Professional Documents

Culture Documents

December 2013 B Group QTR 20022014

Uploaded by

Tedla AbhinayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

December 2013 B Group QTR 20022014

Uploaded by

Tedla AbhinayCopyright:

Available Formats

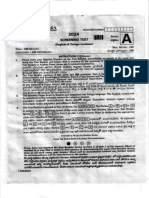

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

20 Microns

20 Microns

20 Microns

20 Microns

20 Microns

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

15.8

70.4

15.8

62.6

15.8

67.3

15.8

80.6

15.8

71.1

21st Cent. Mgmt.

21st Cent. Mgmt.

21st Cent. Mgmt.

21st Cent. Mgmt.

21st Cent. Mgmt.

201212

201303

201306

201309

201312

10.5

10.5

10.5

10.5

10.5

3M India

3M India

3M India

3M India

3M India

201212

201303

201306

201309

201312

8K Miles

8K Miles

8K Miles

8K Miles

8K Miles

O.I

1.5

1.7

1.2

0.6

4.4

T.Income

72.0

64.3

68.4

81.2

75.5

T.Exp.

72.2

52.7

62.2

70.8

66.2

PBIDT

-0.2

11.6

6.3

10.4

9.3

11.2

-11.0

-0.3

-3.5

4.9

0.1

0.8

0.0

0.0

0.1

11.2

-10.1

-0.2

-3.5

5.0

0.1

0.2

0.1

0.3

0.3

11.3

11.3

11.3

11.3

11.3

368.4

403.4

413.5

446.5

417.1

6.0

11.6

9.4

9.0

21.0

374.4

415.0

422.8

455.4

438.1

201212

201303

201306

201309

201312

10.0

10.0

10.0

10.0

10.0

6.3

10.4

6.6

9.0

10.4

0.0

0.1

0.0

0.0

0.0

A.K.Capital Serv

A.K.Capital Serv

A.K.Capital Serv

A.K.Capital Serv

A.K.Capital Serv

201212

201303

201306

201309

201312

6.6

6.6

6.6

6.6

6.6

28.8

34.9

23.3

24.0

20.9

Aarey Drugs

Aarey Drugs

Aarey Drugs

Aarey Drugs

Aarey Drugs

201212

201303

201306

201309

201312

16.8

16.8

16.8

16.8

16.8

48.3

49.1

47.0

57.4

58.3

Int.

Dep.

Tax

D.Tax

-1.8

0.0

2.5

0.0

0.1

0.0

0.2

0.0

0.2

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-3.8

-8.4

4.6 -1.3

21

2.9

-0.1

3.0

0.9

21

-1.5

0.0

-1.5 -0.5

21

2.2

0.0

2.2

0.7

21

0.4

0.0

0.4

0.1

21

51

51

51

51

51

Div%

10

10

10

10

10

41

41

41

41

41

32

32

32

32

32

0

0

0

0

0

2.8

18.7

11.2

1.4

3.1

582

582

582

582

582

645

645

645

645

645

0

0

0

0

0

1.1

1.2

1.2

1.5

2.0

1.1

1.2

1.2

1.5

2.0

22

22

22

22

22

12

12

12

12

12

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

8.1

11.5

5.2

5.2

4.5

12.2

17.4

7.8

7.8

6.9

437

437

437

437

437

282

282

282

282

282

60

60

60

60

60

0.0

0.0

0.0

0.0

0.0

0.3

-0.5

0.2

0.8

0.3

0.2

-0.3

0.2

0.5

0.2

20

20

20

20

20

17

17

17

17

17

0

0

0

0

0

3.4

4.1

5.2

5.5

6.1

2.0

2.0

2.4

2.5

2.6

11.1

-10.4

-0.4

-3.7

4.7

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

11.0

-10.4

-0.4

-3.8

4.7

0.0

0.0

0.0

0.0

0.0

11.0

-10.4

-0.4

-3.8

4.7

10.5

-9.9

-0.4

-3.6

4.5

356.8

373.6

391.8

438.4

409.4

17.7

41.4

31.1

17.0

28.7

2.7

3.6

3.0

3.7

4.4

9.4

9.7

10.3

12.1

12.8

-9.0

14.8

11.0

-7.0

11.2

11.4

-7.7

-5.8

6.7

-3.2

0.0

0.0

0.0

0.0

0.0

3.2

21.1

12.6

1.6

3.4

0.0

0.0

0.0

0.0

0.0

3.2

21.1

12.6

1.6

3.4

6.3

10.5

6.6

9.0

10.4

5.1

8.4

4.5

6.6

7.3

1.2

2.1

2.1

2.4

3.1

0.0

0.0

0.0

0.1

0.1

0.0

0.7

0.6

0.6

0.6

0.1

0.2

0.2

0.2

0.4

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

1.1

1.2

1.2

1.5

2.0

0.0

0.0

0.0

0.0

0.0

0.9

0.9

0.7

0.7

0.7

29.7

35.8

24.0

24.7

21.6

13.9

15.0

13.5

13.1

11.1

15.8

20.8

10.5

11.6

10.5

3.5

2.8

2.3

3.4

3.1

0.4

0.4

0.4

0.4

0.4

3.9

6.1

2.7

2.6

2.4

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

8.1

11.5

5.2

5.2

4.5

0.0

0.2

0.4

0.1

0.1

48.3

49.3

47.3

57.5

58.4

47.6

49.3

46.7

56.3

57.8

0.6

0.0

0.6

1.3

0.6

0.2

0.2

0.2

0.2

0.2

0.2

0.2

0.1

0.1

0.1

0.0

0.2

0.0

0.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.3

-0.5

0.2

0.8

0.3

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Aarti Drugs

Aarti Drugs

Aarti Drugs

Aarti Drugs

Aarti Drugs

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

12.1

198.5

12.1

220.2

12.1

218.6

12.1

247.8

12.1

221.8

Aarti Inds.

Aarti Inds.

Aarti Inds.

Aarti Inds.

Aarti Inds.

201212

201303

201306

201309

201312

39.6

44.3

44.3

44.3

44.3

Aarvee Denims

Aarvee Denims

Aarvee Denims

Aarvee Denims

Aarvee Denims

201212

201303

201306

201309

201312

Aastha Broadcas.

Aastha Broadcas.

Aastha Broadcas.

Aastha Broadcas.

Aastha Broadcas.

O.I

0.7

0.2

0.1

1.1

0.4

T.Income

199.1

220.4

218.7

248.9

222.2

T.Exp.

169.4

185.6

187.6

212.7

184.7

PBIDT

29.8

34.8

31.0

36.1

37.4

450.0

584.2

585.9

637.7

639.7

10.3

13.0

10.2

11.2

10.1

460.3

597.1

596.0

648.9

649.8

392.2

501.9

517.4

539.3

542.0

23.5

23.5

23.5

23.5

23.5

139.3

177.8

164.4

188.3

149.2

5.7

4.7

2.7

5.0

4.6

144.9

182.6

167.1

193.3

153.7

201212

201303

201306

201309

201312

10.0

10.0

10.0

10.0

10.0

0.3

0.3

0.3

0.3

0.3

0.0

0.0

0.1

0.1

0.1

Aban Offshore

Aban Offshore

Aban Offshore

Aban Offshore

Aban Offshore

201212

201303

201306

201309

201312

8.7

8.7

8.7

8.7

8.7

210.4

195.9

162.2

170.0

231.7

Abbott India

Abbott India

Abbott India

Abbott India

Abbott India

201212

201303

201306

201309

201312

21.3

21.3

21.3

21.3

21.3

437.5

406.5

429.7

444.7

471.8

Int.

