Professional Documents

Culture Documents

Modaud1 Unit 2

Modaud1 Unit 2

Uploaded by

5669738019Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Modaud1 Unit 2

Modaud1 Unit 2

Uploaded by

5669738019Copyright:

Available Formats

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-1

UNIT2

AUDITOFCASHANDCASHTRANSACTIONS

EstimatedTime:6.0HOURS

*UseLouwers4

th

edition

Discussionquestions2-1

1. Describethefollowingcash-relatedterms.Showpro-formaschedulesorexamplesto

theclass.

a. Cashcountsheet

b. Bankreconciliation

c. Standardbankconfirmation

d. Proofofcash

e. Kiting

f. Lapping

g. Windowdressing

2. What should be considered in classifying cash items? What are those items that

shouldbeaccountedforascashandcashequivalents?Howshouldweaccountfor

thoseitemsthatarenotcash?

Discussionquestions2-2Controlsoverthereceiptanddisbursementofcash

RefertoLouwers6-9and6-10.

DiscussionQuestions2-3Substantiveauditproceduresfortheauditofcash

RefertoLouwers6-15,6-16,6-17,and6-18.

Problem2-1Analysisandclassificationofcashbalances

The valuation of cash shown on the balance sheet as of end of 2012 was P3,264,400.

Yourexaminationofcashshowedthebreakdowntobe:

Coinsandcurrency P60,000

Checksreceivedfromcustomers 560,000

Certificateofdeposit,term:2months 245,000

Pettycashfund 6,000

Postagestamps 400

BDO,checkingaccountbalance 2,000,100

Post-datedcheck,customer 12,000

Post-datedcheck,employee 8,000

Moneyorderfromcustomer 15,000

Cashinsavingsaccount 117,000

Bankdraftfromcustomer 45,000

Utilitydeposittogascompany,refundable 5,000

Cashadvancereceivedfromcustomer 8,000

NSFcheck,customer 20,000

Cashadvancetocompanyexecutive,collectible

ondemand

180,000

MBTC,checkingaccount,overdraft(OD) (25,000)

IOUsfromemployees 7,900

Total P3,264,400

Computeforthecorrectamountofcashandcashequivalentsanditscompositionasof

December31,2012.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-2

Problem2-2Analysisandclassificationofcashbalances

Boyet Dee, the controller for Fort Bonifacio Company, determined P10,542,700 as the

amountofcashandcashequivalentsthatwouldbereportedonitsDecember31,2012

financialstatements(FS).Asperyouraudit,thefollowingwasthebreakdownofBoyets

scheduleofcashandcashequivalents:

a. CommercialsavingsaccountofP1,200,000andcommercialcheckingaccount

balancesofP1,800,000heldatUCPB.

b. Traveladvancesof360,000forexecutivetravelforthefirstquarterofnextyear

(employeetoreimbursethroughsalarydeduction).

c. AseparatecashfundintheamountofP3,000,000restrictedfortheretirement

oflong-termdebt.

d. PettycashfundofP10,000(inclusiveofunreplenishedvouchersintheamount

ofP4,560).

e. AnIOUfromacompanysupervisorintheamountofP190,000.

f. AbankoverdraftofP250,000whichoccurredatoneofthebanksthecompany

uses to deposit its cash receipts. The company had no deposits at this bank

andtheBoyethadthisamountdeductedfromcashandcashequivalentsinhis

schedule.

g. Two certificates of deposit, each totaling P1,000,000. These certificates of

deposit had a maturity of 90 days from the FS date. Date of purchase:

December30,2012.

h. AcheckdatedJanuary12,2013intheamountofP125,000.

i. A cash balance of P400,000 at all times at UCPB to ensure future credit

availability(alreadyincludedinitemA).Foundouttobenotlegallyrestrictedas

towithdrawal.

j. P2,100,000commercialpaperofPLDTCo.whichisduein190days.

k. CurrencyandcoinsonhandamountingtoP7,700.

