Professional Documents

Culture Documents

A13 Non Ferrous Metals Edited PV

Uploaded by

Neha SrivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A13 Non Ferrous Metals Edited PV

Uploaded by

Neha SrivastavaCopyright:

Available Formats

A13 Non Ferrous Metals

Group Members:

Space for evaluation and remarks by Faculty

Remarks

Hind Zinc and Gujarat Introflux show outlier interest rate position needs recheck or explanation of

the phenomenon.

Focus is conservative, the way it needs to be.

Marks/Grade Assigned

Signature of Faculty

A13 Non Ferrous Metals

Industry Rating: Non Ferrous Metals

Factor Score Rationale

Demand Supply Gap 4

Demand growth stable and high, but strongly linked with economic

growth

Government Policy 4

100% FDI, Low Production efficiency

Extent of Competition 5

Highly concentrated, monopolistic industry eg Hindalco, Sterlite,

Nalco

Supply Side risks 2

Scarce input availability and mining related risks

Return On Capital Employed 3

Average RoCE is 17.62%

Operating margins 6 Average Op. Margin is 31.8%

Variability of operating margins 5.5

Volatility is 5.3

Growth in Operating Margins 2

Avg. growth in operating margin is -0.79%

Rating 3.9375 Marginally Favourable

Qn1 Workings:

MyCRA Industry

Rating.xls

Key Characteristics & Risk Factors: The most important environmental factors affecting the industry

favourably and adversely

Cost of undertaking trade and retaining profits: The rising burden on costs is mainly due to the higher wages

due to pay revision of Public sector workers and employing and retaining talent for the private sector has had its

effects on the bottom line. Increase in land acquisition costs, royalty rate and inefficient system of operation are

all adding up to the reduced profit level.

Global context: Certain global challenges laid out are imposing super profit taxes, resource rents, fees of

licensing, levies on environment and certain quotas have left the non-ferrous metal industry in disorder.

Shortage of qualified professionals in this industry is also a major cause of concern. This global context affects

the industry in an adverse way.

Regulatory pressure: Certain important regulations that come into play are due to the land acquisition bill,

MMDR amendment bill and the relief and rehabilitation bill. All these levy heavy pressure on the regulatory norms

surrounding the non-ferrous metal industry.

Growth of other emerging countries: The growth of other emerging economies with lower energy prices, lower

social and lower environmental costs have become a huge factor of competition. India is constrained by the

regulatory factors and also the availability of abundant resources in this industry and this is the turn of certain

other economies to capitalize on these gains that they possess.

High local demand: The main forte of the non-ferrous metal industry has been the high local/domestic demand

that has been generated by the usage. This has led to the companies in the industry overcome various

A13 Non Ferrous Metals

regulations to produce such metals. The per capita consumption of Aluminium has improved from 0.5 kg to 1.3

kg presently.

Advancement by Indian companies: Certain parameters that contribute in this front are the rapid capacity

expansion of input minerals, emerging indigenous industrial expertise and also effective cost reduction

techniques. These contributes to the heavy competition in the industry. In addition, this segment is seen as a

potential for heavy investment and good returns by many private players who have begun investing in this

industry.

Past performance Recent Developments and Trends and outlook: short (one year) and medium (two to

three years) term outlook for industry.

The heavy regulations of the government has laid heavy constraints on the different companies (public and

private). Though the per capita consumption has increased for these metals, in comparison to the global

scenario it is on a miniscule level. This does not provide high demand from the local market. The production of

non-ferrous metals have fluctuated in spite of a heavy demand in the local market. This has led to the decrease

in the growth pattern of the various companies. One of the important concept that has played a major role in this

industry is recycling. The advantage of the non-ferrous metals is their ability to be recycled. A large number of

new players are beginning to set up units in order to capitalize on this opportunity. Scraps are being considered

as the input for these companies. This is an emerging trend in this industry which further supplements the

industry. Certain important parameters that will gain importance over the next three years are: maturity of the

industry and the value chain, high rate of recovery from scrap, high skilled force, development of technology etc.

Main locations in India for the industry.

