Professional Documents

Culture Documents

Budget 2014 Textile Aspects

Uploaded by

Shrikant GadgeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 2014 Textile Aspects

Uploaded by

Shrikant GadgeCopyright:

Available Formats

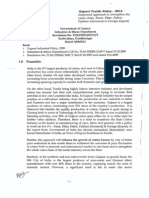

BUDGET 2014-15 Textile and Apparel Sector

Textile Ministry's budget increased to Rs. 5697.43 crores from last year's Rs. 4698.8

crores. TUFS allocation increased to Rs. 2300 crores, SITP to get Rs 240 crores,

TMTT to get Rs. 43 crores and ISDS to receive increased allocation of Rs. 268

crores

To set-up a Trade Facilitation Centre and a Crafts Museum in Varanasi to promote

handloom products of Varanasi with an investment of Rs. 50 crore.

Government to set-up eight Textile Mega Clusters at Varanasi, Bareily, Lucknow,

Surat, Kuttch, Bhagalpur, Mysore and one in Tamil Nadu with a sum of Rs. 200

crore.

To initiate a Pashmina Promotion Program (P-3) in Jammu & Kashmir with a sum of

Rs. 50 crore.

Basic Customs Duty (BCD) on Raw materials (PTMEG etc.) required for

manufacturing of Spandex yarn reduced from 5 percent to Nil.

BCD on ethane, propane, ethylene, propylene, butadiene and ortho-xylene reduced

from 5 percent to 2.5 percent.

To encourage exports of readymade garments, Govt. proposes to increase the duty

free entitlement for import of trimmings, embellishments and other specified items

from 3 percent to 5 percent of the FOB value of their exports. (3 percent of the FOB

value in case of leather garments)

Excise duty reduced from 12 percent to 6 percent on footwear of retail price

exceeding Rs. 500 - 1000 per pair. Footwear of retail price up to Rs. 500 per pair will

continue to remain excise duty exempted.

To exempt PSF and PFY manufactured from plastic waste and scrap PET bottles

from excise duty with effect from 29th June, 2010 to 7th May, 2012. However, such

PSF and PFY will be levied excise duty of 2 percent without Cenvat benefit and 6

percent with Cenvat benefit from the specified date.

Service Tax on loading, unloading, storage, warehousing and transportation of

cotton, whether ginned or baled, is exempted.

You might also like

- 1) Impact of GST On Cotton Textiles IndustriesDocument3 pages1) Impact of GST On Cotton Textiles IndustriessaurabhsarafNo ratings yet

- A Gist of Union Budget 2012Document4 pagesA Gist of Union Budget 2012Robin GandhiNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- Government InitiativesDocument2 pagesGovernment InitiativesViral GondaliyaNo ratings yet

- Union Budgetmacro Economicsbudgets and Budgeting: TopicsDocument7 pagesUnion Budgetmacro Economicsbudgets and Budgeting: TopicsTarik HussainNo ratings yet

- Pakistan Knitwear & Sweater Exporters Association: Budget FY16: No Relief To TextileDocument3 pagesPakistan Knitwear & Sweater Exporters Association: Budget FY16: No Relief To TextileAhmed SaeedNo ratings yet

- Indian Budget 2016 Final 1Document2 pagesIndian Budget 2016 Final 1SiddhanNo ratings yet

- Textile Ministry of IndiaDocument290 pagesTextile Ministry of IndiaSrujan KumarNo ratings yet

- EconomyDocument8 pagesEconomyعبداللہ یاسر بلوچNo ratings yet

- Union BUDGET 2020Document6 pagesUnion BUDGET 2020ANshulNo ratings yet

- BUDGET-2010-11: Import & Export of Textile IndustryDocument10 pagesBUDGET-2010-11: Import & Export of Textile Industrypavan_jaya2008No ratings yet

- Budget 2010 - 2011Document20 pagesBudget 2010 - 2011Kanaka VelNo ratings yet

- Budget Plan: Presented By: Sachin RDocument16 pagesBudget Plan: Presented By: Sachin RSachin RaikarNo ratings yet

- Budget 2019: Outlay For Textile Sector Reduced 16 Per CentDocument9 pagesBudget 2019: Outlay For Textile Sector Reduced 16 Per CentFountain GirlNo ratings yet

- Budget OF 2011-2012.: October 29Document4 pagesBudget OF 2011-2012.: October 29Saumya SinghNo ratings yet

- 20 Non 2013-Karnataka TX Policy To Generate Employment OpportunitiesDocument1 page20 Non 2013-Karnataka TX Policy To Generate Employment OpportunitiesKannan KrishnamurthyNo ratings yet

- Assgn On Legal EnviromentDocument22 pagesAssgn On Legal EnviromentSantoshkumar251987No ratings yet

- O o o o o o o o o o o o o oDocument5 pagesO o o o o o o o o o o o o oAneesha KasimNo ratings yet

- Budget Highlights 2013-14Document18 pagesBudget Highlights 2013-14Dhruva01No ratings yet

- GST Analysis - Textile SectorDocument4 pagesGST Analysis - Textile SectorNikshep AntonyNo ratings yet

- Budget Highlights 2014-15Document4 pagesBudget Highlights 2014-15Udyog Software India Ltd.No ratings yet

- Gujarat Textile Policy 2012Document15 pagesGujarat Textile Policy 2012Michael KingNo ratings yet

- TCG AMC Budget Analysis Feb 2023Document4 pagesTCG AMC Budget Analysis Feb 2023adithyaNo ratings yet

- Budget Highlights 2013-14Document18 pagesBudget Highlights 2013-14pallavichhikaraNo ratings yet

- Union Budget 2015-16: Highlights & Key AnnouncementsDocument4 pagesUnion Budget 2015-16: Highlights & Key AnnouncementssunilNo ratings yet

- Note On Indian Textile and Clothing Exports Intl Trade Section 0Document6 pagesNote On Indian Textile and Clothing Exports Intl Trade Section 0civvjicdoNo ratings yet

- Case StudyDocument20 pagesCase Studyaj98No ratings yet

- Highlights of Union Budget For 2013-14 Personal TaxDocument13 pagesHighlights of Union Budget For 2013-14 Personal Taxindia1965No ratings yet

- Highlights of Union Budget 2013Document10 pagesHighlights of Union Budget 2013sapphire1988No ratings yet

- Highlights of Budget 2016 17Document3 pagesHighlights of Budget 2016 17muntaquirNo ratings yet

- Vidya DhoptkarDocument5 pagesVidya DhoptkarHasrat Ali MansooriNo ratings yet

- Assignment of ET NEWS ECO3Document72 pagesAssignment of ET NEWS ECO3SakshiNo ratings yet

- Exim Policy-2009-2014Document16 pagesExim Policy-2009-2014Viral ShahNo ratings yet

- Budget 2010-2011Document20 pagesBudget 2010-2011Simi SolunkeNo ratings yet

- Indian Union Budget 2011Document4 pagesIndian Union Budget 2011ANKUR BARUANo ratings yet

- Third Five-Year Exim Policy (2002-2007) A Free Trade RegimeDocument7 pagesThird Five-Year Exim Policy (2002-2007) A Free Trade Regimepriyanka_motowaniNo ratings yet

- Live Project On Trade PolicyDocument14 pagesLive Project On Trade Policyvardhan2410No ratings yet

- MY PROJECT - .AWESOME APPARELS - LTD (Repaired)Document91 pagesMY PROJECT - .AWESOME APPARELS - LTD (Repaired)Joydeep ChakrabortyNo ratings yet

- Union Budget 2013-14: Key Takeout's From The BudgetDocument4 pagesUnion Budget 2013-14: Key Takeout's From The BudgetFeedback Business Consulting Services Pvt. Ltd.No ratings yet

- Date 28th February'11: The Following Pages ContainDocument31 pagesDate 28th February'11: The Following Pages ContainGagan Jeet SikhNo ratings yet

- Products Also To Get Costly As Excise Duty Hiked To 72% To 6%Document4 pagesProducts Also To Get Costly As Excise Duty Hiked To 72% To 6%Rajesh KumarNo ratings yet

- Apparel Industry in PakistanDocument19 pagesApparel Industry in PakistanSyeda Neha KhalidNo ratings yet

- Budget 2013 - 14Document3 pagesBudget 2013 - 14Jagdeep PabbaNo ratings yet

- Budget 2013Document15 pagesBudget 2013Sanjana BhattNo ratings yet

- New Foreign Trade Policy 2009-2014Document8 pagesNew Foreign Trade Policy 2009-2014Sharma KawalNo ratings yet

- Highlights of The Annual Supplement 2010-11 To The Foreign Trade Policy 2009-14Document20 pagesHighlights of The Annual Supplement 2010-11 To The Foreign Trade Policy 2009-14churchillsinhaNo ratings yet

- Budget 2017-18Document5 pagesBudget 2017-18saqikhanNo ratings yet

- Highlights of Budget 2011-12 For The Banking SectorDocument8 pagesHighlights of Budget 2011-12 For The Banking SectornehasachdevaNo ratings yet

- Textile Policy 2009-14Document40 pagesTextile Policy 2009-14Arif Haq67% (3)

- Highlights of New Foreign Trade Policy 2009Document15 pagesHighlights of New Foreign Trade Policy 2009shahid440No ratings yet

- Cash Incentives For Export Promotion in NepalDocument30 pagesCash Incentives For Export Promotion in NepalChandan Sapkota100% (2)

- Harmandeep Kaur Roll 3427 SemDocument25 pagesHarmandeep Kaur Roll 3427 Semkuldeep_chand10No ratings yet

- Anand Union Budg 2013-2014 (Document15 pagesAnand Union Budg 2013-2014 (aqib_khan55No ratings yet

- EpcgDocument9 pagesEpcgAshfaque KhanNo ratings yet

- KHDCDocument32 pagesKHDCnivedita_h42404No ratings yet

- Union BudgetDocument9 pagesUnion Budgetsanjeev6204046No ratings yet

- Top of Form: /W Epdw Ujmjy4MDocument10 pagesTop of Form: /W Epdw Ujmjy4MSravanth DikkalaNo ratings yet

- Budget Highlights of Indian Union Budget 2012Document7 pagesBudget Highlights of Indian Union Budget 2012Lokesh VermaNo ratings yet

- Environmental Footprints of Recycled PolyesterFrom EverandEnvironmental Footprints of Recycled PolyesterNo ratings yet

- Vibes of Indian Economy-II: Focus on evolving economic Issues of RajasthanFrom EverandVibes of Indian Economy-II: Focus on evolving economic Issues of RajasthanNo ratings yet

- Spectrum of Textile IndustryDocument59 pagesSpectrum of Textile IndustryShrikant Gadge0% (1)

- AnthropologyDocument44 pagesAnthropologyShrikant GadgeNo ratings yet

- INDIA ITME 2012-PresentationDocument99 pagesINDIA ITME 2012-PresentationShrikant GadgeNo ratings yet

- AnthropologyDocument44 pagesAnthropologyShrikant GadgeNo ratings yet

- Recent Development in Textile IndustryDocument48 pagesRecent Development in Textile IndustryShrikant Gadge0% (2)