corporate members, namey the corporaton

and the stockhoders.

NOTE: How can Tan stand together wth Btong? Btong provded for rues wth regard to certfcate of

stocks, but not a appcabe rues for such were provded by Btong. Tan provdes for rues n reaton

to certfcate of stocks treated as quas-negotabe nstruments.

NOTE: Why s Tan correct n ths case? Why was devery not essenta? Secton 63 of the Corporaton

Code tes us that the devery and ndorsement of a certfcate of stock s |ust one means of

dsposton, as the Code uses the permssve word "MAY". Other ways of constructve devery are

executon of pubc nstrument and en|oyment of the prerogatves of ownershp wth fu knowedge

and consent of the orgna owner. The atter was present n ths case.

DELOS SANTOS v REPUBLIC

NOTE: Ths case hed that a certfcate of stock s not a negotabe nstrument, but s regarded as

quas-negotabe n the sense that t may be transferred by endorsement couped wth devery, but t

s not negotabe because the hoder thereof takes t wthout pre|udce to such rghts or defenses as

the regstered owners thereof may have under the aw, except nsofar as such rghts or defenses are

sub|ect to the mtatons mposed by the prncpes governng estoppe.

NOTE: A transferee under a forged assgnment acqures no tte whch can be asserted aganst the

true owner uness the true owners own neggence has been such as to create an estoppe aganst

hm. Ths woud mean that a bona fde purchaser of shares under a forged or unauthorzed transfer

13

9

acqures no tte as aganst the true owner does not appy where the crcumstances are such as to

estop the atter from assertng hs tte.

PONCE v ALSONS CEMENT

FACTS:

On |anuary 25, 1996, Vcente C. Ponce, fed a compant wth the SEC for mandamus and damages

aganst Asons Cement Corporaton and ts corporate secretary Francsco M. Gron, |r. In hs

compant, pettoner aeged, among others, that:

x x x 5. The ate Fausto G. Gad was an ncorporator of Vctory Cement Corporaton (VCC),

havng subscrbed to and fuy pad 239,500 shares of sad corporaton.

6. On February 8, 1968, pantff and Fausto Gad executed a "Deed of Undertakng" and

"Endorsement" whereby the atter acknowedges that the former s the owner of sad shares

and he was therefore assgnng/endorsng the same to the pantff. A copy of the sad

deed/endorsement s attached as Annex "A".

7. On Apr 10, 1968, VCC was renamed Foro Cement Corporaton (FCC for brevty).

8. On October 22, 1990, FCC was renamed Asons Cement Corporaton (ACC for brevty) as

shown by the Amended Artces of Incorporaton of ACC, a copy of whch s attached as Annex

"B".

9. From the tme of ncorporaton of VCC up to the present, no certfcates of stock

correspondng to the 239,500 subscrbed and fuy pad shares of Gad were ssued n the

name of Fausto G. Gad and/or the pantff.

10. Despte repeated demands, the defendants refused and contnue to refuse wthout any

|ustfabe reason to ssue to pantff the certfcates of stocks correspondng to the 239,500

shares of Gad, n voaton of pantffs rght to secure the correspondng certfcate of stock n

hs name.

Attached to the compant was the Deed of Undertakng and Endorsement upon whch pettoner

based hs petton for mandamus.

DEED O4 5NDERTAKIN6

KNOW ALL MEN BY THESE PRESENTS:

I, VICENTE C. PONCE, s the owner of the tota subscrpton of Fausto Gad wth Vctory

Cement Corporaton n the tota amount of TWO HUNDRED THIRTY NINE THOUSAND FIVE

HUNDRED (P239,500.00) PESOS and that Fausto Gad does not have any abty whatsoever

on the subscrpton agreement n favor of Vctory Cement Corporaton x x x

ENDORSEMENT

I, FAUSTO GAID s ndorsng the tota amount of TWO HUNDRED THIRTY NINE

THOUSAND FIVE HUNDRED (239,500.00) stocks of Vctory Cement Corporaton to VICENTE

C. PONCE. x x x

Wth these aegatons, pettoner prayed that |udgment be rendered orderng respondents (a) to

ssue n hs name certfcates of stocks coverng the 239,500 shares of stocks and ts ega

ncrements and (b) to pay hm damages.

Instead of fng an answer, respondents moved to dsmss the compant. They argued, iner

alia, that there beng no aegaton that the aeged "ENDORSEMENT" was recorded n the books of

the corporaton, sad endorsement by Gad to the pantff of the shares of stock n queston-

assumng that the endorsement was n fact a transfer of stocks-was not vad aganst thrd persons

such as ALSONS under Secton 63 of the Corporaton Code. There was, therefore, no specfc ega

duty on the part of the respondents to ssue the correspondng certfcates of stock, and mandamus

w not e.

