Professional Documents

Culture Documents

Chart of Service Tax Rule 1994 Prakash Aug 2013

Chart of Service Tax Rule 1994 Prakash Aug 2013

Uploaded by

Sudhir BansalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chart of Service Tax Rule 1994 Prakash Aug 2013

Chart of Service Tax Rule 1994 Prakash Aug 2013

Uploaded by

Sudhir BansalCopyright:

Available Formats

HIREGANGE & ASSOCIATES

2 0 1 3

S u m m a ry o f S e rvice Ta x R u le

with C h a rts

Successful people dont do different things; they do things

differently:)

PRAKASH N

pra kash@hiregange.com

J AYANAGAR 4TH T BL OCK , BANGAL ORE

2

Prakash N

SERVICE TAX RULES, 1994

Hi Friends,

It is a well known fact that most of us find it difficult reading the Finance Act and the related Service Tax Rules. However, it is

mandatory for all concerned to understand the Service Tax laws, considering the importance it has been gaining over the years and

also in view of the fact that GST is round the corner.

I have tried my level best to make the presentation simple and easy and have also tried to make it colorful in the slides that are to

follow. I am sure you will find the same beneficial and useful.

3

Prakash N

C

C

O

O

M

M

E

E

!

!

L

L

E

E

T

T

S

S

M

M

A

A

K

K

E

E

B

B

A

A

R

R

E

E

A

A

C

C

T

T

C

C

O

O

L

L

O

O

R

R

F

F

U

U

L

L

!

!

!

!

4

Prakash N

5

Prakash N

6

Prakash N

7

Prakash N

8

Prakash N

9

Prakash N

10

Prakash N

Rule 6(1): Payment of Service Tax

Category of assessee Period of payment Period Due Date

Individuals, proprietary

firms or partnership firms.

Quarterly April to June

July to September

October to December

5

th

(6th in case of e-payment)

of the month immediately

following the said quarter.

January to March 31

st

March

Others Monthly All months except March 5

th

(6th in case of e-payment)

of the month immediately

following the calendar month.

March 31

st

March

Tax on Receipt basis - Individuals and partnership firms having aggregate value of taxable service is =<50 Lakh rupees

in Previous FY, shall have the option to pay tax on receipt basis up to 50Lakhs

E- Payment is Mandatory - If Service tax paid (Including payment through CENVAT credit) is 10 Lakhs or more in the preceding

financial year.

11

Prakash N

12

Prakash N

13

Prakash N

Rule 6 (7): Service tax on Air travel agent by air

On booking of tickets for travel Rate

Domestic booking 0.6% of the basic fare

International Booking 1.2% of the basic fare

Basi c fare means that part of the air fare on whi ch commi ssi on i s normal l y paid to ai r travel agent by the ai r li ne

Rule 6(7A)(ii) - Life Insurance

Gross Amount of Premium Charged Rate

1st year 3%

Subsequent Years 1.5%

Rule 6(7B) - Money Changing

Gross Amount of Currency Exchanged Rate

Up to Rs.1,00,000 0.12% subject to minimum of Rs.30

For an amount exceeding Rs.1,00,000 and up to

Rs.10,00,000

Rs.120 and 0.06%

For an amount exceeding Rs.10,00,000 Rs.660 and 0.012% subject to maximum of Rs.6,000

Rule 6(7C) - Distributor or Selling Agent of Lotteries

Guaranteed Prize Payout Rate

More than 80% Rs.7,000/- on every Rs.10 Lakh (or part of Rs.10 Lakh) of aggregate face value of

lottery tickets printed by the organizing State for a draw

Less than 80% Rs.11,000/- on every Rs.10 Lakh (or part of Rs.10 Lakh) of aggregate face value of

lottery tickets printed by the organizing State for a draw

14

Prakash N

Rule 6A: Export of

Service

15

Prakash N

16

Prakash N

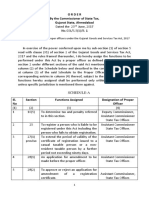

Rules 9: Form of appeals to Appellate Tribunals

Form Description Copy and documents To Whom

ST-5

Form of Appeal to Appellate

Tribunal under section 86 of

the Finance Act,1994

In quadruplicate and shall

be accompanied by a copy of

Order appealed against (one

of which shall be certified

copy)

