Professional Documents

Culture Documents

Business Policy, Ethics and Strategy of Grameen Danone Food Ltd. (GDFL)

Business Policy, Ethics and Strategy of Grameen Danone Food Ltd. (GDFL)

Uploaded by

Shamim Hossain0 ratings0% found this document useful (0 votes)

5 views23 pagesStrategic management analyzes the major initiatives taken by a company's top management on behalf of owners, involving resources and performance in internal and external environments. Strategic management provides overall direction to the enterprise and is closely related to the field of Organization Studies. In short, it entails specifying the organization's objectives, developing policies and plans designed to achieve these objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision making and in understanding infinitely complex macro-economic environments. Strategic management is not static in nature; the models often include a feedback loop to monitor execution and inform the next round of planning.

This report focuses on Business policy, ethics and strategy of Grameen Danone Food Ltd, a Grameen Group and Group DANONE joined forces since March 2006 to create Grameen Danone Foods Ltd, a social business based in Bangladesh. Grameen Danone Foods Ltd’s mission is to reduce poverty by a unique proximity business model that will provide daily healthy nutrition to the poor of Bangladesh. Grameen Danone Foods Ltd is the first investment supported by ‘danone.communities’, an investment fund, created to support businesses that aim to be sustainable.

Original Title

Strategic.grameen

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStrategic management analyzes the major initiatives taken by a company's top management on behalf of owners, involving resources and performance in internal and external environments. Strategic management provides overall direction to the enterprise and is closely related to the field of Organization Studies. In short, it entails specifying the organization's objectives, developing policies and plans designed to achieve these objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision making and in understanding infinitely complex macro-economic environments. Strategic management is not static in nature; the models often include a feedback loop to monitor execution and inform the next round of planning.

This report focuses on Business policy, ethics and strategy of Grameen Danone Food Ltd, a Grameen Group and Group DANONE joined forces since March 2006 to create Grameen Danone Foods Ltd, a social business based in Bangladesh. Grameen Danone Foods Ltd’s mission is to reduce poverty by a unique proximity business model that will provide daily healthy nutrition to the poor of Bangladesh. Grameen Danone Foods Ltd is the first investment supported by ‘danone.communities’, an investment fund, created to support businesses that aim to be sustainable.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views23 pagesBusiness Policy, Ethics and Strategy of Grameen Danone Food Ltd. (GDFL)

Business Policy, Ethics and Strategy of Grameen Danone Food Ltd. (GDFL)

Uploaded by

Shamim HossainStrategic management analyzes the major initiatives taken by a company's top management on behalf of owners, involving resources and performance in internal and external environments. Strategic management provides overall direction to the enterprise and is closely related to the field of Organization Studies. In short, it entails specifying the organization's objectives, developing policies and plans designed to achieve these objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision making and in understanding infinitely complex macro-economic environments. Strategic management is not static in nature; the models often include a feedback loop to monitor execution and inform the next round of planning.

This report focuses on Business policy, ethics and strategy of Grameen Danone Food Ltd, a Grameen Group and Group DANONE joined forces since March 2006 to create Grameen Danone Foods Ltd, a social business based in Bangladesh. Grameen Danone Foods Ltd’s mission is to reduce poverty by a unique proximity business model that will provide daily healthy nutrition to the poor of Bangladesh. Grameen Danone Foods Ltd is the first investment supported by ‘danone.communities’, an investment fund, created to support businesses that aim to be sustainable.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 23

A report on

Business policy, ethics and strategy

Of

Grameen Danone Food Ltd. (GDFL)

University of Dhaka

Dept. of Finance

Faculty of Business Studies

A report on

Business policy, ethics and strategy Of Grameen Danone Food Ltd. (GDFL)

Course code: F-410

Course name: Business policy, ethics and strategy

Prepared for

Shabnaz Abdullah Aditi

Associate Professor

Dept. of Finance

University of Dhaka

Prepared by

No. Name ID

1 Deepangkar Saha 16-089

2 Muhammad Shamim Hossain 16-151

3 Farhanur Rahman Naim 16-135

4 Anowarul Hoque 16-253

5 Robin Kumar Saha 16-039

6 Omar Faruk 16-262

Submission Date:

11th February, 2014

Table of Contents

Introduction

Grameen Danone Food Ltd.

Internal resources and capabilities of GDFL

Industry analysis

External analysis of GDFL

Introduction

Strategic management analyzes the major initiatives taken by a company's top management on

behalf of owners, involving resources and performance in internal and external environments.

Strategic management provides overall direction to the enterprise and is closely related to the

field of Organization Studies. In short, it entails specifying the organization's objectives,

developing policies and plans designed to achieve these objectives, and then allocating resources

to implement the plans. Academics and practicing managers have developed numerous models

and frameworks to assist in strategic decision making and in understanding infinitely complex

macro-economic environments. Strategic management is not static in nature; the models often

include a feedback loop to monitor execution and inform the next round of planning.

This report focuses on Business policy, ethics and strategy of Grameen Danone Food Ltd, a

Grameen Group and Group DANONE joined forces since March 2006 to create Grameen

Danone Foods Ltd, a social business based in Bangladesh. Grameen Danone Foods Ltds

mission is to reduce poverty by a unique proximity business model that will provide daily

healthy nutrition to the poor of Bangladesh. Grameen Danone Foods Ltd is the first investment

supported by danone.communities, an investment fund, created to support businesses that aim

to be sustainable.

Grameen Danone Food Ltd.

During his visit to Paris, France, in 2005, Professor Muhammad Yunus, the founder of Grameen

Bank was invited by Franck Riboud, the chief executive officer of Group Danone . On 12

October 2005, they met in La Fontaine Gaillon, a Parisian restaurant. There Yunus proposed to

form a joint venture between Grameen and Danone with the objective of supplying nutritious

food to poor children of Bangladesh. As proposed by Muhammad Yunus, Franck Riboud agreed

to participate in the project to be styled a social business. Accordingly, the Grameen Group and

Group Danone entered into an agreement to form a company called Grameen Danone Foods - a

social business in Bangladesh. The objective was to bring daily healthy nutrition to low income

nutritionally deprived populations in Bangladesh and alleviate poverty through the

implementation of a community based business model, where no profit will be appropriated by

the investing partners.

