Professional Documents

Culture Documents

Study On Performace of Imf With Special Reference To Other International Organization

Study On Performace of Imf With Special Reference To Other International Organization

Uploaded by

Shweta SawantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study On Performace of Imf With Special Reference To Other International Organization

Study On Performace of Imf With Special Reference To Other International Organization

Uploaded by

Shweta SawantCopyright:

Available Formats

1

A PROJECT REPORT

ON

STUDY ON PERFORMACE OF IMF WITH SPECIAL REFERENCE TO

OTHER INTERNATIONAL ORGANIZATION

In the subject Economics of Global Trade & Finance

Submitted to

University of Mumbai

For 2

nd

semester of M.Com.

BY

SHWETA. C. SAWANT

Roll No. 48

Under the guidance of

Prof. P.S. Iyer

2013-2014

2

C E R T I F I C A T E

This is to certify that the project entitled STUDY ON PERFORMACE OF IMF WITH

SPECIAL REFERENCE TO OTHER INTERNATIONAL ORGANIZATION submitted by

Ms. Shweta C Sawant Roll No.48 student of M.Com. Banking & Finance (University of

Mumbai) (2nd Semester) examination has not been submitted for any other examination and

does not form a part of any other course undergone by the candidate. It is further certified that he

has completed all required phases of the project. This project is original to the best of our

knowledge and has been accepted for Internal Assessment.

Internal Examiner External Examiner

Co-ordinator Principal

College seal

3

DECLARATION BY THE STUDENT

I, Ms. Shweta C Sawant student of M.Com. (Semester 2nd) Banking & Finance, Roll No. 48

hereby declare that the project for the Subject Financial Services titled, Study on performance

of IMF with special reference to other international organization submitted by me to

University of Mumbai, examination during the academic year 2013-2014, is based on actual work

carried by me under the guidance and supervision of Prof. P. s. IYER. I further state that this work is

original and not submitted anywhere else for any examination.

Shweta C Sawant

Signature.

4

ACKNOWLEDGEMENT

At the beginning, I would like to thank GOD for his shower of blessing. The desire of completing this

project was given by my guide Prof. P. S. IYER. I am very much thankful to him for the guidance, support

and for sparing his precious time from a busy schedule.

I would fail in my duty if I dont thank my parents who are pillars of my life. Finally I would express my

gratitude to all those who directly and indirectly helped me in completing this project.

Shweta C Sawant.

5

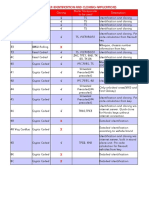

INDEX

SR.NO TOPIC

1 SUMMARY

2 HISTORY

3 BENEFITS

4 CRITICISMS

5 LEADERSHIP

6 IMF & GLOBALISATION

7 ROLE OF IMF

8 ECONOMIC STATISTICS

9 IMF SURVEY

10 FUTURE OF IMF

12 CONCLUSION

13 BIBLIOGRAPHY

6

INTERNATIONAL MONETARY FUND

7

SUMMARY

The International Monetary Fund (IMF) is an international organization that was initiated in

1944 at the Bretton Woods Conference and formally created in 1945 by 29 member countries.

The IMF's stated goal was to assist in the reconstruction of the world's international payment

system postWorld War II. Countries contribute money to a pool through a quota system from

which countries with payment imbalances can borrow funds temporarily. Through this activity

and others such as surveillance of its members' economies and the demand for self-correcting

policies, the IMF works to improve the economies of its member countries.

The IMF describes itself as an organization of 188 countries, working to foster global monetary

cooperation, secure financial stability, facilitate international trade, promote high employment

and sustainable economic growth, and reduce poverty around the world. The organization's

stated objectives are to promote international economic co-operation, international trade,

employment, and exchange rate stability, including by making financial resources available to

member countries to meet balance of payments needs. Its headquarters are in Washington, D.C.,

United States.

Upon initial IMF formation, its two primary functions were: to oversee the fixed exchange rate

arrangements between countries, thus helping national governments manage their exchange rates

and allowing these governments to prioritize economic growth and to provide short-term capital

to aid balance-of-payments. This assistance was meant to prevent the spread of international

economic crises. The Fund was also intended to help mend the pieces of the international

economy post the Great Depression and World War II.

