Professional Documents

Culture Documents

Sales Taxes and Exemptions

Uploaded by

Mercatus Center at George Mason UniversityCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Taxes and Exemptions

Uploaded by

Mercatus Center at George Mason UniversityCopyright:

Available Formats

No.

105

February 2012

MERCATUS CENTER AT GEORGE MASON UNIVERSITY

No. 105

February 2012

MERCATUS

ON POLICY

Sales Taxes and Exemptions

by Thomas Stratmann, Andreea

Militaru, and Rachel Reese

S

tate and local governments often turn

to increases in sales taxes to generate

added revenue. Estimates of fresh reve-

nue from the higher tax tend to be overly

optimistic, partly because the number of

sales tax exemptions tends to rise with the rising tax

rate. Given the fact that politicians seek to raise a cer-

tain amount of revenue and wish to maximize their

chance of re-election, this relationship suggests that

politicians face a trade-off when seeking votes from

groups that favor sales tax decreases and groups that

lobby for certain t ax exemptions.

Assuming that higher tax rates increase the incentive

to lobby for tax exemptions, agencies that estimate the

effects of sales tax increases should take into account the

expected increase in tax exemptions as well. Ultimately,

the link between sales taxes and sales tax exemptions

serves to undermine the certainty of generating addi-

tional revenue by increasing sales taxes.

1

PUBLIC CHOICE MODEL

Public choice economics explains how politicians

seek to maximize votes given that competing groups

of voters vie for political support.

2

For instance, one

group of constituents may want taxes raised on a certain

group or a certain type of transaction, while another

group may favor reductions in taxes or increases in tax

exemptions. In order to maximize votes, politicians can

satisfy both groups by simultaneously increasing taxes

and expanding the number of exemptions, or loopholes.

While the net result on tax revenue generated may be

negligible, a politician can secure additional votes from

both groups.

University of Chicago economist Sam Peltzmans anal-

ysis of the regulation of rms offers insights that are

relevant to the study of sales taxes and exemptions.

3

2 MERCATUS ON POLICY AUGUST 2014

Given that firms demand price regulations that

increase their prots and consumers desire regulations

that lower prices, Peltzman analyzed how politicians

approach regulating rms in order to maximize votes.

This model presents a situation in which both groups

cant be simultaneously satised, just as is the case with

sales taxes and exemptions. In a recent paper,

4

we use

Peltzmans model, showing that politicians seek to max-

imize support from competing groups, to analyze the

relationship between sales taxes and sales tax exemp-

tions.

We analyze the equilibrium relationship between the

sales tax rate and the number of sales tax exemptions

in each state that levies sales taxes. Our theory sug-

gests that as tax rates rise, so do lobbying activities, and

therefore the number of exemptions. In this model, in

order for a politician to maintain a certain amount of

revenue, that politician is not able to satisfy all groups.

In other words, when a politician decreases taxes

thereby increasing support from one groupthat poli-

tician is forced by the revenue constraint to decrease

tax exemptions as wellhence losing support from

the other group. In this way, the wealth of one interest

group increases at the expense of the other group. Given

this state of affairs, the politician is faced with choosing

a tax rate and a number of exemptions that maximizes

the politicians chance of re-election.

SALES TAXES AND EXEMPTIONS

Only five states do not have a statewide sales tax

(Alaska, Delaware, Montana, New Hampshire, and Ore-

gon).

5

These states are therefore omitted from the anal-

ysis. In addition, Hawaii has a complex, tiered system

of sales taxes; this state has also been omitted for ease

of comparison. The remaining 44 states have differing

tax bases (i.e., the variety of transactions for which sales

tax can be charged). States can either adopt a wide tax

base and a low tax rate or a narrow tax base and a high

tax rate. In theory, both options can generate the same

level of revenue.

Federal laws prevent states from levying sales taxes

on certain transactions, such as those covered by food

assistance programs, interstate commerce transactions,

and purchases by federal credit unions.

6

Additional

sales tax exemptions are at the discretion of individual

states. We identify 17 broad exemption categories (some

of which also contain subcategories), including a variety

of exemptions that can be classied as entity-based (the

seller or buyer is an exempt entity, such as a nonprot

organization or a school), product-based (the item sold

is exempt, such as food or health-related items), or

use-based (the buyers intended use of the item entitles

them to an exemption, as with material tools used in

manufacturing).