Hindalco: Mumbai, Aluminium and Copper

Nalco: Orissa, Aluminium

Sterlite: Tamil Nadu, Copper

Vedanta: Mumbai, Aluminium, Copper and zinc

Identify top and bottom (three to five) companies in the industry on the basis of observed financial

parameters. ((Tol/TNW, CR, NCFO/Total outside liabilities, Bank Borrowing, Average Interest Rate,

Commission etc. paid to banks, Ratings if available)

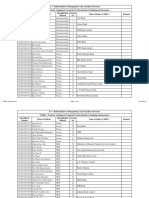

Top 3 Companies TOL/TNW CR NCFO/TOL Bank

Borrowing

Average

Interest Rate

Hind Copper 0.322 2.24 0.761 0 0

Hind Zinc 0.0988 3.56 1.49 0.39 74.61

Gujarat Introflux 0.375 2.988 0.431 1.87 29.94

Bottom 3

Companies

TOL/TNW CR NCFO/TOL Bank

Borrowing

Average

Interest Rate

Nissan Copper 0.50 3.53 0.04 180.02 13.67

BilPower 1.38 2.62 -0.04 96.38 20.31

Baroda Extrusion 3.23 0.72 -0.555 41.83 14.53

A13 Non Ferrous Metals

Focus for your bank total quantum of financial exposure proposed: Identify companies (at least one

per group member) other than the ones mentioned above that can be good target market for the bank

and their financial requirements. Based on this, how much financial exposure your bank can budget for

the current year, what other business opportunities you can foresee and what revenue do you expect to

generate from the identified companies.

Assumptions:

Total Advances and deposits will grow at the same rate as the previous years

Average Lending Rates will remain around 13.2%, maintaining the same spread above PLR

Non-Interest Income-to-Total Income remain around 10% for the bank

Projected Total Advances for F.Y 20X2 : 13800 Crores (@20% growth in total advances)

As the industry is cyclical in nature and the demand is stable with the growth tied to growth in the economy, the

short term to medium term outlook of the industry is only marginally positive. The total quantum of exposure for

this sector should be around 3% of total expected advances as there could be other profitable industries that

could require growth funding.

Since the industry risk rating is only marginally positive, the bank should focus on lending

To individual companies having favourable credit ratings/risk ratings of more than 4

For a period not exceeding 3 years

No individual company should get more than 25% of the budgeted sectoral exposure on account of

average industry outlook, with the exception of companies showing highly favourable individual risk

ratings.

Hence, total sectoral exposure budgeted for the following financial year 20X2 is, 3% of total expected advances,

which is 414 Crores

Exposure for individual companies targeted in the sector is allocated proportional to its risk rating. The table

shows the budgeted exposure for some select companies in the sector.

S.

No

Company Name Risk Rating Maximum Exposure

favourable for bank

(a) In Crores

Maximum Feasible

Borrowing for

Company

(b) In Crores

Budgeted

Exposure

Min (a,b) In

Crores

1 Hind Zinc 5.43 89.26 113.86 89.26

2 Guj Intrux 4.53 74.39 24.54 24.54

3 Cubex Tubings 4.1 67.2 88.04 67.2

4 Sterlite 3.9 64.12 27882 64.12

5 Precision Wires 3.875 63.67 410.17 63.67

6 RamRatna 3.375 55.41 22.824 22.82

7 Others NA 40 - 40

8 Estimated Interest Income (@13.2% of Advances) 43.77

9 Estimated Non Interest Income (10% of Interest Income) 4.377

10 Estimated Total Revenues from the sector 48.15

Qn 5& 6 Workings:

Financial Risk

Assessment.xlsx

You might also like

- Presented by Group 18: Neha Srivastava Sneha Shivam Garg TarunaDocument41 pagesPresented by Group 18: Neha Srivastava Sneha Shivam Garg TarunaNeha SrivastavaNo ratings yet

- Electrolight - New Product LaunchDocument4 pagesElectrolight - New Product LaunchNeha SrivastavaNo ratings yet

- 7 CoagulationDocument103 pages7 CoagulationAkulSenapatiNo ratings yet

- CitibankDocument1 pageCitibankNeha SrivastavaNo ratings yet

- Dogfight RyanairDocument4 pagesDogfight RyanairKiran Banshiwal60% (5)

- How Did Lisa Get Into The Current Mess? Compare It With Her Behaviour in Other Company?Document1 pageHow Did Lisa Get Into The Current Mess? Compare It With Her Behaviour in Other Company?Neha SrivastavaNo ratings yet

- Presentation Industrial AwarenessDocument5 pagesPresentation Industrial AwarenessNeha SrivastavaNo ratings yet

- PP Form OnlineDocument1 pagePP Form OnlineNeha SrivastavaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1 Introduction To BankingDocument8 pages1 Introduction To BankingGurnihalNo ratings yet

- Country Wide Litigation Database 01072007Document15 pagesCountry Wide Litigation Database 01072007Carrieonic100% (1)

- Swiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalDocument46 pagesSwiss Challenge Method by Govt of Madhya Pradesh - SCM11022013FinalkpindiaNo ratings yet

- Document No 76 - Debt Fund Update Jan' 23Document3 pagesDocument No 76 - Debt Fund Update Jan' 23AmrutaNo ratings yet

- List of Groups and Topic For Practical Assignment 1Document5 pagesList of Groups and Topic For Practical Assignment 1pareek gopalNo ratings yet

- Meta Reports Fourth Quarter and Full Year 2022 Results 2023Document12 pagesMeta Reports Fourth Quarter and Full Year 2022 Results 2023Fady EhabNo ratings yet

- CLS Gathers Momentum, Rao, CCILDocument6 pagesCLS Gathers Momentum, Rao, CCILShrishailamalikarjunNo ratings yet

- Solved Rollo and Andrea Are Equal Owners of Gosney Company DuringDocument1 pageSolved Rollo and Andrea Are Equal Owners of Gosney Company DuringAnbu jaromiaNo ratings yet

- Combined Pdfs Katarina BookDocument6 pagesCombined Pdfs Katarina Bookapi-300353710No ratings yet

- Money-Time Relationships: PrinciplesDocument32 pagesMoney-Time Relationships: Principlesimran_chaudhryNo ratings yet

- SIMPLE and COMPOUND INTEREST 11Document69 pagesSIMPLE and COMPOUND INTEREST 11Jay QuinesNo ratings yet

- Chapter 2 Cost Concepts and The Cost Accounting Information SystemDocument44 pagesChapter 2 Cost Concepts and The Cost Accounting Information Systemelite76No ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVara Prasad AvulaNo ratings yet

- Certificate in Bookkeeping and Accounting Level 2Document38 pagesCertificate in Bookkeeping and Accounting Level 2McKay TheinNo ratings yet

- Assignment - 2: Semester Spring 2021Document3 pagesAssignment - 2: Semester Spring 2021Amina HamidNo ratings yet

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocument168 pagesNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNo ratings yet

- Financial Report (October 2017)Document2 pagesFinancial Report (October 2017)Marija DukićNo ratings yet

- ILFS Briefing (April 2019)Document15 pagesILFS Briefing (April 2019)Richard DierdreNo ratings yet

- Partnership Deed Bareilly Gorakhpur Liquor CompanyDocument8 pagesPartnership Deed Bareilly Gorakhpur Liquor CompanyDeepkamal JaiswalNo ratings yet

- Maria Hernandez and AssociatesDocument9 pagesMaria Hernandez and Associatesvineet383No ratings yet

- Effects of A High CAD EssayDocument2 pagesEffects of A High CAD EssayfahoutNo ratings yet

- Central Bank-Monetary Policy ReviewDocument6 pagesCentral Bank-Monetary Policy ReviewAda DeranaNo ratings yet

- Valuation of Bonds and SharesDocument39 pagesValuation of Bonds and Shareskunalacharya5No ratings yet

- LMOR Session 123BLK1Document85 pagesLMOR Session 123BLK1Seera HarisNo ratings yet

- MBA (E) 2021-23, 3rd Semester All Subjects SyllabusDocument40 pagesMBA (E) 2021-23, 3rd Semester All Subjects SyllabusANISHA DUTTANo ratings yet

- Mayuga Vs MetroDocument4 pagesMayuga Vs MetroPaulitoPunongbayanNo ratings yet

- Liska PaystubDocument1 pageLiska PaystubCreative Puppy100% (1)

- Galgotias University Vishwajeet Singh S/O Kuldeep SinghDocument1 pageGalgotias University Vishwajeet Singh S/O Kuldeep SinghAashika SinghNo ratings yet

- Akuntansi 11Document3 pagesAkuntansi 11Zhida PratamaNo ratings yet

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Document4 pagesChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNo ratings yet