Revsed Bagtas Revewer by Ve and Ocfe 2A

Pettoner fed hs opposton to the moton to dsmss on February 19, 1996 contendng that:

(1) mandamus s the proper remedy when a corporaton and ts corporate secretary wrongfuy

refuse to record a transfer of shares and ssue the correspondng certfcates of stocks; (2) he s the

proper party n nterest snce he stands to be benefted or n|ured by a |udgment n the case; (3) the

statute of mtatons dd not begn to run unt defendant refused to ssue the certfcates of stock n

favor of the pantff on Apr 13, 1992.

SEC granted the moton to dsmss sayng that there s no record of any assgnment or transfer n

the books of the defendant corporaton, and there s no nstructon or authorty from the transferor

(Gad) for such assgnment or transfer. There s not even any endorsement of any stock certfcate to

speak of. What the pantff possesses s a document by whch Gad supposedy transferred the

shares to hm.

Pettoner appeaed the Order of dsmssa. On |anuary 6, 1997, the Commsson En Banc

reversed the appeaed Order and drected the Hearng Offcer to proceed wth the case. In rung

that a transfer or assgnment of stocks need not be regstered frst before t can take cognzance of

the case to enforce the pettoners rghts as a stockhoder. A transfer or assgnment of stocks need

not be regstered frst before the Commsson can take cognzance of the case to enforce hs rghts

as a stockhoder. Aso, the probem encountered n securng the certfcates of stock made by the

buyer must be expedtousy taken up through the so-caed admnstratve mandamus proceedngs

wth the SEC than n the reguar courts. It aso found that the Hearng Offcer erred n hodng that

pettoner s not the rea party n nterest.

Ther MR havng been dened, respondents appeaed the decson of the SEC En Banc and the

resouton denyng ther MR to the CA. In ts decson, the CA hed that n the absence of any

aegaton that the transfer of the shares between Fausto Gad and Vcente C. Ponce was regstered

n the stock and transfer book of ALSONS, Ponce faed to state a cause of acton. Thus, sad the CA,

"the compant for mandamus shoud be dsmssed for faure to state a cause of acton. Pettoners

MR was kewse dened.

Pettoner frst contends that the act of recordng the transfer of shares n the stock and transfer

book and that of ssung a certfcate of stock for the transferred shares nvoves ony one contnuous

process. Thus, when a corporate secretary s presented wth a document of transfer of fuy pad

shares, t s hs duty to record the transfer n the stock and transfer book of the corporaton, ssue a

new stock certfcate n the name of the transferee, and cance the od one. A transferee who

requests for the ssuance of a stock certfcate need not spe out each and every act that needs to be

done by the corporate secretary, as a request for ssuance of stock certfcates necessary ncudes a

request for the recordng of the transfer. Ergo, the faure to record the transfer does not mean that

the transferee cannot ask for the ssuance of stock certfcates.

Secondy, accordng to pettoner, there s no aw, rue or reguaton requrng a transferor of

shares of stock to frst ssue express nstructons or execute a power of attorney for the transfer of

sad shares before a certfcate of stock s ssued n the name of the transferee and the transfer

regstered n the books of the corporaton. He contends that /ager vs. Bryan, 19 Ph. 138 (1911),

and ,ivera vs. 0loren-o, 144 SCRA 643 (1986), cted by respondents, do not appy to ths case.

These cases contempate a stuaton where a certfcate of stock has been ssued by the company

whereas n ths case at bar, no stock certfcates have been ssued even n the name of the orgna

stockhoder, Fausto Gad.

Fnay, pettoner mantans that snce he s under no compuson to regster the transfer or to

secure stock certfcates n hs name, hs cause of acton s deemed not to have accrued unt

respondent ALSONS dened hs request.

Respondents, n ther comment, mantan that the transfer of shares of stock not recorded n the

stock and transfer book of the corporaton s non-exstent nsofar as the corporaton s concerned and

no certfcate of stock can be ssued n the name of the transferee. Unt the recordng s made, the

14

1

transfer cannot be the bass of ssuance of a certfcate of stock. They add that pettoner s not the

rea party n nterest, the rea party n nterest beng Fausto Gad snce t s hs name that appears n

the records of the corporaton. They concude that pettoners cause of acton s barred by

prescrpton and aches snce 24 years eapsed before he made any demand upon ALSONS.