Appellate Tribunal

ST-6

Form of memorandum of

cross objections to the

Appellant Tribunal under

section 86 of Finance Act,

1994

ST-7

Form of application to

Appellate Tribunal under

Section 86(2) [or Sec.86(2A)

of the Finance Act,1994

In quadruplicate and shall

be accompanied by a copy of

CCE(one of which shall be

certified copy) and cop of

order passed by CBEC

directing the CCE to apply to

Appellate Tribunal

17

Prakash N

Rule 10: Procedure and facilities for Large taxpayer

Forms under Service TAx

Form

type

Description

GAR-7

G.A.R Pro-forma of Service tax payments

ST-1

Application form for registration under Section 69 of the Finance Act, 1994

ST-2

Certificate of registration under Section 69 of The Finance Act, 1994 (32 of1994)

ST-3

Return under Section 70 of the Finance Act, 1994

ST-3A

Memorandum for provisional deposit under rule 6 of the Service Tax Rules,1994

ST-4

Form of Appeal to the Commissioner of Central Excise (Appeals)

ST-5

Form of Appeal to Appellate Tribunal under section 86 of the Finance Act,1994

ST-6

Form of memorandum of cross objections to the Appellant Tribunal under section 86 of Finance Act,

1994

ST-7

Form of application to Appellate Tribunal under Section 86(2) [or Sec.86(2A) of the Finance Act,1994

18

Prakash N

AAR(ST-I)

Application for Advance Ruling (Service Tax)

ASTR-1

Application for filing a claim of rebate of service tax and Cess paid on taxable services exported

ASTR-2

Application for filing a claim of rebate of duty paid on inputs, service tax and Cess paid on input

services

Application

Pro-forma for Application for permission to file ST-3 Return electronically

Form -A

Application for refund of CENVAT credit under Rule 5 of the CENVAT Credit Rules, 2004

19

Prakash N

I have not covered the Definitions Part covered under Rule 2. This being my first presentation, I am sure

there would be lot of scope for improvement. I therefore sincerely look forward to your valuable feedback

and suggestions which would be of great help to me.

Finally, tax is never loved by anyone since it is a fine for doing things right!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sap MM GuideDocument316 pagesSap MM GuideAnupam Bali100% (8)

- 8 CaroDocument45 pages8 CaroAnupam BaliNo ratings yet

- Export ProcedureDocument37 pagesExport ProcedureSanjivSInghNo ratings yet

- Presentation by As (V) On Rabi Prospects, Kharif Preparations, Issues, EtcDocument26 pagesPresentation by As (V) On Rabi Prospects, Kharif Preparations, Issues, EtcAnupam BaliNo ratings yet

- Levy of Entry Tax Pan India ScenarioDocument14 pagesLevy of Entry Tax Pan India ScenarioAnupam BaliNo ratings yet

- ARFin06 07Document212 pagesARFin06 07Anupam BaliNo ratings yet

- Income Under The Head SalariesDocument21 pagesIncome Under The Head SalariesAnupam BaliNo ratings yet

- Digital SignatureDocument31 pagesDigital SignatureAnupam BaliNo ratings yet

- Basics of TaxationDocument25 pagesBasics of TaxationAnupam BaliNo ratings yet

- Basics of TaxationDocument25 pagesBasics of TaxationAnupam BaliNo ratings yet

- Standard CostingDocument7 pagesStandard CostingAnupam BaliNo ratings yet

- Greer Citizen 4.12.17Document20 pagesGreer Citizen 4.12.17greercitizenNo ratings yet

- State Park RegsDocument24 pagesState Park RegsZARIEK ZENNESHIKNo ratings yet

- 2023 Budget FAQs - Solar Panel Tax IncentiveDocument4 pages2023 Budget FAQs - Solar Panel Tax IncentiveJohn Stupart100% (1)

- Askari AssignmentDocument7 pagesAskari AssignmentSabih TariqNo ratings yet

- Tsu Note G.R. No. 173425 en Banc Tax CaseDocument4 pagesTsu Note G.R. No. 173425 en Banc Tax CaseAnonymous BYeqWt8FHyNo ratings yet

- Income Tax ActDocument711 pagesIncome Tax ActPikinisoNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- Fort Bonifacio Devt Corp V CIRDocument3 pagesFort Bonifacio Devt Corp V CIRBettina Rayos del SolNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- PAL vs. CIRDocument16 pagesPAL vs. CIRVictoria aytonaNo ratings yet

- Your Electronic Access Account Account Summary Your Electronic Access Account Account SummaryDocument9 pagesYour Electronic Access Account Account Summary Your Electronic Access Account Account SummaryJavell S PageNo ratings yet

- Homestead Credit Refund (For Homeowners) and Renter's Property Tax RefundDocument32 pagesHomestead Credit Refund (For Homeowners) and Renter's Property Tax Refundsundevil2010usa4605No ratings yet

- February 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentDocument51 pagesFebruary 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentCbNo ratings yet

- #12. CIR Vs SM Prime Holdings Inc. G.R. No. 183505 February 26, 2010Document11 pages#12. CIR Vs SM Prime Holdings Inc. G.R. No. 183505 February 26, 2010JV PagunuranNo ratings yet

- PKF Kenya Quick Tax Guide 2016Document10 pagesPKF Kenya Quick Tax Guide 2016KalGeorgeNo ratings yet

- Rent Amount Received Which Is Rs. 2,40,000/ - (Rupees Two Lakh Forty Thousand Only)Document4 pagesRent Amount Received Which Is Rs. 2,40,000/ - (Rupees Two Lakh Forty Thousand Only)deepa parabNo ratings yet

- HCM US Balance Adjustments White PaperDocument184 pagesHCM US Balance Adjustments White Paperajay kumarNo ratings yet

- NUAS - Taxation Law (2022)Document12 pagesNUAS - Taxation Law (2022)Darlene GanubNo ratings yet

- Taxation 1 CasesDocument249 pagesTaxation 1 CasesRomero MelandriaNo ratings yet

- Raj Man Rai T1 2022Document23 pagesRaj Man Rai T1 2022Tex FreeNo ratings yet

- Order by The Commissioner of State Tax, Gujarat State, AhmedabadDocument10 pagesOrder by The Commissioner of State Tax, Gujarat State, Ahmedabadarpit85No ratings yet

- CamDocument511 pagesCamgetrandhir100% (1)

- Takenaka Corporation-Philippine Branch, v. Commissioner of Internal RevenueDocument6 pagesTakenaka Corporation-Philippine Branch, v. Commissioner of Internal RevenueKit FloresNo ratings yet

- CIR vs. Primetown Property GroupDocument3 pagesCIR vs. Primetown Property GroupMANUEL QUEZON100% (1)

- Taganito Mining Corporation vs. CIRDocument10 pagesTaganito Mining Corporation vs. CIRAJ AslaronaNo ratings yet

- 1.18.2024 SBFCC Create Morre Eopt Beps 2.0Document70 pages1.18.2024 SBFCC Create Morre Eopt Beps 2.0b86120298alexlinNo ratings yet

- Alliance in Motion Global Company PoliciesDocument31 pagesAlliance in Motion Global Company Policiesapi-256061141No ratings yet

- Secret Files For TXDocument118 pagesSecret Files For TXGrace EnriquezNo ratings yet

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFDocument50 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFTwsif Tanvir Tanoy92% (13)

- Revenue Memorandum Circulars PDFDocument90 pagesRevenue Memorandum Circulars PDFJewellrie Dela CruzNo ratings yet