Professional Documents

Culture Documents

Financial Theory and Corporate Policy (4 Edition) by Copeland Chapter 2: Investment Decisions: The Certainty Case

Financial Theory and Corporate Policy (4 Edition) by Copeland Chapter 2: Investment Decisions: The Certainty Case

Uploaded by

nuruyeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Theory and Corporate Policy (4 Edition) by Copeland Chapter 2: Investment Decisions: The Certainty Case

Financial Theory and Corporate Policy (4 Edition) by Copeland Chapter 2: Investment Decisions: The Certainty Case

Uploaded by

nuruyeCopyright:

Available Formats

JAM May 2012 1.

01 FTCP 2 Page 1 of 9

Financial Theory and Corporate Policy (4

th

edition) by Copeland

Chapter 2: Investment Decisions: The Certainty Case

Introduction

In the investment decision, must decide how much to not consume today so as to enjoy

more consumption in the future

Should maximize expected utility over the planning horizon

Individuals, corporate managers, and public sector managers must all make the allocation

between current and future consumption

Initially interest rates are known and constant

Also assume there are no imperfections in capital markets

The firm objective is to maximize the wealth for its shareholders

Fisher Separation: The Separation of Individual Utility Preferences from the

Investment Decision

It is difficult to determine individual utility functions (how happy is happy?)

Assuming no market friction, individuals can delegate investment decisions to firm

managers

Managers should choose to invest until the rate of return equals the market-determined

rate of return

Maximizing shareholders wealth is equivalent to maximizing the present value of their

lifetime consumption

*

* 1

0 0

1

C

W C

r

= +

+

This implies the slope of the capital market line is (1+r)

The individual shareholders all prefer the same investment decisions at the firm (called

the unanimity principle)

The individuals can adjust for their risk/reward tolerance by borrowing or lending at the

risk-free rate

The Agency Problem

The shareholders wealth is the present value of cash flows discounted at the opportunity

cost of capital

Owners must find a way to monitor (at a cost) the behavior of managers

Owners must balance the monitoring costs with incentive-type compensation (e.g. stock

dividends)

JAM May 2012 1.01 FTCP 2 Page 2 of 9

Shareholder Wealth Maximization

Dividends vs. Capital Gains

Shareholder wealth could be defined as the present value of future dividends

( )

0

1 1

t

t

t

s

Div

S

k

=

=

+

The above formula works if the dividends and discount rates are known with certainty

The effect of capital gains is effectively in the formula above

If the dividend stream is growing at a rate g,

1

0

s

Div

S

k g

=

-

The Economic Definition of Profit

Economic profits equal the mean rates of return in excess of the opportunity cost for

funds

To determine this, must know the timing of the cash flows and the opportunity cost

In this section, dividends include any cash flows that could be paid to shareholders; this

includes items such as capital gains, spin-offs to shareholders, and repurchase of shares

Assume you have an all-equity firm in a no-tax environment

The sources of funds are revenues (Rev) and sale of new equity (m shares at S dollars per

share)

The uses of funds are wages, salaries, materials, and services (W&S); investment (I); and

dividends (Div)

For each time period,

( )

t t t t t

t

Sources Uses

Rev m S Div W &S I

=

+ = + +

Assuming no new equity is issued,

( )

( )

( )

0

1 1

t t t

t

t t

t

t

t

s

Div Rev W &S I

Rev W &S I

S

k

=

= - -

- -

=

+

The accounting definition does not deduct gross investment; rather, it deducts a portion as

depreciation (dep)

( )

t t t

t

NI Rev W &S dep = - -

JAM May 2012 1.01 FTCP 2 Page 3 of 9

Can reconcile the two definitions by realizing the change in asset book value during the

year is the gross investment less the depreciation

( )

0

1 1

t t t

t t

t

t

s

A I dep

NI A

S

k

=

D = -

- D

=

+

The economic definition focuses on the actual timing of cash flows

Managers should not just try to maximize earnings per share, which is based on

accounting profits; rather, should maximize shareholder value

For example, FIFO (first-in, first-out) accounting method results in higher earnings per

share but lower cash flows because more is paid in taxes

So LIFO (last-in, first-out) is better for shareholder value even if it is worse for earnings

per share

Capital Budgeting Techniques

Problems for managers making investment decisions

1. Searching out new opportunities in the market

2. Estimating expected cash flows of projects

3. Evaluating projects according to sound decision rules

Criteria for essential property of maximizing shareholder value

1. All cash flows should be considered

2. Cash flows should be discounted at the opportunity cost of funds

3. Select from mutually exclusive projects the one that maximizes shareholders

wealth

4. Consider one project independently from others (value-additivity principle)

Summing the values of all the projects will compute the firm value

Widely used capital budgeting techniques

1. Payback method

2. Accounting rate of return (ARR)

3. Net present value (NPV)

This is the only method consistent with shareholder maximization

4. Internal rate of return

JAM May 2012 1.01 FTCP 2 Page 4 of 9

Cash flows for four mutually exclusive projects

Year A B C D PV Factor @10%

0 -1000 -1000 -1000 -1000 1.000

1 100 0 100 200 0.909

2 900 0 200 300 0.826

3 100 300 300 500 0.751

4 -100 700 400 500 0.683

5 -400 1300 1250 600 0.621

The Payback Method

Project A has the shortest payback method, only 2 years

However, this method does not consider all the cash flows and does not discount them

This violates the first two criteria for maximizing shareholder value

The Accounting Rate of Return (ARR)

The ARR is the average after-tax profit divided by the initial cash outlay

Similar to the return on assets (ROA) and the return on investment (ROI)

Assuming the cash flows in the table above are profits, the average after-tax profit for

project A is:

1000 100 900 100 100 400

80

5

- + + + - -

= -

And the ARR is -80 / 1000 = -8%

Project B has the highest ARR at 26%

The problems for the ARR method is it uses accounting profits instead of cash flows and

does not consider the time value of money

JAM May 2012 1.01 FTCP 2 Page 5 of 9

Net Present Value (NPV)

The net present value is simply the present value of the free cash flows less the initial

investment

( )

0

1 1

N

t

t

t

FCF

NPV I

k =

= -

+

Using the table above, just multiply the product cash flows by the discount factors

Should accept projects that have a NPV greater than zero

Project C has the highest NPV of 530.85

If the projects are mutually exclusive, then only Project C is accepted

If the projects are independent but not mutually exclusive, then accept Projects B, C, and

D since they all have positive values

Internal Rate of Return (IRR)

The IRR is the rate which equates the present value of cash outflows and inflows

Solve for the rate that makes the NPV = 0

( )

0

1

0

1

N

t

t

t

FCF

NPV I

IRR =

= = -

+

Project D has the highest IRR of 25.4%

Should accept any project that has an IRR greater than the cost of capital

Of course can only accept one project if they are mutually exclusive

Comparison of Net Present Value with Internal Rate of Return

IRR and NPV can lead to different project choices

NPV is appropriate because it uses the market-determined opportunity cost of capital

The IRR method does not discount at the opportunity cost of capital

The Reinvestment Rate Assumption

The NPV approach assumes shareholders can reinvest at the market-determined

opportunity cost of capital

Under the IRR method, it is assumed shareholders can reinvest at the IRR

JAM May 2012 1.01 FTCP 2 Page 6 of 9

The Value-Additivity Principle

IRR does not adhere to the value-additivity principle

The results change when different projects are combined

NPV always follows the value-additivity principle

Multiple Rates of Return

There will be multiple IRR solutions when the sign changes more than once in a cash

flow stream

Could use the opportunity cost of capital to accumulate the positive cash flows in the

calculation to eliminate the multiple roots

This makes sense because the cash flows lent to the firm should be at a reasonable rate