ISSUES:

(1) W/N CA erred n hodng that pettoner has no cause of acton for a wrt of mandamus. (2) W/N

the transfer of shares of stocks not recorded n the stock and transfer book of the corporaton s non-

exstent(3) W/N notce to a corporaton of the sae of the shares and presentaton of certfcates for

transfer s equvaent to regstraton

HELD:

No. The CA dd not err n rung that pettoner had no cause of acton, and that hs petton for

mandamus was propery dsmssed.

In ,ural Ban$ of Salinas, Inc., prvate respondent Meana Guerrero had a Speca Power of

Attorney executed n her favor by Cemente Guerrero, the regstered stockhoder. It gave

Guerrero fu authorty to se or otherwse dspose of the 473 shares of stock regstered n

Cementes name and to execute the proper documents therefor. Pursuant to the authorty so

gven, Meana assgned the 473 shares of stock owned by Guerrero and presented to the

Rura Bank of Sanas the deeds of assgnment coverng the assgned shares. Meana

Guerrero prayed for the transfer of the stocks n the stock and transfer book and the ssuance

of stock certfcates n the name of the new owners thereof. Based on those crcumstances,

there was a cear duty on the part of the corporate secretary to regster the 473 shares n

favor of the new owners, snce the person who sought the transfer of shares had express

nstructons from and specfc authorty gven by the regstered stockhoder to cause the

dsposton of stocks regstered n hs name.

That cannot be sad of ths case. The deed of undertakng wth endorsement presented by

pettoner does not estabsh, on ts face, hs rght to demand for the regstraton of the transfer and

the ssuance of certfcates of stocks. In /ager vs. Bryan, 19 Ph. 138 (1911), ths Court hed that a

petton for mandamus fas to state a cause of acton where t appears that the pettoner s not the

regstered stockhoder and there s no aegaton that he hods any power of attorney from the

regstered stockhoder, from whom he obtaned the stocks, to make the transfer.

Wthout dscussng or decdng the respectve rghts of the partes whch mght be

propery asserted n an ordnary acton or an acton n the nature of an equtabe sut, we are

a agreed that n a case such as that at bar, a mandamus shoud not ssue to compe the

secretary of a corporaton to make a transfer of the stock on the books of the company,

uness t affrmatvey appears that he has faed or refused so to do, upon the demand

ether of the person n whose name the stock s regstered, or of some person hodng a

power of attorney for that purpose from the regstered owner of the stock. There s no

aegaton n the petton that the pettoner or anyone ese hods a power of attorney from

the Bryan-Landon Company authorzng a demand for the transfer of the stock, or that the

Bryan-Landon Company has ever tsef made such demand upon the Vsayan Eectrc

Company, and n the absence of such aegaton we are not abe to say that there was such

a cear ndsputabe duty, such a cear ega obgaton upon the respondent, as to |ustfy the

ssuance of the wrt to compe hm to perform t.

Under the provsons of our statute touchng the transfer of stock (secs. 35 and 36 of Act

No. 1459), the mere endorsement of stock certfcates does not n tsef gve to the ndorsee

such a rght to have a transfer of the shares of stock on the books of the company as w

entte hm to the wrt of mandamus to compe the company and ts offcers to make such

transfer at hs demand, because, under such crcumstances the duty, the ega obgaton, s

not so cear and ndsputabe as to |ustfy the ssuance of the wrt. As a genera rue and

Revsed Bagtas Revewer by Ve and Ocfe 2A

especay under the above-cted statute, as between the corporaton on the one hand, and

ts sharehoders and thrd persons on the other, the corporaton ooks ony to ts books for

the purpose of determnng who ts sharehoders are, so that a mere ndorsee of a stock

certfcate, camng to be the owner, w not necessary be recognzed as such by the

corporaton and ts offcers, n the absence of express nstructons of the regstered owner to

make such transfer to the ndorsee, or a power of attorney authorzng such transfer.

(2) A transfer of shares of stock not recorded n the stock and transfer book of the corporaton s

non-exstent as far as the corporaton s concerned. As between the corporaton on the one hand,

and ts sharehoders and thrd persons on the other, the corporaton ooks ony to ts books for the

purpose of determnng who ts sharehoders are. It s ony when the transfer has been recorded n

the stock and transfer book that a corporaton may rghtfuy regard the transferee as one of ts

stockhoders. From ths tme, the consequent obgaton on the part of the corporaton to recognze

such rghts as t s mandated by aw to recognze arses.