7

The exemption categories were con-

structed such that they are specic enough not to have

exemptions overlap and broad enough to incorporate a

variety of denitions for products or transactions.

Among the 44 states under examination, the average

sales tax rate was 5.6 percent, ranging from 2.9 percent

in Colorado to 7.25 percent in California. We use two

different measuresone broad and one narrowto

calculate the number of exemptions in each state. Both

measures give approximately the same conclusions, so

for simplicity we will focus on one measure here, the

broad one. This measure simply sums the exemptions

from all subcategories. The average number of exemp-

tions in each state calculated in this way is 24 and ranges

from 19 in Illinois to 31 in Vermont.

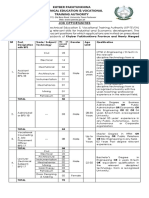

Our analysis of sales taxes and exemptions in each

state has some important implications. The results of

the regression analysis indicate that the relationship

between tax rates and the number of exemptions is both

positive and statistically signicant. In other words, the

estimates indicate that one unit increase in the num-

ber of exemptions calculated based on the broad or

narrow measure is associated with an increase in the

sales tax rate between 0.10 and 0.25 percentage points,

as shown in gure 1. This means that if a state has a

current tax rate of 5.6 percent (the average) and adds

another ve exemptions, then the state can be expected

to increase the tax rate to 6.1 percent, as shown in gure

2.

8

The reverse holds for decreasing exemptions.

CONCLUSIONS AND POLICY IMPLICATIONS

Higher sales taxes ultimately increase the incentive

for special interests to lobby for more tax exemptions.

This relationship suggests that increasing the tax rate

may not generate the additional tax revenues expected.

Government agencies should be aware of two major

consequences of this relationship. First, estimates of the

effects of increasing sales taxes are often overly opti-

mistic; therefore, agencies should be more alert to the

link between sales taxes and exemptions when making

predictions of future increases in revenue.

<INSERT THE FIGURE NEAREST CONVENIENT PLACE: >

MERCATUS CENTER AT GEORGE MASON UNIVERSITY 3

Figure 1. The eect of increasing or decreasing sales tax exemptions and sales tax rate.

Second, increases in sales taxes may lead to other unin-

tended inefciencies. Higher sales taxes can potentially

lead to decreased consumption of certain goods. This

implies that transactions that would have taken place

prior to the added tax will not occur. Moreover, as pre-

viously mentioned, higher sales taxes tend to be asso-

ciated with increased lobbying activities. Lobbying on

behalf of special interests can have distortionary effects

on market transactions and consumer choices. By advo-

cating for different treatments for certain transactions

or activities, lobbying activities (and ultimately sales tax

exemptions) have multiple adverse effects. The sales

exemptions, once implemented, erode the sales tax base.

They also institute preferences for certain transactions

and goods over others. This results in distortions of con-

sumer choices, which alter essential market signals and

results in misallocation of resources and investment.

ENDNOTES

1. Justin Ross, A Primer on State and Local Tax Policy: Trade-Offs

Among Tax Instruments (Mercatus Research, Mercatus Center at

George Mason University, Arlington, VA, 2014).

2. See, e.g., Dennis Mueller, Public Choice III (Cambridge: Cambridge

University Press, 2003).

3. Sam Peltzman, Toward a More General Theory of Regulation, Jour-

nal of Law and Economics 19 (1976): 21140.

4. Andreea Militaru and Thomas Stratmann, A Survey of Sales Tax

Exemptions in the States: Understanding Sales Taxes and Sales

Tax Exemptions (Mercatus Research, Mercatus Center at George

Mason University, Arlington, VA, 2014).

5. Scott Drenkard, State and Local Sales Tax Rates in 2014 (Tax Foun-

dation, Washington, DC, March 18, 2014).

6. State and Local Laws Held Preempted by Federal Law, Justia US

Law, accessed July 3, 2014, http://law.justia.com/constitution/

us/049-state-local-laws-preempted-by-federal-law.html.

