Professional Documents

Culture Documents

5517 FIA001Electronic

5517 FIA001Electronic

Uploaded by

sacripalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5517 FIA001Electronic

5517 FIA001Electronic

Uploaded by

sacripalCopyright:

Available Formats

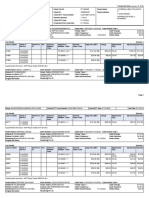

FIA 001

TAX CLEARANCE

Application for a Tax Clearance Certificate

(In respect of foreign investment allowance for

individuals)

Surname *

Rand amount to be invested *

Are you currently aware of any Audit investigation against you?

Expected annual income from this foreign investment: *

What type of investment (call deposit, shares, other financial instruments, etc)? *

Details of foreign investment to be made:

With which institution will the investment be made? *

When will this investment be made? *

What is the anticipated duration of the investment? *

In which country will this investment be made? *

Particulars of applicant

Please note that:

Particulars of foreign investment

Audit

R

R

First name(s) *

VAT registration no

(if applicable)

Customs code

(if applicable)

Income Tax ref no* PAYE ref no

(if applicable)

SDL ref no

(if applicable)

UIF ref no

(if applicable)

Page 1 of 2

Identification no* Date of birth*

4

7

L

U

Telephone no *

Cell phone no *

Physical address* *

Postal address

E-mail address

Fax no *

It is a serious offence to make a false declaration.

Section 75 of the Income Tax Act, 1962 states: Any person who

(a) fails or neglects to furnish, file or submit any return or document as and when required by or under this Act; or

(b) without just cause shown by him, refuses or neglects to -

(i) Furnish, produce or make available any information, documents or things;

(ii) Reply to or answer truly and fully, any questions put to him ... as and when required in terms of this Act ... shall be guilty of an

offence ...

Unless a statement of assets and liabilities has been included in your latest Income tax return, this application will not be considered. The

onus lies with the applicant to ensure that SARS is in possession of his/her latest required statement of assets and liabilities.

SARS will, under no circumstances, issue a tax clearance certificate unless all the fields indicated with an asterisk on the

application form are completed in full.

This application form must be completed for any lump sum amount, or annualised amounts in excess of R30,000 (i.e. R3,000 per month x

12 months) and for recurring foreign investments not exceeding R30,000 p.a.

C C Y Y M M D D

No Yes

Print Form

If the answer is NO then attach a copy of the Statement of Assets and liabilities to this application. Failure to do so will result in this

application being denied.

I have attached a detailed statement of assets and liabilities to my latest IT12 Income Tax return. *

Other details of investment

Page 2 of 2

YES NO

Declaration

I declare that the information furnished in this application as well as the supporting documents is true and correct in every respect.

I undertake to declare any/and all income earned/accrued from such foreign investments, in my annual Income Tax returns.

Appointment of representative/agent

I hereby authorise and instruct to apply to and receive from SARS the applicable Tax

Clearance Certificate on my/our behalf.

*

Name of applicant

Identity number

Name of

representative/ agent

Name of Agent/

Bank

Signature of applicant

Signature of representative/agent

Date

Date

Details of agent/bank handling transfer of funds on behalf of taxpayer:

For office use only

Refer to audit

Brief reason(s) for referral:

Refer to special investigations

TPSC reference number of certificate issued:

/ / / /

Source of the capital to be invested: (Please tick at least one) *

Loan (Attach loan agreement)

Inheritance (Attach letter from the executor of estate and a copy of the L&D

Account and latest statement of relevant bank account)

Other (Attach proof and explanations)

Donation (Attach details of donor and proof of donations tax paid on donation and

latest bank statement of relevant bank account)

Sale of property (Copies of Deed of Sale, transfer duty declarations, transfer duty

receipt. Letter of Conveyancer confirming the transfer of property. Latest statement of

relevant bank account, or letter of Conveyancer stating that the money will be transferred

from Trust Account)

