Professional Documents

Culture Documents

Analysis of A Company On Parameters of Business Model and Financial Ratios

Uploaded by

Kaustubh Barve0 ratings0% found this document useful (0 votes)

15 views4 pagesOriginal Title

Equity Research Report o

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesAnalysis of A Company On Parameters of Business Model and Financial Ratios

Uploaded by

Kaustubh BarveCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Analysis of a Company on Parameters of

Business Model and Financial Ratios

Kaustubh Barve

MET MMS A

ROLL NO 11

(Company Name : Lupin Ltd.)

COMPANY BACKGROUND

An innovation led transnational pharmaceutical company based in Mumbai

Was founded in 1968 with a vision to fight life threatening infectious diseases and to

manufacture drugs of the highest social priority

The Company produces a wide range of quality, affordable generic and branded formulations

and APIs (Active Pharmaceutical Ingredients) for the developed and developing markets of

the world.

2nd largest Indian pharma company by market capitalization and the 14th largest generic

pharmaceutical company globally

SWOT ANALYSIS

Strengths

World-wide leader in Cephalosporin and Anti TB drugs

Considerable presence in market for drugs against Asthma, Pediatrics, Diabetes, and CNS

Fastest growing generic player in USA and Japan

Wide global footprint as it is present in over 70 countries

Weaknesses

High dependence on global formulation business with 84% revenue coming from US market

Forecasting done on technological level is less

Opportunities

Increased health awareness among people

Emerging technological trends in drug delivery

Increasing prevalence of TB in developing countries

Threats

Price regulation by government reduces the pricing ability of company

Exists in a highly competitive sector with around 20000 unorganized and 300 large organized

players

Soaring cost of discovering novel products

UNDERSTANDING OF LUPINS BUSINESS MODEL

Economies of Scale

The company derives its revenues chiefly by resorting to the economies of scale, i.e. mass production

of medicines

Depth in product offerings

Apart from Anti-TB and Cephalosporin segments, The company today has a significant market share

in key markets in the Cardiovascular (prils and statins), Diabetology, Asthma, Pediatrics, CNS, GI,

Anti-Infectives and NSAIDs therapy segment.

This helps them to gain better visibility with the doctor/patient community and strengthens the

companys position over distributor channel

Product Differentiation through value added R & D

Lupins Research Program covers the entire pharma value chain including Generics Research, Process

Research, Pharmaceutical Research, Advanced Drug Delivery Systems (ADDS), Research Intellectual

Property Management, Novel Drug Discovery and Development (NDDD) & Biotechnology Research

Geographical Expansion into new markets

The company focuses on constantly improving its therapeutic mix, This enables Lupin easy entry into

new markets, thereby building upon its brand equity and widening its growth prospects

Backward Integration

Lupin are developing strong backend capabilities, which would give them a strong competitive

advantage in a crowded market. The contribution of API to sales is declining and they are increasingly

using their API capacities for captive consumption and to file their own finished products

Cost Effective Strategies

Lupin believe in launching the common protocol therapies at cost-effective prices to tackle

competitive threats in existing as well as new markets

KEY FINANCIAL RATIOS - ANALYSIS AND INTERPRETATION

EV/EBITDA

Lupin Ltd. shows a EV/EBITDA ratio of 13.30 This is higher than the average of its peer group which

is 12.22 indicating good earnings in relation to competitors.

Current Ratio

Lupins average current ratio over the last 5 financial years has been 1.52 times which indicates that

the Company has been maintaining sufficient cash to meet its short term obligations

Debt to Equity Ratio

Lupins average long term debt to equity ratio over the last 5 financial years has been 0.08 times

which indicates that the Company is operating with a very low level of debt and is well placed to meet

its obligations.

Interest Coverage Ratio

Lupins average interest coverage ratio over the last 5 financial years has been 34.63 times which

indicates that the Company has been generating enough for the shareholders after servicing its debt

obligations.