7. Militaru and Stratmann, Survey of Sales Tax Exemptions, 2014, 17.

8. Militaru and Stratmann, Survey of Sales Tax Exemptions, 2014, 24.

0.17% increase

-0.17% decrease

one additional exemption one less exemption

c

h

a

n

g

e

i

n

s

a

l

e

s

t

a

x

r

a

t

e

The Effect of Increasing or Decreasing Sales Tax

Exemptions and Sales Tax Rate

Source: Author's calculations based on data presented in Thomas Stratmann and Andrea Militaru, "A Survey of Sales Tax

Exemptions in the States: Understanding Sales Taxes and Sales Tax Exemptions," January 2014.

Produced by Thomas Strattman, Rachel Reese, and Rizqi Rachmat, Mercatus Center at George Mason University.

Source: Authors calculations based on data presented in Militaru and Stratmann, Survey of Sales Tax Exemptions, 2014.

Produced by Thomas Stratmann, Rachel Reese, and Rizqi Rachmat, Mercatus Center at George Mason University.

4 MERCATUS ON POLICY AUGUST 2014

Thomas Stratmann is a scholar at the Mercatus Center

and a professor of economics at George Mason Univer-

sity. His primary research interests are political economy,

scal policy, law and economics, health economics, and

experimental economics. He received his BA from the

Free University of Berlin and his MA and PhD in econom-

ics from the University of Maryland.

Andreea Militaru was an MA fellow at the Mercatus

Center at George Mason University and is interested in

nancial regulation and monetary policy issues, as well

as entrepreneurship and international development. She

is currently a consultant for Public-Private Transaction

Advisory Services at the International Finance Corpora-

tion, a member of the World Bank Group.

Rachel Reese is a second year MA student in the Depart-

ment of Economics at George Mason University and

an MA fellow at the Mercatus Center at George Mason

University. Rachel received her BA in economics and East

Asian languages and civilizations from the University of

Pennsylvania.

The Mercatus Center at George Mason University is the

worlds premier university source for market-oriented

ideasbridging the gap between academic ideas and

real-world problems. A university-based research center,

Mercatus advances knowledge about how markets work to

improve peoples lives by training graduate students, con-

ducting research, and applying economics to oer solutions

to societys most pressing problems.

Our mission is to generate knowledge and understanding

of the institutions that aect the freedom to prosper and to

nd sustainable solutions that overcome the barriers pre-

venting individuals from living free, prosperous, and peace-

ful lives. Founded in 1980, the Mercatus Center is located

on George Mason Universitys Arlington campus.

Figure 2. The relationship between the number of sales tax exemptions and sales tax rates.

5.1 percent

5.6 percent

6.1 percent

4.4

4.8

5.2

5.6

6

6.4

s

a

l

e

s

t

a

x

r

a

t

e

(

%

)

What is the relationship between the number of

sales tax exemption and sales tax rates?

average

exemptions

(24)

five more

exemptions

(29)

five fewer

exemptions

(19)

average sales

tax rate

Source: Author's calculations based on data presented in Thomas Stratmann and Andrea Militaru, "A Survey of Sales Tax

Exemptions in the States: Understanding Sales Taxes and Sales Tax Exemptions," January 2014.

Produced by Thomas Strattman, Rachel Reese, and Rizqi Rachmat, Mercatus Center at George Mason University.

Source: Authors calculations based on data presented in Militaru and Stratmann, Survey of Sales Tax Exemptions, 2014.

Produced by Thomas Stratmann, Rachel Reese, and Rizqi Rachmat, Mercatus Center at George Mason University.

You might also like

- Freer Markets Within the Usa: Tax Changes That Make Trade Freer Within the Usa. Phasing-Out Supply-Side Subsidies and Leveling the Playing Field for the Working Person.From EverandFreer Markets Within the Usa: Tax Changes That Make Trade Freer Within the Usa. Phasing-Out Supply-Side Subsidies and Leveling the Playing Field for the Working Person.No ratings yet

- Tax Inefficiencies and Alternative SolutionsDocument13 pagesTax Inefficiencies and Alternative SolutionsAbdullahNo ratings yet

- Tax Inefficiencies and Alternative SolutionsDocument13 pagesTax Inefficiencies and Alternative SolutionsAbdullahNo ratings yet

- University Of: Rochester, Rochester, NY 14627, USADocument31 pagesUniversity Of: Rochester, Rochester, NY 14627, USAWiduri PutriNo ratings yet

- 2014 State Tax Cut RoundupDocument21 pages2014 State Tax Cut RoundupALECNo ratings yet