Hence, wthout such recordng, the transferee may not be regarded by the corporaton as one

among ts stockhoders and the corporaton may egay refuse the ssuance of stock certfcates n

the name of the transferee even when there has been compance wth the requrements of Secton

64 of the Corporaton Code. Ths s the mport of Secton 63 whch states that "No transfer, however,

sha be vad, except between the partes, unt the transfer s recorded n the books of the

corporaton showng the names of the partes to the transacton, the date of the transfer, the number

of the certfcate or certfcates and the number of shares transferred." The stuaton woud be

dfferent f the pettoner was hmsef the regstered owner of the stock whch he sought to transfer to

a thrd party, for then he woud be entted to the remedy of mandamus.

x x x unt regstraton s accompshed, the transfer, though vad between the partes,

cannot be effectve as aganst the corporaton. Thus, n the absence of any aegaton that

the transfer of the shares between Gad and the prvate respondent |heren pettoner| was

regstered n the stock and transfer book of the pettoner corporaton, the prvate

respondent has faed to state a cause of acton.

(3) Pettoners reance on our rung n )be1o vs. (e la Cruz, 149 SCRA 654 (1987), that notce gven

to the corporaton of the sae of the shares and presentaton of the certfcates for transfer s

equvaent to regstraton s mspaced. In the case, there s no aegaton n the compant that

pettoner ever gave notce to respondents of the aeged transfer n hs favor. Moreover, that case

arose between and among the prncpa stockhoders of the corporaton, Pocket Be, due to the

refusa of the corporate secretary to record the transfers n favor of Teectroncs of the corporatons

controng 56% shares of stock whch were covered by duy endorsed stock certfcates. As

aforesad, the request for the recordng of a transfer s dfferent from the request for the ssuance of

stock certfcates n the transferees name. Fnay, n )be1o, the Court dd not say that transfer of

shares need not be recorded n the books of the corporaton before the transferee may ask for the

ssuance of stock certfcates. The Courts statement, that "there s no requrement that a

stockhoder of a corporaton must be a regstered one n order that the Securtes and Exchange

Commsson may take cognzance of a sut seekng to enforce hs rghts as such stockhoder among

whch s the stock purchasers rght to secure the correspondng certfcate n hs name," was

addressed to the ssue of |ursdcton, whch s not pertnent to the ssue at hand.

NOTE: That pettoner was under no obgaton to request for the regstraton of the transfer s not n

ssue. It has no pertnence n ths controversy. One may own shares of corporate stock wthout

possessng a stock certfcate. In Tan vs. SEC, 206 SCRA 740 (1992), we had occason to decare that

a certfcate of stock s not necessary to render one a stockhoder n a corporaton. But a certfcate

of stock s the tangbe evdence of the stock tsef and of the varous nterests theren. The

certfcate s the evdence of the hoders nterest and status n the corporaton, hs ownershp of the

share represented thereby. The certfcate s n aw, so to speak, an equvaent of such ownershp. It

expresses the contract between the corporaton and the stockhoder, but t s not essenta to the

exstence of a share n stock or the creaton of the reaton of sharehoder to the corporaton. In fact,

t rests on the w of the stockhoder whether he wants to be ssued stock certfcates, and a

stockhoder may opt not to be ssued a certfcate. In Won vs. Wack Wack Gof and Country Cub,

14

3

Inc., 104 Ph. 466 (1958), we hed that consderng that the aw does not prescrbe a perod wthn

whch the regstraton shoud be effected, the acton to enforce the rght does not accrue unt there

has been a demand and a refusa concernng the transfer. In the present case, pettoners compant

for mandamus must fa, not because of aches or estoppe, but because he had aeged no cause of

acton suffcent for the ssuance of the wrt.

NOTE: Ponce teaches us that the very fact that a certfcate s ndorsed and devered to a thrd

person does not automatcay entte such person to regster such certfcate n hs name, or compe

the corporaton to regster the certfcate n hs name even. Ths case teaches us that an ndorsed

and devered certfcate does not create a cear rght wth respect to the possesson of such

certfcate by the thrd person, as the same mode (ndorsement and devery) appes to sae, pedge

and mortgage. Ths s where the regstered owner must come n, he must nform the corporaton

whether the dsposton was a pedge, or mortgage or sae, whch woud determne whether or not

the thrd person s entted regstraton. Snce amost a deangs comprse of the same mode, the

owner must apprse the corporaton wth the necessary nformaton and nstructons.

A stock certfcate s merey evdence of a share of stock and not the share tsef.