Dep.

Tax

D.Tax

4.8

0.0

5.9

0.8

4.4

0.8

7.7

0.0

7.1

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

10.9

0.0

10.9

9.0 171

13.8

-0.3

14.1 11.4 171

11.8

0.0

11.8

9.8 171

13.8

0.9

12.8 11.4 171

14.2

0.0

14.2 11.7 171

RES.

Div%

196 100

196 100

196 100

196 100

196 100

7.5

7.6

7.3

7.8

9.2

6.5

6.7

6.7

6.8

7.0

68.1

95.3

78.6

109.6

107.8

20.5

26.4

26.4

27.6

31.9

16.7

21.8

20.2

21.6

22.4

6.8

8.5

6.0

13.5

12.0

2.3

0.0

3.5

4.5

4.5

0.0

0.0

0.0

0.0

0.0

21.8

38.6

22.5

42.4

37.0

0.0

0.0

0.0

0.0

0.0

21.8

38.6

22.5

42.4

37.0

2.8

4.4

2.5

4.8

4.2

85

85

85

85

85

632

632

632

632

632

80

80

80

80

80

123.9

151.5

144.2

163.6

134.9

21.0

31.1

23.0

29.7

18.8

9.0

9.3

9.3

10.8

10.0

7.8

7.8

8.4

7.9

8.4

1.6

2.2

1.6

3.4

-0.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

2.6

11.9

3.7

7.6

0.9

0.0

0.0

0.0

0.0

0.0

2.6

11.9

3.7

7.6

0.9

1.1

5.1

1.6

3.2

0.4

110

110

110

110

110

234

234

234

234

234

5

5

5

5

5

0.3

0.3

0.3

0.3

0.3

0.3

0.6

0.2

0.3

0.3

0.0

-0.3

0.1

0.0

0.1

0.0

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.2

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.2

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0

0

0

0

0

-5

-5

-5

-5

-5

0

0

0

0

0

7.0

6.3

7.4

14.2

15.8

217.4

202.2

169.6

184.2

247.4

118.6

140.8

116.3

127.6

102.6

98.8

61.3

53.4

56.6

144.9

94.9

39.3

54.2

40.6

42.8

12.4

12.2

10.2

10.3

10.5

0.0

0.0

1.5

1.6

16.7

3.3

3.2

3.5

2.8

12.0

0.0

0.0

0.0

0.0

0.0

-11.8

6.6

-16.1

1.3

63.0

0.0

0.0

0.0

0.0

0.0

-11.8

6.6

-16.1

1.3

63.0

-2.7

1.5

-3.7

0.3

14.5

398

398

398

398

398

1722

1722

1722

1722

1722

180

180

180

180

180

16.0

19.5

17.3

19.0

33.5

453.5

426.1

446.9

463.7

505.3

375.2

373.8

397.7

391.3

422.3

78.3

52.3

49.2

72.4

83.0

0.0

0.0

0.0

0.0

0.0

4.8

5.2

4.8

4.3

4.2

23.8

15.3

14.7

23.0

25.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

49.8

31.7

29.7

45.2

53.5

0.0

0.0

0.0

0.0

0.0

49.8

31.7

29.7

45.2

53.5

23.4

14.9

14.0

21.3

25.2

304

304

304

304

304

626

626

626

626

626

170

170

170

170

170

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

ABC Bearings

ABC Bearings

ABC Bearings

ABC Bearings

ABC Bearings

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

11.6

33.6

11.6

33.8

11.6

37.2

11.6

32.3

11.6

29.8

ABC India

ABC India

ABC India

ABC India

ABC India

201212

201303

201306

201309

201312

5.4

5.4

5.4

5.4

5.4

ABG Infra

ABG Infra

ABG Infra

ABG Infra

ABG Infra

201212

201303

201306

201309

201312

ABG Shipyard

ABG Shipyard

ABG Shipyard

ABG Shipyard

ABG Shipyard

O.I

0.4

0.8

0.6

0.6

0.4

T.Income

34.0

34.6

37.8

32.9

30.2

T.Exp.

30.5

31.4

33.8

28.7

26.3

PBIDT

3.5

3.2

4.0

4.2

3.9

41.0

47.6

43.9

39.2

40.3

16.0

0.0

0.1

13.5

0.1

56.9

47.6

43.9

52.7

40.4

41.6

44.6

41.3

38.2

38.7

12.0

12.0

12.0

12.0

12.0

20.8

29.3

24.6

19.4

18.8

4.0

3.7

0.1

1.9

0.0

24.9

32.9

24.7

21.2

18.8

201212

201303

201306

201309

201312

50.9

50.9

50.9

50.9

50.9

468.2

391.6

422.2

373.6

284.6

32.0

23.4

7.9

1.7

7.9

Abirami Fin.

Abirami Fin.

Abirami Fin.

Abirami Fin.

Abirami Fin.

201212

201303

201306

201309

201312

6.0

6.0

6.0

6.0

6.0

0.1

0.1

0.1

0.2

0.1

ABM Knowledge

ABM Knowledge

ABM Knowledge

ABM Knowledge

ABM Knowledge

201212

201303

201306

201309

201312

10.0

10.0

10.0

10.0

10.0

14.5

17.3

15.1

15.4

14.9

Int.

Dep.

Tax

D.Tax

-0.5

0.5

0.0

0.0

0.0

0.1

0.0

0.2

0.0

0.3

F.B.Tax

0.0

0.0

0.0

0.0

0.0

PAT

0.1

0.1

0.3

0.3

0.5

(Rs. Crs.)

Ex.Ord.Item NP Adj. EPS B.V

0.0

0.1

0.1 105

0.0

0.1

0.1 105

0.0

0.3

0.2 105

0.0

0.3

0.3 105

0.0

0.5

0.5 105

RES.