The2012financialstatementsofFortBonifacioshouldinclude(computefortheamounts

orprovidethejournalentries,asapplicable):

1. Cashonhand.

2. Cashinbank.

3. AdjustingentryforitemG.

4. AdjustingentryforitemH.

5. Cashandcashequivalents.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-3

Problem2-3Cashfundcount

You conducted a surprise cash count of the imprest petty cash fund of LLL Cosmetics

CorporationonJanuary5,2013.TheledgerbalanceforpettycashisP5,000.00withPer

Dyasthepettycashcustodian.Resultofyourexaminationrevealedthecashiersdrawer

tocontainthefollowing:

Bills P1,350.00

Coins 874.75

Pettycashvouchers(PCV):

Deliverycharges(12.14.2012) 420.00

Computerrepairs(12.18.2012) 700.00

Messengersfare(12.23.2012) 120.00

Advancestoemployees(12.27.2012) 900.00

Checks(includingCheck30108) 2,600.00

Salesinvoices 1,400.00

Envelopetaggedasemployeescontribution 760.00

Additionalinformation:

1. Check30108,issuedbyMr.A,anemployee,amountingtoP1,200.00wasreturned

bythebankasNSFcheck.

2. The envelope tagged as employees contribution has not been opened and still

intact.

Case1

1. Howmuchisthetotalunreplenishedvoucherscountedinthepettycashfund?

2. Howmuchisthetotalitemscountedinthepettycashfund?

3. Howmuchisthetotalaccountabilityofthecashier?

4. Howmuchisthecashshortage/overage?

5. HowmuchisthepettycashfundasofDecember31,2012?

Case2

In addition to information given above, you found another PCV dated January 3, 2013

spentforphotocopyingamountingtoP24.50.Moreover,youfoundoutthattheenvelope

taggedasemployeescontributionhasbeenopenedandthemoneyremoved.

6. Howmuchisthetotalunreplenishedvoucherscountedinthepettycashfund?

7. Howmuchisthetotalitemscountedinthepettycashfund?

8. Howmuchisthetotalaccountabilityofthecashier?

9. Howmuchisthecashshortage/overage?

10. HowmuchisthepettycashfundasofDecember31,2012?

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-4

Problem2-4Cashfundcount

As an associate member of the team that audits Oak Tree Foods Incorporated for the

year ended December 31, 2012, when the United States (US) dollar ($) to Philippine

pesois$1=P41.50,youwereassignedtoconductasurprisecashcountinthemorning

ofJanuary5,2013.YoufoundthefollowingitemsinsidethepettycashdrawerofPretty,

thecashcustodian:

Pettycashvouchers:

OvertimemealfortheChristmasParty12.19.2012 P725.00

AdditionalexpensesChristmasParty12.21.2012 965.00

Purchaseofhandsanitizer12.21.2012 96.25

Transportation12.22.2012 34.00

Purchaseofprinterinkandfolders12.26.2012 375.00

Gasolineforthevan12.27.2012 690.00

MealsofmaintenanceleftduringNewYearsDay01.01.2013 460.00

Protectivelotionusedbythepersonwhocollectedthecontribution

forMulanaydenguepatients01.03.2013 25.00

FloorwaxandLysol01.03.2013 175.00

Checks

No.0069212.28.2012fromAustralianBazaar,customer 1,400.75

No.1230012.29.2012fromMonina,employee 1,493.50

No.1023601.02.2013fromNeliaMaga,customer 3,150.60

No.4520101.03.2013fromArcticFever,customer 3,700.45

No.7809001.04.2013fromStella,anemployee 1,000.10

Paperbills

2pcs,P1,000;3pcs,P500;2pcs,P100;14pcs,P20;1pc,$5.50 ?

Coins

6loose,P10;34loose,P5;17loose,P1 ?

Envelopecontainingcontributionsforthedenguepatientsof

Mulanay,amountindicatedP1,400)butpercountisP1,375.Inside

theenvelopewasanofficialreceiptnamedtothecompany

amountingtoP25fortheprotectivelotionboughtbyanemployee

whopassedaroundtheenvelopearoundtheoffices.

Additionalinformation:

1. TheclientmaintainsanimprestpettycashbalanceofP10,000.

2. FurtherinvestigationalsodisclosedthattheofficialreceiptsfromDecember28to

January 3 totaled P8,251.80. These were already recorded in the cash receipts

journal.