If sale of property, the Erf number is required

Shares (Attach letter from institution stating the transfer of the funds and containing

the amount of shares and estimated current market value available)

Savings/Cash/Bank Account (Attach 3 months statement of relevant bank

account and proof of source) i.e: Proof of source being where and how you obtained

the money

Telephone no *

Postal address *

E-mail address

Fax no*

You might also like

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorNo ratings yet

- FS Form 1071 (Statement of Ownership)Document2 pagesFS Form 1071 (Statement of Ownership)Benne James100% (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- SAP Accounts Payable AccountingDocument22 pagesSAP Accounts Payable AccountingSultan100% (1)

- Financial Modeling Planning Analysis Toolkit - Overview and ApproachDocument52 pagesFinancial Modeling Planning Analysis Toolkit - Overview and ApproachmajorkonigNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Sbi MF Common Equity Form Arn EuinDocument2 pagesSbi MF Common Equity Form Arn EuinARVINDNo ratings yet

- Zero Balance Form - SFLBDocument3 pagesZero Balance Form - SFLBroshcrazyNo ratings yet

- Direct Client & Broker AgreementDocument55 pagesDirect Client & Broker Agreementdoanthanh88No ratings yet

- Account Opening FormDocument9 pagesAccount Opening FormTej AsNo ratings yet

- SwiftcashDocument33 pagesSwiftcashLibinNo ratings yet

- AlaAL ZAALIG2011Document5 pagesAlaAL ZAALIG2011Ala AlzaaligNo ratings yet

- 27four Tax Free Savings New Investment FormDocument8 pages27four Tax Free Savings New Investment FormLord OversightNo ratings yet

- Merkava Siman 3 Merkava MK 3 in IDF Service PaDocument80 pagesMerkava Siman 3 Merkava MK 3 in IDF Service Pasacripal95% (20)

- Account Opening Form and Investment FormDocument5 pagesAccount Opening Form and Investment FormEngr Muhammad Talha IslamNo ratings yet

- Stasi Files and GDR PDFDocument20 pagesStasi Files and GDR PDFsacripalNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- BIR Form 1800 - Donor's Tax ReturnDocument2 pagesBIR Form 1800 - Donor's Tax ReturnangelgirlfabNo ratings yet

- Amityfees Pay in SlipDocument1 pageAmityfees Pay in SlipPranav JainNo ratings yet

- BGs MTNs Compliance PackageDocument21 pagesBGs MTNs Compliance PackagethienvupleikuNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Dervishes in Early Ottoman Society and PoliticsDocument149 pagesDervishes in Early Ottoman Society and PoliticsbanarisaliNo ratings yet

- Common Application FormDocument2 pagesCommon Application FormJeta SharmaNo ratings yet

- 04 Stasi IntelligenceDocument62 pages04 Stasi IntelligencesacripalNo ratings yet

- 04 Stasi IntelligenceDocument62 pages04 Stasi IntelligencesacripalNo ratings yet

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- ACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Document9 pagesACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Fery AnnNo ratings yet

- Axis Mutual Fund - Lumpsum FormDocument3 pagesAxis Mutual Fund - Lumpsum FormPushpakVanjariNo ratings yet

- SCM Tax Clearance SBD2Document3 pagesSCM Tax Clearance SBD2Michael BenhuraNo ratings yet

- BIR Form No. 0901-D DividendsDocument2 pagesBIR Form No. 0901-D DividendsKoji ZerofourNo ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document7 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Tejas SompuraNo ratings yet

- Common Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoDocument2 pagesCommon Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoVaibhav BansalNo ratings yet

- DSP BlackRock Tax Saver Fund Application FormDocument4 pagesDSP BlackRock Tax Saver Fund Application FormPrajna Capital100% (1)

- Reliance CAF SIP Insure ArnDocument8 pagesReliance CAF SIP Insure ArnARVINDNo ratings yet

- NAME: Mindoro, Kristel Denise T.: BSA - 21 October 19, 2019Document7 pagesNAME: Mindoro, Kristel Denise T.: BSA - 21 October 19, 2019Frances Ann CapalonganNo ratings yet

- Bir 1601fDocument3 pagesBir 1601fJuliet Jayjet Dela CruzNo ratings yet

- It Declaration Year 2011 12Document1 pageIt Declaration Year 2011 12Vijay BokadeNo ratings yet

- Common Application Form: Time StampDocument4 pagesCommon Application Form: Time Stamparshadjafri123No ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Nandish EthirajNo ratings yet

- LRSFormDocument3 pagesLRSFormtirthendu senNo ratings yet

- Investment Certificate in Zanzibar (Zipa)Document10 pagesInvestment Certificate in Zanzibar (Zipa)NuswaibahNo ratings yet

- Systematic Investment Plan: Investo Solutions ARN - 73827Document2 pagesSystematic Investment Plan: Investo Solutions ARN - 73827mbaiifpbatch2No ratings yet

- BIR Form No. 2553Document2 pagesBIR Form No. 2553fatmaaleahNo ratings yet

- Nach Form Mirae PDFDocument8 pagesNach Form Mirae PDFKaushalNo ratings yet

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Anf 1aDocument3 pagesAnf 1adkhatri01No ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- BIR Form No. 0901-O (Other Income) Bureau of Internal RevenueDocument2 pagesBIR Form No. 0901-O (Other Income) Bureau of Internal RevenueChristianNicolasBetantosNo ratings yet

- Barcode: Customer Updation For KYC - NRI / PIO / OCIDocument3 pagesBarcode: Customer Updation For KYC - NRI / PIO / OCItruecallerfinder456No ratings yet

- Application For Certificate of Paymentqc19417Document2 pagesApplication For Certificate of Paymentqc19417parmi_on_scribdNo ratings yet

- Application Form L&T Mutual FundDocument5 pagesApplication Form L&T Mutual FundnanduvermaNo ratings yet

- Bank Account Updation FormDocument2 pagesBank Account Updation Forms.sabapathyNo ratings yet

- Individual KYC PDFDocument2 pagesIndividual KYC PDFSivakumarNo ratings yet

- Requisition Letter Salaried Individual (Noor)Document4 pagesRequisition Letter Salaried Individual (Noor)Ayat FatimaNo ratings yet

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2No ratings yet

- TIN Application ProcedureDocument3 pagesTIN Application ProcedureJuan Dela CruzNo ratings yet

- FATCADocument1 pageFATCAbnanduriNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1No ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Bir46 PDFDocument2 pagesBir46 PDFJulia SmithNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- Form12 PDFDocument16 pagesForm12 PDFAsder DareNo ratings yet

- Sip & Micro Sip PDC Form - 29.04.2013Document4 pagesSip & Micro Sip PDC Form - 29.04.2013Aayush ShahNo ratings yet

- Graduel 1Document797 pagesGraduel 1sacripalNo ratings yet

- Valta GdeDocument12 pagesValta GdesacripalNo ratings yet

- The KarbalaDocument65 pagesThe KarbalasacripalNo ratings yet

- Snir1IF PDFDocument46 pagesSnir1IF PDFsacripal100% (1)

- Summary All DTAs and Protocols 6 June 2012Document4 pagesSummary All DTAs and Protocols 6 June 2012sacripalNo ratings yet

- Accounting Method Used by Ottomans For 500 Years - Stairs (Merdiban) MethodDocument660 pagesAccounting Method Used by Ottomans For 500 Years - Stairs (Merdiban) MethodsacripalNo ratings yet

- Human: Gender Marked Marked TheDocument6 pagesHuman: Gender Marked Marked ThesacripalNo ratings yet

- Taxation in Turkey: SEPTEMBER-2006 Revised in November-2006Document48 pagesTaxation in Turkey: SEPTEMBER-2006 Revised in November-2006sacripalNo ratings yet

- BambaraDocument409 pagesBambarasacripalNo ratings yet

- Uzbekistan Divieto ImportazioneDocument4 pagesUzbekistan Divieto ImportazionesacripalNo ratings yet

- Valta GdeDocument12 pagesValta GdesacripalNo ratings yet

- Wihelmhohenzolle 006539 MBPDocument610 pagesWihelmhohenzolle 006539 MBPsacripalNo ratings yet

- Stock, Stock Valuation and Stock Market EquilibriumDocument10 pagesStock, Stock Valuation and Stock Market Equilibriumlaraib ali100% (1)

- Maharashtra State Electricity Distibution Co. LTD.: NA NADocument17 pagesMaharashtra State Electricity Distibution Co. LTD.: NA NAÄñîRûddhâ JâdHäv ÂjNo ratings yet

- Sapposdm 1Document4 pagesSapposdm 1uk.personNo ratings yet

- RPT CPSPM 4849796 21989Document4 pagesRPT CPSPM 4849796 21989RAM BABU MYNAPUNo ratings yet

- CheckMultipleDetails 2024 01 18 12 06 44Document8 pagesCheckMultipleDetails 2024 01 18 12 06 44hillumbertoNo ratings yet

- CH 1Document19 pagesCH 1Ak AgarwalNo ratings yet

- Greatec PUBLIC RESEARCHDocument4 pagesGreatec PUBLIC RESEARCHNicholas ChehNo ratings yet

- Fsa 2010 14 PDFDocument257 pagesFsa 2010 14 PDFsarapariNo ratings yet

- International Monetary SystemDocument35 pagesInternational Monetary SystemAki CreusNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- Cash Flow From (Used In) Operating ActivitiesDocument4 pagesCash Flow From (Used In) Operating ActivitiesTaranpreetkaur SekhonNo ratings yet

- Course Outline in Mathematics of InvestmentDocument2 pagesCourse Outline in Mathematics of InvestmentMary UmitenNo ratings yet

- Account Register: Accounts Goal % Cleared BalanceDocument5 pagesAccount Register: Accounts Goal % Cleared BalanceDody SuhermantoNo ratings yet

- UAE Real Estate - 12 Sep 08 1443Document44 pagesUAE Real Estate - 12 Sep 08 1443Islam GoudaNo ratings yet

- Export Import Finance AssignmentDocument9 pagesExport Import Finance Assignmentjattboy1No ratings yet

- Tabel Bunga Ekonomi TeknikDocument32 pagesTabel Bunga Ekonomi TeknikTdaNo ratings yet

- Real Estate Finance and Investments 15th Edition Brueggeman Test BankDocument5 pagesReal Estate Finance and Investments 15th Edition Brueggeman Test Bankwilliamvanrqg100% (29)

- Statement of Cash Flow - OnlineDocument36 pagesStatement of Cash Flow - OnlineEvans Galista AHNo ratings yet

- Income From Salary - Allowances and Perks - Feb., 2023Document14 pagesIncome From Salary - Allowances and Perks - Feb., 2023Ayush BholeNo ratings yet

- Full Report Ppta 18.5Document58 pagesFull Report Ppta 18.5kstools. veenaaNo ratings yet

- Practise - Chap 12 (Stu)Document3 pagesPractise - Chap 12 (Stu)Nguyen Trong Bang (K16HCM)No ratings yet

- PAT and EBITDADocument2 pagesPAT and EBITDATravel DiaryNo ratings yet

- Introduction To VC Business ModelDocument3 pagesIntroduction To VC Business ModelMuhammad Shahood JamalNo ratings yet

- Money and CreditDocument15 pagesMoney and CreditG Abhi SheethiNo ratings yet

- MA0038Document2 pagesMA0038Tenzin KunchokNo ratings yet