Summary of Comparison of IRR and NPV

Problems with IRR

1. Does not obey value-additivity principle

2. Assumes funds invested in projects have opportunity costs equal to the IRR for

the project

3. Cash flows cannot be discounted at the market-determined cost of capital

4. Multiple roots can emerge if the sign of the cash flows change more than once

Cash Flows for Capital Budgeting Purposes

This section adds debt and taxes

Investment funds can be provided by creditors and shareholders

Debt holders expect to receive a stream of payments unless the firm is bankrupt;

shareholders get the residual value

Both creditors and shareholders should receive their expected risk-adjusted rates of return

Use the following assumptions in a simplified example

An initial investment of $1000 is required to buy equipment that will depreciate at

$200 per year for 5 years

The owners will borrow $500 at 10% interest

The cost of equity is 30%

JAM May 2012 1.01 FTCP 2 Page 7 of 9

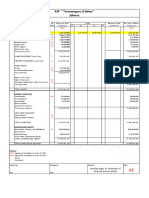

The table below illustrates the pro forma income statement

Rev Revenue 1300

VC

FCC

dep.

Variable costs

Fixed cash costs

Noncash charges (depreciation)

600

0

200

EBIT Earnings Before Interest and Taxes 500

k

d

D Interest Expense 50

EBT Earnings Before Taxes 450

T Taxes @ 50% 225

NI Net Income 225

Assuming the residual cash flows continue forever,

Residual Cash Flow 225

750

30%

s

S

k

= = =

The present value of the bondholders wealth, B, is:

Interest Payments 50

500

10%

b

B

k

= = =

Thus, the market value of the firm, V, is:

V = B + S = 1250

Define the weighted average cost of capital (WACC) in the following manner:

( ) ( )( ) ( ) ( ) ( ) 1 0.10 1 0.5 0.4 0.30 0.6 20%

b c s

B S

k WACC k k

B S B S

t

= = - + = - + =

+ +

Cash flows for capital budgeting purposes is free operating cash flows minus taxes on

free operating cash flows

( ) ( )

( )( )

( )

1

1

c

c c

c

Rev VC FCC Rev VC FCC dep I

Rev VC FCC dep I

EBIT dep I

t

t t

t

D - D - D - D - D - D - D - D

= D - D - D - + D - D

= - + D - D

Notice the cash flows are independent of the capital structure (debt and equity mix); that

is taken into account in determining the WACC

Discounting at the WACC separates the investment decision of the firm from its

financing decision

Must assume the capital structure stays constant or the cost of capital would change each

period

The definition of cash flows includes working capital requirements

JAM May 2012 1.01 FTCP 2 Page 8 of 9

Relaxing the Assumptions

Will need to introduce uncertainty

Also must account for manager flexibility (e.g. could defer the start date, increase or

decrease the scale)

This means the NPV approach systematically undervalues every project

Recommended Problems

You can certainly work all the problems, but the ones below are particularly valuable in

your exam preparation.

1, 4, 5, 8, 9

Solutions to Recommended Problems

1. First calculate the net income:

Revenue 140,000

Variable and fixed costs

Depreciation

100,000

10,000

Earnings Before Interest and Taxes 30,000

Interest Expense 0

Earnings Before Taxes 30,000

Taxes @ 40% 12,000

Net Income 18,000

( )( )

( )( ) ( )( )

1

140, 000 100, 000 1 0.4 0.4 10, 000 28, 000

c c

CF Rev VC FCC dep I t t = D - D - D - + D - D

= - - + =

( ) ( )( ) 1 30, 000 1 0.4 10, 000 0 28, 000

c

CF EBIT dep I t = - + D - D = - + - =

( )

10

1

28, 000

100, 000 58, 200

1.12

t

t

NPV

=

= - =

JAM May 2012 1.01 FTCP 2 Page 9 of 9

4. Calculate the net cash flows and discount back at 12% to find the net present value

At time t = 0 (buy new machine, sell old machine, take tax loss on sale)

( )( ) 100, 000 15, 000 40, 000 15, 000 0.4 75, 000 - + + - = -

In years 1 to 8 (increase in earnings, tax savings from new depreciation amount)

( ) ( ) ( ) ( )

( )[ ]

8

1

100, 000 12, 000 40, 000 0

1.12 31, 000 1 0.4 0.4

8 8

4.968 18, 600 2400 104, 328

t

t

-

=

- -

- + -

= + =

In year 8 (salvage value of new machine)

( ) ( )

8

1.12 12, 000 4, 847

-

=

Note there is no tax effect because this portion of the investment was never

deducted for tax purposes; only 88,000 was deducted over the life of the new

machine

NPV = -75,000 + 104,328 + 4,847 = 34,175

5. Note the financing of the project is irrelevant.

( )( ) ( ) ( )

10, 000

3000 1 0.4 0.4 2.991 10, 000 2, 223.40

5

NPV

= - + - = -

8. The financing information in this project is also irrelevant.

The annual cash flows are increased due to the revenue increase, cost reduction, and

tax savings from the depreciation:

[ ]( ) ( )

1200

200 360 1 0.4 0.4 496

3

+ - + =

( )

3

1

1.10 496 1200 33.55

t

t

NPV

-

=

= - =

9. First calculate the cash flow difference with and without the proposal

( ) ( )

( )( ) ( ) ( )

1

0 290 0 1 0.5 0.5 180 235

c c

CF Rev VC FCC dep t t = D - D - D - + D

= - - - - + =

Then calculate the NPV at the weighted average cost of capital

( )

5

1

1.10 235 900 9.12

t

t

NPV

-

=

= - = -

JAM May 2012 1.02 SN 162 Page 1 of 10

Financial Markets and Corporate Strategy by Greenblatt & Titman

Chapter 18: How Managerial Incentives Affect Financial Decisions

(Study Note FET-162-08)

Introduction

Learning Objectives

1. Distinguish between managerial incentives and shareholder incentives

2. Understand how differences affect ownership structure, capital structure, and

investment policies

3. Describe ways to design compensation contracts that minimize managerial-

shareholder incentive problems

Purposes of Chapter

1. View how financial decisions are actually made in light of incentive problems

2. View how financial decisions should be made in light of incentive problems

Why might management decisions not maximize firm value?

1. Managers take advantage of position and benefit at shareholders expense

For example, Armand Hammer used Occidental funds to build a museum for his

personal art collection

2. Managers serve more than just shareholders (e.g. employees)

18.1 The Separation of Ownership and Control

Most large corporations are effectively controlled by management that own a very small

stake in the company

Whom Do Managers Represent?

1. Investors (e.g. equity holders and debt holders)

2. Customers and suppliers

3. Employees

Managers spend more time with the last two groups relative to investors

JAM May 2012 1.02 SN 162 Page 2 of 10

What Factors Influence Managerial Incentives?

1. Length of time on job

Longer time increases loyalty to those who the manager frequently interacts (e.g.

customers and employees)

2. Proportion of company stock owned by management

Only a fraction of the perquisites (e.g. corporate jet) is paid by the manager

How Management Incentive Problems Hurt Shareholder Value

Share prices normally increase when entrenched executives leave

New CEOs can make the tough decisions that benefit shareholders even if employees are

hurt

Why Shareholders Cannot Control Managers

For most companies, CEOs own a very small fraction of the company (less than 1%)

The ownership of outside shareholder is too diffuse to make a change

Free-rider problem: individual investors are not inclined to discipline management even

though it would be in the best interest of the shareholders as a group

Proxy fights are very expensive and the cost must be borne by the individuals that wage

them

These individuals are only getting a fraction of the benefit; the other shareholders are

getting a free ride

Why is Ownership so Diffuse if it Leads to Less Efficient Management?