3. CheckNo.78090wasencashedbeforeyear-end.

1. Prepareacashcountsheetindicatinganyoverageorshortage.

2. Determine the adjusted balance of petty cash fund as of December 31, 2012

supportedbyaproof.

Problem2-5Proceduresforauditingaclientsbankreconciliation

RefertoLouwers6-47.

Problem2-6Manipulatedbankreconciliation

RefertoLouwers6-50.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-5

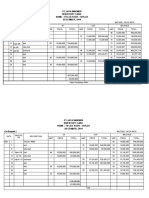

Problem2-7Bankreconciliation

TopCatCorporationhadpoorinternalcontroloveritscashtransactions.Datapertaining

toitscashpositionatOctober31,2012wereasfollows:

The cash book showed a balance of P76,634.77, which included undeposit receipts. A

creditofP950onthebankrecordsforadepositmadedidnotappearonthebooksofthe

company.

The bank statement had a balance of P68,835.99. The outstanding checks were as

follows:

No.0210667 P462.80

0210671 490.00

0210693 1,053.00

0210734 789.94

0210737 1,648.20

0210749 643.15

The cashier misappropriated all undeposited receipts in excess of P10,880.07 and

preparedthefollowingreconciliation:

Balanceperbooks,October31,2012 P76,634.77

Add:Outstandingchecks

No.0210734 P789.94

0210737 1,648.20

0210749 643.15 3,081.29

P78,966.06

Less:Undepositedreceipts 10,880.07

Balanceperbank,October31,2012 P68,835.99

Unrecordedcredit 950.00

Correctcashbalance,October31,2012 P67,885.99

Howmuchdidthecashiermisappropriateandexplainhowdidithappen?

Problem2-8Bankreconciliation

YouareauditingthegeneralcashforDaisyDuckCompanyforthefiscalyearendedJuly

31, 2012. The client has not prepared the July 31 bank reconciliation. After a brief

discussionwiththeowner,youagreetopreparethereconciliation,withassistancefrom

oneofDaisyDucksclerks.Youobtainthefollowinginformation:

General

Ledger

Bank

Statement

Beginningbalance P49,610 P61,030

Deposits 250,560

Cashreceiptsjournal 254,560

Checkscleared (236,150)

Cashdisbursementsjournal (218,110)

Julybankservicecharge (870)

Notepaiddirectly (61,000)

NSFcheck (3,110)

Endingbalance P86,060 P10,460

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-6

June30BankReconciliation

InformationinGeneralLedgerandBankStatement

Balanceperbank P57,530

Depositsintransit 6,000

Outstandingchecks 17,420

Balanceperbooks 46,110

Additionalinformationobtained:

a. ChecksclearingthatwereoutstandingonJune30totalledP16,920.

b. Checks clearing that were recorded in the July disbursements journal totalled

P204,670.

c. A check for P10,600 cleared the bank, but had not been recorded in the cash

disbursements journal. It was for an acquisition of inventory. Daisy Duck uses the

periodicinventorymethod.

d. AcheckforP3,960waschargedtoDaisyDuckCompanybuthadbeenwrittenona

differentcompanysbankaccount.

e. DepositsincludedP6,000fromJuneandP244,560forJuly.

f. The bank charged Daisy Duck Companys account for a non-sufficient check with a

totalamountofP3,110.Thecreditmanagerconcludedthatthecustomerintentionally

closed its account and the owner left the city. The check was turned over to a

collectionagency.

g. AnoteforP58,000,plusinterest,waspaiddirectlytothebankunderanagreement

signedfourmonthsago.ThenotepayablewasrecordedatP58,000onDaisyDuck

Companysbooks.

1. ComputetheamountofchecksoutstandingonJuly31.

2. HowmuchisthedepositsintransitonJuly31?

3. HowmuchistheadjustedcashbalanceonJuly31?

Problem2-9Interbanktransfersschedule

RefertoLouwers6-49.

Problem2-10Proofofcash

RefertoLouwers6-48.