8

HISTORY

The International Monetary Fund was originally laid out as a part of the Bretton Woods system

exchange agreement in 1944.During the earlier Great Depression, countries sharply raised

barriers to foreign trade in an attempt to improve their failing economies. This led to the

devaluation of national currencies and a decline in world trade.

This breakdown in international monetary co-operation created a need for oversight. The

representatives of 45 governments met at the Bretton Woods Conference in the Mount

Washington Hotel in the area of Bretton Woods, New Hampshire in the United States, to discuss

framework for post-World War II international economic co-operation. The participating

countries were concerned with the rebuilding of Europe and the global economic system after the

war.

9

There were two views on the role the IMF should assume as a global economic institution.

British economist John Maynard Keynes imagined that the IMF would be a cooperative fund

upon which member states could draw to maintain economic activity and employment through

periodic crises. This view suggested an IMF that helped governments and to act as the US

government had during the New Deal in response to World War II. The International Monetary

Fund formally came into existence on 27 December 1945, when the first 29 countries ratified its

Articles of Agreement. By the end of 1946 the Fund had grown to 39 members. On 1 March

1947, the IMF began its financial operations, and on 8 May France became the first country to

borrow from it.

The IMF was one of the key organizations of the international economic system; its design

allowed the system to balance the rebuilding of international capitalism with the maximization of

national economic sovereignty and human welfare, also known as embedded liberalism.

[29]

The

IMF's influence in the global economy steadily increased as it accumulated more members. The

increase reflected in particular the attainment of political independence by many African

countries and more recently the 1991 dissolution of the Soviet Union because most countries in

the Soviet sphere of influence did not join the IMF.

The Bretton Woods system prevailed until 1971, when the US government suspended the

convertibility of the US$ (and dollar reserves held by other governments) into gold. This is

known as the Nixon Shock.

[24]

As of January 2012, the largest borrowers from the fund in order

are Greece, Portugal, Ireland, Romania and Ukraine.

10

BENEFITS

The loan conditions ensure that the borrowing country will be able to repay the Fund and that the

country won't attempt to solve their balance of payment problems in a way that would negatively

impact the international economy. The incentive problem of moral hazard, which is the actions

of economic agents maximizing their own utility to the detriment of others when they do not bear

the full consequences of their actions, is mitigated through conditions rather than providing

collateral; countries in need of IMF loans do not generally possess internationally valuable

collateral anyway.

Conditionality also reassures the IMF that the funds lent to them will be used for the purposes

defined by the Articles of Agreement and provides safeguards that country will be able to rectify

its macroeconomic and structural imbalances. In the judgment of the Fund, the adoption by the

member of certain corrective measures or policies will allow it to repay the Fund, thereby

ensuring that the same resources will be available to support other members.

As of 2004, borrowing countries have had a very good track record for repaying credit extended

under the Fund's regular lending facilities with full interest over the duration of the loan. This

indicates that Fund lending does not impose a burden on creditor countries, as lending countries

receive market-rate interest on most of their quota subscription, plus any of their own-currency

subscriptions that are loaned out by the Fund, plus all of the reserve assets that they provide the

Fund.

11

CRITICISMS

In some quarters, the IMF has been criticized for being 'out of touch' with local economic

conditions, cultures, and environments in the countries they are requiring policy reform.

[6]

The

Fund knows very little about what public spending on programs like public health and education

actually means, especially in African countries; they have no feel for the impact that their

proposed national budget will have on people. The economic advice the IMF gives might not

always take into consideration the difference between what spending means on paper and how it

is felt by citizens.

The view is that conditionality undermines domestic political institutions. The recipient

governments are sacrificing policy autonomy in exchange for funds, which can lead to public

resentment of the local leadership for accepting and enforcing the IMF conditions. Political

instability can result from more leadership turnover as political leaders are replaced in electoral

backlashes.

[6]

IMF conditions are often criticized for their bias against economic growth and

reduce government services, thus increasing unemployment.

Another criticism is that IMF programs are only designed to address poor governance, excessive

government spending, excessive government intervention in markets, and too much state

ownership.

