Professional Documents

Culture Documents

Objectives of Fiscal Policy in India

Uploaded by

sadathnoori0%(1)0% found this document useful (1 vote)

376 views4 pagesThe main objectives of India's fiscal policy are to mobilize financial resources, efficiently allocate resources, and reduce inequality. Fiscal policy aims to mobilize resources through taxation, public and private savings, and government borrowing. It allocates resources toward development activities like infrastructure and away from non-development activities. Fiscal policy also aims to reduce income inequality by taxing the rich at higher rates and implementing poverty alleviation programs.

Original Description:

Original Title

Main Objectives of Fiscal Policy in India

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe main objectives of India's fiscal policy are to mobilize financial resources, efficiently allocate resources, and reduce inequality. Fiscal policy aims to mobilize resources through taxation, public and private savings, and government borrowing. It allocates resources toward development activities like infrastructure and away from non-development activities. Fiscal policy also aims to reduce income inequality by taxing the rich at higher rates and implementing poverty alleviation programs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

376 views4 pagesObjectives of Fiscal Policy in India

Uploaded by

sadathnooriThe main objectives of India's fiscal policy are to mobilize financial resources, efficiently allocate resources, and reduce inequality. Fiscal policy aims to mobilize resources through taxation, public and private savings, and government borrowing. It allocates resources toward development activities like infrastructure and away from non-development activities. Fiscal policy also aims to reduce income inequality by taxing the rich at higher rates and implementing poverty alleviation programs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Main Objectives of Fiscal Policy In India

The fiscal policy is designed to achive certain objectives as follows :-

1. Development by effective Mobilisation of Resources

The principal objective of fiscal policy is to ensure rapid economic growth and development.

This objective of economic growth and development can be achieved by Mobilisation of

Financial Resources.

The central and the state governments in India have used fiscal policy to mobilise resources.

The financial resources can be mobilised by :-

1. Taxation : Through effective fiscal policies, the government aims to mobilise resources

by way of direct taxes as well as indirect taxes because most important source of resource

mobilisation in India is taxation.

2. Public Savings : The resources can be mobilised through public savings by reducing

government expenditure and increasing surpluses of public sector enterprises.

3. Private Savings : Through effective fiscal measures such as tax benefits, the government

can raise resources from private sector and households. Resources can be mobilised

through government borrowings by ways of treasury bills, issue of government bonds,

etc., loans from domestic and foreign parties and by deficit financing.

2. Efficient allocation of Financial Resources

The central and state governments have tried to make efficient allocation of financial resources.

These resources are allocated for Development Activities which includes expenditure on

railways, infrastructure, etc. While Non-development Activities includes expenditure on defence,

interest payments, subsidies, etc.

But generally the fiscal policy should ensure that the resources are allocated for generation of

goods and services which are socially desirable. Therefore, India's fiscal policy is designed in

such a manner so as to encourage production of desirable goods and discourage those goods

which are socially undesirable.

3. Reduction in inequalities of Income and Wealth

Fiscal policy aims at achieving equity or social justice by reducing income inequalities among

different sections of the society. The direct taxes such as income tax are charged more on the rich

people as compared to lower income groups. Indirect taxes are also more in the case of semi-

luxury and luxury items, which are mostly consumed by the upper middle class and the upper

class. The government invests a significant proportion of its tax revenue in the implementation of

Poverty Alleviation Programmes to improve the conditions of poor people in society.

4. Price Stability and Control of Inflation

One of the main objective of fiscal policy is to control inflation and stabilize price. Therefore, the

government always aims to control the inflation by Reducing fiscal deficits, introducing tax

savings schemes, Productive use of financial resources, etc.

5. Employment Generation

The government is making every possible effort to increase employment in the country through

effective fiscal measure. Investment in infrastructure has resulted in direct and indirect

employment. Lower taxes and duties on small-scale industrial (SSI) units encourage more

investment and consequently generates more employment. Various rural employment

programmes have been undertaken by the Government of India to solve problems in rural areas.

Similarly, self employment scheme is taken to provide employment to technically qualified

persons in the urban areas.

6. Balanced Regional Development

Another main objective of the fiscal policy is to bring about a balanced regional development.

There are various incentives from the government for setting up projects in backward areas such

as Cash subsidy, Concession in taxes and duties in the form of tax holidays, Finance at

concessional interest rates, etc.

7. Reducing the Deficit in the Balance of Payment

Fiscal policy attempts to encourage more exports by way of fiscal measures like Exemption of

income tax on export earnings, Exemption of central excise duties and customs, Exemption of

sales tax and octroi, etc.

The foreign exchange is also conserved by Providing fiscal benefits to import substitute

industries, Imposing customs duties on imports, etc.

The foreign exchange earned by way of exports and saved by way of import substitutes helps to

solve balance of payments problem. In this way adverse balance of payment can be corrected

either by imposing duties on imports or by giving subsidies to export.

8. Capital Formation

The objective of fiscal policy in India is also to increase the rate of capital formation so as to

accelerate the rate of economic growth. An underdeveloped country is trapped in vicious

(danger) circle of poverty mainly on account of capital deficiency. In order to increase the rate of

capital formation, the fiscal policy must be efficiently designed to encourage savings and

discourage and reduce spending.

9. Increasing National Income

The fiscal policy aims to increase the national income of a country. This is because fiscal policy

facilitates the capital formation. This results in economic growth, which in turn increases the

GDP, per capita income and national income of the country.

10. Development of Infrastructure

Government has placed emphasis on the infrastructure development for the purpose of achieving

economic growth. The fiscal policy measure such as taxation generates revenue to the

government. A part of the government's revenue is invested in the infrastructure development.

Due to this, all sectors of the economy get a boost.

11. Foreign Exchange Earnings

Fiscal policy attempts to encourage more exports by way of Fiscal Measures like, exemption of

income tax on export earnings, exemption of sales tax and octroi, etc. Foreign exchange provides

fiscal benefits to import substitute industries. The foreign exchange earned by way of exports

and saved by way of import substitutes helps to solve balance of payments problem.

Conclusion On Fiscal Policy

The objectives of fiscal policy such as economic development, price stability, social justice, etc.

can be achieved only if the tools of policy like Public Expenditure, Taxation, Borrowing and

deficit financing are effectively used.

Though there are gaps in India's fiscal policy, there is also an urgent need for making India's

fiscal policy a rationalised and growth oriented one.

The success of fiscal policy depends upon taking timely measures and their effective

administration during implementation.

You might also like

- Fiscal Policy Objectives and Tools in IndiaDocument22 pagesFiscal Policy Objectives and Tools in IndiaDr.Ashok Kumar PanigrahiNo ratings yet

- Government Budget ExplainedDocument5 pagesGovernment Budget ExplainedsanthoshNo ratings yet

- Fiscal and Monetary Policies of IndiaDocument13 pagesFiscal and Monetary Policies of IndiaRidhika GuptaNo ratings yet

- National Income and Occupational Structure in IndiaDocument45 pagesNational Income and Occupational Structure in IndiaakshatNo ratings yet

- Unit 2 - National IncomeDocument35 pagesUnit 2 - National IncomeShipra Sudeshna Rohini MinzNo ratings yet

- Meaning and Importance of Capital FormationDocument17 pagesMeaning and Importance of Capital FormationSai Nandan50% (2)

- National Income MeasurementDocument21 pagesNational Income MeasurementmohsinNo ratings yet

- Laws of Production FunctionDocument32 pagesLaws of Production Functionchandanpalai91No ratings yet

- Measuring GDP and Economic Growth: Chapter 4 LectureDocument33 pagesMeasuring GDP and Economic Growth: Chapter 4 LectureIfteakher Ibne HossainNo ratings yet

- SWOT Analysis of Bangladesh EconomyDocument14 pagesSWOT Analysis of Bangladesh EconomyIqbal HasanNo ratings yet

- 5 essential objectives of India's economic planningDocument10 pages5 essential objectives of India's economic planningThippavajjula RavikanthNo ratings yet

- 12 Economics Notes Macro Ch04 Government Budget and The EconomyDocument7 pages12 Economics Notes Macro Ch04 Government Budget and The EconomyvatsadbgNo ratings yet

- Shri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalDocument26 pagesShri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalKaran DalkiNo ratings yet

- Economic ReformsDocument30 pagesEconomic ReformssaritaNo ratings yet

- Objectives of Five Year Plans in IndiaDocument12 pagesObjectives of Five Year Plans in IndiaSunil100% (3)

- Budgeting and Budgetary ControlDocument21 pagesBudgeting and Budgetary ControlShahid AmanNo ratings yet

- Meade's Model of Economic Growth and DeterminantsDocument18 pagesMeade's Model of Economic Growth and DeterminantsHasanah Ameril100% (1)

- Economic Structure of IndiaDocument22 pagesEconomic Structure of IndiaShreedhar DeshmukhNo ratings yet

- Fiscal Policy of IndiaDocument20 pagesFiscal Policy of Indiasaurav82% (11)

- PubFin - Principle of Maximum Social AdvantageDocument15 pagesPubFin - Principle of Maximum Social AdvantageWasif MohammadNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicyAshish MisraNo ratings yet

- Sickness in Small EnterprisesDocument15 pagesSickness in Small EnterprisesRajesh KumarNo ratings yet

- Central Problems of The EconomyDocument7 pagesCentral Problems of The EconomyTanya Kumar100% (1)

- An Evaluation of The Trade Relations of Bangladesh With ASEANDocument11 pagesAn Evaluation of The Trade Relations of Bangladesh With ASEANAlexander DeckerNo ratings yet

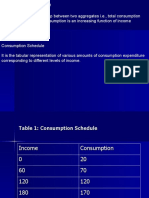

- Consumption FunctionDocument15 pagesConsumption FunctionAkshat MishraNo ratings yet

- Role of Money in Developing and Mixed EconomyDocument3 pagesRole of Money in Developing and Mixed EconomyAjeet KrishnamurthyNo ratings yet

- Engineering and Managerial Economics UPTU GBTU MTU Btech V SemDocument13 pagesEngineering and Managerial Economics UPTU GBTU MTU Btech V SemSenthil Kumar100% (2)

- India - Five Year PlansDocument7 pagesIndia - Five Year PlansvmktptNo ratings yet

- National Income: Submitted byDocument85 pagesNational Income: Submitted byShrutiNo ratings yet

- National IncomeDocument30 pagesNational IncomeTaruna Dureja BangaNo ratings yet

- Principles of ManagementDocument47 pagesPrinciples of ManagementCarmina DongcayanNo ratings yet

- Liquidity Preference Theory PDFDocument12 pagesLiquidity Preference Theory PDFgaurav singhNo ratings yet

- Government Budget and Its ComponentsDocument7 pagesGovernment Budget and Its ComponentsRitesh Kumar SharmaNo ratings yet

- Principles of Public Expenditure: Maximum Social Advantage, Economy, Sanction, Balanced BudgetsDocument1 pagePrinciples of Public Expenditure: Maximum Social Advantage, Economy, Sanction, Balanced BudgetsNikhil Shenai100% (1)

- Business EnvironmentDocument18 pagesBusiness EnvironmentShaifaliChauhanNo ratings yet

- Foreign Trade Multilier and Global RepercussionsDocument8 pagesForeign Trade Multilier and Global RepercussionsangelNo ratings yet

- Ricardian Theory of Rent/ Classical Theory of RentDocument4 pagesRicardian Theory of Rent/ Classical Theory of Rentrspa100% (1)

- Exim PolicyDocument44 pagesExim PolicyRavindra Shenoy100% (1)

- Trade CycleDocument6 pagesTrade CycleGhanshyam BhambhaniNo ratings yet

- Meaning and Nature of Public ExpenditureDocument3 pagesMeaning and Nature of Public ExpenditureMuhammad Shifaz Mamur100% (1)

- Public Sector in IndiaDocument12 pagesPublic Sector in Indiagarganurag1250% (2)

- Characteristics of Undeveloped NationsDocument2 pagesCharacteristics of Undeveloped Nationspdalingay100% (1)

- Macro-Economics Lecture (BBA)Document262 pagesMacro-Economics Lecture (BBA)Sahil NoorzaiNo ratings yet

- Indian Economy On The Eve of IndependenceDocument12 pagesIndian Economy On The Eve of IndependenceHarini BNo ratings yet

- PUBLIC FINANCE & TAXATION: KEY CONCEPTSDocument32 pagesPUBLIC FINANCE & TAXATION: KEY CONCEPTSyechale tafere50% (2)

- Lecture 7 Balance of Payments Adjustment TheoryDocument4 pagesLecture 7 Balance of Payments Adjustment TheoryAnonymous 8aj9gk7GCLNo ratings yet

- Controlling Class 12Document29 pagesControlling Class 12dhaanya goelNo ratings yet

- Economic Growth and DevelopmentDocument3 pagesEconomic Growth and DevelopmentGhalib HussainNo ratings yet

- Ch-1 Indian Economy in The Eve of Independance (True or False)Document3 pagesCh-1 Indian Economy in The Eve of Independance (True or False)social sitesNo ratings yet

- Trips and TrimsDocument14 pagesTrips and TrimsPraveen Kumar100% (1)

- PROJECT of Service TaxDocument34 pagesPROJECT of Service TaxPRIYANKA GOPALE100% (2)

- Heckscher OhlinDocument4 pagesHeckscher OhlinSidNo ratings yet

- Concepts and Indicators of DevelopmentDocument9 pagesConcepts and Indicators of DevelopmentRen Har100% (1)

- 2 Central Problems of An EconomyDocument5 pages2 Central Problems of An Economysoundarya raghuwanshi100% (1)

- Capital VS Revenue Transactions: Classifying ExpendituresDocument20 pagesCapital VS Revenue Transactions: Classifying ExpendituresYatin SawantNo ratings yet

- GST Notes For Sem 4Document7 pagesGST Notes For Sem 4prakhar100% (1)

- Meaning of Fiscal PolicyDocument4 pagesMeaning of Fiscal PolicyPhanindra SankaNo ratings yet

- Fiscal PolicyDocument5 pagesFiscal Policysuman gautamNo ratings yet

- Fiscal Policy MeaningDocument6 pagesFiscal Policy MeaningsurindersalhNo ratings yet

- Fiscal Policy MeaningDocument47 pagesFiscal Policy MeaningKapil YadavNo ratings yet

- Section B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)Document8 pagesSection B Questions and Answers. Each Question Carries 5 Marks 1. Distinguish Between Accounting and Auditing. (2012, 2013)sadathnooriNo ratings yet

- Analyzing Business Environment FactorsDocument11 pagesAnalyzing Business Environment Factorssadathnoori75% (4)

- DOD Penalty Reversal Latter.Document2 pagesDOD Penalty Reversal Latter.sadathnooriNo ratings yet

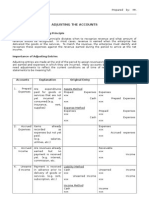

- Prov List 11Document23 pagesProv List 11sadathnooriNo ratings yet

- Pá Éãdä Pàët E ÁséDocument4 pagesPá Éãdä Pàët E ÁsésadathnooriNo ratings yet

- BNP Paribas Bank DetailsDocument1 pageBNP Paribas Bank DetailssadathnooriNo ratings yet

- Deductions On Section 80CDocument8 pagesDeductions On Section 80CsadathnooriNo ratings yet

- Sub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountDocument16 pagesSub:Statement of Diesel Bill: Date Indent HSD in Ltrs Bill No Rate, Rs AmountsadathnooriNo ratings yet

- Indian Currency Coins and BanknotesDocument2 pagesIndian Currency Coins and BanknotessadathnooriNo ratings yet

- 1Document3 pages1sadathnooriNo ratings yet

- Ipo Demat...Document4 pagesIpo Demat...sadathnooriNo ratings yet

- ªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäDocument3 pagesªàiá£Àågé, «Μàaiàä:-°Auàgádä Ja§ «Záåyðaiàä «ΜàaiàäsadathnooriNo ratings yet

- To TB JayachandraDocument1 pageTo TB JayachandrasadathnooriNo ratings yet

- Tax RatesDocument2 pagesTax RatessadathnooriNo ratings yet

- Part-A Unit-I: Business EnvironmentDocument4 pagesPart-A Unit-I: Business EnvironmentShankar ReddyNo ratings yet

- Business LettersDocument16 pagesBusiness LetterssadathnooriNo ratings yet

- Benefits of Reciting Allah's Most Beautiful NamesDocument14 pagesBenefits of Reciting Allah's Most Beautiful NamesJon JayNo ratings yet

- Explain The Various NonDocument1 pageExplain The Various NonsadathnooriNo ratings yet

- Capital Market..........Document10 pagesCapital Market..........sadathnooriNo ratings yet

- Fms TestDocument1 pageFms TestsadathnooriNo ratings yet

- Indian Currency Coins and BanknotesDocument2 pagesIndian Currency Coins and BanknotessadathnooriNo ratings yet

- Business LettersDocument16 pagesBusiness LetterssadathnooriNo ratings yet

- A Stock ExchangeDocument1 pageA Stock ExchangesadathnooriNo ratings yet

- HadisDocument1 pageHadissadathnooriNo ratings yet

- MbaDocument54 pagesMbasadathnooriNo ratings yet

- Business LettersDocument16 pagesBusiness LetterssadathnooriNo ratings yet

- Capital Market..........Document10 pagesCapital Market..........sadathnooriNo ratings yet

- Pradhan Mantri JanDocument1 pagePradhan Mantri JansadathnooriNo ratings yet

- Changing Dimensions of Indian Business-Pranati BapatDocument7 pagesChanging Dimensions of Indian Business-Pranati Bapatdhananjay2014No ratings yet

- Unit 4 Nbfcs MeaningDocument7 pagesUnit 4 Nbfcs MeaningsadathnooriNo ratings yet

- Etisalat Annual Report 2007 PDFDocument2 pagesEtisalat Annual Report 2007 PDFMichelleNo ratings yet

- First Data Annual Report 2008Document417 pagesFirst Data Annual Report 2008SteveMastersNo ratings yet

- 1099 BDocument22 pages1099 Bbharat75% (4)

- 1.1 MC - Exercises On Estate Tax (PRTC)Document8 pages1.1 MC - Exercises On Estate Tax (PRTC)marco poloNo ratings yet

- Methods for redemption of public debtDocument2 pagesMethods for redemption of public debtSana NasimNo ratings yet

- Ratio AnalysisDocument34 pagesRatio Analysismohitsingh1997No ratings yet

- HFM InterviewqueDocument18 pagesHFM Interviewquenara4allNo ratings yet

- Wajith ReportDocument48 pagesWajith ReportRahul RahulNo ratings yet

- D.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IDocument8 pagesD.K.M. College For Women (Autonomous), Vellore - 1 Semester Examinations November - 2018 15CCO1A/CCO1A Financial Accounting - IChandu Raju0% (1)

- Value-Added Tax Matrix Buyer PH or Customs Territory: 0% 1. If Reg. Activity Thru PEZA 0% 1. If Reg. Activity Thru PEZADocument1 pageValue-Added Tax Matrix Buyer PH or Customs Territory: 0% 1. If Reg. Activity Thru PEZA 0% 1. If Reg. Activity Thru PEZAana mae bangudNo ratings yet

- Fra Cia 2BDocument17 pagesFra Cia 2BJohnsey RoyNo ratings yet

- MGT 111 Adjusting EntriesDocument3 pagesMGT 111 Adjusting EntriesErickNo ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- Annual Report 38th AGMDocument268 pagesAnnual Report 38th AGMhNo ratings yet

- Receivables Ledger & Partnership AccountsDocument6 pagesReceivables Ledger & Partnership AccountsAbdul Gaffar0% (1)

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- MGT Acctg Exercises With Solutions-2Document12 pagesMGT Acctg Exercises With Solutions-2Mateen Hashmi100% (1)

- Math ProblemsDocument12 pagesMath ProblemsForhad Ahmad100% (1)

- KrisEnergy 2017 Annual ReportDocument144 pagesKrisEnergy 2017 Annual Reportener0% (1)

- Engineering Economics Notes 11Document88 pagesEngineering Economics Notes 11Tanmay WakchaureNo ratings yet

- Form16 Part ADocument2 pagesForm16 Part ATrinadh CheemaladinneNo ratings yet

- Problem 1246 Dan 1247Document2 pagesProblem 1246 Dan 1247Gilang Anwar HakimNo ratings yet

- No Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedDocument5 pagesNo Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedAmanNo ratings yet

- Pepsi CaseDocument2 pagesPepsi CaseAshish IndoliaNo ratings yet

- ch08 Financial Accounting, 7th EditionDocument72 pagesch08 Financial Accounting, 7th Editionrobbi ajaNo ratings yet

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanNo ratings yet

- Registration Process of Public Charitable TrustDocument5 pagesRegistration Process of Public Charitable Trustpan RegisterNo ratings yet

- New Business Green GrocerDocument40 pagesNew Business Green Grocernaveed009No ratings yet

- Annual Report 2017 18Document122 pagesAnnual Report 2017 18Ali AhmedNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- Minimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingFrom EverandMinimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingNo ratings yet

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Heart and Hustle: Use your passion. Build your brand. Achieve your dreams.From EverandHeart and Hustle: Use your passion. Build your brand. Achieve your dreams.Rating: 3.5 out of 5 stars3.5/5 (3)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)