Problem2-11Proofofcash

WhileperforminganopinionauditofthefinancialstatementsofMalaberCompanyasof

December31,2012,youhaveextractedthefollowingdataregardingthecashaccount:

November30 December31

a. Balancesperbooks P619,304 P670,392

b. Balancesperbank 742,800 774,696

c. Outstandingchecks 254,096 320,184*

*AcheckofP20,000wascertifiedbythebank.

d. The cash receipts book showed a total of P9,341,780 while the bank statement for

themonthofDecembershowedtotalcreditsofP5,401,800.

e. Malaber records NSF checks as reduction of cash receipts. However, NSF checks

whicharelaterredepositedarethenrecordedasregularreceipts.Thedataaboutthe

NSFchecksareasfollows:

1. ReturnedbythebankinDecemberandrecordedbythecompanyinJanuary

2011,P9,200.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-7

2. Returned by the bank in December and recorded by the company in

December,P25,000.

3. Returned by the bank in November and recorded by the company in

December,P1,000.

f. AbankcreditmemodatedDecember27,2012wasreceivedbyMalaberstatingthat

thecompanysaccountwascreditedforthenetproceedsofanoteforP8,060.Thisis

notyetrecordedinthebooks.

g. A check of Malabey Company amounting to P9,292 was charged to the company

accountbythebankinerroronDecember30.

h. The company has hypothecated its accounts receivable with the bank under an

agreementwherebythebanklendsthecompany80%ofthehypothecatedaccounts

receivable. The company performs accounting and collection of the accounts.

Adjustmentsoftheloanaremadefromdailysalesreportsanddeposits.

i. Thebankcreditsthecompanyaccountandincreasestheamountoftheloanfor80%

of the reported sales. The loan agreement states specifically states that the sales

report must be accepted by the bank before the company is credited. Sales reports

areforwardedbythecompanytothebankonthefirstdayfollowingthedateofsales.

The bank allocates each deposit 80% to the payment of the loan, and 20% to the

company account. Thus, only 80% of each days sales and 20% of each collection

deposits are entered in the bank statement. The company accountant records the

hypothecation of new accounts receivable (80% of sales) as a debit to Cash and a

credittotheBankLoanasofthedateofsales.Onehundredpercentofthecollection

onaccountsreceivableisrecordedascashreceipt;80%ofthecollectionisrecorded

in the cash disbursements books as a payment on the loan. In addition with the

hypothecation,thefollowinginformationwerediscovered:

1. Collection on accounts receivable deposited in December, other than

depositsintransit,totaledtoP4,800,000.

2. Included in the undeposited collections is cash from the hypothecation of

accounts receivable. Sales were P162,000 on November 30, and P169,000

on December 31, the balance was made up from collections of P128,440

whichwasenteredinthebooksinthemannerindicatedabove.

j. ForthemonthofDecember,theinterestonthebankloanamountingtoP24,560was

charged by the bank against the account of Malaber. This was not recorded in the

books.

Prepare a four-column proof of cash of the cash receipts and cash disbursements

recordedonthebankstatementandonthecompanysbooksforthemonthofDecember

2012. The reconciliation should agree with the cash figure that will appear in the

companysfinancialstatements.Thereafter,determinethefollowing:

1. CashbalanceasofNovember30.

2. CashbalanceasofDecember31.

3. BookreceiptsforDecember31.

4. BookdisbursementsforDecember31.

5. CashshortageatDecember31,iftheresany.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-8

Problem2-12Comprehensiveproblem

YouwereabletogatherthefollowingfromtheDecember31,2012trialbalanceofBugs

BunnyCorporationinconnectionwithyourauditofthecompany:

Cashonhand P530,000

Pettycashfund 10,450

GoldKeeperBankcurrentaccount 1,230,000

DiamondBankcurrentaccountno.01 1,080,000

DiamondBankcurrentaccountno.02 (80,000)

BronzeBanksavingsaccount 1,200,000

BronzeBanktimedeposit(three-month) 500,000

Cashonhandincludesthefollowingitems:

a. Customers check for P40,000 returned by bank on December 26, 2012 due to

insufficientfundbutsubsequentlyre-depositedandclearedbythebankonJanuary8,

2013.

b. Customers check for P20,000 dated January 2, 2013, received on December 29,

2012.

c. Postalmoneyordersreceivedfromcustomers,P30,000.