[18]

This assumes that this narrow range of issues represents the only possible

problems; everything is standardized and differing contexts are ignored. A country may also be

compelled to accept conditions it would not normally accept had they not been in a financial

crisis in need of assistance.

12

MEMBER COUNTRIES

The 188 members of the IMF include 187 members of the UN and the Republic of Kosovo

.

All

members of the IMF are also International Bank for Reconstruction and Development (IBRD)

members and vice versa. Former members are Cuba (which left in 1964) and the Republic of

China, which was ejected from the UN in 1980 after losing the support of then US President

Jimmy Carter and was replaced by the People's Republic of China. However, "Taiwan Province

of China" is still listed in the official IMF indices. Apart from Cuba, the other UN states that do

not belong to the IMF are Andorra, Liechtenstein, Monaco, Nauru and North Korea. The former

Czechoslovakia was expelled in 1954 for "failing to provide required data" and was readmitted

in 1990, after the Velvet Revolution. Poland withdrew in 1950allegedly pressured by the

Soviet Unionbut returned in 1986.

QUALIFICATIONS

Any country may apply to be a part of the IMF. Post-IMF formation, in the early postwar period,

rules for IMF membership were left relatively loose. Members needed to make periodic

membership payments towards their quota, to refrain from currency restrictions unless granted

IMF permission, to abide by the Code of Conduct in the IMF Articles of Agreement, and to

provide national economic information. However, stricter rules were imposed on governments

that applied to the IMF for funding

.

The countries that joined the IMF between 1945 and 1971 agreed to keep their exchange rates

secured at rates that could be adjusted only to correct a "fundamental disequilibrium" in the

balance of payments, and only with the IMF's agreement.

13

LEADERSHIP

Board of Governor:

The Board of Governors consists of one governor and one alternate governor for each member

country. Each member country appoints its two governors. The Board normally meets once a

year and is responsible for electing or appointing executive directors to the Executive Board.

The Board of Governors is advised by the International Monetary and Financial Committee and

the Development Committee. The International Monetary and Financial Committee has 24

members and monitors developments in global liquidity and the transfer of resources to

developing countries. The Development Committee has 25 members and advises on critical

development issues and on financial resources required to promote economic development in

developing countries. They also advise on trade and global environmental issues

.

Executive Board:

24 Executive Directors make up Executive Board. The Executive Directors represent all 188

member-countries. Countries with large economies have their own Executive Director, but most

countries are grouped in constituencies representing four or more countries.

Following the 2008 Amendment on Voice and Participation, eight countries each appoint an

Executive Director: the United States, Japan, Germany, France, the United Kingdom, China, the

Russian Federation, and Saudi Arabia. The remaining 16 Directors represent constituencies

consisting of 4 to 22 countries. The Executive Director representing the largest constituency of

22 countries accounts for 1.55% of the vote.

14

Managing Director:

The IMF is led by a managing director, who is head of the staff and serves as Chairman of the

Executive Board. The managing director is assisted by a First Deputy managing director and

three other Deputy Managing Directors. Historically the IMF's managing director has been

European and the president of the World Bank has been from the United States. However, this

standard is increasingly being questioned and competition for these two posts may soon open up

to include other qualified candidates from any part of the world

.

In 2011 the world's largest developing countries, the BRIC nations, issued a statement declaring

that the tradition of appointing a European as managing director undermined the legitimacy of

the IMF and called for the appointment to be merit-based. The head of the IMF's European

department is Antonio Borges of Portugal, former deputy governor of the Bank of Portugal. He

was elected in October 2010.

Voting Power:

Voting power in the IMF is based on a quota system. Each member has a number of "basic

votes" (each member's number of basic votes equals 5.502% of the total votes), plus one

additional vote for each Special Drawing Right (SDR) of 100,000 of a member country's quota.

The Special Drawing Right is the unit of account of the IMF and represents a claim to currency.

It is based on a basket of key international currencies. The basic votes generate a slight bias in

favour of small countries, but the additional votes determined by SDR outweigh this bias.

15

IMF & GLOBALIZATION

Globalization encompasses three institutions: global financial markets and transnational

companies, national governments linked to each other in economic and military alliances led by

the US, and rising "global governments" such as World Trade Organization (WTO), IMF, and

World Bank. Charles Debar argues in his book People before Profit, "These interacting

institutions create a new global power system where sovereignty is globalized, taking power and

constitutional authority away from nations and giving it to global markets and international

bodies." Titus Alexander argues that this system institutionalizes global inequality between

western countries and the Majority World in a form of global apartheid, in which the IMF is a

key pillar.

The establishment of globalised economic institutions has been both a symptom of and a

stimulus for globalization. The development of the World Bank, the IMF regional development

banks such as the European Bank for Reconstruction and Development (EBRD), and, more

recently, multilateral trade institutions such as the WTO indicates the trend away from the

dominance of the state as the exclusive unit of analysis in international affairs. Globalization has

thus been transformative in terms of a reconceptualizing of state sovereignty

US President Bill Clinton's administration's aggressive financial deregulation campaign in the

1990s, globalization leaders overturned long-standing restrictions by governments that limited

foreign ownership of their banks, deregulated currency exchange, and eliminated restrictions on

how quickly money could be withdrawn by foreign investors.

16

OBJECTIVES

Consultation and collaboration on international monetary problems.

Maintenance of high level employment and real income.

Promote exchange stability and avoid competitive exchange depreciation.

Establish multilateral system of payments and eliminate foreign exchange restrictions.

Give confidence to members through fund supplies shorten the disequilibria in balance of

payments.

The IMF holds a relatively large amount of gold among its assets, not only for reasons of

financial soundness, but also to meet unforeseen contingencies. The IMF holds about

2,814 metric tons, of gold at designated depositories. The IMF's holdings amount to

about $160 billion.

17

FUNCTIONS

Reviewing and monitoring global financial developments.

Lending hard currencies and reform policies to promote sustainable growth.

Offering wide range of technical assistance and training for government and central bank

officials.

Working with its member governments, international organizations, regulatory bodies

and private sector to strengthen financial system.

Make assessment of member countries to identify actual and potential weakness Improve

regulatory standards.

Preparation of reports publishing information

18

ORGANISATIONAL STRUCTURE

Central office:

In Washington Autonomous body affiliated to UNO Highest authority- Board governors of each

member countries- also policy making bodies Meets once a years.

Day to day decision making:

Executive board International monetary and financial committee- 24 governors representing

group of countries- meet twice a year- discuss key policy issues of IMF Joint committee of IMF

& world bank called development committee advises and reports to governors on developmental

issues concerning developing countries.

FINANCIAL ORGANISATIONS

Resources:

Quota of member countries and supplement borrowings.

Quotas:

Subscription by member countries to capital fund -fixed for each country based on economic

size -forms the basis for deciding SDRs, voting power, and share in allocation of SDRs -25% of

countries quota should be paid in gold/US dollars -75% in own currency -reviewed at intervals of

5years. The more powerful the country the larger the quota -member country can draw to meet

BOP deficits.

19

The IMF works to foster global growth and economic stability. It provides policy advice and

financing to members in economic difficulties and also works with developing nations to help

them achieve macroeconomic stability and reduce poverty. The rationale for this is that private

international capital markets function imperfectly and many countries have limited access to

financial markets. Such market imperfections, together with balance of payments financing,

provide the justification for official financing, without which many countries could only correct

large external payment imbalances through measures with adverse effects on both national and

international economic prosperity. The IMF can provide other sources of financing to countries

in need that would not be available in the absence of an economic stabilization program

supported by the Fund.

The IMF's role was fundamentally altered after the floating exchange rates post 1971. It shifted

to examining the economic policies of countries with IMF loan agreements to determine if a

shortage of capital was due to economic fluctuations or economic policy. The IMF also

researched what types of government policy would ensure economic recovery. The new

challenge is to promote and implement policy that reduces the frequency of crises among the

emerging market countries, especially the middle-income countries that are open to massive

capital outflows. Rather than maintaining a position of oversight of only exchange rates, their

function became one of surveillance of the overall macroeconomic performance of its member

countries. Their role became a lot more active because the IMF now manages economic policy

instead of just exchange rates.

20

SURVIELLENCE TO GLOBAL ECONOMY

The IMF is mandated to oversee the international monetary and financial system and monitor the

economic and financial policies of its 188 member countries. This activity is known as

surveillance and facilitates international co-operation. Since the demise of the Bretton Woods

system of fixed exchange rates in the early 1970s, surveillance has evolved largely by way of

changes in procedures rather than through the adoption of new obligations. The responsibilities

of the Fund changed from those of guardian to those of overseer of members policies.

The Fund typically analyses the appropriateness of each member countrys economic and

financial policies for achieving orderly economic growth, and assesses the consequences of these

policies for other countries and for the global economy.

In 1995 the International Monetary Fund began work on data dissemination standards with the

view of guiding IMF member countries to disseminate their economic and financial data to the

public. The International Monetary and Financial Committee (IMFC) endorsed the guidelines for

the dissemination standards and they were split into two tiers: The General Data Dissemination

System (GDDS) and the Special Data Dissemination Standard (SDDS).

The primary objective of the GDDS is to encourage IMF member countries to build a framework

to improve data quality and increase statistical capacity building. Upon building a framework, a

country can evaluate statistical needs, set priorities in improving the timeliness, transparency,

reliability and accessibility of financial and economic data. Some countries initially used the

GDDS, but later upgraded to SDDS.

21

GOOD GOVERNANCE- IMFS ROLE

Good governance is important for countries at all stages of development. . . . Our approach is to

concentrate on those aspects of good governance that are most closely related to our surveillance

over macroeconomic policies.

The International Monetary Fund has long provided advice and technical assistance that has

helped to foster good governance, such as promoting public sector transparency and

accountability. Traditionally the IMFs main focus has been on encouraging countries to correct

macroeconomic imbalances, reduce inflation, and undertake key trade, exchange, and other

market reforms needed to improve efficiency and support sustained economic growth. While

these remain its first order of business in all its member countries, increasingly the IMF has

found that a much broader range of institutional reforms is needed if countries are to establish

and maintain private sector confidence and thereby lay the basis for sustained growth.

Mirroring the greater importance the membership of the IMF places on this matter, the

declaration Partnership for Sustainable Global Growth that was adopted by the IMFs Interim

Committee at its meeting in Washington on September 29, 1996, identified "promoting good

governance in all its aspects, including ensuring the rule of law, improving the efficiency and

accountability of the public sector, and tackling corruption" as an essential element of a

framework within which economies can prosper. The IMFs Executive Board then met a number

of times to develop guidance for the IMF regarding governance issues.

22

The Guidance Note reprinted in this pamphlet, adopted by the Board in July 1997, reflects the

strong consensus among Executive Directors on the significance of good governance for

economic efficiency and growth. The IMFs role in these issues has been evolving pragmatically

as more was learned about the contribution that greater attention to governance issues could

make to macroeconomic stability and sustainable growth. Executive Directors were strongly

supportive of the role the IMF has been playing in this area in recent years. They also

emphasized that the IMFs involvement in governance should be limited to its economic aspects.

Taking into account lessons from experience and the Executive Boards discussions, the

guidelines seek to promote greater attention by the IMF to governance issues, in particular

through:

A more comprehensive treatment in the context of both Article IV consultations and IMF-

supported programs of those governance issues within the IMFs mandate and expertise;

A more proactive approach in advocating policies and the development of institutions and

administrative systems that eliminate the opportunity for bribery, corruption, and fraudulent

activity in the management of public resources;

An evenhanded treatment of governance issues in all member countries; and

Enhanced collaboration with other multilateral institutions, in particular the World Bank, to

make better use of complementary areas of expertise.

23

ROLE OF IMF IN GOVERNMENT ISSUES

1. Reflecting the increased significance that member countries attach to the promotion of good

governance, on January 15, 1997, the Executive Board held a preliminary discussion on the role

of the IMF in governance issues, followed by a discussion on May 14, 1997, on guidance to the

staff.

1

The discussions revealed a strong consensus among Executive Directors on the

importance of good governance for economic efficiency and growth. It was observed that the

IMFs role in these issues had been evolving pragmatically as more was learned about the

contribution that greater attention to governance issues could make to macroeconomic stability

and sustainable growth in member countries. Directors were strongly supportive of the role the

IMF has been playing in this area in recent years through its policy advice and technical

assistance.

2. The IMF contributes to promoting good governance in member countries through different

channels. First, in its policy advice, the IMF has assisted its member countries in creating

systems that limit the scope for ad hoc decision making, for rent seeking, and for undesirable

preferential treatment of individuals or organizations. To this end, the IMF has encouraged,

among other things, liberalization of the exchange, trade, and price systems, and the elimination

of direct credit allocation. Second, IMF technical assistance has helped member countries in

enhancing their capacity to design and implement economic policies, in building effective

policymaking institutions, and in improving public sector accountability.

24

Third, the IMF has promoted transparency in financial transactions in the government budget,

central bank, and the public sector more generally, and has provided assistance to improve

accounting, auditing, and statistical systems. In all these ways, the IMF has helped countries to

improve governance, to limit the opportunity for corruption, and to increase the likelihood of

exposing instances of poor governance. In addition, the IMF has addressed specific issues of

poor governance, including corruption, when they have been judged to have a significant

macroeconomic impact.

3. Building on the IMFs past experience in dealing with governance issues and taking into

account the two Executive Board discussions, the following guidelines seek to provide greater

attention to IMF involvement in governance issues, in particular through:

a more comprehensive treatment in the context of both Article IV consultations and IMF-

supported programs of those governance issues that are within the IMFs mandate and

expertise;

a more proactive approach in advocating policies and the development of institutions and

administrative systems that aim to eliminate the opportunity for rent seeking, corruption, and

fraudulent activity;

an evenhanded treatment of governance issues in all member countries; and

Enhanced collaboration with other multilateral institutions, in particular the World Bank, to

make better use of complementary areas of expertise.

25

The IMFs Role in the Post Bretton Woods era: externalities and public goods?

The decades following the breakdown of the par value system in 1973 witnessed a sea

change in the international environment from that envisioned by the architects of the Bretton

Woods system. The par value system was gone and with it the IMFs main function as the

umpire of the rules of the game of that system. In the new environment, member countries could

freely choose their exchange rate arrangementspegged exchange rates to secure the benefits of

a nominal anchor and monetary and fiscal discipline, or floating rates for policy independence

and insulation from external shocks. The move by most advanced countries towards floating,

which in theory at least provided policy independence and a reduced need for international

reserves, meant that the only role seemingly left for the Fund was surveillance designed to

achieve responsible exchange rate policies under the amended Article IV. The IMF provided

information and policy advice, and acted as a medium for policy coordination.

A second development that had profound implications for the IMF was the increasing

integration of the world economy. This reflected a reduction in trade and transportation costs

and especially financial integration. The dramatic opening up of private international capital

markets, which had been suppressed through the Bretton Woods years by IMF sanctioned capital

controls, implied that private capital could substitute for official financing of payments

imbalances. This indeed became the case for the advanced countries.

26

INTERNATIONAL POLITICS AND IMF

It remains to examine a final, and controversial, area, in which the IMF has undoubtedly

played a role which has been useful for the general national interest of the United States, but

which may on occasion lead to conflict with the more narrowly conceived economic rationale for

the IMF. What are the general political and security implications of the existence of an

institution such as the IMF?

The IMF was originally largely a creation of the United States, motivated by the belief

that - as Treasury Secretary Morgenthau put it when addressing the inaugural session of the

Bretton Woods conference - "Prosperity, like peace is indivisible. We cannot afford to have it

scattered here or there among the fortunate or to enjoy it at the expense of others."

1

The

institution was a way of projecting a particular way of thinking about the world. Behind this

thinking lay the calculation that a more prosperous world would also be a safer world, and that

the transition to such stability was well worth paying a limited financial price.

Since the collapse of communism, the basic vision of Bretton Woods has become a

matter of a global consensus. In the 1990s, a widespread recognition developed that economic

stability and political stability go together.

2

But this linkage is interpreted much more precisely

than at the time of Bretton Woods: this means a move toward the market and at the same time

moves toward democracy and accountable institutions. It is in the interest of the United States to

promote this development.