Investors must balance the desire to have a diversified portfolio with the need to

control management

An investor that sacrifices diversification for control would benefit other

shareholders, but only the investor would bear the lack of diversification cost

JAM May 2012 1.02 SN 162 Page 3 of 10

Can Financial Institutions Mitigate the Free-Rider Problem?

Large institutional investors (like mutual funds) could control a significant stake in a

company and still be diversified

Mutual funds and insurance companies in the US are precluded by law from owning

more than 5% of the stock of any individual firm

Pension funds have begun to exert more influence, but there is still some reluctance in

private ones

Companies dont want other private pension plans to monitor their actions, so

they provide the same courtesy to other companies with their pension plan

Public pension funds are even more aggressive at monitoring managers of

corporations because they do not have concerns about other plans monitoring them

Changes in Corporate Governance

Changes in the mid-1980s that made managers more responsive to shareholders include:

1. Active takeover market

2. Increased usage of executive incentive plans

3. More active institutional shareholders

The SEC changed two rules in the early 1990s to encourage this

Fuller disclosure of executive compensation packages

Made it easier for shareholders to get information about other

shareholders; this reduced the cost of proxy fights

Board members are becoming more effective at monitoring management

1. Smaller number of members with greater percentage of outsiders

2. Receive more compensation in stock options to align incentives

CEOs are now more likely to lose their jobs for poor performance

Corporate Governance Problems Differ Across Countries?

Some countries, like the US and UK, provide strong legal protection for outside

shareholders

Other countries, like Russia, have very weak protection

The countries with strong protection have more active markets

JAM May 2012 1.02 SN 162 Page 4 of 10

18.2 Management Shareholdings and Market Value

The ownership in many corporations is quite concentrated

Many of the large shareholders are the company founders (e.g. Michael Dell)

The Effect of Management Shareholdings on Stock Prices

A person like Bill Gates may choose not to sell his Microsoft stock for tax reasons or to

avoid sending bad signals to the market

Executives in the industries with the greatest potential incentive problems retain the

largest ownership

The market expects the entrepreneur will work harder if he or she retains a larger

ownership position

Management Shareholdings and Firm Value: The Empirical Evidence

One study showed higher management concentration was good up to a point (5%), but

then it hurt the value of the corporation

This is tough to measure because market-to-book ratios are affected by many factors

Closed-end mutual funds often trade at a significant discount to the net asset value

(NAV)

This indicates investors dislike the large shareholders; negative effects of

management ownership outweigh the positive benefits

18.3 How Management Control Distorts Investment Decisions

The Investment Choices Managers Prefer

1. Making Investments that fit the Managers Expertise

This makes it harder to fire and replace the manager

Mangers want to become entrenched and irreplaceable

2. Making Investments in Visible/Fun Industries

Media companies are more fun to manage than chemical companies

3. Making Investments that Pay Off Early

Managers are focused on short-term results even if the decisions hurt the long-run

JAM May 2012 1.02 SN 162 Page 5 of 10

4. Making Investments that Minimize the Managers Risk and Increase the Scope of the

Firm

Managers want to avoid bankruptcy to keep their jobs

This also explains why managers prefer large empires

Unsystematic risk matters to managers even though it does not matter to shareholders,

so managers prefer diversified structure

Managers also prefer less debt

Managers also like larger companies because pay is correlated with size

Outside Shareholders and Managerial Discretion

Outside shareholders can reduce management discretion though fixed assets and other

technologies

Flexibility is more valuable in uncertain environments, so outside shareholders may be

better off monitoring the managers rather than restricting the decisions

The cost of discretion is greater when manager and shareholder interest do not coincide

18.4 Capital Structure and Managerial Control

Increasing debt may motivate the manager simply trying to avoid bankruptcy and keep

job

The Relation between Shareholder Control and Leverage

Companies managed by individuals with a strong interest in the stock price tend to have

higher leverage

JAM May 2012 1.02 SN 162 Page 6 of 10

How Leverage Affects the Level of Investment

Using debt to limit the firms ability to invest in the future may be beneficial; it avoids

poor investments by management

Large debt limits managements ability to use corporate resources

Selecting the Debt Ratio that Allows a Firm to Invest Optimally

Shareholders should use more debt if management has a tendency to overinvest

In Example 18.3 on page 641

A firm is financed with initial investment of $100

In one year, the firm can invest an additional $100 in a project that has the

following potential payoffs in different states of the economy:

Good Medium Bad

Value with additional investment $250 $175 $125

Value without additional investment 50 50 50

Incremental value added 200 125 75

The $100 additional investment in the bad state of the economy should not be

made because it will lose $25

To prevent management from making the second investment in the bad economy

state, could structure the initial $100 investment to restrict future choices

For example, the initial investment could be $70 of senior debt and $30 of

subordinate debt

The value with the additional investment (the first row in the table above)

must first pay back the $70 of senior debt

Then only if there are sufficient funds could it support the additional $100

investment

In the bad state of the economy, there would only be $55 remaining, which is

clearly not enough to support the $100 additional investment

Thus, management is prevented from investing in a negative NPV project

This restriction will only work if the internal cash flows of the company are not

sufficient to cover the additional investment

JAM May 2012 1.02 SN 162 Page 7 of 10

A Monitoring Role for Banks

Banks could monitor the firm position much better than diffuse debt holders

Many debt holders would have the same free-rider problem discussed above

The bank could review the prospects before deciding to lend additional funds

This is a more flexible option compared to Example 18.3 above

However, if banks have too much influence it could make management too conservative

for the likes of equity holders

Borrowing from a bank can be done discretely; this is advantageous if the firm is trying

to keep proprietary secrets from its competitors

A Monitoring Role for Private Equity

Private equity suppliers (e.g. venture capital firms) could also provide monitoring

services

They are likely to provide more monitoring because

1. They have substantial equity stake

2. Their investment is not liquid, so interested in long-term viability of firm

3. They have the needed expertise

18.5 Executive Compensation

Stockholders are the principals and management is the agent hired by the principals

The Agency Problem

The tenant farmer (the agent) and the owner of the farm (the principal)

The farmer compensation should be tied to the output, but not too much because

outside influences (e.g. weather) can dramatically affect the crop and is not

controllable by the farmer

Two Components of an Agency Problem

1. Uncertainty the agent cannot control

2. Lack of information for the principal (cannot monitor the agent all the time)

Measuring Inputs versus Measuring Outputs

The principal can either closely measure the agent input (labor intensity) or indirectly

monitor the agent by measuring the output

In the mid-1970s it was popular to measure the input; however, it was difficult to

measure the quality of the input even if the quantity was objective

Now there is a tendency to monitor the output

JAM May 2012 1.02 SN 162 Page 8 of 10

Designing Optimal Incentive Contracts

Managers should not be penalized for factors outside their control

So should not tie the managers to the overall stock return; rather, should compare to

the stock return of other firms in the industry

Minimizing Agency Costs

Agency costs are the difference between actual firm value and hypothetical value if

the management and shareholder incentives were in sync

Is Executive Pay Closely Tied to Performance?

The Jensen and Murphy Evidence

In a 1990 article they argued executive compensation is not tied to performance

enough

More Recent Evidence

Subsequent evidence hints Jensen and Murphy underestimated the sensitivity

They failed to capture the future CEO compensation relationship to performance

Positive actions taken by the CEO are immediately reflected in the stock price on a

present value basis; the investors assume the positive results will continue into the

future

It is more important to compare cumulative compensation to cumulative stock gains

over many years

Cross-Sectional Differences in Pay-for-Performance Sensitivities

The performance sensitivities differ greatly by industry

Industries that have more potential agency problems tie the pay more to performance

Higher performance sensitivities is observed at smaller companies

Growth firms in volatile industries have smaller pay-for-performance sensitivities;

too much of the performance is outside the managers control

Is Pay-for-Performance Sensitivity Increasing?