ThepettycashfundconsistedofthefollowingitemsasofDecember31,2012.

Currencyandcoins P2,350

Unreplenishedpettycashvouchers 1,300

Currencyinanenvelopemarkedcollectionsforcharitywith

namesattached

1,200

Employeesvales 1,600

CheckdrawnbyBugsBunnyCorporation,payabletothepetty

cashier

4,000

Total P10,450

IncludedamongthechecksdrawnbyBugsBunnyCorporationagainsttheGoldKeeper

currentaccountandrecordedinDecember2012arethefollowing:

a. Check written and dated December 29, 2012 and delivered to payee on January 2,

2013,P80,000.

b. CheckwrittenonDecember27,2012,datedJanuary2,2013,deliveredtopayeeon

December29,2012,P40,000.

ThecreditbalanceintheDiamondBankcurrentaccountNo.2representschecksdrawn

in excess of the deposit balance. These checks were still outstanding at December 31,

2012.

The savings account deposit in Bronze Bank has been set aside by the board of directors for

acquisition of new equipment. This account is expected to be disbursed in the next four months

fromthebalancesheetdate.

Basedontheaboveandtheresultofyouraudit,determinetheadjustedbalancesofthefollowing

asofDecember31,2012:

1. Cashonhand.

2. Pettycashfund.

3. GoldKeeperBankcurrentaccount.

4. Cashandcashequivalents.

You might also like

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- CH Proble 3 8 PDFDocument29 pagesCH Proble 3 8 PDFYogun Bayona100% (1)

- Uniform CPA Examination Questions May 1980 To November 1981Document260 pagesUniform CPA Examination Questions May 1980 To November 1981Adrienne GonzalezNo ratings yet

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- Unit I - Audit of Investment Property - Final - t31314Document11 pagesUnit I - Audit of Investment Property - Final - t31314Jake Bundok50% (2)

- Hand Book On Cbs Finnacle UCO BankDocument31 pagesHand Book On Cbs Finnacle UCO BankSunil Yadav67% (6)

- Bank Auditing (BLACK BOOK)Document56 pagesBank Auditing (BLACK BOOK)Abhishek Kumar80% (25)

- 3rd On-Line Quiz - Substantive Test For CashDocument3 pages3rd On-Line Quiz - Substantive Test For CashMJ YaconNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- 520-FinalllDocument38 pages520-FinalllHatake KakashiNo ratings yet

- Chapter 01 - Auditing and Assurance ServicesDocument74 pagesChapter 01 - Auditing and Assurance ServicesBettina OsterfasticsNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- DWATCHDocument92 pagesDWATCHFawaz SayedNo ratings yet

- Applied Auditing Report (Audit of Receivables)Document7 pagesApplied Auditing Report (Audit of Receivables)mary louise magana100% (1)

- Aud ProbDocument9 pagesAud ProbKulet AkoNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- CHAPTER 10 - Pre-Board ExaminationsDocument34 pagesCHAPTER 10 - Pre-Board Examinationsmjc24No ratings yet

- Far 102 - Cash and Cash EquivalentsDocument4 pagesFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsmissyNo ratings yet

- Cost2 1 PDF FreeDocument9 pagesCost2 1 PDF FreeIT GAMING100% (1)

- Advanced Financial Accounting 1Document12 pagesAdvanced Financial Accounting 1Gemine Ailna Panganiban NuevoNo ratings yet

- Far 102 - Cash - Bank Reconciliation PDFDocument3 pagesFar 102 - Cash - Bank Reconciliation PDFPatty LapuzNo ratings yet

- Chapter 5 Audit of InventoryDocument10 pagesChapter 5 Audit of InventoryMarkie GrabilloNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Audit of InventoriesDocument2 pagesAudit of InventoriesWawex DavisNo ratings yet

- AssignmentDocument6 pagesAssignmentIryne Kim PalatanNo ratings yet

- Solution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentDocument39 pagesSolution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentCaryll Joy BisnanNo ratings yet

- Review of Accounting ProcessDocument2 pagesReview of Accounting ProcessSeanNo ratings yet

- Substantive Test of LiabilitiesDocument4 pagesSubstantive Test of LiabilitiesJohn Francis IdananNo ratings yet