- Psychic Cost of Tax EvasionDocument5 pagesPsychic Cost of Tax EvasionMohammad Shahjahan SiddiquiNo ratings yet

- RESEARCHDocument5 pagesRESEARCHmanuelitofuentescruzNo ratings yet

- Income Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?Document9 pagesIncome Tax Policy: Is A Single Rate Tax Optimum For Long-Term Economic Growth?RebeccaChuaNo ratings yet

- Tax Is CupsDocument34 pagesTax Is CupsJay SuarezNo ratings yet

- Bba2010business Policy and Strategic PlanningDocument24 pagesBba2010business Policy and Strategic PlanningAus Rica YuNo ratings yet

- Lorena Kukovičić - TAXATIONDocument17 pagesLorena Kukovičić - TAXATIONlorenaNo ratings yet

- Crowley Tax Reform Case Studies v1Document37 pagesCrowley Tax Reform Case Studies v1MahnoorNo ratings yet

- Are Less Visible Taxes Really The Answer?: Factors That Shape American Attitudes Toward TaxationDocument6 pagesAre Less Visible Taxes Really The Answer?: Factors That Shape American Attitudes Toward TaxationRoosevelt InstituteNo ratings yet

- Corporate Taxes and Retail PricesDocument2 pagesCorporate Taxes and Retail PricesCato InstituteNo ratings yet

- Multinational Transfer PricingDocument5 pagesMultinational Transfer Pricingstuddude88No ratings yet

- Legal Entity State: Government ActivityDocument3 pagesLegal Entity State: Government ActivityEunice Bucao BuesaNo ratings yet

- The Quickbooks User'S Guide To Sales and Use Tax: How This Guide May Help YouDocument26 pagesThe Quickbooks User'S Guide To Sales and Use Tax: How This Guide May Help YouCao Minh TríNo ratings yet

- Components of External Business EnvironmentDocument7 pagesComponents of External Business EnvironmentZoe MontillanoNo ratings yet

- Taxes (Perwez)Document30 pagesTaxes (Perwez)Freedom Happy DayNo ratings yet

- Taxation DiazDocument3 pagesTaxation DiazRyan DiazNo ratings yet

- Tax Penalties and Tax Compliance: Scholarship at GEORGETOWN LAWDocument53 pagesTax Penalties and Tax Compliance: Scholarship at GEORGETOWN LAWabbyNo ratings yet

- Zidar TCFW Jpe 2019Document36 pagesZidar TCFW Jpe 2019John SmithNo ratings yet

- Essay FinalDocument6 pagesEssay FinalHananNo ratings yet

- Job Market Paper NaritomiDocument52 pagesJob Market Paper NaritomiPedro Sant'AnnaNo ratings yet

- Malone 2019Document21 pagesMalone 2019eltrolerohdNo ratings yet

- Are You Properly Specifying MaterialsDocument6 pagesAre You Properly Specifying MaterialsDia MujahedNo ratings yet

- Taxes in The United StatesDocument36 pagesTaxes in The United StatesYermekNo ratings yet

- Tax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionDocument28 pagesTax Collection Methods: Understanding Business Tax Collection and The Psyche of EvasionElizabeth CasabarNo ratings yet

- Tricia SnyderDocument8 pagesTricia SnyderTurkanAliyevaNo ratings yet

- Applied Economics ProjectDocument12 pagesApplied Economics ProjectPlied PlipperNo ratings yet

- Who Wins and Who Loses? Debunking 7 Persistent Tax Reform MythsDocument18 pagesWho Wins and Who Loses? Debunking 7 Persistent Tax Reform MythsCenter for American ProgressNo ratings yet

- How Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyDocument12 pagesHow Campaign Contributions and Lobbying Can Lead To Inefficient Economic PolicyCenter for American ProgressNo ratings yet

- REporting ColorDocument15 pagesREporting ColorAndromeda GalaxyNo ratings yet

- TaxesDocument4 pagesTaxesnenzzmariaNo ratings yet

- RITESHDocument94 pagesRITESHRahul RajNo ratings yet

- Six Environmental Forces: Reactively Responding NatureDocument6 pagesSix Environmental Forces: Reactively Responding NatureMwihia PetrNo ratings yet

- Tax Literature ReviewDocument5 pagesTax Literature Reviewc5nr2r46100% (2)

- UW Extension Right To Work Fact SheetDocument2 pagesUW Extension Right To Work Fact SheetIsthmus Publishing CompanyNo ratings yet