It has increased over the past 20 years, mainly through stock options

JAM May 2012 1.02 SN 162 Page 9 of 10

How Does Firm Value Relate to the Use of Performance-Based Pay?

Empirical studies tend to show performance-based pay does improve financial results

However, the positive correlation does not imply causation

Managers may be inclined to accept performance-based pay if they expect high returns in

the short term

Thus, the implementation of performance-based pay could be a form of market signaling

Is Executive Compensation Tied to Relative Performance?

Relative performance compensation tie the managers pay to performance relative to a

benchmark

Stock options are the dominant form of performance-based compensation, and they are

not based on relative performance

Bonuses are easier to tie to relative benchmarks

Relative benchmarks could encourage too much competition within the industry

Stock-Based versus Earnings-Based Performance Pay

Stock-Based Compensation

Advantageous because ties managers directly to shareholder desire

Disadvantages include:

1. Stock prices change for reasons outside the managers control

2. Stock prices change due to changing expectations, not just realizations

This penalizes managers if the market has a favorable opinion of them in

advance

Earnings-Based Compensation

Advantageous because numbers are available for separate business units and privately

held firms

Disadvantages include:

1. Difficult to determine the appropriate measure

2. Accounting numbers can have quirks

Value-Based Management

Based on economic cash flows

Adjusts for the amount of capital used

JAM May 2012 1.02 SN 162 Page 10 of 10

Compensation Issues, Mergers, and Divestitures

Stock-based compensation is not as useful at motivating heads of business units since

their actions are not as impactful on the stock price

Spin-Offs and Carve Outs

Spin-offs create a new company by distributing shares to the existing shareholders

Carve outs create a new company through an IPO

Both of these could be done to better motivate the division heads

Mergers

Mergers combine separate firms into a single entity

Many divestitures undo past mergers

JAM May 2012 1.03 SN 163 Page 1 of 9

Financial Markets and Corporate Strategy by Greenblatt & Titman

Chapter 19: The Information Conveyed by Financial Decisions

(Study Note FET-163-08)

Introduction

Learning Objectives

1. Understand how financial decisions are affected by well-informed managers

2. Indentify situations in which managers may want to distort accounting information

3. Explain how dividend choice, capital structure, and real investments affect stock price

4. Interpret empirical evidence regarding stock price reaction to financing and investing

decisions

Introduction

The stock market reacts greatly to dividend changes and other financial restructurings

Managers often have inside information that cannot be disclosed to investors

The information could give the company a competitive advantage or the management

team may simply want to hide unfavorable news

Investors strive to interpret indirect news from management called signals

These actions (e.g. management purchasing shares) often speak louder than words

Managers often want to maximize the short-term stock price simply to boost their own

pay

Must distinguish between decisions that create value and decisions that simply signal

positively to shareholders

19.1 Management Incentives When Managers Have Better Information Than

Shareholders

Should the manager strive to maximize the current market value of the firms which is

based on public information or the true value of the firm (the intrinsic value) based on

private information?

Long-term shareholders prefer the maximization of intrinsic value

Short-term shareholders prefer the maximization of the current value

At times they even want management to conceal bad news

JAM May 2012 1.03 SN 163 Page 2 of 9

Conflicts between Short-Term and Long-Term Share Price Maximization

Reasons for management concern of current stock prices

1. May plan to issue equity or sell some of own stock

2. Prevent acquisition at a low price

3. Boost management compensation

4. Need higher price to attract customers and outside stakeholders

Managers want to increase the weighted average of the current and intrinsic value; must

determine these weights based on the particular circumstances

Good decisions can reveal unfavorable information and bad decisions can reveal

favorable information

This means stock price reactions do not necessarily imply the decision was good or bad

19.2 Earnings Manipulation

Managers often increase reported earnings in the current year at the expense of future

years

Depreciation and inventory methods can be used to manage earnings

Some of the methods are disclosed, but other estimates left to manager discretion are

hidden from shareholders

Incentives to Increase or Decrease Accounting Earnings

Earnings are manipulated most when it is most advantageous

For example, earnings will be increased prior to a stock issue

Sometimes the earnings will be lowered (e.g. prior to union negotiations or plea for

government assistance)

JAM May 2012 1.03 SN 163 Page 3 of 9

19.3 Shortsighted Investment Choices

Savvy investors rarely take the reported earnings at face value

Sometimes cash flow numbers are more reliable

Managements Reluctance to Undertake Long-Term Investments

Some investments will not generate significant profits for many years

Analysts are skeptical about management claims of future profits; they are more

concerned about the current year profits

This causes reluctance for managers to invest in long-term projects

A manager only concerned about maximizing intrinsic value would still undertake good

long-term investments

What Determines a Managers Incentive to be Shortsighted?

The weights assigned to the current value and intrinsic value determine the

shortsightedness

19.4 The Information Content of Dividend and Share Repurchase Announcements

Empirical Evidence on Stock Returns at the Time of Dividend Announcements

Stock prices increase about 2% on announcement of a dividend increase; the jump is

greater if no previous dividends have been paid

Stock prices drop about 9.5% when dividends are cut or omitted

However, this does not mean increased dividends are good for intrinsic value

maximization

JAM May 2012 1.03 SN 163 Page 4 of 9

A Dividend Signaling Model

Operating Cash Flow = Investment Expenditures Change in Equity + Dividends

A company must use the internal cash flows for investments or give it back to

shareholders

Information Observed by Investors

Assume investors cannot observe the operating cash flows and investment

expenditures

They can observe the dividends paid and amount of capital raised

The Information Content of a Dividend Change

Increased dividends could mean higher operating cash flow (which is good) or

reduced investment expenditures (which is bad)

Dividend Signaling and Underinvestment

If the manager is focused on the current stock price, will likely forgo some

investment opportunities to increase the current dividends

Often this will hurt the intrinsic value of the company

Do Positive Stock Price Responses Imply That a Decision Creates Value?

Not necessarily

As mentioned above, increased dividends could actually mean the company is not

making proper investments

Also, dividend cuts could be viewed negatively by the market when it is the prudent

decision for management to make worthwhile investments

Share Repurchases versus Dividends

Share repurchases are equivalent to dividends, ignoring transaction costs and taxes

Studies have shown stock prices react favorably to share repurchase announcements

A greater stock price reaction is observed for tender offers compared to purchases

made in the open market

This occurs because tender offers are usually larger in size and at a premium

Simultaneous dividend cuts and share repurchases should be a wash in the market

However, the market may view the share repurchase as a one-time event and the

dividend cut as permanent

Share repurchases are more tax efficient for the investor

There is very limited empirical evidence on simultaneous dividend cuts and share

repurchases

JAM May 2012 1.03 SN 163 Page 5 of 9

Dividend Policy and Investment Incentives

Investors and analysts rarely know details about the investment opportunities of the firm

Can Dividend Cuts Signal Improved Investment Opportunities?