The launch of Grameen Danone received considerable attention and was attended by celebrities

including French soccer player Zinedine Zidane of France. The plan in 2006 was to build 50

additional dairy plants over the 10 years to 2016 in rural areas of Bangladesh. There is no

mention on the organizations website about how far towards this goal the company has

progressed.

Ownership

While Group Danone is represented by

its subsidiary Danone Asia Pte Ltd. (21%)

and Danone Communities(29%),

The Grameen Group is represented by four subsidiaries of the Grameen Bank,

Grameen Business Promotion (12.5%)

Grameen Welfare (12.5%)

Grameen Energy, (12.5%)

Grameen Telecom (12.5%)

Products and Services

The collective brand name for the companys current bundle of products is Shokti+, a Bengali

expression for energy plus. The + points to the nutritional value of the yoghurt. Shokti Doi

(energy yoghurt) consists of pure, full cream cow milk, live fermenting cultures, data molasses (a

local sweetener), and sugar. Fortified with a high dose of micronutrients, a 60 gram cup covers

30% of childrens daily needs of vitamin A, zinc, iron, and iodine37. The yoghurt is furthermore

a natural source of calcium and protein. Developed by nutrition experts from GAIN and Danone,

Shokti Doi is supposed to improve the nutritional status of children aged 3 to 15 years, who eat

the yoghurt on a regular base at least one cup twice a week. In the absence of a perfect cold

chain, the product has a limited shelf-life of around 6 instead of 28 days.

Since production start in February 2007, Grameen Danone has gradually expanded its product

portfolio in order to better cater to the requirements of different customer segments. The current

product portfolio comprises plain yoghurt, plain with extra protein, and mango flavor for 7

(previously 6) to 12 Taka per cup (i.e., 7 to 13 cents), depending on product formula and

container size (60 and 80 gram).

Business Model

Grameen Danone is considered to be the worlds first consciously-designed multinational social

business e an international business with a social mission but run as a for-profit organization e so

special lessons can be learned from this case. As noted earlier, building social business models

relies on some of the same strategic moves as conventional business model innovation. However,

the Grameen Danone example also illustrates the specificities of this type of business model: the

need to take all stakeholders (not just shareholders) into account and the need to define the social

profit expected from the social business.

Thus, a social business is designed and operated just like a regular business enterprise, with

products, services, customers, markets, expenses and revenues. It is a no-loss, no-dividend, self-

sustaining company that sells goods or services and repays investments to its owners, but whose

primary purpose is to serve society and improve the lot of the poor.

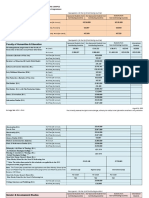

Figure 1.The GDFL Social Business Model

Objectives

The companys mission is to reduce poverty by a unique proximity business model which

brings daily healthy nutrition to the poor

Business

In terms of profit and loss, the joint venture should be a non-loss operation company. No

shareholder should lose money in their participation. The business model should be

profitable for each party.

After having made up for previous losses, Grameen Danone should generate enough

surpluses to pay back the invested capital to the parties as early as possible.

After the capital amount is paid back, Grameen Danone will pay a 1% dividend annually

to the shareholders. The remaining profits will be reinvested in the joint venture

company.

Social

Allow low-income, nutritionally deprived populations (especially children) to have

access (in terms of affordability and availability) to daily healthy nutrition in order to

improve their nutritional status.

Reduce poverty: improve the economic conditions of the local population by involving

local suppliers (farmers) and helping them to improve their practices (upstream),

involving the local population via a low-cost / labor-intensive manufacturing model

(production), and contributing to the creation of jobs through the distribution model

(downstream).

Investment

Danone invest on the creation of a

company to produce yogurt

containing 12 nutrients missing from

malnourished children in Bangladesh

Local Development

Decrease the number of

malnourished children in Bangladesh

Provision of nutrition and cheap food

for poor children

Reinvestment

With the profits from the sale of

yogurts cups, the company can

expand and reach more people in

Bangladesh

Refund

All invested monies will be refunded

to Danone

Production capacity

Grameen Danone has planned to set up and launch as many as 50 production plants during the

ten years between 2006 and 2016. The first factory has been built in Bogra district which is about

230 km north of, the capital city of Bangladesh. The first factory is a small one built upon an

area of 7,000 sq ft (650 m

2

).Its daily production capacity was 3,000 kg of yogurt when launched

in 2006. In 2008, the production capacity has been planned to be enhanced to 10,000 kg and

beyond. Several hundred livestock-farming and distribution jobs would be created in the local

community as a result of establishment of the first factory.

Analyzing internal resources & capabilities of GDFL

Tangible resources

Plant and Equipment: Packaging automated system (a PLC, programmable logic controller) for

the yogurt product. The packaging equipment the Zhongya was ordered from an independent

Chinese supplier. Once on-site, the Zhongyas supplier installed the equipment and helped run

the first trials. Furthermore, Danone aimed at using biodegradable yoghurt pots in Bangladesh.

Chilling centers:

Transportation vehicles:

Owned retail outlets:

Intangible resources

Worlds best partner organization: Present in 52 countries through more than 180 subsidiaries,

while being the worlds largest producer of fresh dairy products, Europes largest producer of

medical nutrition and the worlds second largest producer of baby nutrition and bottled water, it

is axiomatic that Danone, a large French MNE has world-leading innovative capabilities across

diverse technological functions. Danone enjoys a leading technological position not only in the

context of advanced economies, but also worldwide.

Skilled managers: The current management committee in Dhaka is composed of the Managing

Director, Finance Manager, Supply Chain, Sourcing and Supplier Development (SSD) Manager,

Marketing Manager, Human Resources Manager and Retail Manager. All the recruited managers

are university graduates and Bangladeshis. The managers are well trained by the Danone to

enable them skilled.

Capabilities of Grameen Danone Food Ltd.

Internal knowledge socialization process: the GDFL is capable of designing and development of

production process through an internal knowledge socialization process between GDFL and its

Germany-based sister company. GDFL has a culture of sharing and learning from each others

regarding any sort of task. The Bangladesh team and Germany team work collaborative way in

making decisions.

Environment friendly waste management: In terms of waste management, liquid industrial waste

runs to an effluent treatment plant while the solid wastes (mainly plastic) are stored in special

dustbins where local vendors can purchase them by the kilo for resale to recycling companies.

With regards to market wastage such as market returns of yoghurt, the cups are crushed and the

yoghurt is redirected to a biogas chamber which was constructed at the same time as the GDFL.

