Professional Documents

Culture Documents

Chapter 13 - Return, Risk, and The Security Market Line

Chapter 13 - Return, Risk, and The Security Market Line

Uploaded by

Ho Yuen Chi EugeneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 13 - Return, Risk, and The Security Market Line

Chapter 13 - Return, Risk, and The Security Market Line

Uploaded by

Ho Yuen Chi EugeneCopyright:

Available Formats

Chapter 13 - Return, Risk, and the Security Market Line

Chapter 13

Return, Risk, and the Security Market Line

Multiple Choice Questions

1. You own a stock that you think will produce a return of 11 percent in a good econoy and

3 percent in a poor econoy. !i"en the pro#a#ilities of each state of the econoy occurring,

you anticipate that your stock will earn $.% percent ne&t year. 'hich one of the following

ters applies to this $.% percent(

). arithetic return

*. historical return

C. e&pected return

+. geoetric return

,. re-uired return

.. Su/ie owns fi"e different #onds "alued at 03$,111 and twel"e different stocks "alued at

02.,%11 total. 'hich one of the following ters ost applies to Su/ie3s in"estents(

). inde&

*. portfolio

C. collection

+. grouping

,. risk-free

3. Ste"e has in"ested in twel"e different stocks that ha"e a co#ined "alue today of 01.1,311.

4ifteen percent of that total is in"ested in 'ise Man 4oods. 5he 1% percent is a easure of

which one of the following(

). portfolio return

*. portfolio weight

C. degree of risk

+. price-earnings ratio

,. inde& "alue

13-1

Chapter 13 - Return, Risk, and the Security Market Line

6. 'hich one of the following is a risk that applies to ost securities(

). unsysteatic

*. di"ersifia#le

C. systeatic

+. asset-specific

,. total

%. ) news flash 7ust appeared that caused a#out a do/en stocks to suddenly drop in "alue #y

a#out .1 percent. 'hat type of risk does this news flash represent(

). portfolio

*. nondi"ersifia#le

C. arket

+. unsysteatic

,. total

$. 5he principle of di"ersification tells us that8

). concentrating an in"estent in two or three large stocks will eliinate all of the

unsysteatic risk.

*. concentrating an in"estent in three copanies all within the sae industry will greatly

reduce the systeatic risk.

C. spreading an in"estent across fi"e di"erse copanies will not lower the total risk.

+. spreading an in"estent across any di"erse assets will eliinate all of the systeatic

risk.

,. spreading an in"estent across any di"erse assets will eliinate soe of the total risk.

9. 5he ::::: tells us that the e&pected return on a risky asset depends only on that asset3s

nondi"ersifia#le risk.

). efficient arkets hypothesis

*. systeatic risk principle

C. open arkets theore

+. law of one price

,. principle of di"ersification

13-.

Chapter 13 - Return, Risk, and the Security Market Line

2. 'hich one of the following easures the aount of systeatic risk present in a particular

risky asset relati"e to the systeatic risk present in an a"erage risky asset(

). #eta

*. reward-to-risk ratio

C. risk ratio

+. standard de"iation

,. price-earnings ratio

;. 'hich one of the following is a positi"ely sloped linear function that is created when

e&pected returns are graphed against security #etas(

). reward-to-risk atri&

*. portfolio weight graph

C. noral distri#ution

+. security arket line

,. arket real returns

11. 'hich one of the following is represented #y the slope of the security arket line(

). reward-to-risk ratio

*. arket standard de"iation

C. #eta coefficient

+. risk-free interest rate

,. arket risk preiu

11. 'hich one of the following is the forula that e&plains the relationship #etween the

e&pected return on a security and the le"el of that security3s systeatic risk(

). capital asset pricing odel

*. tie "alue of oney e-uation

C. unsysteatic risk e-uation

+. arket perforance e-uation

,. e&pected risk forula

13-3

Chapter 13 - Return, Risk, and the Security Market Line

1.. 5reynor <ndustries is in"esting in a new pro7ect. 5he iniu rate of return the fir

re-uires on this pro7ect is referred to as the8

). a"erage arithetic return.

*. e&pected return.

C. arket rate of return.

+. internal rate of return.

,. cost of capital.

13. 5he e&pected return on a stock gi"en "arious states of the econoy is e-ual to the8

). highest e&pected return gi"en any econoic state.

*. arithetic a"erage of the returns for each econoic state.

C. suation of the indi"idual e&pected rates of return.

+. weighted a"erage of the returns for each econoic state.

,. return for the econoic state with the highest pro#a#ility of occurrence.

16. 5he e&pected return on a stock coputed using econoic pro#a#ilities is8

). guaranteed to e-ual the actual a"erage return on the stock for the ne&t fi"e years.

*. guaranteed to #e the inial rate of return on the stock o"er the ne&t two years.

C. guaranteed to e-ual the actual return for the iediate twel"e onth period.

+. a atheatical e&pectation #ased on a weighted a"erage and not an actual anticipated

outcoe.

,. the actual return you should anticipate as long as the econoic forecast reains constant.

1%. 5he e&pected risk preiu on a stock is e-ual to the e&pected return on the stock inus

the8

). e&pected arket rate of return.

*. risk-free rate.

C. inflation rate.

+. standard de"iation.

,. "ariance.

13-6

Chapter 13 - Return, Risk, and the Security Market Line

1$. Standard de"iation easures which type of risk(

). total

*. nondi"ersifia#le

C. unsysteatic

+. systeatic

,. econoic

19. 5he e&pected rate of return on a stock portfolio is a weighted a"erage where the weights

are #ased on the8

). nu#er of shares owned of each stock.

*. arket price per share of each stock.

C. arket "alue of the in"estent in each stock.

+. original aount in"ested in each stock.

,. cost per share of each stock held.

12. 5he e&pected return on a portfolio considers which of the following factors(

<. percentage of the portfolio in"ested in each indi"idual security

<<. pro7ected states of the econoy

<<<. the perforance of each security gi"en "arious econoic states

<=. pro#a#ility of occurrence for each state of the econoy

). < and <<< only

*. << and <= only

C. <, <<<, and <= only

+. <<, <<<, and <= only

,. <, <<, <<<, and <=

13-%

Chapter 13 - Return, Risk, and the Security Market Line

1;. 5he e&pected return on a portfolio8

<. can ne"er e&ceed the e&pected return of the #est perforing security in the portfolio.

<<. ust #e e-ual to or greater than the e&pected return of the worst perforing security in the

portfolio.

<<<. is independent of the unsysteatic risks of the indi"idual securities held in the portfolio.

<=. is independent of the allocation of the portfolio aongst indi"idual securities.

). < and <<< only

*. << and <= only

C. < and << only

+. <, <<, and <<< only

,. <, <<, <<<, and <=

.1. <f a stock portfolio is well di"ersified, then the portfolio "ariance8

). will e-ual the "ariance of the ost "olatile stock in the portfolio.

*. ay #e less than the "ariance of the least risky stock in the portfolio.

C. ust #e e-ual to or greater than the "ariance of the least risky stock in the portfolio.

+. will #e a weighted a"erage of the "ariances of the indi"idual securities in the portfolio.

,. will #e an arithetic a"erage of the "ariances of the indi"idual securities in the portfolio.

.1. 5he standard de"iation of a portfolio8

). is a weighted a"erage of the standard de"iations of the indi"idual securities held in the

portfolio.

*. can ne"er #e less than the standard de"iation of the ost risky security in the portfolio.

C. ust #e e-ual to or greater than the lowest standard de"iation of any single security held in

the portfolio.

+. is an arithetic a"erage of the standard de"iations of the indi"idual securities which

coprise the portfolio.

,. can #e less than the standard de"iation of the least risky security in the portfolio.

13-$

Chapter 13 - Return, Risk, and the Security Market Line

... 5he standard de"iation of a portfolio8

). is a easure of that portfolio3s systeatic risk.

*. is a weighed a"erage of the standard de"iations of the indi"idual securities held in that

portfolio.

C. easures the aount of di"ersifia#le risk inherent in the portfolio.

+. ser"es as the #asis for coputing the appropriate risk preiu for that portfolio.

,. can #e less than the weighted a"erage of the standard de"iations of the indi"idual securities

held in that portfolio.

.3. 'hich one of the following stateents is correct concerning a portfolio of .1 securities

with ultiple states of the econoy when #oth the securities and the econoic states ha"e

une-ual weights(

). !i"en the une-ual weights of #oth the securities and the econoic states, the standard

de"iation of the portfolio ust e-ual that of the o"erall arket.

*. 5he weights of the indi"idual securities ha"e no effect on the e&pected return of a portfolio

when ultiple states of the econoy are in"ol"ed.

C. Changing the pro#a#ilities of occurrence for the "arious econoic states will not affect the

e&pected standard de"iation of the portfolio.

+. 5he standard de"iation of the portfolio will #e greater than the highest standard de"iation

of any single security in the portfolio gi"en that the indi"idual securities are well di"ersified.

,. !i"en #oth the une-ual weights of the securities and the econoic states, an in"estor ight

#e a#le to create a portfolio that has an e&pected standard de"iation of /ero.

.6. 'hich one of the following e"ents would #e included in the e&pected return on Susse&

stock(

). 5he chief financial officer of Susse& une&pectedly resigned.

*. 5he la#or union representing Susse&3 eployees une&pectedly called a strike.

C. 5his orning, Susse& confired that its C,> is retiring at the end of the year as was

anticipated.

+. 5he price of Susse& stock suddenly declined in "alue #ecause researchers accidentally

disco"ered that one of the fir3s products can #e to&ic to household pets.

,. 5he #oard of directors ade an unprecedented decision to gi"e si/ea#le #onuses to the

fir3s internal auditors for their efforts in unco"ering wasteful spending.

13-9

Chapter 13 - Return, Risk, and the Security Market Line

.%. 'hich one of the following stateents is correct(

). 5he une&pected return is always negati"e.

*. 5he e&pected return inus the une&pected return is e-ual to the total return.

C. >"er tie, the a"erage return is e-ual to the une&pected return.

+. 5he e&pected return includes the surprise portion of news announceents.

,. >"er tie, the a"erage une&pected return will #e /ero.

.$. 'hich one of the following stateents related to une&pected returns is correct(

). )ll announceents #y a fir affect that fir3s une&pected returns.

*. ?ne&pected returns o"er tie ha"e a negati"e effect on the total return of a fir.

C. ?ne&pected returns are relati"ely predicta#le in the short-ter.

+. ?ne&pected returns generally cause the actual return to "ary significantly fro the

e&pected return o"er the long-ter.

,. ?ne&pected returns can #e either positi"e or negati"e in the short ter #ut tend to #e /ero

o"er the long-ter.

.9. 'hich one of the following is an e&aple of systeatic risk(

). in"estors panic causing security prices around the glo#e to fall precipitously

*. a flood washes away a fir3s warehouse

C. a city iposes an additional one percent sales ta& on all products

+. a toyaker has to recall its top-selling toy

,. corn prices increase due to increased deand for alternati"e fuels

.2. ?nsysteatic risk8

). can #e effecti"ely eliinated #y portfolio di"ersification.

*. is copensated for #y the risk preiu.

C. is easured #y #eta.

+. is easured #y standard de"iation.

,. is related to the o"erall econoy.

13-2

Chapter 13 - Return, Risk, and the Security Market Line

.;. 'hich one of the following is an e&aple of unsysteatic risk(

). incoe ta&es are increased across the #oard

*. a national sales ta& is adopted

C. inflation decreases at the national le"el

+. an increased feeling of prosperity is felt around the glo#e

,. consuer spending on entertainent decreased nationally

31. 'hich one of the following is least apt to reduce the unsysteatic risk of a portfolio(

). reducing the nu#er of stocks held in the portfolio

*. adding #onds to a stock portfolio

C. adding international securities into a portfolio of ?.S. stocks

+. adding ?.S. 5reasury #ills to a risky portfolio

,. adding technology stocks to a portfolio of industrial stocks

31. 'hich one of the following stateents is correct concerning unsysteatic risk(

). )n in"estor is rewarded for assuing unsysteatic risk.

*. ,liinating unsysteatic risk is the responsi#ility of the indi"idual in"estor.

C. ?nsysteatic risk is rewarded when it e&ceeds the arket le"el of unsysteatic risk.

+. *eta easures the le"el of unsysteatic risk inherent in an indi"idual security.

,. Standard de"iation is a easure of unsysteatic risk.

3.. 'hich one of the following stateents related to risk is correct(

). 5he #eta of a portfolio ust increase when a stock with a high standard de"iation is added

to the portfolio.

*. ,"ery portfolio that contains .% or ore securities is free of unsysteatic risk.

C. 5he systeatic risk of a portfolio can #e effecti"ely lowered #y adding 5-#ills to the

portfolio.

+. )dding fi"e additional stocks to a di"ersified portfolio will lower the portfolio3s #eta.

,. Stocks that o"e in tande with the o"erall arket ha"e /ero #etas.

13-;

Chapter 13 - Return, Risk, and the Security Market Line

33. 'hich one of the following risks is irrele"ant to a well-di"ersified in"estor(

). systeatic risk

*. unsysteatic risk

C. arket risk

+. nondi"ersifia#le risk

,. systeatic portion of a surprise

36. 'hich of the following are e&aples of di"ersifia#le risk(

<. earth-uake daages an entire town

<<. federal go"ernent iposes a 0111 fee on all #usiness entities

<<<. eployent ta&es increase nationally

<=. toyakers are re-uired to ipro"e their safety standards

). < and <<< only

*. << and <= only

C. << and <<< only

+. < and <= only

,. <, <<<, and <= only

3%. 'hich of the following stateents are correct concerning di"ersifia#le risks(

<. +i"ersifia#le risks can #e essentially eliinated #y in"esting in thirty unrelated securities.

<<. 5here is no reward for accepting di"ersifia#le risks.

<<<. +i"ersifia#le risks are generally associated with an indi"idual fir or industry.

<=. *eta easures di"ersifia#le risk.

). < and <<< only

*. << and <= only

C. < and <= only

+. <, << and <<< only

,. <, <<, <<<, and <=

3$. 'hich one of the following is the #est e&aple of a di"ersifia#le risk(

). interest rates increase

*. energy costs increase

C. core inflation increases

+. a fir3s sales decrease

,. ta&es decrease

13-11

Chapter 13 - Return, Risk, and the Security Market Line

39. 'hich of the following stateents concerning risk are correct(

<. @ondi"ersifia#le risk is easured #y #eta.

<<. 5he risk preiu increases as di"ersifia#le risk increases.

<<<. Systeatic risk is another nae for nondi"ersifia#le risk.

<=. +i"ersifia#le risks are arket risks you cannot a"oid.

). < and <<< only

*. << and <= only

C. < and << only

+. <<< and <= only

,. <, <<, and <<< only

32. 5he priary purpose of portfolio di"ersification is to8

). increase returns and risks.

*. eliinate all risks.

C. eliinate asset-specific risk.

+. eliinate systeatic risk.

,. lower #oth returns and risks.

3;. 'hich one of the following indicates a portfolio is #eing effecti"ely di"ersified(

). an increase in the portfolio #eta

*. a decrease in the portfolio #eta

C. an increase in the portfolio rate of return

+. an increase in the portfolio standard de"iation

,. a decrease in the portfolio standard de"iation

61. Aow any di"erse securities are re-uired to eliinate the a7ority of the di"ersifia#le risk

fro a portfolio(

). %

*. 11

C. .%

+. %1

,. 9%

13-11

Chapter 13 - Return, Risk, and the Security Market Line

61. Systeatic risk is easured #y8

). the ean.

*. #eta.

C. the geoetric a"erage.

+. the standard de"iation.

,. the arithetic a"erage.

6.. 'hich one of the following is ost directly affected #y the le"el of systeatic risk in a

security(

). "ariance of the returns

*. standard de"iation of the returns

C. e&pected rate of return

+. risk-free rate

,. arket risk preiu

63. 'hich one of the following stateents is correct concerning a portfolio #eta(

). Bortfolio #etas range #etween -1.1 and C1.1.

*. ) portfolio #eta is a weighted a"erage of the #etas of the indi"idual securities contained in

the portfolio.

C. ) portfolio #eta cannot #e coputed fro the #etas of the indi"idual securities coprising

the portfolio #ecause soe risk is eliinated "ia di"ersification.

+. ) portfolio of ?.S. 5reasury #ills will ha"e a #eta of C1.1.

,. 5he #eta of a arket portfolio is e-ual to /ero.

66. 5he systeatic risk of the arket is easured #y8

). a #eta of 1.1.

*. a #eta of 1.1.

C. a standard de"iation of 1.1.

+. a standard de"iation of 1.1.

,. a "ariance of 1.1.

13-1.

Chapter 13 - Return, Risk, and the Security Market Line

6%. )t a iniu, which of the following would you need to know to estiate the aount of

additional reward you will recei"e for purchasing a risky asset instead of a risk-free asset(

<. asset3s standard de"iation

<<. asset3s #eta

<<<. risk-free rate of return

<=. arket risk preiu

). < and <<< only

*. << and <= only

C. <<< and <= only

+. <, <<<, and <= only

,. <, <<, <<<, and <=

6$. 5otal risk is easured #y ::::: and systeatic risk is easured #y :::::.

). #etaD alpha

*. #etaD standard de"iation

C. alphaD #eta

+. standard de"iationD #eta

,. standard de"iationD "ariance

69. 5he intercept point of the security arket line is the rate of return which corresponds to8

). the risk-free rate.

*. the arket rate.

C. a return of /ero.

+. a return of 1.1 percent.

,. the arket risk preiu.

62. ) stock with an actual return that lies a#o"e the security arket line has8

). ore systeatic risk than the o"erall arket.

*. ore risk than that warranted #y C)BM.

C. a higher return than e&pected for the le"el of risk assued.

+. less systeatic risk than the o"erall arket.

,. a return e-ui"alent to the le"el of risk assued.

13-13

Chapter 13 - Return, Risk, and the Security Market Line

6;. 5he arket rate of return is 11 percent and the risk-free rate of return is 3 percent. Le&ant

stock has 3 percent less systeatic risk than the arket and has an actual return of 1. percent.

5his stock8

). is underpriced.

*. is correctly priced.

C. will plot #elow the security arket line.

+. will plot on the security arket line.

,. will plot to the right of the o"erall arket on a security arket line graph.

%1. 'hich one of the following will #e constant for all securities if the arket is efficient and

securities are priced fairly(

). "ariance

*. standard de"iation

C. reward-to-risk ratio

+. #eta

,. risk preiu

%1. 5he reward-to-risk ratio for stock ) is less than the reward-to-risk ratio of stock *. Stock

) has a #eta of 1.2. and stock * has a #eta of 1..;. 5his inforation iplies that8

). stock ) is riskier than stock * and #oth stocks are fairly priced.

*. stock ) is less risky than stock * and #oth stocks are fairly priced.

C. either stock ) is underpriced or stock * is o"erpriced or #oth.

+. either stock ) is o"erpriced or stock * is underpriced or #oth.

,. #oth stock ) and stock * are correctly priced since stock ) is riskier than stock *.

%.. 5he arket risk preiu is coputed #y8

). adding the risk-free rate of return to the inflation rate.

*. adding the risk-free rate of return to the arket rate of return.

C. su#tracting the risk-free rate of return fro the inflation rate.

+. su#tracting the risk-free rate of return fro the arket rate of return.

,. ultiplying the risk-free rate of return #y a #eta of 1.1.

13-16

Chapter 13 - Return, Risk, and the Security Market Line

%3. 5he e&cess return earned #y an asset that has a #eta of 1.36 o"er that earned #y a risk-free

asset is referred to as the8

). arket risk preiu.

*. risk preiu.

C. systeatic return.

+. total return.

,. real rate of return.

%6. 5he ::::: of a security di"ided #y the #eta of that security is e-ual to the slope of the

security arket line if the security is priced fairly.

). real return

*. actual return

C. noinal return

+. risk preiu

,. e&pected return

%%. 5he capital asset pricing odel EC)BMF assues which of the following(

<. a risk-free asset has no systeatic risk.

<<. #eta is a relia#le estiate of total risk.

<<<. the reward-to-risk ratio is constant.

<=. the arket rate of return can #e appro&iated.

). < and <<< only

*. << and <= only

C. <, <<<, and <= only

+. <<, <<<, and <= only

,. <, <<, <<<, and <=

%$. )ccording to C)BM, the aount of reward an in"estor recei"es for #earing the risk of an

indi"idual security depends upon the8

). aount of total risk assued and the arket risk preiu.

*. arket risk preiu and the aount of systeatic risk inherent in the security.

C. risk free rate, the arket rate of return, and the standard de"iation of the security.

+. #eta of the security and the arket rate of return.

,. standard de"iation of the security and the risk-free rate of return.

13-1%

Chapter 13 - Return, Risk, and the Security Market Line

%9. 'hich one of the following should earn the ost risk preiu #ased on C)BM(

). di"ersified portfolio with returns siilar to the o"erall arket

*. stock with a #eta of 1.32

C. stock with a #eta of 1.96

+. ?.S. 5reasury #ill

,. portfolio with a #eta of 1.11

%2. You want your portfolio #eta to #e 1.;%. Currently, your portfolio consists of 06,111

in"ested in stock ) with a #eta of 1.69 and 03,111 in stock * with a #eta of 1.%6. You ha"e

another 0;,111 to in"est and want to di"ide it #etween an asset with a #eta of 1.96 and a risk-

free asset. Aow uch should you in"est in the risk-free asset(

). 06,31$.12

*. 06,6.%..;

C. 06,;1...;

+. 06,%96.91

,. 06,$23.;.

%;. You ha"e a 01.,111 portfolio which is in"ested in stocks ) and *, and a risk-free asset.

0%,111 is in"ested in stock ). Stock ) has a #eta of 1.9$ and stock * has a #eta of 1.2;. Aow

uch needs to #e in"ested in stock * if you want a portfolio #eta of 1.11(

). 03,9%1.11

*. 06,333.33

C. 06,91$..1

+. 06,;63.2.

,. 0%,61;..9

$1. You recently purchased a stock that is e&pected to earn .. percent in a #ooing econoy,

; percent in a noral econoy, and lose 33 percent in a recessionary econoy. 5here is a %

percent pro#a#ility of a #oo and a 9% percent chance of a noral econoy. 'hat is your

e&pected rate of return on this stock(

). -3.61 percent

*. -...% percent

C. 1..% percent

+. ..$1 percent

,. 3.%1 percent

13-1$

Chapter 13 - Return, Risk, and the Security Market Line

$1. 5he coon stock of Manchester G Moore is e&pected to earn 13 percent in a recession,

$ percent in a noral econoy, and lose 6 percent in a #ooing econoy. 5he pro#a#ility of

a #oo is % percent while the pro#a#ility of a recession is 6% percent. 'hat is the e&pected

rate of return on this stock(

). 2.%. percent

*. 2.96 percent

C. 2.$% percent

+. ;.1% percent

,. ;..2 percent

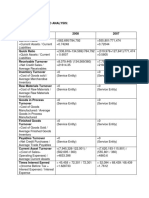

$.. You are coparing stock ) to stock *. !i"en the following inforation, what is the

difference in the e&pected returns of these two securities(

). -1.2% percent

*. 1.;% percent

C. ..1% percent

+. 13.6% percent

,. 13.%% percent

$3. Herilu Markets has a #eta of 1.1;. 5he risk-free rate of return is ..9% percent and the

arket rate of return is ;.21 percent. 'hat is the risk preiu on this stock(

). $.69 percent

*. 9.13 percent

C. 9.$2 percent

+. 2.;; percent

,. ;.21 percent

13-19

Chapter 13 - Return, Risk, and the Security Market Line

$6. <f the econoy is noral, Charleston 4reight stock is e&pected to return 1%.9 percent. <f

the econoy falls into a recession, the stock3s return is pro7ected at a negati"e 11.$ percent.

5he pro#a#ility of a noral econoy is 21 percent while the pro#a#ility of a recession is .1

percent. 'hat is the "ariance of the returns on this stock(

). 1.11136$

*. 1.111;.%

C. 1.1136.1

+. 1.113;.9

,. 1.11631%

$%. 5he rate of return on the coon stock of Lancaster 'oolens is e&pected to #e .1 percent

in a #oo econoy, 11 percent in a noral econoy, and only 3 percent in a recessionary

econoy. 5he pro#a#ilities of these econoic states are 11 percent for a #oo, 91 percent for

a noral econoy, and .1 percent for a recession. 'hat is the "ariance of the returns on this

coon stock(

). 1.11.1%1

*. 1.11.$1$

C. 1.11..66

+. 1.11.3%;

,. 1.11.6.1

$$. 5he returns on the coon stock of @ew <age Broducts are -uite cyclical. <n a #oo

econoy, the stock is e&pected to return 3. percent in coparison to 16 percent in a noral

econoy and a negati"e .2 percent in a recessionary period. 5he pro#a#ility of a recession is

.% percent while the pro#a#ility of a #oo is 11 percent. 'hat is the standard de"iation of the

returns on this stock(

). 1;.;6 percent

*. .1.%$ percent

C. .%.23 percent

+. 3..12 percent

,. 3;.99 percent

13-12

Chapter 13 - Return, Risk, and the Security Market Line

$9. 'hat is the standard de"iation of the returns on a stock gi"en the following inforation(

). 1.%9 percent

*. ..13 percent

C. ..2; percent

+. 3.6. percent

,. 6.11 percent

$2. You ha"e a portfolio consisting solely of stock ) and stock *. 5he portfolio has an

e&pected return of 2.9 percent. Stock ) has an e&pected return of 11.6 percent while stock * is

e&pected to return $.6 percent. 'hat is the portfolio weight of stock )(

). 3; percent

*. 6$ percent

C. %6 percent

+. $1 percent

,. $9 percent

$;. You own the following portfolio of stocks. 'hat is the portfolio weight of stock C(

). 3;.2% percent

*. 6..2$ percent

C. 66.61 percent

+. 62.1; percent

,. %..$% percent

13-1;

Chapter 13 - Return, Risk, and the Security Market Line

91. You own a portfolio with the following e&pected returns gi"en the "arious states of the

econoy. 'hat is the o"erall portfolio e&pected return(

). $.6; percent

*. 2.$6 percent

C. 2.29 percent

+. ;.1% percent

,. ;..3 percent

91. 'hat is the e&pected return on a portfolio which is in"ested .% percent in stock ), %%

percent in stock *, and the reainder in stock C(

). -1.1$ percent

*. ..32 percent

C. ..;; percent

+. %.;3 percent

,. $.11 percent

13-.1

Chapter 13 - Return, Risk, and the Security Market Line

9.. 'hat is the e&pected return on this portfolio(

). 11.62 percent

*. 11.;. percent

C. 13.13 percent

+. 13.6. percent

,. 13.;9 percent

93. 'hat is the e&pected return on a portfolio that is e-ually weighted #etween stocks I and

L gi"en the following inforation(

). 11.13 percent

*. 11.2$ percent

C. 1...% percent

+. 13.3. percent

,. 16.61 percent

13-.1

Chapter 13 - Return, Risk, and the Security Market Line

96. 'hat is the e&pected return on a portfolio coprised of 0$,.11 of stock M and 06,%11 of

stock @ if the econoy en7oys a #oo period(

). 11.;3 percent

*. 11.1$ percent

C. 1..%% percent

+. 13.92 percent

,. 1%.63 percent

9%. 'hat is the "ariance of the returns on a portfolio that is in"ested $1 percent in stock S and

61 percent in stock 5(

). .111119

*. .1111.3

C. .111112

+. .11113$

,. .1111$1

13-..

Chapter 13 - Return, Risk, and the Security Market Line

9$. 'hat is the "ariance of the returns on a portfolio coprised of 0%,611 of stock ! and

0$,$11 of stock A(

). .11191;

*. .111262

C. .1111;9

+. .111.%6

,. .1116$2

99. 'hat is the standard de"iation of the returns on a portfolio that is in"ested %. percent in

stock J and 62 percent in stock R(

). 1.$$ percent

*. ..69 percent

C. ..$3 percent

+. 3..2 percent

,. 3.61 percent

13-.3

Chapter 13 - Return, Risk, and the Security Market Line

92. 'hat is the standard de"iation of the returns on a 031,111 portfolio which consists of

stocks S and 5( Stock S is "alued at 01.,111.

). 1.19 percent

*. 1... percent

C. 1.3$ percent

+. 1.6; percent

,. 1.$3 percent

9;. 'hat is the standard de"iation of the returns on a portfolio that is in"ested in stocks ), *,

and C( 5wenty fi"e percent of the portfolio is in"ested in stock ) and 61 percent is in"ested in

stock C.

). $.31 percent

*. $.6; percent

C. 9.61 percent

+. 9.23 percent

,. 2.9. percent

13-.6

Chapter 13 - Return, Risk, and the Security Market Line

21. 'hat is the #eta of the following portfolio(

). 1.16

*. 1.19

C. 1.13

+. 1.1$

,. 1..3

21. Your portfolio is coprised of 61 percent of stock K, 1% percent of stock Y, and 6%

percent of stock L. Stock K has a #eta of 1.1$, stock Y has a #eta of 1.69, and stock L has a

#eta of 1.6.. 'hat is the #eta of your portfolio(

). 1.29

*. 1.1;

C. 1.13

+. 1.12

,. 1..1

2.. Your portfolio has a #eta of 1.1.. 5he portfolio consists of .1 percent ?.S. 5reasury #ills,

%1 percent stock ), and 31 percent stock *. Stock ) has a risk-le"el e-ui"alent to that of the

o"erall arket. 'hat is the #eta of stock *(

). 1.69

*. 1.%.

C. 1.$;

+. 1.26

,. ..19

13-.%

Chapter 13 - Return, Risk, and the Security Market Line

23. You would like to co#ine a risky stock with a #eta of 1.$2 with ?.S. 5reasury #ills in

such a way that the risk le"el of the portfolio is e-ui"alent to the risk le"el of the o"erall

arket. 'hat percentage of the portfolio should #e in"ested in the risky stock(

). 3. percent

*. 61 percent

C. %6 percent

+. $1 percent

,. $2 percent

26. 5he arket has an e&pected rate of return of 11.9 percent. 5he long-ter go"ernent

#ond is e&pected to yield %.2 percent and the ?.S. 5reasury #ill is e&pected to yield 3.;

percent. 5he inflation rate is 3.$ percent. 'hat is the arket risk preiu(

). $.1 percent

*. $.2 percent

C. 9.% percent

+. 2.% percent

,. ;.3 percent

2%. 5he risk-free rate of return is 3.; percent and the arket risk preiu is $.. percent.

'hat is the e&pected rate of return on a stock with a #eta of 1..1(

). 11.;. percent

*. 11.61 percent

C. 1.... percent

+. 1..69 percent

,. 1..9; percent

2$. 5he coon stock of Hensen Shipping has an e&pected return of 1$.3 percent. 5he return

on the arket is 11.2 percent and the risk-free rate of return is 3.2 percent. 'hat is the #eta of

this stock(

). .;.

*. 1..3

C. 1.33

+. 1.$9

,. 1.9;

13-.$

Chapter 13 - Return, Risk, and the Security Market Line

29. 5he coon stock of ?nited <ndustries has a #eta of 1.36 and an e&pected return of 16..;

percent. 5he risk-free rate of return is 3.9 percent. 'hat is the e&pected arket risk

preiu(

). 9.1. percent

*. 9.;1 percent

C. 11.$3 percent

+. 11... percent

,. 11.$1 percent

22. 5he e&pected return on HI stock is 1%.92 percent while the e&pected return on the arket

is 11.36 percent. 5he stock3s #eta is 1.$.. 'hat is the risk-free rate of return(

). 3... percent

*. 3.%; percent

C. 3.$3 percent

+. 3.9; percent

,. 6.12 percent

2;. 5hayer 4ars stock has a #eta of 1.1.. 5he risk-free rate of return is 6.36 percent and the

arket risk preiu is 9.;. percent. 'hat is the e&pected rate of return on this stock(

). 2.3% percent

*. ;.11 percent

C. 11..3 percent

+. 13..1 percent

,. 13.93 percent

;1. 5he coon stock of )lpha Manufacturers has a #eta of 1.69 and an actual e&pected

return of 1%..$ percent. 5he risk-free rate of return is 6.3 percent and the arket rate of return

is 1..11 percent. 'hich one of the following stateents is true gi"en this inforation(

). 5he actual e&pected stock return will graph a#o"e the Security Market Line.

*. 5he stock is underpriced.

C. 5o #e correctly priced according to C)BM, the stock should ha"e an e&pected return of

.1.;% percent.

+. 5he stock has less systeatic risk than the o"erall arket.

,. 5he actual e&pected stock return indicates the stock is currently o"erpriced.

13-.9

Chapter 13 - Return, Risk, and the Security Market Line

;1. 'hich one of the following stocks is correctly priced if the risk-free rate of return is 3.9

percent and the arket risk preiu is 2.2 percent(

). )

*. *

C. C

+. +

,. ,

;.. 'hich one of the following stocks is correctly priced if the risk-free rate of return is 3..

percent and the arket rate of return is 11.9$ percent(

). )

*. *

C. C

+. +

,. ,

Essay Questions

13-.2

Chapter 13 - Return, Risk, and the Security Market Line

;3. )ccording to C)BM, the e&pected return on a risky asset depends on three coponents.

+escri#e each coponent and e&plain its role in deterining e&pected return.

;6. ,&plain how the slope of the security arket line is deterined and why e"ery stock that

is correctly priced, according to C)BM, will lie on this line.

;%. ,&plain how the #eta of a portfolio can e-ual the arket #eta if %1 percent of the portfolio

is in"ested in a security that has twice the aount of systeatic risk as an a"erage risky

security.

;$. ,&plain the difference #etween systeatic and unsysteatic risk. )lso e&plain why one of

these types of risks is rewarded with a risk preiu while the other type is not.

13-.;

Chapter 13 - Return, Risk, and the Security Market Line

;9. ) portfolio #eta is a weighted a"erage of the #etas of the indi"idual securities which

coprise the portfolio. Aowe"er, the standard de"iation is not a weighted a"erage of the

standard de"iations of the indi"idual securities which coprise the portfolio. ,&plain why this

difference e&ists.

Multiple Choice Questions

;2. You own a portfolio that has 0.,111 in"ested in Stock ) and 01,611 in"ested in Stock *.

5he e&pected returns on these stocks are 16 percent and ; percent, respecti"ely. 'hat is the

e&pected return on the portfolio(

). 11.1$ percent

*. 11.%1 percent

C. 11.;6 percent

+. 1..13 percent

,. 1..61 percent

;;. You ha"e 011,111 to in"est in a stock portfolio. Your choices are Stock K with an

e&pected return of 13 percent and Stock Y with an e&pected return of 2 percent. Your goal is

to create a portfolio with an e&pected return of 1..6 percent. )ll oney ust #e in"ested.

Aow uch will you in"est in stock K(

). 0211

*. 01,.11

C. 06,$11

+. 02,211

,. 0;,.11

13-31

Chapter 13 - Return, Risk, and the Security Market Line

111. 'hat is the e&pected return and standard de"iation for the following stock(

). 1%.6; percentD 16..2 percent

*. 1%.6; percentD 16.$9 percent

C. 19.11 percentD 1%..6 percent

+. 19.11 percentD 1%.96 percent

,. 19.11 percent3D 1$.11 percent

111. 'hat is the e&pected return of an e-ually weighted portfolio coprised of the following

three stocks(

). 1$.33 percent

*. 12.$1 percent

C. 1;.$9 percent

+. .1.62 percent

,. .1.33 percent

13-31

Chapter 13 - Return, Risk, and the Security Market Line

11.. Your portfolio is in"ested .$ percent each in Stocks ) and C, and 62 percent in Stock *.

'hat is the standard de"iation of your portfolio gi"en the following inforation(

). 1..32 percent

*. 1..$6 percent

C. 1..9. percent

+. 1..2; percent

,. 13.93 percent

113. You own a portfolio e-ually in"ested in a risk-free asset and two stocks. >ne of the

stocks has a #eta of 1.; and the total portfolio is e-ually as risky as the arket. 'hat is the

#eta of the second stock(

). 1.9%

*. 1.21

C. 1.;6

+. 1.11

,. 1.11

116. ) stock has an e&pected return of 11 percent, the risk-free rate is $.1 percent, and the

arket risk preiu is 6 percent. 'hat is the stock3s #eta(

). 1.12

*. 1..3

C. 1..;

+. 1.3.

,. 1.3%

13-3.

Chapter 13 - Return, Risk, and the Security Market Line

11%. ) stock has a #eta of 1.. and an e&pected return of 19 percent. ) risk-free asset currently

earns %.1 percent. 5he #eta of a portfolio coprised of these two assets is 1.2%. 'hat

percentage of the portfolio is in"ested in the stock(

). 91 percent

*. 99 percent

C. 26 percent

+. 2; percent

,. ;. percent

11$. Consider the following inforation on three stocks8

) portfolio is in"ested 3% percent each in Stock ) and Stock * and 31 percent in Stock C.

'hat is the e&pected risk preiu on the portfolio if the e&pected 5-#ill rate is 3.2 percent(

). 11.69 percent

*. 1..32 percent

C. 1$.$9 percent

+. .6..; percent

,. .;.;; percent

13-33

Chapter 13 - Return, Risk, and the Security Market Line

119. Suppose you o#ser"e the following situation8

)ssue these securities are correctly priced. *ased on the C)BM, what is the return on the

arket(

). 13.;; percent

*. 16.6. percent

C. 16.$9 percent

+. 16.92 percent

,. 1%.11 percent

112. Consider the following inforation on Stocks < and <<8

5he arket risk preiu is 2 percent, and the risk-free rate is 3.$ percent. 5he #eta of stock <

is ::::: and the #eta of stock << is :::::.

). ..12D ..69

*. ..12D ..9$

C. 3..1D 3.26

+. 6.69D 3.2;

,. 6.69D 6..$

13-36

Chapter 13 - Return, Risk, and the Security Market Line

11;. Suppose you o#ser"e the following situation8

)ssue the capital asset pricing odel holds and stock )3s #eta is greater than stock *3s #eta

#y 1..1. 'hat is the e&pected arket risk preiu(

). 2.2 percent

*. ;.% percent

C. 1..$ percent

+. 19.; percent

,. .1.1 percent

13-3%

Chapter 13 - Return, Risk, and the Security Market Line

Chapter 13 Return, Risk, and the Security Market Line )nswer Iey

Multiple Choice Questions

1. You own a stock that you think will produce a return of 11 percent in a good econoy and

3 percent in a poor econoy. !i"en the pro#a#ilities of each state of the econoy occurring,

you anticipate that your stock will earn $.% percent ne&t year. 'hich one of the following

ters applies to this $.% percent(

). arithetic return

*. historical return

C. e&pected return

+. geoetric return

,. re-uired return

Refer to section 13.1

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: ()'ected return

.. Su/ie owns fi"e different #onds "alued at 03$,111 and twel"e different stocks "alued at

02.,%11 total. 'hich one of the following ters ost applies to Su/ie3s in"estents(

). inde&

B. portfolio

C. collection

+. grouping

,. risk-free

Refer to section 13..

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$*

Section: "#%*

&o'ic: +ortfolio

13-3$

Chapter 13 - Return, Risk, and the Security Market Line

3. Ste"e has in"ested in twel"e different stocks that ha"e a co#ined "alue today of 01.1,311.

4ifteen percent of that total is in"ested in 'ise Man 4oods. 5he 1% percent is a easure of

which one of the following(

). portfolio return

B. portfolio weight

C. degree of risk

+. price-earnings ratio

,. inde& "alue

Refer to section 13..

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$*

Section: "#%*

&o'ic: +ortfolio weig,t

6. 'hich one of the following is a risk that applies to ost securities(

). unsysteatic

*. di"ersifia#le

C. systeatic

+. asset-specific

,. total

Refer to section 13.6

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%-

&o'ic: Systematic ris.

13-39

Chapter 13 - Return, Risk, and the Security Market Line

%. ) news flash 7ust appeared that caused a#out a do/en stocks to suddenly drop in "alue #y

a#out .1 percent. 'hat type of risk does this news flash represent(

). portfolio

*. nondi"ersifia#le

C. arket

D. unsysteatic

,. total

Refer to section 13.6

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%-

&o'ic: /nsystematic ris.

$. 5he principle of di"ersification tells us that8

). concentrating an in"estent in two or three large stocks will eliinate all of the

unsysteatic risk.

*. concentrating an in"estent in three copanies all within the sae industry will greatly

reduce the systeatic risk.

C. spreading an in"estent across fi"e di"erse copanies will not lower the total risk.

+. spreading an in"estent across any di"erse assets will eliinate all of the systeatic

risk.

E. spreading an in"estent across any di"erse assets will eliinate soe of the total risk.

Refer to section 13.%

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$*

Section: "#%0

&o'ic: Di!ersification

13-32

Chapter 13 - Return, Risk, and the Security Market Line

9. 5he ::::: tells us that the e&pected return on a risky asset depends only on that asset3s

nondi"ersifia#le risk.

). efficient arkets hypothesis

B. systeatic risk principle

C. open arkets theore

+. law of one price

,. principle of di"ersification

Refer to section 13.$

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%1

&o'ic: Systematic ris.

2. 'hich one of the following easures the aount of systeatic risk present in a particular

risky asset relati"e to the systeatic risk present in an a"erage risky asset(

A. #eta

*. reward-to-risk ratio

C. risk ratio

+. standard de"iation

,. price-earnings ratio

Refer to section 13.$

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%1

&o'ic: Beta

13-3;

Chapter 13 - Return, Risk, and the Security Market Line

;. 'hich one of the following is a positi"ely sloped linear function that is created when

e&pected returns are graphed against security #etas(

). reward-to-risk atri&

*. portfolio weight graph

C. noral distri#ution

D. security arket line

,. arket real returns

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Security mar.et line

11. 'hich one of the following is represented #y the slope of the security arket line(

). reward-to-risk ratio

*. arket standard de"iation

C. #eta coefficient

+. risk-free interest rate

E. arket risk preiu

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Security mar.et line

13-61

Chapter 13 - Return, Risk, and the Security Market Line

11. 'hich one of the following is the forula that e&plains the relationship #etween the

e&pected return on a security and the le"el of that security3s systeatic risk(

A. capital asset pricing odel

*. tie "alue of oney e-uation

C. unsysteatic risk e-uation

+. arket perforance e-uation

,. e&pected risk forula

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Ca'ital asset 'ricing model

1.. 5reynor <ndustries is in"esting in a new pro7ect. 5he iniu rate of return the fir

re-uires on this pro7ect is referred to as the8

). a"erage arithetic return.

*. e&pected return.

C. arket rate of return.

+. internal rate of return.

E. cost of capital.

Refer to section 13.2

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%3

&o'ic: Cost of ca'ital

13-61

Chapter 13 - Return, Risk, and the Security Market Line

13. 5he e&pected return on a stock gi"en "arious states of the econoy is e-ual to the8

). highest e&pected return gi"en any econoic state.

*. arithetic a"erage of the returns for each econoic state.

C. suation of the indi"idual e&pected rates of return.

D. weighted a"erage of the returns for each econoic state.

,. return for the econoic state with the highest pro#a#ility of occurrence.

Refer to section 13.1

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: ()'ected return

16. 5he e&pected return on a stock coputed using econoic pro#a#ilities is8

). guaranteed to e-ual the actual a"erage return on the stock for the ne&t fi"e years.

*. guaranteed to #e the inial rate of return on the stock o"er the ne&t two years.

C. guaranteed to e-ual the actual return for the iediate twel"e onth period.

D. a atheatical e&pectation #ased on a weighted a"erage and not an actual anticipated

outcoe.

,. the actual return you should anticipate as long as the econoic forecast reains constant.

Refer to section 13.1

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: ()'ected return

13-6.

Chapter 13 - Return, Risk, and the Security Market Line

1%. 5he e&pected risk preiu on a stock is e-ual to the e&pected return on the stock inus

the8

). e&pected arket rate of return.

B. risk-free rate.

C. inflation rate.

+. standard de"iation.

,. "ariance.

Refer to section 13.1

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: 4is. 'remium

1$. Standard de"iation easures which type of risk(

A. total

*. nondi"ersifia#le

C. unsysteatic

+. systeatic

,. econoic

Refer to section 13.1

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%"

&o'ic: Standard de!iation

13-63

Chapter 13 - Return, Risk, and the Security Market Line

19. 5he e&pected rate of return on a stock portfolio is a weighted a"erage where the weights

are #ased on the8

). nu#er of shares owned of each stock.

*. arket price per share of each stock.

C. arket "alue of the in"estent in each stock.

+. original aount in"ested in each stock.

,. cost per share of each stock held.

Refer to section 13..

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%*

&o'ic: ()'ected return

12. 5he e&pected return on a portfolio considers which of the following factors(

<. percentage of the portfolio in"ested in each indi"idual security

<<. pro7ected states of the econoy

<<<. the perforance of each security gi"en "arious econoic states

<=. pro#a#ility of occurrence for each state of the econoy

). < and <<< only

*. << and <= only

C. <, <<<, and <= only

+. <<, <<<, and <= only

E. <, <<, <<<, and <=

Refer to section 13..

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%*

&o'ic: ()'ected return

13-66

Chapter 13 - Return, Risk, and the Security Market Line

1;. 5he e&pected return on a portfolio8

<. can ne"er e&ceed the e&pected return of the #est perforing security in the portfolio.

<<. ust #e e-ual to or greater than the e&pected return of the worst perforing security in the

portfolio.

<<<. is independent of the unsysteatic risks of the indi"idual securities held in the portfolio.

<=. is independent of the allocation of the portfolio aongst indi"idual securities.

). < and <<< only

*. << and <= only

C. < and << only

D. <, <<, and <<< only

,. <, <<, <<<, and <=

Refer to sections 13.. and 13.$

AACSB: N/A

Bloom's: Com're,ension

Difficulty: 5ntermediate

Learning Obecti!e: "#$"

Section: "#%* and "#%1

&o'ic: ()'ected return

.1. <f a stock portfolio is well di"ersified, then the portfolio "ariance8

). will e-ual the "ariance of the ost "olatile stock in the portfolio.

B. ay #e less than the "ariance of the least risky stock in the portfolio.

C. ust #e e-ual to or greater than the "ariance of the least risky stock in the portfolio.

+. will #e a weighted a"erage of the "ariances of the indi"idual securities in the portfolio.

,. will #e an arithetic a"erage of the "ariances of the indi"idual securities in the portfolio.

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$*

Section: "#%0

&o'ic: Di!ersification

13-6%

Chapter 13 - Return, Risk, and the Security Market Line

.1. 5he standard de"iation of a portfolio8

). is a weighted a"erage of the standard de"iations of the indi"idual securities held in the

portfolio.

*. can ne"er #e less than the standard de"iation of the ost risky security in the portfolio.

C. ust #e e-ual to or greater than the lowest standard de"iation of any single security held in

the portfolio.

+. is an arithetic a"erage of the standard de"iations of the indi"idual securities which

coprise the portfolio.

E. can #e less than the standard de"iation of the least risky security in the portfolio.

Refer to section 13..

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%*

&o'ic: Standard de!iation

... 5he standard de"iation of a portfolio8

). is a easure of that portfolio3s systeatic risk.

*. is a weighed a"erage of the standard de"iations of the indi"idual securities held in that

portfolio.

C. easures the aount of di"ersifia#le risk inherent in the portfolio.

+. ser"es as the #asis for coputing the appropriate risk preiu for that portfolio.

E. can #e less than the weighted a"erage of the standard de"iations of the indi"idual securities

held in that portfolio.

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: 5ntermediate

Learning Obecti!e: "#$*

Section: "#%0

&o'ic: Standard de!iation

13-6$

Chapter 13 - Return, Risk, and the Security Market Line

.3. 'hich one of the following stateents is correct concerning a portfolio of .1 securities

with ultiple states of the econoy when #oth the securities and the econoic states ha"e

une-ual weights(

). !i"en the une-ual weights of #oth the securities and the econoic states, the standard

de"iation of the portfolio ust e-ual that of the o"erall arket.

*. 5he weights of the indi"idual securities ha"e no effect on the e&pected return of a portfolio

when ultiple states of the econoy are in"ol"ed.

C. Changing the pro#a#ilities of occurrence for the "arious econoic states will not affect the

e&pected standard de"iation of the portfolio.

+. 5he standard de"iation of the portfolio will #e greater than the highest standard de"iation

of any single security in the portfolio gi"en that the indi"idual securities are well di"ersified.

E. !i"en #oth the une-ual weights of the securities and the econoic states, an in"estor ight

#e a#le to create a portfolio that has an e&pected standard de"iation of /ero.

Refer to section 13..

AACSB: N/A

Bloom's: Analysis

Difficulty: 5ntermediate

Learning Obecti!e: "#$*

Section: "#%*

&o'ic: Standard de!iation

.6. 'hich one of the following e"ents would #e included in the e&pected return on Susse&

stock(

). 5he chief financial officer of Susse& une&pectedly resigned.

*. 5he la#or union representing Susse&3 eployees une&pectedly called a strike.

C. 5his orning, Susse& confired that its C,> is retiring at the end of the year as was

anticipated.

+. 5he price of Susse& stock suddenly declined in "alue #ecause researchers accidentally

disco"ered that one of the fir3s products can #e to&ic to household pets.

,. 5he #oard of directors ade an unprecedented decision to gi"e si/ea#le #onuses to the

fir3s internal auditors for their efforts in unco"ering wasteful spending.

Refer to section 13.3

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%#

&o'ic: ()'ected return

13-69

Chapter 13 - Return, Risk, and the Security Market Line

.%. 'hich one of the following stateents is correct(

). 5he une&pected return is always negati"e.

*. 5he e&pected return inus the une&pected return is e-ual to the total return.

C. >"er tie, the a"erage return is e-ual to the une&pected return.

+. 5he e&pected return includes the surprise portion of news announceents.

E. >"er tie, the a"erage une&pected return will #e /ero.

Refer to section 13.3

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%#

&o'ic: /ne)'ected returns

.$. 'hich one of the following stateents related to une&pected returns is correct(

). )ll announceents #y a fir affect that fir3s une&pected returns.

*. ?ne&pected returns o"er tie ha"e a negati"e effect on the total return of a fir.

C. ?ne&pected returns are relati"ely predicta#le in the short-ter.

+. ?ne&pected returns generally cause the actual return to "ary significantly fro the

e&pected return o"er the long-ter.

E. ?ne&pected returns can #e either positi"e or negati"e in the short ter #ut tend to #e /ero

o"er the long-ter.

Refer to section 13.3

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%#

&o'ic: /ne)'ected returns

13-62

Chapter 13 - Return, Risk, and the Security Market Line

.9. 'hich one of the following is an e&aple of systeatic risk(

A. in"estors panic causing security prices around the glo#e to fall precipitously

*. a flood washes away a fir3s warehouse

C. a city iposes an additional one percent sales ta& on all products

+. a toyaker has to recall its top-selling toy

,. corn prices increase due to increased deand for alternati"e fuels

Refer to section 13.6

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%-

&o'ic: Systematic ris.

.2. ?nsysteatic risk8

A. can #e effecti"ely eliinated #y portfolio di"ersification.

*. is copensated for #y the risk preiu.

C. is easured #y #eta.

+. is easured #y standard de"iation.

,. is related to the o"erall econoy.

Refer to section 13.6

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%-

&o'ic: /nsystematic ris.

13-6;

Chapter 13 - Return, Risk, and the Security Market Line

.;. 'hich one of the following is an e&aple of unsysteatic risk(

). incoe ta&es are increased across the #oard

*. a national sales ta& is adopted

C. inflation decreases at the national le"el

+. an increased feeling of prosperity is felt around the glo#e

E. consuer spending on entertainent decreased nationally

Refer to section 13.6

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%-

&o'ic: /nsystematic ris.

31. 'hich one of the following is least apt to reduce the unsysteatic risk of a portfolio(

A. reducing the nu#er of stocks held in the portfolio

*. adding #onds to a stock portfolio

C. adding international securities into a portfolio of ?.S. stocks

+. adding ?.S. 5reasury #ills to a risky portfolio

,. adding technology stocks to a portfolio of industrial stocks

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0

&o'ic: /nsystematic ris.

13-%1

Chapter 13 - Return, Risk, and the Security Market Line

31. 'hich one of the following stateents is correct concerning unsysteatic risk(

). )n in"estor is rewarded for assuing unsysteatic risk.

B. ,liinating unsysteatic risk is the responsi#ility of the indi"idual in"estor.

C. ?nsysteatic risk is rewarded when it e&ceeds the arket le"el of unsysteatic risk.

+. *eta easures the le"el of unsysteatic risk inherent in an indi"idual security.

,. Standard de"iation is a easure of unsysteatic risk.

Refer to sections 13.% and 13.$

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0 and "#%1

&o'ic: /nsystematic ris.

3.. 'hich one of the following stateents related to risk is correct(

). 5he #eta of a portfolio ust increase when a stock with a high standard de"iation is added

to the portfolio.

*. ,"ery portfolio that contains .% or ore securities is free of unsysteatic risk.

C. 5he systeatic risk of a portfolio can #e effecti"ely lowered #y adding 5-#ills to the

portfolio.

+. )dding fi"e additional stocks to a di"ersified portfolio will lower the portfolio3s #eta.

,. Stocks that o"e in tande with the o"erall arket ha"e /ero #etas.

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0

&o'ic: 4is.

13-%1

Chapter 13 - Return, Risk, and the Security Market Line

33. 'hich one of the following risks is irrele"ant to a well-di"ersified in"estor(

). systeatic risk

B. unsysteatic risk

C. arket risk

+. nondi"ersifia#le risk

,. systeatic portion of a surprise

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0

&o'ic: /nsystematic ris.

36. 'hich of the following are e&aples of di"ersifia#le risk(

<. earth-uake daages an entire town

<<. federal go"ernent iposes a 0111 fee on all #usiness entities

<<<. eployent ta&es increase nationally

<=. toyakers are re-uired to ipro"e their safety standards

). < and <<< only

*. << and <= only

C. << and <<< only

D. < and <= only

,. <, <<<, and <= only

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$* and "#$#

Section: "#%0

&o'ic: /nsystematic ris.

13-%.

Chapter 13 - Return, Risk, and the Security Market Line

3%. 'hich of the following stateents are correct concerning di"ersifia#le risks(

<. +i"ersifia#le risks can #e essentially eliinated #y in"esting in thirty unrelated securities.

<<. 5here is no reward for accepting di"ersifia#le risks.

<<<. +i"ersifia#le risks are generally associated with an indi"idual fir or industry.

<=. *eta easures di"ersifia#le risk.

). < and <<< only

*. << and <= only

C. < and <= only

D. <, << and <<< only

,. <, <<, <<<, and <=

Refer to sections 13.% and 13.$

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0 and "#%1

&o'ic: /nsystematic ris.

3$. 'hich one of the following is the #est e&aple of a di"ersifia#le risk(

). interest rates increase

*. energy costs increase

C. core inflation increases

D. a fir3s sales decrease

,. ta&es decrease

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$* and "#$#

Section: "#%0

&o'ic: /nsystematic ris.

13-%3

Chapter 13 - Return, Risk, and the Security Market Line

39. 'hich of the following stateents concerning risk are correct(

<. @ondi"ersifia#le risk is easured #y #eta.

<<. 5he risk preiu increases as di"ersifia#le risk increases.

<<<. Systeatic risk is another nae for nondi"ersifia#le risk.

<=. +i"ersifia#le risks are arket risks you cannot a"oid.

A. < and <<< only

*. << and <= only

C. < and << only

+. <<< and <= only

,. <, <<, and <<< only

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0

&o'ic: Systematic and unsystematic ris.

32. 5he priary purpose of portfolio di"ersification is to8

). increase returns and risks.

*. eliinate all risks.

C. eliinate asset-specific risk.

+. eliinate systeatic risk.

,. lower #oth returns and risks.

Refer to section 13.%

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$* and "#$#

Section: "#%0

&o'ic: Di!ersification

13-%6

Chapter 13 - Return, Risk, and the Security Market Line

3;. 'hich one of the following indicates a portfolio is #eing effecti"ely di"ersified(

). an increase in the portfolio #eta

*. a decrease in the portfolio #eta

C. an increase in the portfolio rate of return

+. an increase in the portfolio standard de"iation

E. a decrease in the portfolio standard de"iation

Refer to section 13.%

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%0

&o'ic: Di!ersification

61. Aow any di"erse securities are re-uired to eliinate the a7ority of the di"ersifia#le risk

fro a portfolio(

). %

*. 11

C. .%

+. %1

,. 9%

Refer to section 13.%

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$* and "#$#

Section: "#%0

&o'ic: Di!ersification

13-%%

Chapter 13 - Return, Risk, and the Security Market Line

61. Systeatic risk is easured #y8

). the ean.

B. #eta.

C. the geoetric a"erage.

+. the standard de"iation.

,. the arithetic a"erage.

Refer to section 13.$

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$#

Section: "#%1

&o'ic: Systematic ris.

6.. 'hich one of the following is ost directly affected #y the le"el of systeatic risk in a

security(

). "ariance of the returns

*. standard de"iation of the returns

C. e&pected rate of return

+. risk-free rate

,. arket risk preiu

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: CA+6

13-%$

Chapter 13 - Return, Risk, and the Security Market Line

63. 'hich one of the following stateents is correct concerning a portfolio #eta(

). Bortfolio #etas range #etween -1.1 and C1.1.

B. ) portfolio #eta is a weighted a"erage of the #etas of the indi"idual securities contained in

the portfolio.

C. ) portfolio #eta cannot #e coputed fro the #etas of the indi"idual securities coprising

the portfolio #ecause soe risk is eliinated "ia di"ersification.

+. ) portfolio of ?.S. 5reasury #ills will ha"e a #eta of C1.1.

,. 5he #eta of a arket portfolio is e-ual to /ero.

Refer to section 13.$

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%1

&o'ic: Beta

66. 5he systeatic risk of the arket is easured #y8

A. a #eta of 1.1.

*. a #eta of 1.1.

C. a standard de"iation of 1.1.

+. a standard de"iation of 1.1.

,. a "ariance of 1.1.

Refer to section 13.$

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%1

&o'ic: Beta

13-%9

Chapter 13 - Return, Risk, and the Security Market Line

6%. )t a iniu, which of the following would you need to know to estiate the aount of

additional reward you will recei"e for purchasing a risky asset instead of a risk-free asset(

<. asset3s standard de"iation

<<. asset3s #eta

<<<. risk-free rate of return

<=. arket risk preiu

). < and <<< only

B. << and <= only

C. <<< and <= only

+. <, <<<, and <= only

,. <, <<, <<<, and <=

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: CA+6

6$. 5otal risk is easured #y ::::: and systeatic risk is easured #y :::::.

). #etaD alpha

*. #etaD standard de"iation

C. alphaD #eta

D. standard de"iationD #eta

,. standard de"iationD "ariance

Refer to section 13.$

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%1

&o'ic: 4is. measures

13-%2

Chapter 13 - Return, Risk, and the Security Market Line

69. 5he intercept point of the security arket line is the rate of return which corresponds to8

A. the risk-free rate.

*. the arket rate.

C. a return of /ero.

+. a return of 1.1 percent.

,. the arket risk preiu.

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Security mar.et line

62. ) stock with an actual return that lies a#o"e the security arket line has8

). ore systeatic risk than the o"erall arket.

*. ore risk than that warranted #y C)BM.

C. a higher return than e&pected for the le"el of risk assued.

+. less systeatic risk than the o"erall arket.

,. a return e-ui"alent to the le"el of risk assued.

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Security mar.et line

13-%;

Chapter 13 - Return, Risk, and the Security Market Line

6;. 5he arket rate of return is 11 percent and the risk-free rate of return is 3 percent. Le&ant

stock has 3 percent less systeatic risk than the arket and has an actual return of 1. percent.

5his stock8

A. is underpriced.

*. is correctly priced.

C. will plot #elow the security arket line.

+. will plot on the security arket line.

,. will plot to the right of the o"erall arket on a security arket line graph.

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: Security mar.et line

%1. 'hich one of the following will #e constant for all securities if the arket is efficient and

securities are priced fairly(

). "ariance

*. standard de"iation

C. reward-to-risk ratio

+. #eta

,. risk preiu

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4eward$to$ris. ratio

13-$1

Chapter 13 - Return, Risk, and the Security Market Line

%1. 5he reward-to-risk ratio for stock ) is less than the reward-to-risk ratio of stock *. Stock

) has a #eta of 1.2. and stock * has a #eta of 1..;. 5his inforation iplies that8

). stock ) is riskier than stock * and #oth stocks are fairly priced.

*. stock ) is less risky than stock * and #oth stocks are fairly priced.

C. either stock ) is underpriced or stock * is o"erpriced or #oth.

D. either stock ) is o"erpriced or stock * is underpriced or #oth.

,. #oth stock ) and stock * are correctly priced since stock ) is riskier than stock *.

Refer to section 13.9

AACSB: N/A

Bloom's: Analysis

Difficulty: 5ntermediate

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4eward$to$ris. ratio

%.. 5he arket risk preiu is coputed #y8

). adding the risk-free rate of return to the inflation rate.

*. adding the risk-free rate of return to the arket rate of return.

C. su#tracting the risk-free rate of return fro the inflation rate.

D. su#tracting the risk-free rate of return fro the arket rate of return.

,. ultiplying the risk-free rate of return #y a #eta of 1.1.

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 6ar.et ris. 'remium

13-$1

Chapter 13 - Return, Risk, and the Security Market Line

%3. 5he e&cess return earned #y an asset that has a #eta of 1.36 o"er that earned #y a risk-free

asset is referred to as the8

). arket risk preiu.

B. risk preiu.

C. systeatic return.

+. total return.

,. real rate of return.

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4is. 'remium

%6. 5he ::::: of a security di"ided #y the #eta of that security is e-ual to the slope of the

security arket line if the security is priced fairly.

). real return

*. actual return

C. noinal return

D. risk preiu

,. e&pected return

Refer to section 13.9

AACSB: N/A

Bloom's: Knowledge

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4eward$to$ris. ratio

13-$.

Chapter 13 - Return, Risk, and the Security Market Line

%%. 5he capital asset pricing odel EC)BMF assues which of the following(

<. a risk-free asset has no systeatic risk.

<<. #eta is a relia#le estiate of total risk.

<<<. the reward-to-risk ratio is constant.

<=. the arket rate of return can #e appro&iated.

). < and <<< only

*. << and <= only

C. <, <<<, and <= only

+. <<, <<<, and <= only

,. <, <<, <<<, and <=

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: 5ntermediate

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: CA+6

%$. )ccording to C)BM, the aount of reward an in"estor recei"es for #earing the risk of an

indi"idual security depends upon the8

). aount of total risk assued and the arket risk preiu.

B. arket risk preiu and the aount of systeatic risk inherent in the security.

C. risk free rate, the arket rate of return, and the standard de"iation of the security.

+. #eta of the security and the arket rate of return.

,. standard de"iation of the security and the risk-free rate of return.

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4is. 'remium

13-$3

Chapter 13 - Return, Risk, and the Security Market Line

%9. 'hich one of the following should earn the ost risk preiu #ased on C)BM(

). di"ersified portfolio with returns siilar to the o"erall arket

B. stock with a #eta of 1.32

C. stock with a #eta of 1.96

+. ?.S. 5reasury #ill

,. portfolio with a #eta of 1.11

Refer to section 13.9

AACSB: N/A

Bloom's: Com're,ension

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%2

&o'ic: 4is. 'remium

%2. You want your portfolio #eta to #e 1.;%. Currently, your portfolio consists of 06,111

in"ested in stock ) with a #eta of 1.69 and 03,111 in stock * with a #eta of 1.%6. You ha"e

another 0;,111 to in"est and want to di"ide it #etween an asset with a #eta of 1.96 and a risk-

free asset. Aow uch should you in"est in the risk-free asset(

). 06,31$.12

*. 06,6.%..;

C. 06,;1...;

D. 06,%96.91

,. 06,$23.;.

*etaBortfolio M 1.;% M E06,111N01$,111FE1.69F C E03,111N01$,111FE1.%6F C E&N01$,111FE1.96F C

EE0;,111 - &FN01$,111FE1FD <n"estent in risk-free asset M 0;,111 - 06,6.%..; M 06,%96.91

AACSB: Analytic

Bloom's: A''lication

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%* and "#%1

&o'ic: +ortfolio beta

13-$6

Chapter 13 - Return, Risk, and the Security Market Line

%;. You ha"e a 01.,111 portfolio which is in"ested in stocks ) and *, and a risk-free asset.

0%,111 is in"ested in stock ). Stock ) has a #eta of 1.9$ and stock * has a #eta of 1.2;. Aow

uch needs to #e in"ested in stock * if you want a portfolio #eta of 1.11(

). 03,9%1.11

*. 06,333.33

C. 06,91$..1

D. 06,;63.2.

,. 0%,61;..9

*etaBortfolio M 1.11 M E0%,111N01.,111FE1.9$F C E&N01.,111FE1.2;F C EE01.,111 - 0%,111 - &FN

01.,111FE1FD & M 06,;63.2.

AACSB: Analytic

Bloom's: A''lication

Difficulty: Basic

Learning Obecti!e: "#$-

Section: "#%* and "#%1

&o'ic: +ortfolio beta

$1. You recently purchased a stock that is e&pected to earn .. percent in a #ooing econoy,

; percent in a noral econoy, and lose 33 percent in a recessionary econoy. 5here is a %

percent pro#a#ility of a #oo and a 9% percent chance of a noral econoy. 'hat is your

e&pected rate of return on this stock(

). -3.61 percent

*. -...% percent

C. 1..% percent

+. ..$1 percent

,. 3.%1 percent

,ErF M E1.1% 1...F C E1.9% 1.1;F C E1..1 -1.33F M 1..% percent

AACSB: Analytic

Bloom's: A''lication

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: ()'ected return

13-$%

Chapter 13 - Return, Risk, and the Security Market Line

$1. 5he coon stock of Manchester G Moore is e&pected to earn 13 percent in a recession,

$ percent in a noral econoy, and lose 6 percent in a #ooing econoy. 5he pro#a#ility of

a #oo is % percent while the pro#a#ility of a recession is 6% percent. 'hat is the e&pected

rate of return on this stock(

). 2.%. percent

*. 2.96 percent

C. 2.$% percent

+. ;.1% percent

,. ;..2 percent

,ErF M E1.6% 1.13F C E1.%1 1.1$F C E1.1% -1.16F M 2.$% percent

AACSB: Analytic

Bloom's: A''lication

Difficulty: Basic

Learning Obecti!e: "#$"

Section: "#%"

&o'ic: ()'ected return

13-$$

Chapter 13 - Return, Risk, and the Security Market Line

$.. You are coparing stock ) to stock *. !i"en the following inforation, what is the

difference in the e&pected returns of these two securities(

). -1.2% percent