- TBCH09Document6 pagesTBCH09Samit TandukarNo ratings yet

- Easy Round-APDocument69 pagesEasy Round-APDaneen GastarNo ratings yet

- Cash and Cash Equivalent LatestDocument53 pagesCash and Cash Equivalent LatestxagocipNo ratings yet

- IntAcct Cash CashEquivalents 1Document3 pagesIntAcct Cash CashEquivalents 1Arkhie DavocolNo ratings yet

- LG2 - Audit of Cash (S)Document8 pagesLG2 - Audit of Cash (S)Moira VilogNo ratings yet

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocument10 pagesQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNo ratings yet

- ReSA First Preboard Complete Answer Key Batch 39Document3 pagesReSA First Preboard Complete Answer Key Batch 39Paul Adriel BalmesNo ratings yet

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- Auditing Theory Test BankDocument26 pagesAuditing Theory Test Bankdfgmlk dsdwNo ratings yet

- 10 Responsibility Accounting Live DiscussionDocument4 pages10 Responsibility Accounting Live DiscussionLee SuarezNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- Reviewer ErrorDocument13 pagesReviewer ErrorPatriciaSamaritaNo ratings yet

- PRTC - Final PREBOARD Solution Guide (1 of 2)Document4 pagesPRTC - Final PREBOARD Solution Guide (1 of 2)Charry RamosNo ratings yet

- Long Problems For Prelim'S Product: Case 1Document7 pagesLong Problems For Prelim'S Product: Case 1Mae AstovezaNo ratings yet

- Audit of CashDocument1 pageAudit of CashXandae MempinNo ratings yet

- Auditing TheoryDocument13 pagesAuditing TheoryRaven GarciaNo ratings yet

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Revew ExercisesDocument40 pagesRevew Exercisesjose amoresNo ratings yet

- Auditing Quiz - Cash and Cash EquivalentsDocument2 pagesAuditing Quiz - Cash and Cash EquivalentsRonel CaagbayNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- AT Quizzer 13 - Reporting Issues (2TAY1718) PDFDocument10 pagesAT Quizzer 13 - Reporting Issues (2TAY1718) PDFWihl Mathew Zalatar0% (1)

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- ADFINA 1 - Home Office - Quiz - 2016NDocument2 pagesADFINA 1 - Home Office - Quiz - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- PSBA - GAAS and System of Quality ControlDocument10 pagesPSBA - GAAS and System of Quality ControlephraimNo ratings yet

- Philippine School of Business Administration: Auditing (Theoretical Concepts)Document5 pagesPhilippine School of Business Administration: Auditing (Theoretical Concepts)John Ellard M. SaturnoNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- Calendar - 2015 02 01 - 2015 03 01 PDFDocument1 pageCalendar - 2015 02 01 - 2015 03 01 PDFJake BundokNo ratings yet

- Jan 2015 (Manila) ,: Holidays in PhilippinesDocument1 pageJan 2015 (Manila) ,: Holidays in PhilippinesJake BundokNo ratings yet

- REVIEW QUESTIONS Investment in Debt SecuritiesDocument1 pageREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNo ratings yet

- MODAUD1 UNIT 3 - Audit of ReceivablesDocument11 pagesMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokNo ratings yet

- Debt Securities: BondsDocument9 pagesDebt Securities: BondsCorinne GohocNo ratings yet

- Seitani (2013) Toolkit For DSGEDocument27 pagesSeitani (2013) Toolkit For DSGEJake BundokNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- X Deal FoodDocument1 pageX Deal FoodJake BundokNo ratings yet

- Dlsu Thesis Paper LetterheadDocument1 pageDlsu Thesis Paper LetterheadJake BundokNo ratings yet

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- MODAUD1 UNIT 4 - Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 - Audit of Inventories PDFJake BundokNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- Methods of Evaluating Capital InvestmentsDocument5 pagesMethods of Evaluating Capital InvestmentsJake BundokNo ratings yet

- MODAUD1 UNIT 5 - Audit of Biological AssetsDocument5 pagesMODAUD1 UNIT 5 - Audit of Biological AssetsJake BundokNo ratings yet