As for the crushed cups and other plastic waste, they are also sold to local vendors for recycling

purposes

Experimentation approach to solve problem: they encountered a yoghurt viscosity problem. For a

product to be released on the market its texture should be of a certain thickness. The Quality

Control team was faced with yoghurt batches which were liquid and which implied a high reject

rate. Through interactions with Guy Gavelle, the Bogra Quality Control team learnt how to

standardize milk before starting the process in order to overcome such viscosity problems.

Thereafter, the team faced a finished yoghurt foaming problem, whereby 2500 litres of product

would foam while in the fermentation tank, leading once again to a high reject rate. They had to

destroy several batches. What they did is we tried to define the sources of the problem. They

found out the problem came from the one of its two chilling centers where the milk is stored

before it arrives to its factory. They took all the milk to its lab and tested it. They were able to

pinpoint which supplier was giving them bitter and adulterated milk which led to the foaming

issue. This highlights the fact that the quality controllers are capable of adopting an independent

problem solving and searching through experimentation approach.

Cold chain creation and management: Shokti+ was for a 4-day shelf life. With the added sales

through modern trade shops and large cities located far from Bogra, the 60 grams pots shelf-life

was extended to 10 days and the 80 grams pots to 20 days. Over a period of a few months, the

products, after being packaged, were kept in refrigerators and tested. The GDFL Quality Control

team found that if they maintained the cold chain, the products shelf life could be extended to 30

days. So today, after packaging, the products are kept in the cold room for 24 hours. Thereafter,

the products are released from Quality Control and sent to the supply chain. The supply chain

delivers the products through refrigerated vans and to the various GDFL owned cold rooms in all

main markets. From these cold rooms, other refrigerated vans deliver the yoghurt to the modern

trade shops where the products are kept in fridges.

Value chain of Grameen Danone Food Ltd.

Grameen Danones scope of business covers the manufacturing, packaging, marketing, sales, and

distribution of fermented fresh dairy products under the brand name Shokti+. Additional core

activities are linked to social marketing (i.e., educating consumers about their nutritional needs

and health topics) and setting up a rural sales and distribution system.

Core activities

Research and Development

Manufacturing and production

Marketing and sales

Additional activities

Materials management

Human resources

setting up a rural sales and distribution system

Figure: Comprehensive Supply chain of GDFL

Grameen Danone has adjusted the companys entire value chain to its social mission and rural

business environment. Trying to realize a proximity business model, the company involves local

communities in all parts of its value chain: as of spring 2010, around 280 farmers act as suppliers

of raw milk, around 30 residents are employed within the factory (in quality control,

maintenance, and production), and around 175 local women are engaged as sales ladies in daily

rural distribution. In order to maintain the flavor, texture, and acid content of the yoghurt in the

absence of a functioning cold chain, Grameen Danone emphasizes a quick turnaround (48 hours)

from factory to consumer.

Cost Structure

In line with its social mission, Grameen Danone aims to provide nutrition at a price that is

affordable by low-income consumers. In order to keep the initial price point low, the yoghurt

business is trying to minimize costs wherever possible. The companys business model is, thus,

strongly cost-driven. Up to now, Grameen Danones cost structure has been characterized by a

high proportion of indirect costs (34% in 2008 and 36% in 2009). According to the Deputy

Managing Director (MD), a proportion of 25% (comprising 10% of commercial fixed costs, 10%

marketing spend, and some royalty fees) would be a proper benchmark. Among the direct costs,

milk and packaging material have been the companys most expensive key resources in the past,

but high distribution costs add to the companys direct costs.

Manufactu

ring &

packaging

centre

Quality

control

centre

GDFL owned

cold rooms

in market

Trade

shops

Customers

Raw milk

Data

molasses,

nutrients

Raw

material

Company-Owned Milk Collection Center, Grameen

Livestock Foundation, Nandigram Farm, Spot

Market

Kajur gur (date molasses) is processed sap of palm

trees, Nutrients sourced in powder form from

Europe

Revenue Streams

Grameen Danones yoghurt business is confined to so-called transaction revenues. For each cup,

customers pay a fixed price. The quantity of yoghurts a customer purchases has no price impact.

Reflecting its different customer segments and channels, Grameen Danone has lately generated

revenues from the product portfolio displayed in Figure 15 below (GDFL 2009a). Since

September 2010, the portfolio has been extended by a new pouch product priced at 5 Taka for 40

gram.

Industry Analysis

Bangladesh is home to over 150 million people or roughly 25 million households. The

population is spread across seven divisions, which are sub-divided into 64 zilas (districts).

About 70 percent of the population is concentrated in three divisions: Dhaka, Rajshahi, and

Chittagong. Bangladeshs small landmass and large population make the country one of the

worlds most densely populated nations with almost 3,000 people per square mile. Over 50

percent of the population lives in more than 8,000 villages or impermanent settlements called

chars (riverbanks and sandbars) that are adjacent to Bangladeshs many rivers. The countrys six

official incorporated cities Dhaka, Chittagong, Khulna, Rajshahi, Barisal, and Sylhet are home to

over 20 million people. More than 60 percent of these people live in Dhaka with an additional 20

percent in Chittagong. The remainder of urban Bangladeshis lives in over 200 smaller

municipalities around the country. While aggregate household expenditures were greater than

US$26 billion in 2005, there is great income inequality. About 94 percent of Bangladeshi

households earn less than the equivalent of US$3,000 per year. They participate in a market that

is characterized by significant unmet needs, dependence on informal or subsistence livelihoods,

and high prices for basic products and services (relative to the prices paid by upper income

segments. About 45 percent of all households earn less than US$2 a day, and 80 percent live in

rural areas. These households account for only 26 percent of total national expenditure (US$6.6

billion). The upper 20 percent of households account for 40 percent ($10.6 billion) of household

expenditures, and the upper five percent of households represent 16 percent (US$4.2 billion)

Culture, history and geography play an important role in the nature of the market.

The Dairy Market

In 2005, Bangladesh produced about 2.27 billion liters of dairy products. Annual milk production

tends to peak in the dry season (October to March) when there is more land available for grazing

Liquid milk and milk equivalent products (e.g. powdered milk) represent more than 90 percent of

total consumption, and products from processed liquid milk (e.g. yogurt and butter) account for

an additional five percent. A 2003 sample of 300 consumers from different geographic areas and

economic groups found that roughly 44 percent of poor Bangladeshis had consumed milk in the

prior three days compared with 69 percent of middle class consumers, and 88 percent of rich

consumers. In villages, about 60 percent of the sample had consumed milk in the past three days

versus 43 percent in urban slums, and 73 percent in the char (riverbank areas). When a family

purchases milk, it was usually shared among all members. However, when there is a limited

supply, children under five are usually given preference. Poor families spent about 3.5 percent of

their daily food expenditures on milk, while middle class families spent eight percent, and rich

families six percent (Halder and Barua2003) In general, milk sales increase during the forty days

of Ramadan and the two annual Eid festivals. Between 2003 04 and 2005-06, total milk

production in Bangladesh grew by six percent. With a growing middle class, the trends toward

increased milk consumption should continue

Milk and other dairy products are acquired through three primary channels:

Self-production up to 30 percent of milk-consuming households in villages and 69

percent of families living in chars (riverbank areas) produced their own milk.

Informal market buying from neighbors, door-to-door salespeople, and street vendors

accounted for an additional 50 to 60 percent of consumption in villages, 29 percent in

slums, 24 percent in char areas, and about 49 percent for middle class consumers.

Fixed market sales milk purchased from formal retail outlets represented less than 20

percent of village sales, over 70 percent of slum sales, and over 30 percent for upper and

middle class consumers. With more supermarkets in cities around the country, middle

and upper class consumers are increasingly purchasing milk through established retail

outlets.

The Milk Industry

Raw Milk

Milk is typically purchased from town bazaars where 100 to 150 farmers bring one to five liters

of milk to sell directly to local households or small businesses. Sales for household consumption

are usually less than one liter, but sales to small businesses can exceed 50 liters per day. The

price of raw milk varies greatly depending on location and season.

Traditional Processing

Traditionally, milk is processed into solid butter, liquid butter (ghee), yogurt, and milk-based

sweets. Milk-based sweets are popular during festivals and special events such as weddings.

Historically, Hindu Ghose families operate sweet shops that specialize in producing and

selling products like sweet yogurt (mishtee doi) and other milk-based sweets. These sweets are

one of the primary uses for processed milk. While the current sweet-making industry is no longer

solely dominated by Ghoses, traditional sweet-making processes remain relatively unchanged.

Modern Processing

Bangladesh is also home to a large and growing modern milk processing industry with the top

nine processors employing over 80,000 dairy farmers, 1,200 permanent employees, 2,000

collectors and transporters, and 100 distributors. Processors usually have centralized facilities

located in rural areas with equipment for large-scale pasteurization, storage, processing, and

packaging.

Competitive Landscape

The processed dairy market is dominated by two organizations Milk Vita and BRAC Aarong.

Until 1994, when private competitors began entering the market, Milk Vita had virtually 100

percent of the total market. Milk Vita now controls about 60 percent of the market while BRAC

controls 20 percent. BRAC began operating in 1998 as a way to increase incomes for dairy

farmers. Approximately seven other enterprises account for the remaining 20 percent of the

market. There are 5 government-owned dairy farms in Savar, Bogra, Sylhet, Faridpur, and

Barisal that were partially funded by foreign aid. The Savar farm is the flagship dairy farm and is

also the largest single-site cow farm in Bangladesh with roughly 400 employees and 1500 cows.

The campus includes an artificial insemination program and feed production plant as well as

milk processing and packaging facilities. The Bangladesh Livestock Research Center is adjacent

to the Savar farm and focuses on new product development, breed research, and contributes to

the national livestock strategy. In 2002, the Savar Dairy controlled about 1 percent of the total

market for processed milk, but by 2010, it was producing less than 800 liters of milk a day and

primarily selling to employees. But mismanagement and corruption have plagued these facilities

in recent years; they now produce a negligible share of Bangladeshs processed milk. A chart

about the overall mil-market in Bangladesh is presented below:

External Analysis of Grameen Danone Food Ltd.

Opportunities

Involving local communities in all parts of the companys value chain is changing poor women

and men from aid beneficiaries into suppliers, producers, distributors, and customers: a

transformation that involves positive livelihood outcomes going far beyond the economic

dimension of poverty.

Grameen Danone plans to expand. Within the next 10 years, more plants will be established and

several hundred distribution jobs will be created. The Danone Communities Fund has been

created to support this endeavor. In November 2011, the preliminary study results were released

saying that the impact of the Grameen Danone yoghurt shows a positive impact on growth and

cognitive performance of children.

Several hundred livestock-farming and distribution jobs have been created in the local

community as a result of establishment of the first factory. It may take a relatively longer time

for Grameen Danone to create an overall impact on the nutritional state of the country but the

concept of social business will inspire others to change the present state of poverty in the world.

Company will start a second unit beside the existing factory to extend its capacity in 2014.

Company looks forward to replicate the Bogra model all over Bangladesh to be able to cover t he

needs of all the kids of the country. Company will welcome partners to invest in this social

business and take responsibility of various clusters of these mini plants to extend healthy

nutrition over the rest of the country.

About 589 ladies have been getting an additional income of 50 to 100 taka per day by selling

Shokti+ products door-to-door. This is limited but contributes to improve their living conditions.

They benefit from having a regular source of income, new social capital related to their formal

job, more freedom to move in public space, and an improved self-esteem. About 370 micro-

farmers around the plant sell daily to Grameen Danone, getting a regular fixed income, without

having to go to the market. Grameen Danone has directly created 264 jobs.

Grameen Danone will be highly committed to protect the environment of its communities

developing solar energy and bio gas energies. It will also develop innovative and

environmentally friendly packaging.

The initial focus of Grameen Danone will be to launch an easily affordable dairy product to

fulfill the nutritional needs of children in Bangladesh and contribute to their strong growth by

bringing them the benefits of milk and micronutrients that they lack, including vitamins and

minerals such as Iron, Zinc, and Calcium.

Threats

Accounting for around two-thirds of the companys raw material costs, milk became the main

driver of cost explosion, eliminating the small profit margin that had been established when

pricing the yoghurt product. At the same time, sourcing costs for packaging material,

micronutrients, sugar, and date molasses went up. Grameen Danones Board of Directors finally

decided to raise the selling price from 5 to 8 Taka, which equals a 60% price increase, in order to

cover growing production costs. In consequence, the yoghurt business lost around 80% of sales

in its rural market.

Despite early praise, there have been some troubling criticisms of the project. While Shokti Doi

is more affordable than other yogurts on the market, this did not translate into high sales within

the Base of the Pyramid (BOP). This was due to several factors, including the following:

There are some indications that suggest that yogurt is considered a luxury item and is not

regularly consumed by low-income people.

In South Asia, yogurt is more commonly made in the home rather than purchased from a

store.

Yogurt requires proper storage in order to retain the same level of quality. Although the

Shokti yogurt remains safe without refrigeration for a period of time, the yogurt becomes

more liquid in consistency and is less appealing to consumers.

Grameen sales ladies did not treat yogurt sales as a full-time income generation activity,

but rather as a source of supplemental income. This could be a result of personal

preference, a potential overestimation of the demand for yogurt in the BOP/rural markets

or a combination of the above.

Offering nutrition through a fresh dairy product has been a structural weakness in Grameen

Danones business model from day one. Since then the company has been trying to reduce the

milk quantity (smaller cup, cheaper ingredients), and to increase the products shelf-life in the

absence of a functioning cold chain (pouch product).

Business level Strategy

Group Danone the worlds largest producer of fresh dairy products takes the initiative to develop

a social perspective in its business activities by engaging in a partnership with the Grameen

Group to create the Grameen Danone Food Limited. This action seems to reflect Danones

concern with the implications of its business and its technological innovation for social

development. Indeed, GDFL is unique not only to Danone but to the world.

Grameen Danone Foods Ltd. produces a special yogurt called Shakti Doi from pure full cream

milk that contains protein, vitamins, iron, calcium, zinc and other micronutrients needed to fulfill

the nutritional requirements of children of Bangladesh, thus contributing to improving their

health. While Shakti Doi which means 'power yogurt' is primarily intended for children, it is

also appropriate for adults. The price of each 80 gram cup of yogurt is kept at an affordable rate

of BDT 5 that can be bought regularly by even the poorest families.

Grameen Danone and Food Limiteds Social Business Model:

Danone invests on the creation of

a company to produce yoghurt

containing 12 nutrients missing

from malnourished children in

Bangladesh

Decrease the number of

malnourished children in

Bangladesh.

Provision of nutrition and cheap

food for poor children in

Bangladesh.

With the profits from the sale of

yoghurt cups the company can

expand and reach more people in

Bangladesh.

All investment monies will be

returned to Danone.

The business structure is designed such that there are no dividends for the shareholders. The

profits are reinvested into the company and the market prices are set with the aim to make the

enterprise self sustaining. All the distribution is done by local female Grameen Bank

beneficiaries, who play a significant role in the sales program.

The aim of this social business, as per Professor Yunus seven principles of social business is to

create a no loss, no dividend business. Investors get back their investment amount only. No

dividend is given beyond investment money. When investment amount is paid back, company

profit stays with the company for expansion and improvement.

GDFL was created to supply 3000 tons of yoghurt per year to 3 million inhabitants in Bogra

within a radius of 30 to 50 Km. Knowing that there are 150 million people in Bangladesh, the

plan is to eventually have 50 factories across the country each supplying within their own 30 to

50 Km radius. Thus, the profits earned by GDFL in Bogra will be used down the line to build the

next factory and the process will continue until the other 49 factories are eventually built.

A Door-to-door selling approach has been adapted, where Danone Yoghurt, produced entirely

from local milk supplies, are marketed and sold among friends, families and small groceries. The

program has thus been able to generate a lot of employment in the rural communities. The social

business also focuses on creating independent business and job opportunities in farming,

processing, sales and distribution sector. The business also integrates its social objective in every

aspect of its business operation. It helps to protect the environment relying on solar and biogas

energy and develop innovative, environment friendly packaging solution for its product.

The primary objective of the company was to combat the widespread problem of malnutrition in

rural Bangladesh through the production and sale of fortified yogurt called Shokti Doi or

strengthening yogurt. The yogurt was priced well below the market price for unfortified yogurts

in Bangladesh, making it more affordable for low-income consumers. In addition to combating

rural malnutrition, yogurt production operations would provide numerous jobs to dairy

producers, factory workers, and the Grameen sales ladies women who would operate as local

distributors in rural areas. Since yogurt sales were targeted exclusively for the rural population,

the Grameen ladies were the only distributors of Shokti Doi.

Customer Segments

Grameen Danones rural and urban customer segments can be distinguished by the following

attributes: rural children and their guardians usually live in remote and dispersed settlements. T

heir families are short of purchasing power and nutritional awareness. By contrast, urban

children and their guardians can be divided in three groups: lower-class consumers living in

smaller cities (characterized by limited purchasing power, little nutritional awareness, but

accessible through corner stores), middle- and upper-class children and their guardians

(including foreigners) in Dhaka (disposing of sufficient buying power, general health awareness,

and accessible through modern trade or cornerstones), and slum dwellers in Dhaka (with little

purchasing power and nutritional awareness and best accessible through door-to-door sales).

These different customer segments receive slightly different offers and are served through

various distribution and marketing channels (see Channels further below).

Competition

So far, the competitive rivalry for Grameen Danone has been low. Findings from the FGDs

suggest that due to its different product features in terms of taste, texture, color, packaging, and

price, rural consumers perceive Shokti+and Mishti Doi as two completely different offers. Shokti

Doi is predominantly regarded as a snack for children (not yoghurt), similar to juice or sweets

that are available for 1 to 10 Taka in local stores. Snack-producing companies such as Pran,

Unilever, and Nestl are, thus, Grameen Danones indirect competitors in terms of peoples

share-of-wallet for childrens sweets and snacks. The FGDs with consumers and sales ladies

have also indicated that consumers, who have a concept of nutrition, tend to compare Shokti Doi

with pure milk. Other than that no substitute product (promising nutrition at an affordable price)

could be traced in Bogra District. In Dhaka however, a growing number of providers are

currently entering modern trade stores with packaged yoghurt products that are bigger in size

than Grameen Danones offer, higher in price, and not fortified.

Cost Structure

In line with its social mission, Grameen Danone aims to provide nutrition at a price that is

affordable by low-income consumers. In order to keep the initial price point low, the yoghurt

business is trying to minimize costs wherever possible. The companys business model is, thus,

strongly cost-driven. Up to now, Grameen Danones cost structure has been characterized by a

high proportion of indirect costs. Among the direct costs, milk and packaging material have been

the companys most expensive key resources in the past, but high distribution costs add to the

companys direct costs.

Revenue Streams

Grameen Danones yoghurt business is confined to so-called transaction revenues. For each cup,

customers pay a fixed price. The quantity of yoghurts a customer purchases has no price impact.

Reflecting its different customer segments and channels, Grameen Danone has lately generated

revenues from the product portfolio displayed in Figure 15 below (GDFL 2009a). Since

September 2010, the portfolio has been extended by a new pouch product priced at 5 Taka for 40

gram

Functional Level Strategy

Functional level Strategies of a business aimed at improving the effectiveness of a companys

operations and thus its ability to attain superior efficiency, quality, innovation and customer

responsiveness. There is a strong relationship among functional strategies, distinctive

competencies and value creation. Distinctive competencies shape the functional level strategies

that a company can pursue and with regard to functional level strategy it can build resources and

capabilities that enhance a businesss distinctive competencies.

Grameen Danones value proposition comprises quantitative (low price) as well as qualitative

elements (high-quality nutrition, professional product design, and brand), the novelty of the

product category (packaged child nutrition), and its intangible benefits (improved nutritional

status if consumed regularly) are limiting consumer demand in the companys virtual target

market.

Adjusting the Product to Local Preferences

Initially, consumers complained about Shokti Dois bad smell, strange color, and sour

taste. Grameen Danone reformulated the yoghurt recipe to better adjust the product to local

preferences. Some more sugar and date molasses were added to make the yoghurt sweeter.

Professionalization of Sales-Lady Approach

In order to improve their sales ladies retention rate, Grameen Danone has started to select

women more strategically. Particularly needy women that are confident enough to walk alone in

public have become the companys first choice. Ideally, they bring some experience in selling

saris or food items. Other selection criteria are their age and education. The better educated a

women is, the better she usually manages product promotion and accounting. Trying to boost

daily rotation and the sales ladies number of working days, Grameen Danone is now

experimenting with new incentive schemes. Since the companys fixed salary policy in 2009 was

not successful in pushing sales, a new policy rewards women that sell more than 66 cups per day

and work at least 6 days per.

Price Increase to Cover Production Costs

When the sharp increase in raw material costs eliminated Grameen Danones profit margin in the

course of 2007 and 2008, the companys board decided to raise Shokti Dois selling price from 5

to 8 Taka for 80 grams. Consequently, the business lost around 80 percent of sales in its rural

market and the companys sales-lady network collapsed. With their customers disappearing,

sales ladies also abandoned the business. The companys management had to accept that a 60%

price increase was too much of a shock for the rural market.

Product Diversification and Urban Expansion

In response to the sales collapse, Grameen Danone reformulated the yoghurt product and

managed to offer the same amount of micronutrients in a smaller cup without compromising on

taste. The new 60 gram cup was introduced for 6 Taka, which was 1 Taka above the companys

initial price point of 5 Taka for 80 gram. Since rural sales volumes remained low, causing high

per-unit-costs in production and distribution, Grameen Danones board decided to expand the

companys selling area beyond its original boundaries. From November 2008 onwards urban

expansion, based on sales through retail stores in new cities such as Pabna and Rajshahi plus

sales in Dhaka City, was considered to be the easiest way to quickly boost sales and improve the

factorys capacity utilization. This move achieved the desired sales effect: from 2008 to 2009,

the annual sales volume grew from 127 to 707 tons (by 550%). In order to cover the higher

delivery costs, the price for an 80 gram cup in Dhaka was set at 12 Taka

Direct Marketing through Rural Mini-events

Meanwhile, Grameen Danone is trying to stimulate rural sales through direct marketing

activities. Rural mini events are the companys major toehold. During these area-based events, a

boy, masquerading as a lion puppet, creates curiosity among children in a village and gathers

their guardians in a central place. With reference to a ready-made poster, a female student then

gives a lecture on health and nutrition. Her key message: if you cannot afford a balanced diet for

your children, take Shokti Doi. Going forward, Grameen Danone aims to reshape the format and

make the events more interactive by means of a fantasy story about nutrition and health. The

total number of mini-events should have increased from 1,000 in 2009 to 10,000 in 2010.

Creating Brand Awareness through TV Ads

Initially, Grameen Danone concentrated on local marketing methods (basically leaflet sand

rickshaw announcements) but, in parallel with the companys urban expansion, the management

also decided to go for mass marketing through TV advertisements, sponsored by Danone.

Involving Yunus as a brand ambassador, the company took out two ad waves in Bangladeshs

national television. Both waves aimed at raising public awareness about childrens nutritional

needs.

Creating a Network of Dedicated Milk Suppliers

In January 2009, Grameen Danone also started to create a network of micro-farmers dedicated to

supplying their milk for a fixed price. In this way, Grameen Danone wants to shield the business

from further price fluctuations and secure regular milk supply. As of April 2010, the company is

collaborating with 280 micro-farmers, organized around two milk collection points. According to

the plant manager, this strategy has already has paid off, because the milk sourced from larger

suppliers was more costly in terms of price per liter and transportation.

Improving Profit Margin through Product Innovation and New Pricing

The companys latest strategic initiative is linked to a product innovation. With a non-chilled

pouch product called Shokti+ Pocket, Grameen Danone intends to overcome most of Shokti

Dois unfavorable product features. Although smaller in size (40 gram), the sachet type product

offers the same nutritional value as Shokti Doi in a 60 gram cup. The quantity of milk has been

reduced but cereals (rice and wheat flour) have been added as protein sources. Live cultures have

also been eliminated, raising the products shelf-life up to 15 days and facilitating sales through

village shops without refrigeration.

The new format also reduces the packaging costs and allows for consumption without a spoon. In

order to make the product more affordable, the pouch was introduced at a price of 5 Taka for 40

gram. In return, the price for the 60 gram cup has been increased from 6 to 7 Taka.

You might also like

- Our IMC PlanDocument25 pagesOur IMC PlanHassan AhmadNo ratings yet

- Business Proposal For Using Fintech in Banking ArenaDocument4 pagesBusiness Proposal For Using Fintech in Banking ArenawoosanNo ratings yet

- Case I - ChemcoDocument6 pagesCase I - ChemcoNarendr Gaikwad50% (2)

- Summary For Chapter 1 Entrepreneurs: The Driving Force Behind Small BusinessesDocument2 pagesSummary For Chapter 1 Entrepreneurs: The Driving Force Behind Small BusinessesahmedknightNo ratings yet

- Dano Milk PowderDocument21 pagesDano Milk PowderZishan NiazNo ratings yet

- GlowCorp CaseDocument25 pagesGlowCorp CaseJAMES WILLIAM BALAONo ratings yet

- Dannon FinalDocument12 pagesDannon Finalmanoj kumarNo ratings yet

- Lazarsfeld Oberschall Max Weber and Empirical Social ResearchDocument16 pagesLazarsfeld Oberschall Max Weber and Empirical Social Researchsima_sociologyNo ratings yet

- Grameen Danone Foodsfood CorporationDocument17 pagesGrameen Danone Foodsfood CorporationKarun Kiran Polimetla100% (1)

- Agricultural MarketingDocument46 pagesAgricultural MarketingAmrit Sharma100% (1)

- Ethics Case 1 WalmartDocument6 pagesEthics Case 1 WalmartJaskeerat SinghNo ratings yet

- Biscuit Industry Analysis and Applied Family Brand StrategiesDocument28 pagesBiscuit Industry Analysis and Applied Family Brand StrategiessachipmNo ratings yet

- Pest Analysis SafeguardDocument6 pagesPest Analysis Safeguardask4mohsinNo ratings yet

- Slavery in The Chocolate Industry Reading 1Document3 pagesSlavery in The Chocolate Industry Reading 1api-226538958100% (1)

- Agricultural Development in The PhilipppinesDocument4 pagesAgricultural Development in The PhilipppinesJon Te100% (1)

- Frito LayDocument6 pagesFrito LayShilpi JainNo ratings yet

- 02 - Developing Marketing Strategies and PlansDocument21 pages02 - Developing Marketing Strategies and PlansIbrahim Ahmed FurrukhNo ratings yet

- Ice Cream QuestionDocument25 pagesIce Cream QuestionAshutosh SinhaNo ratings yet

- Resource Utilization and EconomicsDocument35 pagesResource Utilization and EconomicsAilaneJadeTuazon100% (1)

- Reporte Anual 2019 - IkeaDocument54 pagesReporte Anual 2019 - IkeaLeodan ZapataNo ratings yet

- VCA of Banana Cardava (Mindanao)Document88 pagesVCA of Banana Cardava (Mindanao)lani_concepcion100% (1)

- International MarketingDocument48 pagesInternational MarketingAshish100% (1)

- Strategic Marketing: 2. Markets and Competitive SpaceDocument48 pagesStrategic Marketing: 2. Markets and Competitive SpaceAnil Kumar KashyapNo ratings yet

- 2012 Economic Benefits of Standards2 Egypt Juhayna Food Industries enDocument40 pages2012 Economic Benefits of Standards2 Egypt Juhayna Food Industries enMohmed SarhanNo ratings yet

- Week 3 Supply and DemandDocument4 pagesWeek 3 Supply and DemandJasmin EspeletaNo ratings yet

- Economic Liberalization Policy NepalDocument3 pagesEconomic Liberalization Policy NepalSaroj LamichhaneNo ratings yet

- Cooperation in Coffee Markets The Case of Vietnam and ColombiaDocument18 pagesCooperation in Coffee Markets The Case of Vietnam and ColombiaFananh11No ratings yet

- Analysing Strategy (BCG Matrix)Document6 pagesAnalysing Strategy (BCG Matrix)yadavpankaj1992No ratings yet

- Global Marketing - Ch10 Brand and Product Decisions in Global MarketingDocument22 pagesGlobal Marketing - Ch10 Brand and Product Decisions in Global MarketingIsmadth2918388No ratings yet

- Cos MVDocument4 pagesCos MVrupokNo ratings yet

- 1.0 Executive SummaryDocument52 pages1.0 Executive SummaryTanveer MasudNo ratings yet

- Study CaseDocument18 pagesStudy CaseHichem TaouafNo ratings yet

- Grameen Danone FoodsDocument7 pagesGrameen Danone FoodsJoshua ChegeNo ratings yet

- Grameen DanoneDocument15 pagesGrameen DanoneHichem TaouafNo ratings yet

- Corporate Social ResponsibilityDocument6 pagesCorporate Social ResponsibilitySulianur NasuhaNo ratings yet

- Case StudyDocument6 pagesCase StudyShahed AhamedNo ratings yet

- Presentation On The Subject of Business Strategies and PoliciesDocument23 pagesPresentation On The Subject of Business Strategies and PoliciesJoydeep DattaNo ratings yet

- Grameen Danone Foods Limited (GDF) : Keywords: Teaching Case, Social Entrepreneurship, Bangladesh, Yogurt, Dairy IndustryDocument32 pagesGrameen Danone Foods Limited (GDF) : Keywords: Teaching Case, Social Entrepreneurship, Bangladesh, Yogurt, Dairy IndustryZahirkhan71No ratings yet

- Corporate Social Responsibility Through Joint VentureDocument12 pagesCorporate Social Responsibility Through Joint VentureAruna RNo ratings yet

- GDFLDocument8 pagesGDFLFuzail A. SiddiquiNo ratings yet

- ShoktiDocument4 pagesShoktiAhnaf SaminNo ratings yet

- Evaluate and Analyze The Sustainability Efforts of Competitors DanoneDocument3 pagesEvaluate and Analyze The Sustainability Efforts of Competitors Danonexyz100% (1)

- Danone - Report - LatestDocument39 pagesDanone - Report - LatestSushrut ChoubeyNo ratings yet

- Case Study - SampleDocument13 pagesCase Study - SampleAthenaSakura1306100% (2)

- Sana Ethics ProjectDocument4 pagesSana Ethics ProjectSana TrannumNo ratings yet

- GCPL BRR Fy 201920Document39 pagesGCPL BRR Fy 201920S.v 101No ratings yet

- Gareem LTD NotesDocument19 pagesGareem LTD NotesHaroon Z. ChoudhryNo ratings yet

- An Overview of PRANDocument10 pagesAn Overview of PRANkrakoNo ratings yet

- North South University: Mkt382 Section-4 Group ProjectDocument20 pagesNorth South University: Mkt382 Section-4 Group ProjectNawar E JannatNo ratings yet

- A Study On Corporate Social Responsibility of 20 CompaniesDocument90 pagesA Study On Corporate Social Responsibility of 20 Companiesfriendajeet123No ratings yet

- International Marketing Group Project Tuesday 10-11.30am Group 2 Koh Daphney, HanChien 17635884Document33 pagesInternational Marketing Group Project Tuesday 10-11.30am Group 2 Koh Daphney, HanChien 17635884Alfredd HoNo ratings yet

- 4.0 FinancialsDocument6 pages4.0 FinancialsIftekharul MahdiNo ratings yet

- Pixelsutra Dairy Industry Market Analysis & StrategiesDocument19 pagesPixelsutra Dairy Industry Market Analysis & StrategiesjackNo ratings yet

- Social Business ModelsDocument12 pagesSocial Business ModelsVarun DeoNo ratings yet

- Amul Summer Internship ProjectDocument29 pagesAmul Summer Internship ProjectSharath NairNo ratings yet

- Pran HRDocument29 pagesPran HRDa Bhaai100% (1)

- Independent University, BangladeshDocument21 pagesIndependent University, BangladeshRidwan RafiNo ratings yet

- Capstone+Interim+Report+Template V1Document14 pagesCapstone+Interim+Report+Template V1Sakshi GuptaNo ratings yet

- FranchisingDocument5 pagesFranchisingTwinkle TricksNo ratings yet

- Project Managent Task 1Document3 pagesProject Managent Task 1Michael OpokuNo ratings yet

- Study of Marketing of The Dairy Products at Mother Dairy (Firoz)Document92 pagesStudy of Marketing of The Dairy Products at Mother Dairy (Firoz)Nilabjo Kanti PaulNo ratings yet

- Passport 3Document8 pagesPassport 3api-340266765No ratings yet

- Structural Analysis - I Unit-IDocument22 pagesStructural Analysis - I Unit-ITamizhan_KNo ratings yet

- Effects of Online Games To The Selected Students of Pangasinan State University Bayambang-CampusDocument19 pagesEffects of Online Games To The Selected Students of Pangasinan State University Bayambang-CampusMarianne GasmenNo ratings yet

- WSH Guidelines Safe Operation of Forklift TrucksDocument19 pagesWSH Guidelines Safe Operation of Forklift TrucksAravind Appi RajNo ratings yet

- CV No. Descrription Default After Reset: VstartDocument2 pagesCV No. Descrription Default After Reset: VstartWESORNo ratings yet

- Course Work PHD UgcDocument8 pagesCourse Work PHD Ugcafazamfbk100% (2)

- UWI-Mona 2020-2021 Undergraduate Fee Schedule (27.07.2020)Document5 pagesUWI-Mona 2020-2021 Undergraduate Fee Schedule (27.07.2020)Abigail WilliamsNo ratings yet

- StatusOutcome 14 April 2020 PDFDocument4 pagesStatusOutcome 14 April 2020 PDFnicu stanaNo ratings yet

- Welcome! Our World: True' or False'Document3 pagesWelcome! Our World: True' or False'Asiraz InaliajNo ratings yet

- Cover Letter Examples Dental HygieneDocument6 pagesCover Letter Examples Dental Hygieneafjwftijfbwmen100% (1)

- A Practical Approach To Tds & Tcs (Amended Upto 31.10.2020) : Ca Rs KalraDocument177 pagesA Practical Approach To Tds & Tcs (Amended Upto 31.10.2020) : Ca Rs KalraRohini UbaleNo ratings yet

- Lean-7waste, Takt Time, Crew SizeDocument80 pagesLean-7waste, Takt Time, Crew Sizeapi-3770121100% (2)

- Medical Myths, Lies, and Half-Truths (Starter)Document2 pagesMedical Myths, Lies, and Half-Truths (Starter)PhalachandraNo ratings yet

- Union Representation and Collective Bargaining Chapter 13-Kelompok 4 v1Document18 pagesUnion Representation and Collective Bargaining Chapter 13-Kelompok 4 v1Andy TjandraNo ratings yet

- WWW Courses Psu Edu Biol Biol110 - hw7 Dihybrid HTM PDFDocument2 pagesWWW Courses Psu Edu Biol Biol110 - hw7 Dihybrid HTM PDFnareshyadavNo ratings yet

- Cert For Brigada ActivitiesDocument4 pagesCert For Brigada ActivitiesJelene FelixNo ratings yet

- On The Nature of Nibbana - MahasiDocument130 pagesOn The Nature of Nibbana - MahasiJérôme CourtemancheNo ratings yet

- Margaret Atwood PoemsDocument15 pagesMargaret Atwood Poemsjovesiddique100% (1)

- Chap. 6 8Document44 pagesChap. 6 82vpsrsmg7jNo ratings yet

- Introducing Protest Art As A Part of Civic Education For Indonesian TeacherDocument6 pagesIntroducing Protest Art As A Part of Civic Education For Indonesian Teachervirgiawan kristiantoNo ratings yet

- Module 7 AssignementDocument6 pagesModule 7 AssignementAndy ChilaNo ratings yet

- Balance Ad or Car Gap CCC On Fail OverDocument4 pagesBalance Ad or Car Gap CCC On Fail OverAlfredoNo ratings yet

- Are You Living With A Psychopath The 39 Simple Ways You Can Diagnose A Psychopath. by DR Vernon Coleman (Coleman, DR Vernon)Document109 pagesAre You Living With A Psychopath The 39 Simple Ways You Can Diagnose A Psychopath. by DR Vernon Coleman (Coleman, DR Vernon)angelusdrea100% (1)

- The Colors of The Horn in Ravel's Pavane For A Dead PrincessDocument8 pagesThe Colors of The Horn in Ravel's Pavane For A Dead Princessjesscl07100% (1)

- Draft PDPDocument2 pagesDraft PDPapi-33630204No ratings yet

- Re Petition For Radio and Television Coverage of The Multiple Murder Cases Against Maguindanao Governor Zaldy Ampatuan Et Al #32 Rights of The AccusedDocument5 pagesRe Petition For Radio and Television Coverage of The Multiple Murder Cases Against Maguindanao Governor Zaldy Ampatuan Et Al #32 Rights of The AccusedErika Mariz Sicat CunananNo ratings yet

- ICIESA 2015 Proceeding Book 3-1Document134 pagesICIESA 2015 Proceeding Book 3-1Nurrahmah QoyimahNo ratings yet

- Slidingmesh GearboxDocument27 pagesSlidingmesh GearboxalebiegashityNo ratings yet

- Remote Controller: System OverviewDocument18 pagesRemote Controller: System OverviewIm ChinithNo ratings yet