Div%

110

25

110

25

110

25

110

25

110

25

0.7

1.0

1.0

1.3

0.6

2.7

2.0

2.6

2.5

2.5

15.4

3.0

2.7

14.5

1.8

2.7

2.4

2.3

2.2

2.6

2.4

2.3

2.4

2.3

2.3

1.8

-0.3

0.0

0.8

-0.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

8.5

-1.5

-2.0

9.2

-2.7

13.8

0.3

-0.1

12.6

0.0

-5.3

-1.7

-1.9

-3.4

-2.7

16.0

-3.0

-4.0

17.0

-5.0

92

92

92

92

92

44

44

44

44

44

15

15

15

15

15

11.2

17.0

11.0

8.2

10.2

13.6

15.9

13.8

13.0

8.6

8.4

6.4

8.4

7.0

7.5

9.4

8.5

9.0

9.8

9.3

0.0

0.0

0.0

0.0

0.0

-1.8

-0.8

-0.8

0.2

-4.9

0.0

0.0

0.0

0.0

0.0

-2.4

1.9

-2.8

-3.9

-3.3

4.0

0.0

0.0

0.0

0.0

-6.4

1.9

-2.8

-3.9

-3.3

-2.0

1.6

-2.3

-3.2

-2.7

193

193

193

193

193

219

219

219

219

219

0

0

0

0

0

500.2

415.0

430.1

375.3

292.5

339.7

246.4

276.2

222.9

264.7

160.5

168.6

154.0

152.4

27.8

106.1

105.8

123.0

131.3

162.8

26.9

26.3

24.6

19.2

23.8

9.0

22.0

2.1

0.6

-2.7

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

18.6

14.4

4.3

1.3

-156.1

0.0

0.0

0.0

0.0

-72.1

18.6

14.4

4.3

1.3

-84.0

3.7

2.8

0.8

0.3

-30.7

300

300

300

300

300

1519

1519

1519

1519

1519

0

0

0

0

0

0.2

0.2

0.3

0.1

0.2

0.3

0.3

0.4

0.3

0.3

0.1

0.1

0.2

0.1

0.2

0.1

0.2

0.1

0.1

0.2

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.0

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.1

0.1

0.1

0.2

0.2

0.1

0.1

0.2

13

13

13

13

13

2

2

2

2

2

0

0

0

0

0

0.2

0.4

0.2

0.4

0.3

14.7

17.7

15.3

15.8

15.3

9.6

13.3

10.4

10.7

9.2

5.1

4.4

4.9

5.1

6.1

0.1

0.0

0.1

0.1

0.0

0.1

0.1

0.2

0.2

0.2

1.6

1.4

1.6

1.6

2.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

3.3

2.9

3.1

3.2

3.9

0.0

0.0

0.0

0.0

0.0

3.3

2.9

3.1

3.2

3.9

3.3

2.9

3.1

3.2

3.9

58

58

58

58

58

49

49

49

49

49

15

15

15

15

15

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Accel Trans

Accel Trans

Accel Trans

Accel Trans

Accel Trans

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

11.0

0.3

11.0

0.0

11.0

0.1

11.0

0.0

11.0

0.4

Accelya Kale

Accelya Kale

Accelya Kale

Accelya Kale

Accelya Kale

201212

201303

201306

201309

201312

14.9

14.9

14.9

14.9

14.9

Acclaim Indus.

Acclaim Indus.

Acclaim Indus.

Acclaim Indus.

Acclaim Indus.

201212

201303

201306

201309

201312

Accurate Trans.

Accurate Trans.

Accurate Trans.

Accurate Trans.

Accurate Trans.

O.I

0.0

0.6

0.0

0.0

0.0

T.Income

0.3

0.7

0.1

0.1

0.5

T.Exp.

0.7

0.5

0.4

0.6

0.4

PBIDT

-0.4

0.2

-0.3

-0.5

0.1

62.8

67.4

70.9

71.1

65.3

2.4

0.8

1.3

1.5

14.9

65.2

68.2

72.2

72.5

80.2

34.6

36.4

46.7

48.9

36.5

5.0

5.0

5.0

5.0

5.0

112.1

19.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

112.1

19.1

0.0

0.0

0.0

201212

201303

201306

201309

201312

3.0

3.0

3.0

3.0

3.0

48.3

70.1

15.7

84.6

41.0

0.1

1.0

0.1

0.8

0.9

ACE Edu.

ACE Edu.

ACE Edu.

ACE Edu.

ACE Edu.

201212

201303

201306

201309

201312

9.2

9.2

9.2

9.2

9.2

5.6

6.0

5.4

5.7

5.8

Ace Soft. Exp.

Ace Soft. Exp.

Ace Soft. Exp.

Ace Soft. Exp.

Ace Soft. Exp.

201212

201303

201306

201309

201312

4.7

4.7

4.7

4.7

4.7

0.8

1.7

0.8

1.1

1.3

Int.

Dep.

Tax

D.Tax

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-2.3

0.0

-2.3 -2.1

-2

-1.9

0.0

-1.9 -1.7

-2

-1.9

0.0

-1.9 -1.7

-2

-2.2

0.0

-2.2 -2.0

-2

-1.5

0.0

-1.5 -1.4

-2

RES.

Div%

-13

0

-13

0

-13

0

-13

0

-13

0

0.6

0.8

0.6

0.6

0.6

1.3

1.3

1.0

1.1

1.0

30.5

31.8

25.5

23.7

43.7

0.1

0.2

0.1

0.1

0.1

2.8

2.7

2.8

3.0

3.0

8.6

9.1

7.3

6.6

9.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

19.0

19.8

15.3

14.0

31.3

0.0

0.0

0.0

0.0

0.0

19.0

19.8

15.3

14.0

31.3

12.8

13.3

10.2

9.4

21.0

51

51

51

51

51

61

61

61

61

61

700

700

700

700

700

112.8

34.5

0.1

0.1

0.1

-0.8

-15.4

-0.1

-0.1

-0.1

0.5

0.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-1.3

-16.0

-0.1

-0.1

-0.1

0.0

0.0

0.0

0.0

0.0

-1.3

-16.0

-0.1

-0.1

-0.1

-2.5

0.0

-2.2

-0.2

-0.2

-10

-10

-10

-10

-10

-10

-10

-10

-10

-10

0

0

0

0

0

48.4

71.1

15.7

85.4

41.9

39.8

60.4

12.6

73.9

33.5

8.7

10.7

3.1

11.5

8.4

7.1

11.1

2.8

11.0

8.0

0.4

0.1

0.2

0.3

0.3

0.1

0.2

0.0

0.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

1.1

-0.7

0.1

0.0

0.1

0.0

0.0

0.0

0.0

0.0

1.1

-0.7

0.1

0.0

0.1

3.8

-2.3

0.3

0.0

0.5

182

182

182

182

182

51

51

51

51

51

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

5.6

6.0

5.4

5.7

5.8

5.0

4.4

4.8

5.1

5.1

0.6

1.6

0.6

0.6

0.7

0.0

0.0

0.0

0.0

0.0

0.0

2.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.6

-0.5

0.6

0.6

0.7

0.0

0.0

0.0

0.0

0.0

0.6

-0.5

0.6

0.6

0.7

0.7

-0.5

0.7

0.7

0.7

12

12

12

12

12

2

2

2

2

2

0

0

0

0

0

0.1

0.5

0.3

0.1

0.1

1.0

2.1

1.1

1.2

1.4

0.6

2.1

0.8

1.0

1.2

0.3

0.0

0.3

0.2

0.2

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.3

0.0

0.2

0.1

0.2

0.0

0.0

0.0

0.0

0.0

0.3

0.0

0.2

0.1

0.2

0.6

-0.1

0.5

0.3

0.4

31

31

31

31

31

10

10

10

10

10

0

0

0

0

0

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Acil Cott. Inds.

Acil Cott. Inds.

Acil Cott. Inds.

Acil Cott. Inds.

Acil Cott. Inds.

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

22.2

0.2

22.2

0.2

22.2

0.1

22.2

0.1

22.2

0.2

Acrysil

Acrysil

Acrysil

Acrysil

Acrysil

201212

201303

201306

201309

201312

4.5

4.5

4.5

4.5

4.5

Action Const.Eq.

Action Const.Eq.

Action Const.Eq.

Action Const.Eq.

Action Const.Eq.

201212

201303

201306

201309

201312

Action Fin.Serv

Action Fin.Serv

Action Fin.Serv

Action Fin.Serv

Action Fin.Serv

O.I

0.0

0.0

0.0

0.0

0.0

T.Income

0.2

0.2

0.1

0.1

0.2

T.Exp.