- Chapter 03Document30 pagesChapter 03ajbalcitaNo ratings yet

- 08 Handout 1 PDFDocument6 pages08 Handout 1 PDFJanleoRosalesPraxidesNo ratings yet

- Barangay Accounting System Manual: For Use by City/ Municipal AccountantsDocument104 pagesBarangay Accounting System Manual: For Use by City/ Municipal Accountantsemman neriNo ratings yet

- Sber Bank User GuideDocument62 pagesSber Bank User GuidearunmirandaNo ratings yet

- Senior High School Department SY 2020-2021: First Quarter First QuarterDocument8 pagesSenior High School Department SY 2020-2021: First Quarter First QuarterByerus TvNo ratings yet

- SAP FICO General Ledger Enduser TrainingDocument80 pagesSAP FICO General Ledger Enduser TrainingJinwoo Park50% (4)

- CLE RO UG LocalizationRODocument79 pagesCLE RO UG LocalizationROIrina GrosuNo ratings yet

- Topic - Accumulated Profits (Losses)Document3 pagesTopic - Accumulated Profits (Losses)Kaye ArsadNo ratings yet

- Reviewer: Accounting For Partnership Part 1Document22 pagesReviewer: Accounting For Partnership Part 1gab mNo ratings yet

- 1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesDocument17 pages1.) Transaction Cycles - The Means Through Which An Accounting System Processes Transactions of Related ActivitiesKhizzyia Paula Gil ManiscanNo ratings yet

- 2009 S3 Ase2007Document15 pages2009 S3 Ase2007May CcmNo ratings yet

- Materi Ke 10 Diklat Teknisi Pajak Siklus Akuntansilapkeu PT - Jaya Makmur D419Document92 pagesMateri Ke 10 Diklat Teknisi Pajak Siklus Akuntansilapkeu PT - Jaya Makmur D419jihankarlinaNo ratings yet

- Marasigan (Ledger & PCTB)Document17 pagesMarasigan (Ledger & PCTB)Mika CunananNo ratings yet

- Books of Accounts For StudentsDocument31 pagesBooks of Accounts For StudentsRICHARD OKIRUNo ratings yet

- Acc 201 CH3Document7 pagesAcc 201 CH3Trickster TwelveNo ratings yet

- Journalizing Posting and Preparing A Trial BalanceDocument38 pagesJournalizing Posting and Preparing A Trial BalanceJules Beltran100% (3)

- Demo Script For SAP S - 4HANA 1909 FPS01 Fully-Activated Appliance - Accounting, Financial Close & Financial Closing Cockpit PDFDocument37 pagesDemo Script For SAP S - 4HANA 1909 FPS01 Fully-Activated Appliance - Accounting, Financial Close & Financial Closing Cockpit PDFAnkit HarishNo ratings yet

- Open Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursDocument7 pagesOpen Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursNUR BALQIS BINTI MOHD TAJUDDIN BGNo ratings yet

- Accounting For Non-Accountants - Compendium 220913Document26 pagesAccounting For Non-Accountants - Compendium 220913Romuald DongNo ratings yet

- Hunter Mcintosh ch9pt2Document3 pagesHunter Mcintosh ch9pt2api-548202574No ratings yet

- GEN 010 P1 ExamDocument20 pagesGEN 010 P1 ExamJulian Adam PagalNo ratings yet

- Book Value Realizable ValueDocument4 pagesBook Value Realizable ValueGennia Mae Martinez100% (1)

- Business Plan of Pasa-Buy DeluxeDocument30 pagesBusiness Plan of Pasa-Buy DeluxeExynos NemeaNo ratings yet

- Chapter 7.5 AccountDocument1 pageChapter 7.5 Accountmarianne raelNo ratings yet

- Cost Accounting Cost Control FinalsDocument12 pagesCost Accounting Cost Control FinalsCindy Dela CruzNo ratings yet

- Sonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 02/05/2022 To 28/07/2022Document2 pagesSonai Gramin Bigarsheti Sahakari Patsanstha Maryadit: Loan Account Statement Date 02/05/2022 To 28/07/2022Bandopant KapaseNo ratings yet

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet