Professional Documents

Culture Documents

Chapter 8: Strategy and The Master Budget

Chapter 8: Strategy and The Master Budget

Uploaded by

Maxtullner0 ratings0% found this document useful (0 votes)

23 views83 pagesOriginal Title

Ch8_000

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views83 pagesChapter 8: Strategy and The Master Budget

Chapter 8: Strategy and The Master Budget

Uploaded by

MaxtullnerCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 83

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-1 The McGraw-Hill Companies 2008

CHAPTER 8: STRATEGY AND THE MASTER BUDGET

QUESTIONS

8-1 Compel strategic planning and facilitate implementation of strategic plans. An

organizations strategy, strategic plans, and budgets are interrelated. Preparing

budgets compels reviews of an organizations strategy and its strategic plans and can

facilitate implementations of the strategic plan. Feedback from budgets often results

in improvements to an organizations strategy and strategic plan.

Serve as a basis for performance evaluation. Budgets serve as the benchmark

against which actual performance can be compared. Budgets are a better basis for

judging performance than past performance for two reasons. First, budgeted amounts

take into account expected changes and improvements in the environment. Second,

past performance is a result of past events and operations and may not be suitable to

serve as a benchmark. To the extent past performance was not effective/efficient it

does not make sense to use this as the standard against which actual performance is

compared.

Motivate managers and employees. Budgets, if internalized, serve as goals for

managers and employees and, if properly implemented, can motivate them toward

achievements of the goals.

Promote coordination and communication within the organization. Budgets compel

managers to think of interdependencies and interrelationships among subunits of the

organization. A budget is also a communication device that helps all employees and

managers understand and accept the organizations objectives and expected roles

and contributions over the coming period.

Authorization to act. The approved budget, particularly in a not-for-profit setting, gives

the manager authorization to act (make decisions, etc.).

Other benefits include serving as a basis for resource allocation, aiding cash-flow

management, and providing authorization documentation.

8-2 An organizations strategic plan describes how the organization matches its strengths

and weaknesses with the opportunities and threats in the marketplace in order to

accomplish its long-term goals (e.g., achieve sustainable competitive advantage). It is

the guideline for the firms short-term and long-term operations. A strategic plan may

extend over several budget periods (e.g., years) covered by a master budget.

A master budget is a comprehensive operational plan of action for the coming

year. It includes both operating budgets and financial budgets and culminates in a set

of forecasted (i.e., pro-forma) financial statements (cash flow, income statement, and

balance sheet). The strategic plan of a firm guides, in a general sense, the

determination of the master budgets prepared annually by the organization.

Specialized consulting companies now provide software that can be used to integrate

master budgets with strategic plans as part of a comprehensive performance

management system. (See, for example, Geac, at www.performance.geac.com.)

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-2 The McGraw-Hill Companies 2008

8-3 A master budget is a comprehensive plan of action for an organization for a future

period while a capital budget is an investment (and financing) plan for a major project

or program that has long-range effects on operations. As indicated in text Exhibit 8.3,

resources specified in the capital budget of the current period are included in the

master budget of the period.

8-4 A master budget is a comprehensive plan of action for a future period; as such, the

master budget includes both operating and financial budgets. An operating budget

consists of plans regarding revenues and resource acquisition/use across all major

operating areas of the organization (e.g., sales, production, purchasing, marketing,

research and development, and general administrative activities). The set of operating

budgets culminates in a budgeted income statement. Financial budgets relate to

sources and uses of funds for an upcoming period. The set of financial budgets

culminates in a budgeted cash flow statement and budgeted balance sheet.

8-5 Successful budgeting systems typically:

have full support by one or more key managers in the organization

become personalized budgets of the people who have the responsibility for

carrying them out; as such, they serve an important motivational function

are perceived by managers and employees as planning and coordinating tools,

not pressure devices or mechanisms designed to stifle creativity and opportunity

are not viewed as a basis for placing blame.

provide for a two-way flow of information in the budget-preparation process

include budgets that are highly achievable

8-6 The budget committee of an organization is the highest authority in the organization

for all matters related to the budget. The committee sets or approves the overall

budget goals for the organization and its major business units, directs and

coordinates budget preparation, resolves conflicts and differences that may arise

during the budget-preparation process, approves the final budget, monitors

operations as the year unfolds, and reviews operating results at the end of the period.

The budget committee also approves major revisions of the budget during the period.

8-7 No, these terms are not synonymous. The term sales forecast refers to estimated

sales volume for an upcoming period. As such, the sales forecast is generally the

starting point in preparing the sales budget for the period. The term sales budget

refers to forecasted sales dollars for an upcoming period.

Alternatively, rather than focusing on the difference between sales volume and

sales dollars, some writers distinguish between these two terms on the basis of the

level of control: we use the term sales forecast to refer to both units and dollars

because, unlike costs, these elements are affected by external (e.g., competitor

actions) as well as internal factors (e.g., product promotion expenditures).

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-3 The McGraw-Hill Companies 2008

8-8 The sales budget is often regarded as the cornerstone in the master budget because

all operating activities in a business emanate from efforts to attain the level of sales

specified in the sales budget. A firm can complete the plan for other activities of a

period only after it knows the expected sales levels for the current and the immediate

future periods. A manufacturing firm, for example, cannot complete its production

schedule for the upcoming period without knowing the number of units it must

produce for each of its products. The firm can ascertain the number of units to be

produced only after it knows both forecasted sales and the desired ending inventory.

The units to be produced, in turn, affect many other activities of the firm including

amount and kinds of materials to be purchased, number of employees to be hired,

levels of factory overhead, and selling and administrative expenses.

8-9 When sales volume is seasonal in nature, the three most significant items to

coordinate are: production volume, finished goods inventory, and sales volume.

8-10 Additional factors include:

beginning and desired ending inventories of work-in-process and finished goods

the required material inputs (in lbs., liters, etc.) for each product

beginning and desired ending inventories of direct materials

the cost of materials (per lb., liter, etc.)

8-11 The two factors that determine the amount of factory overhead for a period are

management decision and planned production volume. The former refers to

capacity-related (i.e., fixed overhead) costs while the latter refers to the planned

utilization of that capacity (i.e., variable overhead costs).

8-12 A cash budget generally includes three major components:

Cash available (i.e., beginning cash balance plus budgeted cash receipts)

Cash disbursements (other than interest expense), and

Financing activity (new financing, repayment of principal, and interest expense)

8-13 The following are some of the similarities between cash budgets and cash-flow

statements required by GAAP:

Both include sources and uses of funds

Both are prepared for a period of time

Neither includes any non-cash revenues and expenses

Among differences between these two statements are:

A cash-flow statement reports the results of past activities while a cash budget

describes effects of planned operations.

A firm needs to follow GAAP in preparing cash-flow statement while the guiding

principle for preparing a cash budget is relevance and usefulness to

management.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-4 The McGraw-Hill Companies 2008

The major categories of cash-flow statements are operating, financing, and

investing activities. Each of these categories may include both sources and uses

of cash. The major categories of cash budgets are cash available, cash

disbursements, and financing. Both cash available and cash disbursements may

include cash from either operating or investing activities.

8-14 In comparison with manufacturing organizations, unique budget characteristics of

service organizations include:

absence of production and materials purchases budgets

emphasis on workforce planning

8-15 In contrast to business firms (i.e., for-profit entities), a not-for-profit organization:

has no single bottom-line amount such as operating income

is more likely to use its budgets as the source of authorization for its activities

limits the total amount in the budget to the expected total revenues (Federal

budgets are exceptions)

8-16 Zero-base budgeting (ZBB) is a budgeting process that requires managers to

prepare budgets each period from ground zero for all operations.

A typical budgeting process is incremental in nature. That is, budgets for the

upcoming period start from the approved budgets for the current period, with

amounts added to reflect planned changes for the upcoming period. Thus, traditional

budgets assume that most, if not all, of the current activities and functions will

continue into the coming budget period. In contrast, a zero-base budgeting process

allows no activities or functions to be included in the budget unless managers can

justify their need. Pure forms of ZBB are expensive and time-consuming. For this

reason, some companies have partial ZBB systems.

A number of companies (e.g., Xerox, Texas Instruments) and government

organizations (e.g., State of Georgia) have at one time or another used ZBB.

8-17 No. Kaizen budgeting is a budgeting approach that explicitly incorporates continuous

improvement standards/expectations in the approved budgets.

In contrast, activity-based budgeting (ABB) is a budgeting process that relies on

the costs of activities and activity-cost drivers to prepare budgets. In other words,

ABB develops master budget data using the organizations activity-based cost (ABC)

system. Thus, ABB begins by quantifying products and services to be produced for

an upcoming period. These forecasts are then used to estimate the amount of

activities, across the internal value chain, that are needed to meet forecasted output

(products or services). The budgeting process is completed by assigning estimated

resource costs to the specified activities. Both American Express and AT&T

Paradyne provide examples of actual implementation of ABB systems. See, Player,

S. & Keys, D. E. (eds.), Activity-Based Management: Arthur Andersens Lessons

from the ABM Battlefield. New York: John Wiley & Sons, 1999.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-5 The McGraw-Hill Companies 2008

8-18 Budgetary slack, or "padding" the budget, is the practice of knowingly including a

higher amount of expenditure in the budget (or lower amount of revenue) than

managers actually believe should be the case. One reason that it is common to find

slacks in budgets is the desire of managers to use such slack as a cushion for

unpredictable/uncontrollable future events (e.g., worker attrition, machine

breakdowns/malfunctions). Another reason is the increased recognition or reward

that might accrue to those who beat their budget target. Finally, managers may

believe that the budgets they submit will be cut in the budget negotiation process.

Therefore, such managers must pad their budgets in order to secure the amount of

resources they feel they actually need.

8-19 A highly achievable budget has a target that is achievable by most managers most

of the time (e.g., 80 to 90 percent of the time). In a study by Merchant (1990), the

author finds that a budget with a highly achievable target serves well in the vast

majority of organizational situations, especially when accompanied by extra rewards

for performance exceeding the target.

Among the advantages of using a highly achievable budget target are the

following:

1. Increasing managers' commitment to achieving the budget target.

2. Maintaining managers' confidence in the budget.

3. Decreasing organizational control cost.

4. Reducing the risk that managers will engage in harmful earnings-

management practices or violate corporate ethical standards.

5. Allowing effective and efficient managers greater operating flexibility.

6. Improving predictability of earnings or operating results.

7. Enhancing the usefulness of a budget as a planning and coordinating tool.

8-20 Participative budgeting is a bottom-up approach that involves everyone in the

budget-preparation processfrom low-level workers all the way to the top managers

of the organization. The principal idea is to have employees/managers internalize

(i.e., take ownership of) the budgets that are prepared.

For participative budgeting to be effective, top management needs to be actively

involved. Furthermore, top management should institute incentives to guard against

excessive budget padding, and encourage the generation of accurate budgetary

projections. Finally, top managers may have to serve as arbiters when irreconcilable

differences occur in the budget preparation process.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-6 The McGraw-Hill Companies 2008

BRIEF EXERCISES

8-21

Q2 Q3

Sales2007 16,000 15,000

Projected % increase for 2008 25% 25%

Estimated Sales Volume2008 20,000 18,750

x Estimated Unit Selling Price2008 $4.00 $4.00

Estimated Sales Dollars2008 $80,000 $75,000

8-22 Payment history:

% paid in month of purchase: 25%

% paid in month following month of purchase: 75%

Expected Cash Disbursements:

February: ($5,500 x 0.75) + ($6,500 x 0.25) = $5,750

March: ($6,500 x 0.75) + ($8,000 x 0.25) = $6,875

8-23 Number of units produced in Qtr. 1:

Ending inventory of DM (in lbs.) = 50,000

Target ending inventory % = 25% of following months production

requirements

Therefore, RM used for production in Qtr. 1 = 50,000/0.25 = 200,000 lbs.

Units produced in Qtr. 1 = lbs. of RM used/lbs. of RM per unit of

output = 200,000/8 = 25,000 units

DM requirements (in lbs.), Qtr. 2 = Planned production, Qtr. 2 x DM lbs./unit

= (25,000 units x 1.10) x 8 lbs./unit

= 27,500 units x 8 lbs./unit = 220,000 lbs.

8-24 Scheduled Production, Quarter 2:

Units required to meet estimated sales, Qtr. 2 = 12,000 units

Units required to meet targeted ending inventory:

15,000 units x 10% = 1,500 units

Total units needed 13,500 units

Less: Beginning inventory, Qtr.2 (12,000 units x 10%) = 1,200 units

Scheduled production, Quarter 2 = 12,300 units

8-25 Current level of monthly operating costs = $10,000:

Estimated operating costs, January = $10,000 x 0.99

1

= $9,900

Estimated operating costs, June = $10,000 x 0.99

6

= $9,415

Estimated operating costs, December = $10,000 x 0.99

12

= $8,864

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-7 The McGraw-Hill Companies 2008

8-26 Collection of Credit SalesNovember:

30% of Credit Sales made in October = 0.30 x $30,000 = $9,000

70% of Credit Sales made in November = 0.70 x $24,000 = $16,800

Total Estimated Collections--November = $25,800

Collection of Credit SalesDecember:

30% of Credit Sales made in November = 0.30 x $24,000 = $7,200

70% of Credit Sales made in December = 0.70 x $20,000 = $14,000

Total Estimated Collections--December = $21,200

8-27 Collection of Credit SalesDecember:

From credit sales made in November = 0.20 x $90,000 = $18,000

From credit sales made in December:

= (0.75 x $100,000) x 0.98 = $73,500

Total Estimated CollectionsDecember = $91,500

8-28 Estimated interest expenseApril = borrowing in April x (annual rate/12)

= [($30,000 - $18,000) + $1,000] x (0.12/12)

= $13,000 x 0.01 = $130.00

Note that, strictly speaking, to maintain a minimum cash balance of $30,000, the

company would have to borrow an extra $1,000 to be able to cover the interest

payment (eom) and still have at least $30,000 of cash.

Estimated financing transactionsMay:

Interest expense (paid eom): $13,000 x 0.01 = $130

Principal repayment:

Beginning-of-month cash balance

= $18,000 + ($13,000 - $130) = $30,870

Plus: net cash flow in May, prior to financing = $22,000

Cash balance prior to financing transactions = $52,870

Less: interest expense (eom) for May ($130)

Less: minimum cash balance requirement = ($30,000)

Cash available for principal repayment = $22,740

Rounded down to nearest $1,000 = $22,000

Total financing transactionsMay = $22,130

8-29 DM purchases, December = (DM issued to production +

ending DM inventory) - beginning DM inventory

= ($150,000 + $39,500) - $37,000 = $152,500

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-8 The McGraw-Hill Companies 2008

8-30 Total estimated marketing expenses, 4

th

quarter:

Variable costs = $0.05/unit x (4,000 units x 1.10)

= $0.05/unit x 4,400 units = $220

Fixed costs:

Salaries = $10,000

Depreciation = $5,000

Insurance = $2,000 $17,000

Total estimated marketing expenses, 4

th

quarter $17,220

Less: non-cash charges:

Depreciation expense $5,000

Estimated cash payments for marketing expenses $12,220

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-9 The McGraw-Hill Companies 2008

EXERCISES

8-31 What-If Analysis (20 Minutes)

1. The term what if analysis is one example of the more general term sensitivity

analysis and is used to explore the effects (e.g., on a decision or a budget for an

upcoming period) of different marketing, production, or selling strategies (e.g., the

effect on revenues of lowering product selling prices, the profit-effect of using a

different sales-promotion plan). That is, a what-if analysis examines how a result

will change if the original (base-line) data are not achieved or, as in the present case,

if an underlying assumption (viz., rate of bad-debts expense) changes.

2.

3. Managers today work in a world of uncertainty. One way to cope with uncertainty in

the master budgeting process is to model the underlying relationships associated

with the various budgets that are prepared and then to perform sensitivity analysis.

One form of sensitivity analysis is the what-if analysis described above. For Tyson

Company, this type of analysis can help the firm decide whether it might need to

implement a more restrictive credit-granting policy and, if so, how much it might be

willing to spend in this regard.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-10 The McGraw-Hill Companies 2008

8-32 Behavioral Considerations (15 Minutes)

There are at least two issues here. One is the failure to take advantage of all the

cash discount included in the sales term. (In this regard, see Exercise 8-37.) The

other is the constant occurrence of rush orders, last-minute changes, and other

operating emergencies that require the purchasing department to do last minute

purchases.

Janet needs to ensure that the Accounting Department records all purchases at

the net price whenever a purchase is made with cash discounts included in the sales

terms. Any additional amount that the firm has to pay because of the failure to make

the payment within the payment terms should be charged to the finance department

as a loss and not treated as an adjustment to the cost of purchase.

The firm needs to be very clear in its operating procedures about the minimum

amount of time required for purchases. Any additional acquisition cost because of

rush orders, last-minute changes, or operating emergencies should be borne by the

department making the request.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-11 The McGraw-Hill Companies 2008

8-33 Budgetary Slack and Zero-Based Budgeting (ZBB) (20 minutes)

1. Budgetary slack is a planned difference between budgeted revenue and expected

revenue, and/or budgeted expenditures and expected expenditures. Budgetary slack

describes the tendency of managers to under-estimate revenues and over-estimate

expenditures during the budgetary process in order to build in allowances

(cushions) for unexpected declines in revenue and/or unforeseen expenses.

Budgetary slack occurs because of conflicts between the personal interests of a

manager and the interests of the organization. These conflicts include pressure from

top management to achieve budgets and the desire on the part of the manager to

look favorable in the eyes of top management.

2. a. From the point of view of the business unit manager, budgetary slack provides:

performance that will look better in the eyes of their superiors

a coping mechanism regarding uncertainty

a way to obtain what is needed since initially submitted budgets tend to be cut

during the budget-negotiation process

However, the use of budgetary slack limits the objective evaluation of a business

unit and, therefore, limits the objective evaluation of the performance of the unit

manager. It also becomes more difficult for the business unit manager to evaluate

the performance of subordinates and to use the budget as a control mechanism

over subordinate performance.

b. From the perspective of corporate management, the use of budgetary slack

increases the probability that budgets will be achieved. This increased probability

facilitates the overall corporate budgeting process. Corporate management may

also allow budgetary slack as a form of reward to managers for previous good

performance.

However, from the point of view of the business unit management, the use of

budgetary slack increases the likelihood of inefficient allocation of scarce

resources, and decreases the ability to identify potential weaknesses or trouble

spots in operating activities.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-12 The McGraw-Hill Companies 2008

8-33 (Continued)

3. a. Zero-based budgeting (ZBB) is a budgeting technique that evaluates all proposed

operating and administrative expenditures as though they were being initiated for

the first time. Each manager must evaluate the proposed expenditure for each

activity to be undertaken during the upcoming budget period, investigate

alternative means of conducting each activity, and rank expenditures in order of

perceived importance.

b. Atlantis Laboratories could benefit from ZBB as each of the business unit

managers would be required to identify and justify all proposed expenditures for

the upcoming year. This increased evaluation of expenditures would make it

difficult to include budgetary slack in the budget for the upcoming year and likely

uncover opportunities of cost savings and operational improvements.

c. The biggest disadvantage of ZBB is the significant amount of time and cost

involved in its implementation. In addition, the concept of zero-based budgeting

may be difficult for management to learn and accept. Atlantis must be sure that

the benefits of ZBB outweigh the associated costs.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-13 The McGraw-Hill Companies 2008

8-34 Budgeted Cash Disbursements (25 minutes)

1. Budgeted cash payments for merchandise purchases:

a. February:

25% x $100,000 = $25,000

75% x $120,000 = $90,000 $115,000

b. March:

25% x $120,000 = $30,000

75% x $110,000 = $82,500 $112,500

2. Budgeted cash payments for merchandise purchases:

a. February:

25% x $100,000 x 0.98 = $24,500

75% x $120,000 x 0.98 = $88,200 $112,700

b. March:

25% x $120,000 x 0.98 = $29,400

75% x $110,000 x 0.98 = $80,850 $110,250

3. The financial cost of not taking advantage of the early-payment discount can be

approximated by the following formula:

Opportunity cost (%) = [discount %/(1 - discount %)] x [365/no. of extra

days allowed if discount is not taken]

= [0.02/(1 - 0.02)] x [365/20] = 0.020408 x 18.25 = 37.25%

Basically, if you choose not to take the early-payment discount, you are giving up a

2% discount (on the net amount) in return for an extra 20 days in which to pay.

There are 18.25 (365/20) 20-day periods in a year. Note that in the first term of this

formula we divide the 2% discount rate by 98% (1 - 2%) because, in effect, you are

paying 2% to delay for 20 days paying 98% of the total bill. So, the percentage rate

you are paying in this case is really 2.0408% of the net bill (the bill without financing

cost). Regardless of the technicalities here, students should understand that the

opportunity cost of not taking advantage of the early-payment (cash) discount can

be very significant, as is the case here. For this reason, firms record purchases at

net cost and any discounts lost as interest expense.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-14 The McGraw-Hill Companies 2008

8-35 Budgeted Cash Receipts and Disbursements (20 minutes)

1. Budgeted Cash Receipts:

November:

($100,000 x 0.95) x 0.35 x 0.80 x 0.98 = $26,068

($100,000 x 0.95) x 0.35 x 0.20 = $6,650

($150,000 x 0.95) x 0.65 x 0.80 x 0.98 = $72,618

($150,000 x 0.95) x 0.65 x 0.20 = $18,525 $123,861

December:

($150,000 x 0.95) x 0.35 x 0.80 x 0.98 = $39,102

($150,000 x 0.95) x 0.35 x 0.20 = $9,975

($ 90,000 x 0.95) x 0.65 x 0.80 x 0.98 = $43,571

($ 90,000 x 0.95) x 0.65 x 0.20 = $11,115 $103,763

2. Budgeted Cash Disbursements:

November:

($170,000 x 0.75) x 0.25 = $31,875

($270,000 x 0.75) x 0.75 = $151,875 $183,750

December:

($200,000 x 0.75) x 0.25 = $37,500

($170,000 x 0.75) x 0.75 = $95,625 $133,125

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-15 The McGraw-Hill Companies 2008

8-36 Production and materials purchases budgets (20 minutes)

Production Budget:

2nd Quarter 3rd Quarter

Budgeted sales 38,000 34,000

Desired ending inventory (10%) + 3,400 + 4,800

Total units needed 41,400 38,800

Beginning inventory 3,800 3,400

Total units to produce 37,600 35,400

Budgeted Purchases of Direct Materials for the Second quarter:

2nd Quarter 3rd Quarter

Budgeted production 37,600 35,400

Direct materials per unit x 3 x 3

Direct materials needed in production 112,800 106,200

Desired ending inventory of direct materials

(20% of 106,200) + 21,240

Total direct materials needed 134,040

Beginning inventory of DM (20% of 112,800) 22,560

Budgeted purchases of direct materials (lbs.) 111,480

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-16 The McGraw-Hill Companies 2008

8-37 Purchase Discounts on Credit Purchases (20 minutes)

The financial cost of not taking advantage of the early-payment discount for

purchases made on credit can be approximated by the following formula (we use the

term approximate here to denote the fact that the estimate below does not assume

compounding of interest and as such provides a conservative estimate):

Opportunity cost (%) = [discount %/(1 - discount %)] x [365/no. of

extra days allowed if discount is not taken]

1. In the case of 2/10, n/30, the approximate economic cost of not taking

advantage of the early-payment discount is:

= [0.02/(1 - 0.02)] x [365/20] = 0.020408 x 18.25 = 37.25%

Basically, if you choose not to take the early-payment discount, you are giving

up a 2% discount (on the net amount) in return for an extra 20 days in which to

pay. There are 18.25 (365/20) 20-day periods in a year. Note that in the first

term of this formula we divide the 2% discount rate by 98% (1 - 2%) because, in

effect, you are paying 2% to delay for 20 days paying 98% of the total bill. So,

the percentage rate you are paying in this case is really 2.0408% of the net bill

(the bill without financing cost).

2. In the case of 1/10, n/30, the opportunity cost of not taking advantage of the

early-payment cash discount is:

= [0.01/(1 - 0.01)] x [365/20] = 0.010101 x 18.25 = 18.43%

3. Given the significant opportunity cost of not taking advantage of early-payment

cash discounts, good accounting practice would be to record purchases at their

net-of-discount amount and then to record as interest expense or purchase

discounts lost any cash discounts not taken advantage of.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-17 The McGraw-Hill Companies 2008

8-38 Production and materials budgets--process costing (20 minutes)

1. Budgeted Production (XPL30):

Units

Budgeted sales 480,000

Budgeted finished goods ending inventory (June 30, 2008) + 50,000

Total number of units needed 530,000

Less: Budgeted finished goods beginning inventory 80,000

Budgeted production (units) 450,000

2. Units of XPL30 to Start into Production:

Budgeted production (from (1) above) 450,000

Budgeted WIP ending inventory (June 30, 2008) + 20,000

Total number of units needed 470,000

Less: Budgeted WIP beginning inventory (July 1, 2007) 10,000

Total units of XPL30 to start into production 460,000

3. Raw Materials Purchases Budget:

Units of XPL30 to start into production (from (2) above) 460,000

Units of raw materials needed per unit of XPL30 x 2

Total raw materials needed for production 920,000

Budgeted raw materials ending inventory (June 30, 2008) + 50,000

Total number of units of raw materials needed 970,000

Budgeted raw materials beginning inventory (July 1, 2007) 40,000

Total units of raw materials that must be purchased 930,000

4. While the timing of the addition of materials would affect the calculation for number of

equivalent units produced, number of equivalent units in the ending WIP inventory, and

the raw materials cost per equivalent unit, it will have no impact on the budgeted

purchases of materials for the period.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-18 The McGraw-Hill Companies 2008

8-39 Cash Budget--Financing Effects (20 minutes)

Hartz & Co.

Cash Budget

For November and December, 2007

November December

Cash balance, beginning $75,000 $99,000

Plus: Cash receipts $525,000 $450,000

Total cash available (A) $600,000 $549,000

Cash disbursements, prior to financing (B) $450,500 $550,000

Plus: Minimum cash balance (given) $50,000 $50,000

Total cash needed (C) $500,500 $600,000

Excess (deficiency of) cash, before

financing (D) = (A) - (B) $99,500 ($51,000)

Financing:

Short-term borrowing -0- $51,000

Repayments (loan principal) ($50,000) -0-

Interest (@12%) ($500) ($510)

Total Effects of Financing = (E) ($50,500) $50,490

Ending cash balance = (A) - (B) + (E) $99,000 $49,490

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-19 The McGraw-Hill Companies 2008

8-40 Cash budget (10-15 minutes)

Cash Available

Cash balance, beginning $ 10,000

Cash collections from customers + 150,000

Total cash available $160,000

Cash Disbursements

Direct materials purchases $ 25,000

Operating expenses $50,000

Less: Depreciation expenses - 20,000 30,000

Payroll 75,000

Income taxes 6,000

Machinery purchase + 30,000

Total cash disbursements prior to financing $166,000

Financing:

Cash excess (shortage) before financing ($ 6,000)

Minimum cash balance desired - 20,000

Financing need $26,000

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-20 The McGraw-Hill Companies 2008

8-41 Cash budget (15 minutes)

Cash Available:

Cash balance, beginning (given) $ 6,000

Cash collections from customers (given) + 175,000

Total cash available $181,000

Budgeted Cash Disbursements, 2007:

Payroll $160,000

Other operating expenses $18,000

Less: Property taxes (see below) - 3,000

Less: Depreciation expense - 5,000

Cash operating expenses 10,000

Property taxes:

2

nd

half of 2006 (0.50 x $2,500) $1,250

1

st

half of 2007 (0.50 x $3,000) 1,500 2,750

Payment for office equipment + 6,000

Total cash disbursements, prior to financing $178,750

Financing:

Cash balance before financing $2,250

No, the cash budget shows that Bill will not be able to meet the minimum cash

balance requirement of $6,000. As such, borrowing (or some other source of

financing) must occur in order to meet the minimum cash requirement.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-21 The McGraw-Hill Companies 2008

8-42 Cash Budgeting: Not-for-Profit Context (30 minutes)

1. Endowment fund: a gift (contribution) whose principal must be maintained but whose

income may be expended. (You might use the example of an endowed

professorship as an example.)

2.

Cash Budget for Tri-County Social Service Agency

2007

(in thousands)

Quarters

I II III IV Year

Cash Balance, beginning $11 $8 $8 $8 $11

Receipts:

Grants $80 $70 $75 $75 $300

Contracts $20 $20 $20 $20 $80

Mental Health Income $20 $25 $30 $30 $105

Charitable donations $250 $350 $200 $400 $1,200

Total Cash Available $381 $473 $333 $533 $1,696

Less: Disbursements:

Salaries and Benefits $335 $342 $342 $346 $1,365

Office expenses $70 $65 $71 $50 $256

Equipment purchases & maintenance $2 $4 $6 $5 $17

Specific assistance $20 $15 $18 $20 $73

Total disbursements $427 $426 $437 $421 $1,711

Excess (deficiency) of cash available

over disbursements ($46) $47 ($104) $112 ($15)

Financing:

Borrow from endowment fund $54 $0 $112 $0 $166

Repayments $0 ($39) $0 ($104) ($143)

Total financing effects $54 ($39) $112 ($104) $23

Cash Balance, ending $8 $8 $8 $8 $8

3. $23,000.

4. It is probable that both donations and requests for services are unevenly distributed over

the year. The agency may want to increase requests for donations and seek additional

grants.

5. No. Assuming there is careful fiscal management, borrowing only occurs when necessary.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-22 The McGraw-Hill Companies 2008

8-43 Collection of Accounts Receivable (15-20 minutes)

1. Month Total % to be Collected Budgeted Cash

of Sale Credit Sales in October Collection In October

October $90,000 70% $ 63,000

September 80,000 15% 12,000

August 70,000 10% 7,000

July 60,000 4% 2,400

Estimated Total Cash Collections in October $84,400

2. Amount Budgeted collection

Month of Credit % Collected in in the 4

th

quarter from

of Sale Sales Oct. Nov. Dec. sales in the 4

th

Quarter

October $ 90,000 70% $ 63,000

15% 13,500

10% 9,000

November 100,000 70% 70,000

15% 15,000

December 85,000 70% 59,500

Total budgeted cash collections in the 4

th

quarter

from credit sales made in the 4

th

quarter $230,000

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-23 The McGraw-Hill Companies 2008

8-44 Accounts Receivable Collections and Sensitivity Analysis (45 minutes)

Original Assumptions/Data:

Actual credit sales for March $120,000

Actual credit sales for April $150,000

Estimated credit sales for May $200,000

Estimated collections in month of sale 25%

Estimated collections in first month following month of sale 60%

Estimated collections in the second month after month of sale 10%

Estimated provision for bad debts in month of sale 5%

1. Estimated cash receipts from collections in May:

Collection from sales in March (0.10 x $120,000) $12,000

Collection from sales in April (0.60 x $150,000) $90,000

Collection from sales in May (0.25 x $200,000) $50,000

Total estimated cash collections in May $152,000

2. Gross accounts receivable, May 31

st

:

From credit sales made in April (0.15 x $150,000) $22,500

From credit sales made in May (0.75 x $200,000) $150,000

Estimated gross accounts receivable, May 31

st

$172,500

3. Net accounts receivable, May 31

st

:

Gross accounts receivable, May 31

st

$172,500

Less: Allowance for uncollectible accounts:

From credit sales made in April $7,500

From credit sales made in May $10,000

Net accounts receivable, May 31

st

$155,000

4. Revised data/assumptions:

Actual credit sales for March $120,000

Actual credit sales for April $150,000

Estimated credit sales for May $200,000

Estimated collections in month of sale 60%

Estimated collections in first month following month of sale 25%

Estimated collections in the second month after month of sale 10%

Estimated provision for bad debts in month of sale 5%

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-24 The McGraw-Hill Companies 2008

8-44 (Continued)

a. Estimated cash receipts from collections in May:

Collection from sales in March (0.10 x $120,000) $12,000

Collection from sales in April (0.25 x $150,000) $37,500

Collection from sales in May (0.60 x $200,000) $120,000

Total cash collections in May $169,500

b. Gross accounts receivable, May 31st:

From credit sales made in April (0.15 x $150,000) $22,500

From credit sales made in May (0.40 x $200,000) $80,000

Gross accounts receivable, May 31st $102,500

Note to Instructor: An Excel spreadsheet solution file is embedded in this document.

You can open the spreadsheet object that follows by doing the following:

1. Right click anywhere in the worksheet area below.

2. Select worksheet object and then select Open.

3. To return to the Word document, select File and then Close and return

to... while you are in the spreadsheet mode. The screen should then return

you to the Word document.

5. The principal benefit is the accelerated receipt of cash, which the company can

potentially employ to pay down debt, reduce borrowing, invest, etc. Principal costs

would relate to whatever programs are needed to secure the accelerated collection

of cash. These costs could include personal, travel, mailings, telephone, incentive

programs, and costs related to customer relations.

Input Data

Actual credit sales for March $120,000

Actual credit sales for April $150,000

Estimated credit sales for May $200,000

Estimated collections in month of sale 25%

Estimated collections in first month following month of sale 60%

Estimated collections in the second month after month of sale 10%

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-25 The McGraw-Hill Companies 2008

8-45 Budgeting: Not-for-Profit Sector (25 minutes)

1. Stewardship is defined by Merriam-Webster Online Dictionary as the conducting,

supervising, or managing of something; especially: the careful and responsible

management of something entrusted to one's care.

The Socially Responsible Investment Guidelines cited states: Although it is a moral

and legal fiduciary responsibility of the trustees to ensure an adequate return on

investment for the support of the work of the church, their stewardship embraces

broader moral concerns. Also, the principles of stewardship lists two fundamental

and interdependent principles: The Conference should exercise responsible financial

stewardship over its economic resources. and The Conference should exercise

ethical and social stewardship in its investment policy.

The latter states: Socially responsible investment involves investment strategies

based on Catholic moral principles. These strategies are based on the moral

demands posed by the virtues of prudence and justice. They recognize the reality that

socially beneficial activities and socially undesirable or even immoral activities are

often inextricably linked in the products produced and the policies followed by

individual corporations. Given the realities of mergers, buyouts and conglomeration, it

is increasingly likely that investments will be in companies whose policies or products

make the holding of their stock a "mixed investment" from a moral and social point of

view. Nevertheless, by prudently applying traditional Catholic moral teaching, and

employing traditional principles on cooperation and toleration, as well as the duty to

avoid scandal, the Conference can reflect moral and social teaching in investments.

2. These two major principles work together to encourage the Conference to identify

investment opportunities that meet both our financial needs and our social criteria.

These principles are carried out through strategies that seek: 1) to avoid participation

in harmful activities, 2) to use the Conference's role as stockholder for social

stewardship, and 3) to promote the common good.

3. No. (Reasons should vary.)

4. Yes.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-26 The McGraw-Hill Companies 2008

8-46 Budgeting Cash Receipts: Cash Discounts Allowed on Receivables (30

Minutes)

1. Breakdown of Cash/

Sales Data Amount Bank Credit-Card Sales

June $60,000 Cash sales 40%

July $80,000 Credit cards 60%

August $90,000

September $96,000 Bank charges 3%

October $88,000

Credit sales: Collection of Credit Sales

Current month 20%

Sales Breakdown and Terms 1st month 50%

Cash and bank credit card sales 25% 2nd month 15%

Credit sales 75% 3rd month 12%

Terms 1/eom, n/45 Late charge/mo. 2%

Sales % % Cash

September Total % Paid Collected Receipts

Cash sales $96,000 25% 40% $ 9,600

Bank credit card sales $96,000 25% 60% 97% $13,968

Collections of A/R:

September credit sales $96,000 75% 20% 99% $14,256

August credit sales $90,000 75% 50% $33,750

July credit sales $80,000 75% 15% $ 9,000

June credit sales $60,000 75% 12% 102% $ 5,508

Total Cash Receipts, September $86,082

2. Appropriate accounting treatment for:

a) Bank service (collection) fees: these can be considered an offset to gross sales and

thus can be reflected as a deduction in determining net sales (see text Exhibit

8.15). Alternatively, these amounts can be considered selling expenses and, as

such, be treated as an operating expense, (i.e., an element of Selling and

Administrative Expenses on the Income Statement).

b) Cash discounts allowed on collection of receivables: these can be considered a

selling expense and, as such, would be included within the Selling and

Administrative expense category on the Income Statement.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-27 The McGraw-Hill Companies 2008

8-47 Cash Discounts; Spreadsheet application (45 Minutes)

Note to Instructor: An Excel spreadsheet solution file is embedded in this document.

You can open the spreadsheet object that follows by doing the following:

1. Right click anywhere in the worksheet area below.

2. Select worksheet object, then select Open

3. To return to the Word document, select File and then Close and return to...

while you are in the spreadsheet mode. The screen should then return you to

the Word document below.

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

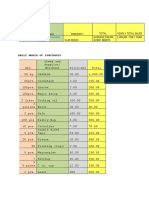

B C D E F G

Sales Data Amount Breakdown of Cash/Bank Credit-Card Sales

June $60,000 Cash sales 40%

July $80,000 Bank credit-card sales 60%

August $90,000 Bank processing fee 3%

September $96,000 Collection of Credit Sales:

October $88,000 Current month 20%

Sales Terms 1st month 50%

Cash and bank credit-card sales 25% 2nd month 15%

Credit sales 75% 3rd month 12%

Discount term 1% Late charge/mo. 2%

Sales Pay. Coll. Cash

Total % % % Receipts

Cash Receipts for September

Cash sales $96,000 25% 40% 9,600 $

Bank credit-card sales $96,000 25% 60% 97% 13,968 $

Collection of accounts receivable:

September credit sales $96,000 75% 20% 99% 14,256 $

August credit sales $90,000 75% 50% 33,750 $

July credit sales $80,000 75% 15% 9,000 $

June credit sales $60,000 75% 12% 102% 5,508 $

Total Cash Receipts 86,082 $

Cash Receipts for October

Cash sales $88,000 25% 40% 8,800 $

Credit cards sales $88,000 25% 60% 97% 12,804 $

Collections of account receivables

October credit sales $88,000 75% 20% 99% 13,068 $

September credit sales $96,000 75% 50% 36,000 $

August credit sales $90,000 75% 15% 10,125 $

July credit sales $80,000 75% 12% 102% 7,344 $

Total Cash Receipts 88,141 $

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-28 The McGraw-Hill Companies 2008

8-48 Activity-Based Budgeting (ABB) (20 Minutes)

1. Budgeted Cost

Activity Volume Driver Rate Total Cost

Storage 400,000 $0.4925 $ 197,000

Requisition Handling 30,000 $12.50 $ 375,000

Pick Packing 800,000 $ 1.50 $1,200,000

Data Entry 800,000 $ 0.80 $ 640,000

30,000 $ 1.20 $ 36,000

Desktop Delivery 12,000 $30.00 $ 360,000

Total Budgeted Cost for the Division $2,808,000

2. Average number of cartons/delivery

= 1,170,000 cartons 11,700 deliveries = 100 cartons/delivery

Total number of cartons budgeted for delivery in January 2007:

12,000 deliveries x 100 cartons/delivery = 1,200,000 cartons

Cost per carton delivered = $2,808,000 1,200,000 = $2.34

Therefore, the total budgeted cost for the division remains the same at

$2,808,000.

3. Expected saving in costsJanuary 2007:

Requisition Handling $ 375,000

Data Entry: number of lines 640,000

Data Entry: number of requisitions 36,000

Expected Cost Savings, January 2007 = $1,051,000

If the firm uses a single cost-rate system based on the number of cartons

delivered, the firm will not be able to estimate the savings without special

efforts to gather additional information.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-29 The McGraw-Hill Companies 2008

8-49 Activity-Based Budgeting with Kaizen (40 Minutes)

1. Unit-Level: Pick packing, Data entryLines

Batch-Level: Requisition handling, Data entryRequisitions,

Desktop delivery

2. Cost driver rates:

Cost-Reduction Cost-Driver Rates

Activity Rate (per month) January February March

Requisition Handling 98% $12.50 $12.250 $12.0050

Pick Packing 99% $ 1.50 $ 1.485 $ 1.4702

Data EntryLines 99% $ 0.80 $ 0.792 $ 0.7841

Data EntryRequisitions 98% $ 1.20 $ 1.176 $ 1.1525

Desktop Delivery 98% $30.00 $29.400 $28.8120

Budgeted Costs:

Activity

Activity Volume February March

Requisition Handling 30,000 $ 367,500 $ 360,150

Pick Packing 800,000 $1,188,000 $1,176,120

Data EntryLines 800,000 $ 633,600 $ 627,264

Data EntryRequisitions 30,000 $ 35,280 $ 34,574

Desktop Delivery 12,000 $ 352,800 $ 345,744

Divisional Totals $2,577,180 $2,543,852

3. Factors that may influence the success of a continuous improvement (Kaizen)

program include:

Reasonable or achievable cost reductions.

Awareness of all employees on the expected (scheduled) cost

improvements over at least the immediate future periods.

Acceptance by both management and employees.

Commitment of both management and employees on the strategic

importance of the success of the continuous improvement program.

Close link between the scheduled improvements and performance

evaluations and rewards.

Cost reductions possible from small, incremental improvements, not from

large discontinuous changes in factors such as operating processes, capital

equipment, supplier networks, or customer interactions.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-30 The McGraw-Hill Companies 2008

8-49 (Continued)

4. Primary criticisms of Kaizen (continuous improvement) budgets include the

following:

The budgeting process tends to place enormous pressure on employees to

reduce all costs, which can lead to employee burnout.

The use of Kaizen budgets tends to motivate small, incremental rather than

major/significant process improvements.

If the Kaizen targets are confined to the manufacturing function (including

product and process design engineering), frictions can arise if

manufacturing believes that other parts of the organization (e.g., marketing)

are not subjected to the same budgetary pressure.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-31 The McGraw-Hill Companies 2008

8-50 Cash budget (30 minutes)

1. Total credit sales in November $240,000

Percentage collectible x _ 95%

Total amount collectible from credit sales in November $228,000

Percentage collected in the month following month of sales x 40%

Budgeted collections in December from Nov. credit sales $ 91,200

2. Cash sales in January $ 60,000

Collections from credit sales in January:

Total collectible from credit sales

$180,000 x 95% = $171,000

Percentage to be collected in January x 60% $102,600

Collections from credit sales in December:

Total collectible from credit sales

$360,000 x 95% = $342,000

Percentage to be collected in January x 40% 136,800

Budgeted total cash receipts in January $299,400

3. Total inventory purchases in November:

For November sales: $320,000 x 0.3 X 0.6 = $ 57,600

For December sales: $460,000 x 0.7 X 0.6 = 193,200 $250,800

Percentage of Nov. purchases to be paid in December x 75%

Payment in December for purchases in November $188,100

Budgeted purchases in December:

For December sales: $460,000 x 0.3 X 0.6 = $ 82,800

For January sales: $240,000 x 0.7 X 0.6 = 100,800 $183,600

Percentage of Dec. purchases to be paid in December x 25%

Payment in December for purchases in December $45,900

Budgeted payment in December for inventory purchases $234,000

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-32 The McGraw-Hill Companies 2008

8-51 Budgeting for a Service Firm (60-75 minutes)

Total hours for the budgeted activities:

Total Hourly

Revenue Rate Total

(Given) (Given) Hours

Business return $1,000,000 $250 4,000

Complex individual return $1,200,000 $100 12,000

Simple individual return $1,640,000 $50 32,800

$3,840,000

Staff requirements for the budgeted activities:

Senior

Total Hours Partner Manager Consultant

Required Each Total Each Total Each Total Each Total

Business return 4,000 0.30 1,200 0.20 800 0.50 2,000 0.00 0

Complex individual return 12,000 0.05 600 0.15 1,800 0.40 4,800 0.40 4,800

Simple individual return 32,800 0.00 0 0.00 0 0.20 6,560 0.80 26,240

Total Hours 48,800 1,800 2,600 13,360 31,040

Hours per week 50 45 40 40

# of weeks needed 36 58 334 776

# of weeks per employee per year 40 45 45 48

# of employees needed 1 2 8 16

Excess (deficiency) hours 1,040 (320)

Note: Because Consultants can be hired on a part-time basis, we round the calculation DOWN for this class of labor. The

other three labor classes are given (i.e., do not have to be planned for based on data in the problem).

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-33 The McGraw-Hill Companies 2008

8-51 (Continued)

SOLUTION:

1. Since, according to the present staffing plan and anticipated workload needs, there is an

excess of senior consultant hours, the budgeted cost for overtime hours worked by

senior consultants would be $0.

2. Number of full-time consultants needed for the year:

Total number of consultant-weeks needed for the year = 776

Number of weeks per full-time consultant per year = 48

Number of full-time consultants needed per year = 16

3. The manager's total compensation, assuming that the revenues from preparing tax

returns remains the same:

Annual Salaries:

Per partner = $250,000

Per manager = $90,000

Per senior consultant = $90,000

Per support staff = $40,000

Consultant's pay (assumed paid on an hourly basis):

Earnings per year = $60,000

Hrs. worked/year = 1,920

Hourly pay rate = $31.25

Staffing Plan:

Partners = 1

Managers = 1

Senior consultants = 8

Full-time Consultants = 16

Support staff = 5

Number of part-time (PT) hours, consultants = 320

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-34 The McGraw-Hill Companies 2008

8-51 (Continued)

AccuTax, Inc.

Budget Operating Income

Year ended August 31, 2007

Revenue $3,840,000 Payroll expenses:

Partner $250,000

Manager $90,000

Senior consultantsbase pay $720,000

Senior consultantspay for overtime hours $0

Consultants:

Full-time $960,000

Part-time $10,000 $970,000

Support staff $200,000 $2,230,000

General and administrative expenses $373,000

Operating income before bonus to manager $1,237,000

Less: manager's bonus $73,700

Operating income before taxes $1,163,300

Total compensation for the manager:

Salary (given) $90,000

Bonus (0.10 x [$1,237,000 - $500,000]) $73,700

Total $163,700

Note to Instructor: An Excel spreadsheet solution file is embedded in this document.

You can open the spreadsheet object that follows by doing the following:

1. Right click anywhere in the worksheet area below.

2. Select Worksheet Object, then Open.

3. To return to the Word document, select File and then Close and return to...

while you are in the spreadsheet mode.

Total hours for the budgeted activities:

Total Hourly

Revenue Rate Total

(Given) (Given) Hours

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-35 The McGraw-Hill Companies 2008

8-52 Budgetary Pressure and Ethics (20-25 minutes)

1. The use of alternative accounting methods to manipulate reported earnings is

professionally unethical because it violates the Standards contained in the IMAs

Statement of Ethical Professional Practice (see: www.imanet.org). The Competence

standard is violated because of failure to perform duties in accordance with relevant

accounting (technical) standards. It can probably be argued that the competence

standard is also violated because the accountant is not providing information that is

accurate. The Integrity standard is violated because the underlying activity would

discredit the profession. The Credibility standard is violated because of failure to

communicate information fairly and objectively.

2. Yes, costs related to revenue should be expensed in the period in which the revenue

is recognized (matching principle). Perishable supplies are purchased for use in the

current period, will not provide benefits in future periods, and should therefore be

matched against revenue recognized in the current period. In short, the accounting

treatment for supplies was not in accordance with generally accepted accounting

principles (GAAP). Note that similar issues, but on an extremely large basis,

occurred at WorldCom and at Global Crossing. In the case of the latter, the company

was engaging simultaneously in contracts to buy and to sell bandwidth, treating the

former as capitalized expenses and the latter as revenue for the current accounting

period.

3. The actions of Gary Woods were appropriate. Upon discovering how supplies were

being accounted for, Wood brought the matter to the attention of his immediate

superior, Gonzales. Upon learning of the arrangement with P&R, Wood told

Gonzales that the action was improper; he then requested that the accounts be

corrected and the arrangement discontinued. Wood clarified the situation with a

qualified and objective peer (advisor) before disclosing Gonzaless arrangement with

P&R to Belcos division manager, Tom LinGonzaless immediate superior. Contact

with levels above the immediate superior should be initiated only with the superiors

knowledge, assuming the superior is not involved. In this case, however, the superior

is involved. According to the IMAs statement regarding Resolution of Ethical

Conduct, Wood acted appropriately by approaching Lin without Gonzaless

knowledge and by having a confidential discussion with an impartial advisor.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-36 The McGraw-Hill Companies 2008

PROBLEMS

8-53 Small business budgets (30 minutes)

1. Key features that need to be considered in developing a profit plan for a small

business include:

Estimation of key factors such as revenues (sales demand, sales price) and

expenses for the budget period.

Systematic evaluation of all available resources (materials, labor, technology) and

their utilization rates.

Coordination of related functions or elements, such as scheduling production to

meet sales forecasts or providing sufficient capacity to meet sales demand.

Critical evaluations of non-operational sources and uses of cash. Nonoperational

items may pose a more serious threat to small businesses than to large businesses.

Greater control over monthly cash flows and short-term financing than may be

necessary in large enterprises.

Greater needs for continuous budgeting than for large organizations, because of the

higher risks associated with economic, competitive, and financial factors for small

businesses.

2. The management accountant must exercise care to ensure that the small business

manager does not suffer from information overload (i.e., strive for simplicity and

parsimony). A profit-management system should be established that captures sufficient

data on a timely basis to allow a reasonable level of operational control and evaluation

without becoming too costly or too sophisticated for the business.

Many large enterprises may continue operations simply by inertia. With small

businesses, a strategic plan linked to the master budget is critical, especially in the

early stage of a products life cycle. The concepts of activity-based management

(ABM), total quality management (TQM), logistics management, life-cycle and target

costing, and constraints- management (e.g., Theory of Constraints) are essential for the

long-run survival and growth of small businesses.

3. The management accountant can insist upon, and assist in the preparation of,

continuous cash budgets. These cash-flow reports should identify the major operational

and nonoperational sources and uses of cash, and point out the periods of potential

cash shortages or surpluses. This will facilitate planning for short-term lines-of-credit

financing and short-term investments.

A profit-management system should be created, utilizing the principles of activity-based

costing (ABC) and cost-variance reporting including activity-based standard costing and

activity-based cost variances. Segmented income statements comparing budgeted to

actual results with profit-variance summaries should be an integral component of the

high-quality profit-management system.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-37 The McGraw-Hill Companies 2008

8-54 Ethics in Budgeting/Budgetary Slack (40 minutes)

1. a. The reasons that Marge Atkins and Pete Granger use budgetary slack include the

following:

These employees are hedging against the unexpected (i.e., they use slack to

deal with or reduce uncertainty and risk).

Budgetary slack allows employees to look good, (i.e., to exceed expectations

and/or show consistent performance). This is particularly important when

performance is evaluated on the basis of actual versus budgeted results.

Employees who are able to blend personal and organizational goals through

budgetary slack and show good performance generally are rewarded with higher

salaries, promotions, and bonuses.

By padding the budget, the manager is more likely to get what he/she actually

needs in terms of resources for the upcoming period.

b. The use of budgetary slack can adversely affect Atkins and Granger by:

limiting the usefulness of the budget to motivate their employees to top

performance

affecting their ability to identify trouble spots and take appropriate corrective

action

reducing their credibility in the eyes of management

reducing the ability of top management to effectively allocate resources to

organizational subunits on the basis of actual economic performance. For

example, the use of budgetary slack may affect management decision-making,

as the budgets will show lower contribution margins (lower sales, higher

expenses). Decisions regarding the profitability of product lines, staffing levels,

incentives, etc. could have an adverse effect on Atkins's and Granger's

departments.

2. The use of budgetary slack, particularly if it has a detrimental effect on the company,

may be unethical. In assessing the situation, the IMAs Statement of Ethical

Professional Practice can be consulted (www.imanet.org). This statement notes that a

commitment to ethical professional practice includes: overarching principles

(expressions of core values) and a set of standards intended to guide actual conduct

and practice.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-38 The McGraw-Hill Companies 2008

8-54 (Continued)

The IMAs overarching PRINCIPLES include: Honesty, Fairness, Objectivity, and

Responsibility. The list of STANDARDS includes the following: Competence,

Confidentiality, Integrity, and Credibility. The following Standards could be referenced in

conjunction with the use of budgetary slack, as described above:

Competence: Provide decision support information and recommendations that are

accurate, clear, concise, and timely.

Integrity: Refrain from engaging in any conduct that would prejudice carrying out

duties ethically.

Credibility: Communicate information fairly and objectively; disclose all relevant

information that could reasonably be expected to influence an intended users

understanding of the reports, analyses, or recommendations.

Though not asked for in the original CMA exam problem, you might want to discuss

with students how, in practice, they would deal with ethical dilemmas. In its Resolution

of Ethical Conflict statement the IMA provides the following guidance:

1. Discuss the issue with your immediate supervisor except when it appears that the

supervisor is involved. In that case, present the issue to the next level. If you

cannot achieve a satisfactory resolution, submit the issue to the next

management level. If your immediate superior is the chief executive officer or

equivalent, the acceptable reviewing authority may be a group such as the audit

committee, executive committee, board of directors, board of trustees, or owners.

Contact with levels above the immediate superior should be initiated only with

your superiors knowledge, assuming he or she is not involved. Communication of

such problems to authorities or individuals not employed or engaged by the

organization is not considered appropriate, unless you believe there is a clear

violation of the law.

2. Clarify relevant ethical issues by initiating a confidential discussion with an IMA

Ethics Counselor or other impartial advisor to obtain a better understanding of

possible courses of action.

3. Consult your own attorney as to legal obligations and rights concerning the

ethical conflict.

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-39 The McGraw-Hill Companies 2008

8-55 Master Budget (40-45 minutes)

1. The benefits that can be derived from implementing a master budgeting system include

the following:

The preparation of budgets forces management to plan ahead and to establish

goals and objectives that can be quantified.

Budgeting compels departmental managers to make plans that are in congruence

with the plans of other departments as well as the objectives of the entire firm.

The budgeting process promotes internal communication and coordination of

subunit activities.

Budgets provide directions for day-to-day operations, clarify duties to be performed,

and assign responsibility for these duties.

Budgets provide a framework for measuring financial performance.

A properly implemented budgeting system can motivate employees and managers

to higher levels of performance, particularly if goals and outputs are linked through

appropriate incentives.

Budgets allow managers to anticipate problem areas (e.g., cash short-falls) and

opportunities (e.g., short-term investment of excess cash).

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-40 The McGraw-Hill Companies 2008

8-55 (Continued)

2. a & b: The basic intent here is to demonstrate the interrelationships that exist among

budgets contained in the organizations master budget.

Subsequent

Schedule/Statement Budget Schedule/Statement

Sales Budget Production Budget

Selling Expense Budget

Budgeted Income Statement

Ending Inventory Budget (units) Production Budget

Production Budget (units) Direct Materials Purchases Budget

Direct Materials Usage Budget

Direct Labor Budget

Factory Overhead Budget

Direct Materials Budget Cost of Goods Manufactured Budget

Direct Labor Budget Cost of Goods Manufactured Budget

Factory Overhead Budget Cost of Goods Manufactured Budget

Cost of Goods Manufactured Cost of Goods Sold Budget

Budget

Cost of Goods Sold Budget Budgeted Income Statement

Budgeted Balance Sheet

Selling Expense Budget Budgeted Income Statement

Research & Development Budget Budgeted Income Statement

Budgeted Income Statement Budgeted Balance Sheet

Capital Expenditures Budget Cash Budget

Cash Receipts Budget Cash Budget

Cash Disbursements Budget Cash Budget

Cash Budget Budgeted Balance Sheet

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-41 The McGraw-Hill Companies 2008

8-56 Comprehensive Profit Plan (90 minutes)

1. Sales Budget

Spring Manufacturing Company

Sales Budget

2007

C12 D57 Total

Sales (in units) 12,000 9,000 21,000

x Selling Price Per Unit $150 $220

Total Sales Revenue $1,800,000 $1,980,000 $3,780,000

2. Production Budget

Spring Manufacturing Company

Production Budget

2007

C12 D57

Budgeted Sales (in units) 12,000 9,000

+ Desired finished goods ending inventory 300 200

Total units needed 12,300 9,200

Beginning finished goods inventory 400 150

Budgeted Production (in units) 11,900 9,050

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-42 The McGraw-Hill Companies 2008

8-56 (Continued-1)

3. Direct Materials Purchases Budget

Spring Manufacturing Company

Direct Materials Purchases Budget (units and dollars)

2007

C12 D57 Total

Raw Material (RM) 1:

Budgeted Production 11,900 9,050

Pounds per Unit x 10 x 8

RM 1 needed for production 119,000 72,400 191,400

Plus: Desired Ending Inventory (lbs.) 4,000

Total RM 1 needed (lbs.) 195,400

Less: Beginning inventory (lbs.) 3,000

Required purchases of RM 1 (lbs.) 192,400

Cost per pound $2.00

Budgeted purchases, RM 1 $384,800

Raw Material (RM) 2:

Budgeted Production 11,900 9,050

Pounds per Unit x 0 x 4

RM 2 needed for production 0 36,200 36,200

Plus: Desired Ending Inventory (lbs.) 1,000

Total RM 2 needed (lbs.) 37,200

Less: Beginning inventory (lbs.) 1,500

Required purchases of RM 2 (lbs.) 35,700

Cost per pound $2.50

Budgeted purchases, RM 2 $89,250

Raw Material 3:

Budgeted Production 11,900 9,050

Pounds per Unit x 2 x 1

RM 3 needed for production 23,800 9,050 32,850

Plus: Desired Ending Inventory (lbs.) 1,500

Total RM 3 needed (lbs.) 34,350

Less: Beginning inventory (lbs.) 1,000

Required purchases of RM 3 (lbs.) 33,350

Cost per pound $0.50

Budgeted purchases, RM 3 $16,675

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-43 The McGraw-Hill Companies 2008

8-56 (Continued-2)

4. Direct Manufacturing Labor Budget

Spring Manufacturing Company

Direct Labor Budget

2007

C12 D57 Total

Budgeted production 11,900 9,050

Direct labor hours per unit x 2 x 3

Total direct labor hours needed 23,800 27,150 50,950

Hourly wage rate $25.00

Budgeted direct labor costs $1,273,750

5. Factory Overhead Budget

Spring Manufacturing Company

Factory Overhead Budget

2007

Variable Factory Overhead:

Indirect materials $10,000

Miscellaneous supplies and tools 5,000

Indirect labor 40,000

Payroll taxes and fringe benefits 250,000

Maintenance costs 10,080

Heat, light, and power 11,000 $326,080

Fixed Factory Overhead:

Supervision $120,000

Maintenance costs 20,000

Heat, light, and power 43,420

Total Cash Fixed Factory Overhead $183,420

Depreciation 71,330 $254,750

Total Budgeted Factory Overhead $580,830

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-44 The McGraw-Hill Companies 2008

8-56 (Continued-3)

6. Budgeted Cost of Goods Sold

Spring Manufacturing Company

Ending Finished Goods Inventory and Budgeted CGS

2007

C12 D57 Total

Sales volume 12,000 9,000 21,000

Cost per unit (Schedule 1 and 2) $93.80 $135.70

Cost of goods sold $1,125,600 $1,221,300 $2,346,900

Finished goods ending inventory 300 200

Cost per unit (Schedule 1 and 2) $93.80 $135.70

Budgeted ending inventories $28,140 $27,140 $55,280

Schedule 1: Cost per Unit--Product C12:

Inputs Cost

Cost Element Unit Input Cost Quantity Per Unit

RM-1 $2.00 10 $20.00

RM-3 $0.50 2 $1.00

Direct labor $25.00 2 $50.00

Variable factory OH ($326,080/50,950) $6.40 2 $12.80

Fixed factory OH ($254,750/50,950) $5.00 2 $10.00

Manufacturing cost per unit $93.80

Schedule 2: Cost per Unit--Product D57:

Inputs Cost

Cost Element Unit Input Cost Quantity Per Unit

RM-1 $2.00 8 $16.00

RM-2 $2.50 4 $10.00

RM-3 $0.50 1 $0.50

Direct labor $25.00 3 $75.00

Variable factory OH ($326,080/50,950) $6.40 3 $19.20

Fixed factory OH ($254,750/50,950) $5.00 3 $15.00

Manufacturing cost per unit $135.70

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-45 The McGraw-Hill Companies 2008

8-56 (Continued-4)

7. Budgeted selling and administrative expenses:

Spring Manufacturing Company

Selling and Administrative Expense Budget

2007

Selling Expenses:

Advertising $60,000

Sales salaries 200,000

Travel and entertainment 60,000

Depreciation 5,000 $325,000

Administrative expenses:

Offices salaries $60,000

Executive salaries 250,000

Supplies 4,000

Depreciation 6,000 $320,000

Total selling and administrative expenses $645,000

8. Budgeted Income Statement:

Spring Manufacturing Company

Budget Income Statement

For the Year 2007

C12 D57 Total

Sales (part 1) $1,800,000 $1,980,000 $3,780,000

Cost of goods sold (part 6) 1,125,600 1,221,300 2,346,900

Gross profit $674,400 $758,700 $1,433,100

Selling and administrative expenses (part 7) $645,000

Pre-tax operating income $788,100

Income taxes (@40%) $315,240

After-tax operating income $472,860

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-46 The McGraw-Hill Companies 2008

8-56 (Continued-5)

Note to Instructor: An Excel spreadsheet solution file is embedded in this document.

You can open the spreadsheet object that follows by doing the following:

1. Right click anywhere in the worksheet area below.

2. Select Worksheet Object, then Open.

3. To return to the Word document, select File and then Close and return to...

while you are in the spreadsheet mode.

8-56 Spring Manufacturing Company

1. Sales Budget

Spring Manufacturing Company

Sales Budget

C12 D57 Total

2007

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-47 The McGraw-Hill Companies 2008

8-57 Spring Manufacturing CompanyComprehensive Profit Plan (90 Minutes, but

much less if used in conjunction with 8-56 and completed with an Excel

spreadsheet)

1. Sales Budget

Spring Manufacturing Company

Sales Budget

2007

C12 D57 Total

Sales (in units) 12,000 18,000 30,000

x Selling Price Per Unit $160 $180

Total revenue $1,920,000 $3,240,000 $5,160,000

2. Production Budget

Spring Manufacturing Company

Production Budget

2007

C12 D57

Budgeted Sales (in units) 12,000 18,000

Plus: Desired finished goods ending inventory 300 200

Total units needed 12,300 18,200

Less: Beginning finished goods inventory 400 150

Budgeted Production (in units) 11,900 18,050

Blocher, Stout, Cokins, Chen, Cost Management, 4/e 8-48 The McGraw-Hill Companies 2008

8-57 (Continued-1)

3. Direct Materials Purchases Budget (units and dollars)

Spring Manufacturing Company

Direct Materials Purchases Budget (units and dollars)

2007

C12 D57 Total

Raw Material (RM) 1:

Budgeted Production 11,900 18,050

Pounds per Unit x 10 x 8

RM 1 needed for production 119,000 144,400 263,400

Plus: Desired Ending Inventory (lbs.) 4,000

Total RM 1 needed (lbs.) 267,400

Less: Beginning inventory (lbs.) 3,000