0.2

0.1

0.1

0.1

0.1

PBIDT

0.0

0.1

0.0

0.0

0.0

19.3

20.5

25.5

26.9

25.3

0.2

0.3

0.2

0.1

0.4

19.4

20.8

25.7

27.0

25.7

16.0

17.2

20.9

22.0

21.3

19.8

19.8

19.8

19.8

19.8

169.3

169.1

140.1

142.8

156.4

2.7

4.6

2.6

2.0

2.8

172.0

173.6

142.7

144.8

159.2

201212

201303

201306

201309

201312

12.5

12.5

12.5

12.5

12.5

0.4

0.4

0.4

0.4

0.3

0.4

3.1

0.0

1.1

0.7

AD Manum Finance

AD Manum Finance

AD Manum Finance

AD Manum Finance

AD Manum Finance

201212

201303

201306

201309

201312

7.5

7.5

7.5

7.5

7.5

8.2

7.9

7.6

7.1

4.8

Adarsh Plant

Adarsh Plant

Adarsh Plant

Adarsh Plant

Adarsh Plant

201212

201303

201306

201309

201312

9.9

9.9

9.9

9.9

9.9

2.9

-0.1

0.7

3.1

1.8

Int.

Dep.

Tax

D.Tax

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

PAT

0.0

0.1

0.0

0.0

0.0

(Rs. Crs.)

Ex.Ord.Item NP Adj. EPS B.V

0.0

0.0

0.0

1

0.0

0.1

0.0

1

0.0

0.0

0.0

1

0.0

0.0

0.0

1

0.0

0.0

0.0

1

2

2

2

2

2

Div%

0

0

0

0

0

71

71

71

71

71

27

27

27

27

27

33

33

33

33

33

0.2

0.3

0.1

0.1

0.1

25

25

25

25

25

284

284

284

284

284

10

10

10

10

10

-0.2

1.1

-0.7

0.1

0.0

0.0

1.0

-0.5

0.1

0.0

19

19

19

19

19

11

11

11

11

11

0

0

0

0

0

0.0

-0.4

0.0

0.0

0.0

2.4

1.5

2.3

2.2

0.6

3.1

1.5

3.1

2.9

0.8

54

54

54

54

54

33

33

33

33

33

10

10

10

10

10

0.0

0.0

0.0

0.0

0.0

0.6

0.1

-0.5

0.2

-0.3

0.6

0.1

-0.5

0.2

-0.3

4

4

4

4

4

-6

-6

-6

-6

-6

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

3.4

3.6

4.8

5.0

4.5

0.7

0.8

0.7

0.8

0.8

1.0

1.1

1.0

1.0

1.1

0.4

0.3

0.6

0.7

0.6

0.1

0.1

-0.1

0.2

0.0

0.0

0.0

0.0

0.0

0.0

1.3

1.2

2.6

2.3

2.1

0.0

0.0

0.0

0.0

0.0

1.3

1.2

2.6

2.3

2.1

2.9

2.7

5.9

5.2

4.6

163.0

162.4

135.8

138.2

151.0

9.1

11.2

7.0

6.6

8.2

2.9

2.7

2.0

2.0

3.2

3.5

3.7

3.6

3.8

3.9

1.2

1.8

0.3

0.3

0.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

1.5

3.1

1.0

0.5

0.8

0.0

0.0

0.0

0.0

0.0

1.5

3.1

1.0

0.5

0.8

0.8

3.6

0.5

1.5

1.0

0.7

1.9

0.9

1.1

0.7

0.1

1.7

-0.4

0.4

0.3

0.2

0.2

0.2

0.2

0.2

0.1

0.1

0.1

0.1

0.1

0.0

0.1

0.0

0.0

0.0

0.0

0.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.2

1.1

-0.7

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.1

0.0

8.2

7.9

7.6

7.2

4.8

1.7

2.9

1.7

1.4

1.7

6.5

5.0

5.9

5.8

3.1

2.7

3.0

2.1

2.2

1.9

0.3

0.3

0.3

0.3

0.3

1.2

0.6

1.1

1.1

0.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

2.4

1.2

2.3

2.2

0.6

0.0

0.7

0.0

0.0

0.0

2.9

0.6

0.7

3.1

1.8

2.0

0.3

1.0

2.7

1.9

0.8

0.3

-0.3

0.4

-0.1

0.2

0.1

0.1

0.1

0.1

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.6

0.1

-0.5

0.2

-0.3

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

ADC India

ADC India

ADC India

ADC India

ADC India

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

4.6

7.6

4.6

10.7

4.6

10.2

4.6

11.6

4.6

13.1

Addi Inds.

Addi Inds.

Addi Inds.

Addi Inds.

Addi Inds.

201212

201303

201306

201309

201312

5.4

5.4

5.4

5.4

5.4

ADF Foods

ADF Foods

ADF Foods

ADF Foods

ADF Foods

201212

201303

201306

201309

201312

Adhunik Metal

Adhunik Metal

Adhunik Metal

Adhunik Metal

Adhunik Metal

O.I

0.6

0.5

0.4

0.6

1.0

T.Income

8.2

11.2

10.6

12.2

14.2

T.Exp.

9.7

10.0

10.0

11.5

12.9

PBIDT

-1.5

1.2

0.6

0.7

1.3

0.0

0.1

0.0

0.0

0.4

0.1

4.0

0.2

0.2

0.2

0.1

4.0

0.2

0.2

0.6

0.2

1.2

0.3

0.2

0.7

20.6

22.4

22.4

22.4

22.4

29.0

35.8

27.6

33.2

30.5

2.3

11.3

5.4

3.6

2.1

31.3

47.2

32.9

36.8

32.7

201212

201303

201306

201309

201312

123.5

123.5

123.5

123.5

123.5

350.9

561.9

351.7

381.4

433.1

15.2

26.3

4.5

28.5

31.2

Adi Finechem

Adi Finechem

Adi Finechem

Adi Finechem

Adi Finechem

201212

201303

201306

201309

201312

11.4

11.4

11.4

12.5

12.5

27.8

29.2

30.7

36.6

39.2

Adinath Bio-Labs

Adinath Bio-Labs

Adinath Bio-Labs

Adinath Bio-Labs

Adinath Bio-Labs

201212

201303

201306

201309

201312

22.1

22.1

22.1

22.1

22.1

Adit.Birla Money

Adit.Birla Money

Adit.Birla Money

Adit.Birla Money

201212

201303

201306

201309

5.5

5.5

5.5

5.5

Int.

Dep.

Tax

D.Tax

-0.1

0.0

1.6

0.0

0.0

0.0

0.0

0.0

0.3

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-1.5

0.0

-1.5 -3.3 101

-0.6

-0.1

-0.6 -1.3 101

0.5

0.0

0.5

1.0 101

0.6

0.0

0.6

1.2 101

0.9

0.0

0.9

1.9 101

42

42

42

42

42

Div%

15

15

15

15

15

18

18

18

18

18

14

14

14

14

14

0

0

0

0

0

0.3

4.7

1.8

1.5

0.9

70

70

70

70

70

133

133

133

133

133

15

15

15

15

15

10.1

0.9

0.6

1.6

4.5

0.8

0.1

0.1

0.1

0.4

55

55

55

55

55

1100

1100

1100

1100

1100

0

0

0

0

0

-1.5

0.9

0.0

0.0

0.0

2.7

1.7

2.8

3.9

5.5

2.2

2.1

2.5

3.1

4.4

27

27

27

27

27

19

19

19

19

19

10

10

10

10

10

0.2

0.0

0.2

0.2

0.1

0.0

0.0

0.0

0.0

0.0

0.2

0.0

0.2

0.2

0.1

0.0

0.0

0.0

0.0

0.0

1

1

1

1

1

7

7

7

7

7

0

0

0

0

0

-2.8

-3.0

-4.3

-2.8

0.0

0.0

0.0

0.0

-2.8

-3.0

-4.3

-2.8

-0.5

-0.5

-0.8

-0.5

5

5

5

5

22

22

22

22

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.2

0.2

0.2

0.1

0.1

-0.2

2.8

0.0

-0.1

-0.1

0.0

0.0

0.0

0.0

0.0

0.2

0.2

0.1

0.1

0.1

0.0

-0.1

0.0

0.0

0.0

0.0

-0.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.3

3.0

-0.2

-0.2

-0.2

0.0

1.9

0.0

0.0

0.0

-0.3

1.1

-0.2

-0.2

-0.2

-0.3

2.8

-0.2

-0.2

-0.2

28.9

33.6

25.3

29.6

27.7

2.4

13.5

7.7

7.2

4.9

0.4

0.6

0.2

0.3

0.2

1.0

1.2

1.7

1.7

1.7

0.4

1.5

1.8

1.9

1.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.6

10.3

4.0

3.4

2.0

0.0

6.3

0.0

0.0

0.0

0.6

4.0

4.0

3.4

2.0

366.1

588.2

356.2

409.9

464.3

281.3

505.3

281.4

334.9

380.0

84.8

83.0

74.8

75.0

84.3

58.5

58.6

50.0

48.6

56.7

24.2

23.7

23.8

24.0

24.0

0.0

0.0

0.0

0.0

0.0

-8.0

-0.2

0.5

0.8

-0.8

0.0

0.0

0.0

0.0

0.0

10.1

0.9

0.6

1.6

4.5

0.0

0.0

0.0

0.0

0.0

0.4

1.4

0.8

0.3

0.4

28.1

30.5

31.5

36.9

39.6

24.6

25.8

25.8

30.0

29.9

3.5

4.8

5.7

7.0

9.7

0.6

0.5

0.6

0.7

0.7

0.6

0.6

0.6

0.7

0.7

1.1

1.1

1.6

1.8

2.8

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

1.2

2.6

2.8

3.9

5.5

11.0

10.5

10.4

10.5

9.9

0.0

0.0

0.1

0.0

0.0

11.0

10.5

10.5

10.5

9.9

10.8

10.4

10.2

10.3

9.7

0.3

0.1

0.3

0.3

0.2

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

14.7

13.4

12.9

13.6

3.7

3.9

3.2

2.9

18.5

17.3

16.0

16.5

18.4

17.7

17.4

17.1

0.0

-0.3

-1.4

-0.6

1.0

0.9

1.1

0.6

1.9

1.8

1.8

1.6

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Adit.Birla Money

Year

201312

Eq.

N.Sales

5.5

14.8

O.I

T.Income

2.9

17.8

T.Exp.

17.2

PBIDT

0.6

Aditya Bir.Chem.

Aditya Bir.Chem.

Aditya Bir.Chem.

Aditya Bir.Chem.

Aditya Bir.Chem.

201212

201303

201306

201309

201312

23.4

23.4

23.4

23.4

23.4

201.2

194.8

220.5

233.6

275.7

2.2

19.1

14.7

36.1

12.0

203.5

213.9

235.2

269.6

287.7

158.8

167.8

165.3

212.3

221.7

Aditya Spinners

Aditya Spinners

Aditya Spinners

Aditya Spinners

Aditya Spinners

201212

201303

201306

201309

201312

16.7

16.7

16.7

16.7

16.7

10.0

10.3

10.0

10.9

10.7

0.0

0.2

0.0

0.1

0.0

10.0

10.5

10.0

11.0

10.7

Ador Fontech

Ador Fontech

Ador Fontech

Ador Fontech

Ador Fontech

201212

201303

201306

201309

201312

3.5

3.5

3.5

3.5

3.5

30.5

39.9

30.7

35.4

32.9

0.7

10.0

0.7

0.6

0.6

Ador Welding

Ador Welding

Ador Welding

Ador Welding

Ador Welding

201212

201303

201306

201309

201312

13.6

13.6

13.6

13.6

13.6

74.8

118.4

68.1

91.4

85.2

Advance Meter.

Advance Meter.

Advance Meter.

Advance Meter.

Advance Meter.

201212

201303

201306

201309

201312

8.0

8.0

8.0

8.0

8.0

Advanced Micron.

Advanced Micron.

Advanced Micron.

Advanced Micron.

Advanced Micron.

201212

201303

201306

201309

201312

Advani Hotels.

Advani Hotels.

201212

201303

Int.

Dep.

Tax

D.Tax

0.0

0.0

F.B.Tax

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-0.9

0.0

-0.9 -0.2

5

22

Div%

0

161

161

161

161

161

354

354

354

354

354

10

10

10

10

10

0.5

-0.2

0.1

0.2

0.2

4

4

4

4

4

-9

-9

-9

-9

-9

0

0

0

0

0

2.5

8.4

2.5

3.2

2.8

1.4

4.8

1.4

1.8

1.6

44

44

44

44

44

74

74

74

74

74

175

175

175

175

175

0.0

0.0

0.0

0.0

0.0

1.5

8.9

1.6

4.7

2.9

1.1

6.6

1.2

3.4

2.1

136

136

136

136

136

171

171

171

171

171

60

60

60

60

60

-0.6

0.8

0.9

-1.5

-8.1

0.0

1.4

0.0

-0.6

-5.1

-0.6

-0.6

0.9

-0.9

-3.0

-0.4

0.5

0.6

-0.9

-5.0

101

101

101

101

101

155

155

155

155

155

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

-0.2

-5.0

-6.1

-2.9

2.6

-0.5

-0.7

0.0

0.0

0.0

0.3

-4.2

-6.1

-2.9

2.6

-0.4

-9.4

-11.6

-5.5

4.9

29

29

29

29

29

10

10

10

10

10

0

0

0

0

0

0.0

0.0

1.5

4.4

0.0

-0.1

1.5

4.6

0.3

1.0

7

7

23

23

13

13

0.1

1.4

44.7

46.2

69.9

57.4

66.0

22.6

21.4

21.3

21.3

23.2

14.8

15.1

17.0

17.8

18.4

7.0

1.9

11.4

5.9

8.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.2

7.9

20.2

12.4

16.4

-0.3

0.0

0.0

0.0

0.0

0.5

7.9

20.2

12.4

16.4

0.1

3.4

8.7

5.3

7.0

9.1

10.1

9.6

10.5

10.0

1.0

0.5

0.4

0.5

0.7

0.0

0.6

0.0

0.0

0.1

0.2

0.2

0.2

0.2

0.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.8

-0.3

0.2

0.3

0.4

0.0

0.0

0.0

0.0

0.0

0.8

-0.3

0.2

0.3

0.4

31.2

49.9

31.3

36.0

33.5

27.4

36.5

26.9

30.3

28.6

3.8

13.4

4.4

5.7

4.9

0.0

0.0

0.0

0.0

0.0

0.6

0.8

0.7

0.6

0.7

0.8

4.2

1.3

1.8

1.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

2.5

8.4

2.5

3.2

2.8

0.0

0.0

0.0

0.0

0.0

1.4

1.4

2.3

1.7

0.6

76.2

119.8

70.4

93.1

85.7

71.0

103.2

65.0

83.0

78.8

5.2

16.6

5.3

10.1

6.9

0.2

0.3

0.2

0.3

0.3

3.1

3.5

2.8

2.9

3.0

0.5

3.9

0.7

2.2

0.6

-0.1

0.0

-0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

1.5

8.9

1.6

4.7

2.9

0.8

1.6

3.9

4.5

2.5

2.1

5.1

2.7

1.3

2.0

2.9

6.7

6.6

5.8

4.5

2.6

3.5

3.8

5.2

11.0

0.3

3.2

2.9

0.6

-6.5

0.2

0.4

0.5

1.0

1.0

0.9

1.2

1.2

1.3

1.3

0.0

0.0

0.2

-0.2

0.0

-0.2

0.8

0.0

0.0

-0.8

0.0

0.0

0.0

0.0

0.0

5.3

5.3

5.3

5.3

5.3

9.5

5.2

5.6

3.2

2.2

0.0

0.1

0.0

0.0

7.5

9.6

5.3

5.6

3.2

9.7

8.9

9.2

10.5

5.0

4.3

0.7

-4.0

-5.0

-1.8

5.4

0.6

0.7

0.7

0.6

0.6

0.5

0.2

0.5

0.5

0.5

-0.1

0.0

0.0

0.0

1.8

-0.1

0.2

0.0

0.0

0.0

9.2

9.2

10.1

14.4

1.1

1.6

11.2

16.1

8.5

8.7

2.7

7.3

0.5

0.4

0.7

0.8

0.0

1.7

0.0

0.0

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Advani Hotels.

Advani Hotels.

Advani Hotels.

Year

201306

201309

201312

Eq.

N.Sales

9.2

6.8

9.2

3.9

9.2

11.1

O.I

T.Income

1.1

7.9

0.5

4.5

1.5

12.6

T.Exp.

7.7

8.1

8.5

PBIDT

0.2

-3.7

4.1

Advanta

Advanta

Advanta

Advanta

Advanta

201212

201303

201306

201309

201312

16.9

16.9

16.9

16.9

16.9

4.5

15.8

40.3

6.7

8.7

16.0

7.9

12.3

10.5

9.5

20.5

23.8

52.6

17.2

18.2

1.9

13.2

29.9

10.8

10.2

Advik Labs.

Advik Labs.

Advik Labs.

Advik Labs.

Advik Labs.

201212

201303

201306

201309

201312

9.4

9.4

9.4

9.4

15.0

8.6

4.2

7.3

3.4

8.4

0.3

1.5

0.6

0.3

-0.4

8.9

5.7

7.9

3.7

8.0

Aegis Logistics

Aegis Logistics

Aegis Logistics

Aegis Logistics

Aegis Logistics

201212

201303

201306

201309

201312

33.4

33.4

33.4

33.4

33.4

114.7

98.6

93.6

92.5

92.6

3.4

7.9

2.3

2.6

2.2

Aeonian Invest.

Aeonian Invest.

Aeonian Invest.

Aeonian Invest.

Aeonian Invest.

201212

201303

201306

201309

201312

1.0

1.0

1.0

1.0

1.0

0.0

0.0

0.0

0.0

0.0

Aftek

Aftek

Aftek

Aftek

Aftek

201212

201303

201306

201309

201312

22.0

22.0

22.0

22.0

22.0

Agarwal Indl.

Agarwal Indl.

Agarwal Indl.

Agarwal Indl.

Agarwal Indl.

201212

201303

201306

201309

201312

4.5

5.5

5.5

5.5

5.5

Int.

Dep.

Tax

D.Tax

0.0

0.0

0.1

0.0

0.0

0.0

F.B.Tax

0.0

0.0

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-0.9

0.0

-0.9 -0.2

7

-5.0

0.0

-5.0 -1.1

7

2.5

0.0

2.5

0.5

7

23

23

23

Div%

13

13

13

195

195

195

195

195

311

311

311

311

311

0

0

0

0

0

-0.1

0.5

0.0

0.0

0.1

12

12

12

12

12

2

2

2

2

2

0

0

0

0

0

6.4

9.4

5.8

6.2

5.3

1.9

2.8

1.7

1.9

1.6

97

97

97

97

97

290

290

290

290

290

40

40

40

40

40

0.0

0.0

0.0

-0.5

0.0

5.6

6.8

1.4

-0.2

-0.1

11.6

14.2

2.8

-1.5

-0.2

211

211

211

211

211

100

100

100

100

100

0

0

0

0

0

9.4

-34.8

-0.7

-0.1

-9.4

0.0

0.0

0.0

0.0

0.0

9.4

-34.8

-0.7

-0.1

-9.4

0.9

-3.5

-0.1

0.0

-0.9

41

41

41

41

41

427

427

427

427

427

0

0

0

0

0

0.9

0.0

1.8

0.6

0.3

0.0

0.0

0.0

0.0

0.0

0.9

0.0

1.8

0.6

0.3

2.0

0.0

3.3

1.2

0.6

60

60

60

60

60

27

27

27

27

27

12

12

12

12

12

0.4

0.5

0.7

0.7

0.8

0.8

18.6

10.5

22.7

6.5

8.0

8.5

8.7

6.7

10.9

7.0

1.6

2.3

2.3

2.3

2.4

-1.8

0.0

0.0

0.0

0.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

10.3

-0.5

13.7

-6.7

-1.8

-2.9

0.0

0.0

0.0

0.0

13.2

-0.5

13.7

-6.7

-1.8

6.1

-0.3

8.1

-0.8

-0.2

8.7

4.2

7.4

3.3

7.4

0.3

1.6

0.5

0.4

0.6

0.3

0.4

0.4

0.3

0.2

0.1

0.2

0.1

0.1

0.1

0.0

0.5

0.0

0.0

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.1

0.5

0.0

0.0

0.2

0.0

0.0

0.0

0.0

0.0

-0.1

0.5

0.0

0.0

0.2

118.1

106.5

95.9

95.1

94.8

102.6

89.4

80.8

80.2

80.2

15.5

17.0

15.2

14.8

14.6

2.2

3.0

2.7

2.7

3.2

3.0

3.0

3.1

3.4

3.2

4.0

2.6

3.2

2.7

2.9

0.0

-1.0

0.4

-0.2

0.0

0.0

0.0

0.0

0.0

0.0

6.4

9.4

5.8

6.2

5.3

0.0

0.0

0.0

0.0

0.0

6.4

9.0

1.7

-0.1

0.0

6.4

9.0

1.7

-0.1

0.0

0.1

0.2

0.1

0.9

0.1

6.3

8.8

1.6

-1.0

-0.1

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.0

0.0

0.0

0.7

2.0

0.3

-0.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

5.6

6.8

1.4

-0.7

-0.1

29.3

24.2

20.3

18.5

18.2

0.0

0.0

0.0

0.0

0.0

29.3

24.2

20.3

18.5

18.2

-3.2

41.8

-0.6

-3.6

5.3

32.5

-17.6

20.9

22.2

12.9

2.3

2.2

1.9

1.9

2.0

20.5

19.7

19.6

20.3

20.3

0.4

-4.7

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

11.3

28.0

40.4

6.7

30.9

9.3

8.6

6.4

5.7

8.8

20.6

36.6

46.8

12.4

39.6

18.1

33.8

42.9

9.7

36.8

2.5

2.8

3.9

2.7

2.8

0.5

0.8

0.7

0.7

0.9

1.0

1.1

1.0

1.3

1.2

0.2

0.9

0.5

0.2

0.3

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

AGC Networks

AGC Networks

AGC Networks

AGC Networks

AGC Networks

Year

201212

201303

201306

201309

201312

Eq.

N.Sales

28.5

133.8

28.5

169.7

28.5

77.1

28.5

87.1

28.5

73.5

O.I

T.Income

29.5

163.3

5.6

175.3

6.7

83.8

14.7

101.8

4.4

77.9

T.Exp.

144.7

191.2

125.6

120.0

116.0

PBIDT

18.6

-15.9

-41.8

-18.2

-38.1

Agro Tech Foods.

Agro Tech Foods.

Agro Tech Foods.

Agro Tech Foods.

Agro Tech Foods.

201212

201303

201306

201309

201312

24.4

24.4

24.4

24.4

24.4

219.9

204.7

183.4

194.6

197.1

1.3

0.7

0.4

0.4

0.5

221.2

205.5

183.7

195.0

197.5

200.3

184.4

172.5

178.6

176.5

Ahlcon Parent(I)

Ahlcon Parent(I)

Ahlcon Parent(I)

Ahlcon Parent(I)

Ahlcon Parent(I)

201212

201303

201306

201309

201312

7.2

7.2

7.2

7.2

7.2

27.2

30.0

28.3

28.8

29.9

0.9

0.4

0.7

0.7

0.7

28.1

30.4

29.0

29.6

30.6

Ahluwalia Contr.

Ahluwalia Contr.

Ahluwalia Contr.

Ahluwalia Contr.

Ahluwalia Contr.

201212

201303

201306

201309

201312

12.6

12.6

12.6

12.6

12.6

316.4

372.8

219.0

248.7

239.5

7.2

6.6

3.3

16.5

2.4

Ahmednagar Forg.

Ahmednagar Forg.

Ahmednagar Forg.

Ahmednagar Forg.

Ahmednagar Forg.

201212

201303

201306

201309

201312

36.8

36.8

36.8

36.8

36.8

281.0

299.6

335.8

463.1

508.6

AIA Engg.

AIA Engg.

AIA Engg.

AIA Engg.

AIA Engg.

201212

201303

201306

201309

201312

18.9

18.9

18.9

18.9

18.9

Aishwarya Tele.

Aishwarya Tele.

Aishwarya Tele.

Aishwarya Tele.

201212

201303

201306

201309

10.8

10.8

10.8

10.8

Int.

Dep.

Tax

D.Tax

0.1

0.0

10.6

0.0

0.0

0.0

0.0

0.0

0.0

0.0

F.B.Tax

0.0

0.0

0.0

0.0

0.0

PAT

7.7

-39.0

-51.2

-27.8

-47.9

(Rs. Crs.)

Ex.Ord.Item NP Adj. EPS B.V

0.0

7.7

3.0

84

0.0

-39.0 -13.7

84

0.0

-51.2 -18.0

84

6.9

-34.7 -10.0

84

-16.4

-31.5 -17.0

84

RES.

Div%

211

0

211

0

211

0

211

0

211

0

8.9

9.8

7.0

7.5

7.5

1.9

2.7

2.4

2.1

2.3

20.9

21.0

11.2

16.4

21.0

0.0

0.0

0.1

0.4

0.8

1.7

1.8

2.2

2.4

2.7

6.0

3.8

1.4

1.7

2.8

0.3

1.5

1.1

1.2

1.7

0.0

0.0

0.0

0.0

0.0

13.1

13.9

6.4

10.6

13.1

0.0

0.0

0.0

0.0

0.0

13.1

13.9

6.4

10.6

13.1

5.4

5.7

2.6

4.4

5.4

100

100

100

100

100

220

220

220

220

220

20

20

20

20

20

20.5

22.0

20.4

21.8

22.1

7.6

8.4

8.7

7.7

8.5

0.7

0.7

0.5

0.5

0.4

0.9

0.9

0.9

0.9

0.9

1.7

2.3

2.3

2.6

2.6

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

4.3

4.5

5.0

3.8

4.7

0.0

0.0

0.0

0.0

0.0

4.3

4.5

5.0

3.8

4.7

5.9

6.3

7.0

5.2

6.5

75

75

75

75

75

47

47

47

47

47

0

0

0

0

0

323.7

379.4

222.3

265.2

241.9

333.8

351.5

207.6

252.7

227.4

-10.1

27.9

14.8

12.5

14.5

8.3

8.5

9.3

9.4

8.4

8.7

5.6

4.4

1.7

3.0

0.0

0.0

0.2

0.3

0.6

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-27.1

13.7

0.9

1.2

2.5

-2.5

8.3

0.0

13.8

0.0

-24.6

5.4

0.9

-12.7

2.5

-4.3

2.2

0.1

0.2

0.4

32

32

32

32

32

192

192

192

192

192

0

0

0

0

0

21.7

30.6

26.7

13.2

17.2

302.7

330.2

362.5

476.2

525.8

222.5

237.2

264.0

368.2

402.6

80.2

93.0

98.5

108.0

123.2

18.4

20.9

22.7

22.9

41.5

17.7

17.7

20.5

24.3

28.8

13.2

10.7

16.6

24.8

17.5

0.0

5.6

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

30.8

38.0

38.7

36.0

35.5

0.0

0.0

0.0

0.0

0.0

30.8

38.0

38.7

36.0

35.5

8.4

10.4

10.5

9.8

9.7

201

201

201

201

201

702

702

702

702

702

10

10

10

10

10

377.1

414.3

385.7

432.6

436.0

17.1

27.3

25.8

14.4

28.1

394.3

441.6

411.5

447.0

464.1

322.6

340.2

303.3

341.5

372.6

71.7

101.5

108.2

105.5

91.5

0.6

1.1

1.2

1.5

0.1

7.8

7.8

8.0

8.2

8.4

22.1

26.4

30.3

30.4

26.4

0.5

0.5

0.7

0.2

0.0

0.0

0.0

0.0

0.0

0.0

40.8

65.6

68.1

65.2

56.7

0.0

0.0

0.0

0.0

-21.2

40.8

65.6

68.1

65.2

77.9

4.3

7.0

7.2

6.9

6.0

115

115

115

115

115

1065

1065

1065

1065

1065

200

200

200

200

200

3.1

11.0

6.9

7.0

0.1

0.2

0.0

0.1

3.2

11.2

6.9

7.1

2.4

9.8

6.2

6.1

0.8

1.4

0.8

1.0

0.3

0.3

0.3

0.4

0.3

0.3

0.2

0.2

0.0

0.0

0.1

0.0

-1.0

-1.2

0.0

0.3

0.0

0.0

0.0

0.0

1.2

2.0

0.1

0.1

0.0

0.0

0.0

0.0

1.2

2.0

0.1

0.1

0.6

0.9

0.1

0.0

18

18

18

18

27

27

27

27

0

0

0

0

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Aishwarya Tele.

Year

201312

Eq.

N.Sales

10.8

6.1

O.I

T.Income

0.1

6.2

T.Exp.

7.7

PBIDT

-1.4

Ajanta Pharma

Ajanta Pharma

Ajanta Pharma

Ajanta Pharma

Ajanta Pharma

201212

201303

201306

201309

201312

11.8

11.8

11.8

17.7

17.7

225.7

249.2

215.4

270.8

292.6

4.1

6.5

10.4

15.4

12.3

229.8

255.7

225.8

286.1

304.9

169.5

180.4

167.9

195.7

203.6

Ajanta Soya

Ajanta Soya

Ajanta Soya

Ajanta Soya

Ajanta Soya

201212

201303

201306

201309

201312

11.9

15.5

15.5

15.5

15.5

102.3

97.8

87.4

113.7

138.7

0.7

0.2

0.4

0.2

0.7

102.9

98.0

87.8

113.9

139.4

Ajcon Global

Ajcon Global

Ajcon Global

Ajcon Global

Ajcon Global

201212

201303

201306

201309

201312

6.1

6.1

6.1

6.1

6.1

1.7

1.5

1.2

1.3

1.2

0.0

0.0

0.0

0.0

0.0

Ajel

Ajel

Ajel

Ajel

Ajel

201212

201303

201306

201309

201312

10.8

10.8

10.8

11.7

11.7

1.9

3.7

1.9

1.8

1.5

Ajmera Realty

Ajmera Realty

Ajmera Realty

Ajmera Realty

Ajmera Realty

201212

201303

201306

201309

201312

35.5

35.5

35.5

35.5

35.5

Akar Tools

Akar Tools

Akar Tools

Akar Tools

Akar Tools

201212

201303

201306

201309

201312

Aksh Optifibre

Aksh Optifibre

201212

201303

Int.

Dep.

Tax

D.Tax

0.0

-0.8

F.B.Tax

0.0

(Rs. Crs.)

PAT

Ex.Ord.Item NP Adj. EPS B.V

-1.2

0.0

-1.2 -0.6

18

27

Div%

0

151

151

151

151

151

344

344

344

344

344

125

125

125

125

125

0.0

0.2

-0.3

0.3

0.3

17

17

17

17

17

11

11

11

11

11

0

0

0

0

0

0.2

0.1

0.0

0.1

0.1

0.3

0.1

0.0

0.1

0.1

22

22

22

22

22

7

7

7

7

7

0

0

0

0

0

0.0

0.0

0.0

0.0

0.0

0.2

0.5

0.0

0.0

0.0

0.1

0.4

0.0

0.0

0.0

10

10

10

10

10

0

0

0

0

0

0

0

0

0

0

0.8

5.2

0.4

0.2

0.2

0.0

0.0

0.0

0.0

0.0

0.8

5.2

0.4

0.2

0.2

0.2

1.5

0.1

0.1

0.1

98

98

98

98

98

312

312

312

312

312

15

15

15

15

15

0.0

0.0

0.0

0.0

0.0

0.3

0.0

0.3

0.2

0.3

0.0

0.0

0.0

0.0

0.0

0.3

0.0

0.3

0.2

0.3

0.6

0.1

0.5

0.4

0.5

45

45

45

45

45

19

19

19

19

19

5

5

5

5

5

0.0

0.0

6.2

1.7

0.0

1.4

6.2

0.3

0.4

0.1

24

24

285

285

0

0

0.3

0.3

60.3

75.4

58.0

90.5

101.3

3.4

6.0

1.6

2.2

2.2

8.1

9.0

8.6

9.0

9.5

16.3

33.3

15.2

23.5

27.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

32.6

27.1

32.5

55.8

62.4

0.0

0.0

0.0

0.0

0.0

32.6

27.1

32.5

55.8

62.4

13.8

11.6

13.9

15.9

17.8

102.6

97.7

86.4

111.4

138.2

0.4

0.3

1.4

2.5

1.2

0.2

-0.3

1.7

1.3

0.3

0.4

0.4

0.4

0.4

0.4

-0.2

0.0

-0.2

0.3

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

-0.1

0.2

-0.5

0.5

0.4

0.0

0.0

0.0

0.0

0.0

-0.1

0.2

-0.5

0.5

0.4

1.7

1.6

1.2

1.4

1.3

1.2

1.1

1.0

1.0

0.9

0.5

0.4

0.3

0.4

0.4

0.2

0.1

0.1

0.2

0.1

0.1

0.1

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.2

0.1

0.0

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.1

0.0

0.0

0.0

1.9

3.7

1.9

1.8

1.5

1.7

2.6

1.9

1.7

1.5

0.2

1.2

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.2

0.0

0.0

0.0

0.0

0.5

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.2

0.5

0.0

0.0

0.0

1.2

0.0

0.3

0.0

0.0

0.4

5.6

0.6

0.6

0.6

1.5

5.6

0.9

0.6

0.6

0.1

0.2

0.1

0.0

0.1

1.5

5.5

0.8

0.6

0.5

0.0

0.0

0.0

0.0

0.0

0.3

0.3

0.3

0.3

0.3

0.4

0.0

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

5.4

5.4

5.4

5.4

5.4

29.4

26.3

35.4

39.5

33.9

0.0

0.0

0.0

0.0

0.0

29.5

26.3

35.4

39.5

33.9

27.5

24.0

33.2

37.4

31.7

2.0

2.2

2.2

2.1

2.2

1.0

1.5

1.3

1.3

1.3

0.6

0.6

0.6

0.6

0.6

0.1

0.1

0.1

0.1

0.1

0.0

0.0

0.0

0.0

0.0

74.3

74.3

52.0

53.8

2.2

3.0

54.2

56.8

44.1

47.8

10.2

9.0

0.7

0.6

3.3

6.6

0.0

0.0

0.0

0.0

RES.

B Group Quarterly Results (Stand Alone) - December - 2013

Co. Name

Aksh Optifibre

Aksh Optifibre

Aksh Optifibre

Year

201306

201309

201312

Eq.

N.Sales

74.3

56.0

74.3

65.9

74.3

46.1

O.I

T.Income

1.7

57.7

2.0

67.8

2.0

48.1

T.Exp.

47.5

55.4

39.5

PBIDT

10.1

12.4

8.6

AksharChem (I)

AksharChem (I)

AksharChem (I)

AksharChem (I)

AksharChem (I)

201212

201303

201306

201309

201312

5.0

5.0

5.0

5.0

5.0

26.9

27.9

30.7

42.1

35.3

0.0

0.0

0.0

0.0

0.1

26.9

27.9

30.8

42.1

35.4

25.2

25.4

25.7

29.3

26.6

Akzo Nobel

Akzo Nobel

Akzo Nobel

Akzo Nobel

Akzo Nobel

201212

201303

201306

201309

201312

46.7

46.7

46.7

46.7

46.7

594.1

524.7

561.6

565.0

643.9

35.2

66.9

22.3

31.1

16.7

629.3

591.6

583.8

596.0

660.6

Albert David

Albert David

Albert David

Albert David

Albert David

201212

201303

201306

201309

201312

5.7

5.7

5.7

5.7

5.7

54.0

65.8

70.2

81.4

63.8

0.6

0.8

0.5

0.4

0.9

Alchemist

Alchemist

Alchemist

Alchemist

Alchemist

201212

201303

201306

201309

201312

13.6

13.6

13.6

13.6

13.6

158.5

168.8

190.1

235.2

229.4

Alchemist Realty

Alchemist Realty

Alchemist Realty

Alchemist Realty

Alchemist Realty

201212

201303

201306

201309

201312

14.8

14.8

14.8

14.8

14.8

Alembic

Alembic

Alembic

Alembic

Alembic

201212

201303

201306

201309

201312

26.7

26.7

26.7

26.7

53.4

Int.

Dep.

Tax

D.Tax

0.0

0.0

0.0

0.0

0.0

0.0

F.B.Tax

0.0

0.0

0.0

PAT

(Rs. Crs.)

Ex.Ord.Item NP Adj. EPS B.V

5.2

0.0

5.2

0.4

24

6.4

-0.1

6.4

0.4

24

2.5

-0.1

2.6

0.2

24

RES.

Div%

285

0

285

0

285

0

1.0

2.2

2.4

4.0

3.8

3.7

1.7

2.5

5.0