Management must convince the shareholders the investments are worthwhile

Sometimes the shareholders will believe management, other times they will not

Dividend Cuts and the Incentive to Overinvest

Managers may overinvest simply to see the firm grow rather than add value for the

shareholders

Studies have shown companies with better investment opportunities (measured by the

ratio of the market value to the book value) have smaller market reactions to dividend

cuts and dividend increases

This could simply show people who invest in growth stocks (high MV to BV ratio)

are not interested in dividends

Dividends Attract Attention

There is more incentive for management to attract attention when it feels the firm is

undervalued

Stock dividends and stock splits also usually increase the share price even though they do

not affect the firms cash flows

This could be due solely to the attention the announcement solicits

19.5 The Information Content of the Debt-Equity Choice

Two key pieces of information in the debt/equity choice

1. Managers will avoid debt if think it will be difficult to repay; therefore, debt

issues express the management confidence in future cash flow

2. Managers would be reluctant to issue equity if they thought the shares were

underpriced; therefore, equity issues may signal overpriced shares

A Signaling Model Based on the Tax Gain/Financial Distress Trade-Off

When issuing debt, management must weigh the tax benefits with the cost of financial

distress

Management that expects large future cash flows will favor debt financing

Management may even increase leverage when it reduces the intrinsic value just to pump

up the current stock price

In order for this to be a credible market signal firms with poor prospects must find it

difficult to issue debt

JAM May 2012 1.03 SN 163 Page 6 of 9

The Credibility of the Debt-Equity Signal

Sometimes a firm will take on more debt than desired just to send a strong market

signal

Investors must take into account the motives of management

For example, the CEO would like to increase the stock price right before a sale of his

or her personal shares

The investors must determine if management (in particular the CEO) has a long-term

or short-term agenda

Adverse Selection Theory

Adverse selection is displayed when individuals choose among various medical or dental

insurance plans

Managers have the greatest incentive to sell stock when it is a lemon (overpriced)

Adverse Selection Problems When Insiders Sell Shares

An entrepreneur must consider the following when deciding how many shares to sell:

1. Diversification benefits

2. Tax costs

3. Whether the shares are undervalued or overvalued

Investors watch carefully the buying and selling by insiders

The big inside investors must convince the market that selling shares is not a bad

signal for the company stock

Adverse Selection Problems When Firms Raise Money for New Investments

Firms may pass up good investments just to avoid issuing equity

This is especially true if the current stock price is below the intrinsic value

Using Debt Financing to Mitigate the Adverse Selection Problem

With debt financing, a company should take on a new project provided it has a

positive NPV

Management does not have to worry about the current stock price be undervalued

Management may still pass up good investments if it increases the risk of bankruptcy

too much

Adverse Selection and the Use of Preferred Stock

Preferred stock has fixed payments like a bond but avoids the financial distress risk

because missing payments does not cause bankruptcy

Preferred stock may be a good option for firms that are experiencing temporary

financial problems

JAM May 2012 1.03 SN 163 Page 7 of 9

Empirical Implications of the Adverse Selection Theory

1. The reluctance of managers to issue equity when the stock price is undervalued

explains why the stock price drops when equity is issued

2. Also explains why managers prefer the following order for financing projects:

a. Retained earnings

b. Debt

c. Equity

19.6 Empirical Evidence

What is an Event Study?

Examine stock price responses to announcements

The stock price often moves a few days before the announcement because information is

leaked to the public

Also, sometimes the stock price reacts slowly to the news over several days

Therefore, many studies average the total return or excess return over several days

Excess return calculations adjust for the market returns, which is most important for

small samples

Event Study Evidence

Capital Structure Changes

Leverage-increasing events (e.g. stock repurchase, exchange debt for preferred) tend

to increase stock prices and leverage-decreasing events (e.g. conversion-forcing call,

common stock sale) tend to decrease stock prices

Issuing Securities

In general raising capital is viewed negatively by the market

It implies the company has generated insufficient internal capital

The negative reaction is much more severe for equity issues because it also implies

management thinks the stock is overpriced

Debt issues get almost a neutral market reaction because the market likes the increase

in leverage

JAM May 2012 1.03 SN 163 Page 8 of 9

Explanations for the Event Study Results

The empirical findings above are consistent with the adverse selection theory

Equity issues are most subject to adverse selection (management knows the stock

price is overvalued) and short-term bank debt is least subject to adverse selection

Management is enticed to buy back shares when the stock price is undervalued

Managers also are willing to take on debt when they expect the future profits to be

sufficient to cover the cash flow needs

Summary of the Event Study Findings

Stock prices react favorably to

1. Distributing cash to shareholders

2. Increasing leverage

Stock prices react negatively to

1. Raising cash

2. Decreasing leverage

Differential Announcement Date Returns

Announcements of equity issues will be perceived less negatively if investors realize

the company cannot easily issue debt

The empirical evidence supports this conclusion

Postannouncement Drift

The market often underreacts to important information

Studies have shown the market underreacts to dividend initiations and omissions

It also underracts to equity issues and share repurchases

Investors may place too much confidence in their own analysis of the firms value

before the announcement

JAM May 2012 1.03 SN 163 Page 9 of 9

How Does the Availability of Cash Affect Investment Expenditures?

The borrowing capacity and availability of cash affect a firms ability to invest

Too much debt financing can hurt the companys credit rating, which could affect its

ability to attract customers

Empirical Evidence in the United States

Studies have shown companies limit investments based on cash flows

This is especially true for companies that pay lower dividends

Empirical Evidence in Japan

A keiretsu family is a group of firms with interlocking ownership structures

It makes it difficult for another firm to take them over

The family is usually held by a large bank that can supply the capital needs

Therefore, investment decisions are not greatly impacted by cash flow

JAM May 2012 1.04 SN 170 Page 1 of 7

The New Corporate Finance

Where Theory Meets Practice (Third Edition) by Chew

Chapter 31: Theory of Risk Capital in Financial Firms

(Study Note FET-170-09)

Introduction

Primarily focused on principals in business parties that engage in asset-related (e.g.

lending) and liability-related (e.g. deposit taking) activities

Distinguishing features of principal financial firms

1. Credit-sensitivity of customers

Because customers can be major liabilityholders

Customers prefer high credit quality

2. High cost of capital

Because of opaqueness to customers and investors

The detailed asset holdings and business activities are not publicly disclosed

Changes can occur quickly and cannot be easily monitored by customers and

investors

This causes high agency and information costs

3. Profitability is highly sensitive to cost of capital

Because operate in competitive financial markets

Must correctly charge for the capital commitments

Difficult to allocate capital to business units

What is Risk Capital?

Smallest amount to insure value of the firms net assets against a loss

Net assets are the gross assets less the customer liabilities

The riskiness of the net assets depends on riskiness of gross assets and customer

liabilities

Risk capital differs from both regulatory capital (based on accounting standard) and cash

capital (cash required to execute transaction)

JAM May 2012 1.04 SN 170 Page 2 of 7

Measuring Risk Capital

Hypothetical Example

New firm (Merchant Bank) with no initial assets

Only deal is one-year $100 million bridge loan paying 20% interest

The risk-free rate is 10%

Three potential scenarios

1. Anticipated Return of $120 million

2. Disaster Return of $60 million

3. Catastrophe Return of $0

Possibilities with No Customer Liabilities

1. Risk Capital and Asset Guarantees

Finance with risk-free note that pays $110 million at maturity

For $5 million Merchant Bank can buy insurance that guarantees a return of $110

million on the bridge loan

The price of the loan insurance is the risk capital

Accounting Balance Sheet

Assets Liabilities

Bridge Loan $100 Note (default free) $100

Loan Insurance 5 Shareholder Equity 5

Risk-Capital Balance Sheet

Assets Liabilities

Bridge Loan $100 Note (default free) $100

Loan Insurance 5 Risk capital 5

The payoff scenarios are as follows:

Scenario Bridge Loan Loan Insurance

Bridge Loan +

Loan Insurance Note Shareholder

Anticipated 120 0 120 110 10

Disaster 60 50 110 110 0

Catastrophe 0 110 110 110 0

JAM May 2012 1.04 SN 170 Page 3 of 7

2. Risk Capital and Liability Guarantees

Rather than purchasing insurance on the bridge loan, the parent of Merchant Bank

could guarantee the note

Accounting Balance Sheet

Assets Liabilities

Bridge Loan $100 Note (default free) $100

Shareholder Equity 0

Risk-Capital Balance Sheet

Assets Liabilities

Bridge Loan $100 Note (default free) $100

Note Guarantee

(from parent)

G Risk capital G

Since economically it is the same as purchasing insurance on the bridge loan, G must

equal $5 million

The shareholder payoffs are the same

3. Liabilities with Default Risk

Now Merchant Bank will finance by issuing a liability with some default risk

The risky note is only worth $95 million since $5 million must be subtracted for the

default risk

Risky Note = Default-free Note Note Insurance

The economic effect and shareholder payoffs are again the same

Accounting Balance Sheet

Assets Liabilities

Bridge Loan $100 Note (risky) $100 D

Shareholder Equity D

Assets Liabilities

Bridge Loan $100 Note (default free) $100

Asset insurance

(from note holder)

5 Risk Capital 5

The accounting balance sheet for the above three examples could be different, but the

risk-capital balance sheets are all very similar

JAM May 2012 1.04 SN 170 Page 4 of 7

Possibility with Fixed Customer Liability

Assume a firm has risky assets worth $2.5 billion

The price of complete insurance for the asset portfolio is $500 million

The firm has issued one-year guaranteed investment contracts (GICs) promising 10% on

the face value of $1 billion

Junior debt with a face value of $1 billion and promised return of 10% is used with $500

million of equity to fund the balance

Partial insurance on the investment portfolio has been purchased for $200 million; it will

cover the first $300 million of losses

Insurance on the entire $2.5 billion portfolio is valued at $500 million; this is the value of

an at-the-money put option on the risky asset portfolio

Assuming the GIC has a market value of $990 million (11% yield) and the junior debt

has a market value of $900 million (22% yield), the accounting balance sheet looks like:

Assets Liabilities

Investment portfolio $2,500 GICs (par $1,000) $990

Third-party insurance 200 Debt (par $1,000) 900

Equity 810

Total Assets 2,700 Total Liabilities 2,700

The risk-capital balance sheet of the firm is as follows:

Assets Liabilities

Investment portfolio $2,500 Cash Capital (default free)

Customers (GICs) $1,000

Asset Insurance Debtholders 1,000

Equityholders (residual) 190 Equityholders 500

Insurance Co. (third-party) 200 Total Cash Capital 2,500

Debtholders (disaster) 100

Customers (catastrophe) 10 Risk Capital (Equityholders) 500

Total Insurance 500

Total Assets 3,000 Total Capital 3,000

The debtholder and customer asset insurance is simply the par value minus the market

value (1000 900 = 100 and 1000 990 = 10)

The equityholder asset insurance is just the plug to make the total equal $500, which

is the value of complete insurance on the risky assets

JAM May 2012 1.04 SN 170 Page 5 of 7

Basic functions of capital providers

1. All provide cash capital

2. All are sellers of asset insurance (to varying degrees)

Customers usually offer the least amount because they prefer the contract values

not be tied to the firm

3. Provision of risk capital

Possibility with Contingent Customer Liabilities

Assume a company issues a liability that credits the total return on the S&P 500

Consider three investment strategies for the company

1. Invest all in risk-free securities

In this case the gross assets are risk-free, but the net assets (gross assets less

liabilities) are very risky

Effectively the company is short the S&P 500 index

The company could protect itself by purchasing a call option on the index, so that

represents the risk capital of the company

2. Invest in the S&P 500

Now the gross assets are risky, but the net assets are risk-free

Hence no risk-capital is required

3. Invest in a customized stock portfolio

Now both the gross assets and net assets are risky

The net assets are risky to the extent the customized stock portfolio does not track

the S&P 500 index

Accounting for Risk Capital in the Calculation of Profits

Risk capital is used to implicitly or explicitly purchase insurance on the net assets of the

firm

The gains and losses on this insurance should affect profitability

External insurance commonly shows up as an expense on the income statement; internal

transactions should do the same

If the parent company provides a guarantee, the cost of the guarantee (i.e. insurance

premium) should show up as an expense for the subsidiary

This will not affect consolidated earnings, but it will impact the results by line

JAM May 2012 1.04 SN 170 Page 6 of 7

The Economic Cost of Risk Capital

The expected economic cost of capital must be calculated to adjust the expected profits

If insurance can be purchased at its fair value, then risk capital will not be costly

Usually a spread is built into the price of insurance, which turns out to be the economic

cost

The spread is needed to cover various forms of insurance risk, such as:

1. Adverse selection (the insurance company cannot distinguish good risks from bad

risks)

2. Moral hazard (cannot monitor the actions of the insured)

3. Agency costs (due to inefficiency or mismanagement)

Spreads are relatively high because the principal financial firms are opaque in structure

The cost of the capital is dependent on the form

Shareholders in all equity firms will have high agency costs (flexibility for

management) but low moral hazard (no incentive to increase risk haphazardly)

Debt financing has high moral hazard but less agency costs

The transparency could be increased to reduce the cost of risk capital, but then would

give away potential competitive advantages

The full insurance premium is deducted when measuring the profits after the fact; only

the economic cost is deducted ex ante

Hedging and Risk Management

Firms that speculate on the direction of the market will require more risk capital

Market risk can be hedged with derivatives like futures, forwards, swaps, and options

Hedging broad market risks is usually not that expensive because the spreads are small

JAM May 2012 1.04 SN 170 Page 7 of 7

Capital Allocation and Capital Budgeting

Could assume the capital for a particular business is just the risk capital applicable to that

business; this ignores the benefits of diversification

The amount of risk capital is needed (in addition to just the economic cost) to calculate

the profits after the fact

The diversification benefit will be more pronounced when the businesses are not that

correlated

Notice in Table 3 on page 450 the total risk capital should be $394 rather than $294

Marginal capital should be used for each business rather than the risk capital required on

a stand-alone basis

Correlations among business units affect the total economic cost of capital

Technical Appendix

The risk capital in Table 1 (on page 450) is based on the price of a put option

If the net assets were invested risklessly, they would grow to ( )

0 0

rT

A L e -

The shortfall in net assets relative to the riskless return is ( ) ( )

0 0

rT

T T

A L e A L - - -

Insurance to permit default-free financing is effectively a put option on the net assets with

a strike of ( )

0 0

rT

A L e -

The put option value can be approximated with the following formula

( )

0

Risk Capital 0.4 A T s =

! is the volatility of A

t

/L

t

JAM May 2012 1.05 SN 114 Page 1 of 5

Capital Allocation in Financial Firms by Andre Perold

(Study Note FET-114-07)

Introduction

The approach in this article is similar to the risk-adjusted return on capital (RAROC)

Risk capital is determined by the loss exposure of its stakeholders

It is very important to financial firms because customers only want policies from highly-

rated entities

Most of the risk is borne by equity-holders and uninsured debt holders, not customers

who purchase low-default-risk liabilities

Low-default-risk (cash capital) and risk-bearing (risk capital) funding is provided by

the various stakeholders

Firms should try to most efficiently manage risk capital (i.e. minimize blended

deadweight costs)

Sources of deadweight capital costs

1. Information costs

Financial firms are secretive and can change quickly, thus making it impossible

for outsiders to adequately monitor them

2. Higher taxes and agency costs of free cash flow

The tendency of companies to waste excess cash flow on low-return projects

Decreasing firm-wide risk can reduce the cost of guarantees

Diversified firms have more investment opportunities because the risk capital is reduced

Should not operate a transparent business (e.g. S&P 500 index fund) within an opaque

financial firm

Outsiders cannot clearly see the holdings and strategies of opaque financial firms

Risk Capital

Often calculated with value at risk (VaR)

Merton and Perold definition of risk capital

Smallest amount that can be invested to insure the value of the firms net assets

against a loss in value relative to a risk-free investment

Using the above definition, the risk capital for a treasury bond is the price of a put option

struck at the forward price of the bond

VaR ignores the magnitude of the loss in the extreme tail of the distribution

Diversification benefits can be very large

JAM May 2012 1.05 SN 114 Page 2 of 5

Allocation of the Cost of Risk Capital

Diversified financial firms should have lower capital costs and thus greater returns

Opaque financial firms should use low-cost hedging instruments when possible

Capital can be allocated on a stand-alone, fully allocated, or marginal basis

Example

Assume both business units A and B have stand-alone capital requirements of 100

The correlation of their profits is zero

The fully allocated risk capital for both businesses is

2 2

100 100 141.4 + =

The marginal capital for each is 141.4 100 = 41.4

Different investment decisions will be made based on the choice of capital allocation

Many firms only recognize diversification within business units, not between them

A Model of the Financial Firm

In this example, SwapCo is a low-cost swap dealer

SwapCo is in business for one time period; all contracts are due at time 1

SwapCo hedges the liabilities, but there is some residual basis risk that is unhedged

SwapCos profits are , which is the present value of the spread over the fair value of the

customer liabilities

The initial price for the customer is L(0) + , where L(0) is the default-free value

L(0) is invested in the hedge portfolio H; is invested at the risk-free rate

The cumulative hedging error is E(t) = H(t) L(t), which makes the total end-of-year

operating profits equal (1 + r) + E(1)

Assume the profits are normally distributed with mean of (1 + r) + " and standard

deviation of !; the term " represents the risk premium for exposure of the hedging error

to systematic risk

SwapCos Balance Sheet

The initial assets consist of a hedge portfolio, external guarantee, and a cash cushion C

(part of which is from the spread)

The external investment required = C + Cost of Guarantee

The net assets (excluding the external guarantee) at time 1 are:

( ) 1 (1) S C r E = + +

The payoff from the external guarantee is { } , 0 S Max S

-

= -

Only has a positive payoff if the net assets are negative

JAM May 2012 1.05 SN 114 Page 3 of 5

Deadweight Costs

1. Guarantor monitoring SwapCo

Modeled as a fraction, m, of the shareholder deficit, S

-

{ }

m V S

-

, where

{ }

V S

-

is a present value calculation (defined below)

This makes the total cost of insurance equal

( ) { }

1 m V S

-

+

2. Double taxation and free cash flow agency costs

Modeled as a fraction, d, of the shareholder surplus, S

+

The shareholder equity is therefore worth

( ) { }

1 d V S

+

-

Valuation

( ) { } ( ) ( ) { } { } { }

1 1 NPV d V S C m V S dV S mV S m m

+ - + -

= - - - - + = - +

So the net present value is the firms operating profits less the value of the deadweight

capital

{ }

[ ]

{ }

[ ] ( ) ( ) ( ) ( )

1 1

n z zN z n z zN z

V S V S

r r

s s

+ -

+ - -

= =

+ +

, where

( ) 1 C r

z

s

+

= and n( ) and N( ) are the standard normal and cumulative standard

normal distributions

! is the risk-neutral standard deviation of the hedging error

Minimization of Deadweight Costs

Higher initial cash will reduce the guarantee premium and monitoring costs but increase

the double taxation and free cash flow agency costs

Minimize total deadweight costs when the shortfall probability =

d

d m +

The initial cash cushion that minimizes the deadweight costs is

( )

*

1

m

d m

Z

C

r

s

+

=

+

, where Z( ) is the inverse of the cumulative normal distribution

At the optimal cash cushion, the value of the deadweight costs is

{ } { }

( ) ( )

2

1

2

exp

2

1

m

d m

d m Z

dV S mV S

r

s

p

+

+ -

+ -

+ =

+

JAM May 2012 1.05 SN 114 Page 4 of 5

Main Result

( )

( ) ( )

2

1

2

where

exp

2 1

m

d m

NPV kR

R k d m Z

r

m

s

p

+

= -

= = + -

+

R is the value of the put option on the hedging error, which is the Merton and Perold

measure of risk capital

k is the minimized cost of deadweight capital

Numerical Example

Risk-free rate = r = 10% = 150 ! = 250 d = 10% m = 100%

( )

90.7

2 1

R

r

s

p

= =

+

, which means the return on capital is

150

165%

90.7

=

( ) ( ) ( )

*

0.909 250

1 1.1

m

d m

Z Z

C

r

s

+

= = =

+

303

N(1.335) = 0.909

( ) ( ) ( ) ( )

2

2

1 1

2 2

exp 1.1 exp 1.335 45.1%

m

d m

k d m Z

+

= + - = - =

The return on capital (165%) is clearly more than the deadweight cost of capital (45.1%)

Cost of the Guarantee

( ) ( ) ( )

{ }

[ ] ( )[ ]

( ) { }

2

1

2

1 303 1.1

1.3332

250

1

( ) exp 0.1641 ( ) 0.0912

2

( ) ( ) 250 0.0425

9.66

1 1.1

Guarantee Cost 1 19

C r

z

n z z N z

n z zN z

V S

r

m V S

s

p

s

-

-

+

= = =

= - = - =

- -

= = =

+

= + =

Total Investor Capital = C + Cost of Guarantee = 172

( ) ( ) 150 45.1% 90.7 109 NPV kR m = - = - =

JAM May 2012 1.05 SN 114 Page 5 of 5

Application of the Model to Capital Allocation Within the Firm

Should seek to maximize NPV of the firm

Capital Budgeting

If k is constant, then for any project just need the marginal effect on the profits and firm-

wide risk capital

Should accept the project if 0 k R m D - D >

The incremental risk capital can be approximated with R bR D = , where b is the

correlation coefficient of the projects profits with firm-wide profits

If b is negative, then the project will act like a hedge

Risk Management

Any risk that can be costlessly hedged should be hedged

Costly hedges should be evaluated like any other project

Comparison with RAROC

In this model the numerator (#) is the economic value of profits and the denominator

(#R) is the marginal risk capital

The hurdle rate (k) measures the firms deadweight cost of capital

JAM May 2012 1.06 SN 166 Page 1 of 10

Corporate Finance Theory by Megginson

Chapter 2: Ownership, Control, and Compensation

(Study Note FET-166-09)

Introduction

Corporate finance theory usually assumes perfect capital markets

A countrys legal, cultural, and historical environment affect finances

Successful countries (e.g. US, Japan, and Germany) have different structures

An economic system must simultaneously promote competition and cooperation

Companies must be monitored and disciplined

Legal Forms of Business Organization in the United States

Basic forms of business ownership in the United States

1. Sole proprietorship

2. Partnership

3. Corporation

The forms differ in the number of people that own the business, legal responsibility of

members, and tax treatment

There are also hybrid organizations such as limited partnerships

Regular corporations constitutes most of the business

The Sole Proprietorship Form

A sole proprietorship is a business with a single owner

All business assets belong to the owner personally

They are easy to start and terminate

The tax reporting is also simple

Sole proprietorships dominate industries in which the optimal size is small

Key disadvantages

1. Limited life

2. Limited access to capital

Can only access capital from reinvested profits and personal borrowings

3. Unlimited personal liability

JAM May 2012 1.06 SN 166 Page 2 of 10

The Partnership Form

Like a proprietorship, but more than one owner

All partners can execute contracts binding on others, and all partners are personally liable

Usually the partnership agreements are in writing

Partnership income is only taxed at the personal level

Advantageous because people can pool resources and expertise

Partnerships strive in industries that should not separate ownership and control

Also competitive in knowledge-intensive businesses that need little financial capital

Advantages

1. Income only taxed once

2. Can raise funds from multiple partners

Disadvantages

1. Limited life

2. Limited access to capital

3. Unlimited personal liability

The Corporate Form

A corporation is a separate legal entity

It can own property, sue and be sued, and execute contracts

Benefits

1. Limited liability for shareholders

2. Perpetual life

3. Can contract with many managers, suppliers, customers, and employees

4. Many ways to raise capital

5. Ownership shares can be traded freely if it is a public corporation

Disadvantages

1. Corporate income is taxed at both the company and personal levels

This is a huge incentive to remain a sole proprietorship or partnership

2. Transaction costs of setting up and running corporations

SEC filings, shareholder communications

JAM May 2012 1.06 SN 166 Page 3 of 10

3. Monitoring and disciplining corporate executives (separation of ownership and

control)

Shareholders are residual claimants that can diversify

No individual shareholders steps up to effectively monitor management even

though it is in their collective best interest

Individual shareholders are looking for a free ride

Executives effectively seize control of the corporation

The Limited Partnership Form

Combines the best features of the general partnership and corporate organization

Limited liability without the double taxation

Only the general partners are legally liable

Usually there are many passive investors (limited partners)

Common for commercial real estate ventures and research and development

Investors can utilize tax losses in the early years

Disadvantages include long lives and illiquidity

Also difficult to set up and monitor

The S Corporation Form

Allows shareholders to be taxed as partners while retaining limited liability status

To be eligible, must have less than 35 non-corporate shareholders and cannot be a

holding company

Only a single class of equity can be outstanding

Can easily switch to a C corporation if outgrows the 35 shareholder limit

Organizational Choices Confronting US Business Owners

The forms differ from each other in ease of formation, length of existence, access to

capital, liability of equity investors, and tax treatment

Public companies have stock listed on the exchange

Private companies rarely report much information

Capital requirements usually force companies to choose C corporations, despite the tax

disadvantage

JAM May 2012 1.06 SN 166 Page 4 of 10

Forms of Business Organization Used by Non-US Companies

Worldwide Patterns

In most capitalistic economies, some form of joint-stock, limited liability structure

dominates

They are similar to publicly traded US companies

State-Owned Enterprises and Privatization

Outside the US, state-owned enterprises (SOEs) were common in industries such as

telephone, television and airline

Privatization programs are transforming this

The British government privatized much of their industry in the 1980s

The success of Britain led to similar programs in other countries

Ownership Structure and Corporate Policy

Three basic models

1. Open corporate model (common in large American corporations)

2. Closed or entrepreneurial model (common in large private companies in western

Europe and east Asia)

3. Industrial group model (e.g. Keiretsu in Japan)

The Open Corporate Model

Limited liability company with transferable claims

Professional managers with many financing sources

These companies dominate business in the US, Canada, and Great Britain

Many of these corporations are very large

Key financial characteristics

1. Rely on public capital markets for external financing (but finance most internally)

2. Shares are held by many shareholders that each hold a small percentage

3. Countries rely on formal legal contracting, government regulation, and private

litigation to control

4. Large, liquid, and informationally efficient stock and bond markets

5. Regulations designed to protect small stockholders

6. Controlled by professional managers

7. Equity-based compensation for managers and employees

8. Active market for corporate control

JAM May 2012 1.06 SN 166 Page 5 of 10

Weaknesses

1. Separation of ownership and control

Many agency problems

Managers may select directors who are loyal to management

Difficult to control managers that have enough free cash flow

Institutional investors could take a more active monitoring role, but American

security laws prevent this

Takeovers are expensive and difficult to execute successfully

2. Entrenchment incentives

3. Lack of powerful, informed monitors

4. Excessive, mandated information disclosure

Reduces value of proprietary information

Strengths

1. Can raise enormous sums to finance corporate investments

2. Financing transparency promotes investor and political support (reduces mistrust)

3. Allocational efficiency corporate resources given to most successful managers

Disciplined by internal governance and market competition

Focus on value-maximizing activities since shareholders want to maximize

earnings

4. Specialization of labor through ownership separation

5. Promotes private pension plans

6. Risk-tolerant equity markets promote entrepreneurial growth

7. Technology lowers information acquisition and monitoring

The Closed, (Entrepreneurial) Corporate Form

Sometimes appears to be a younger, not-yet-mature open corporation

However, many choose to remain small

Consists of non tradeable shares and a very tight ownership structure

Many are controlled by their entrepreneur/founders

Typical of the financial-intermediary-based corporate finance systems

Geographic Distribution

More important outside the US (Europe and east Asia)

These economies are much smaller than the US, so smaller companies are optimal

JAM May 2012 1.06 SN 166 Page 6 of 10

Characteristics of Financial-Intermediary-Based System of Corporate Finance

1. Many mid-sized, closely-held companies; few large, publicly-traded companies

2. A few strong commercial banks dominate corporate financing and governance

3. Commercial banks also serve as investment banks

4. Capital markets play small, but growing role

5. Little mandated information disclosure, so less transparency

6. Less reliance on professional managers and stock-based compensation

7. Rare struggles for corporate control; protection from hostile foreign acquisition

Strengths of Financial-Intermediary-Based System of Corporate Finance

1. Intermediaries are natural corporate monitors; European bankruptcy laws favor

creditors over shareholders and managers

2. Commercial banks have comparative advantage in raising investment capital

compared to public capital markets

3. Intermediaries can build long-term relationships with client firm management

teams

4. Can better handle borrower financial distress

5. Better at funding multi-year investment programs

Weaknesses of Financial-Intermediary-Based System of Corporate Finance

1. Conflict of interest for bankers acting as creditors and shareholders

2. Very little public transparency

3. Higher costs for large scale financing

4. Information processing technology is reducing value of bank franchises

Strengths of Closed Corporate Form

1. Important decisions can be made quickly and executed by people with a stake in

the business

2. Very few agency problems since managers and shareholders tend to be the same

people

3. Develop niche marketing strategy that is focused

Weaknesses of Closed Corporate Form

1. Current stockholders cannot diversify or attract professional managers with equity

2. Often become trapped in hostile control coalition (nobody can leave)

3. Financially constrained (usually limited to debt issues)

JAM May 2012 1.06 SN 166 Page 7 of 10

Large Industrial Groupings

Virtually no role in the US since the early 1900s; now mostly prominent in Asia

Key features

1. Close alliance of manufacturing, marketing, and banking companies

2. Group held together with cross-shareholdings and joint ventures

3. A commercial bank typically provides financing

Successful examples are in Japan and South Korea

Historical Evolution

Japan began to industrialize at a rapid rate around 1870

Large, family-controlled corporate groups led the way (called Zaibatsu)

The Zaibatsu were broken up following World War II, but reemerged as Keiretsu in

1955

Characteristics of Industrial Group System

1. National economies dominated by small number of large and powerful industrial

groups

2. Commercial bank leads a group of manufacturing, distribution, and assembly

companies

3. The lead company exercises control through direct majority shareholdings or

managerial authority

4. Leading exporters for country, so close relationship with national government

5. Some are run by founding families while others are run by professional managers

6. Capital markets play a very small role

7. Stock-based compensation is almost never used

Strengths of the Industrial Group Corporate Finance System

1. Good for rapid economic development without need for foreign investment or

heavy government involvement

2. Groups become very strong and discourage foreign competitors