Earnings Per Share

Lupins earnings per share for FY14 came in at Rs.40.8, translating to a price-to-earnings multiple of

24.3 times

CORPORATE ACTIONS:

Share Capital as on April 25, 2014

Share Capital Issued, subscribed and paid up Rs. 893,868,110/- comprising 448,434,055 equity

shares of Rs. 2/- each

Dividend Policy

Lupin announced that the Board of Directors of the Company at its meeting held on 07 May 2014,

have recommended final dividend @ 150% i.e. Rs 3 per equity share of the face value of Rs 2 each

for the year ended 31 March 2014

Thus, the total dividend for the year ended 31 March 2014 would be Rs 6 per equity share (declared

and paid interim dividend of Rs 3 in Feb 2014)

At the current share price of Rs 990.20 this results in a dividend yield of 0.6%

The company has a good dividend track report and has consistently declared dividends for the last 10

years

Bonus Policy

The only bonus issue that Lupin had announced was in 2006 in the ratio of 1:1.The share has been

quoting ex-bonus from August 11, 2006.

Rights Issues

Lupin has not announced any rights issues till today.

Stock Split

Lupin had last split the face value of its shares from Rs 10 to Rs 2 in 2010.The share has been quoting

on an ex-split basis from August 27, 2010.

RECOMMENDATIONS:

Buoyed by a strong traction in the US and European businesses, Lupin has reported a 20% growth in

the net sales and a 243 basis points expansion in the OPM during Q4FY2014. This led the adjusted

net profit to jump by 15% to Rs553 crore during the quarter, despite a steep rise in the effective tax

rate

From its vertically integrated business model it is evident that Lupin has the following attributes:

sustainable business models

optimum geographic mix

ability to withstand regulatory risks

This make the stock of Lupin very attractive in the long as well as short term perspective.

Thus due to its consistently superior performance in the generic space, a strong product pipeline and a

healthy growth visibility; coupled with strong fundamentals and good technical indicators I would

give Lupin a BUY recommendation at the current market price of Rs.990.20

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hypertension Drugs Cheat Sheet: by ViaDocument3 pagesHypertension Drugs Cheat Sheet: by ViaGulzaib KhokharNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Information Technology ActDocument53 pagesInformation Technology ActKaustubh Barve100% (1)

- Information Technology ActDocument53 pagesInformation Technology ActKaustubh Barve100% (1)

- Project Report On "Indian Premier League (Ipl) "Document72 pagesProject Report On "Indian Premier League (Ipl) "Kaustubh Barve83% (6)

- Practical Manual of PharmacologyDocument136 pagesPractical Manual of PharmacologyDIKSHA VERMANo ratings yet

- 2009 Oral and Maxillofacial Surgery Self Assessment Tool (OMSSAT)Document272 pages2009 Oral and Maxillofacial Surgery Self Assessment Tool (OMSSAT)Julie100% (1)

- Cardiac EmergenciesDocument26 pagesCardiac Emergenciespreet kaurNo ratings yet

- Nostro and Vostro AccountsDocument3 pagesNostro and Vostro AccountsKaustubh BarveNo ratings yet

- Performance Management & ApraisalDocument22 pagesPerformance Management & ApraisalKaustubh Barve0% (1)

- Research Project Plan On Comparative Study of Hero Honda and Bajaj AutoDocument3 pagesResearch Project Plan On Comparative Study of Hero Honda and Bajaj AutoKaustubh BarveNo ratings yet

- PERFORMANCE MANAGEMENT and APPRAISALDocument10 pagesPERFORMANCE MANAGEMENT and APPRAISALKaustubh BarveNo ratings yet

- Dissolution MethodsDocument248 pagesDissolution MethodsAnzhela GrigoryanNo ratings yet

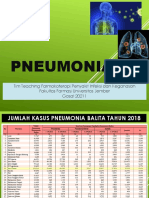

- Pneumonia: Tim Teaching Farmakoterapi Penyakit Infeksi Dan Keganasan Fakultas Farmasi Universitas Jember Gasal 20211Document67 pagesPneumonia: Tim Teaching Farmakoterapi Penyakit Infeksi Dan Keganasan Fakultas Farmasi Universitas Jember Gasal 20211Evie WulansariNo ratings yet

- Understanding Lab Values When On Dialysis-2Document86 pagesUnderstanding Lab Values When On Dialysis-2Ericka Lj Robles DimaculanganNo ratings yet

- Drug Abuse and Drug AddictionDocument8 pagesDrug Abuse and Drug AddictionChetan CherryNo ratings yet

- Guias Hipertension 2023 Esc DDocument11 pagesGuias Hipertension 2023 Esc Dmiguel contrerasNo ratings yet

- Skill Anastesi LokalDocument37 pagesSkill Anastesi Lokalfeda makkiyahNo ratings yet

- Drug Study AtropineDocument3 pagesDrug Study AtropineAerron Severus Secano ShuldbergNo ratings yet

- HPLC RifampicinDocument6 pagesHPLC RifampicinJatuna AyundaNo ratings yet

- Parsik YavaniDocument17 pagesParsik Yavanipradeep soniNo ratings yet

- NMDAR4Document4 pagesNMDAR4Sirly PutriNo ratings yet

- Unit 2 - LadmerDocument3 pagesUnit 2 - LadmerLAONo ratings yet

- Chemotherapeutic AgentsDocument53 pagesChemotherapeutic AgentsGrape JuiceNo ratings yet

- Unit - 3Document18 pagesUnit - 3Meharaj UnnisaNo ratings yet

- Lewis: Medical-Surgical Nursing, 10 Edition: Assessment of Endocrine System Key PointsDocument3 pagesLewis: Medical-Surgical Nursing, 10 Edition: Assessment of Endocrine System Key PointsDeo FactuarNo ratings yet

- Characteristics of The Novel Potassium-Competitive Acid Blocker Vonoprazan Fumarate (TAK-438)Document18 pagesCharacteristics of The Novel Potassium-Competitive Acid Blocker Vonoprazan Fumarate (TAK-438)mNo ratings yet

- Instructions For Filling Out Form Fda 356H - Application To Market A New or Abbreviated New Drug or Biologic For Human UseDocument3 pagesInstructions For Filling Out Form Fda 356H - Application To Market A New or Abbreviated New Drug or Biologic For Human UseSiva PrasadNo ratings yet

- Local Plants From Lom and Sawang Ethnics As Anti - DiahrezaDocument4 pagesLocal Plants From Lom and Sawang Ethnics As Anti - DiahrezaMuhammad Faiq FadhllurohmanNo ratings yet

- Daftar Harga KFTD Sby Per 1 April 2022Document370 pagesDaftar Harga KFTD Sby Per 1 April 2022farmasi psrNo ratings yet

- Daftar Obat DR - Sps DalamDocument3 pagesDaftar Obat DR - Sps DalamKlinik Sosa Graha MedikaNo ratings yet

- Tech LA and ComplicationsDocument43 pagesTech LA and ComplicationsPakistan Dental SocietyNo ratings yet

- 06 - Product Training - TruNarcDocument45 pages06 - Product Training - TruNarclemoscamboja28121975No ratings yet

- Combination Effect of Edible Mushroom - Sliver Nanoparticles and Antibiotics Against Selected Multidrug Biofilm PathogensDocument7 pagesCombination Effect of Edible Mushroom - Sliver Nanoparticles and Antibiotics Against Selected Multidrug Biofilm PathogensAKNo ratings yet

- Spesialite Golongan AntibiotikDocument5 pagesSpesialite Golongan AntibiotikBella LunaNo ratings yet

- 1 s2.0 S0378517311000226 MainDocument9 pages1 s2.0 S0378517311000226 MainFIRMAN MUHARAMNo ratings yet

- PPT Farmakologi Molekuler Inflamasi - RA & IBDDocument40 pagesPPT Farmakologi Molekuler Inflamasi - RA & IBDVicko SuswidiantoroNo ratings yet

- Coverage Midterm Examination 2021 Drug and Vice ControlDocument4 pagesCoverage Midterm Examination 2021 Drug and Vice ControlTaga Phase 7No ratings yet