- EconomicsDocument5 pagesEconomicsMehedi Hasan DurjoyNo ratings yet

- Theoretical FrameworkDocument14 pagesTheoretical Frameworkfadi786No ratings yet

- Different Taxation Systems - Advantages and DisadvantagesDocument4 pagesDifferent Taxation Systems - Advantages and DisadvantagesGabriella PopovaNo ratings yet

- Report - BZEA Econ GrowthDocument18 pagesReport - BZEA Econ GrowthDavidReevelyNo ratings yet

- Department of Commerce: A Study On Us Corporate Taxation Adopted by Grant Thornton LLPDocument6 pagesDepartment of Commerce: A Study On Us Corporate Taxation Adopted by Grant Thornton LLPAnish PoojaryNo ratings yet

- LESSON 4. LEGAL, REGULATORY and POLITICAL ISSUESDocument5 pagesLESSON 4. LEGAL, REGULATORY and POLITICAL ISSUESLEOPOLDO L SALAS JR.No ratings yet

- Assignment3-Module3 FERRIOLDocument2 pagesAssignment3-Module3 FERRIOLTerrence FerriolNo ratings yet

- The Hidden Costs of Tax ComplianceDocument21 pagesThe Hidden Costs of Tax ComplianceMercatus Center at George Mason UniversityNo ratings yet

- TERRITORIAL VS. WORLDWIDE TAX SYSTEMS p130424003Document11 pagesTERRITORIAL VS. WORLDWIDE TAX SYSTEMS p130424003alanqNo ratings yet

- Chapter 6: Supply, Demand, and Government Poli... : Economists Have Two RolesDocument7 pagesChapter 6: Supply, Demand, and Government Poli... : Economists Have Two RolesSavannah Simone PetrachenkoNo ratings yet

- Purposes and EffectsDocument16 pagesPurposes and EffectsChelle OcampoNo ratings yet

- A Primer On National Tax Reform ProposalsDocument2 pagesA Primer On National Tax Reform ProposalsJoshua StokesNo ratings yet

- MCLACSON Paper4Document7 pagesMCLACSON Paper4Ma. Lourdes LacsonNo ratings yet

- Under The Guidance Of: Mr. Shail ShakyaDocument21 pagesUnder The Guidance Of: Mr. Shail ShakyaJai ShreeramNo ratings yet

- Debate: Tax Competition and Global Interdependence : Athias IsseDocument19 pagesDebate: Tax Competition and Global Interdependence : Athias IssekdrtkrdglNo ratings yet

- Dissertation Tax AvoidanceDocument8 pagesDissertation Tax AvoidanceCustomCollegePaperSingapore100% (1)

- Macroeconomics and Micro EconomicsDocument8 pagesMacroeconomics and Micro EconomicsDeepanshi PNo ratings yet

- Importance of Tax in EconomyDocument7 pagesImportance of Tax in EconomyAbdul WahabNo ratings yet

- Developing Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncDocument10 pagesDeveloping Consistent Tax Bases For Broad-Based Reform: Fiscal Associates, IncThe Washington PostNo ratings yet

- Tax Avoidance and Coporate Capital Structure (Cristine Harrington)Document20 pagesTax Avoidance and Coporate Capital Structure (Cristine Harrington)Risa Nadya SafrizalNo ratings yet

- W 25578Document29 pagesW 25578jigarchhatrolaNo ratings yet

- Protectionism Among The States: How Preference Policies Undermine CompetitionDocument19 pagesProtectionism Among The States: How Preference Policies Undermine CompetitionMercatus Center at George Mason UniversityNo ratings yet

- Active Defense: An Overview of The Debate and A Way ForwardDocument28 pagesActive Defense: An Overview of The Debate and A Way ForwardMercatus Center at George Mason UniversityNo ratings yet

- Do Governments Impede Transportation Innovation?Document15 pagesDo Governments Impede Transportation Innovation?Mercatus Center at George Mason UniversityNo ratings yet

- Certificate-of-Need: TennesseeDocument4 pagesCertificate-of-Need: TennesseeMercatus Center at George Mason UniversityNo ratings yet

- Do Certificate-of-Need Laws Increase Indigent Care?Document32 pagesDo Certificate-of-Need Laws Increase Indigent Care?Mercatus Center at George Mason UniversityNo ratings yet

- Why The Nutrition Label Fails To Inform ConsumersDocument31 pagesWhy The Nutrition Label Fails To Inform ConsumersMercatus Center at George Mason UniversityNo ratings yet

- The Budget Act at Forty: Time For Budget Process ReformDocument25 pagesThe Budget Act at Forty: Time For Budget Process ReformMercatus Center at George Mason UniversityNo ratings yet

- KP Tevta Advertisement 16-09-2019Document4 pagesKP Tevta Advertisement 16-09-2019Ishaq AminNo ratings yet

- Dalasa Jibat MijenaDocument24 pagesDalasa Jibat MijenaBelex ManNo ratings yet

- DNA ReplicationDocument19 pagesDNA ReplicationLouis HilarioNo ratings yet

- Nutrition and CKDDocument20 pagesNutrition and CKDElisa SalakayNo ratings yet

- Plaza 66 Tower 2 Structural Design ChallengesDocument13 pagesPlaza 66 Tower 2 Structural Design ChallengessrvshNo ratings yet

- Revenue and Expenditure AuditDocument38 pagesRevenue and Expenditure AuditPavitra MohanNo ratings yet

- Oracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qDocument49 pagesOracle - Prep4sure.1z0 068.v2016!07!12.by - Lana.60qLuis AlfredoNo ratings yet

- Electro Fashion Sewable LED Kits WebDocument10 pagesElectro Fashion Sewable LED Kits WebAndrei VasileNo ratings yet

- School of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1Document2 pagesSchool of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1STEM Education Vung TauNo ratings yet

- Hey Friends B TBDocument152 pagesHey Friends B TBTizianoCiro CarrizoNo ratings yet

- Stress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingDocument9 pagesStress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingRory Cristian Cordero RojoNo ratings yet

- Sindi and Wahab in 18th CenturyDocument9 pagesSindi and Wahab in 18th CenturyMujahid Asaadullah AbdullahNo ratings yet

- Lithuania DalinaDocument16 pagesLithuania DalinaStunt BackNo ratings yet

- History of The Sikhs by Major Henry Cour PDFDocument338 pagesHistory of The Sikhs by Major Henry Cour PDFDr. Kamalroop SinghNo ratings yet

- Evaluation TemplateDocument3 pagesEvaluation Templateapi-308795752No ratings yet

- Elements of ArtDocument1 pageElements of Artsamson8cindy8louNo ratings yet

- The Mantel Colonized Nation Somalia 10 PDFDocument5 pagesThe Mantel Colonized Nation Somalia 10 PDFAhmad AbrahamNo ratings yet

- Hima OPC Server ManualDocument36 pagesHima OPC Server ManualAshkan Khajouie100% (3)

- Duavent Drug Study - CunadoDocument3 pagesDuavent Drug Study - CunadoLexa Moreene Cu�adoNo ratings yet

- Principals' Leadership Styles and Student Academic Performance in Secondary Schools in Ekiti State, NigeriaDocument12 pagesPrincipals' Leadership Styles and Student Academic Performance in Secondary Schools in Ekiti State, NigeriaiqraNo ratings yet

- Famous Russian PianoDocument10 pagesFamous Russian PianoClara-Schumann-198550% (2)

- 7400 IC SeriesDocument16 pages7400 IC SeriesRaj ZalariaNo ratings yet

- Mcom Sem 4 Project FinalDocument70 pagesMcom Sem 4 Project Finallaxmi iyer75% (4)

- Networker Performance Tuning PDFDocument49 pagesNetworker Performance Tuning PDFHarry SharmaNo ratings yet

- 2SB817 - 2SD1047 PDFDocument4 pages2SB817 - 2SD1047 PDFisaiasvaNo ratings yet

- Agnes de MilleDocument3 pagesAgnes de MilleMarie-Maxence De RouckNo ratings yet

- Sam Media Recruitment QuestionnaireDocument17 pagesSam Media Recruitment Questionnairechek taiNo ratings yet

- Introduction-: Microprocessor 68000Document13 pagesIntroduction-: Microprocessor 68000margyaNo ratings yet

- g6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERDocument23 pagesg6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERPrincess Nicole LugtuNo ratings yet

- Existential ThreatsDocument6 pagesExistential Threatslolab_4No ratings yet