27

The collapse of the communist economies, or (in the case of China) their transformation

into market economies was the last stage in the creation of the new consensus. The consequence

has been an increasing homogeneity of political outlook, as well as of the economic order.

Indeed, one key insight is that the two are linked: that economic efficiency depends on a

functioning civil society, on the rule of law, and on respect for private property. Thus in the

1990s, the IMF (and the World Bank) have become intensely concerned with problems of

governance.

Such issues raise questions of political costs and limitations that may not always coincide

with economic rationality, however. There is a strategic or geo-political element to some of the

work of the Fund. Attacking excessive military expenditure, corruption, and undemocratic

practices is easier for international institutions in the cases of small countries, such as Croatia,

Kenya or Romania, or even in isolated states such as Pakistan or Nigeria. But it is likely to be

hard and controversial in large states with substantial military and economic potential, for

instance, in say Russia or China. The public position is that expressed by the IMFs Managing

Director when he recalls telling President Yeltsin that the IMF would treat Russia in exactly the

same way it treated Burkina Faso.

3

But Russia, and its strategic stability, is clearly of direct

concern to the United States, and to other major countries, in a way that Burkina Faso is not.

During the Cold War era, there was political pressure from the international community

(i.e. the West) to support financially particular states for foreign policy reasons, because they

were essential to the stability of a particular region (Egypt, or Zaire).

28

IMF-EVALUIATING THE PERFORMANCE OF INTERNATIONAL

ORGANISATON

An organizational assessment is a systematic process for obtaining valid information about the

performance of an organization and the factors that affect performance. It differs from other

types of evaluations because the assessment focuses on the organization as the primary unit of

analysis.

Organizations are constantly trying to adapt, survive, perform and influence. However, they are

not always successful. To better understand what they can or should change to improve their

ability to perform, organizations can conduct organizational assessments. This diagnostic tool

can help organizations obtain useful data on their performance, identify important factors that aid

or impede their achievement of results, and situate themselves with respect to competitors.

Interestingly, the demand for such evaluations is gaining ground. Donors are increasingly trying

to deepen their understanding of the performance of organizations which they fund (e.g.,

government ministries, International Financial Institutions and other multilateral organizations,

NGOs, as well as research institutions) not only to determine the contributions of these

organizations to development results, but also to better grasp the capacities these organizations

have in place to support the achievement of results.

29

IMF Quotas; Constructing an International Organization Using Inferior

Building Blocks

The International Monetary Funds structure and rules are based on the quota system that

was constructed when the Fund was set up in 1946. Quotas affect contributions and resource

availability at the Fund, access to resources, the distribution of Special Drawing Rights, and

voting rights. Despite periodic reviews and modifications, the quota system has gradually been

eroded and undermined. The fundamental problem is that a single system is attempting to serve

four separate and incompatible functions. We illustrate how this erosion has taken place, and

how an unreformed quota system will compromise the future operations of the IMF and the

international monetary and financial system. Although the difficulties associated with reforming

quotas are myriad and complex, the legacy of an unreformed quota system may be profoundly

undesirable. We argue that a refined IMF structure must accommodate a clearer separation of a

members contributions to the IMF, its access to IMF resources, and its voting rights at the

institution.

Quotas are significant to the Funds operations because they affect voting rights, subscriptions,

the size of ordinary drawing rights and access to special facilities, as well as the distribution of

Special Drawing Rights (SDRs). However from the outset of the Funds operations in 1946 the

formula used to calculate quotas was spurious, since agreement had already been reached about

the total amount of quotas and the relative sizes of the quotas for the most powerful countries. A

30

trial-and-error process was then used to devise a formula the Bretton Woods formula- that

generated the desired results.

IMF-COUNCIL ON INTERNATIONAL ORGANIZATIONS

The International Monetary Fund (IMF) has undergone considerable change as chief steward of

the world's monetary system. The IMF is officially charged with managing the global regime of

exchange rates and international payments that allows nations to do business with one another.

The Fund recast itself in a broader, more active role following the 1973 collapse of fixed

exchange rates, and has since received both criticism and credit for its efforts to promote

financial stability, prevent crises, facilitate trade, and reduce poverty.

In 2010, the IMF catapulted back onto the international stage as the European sovereign debt

crisis unfolded, and once again, the organization's fiscal firefighting prowess is in high demand.

Some economists claim the Fund is in the midst of a major transformation, citing its vast

expansion of lending capacity, governance reform, and the move away from free market

fundamentalism. However, others suggest the IMF must go further in implementing changes that

will improve the plight of the world's poor and guarantee the Fund's relevance in a shifting

global economy.

Forty-four allied nations convened at the Bretton Woods Conference in 1944 to establish a post-

war financial order that would facilitate economic cooperation and prevent a rehash of the

currency warfare (Foreign Affairs) that helped usher in the Great Depression. The new regime

was intended to foster sustainable economic growth, promote higher standards of living, and

31

reduce poverty. The historic accord founded the twin institutions of the World Bank and the

IMF, and required signatory countries to peg their currencies to the U.S. dollar.

The IMF is akin to a credit union that permits its membership access to a common pool of

resources--funds that represent the financial commitment or quota contributed by each nation

(relative to its size). In theory, members with balance-of-payments trouble seek recourse with the

IMF to buy time to rectify their economic policies and restore economic growth. The Fund

pursues its mission in three fundamental ways:

1) Surveillance:

A formal system of review that monitors the financial and economic policies of member

countries to ensure they are living within their means--tracking developments on a

national, regional, and global level. In this process, IMF officials consult regularly with

member countries and offer macroeconomic and financial policy advice.

2) Technical Assistance:

Practical support and training directed mainly at low- and middle-income countries to

help manage their economies (e.g., providing advice on tax policy, expenditure

management, monetary and exchange rate policy, financial system regulation,

privatization, trade liberalization, etc.).

3) Lending:

Giving short- to mid-term loans to member nations that are struggling to meet their

international obligations. Loans (or bailouts) are provided in return for implementing

32

specific IMF conditions designed to help restore the macroeconomic dynamics conducive

to sustainable growth.

ECONOMIC STATISTICS

Macroeconomic statistics (IMF)

The IMF is coordinating international efforts to improve the availability of macroeconomic data

essential for tracking financial and economic development. In late 2008, the Statistics

Department of the IMF created the Inter-Agency Group on Economic and Financial Statistics -

involving the Bank for International Settlements (BIS), the European Central Bank (ECB),

Eurostat, the Organization for Economic Co-operation and Development (OECD), the United

Nations (UN), and the World Bank (WB)- to address economic and financial data gaps needed to

monitor financial developments. One of the key outcomes of the Inter-Agency Group was the

launching of Principal Global Indicators Website (PGI website) in April 2009.

In December 2009 the website was revamped to allow presentation of its rich collection of data

in a more user-friendly fashion by shifting emphasis to cross-country indicators---currently over

forty indicators. Among the new additions include:

Additional cross-country tables of key indicators with more data transformation in harmonized

units of measurement to facilitate comparative analysis;

Longer runs of historical data via real-time access to the underlying PGI database;

On-line access to referential metadata which provide information on the data sources, economic

concepts, or national practices used in compiling the data; and

Visual display of key cross-country indicators.

33

Reports on Observance of Standards and Codes (ROSCs)

The IMF also conducts two - to three-week on-site missions to its member countries to assess the

quality of data and assist in their further development. The ROSC data module provides an

assessment of data quality in five areas of macroeconomic statistics - national accounts (NA),

prices (consumer and producer price indices), government finance, monetary, and balance of

payments (BOP)- based on the July 2003 Data Quality Assessment Framework (DQAF), as well

as an assessment of whether the data dissemination practices are in accordance with those

specified in the Special Data Dissemination Standard (SDDS).

The assessments are disseminated as data modules of the Reports on Observance of Standards

and Codes. As of December 2010, 124 data module ROSCs had been completed, including

updates and reassessments. These include - using the IMF's World Economic Outlook country

group classification - 27 from advanced economies, 27 from Africa, 9 from developing Asia, 20

from Central and Eastern Europe, 16 from the Commonwealth of Independent States (CIS), 4

from the Middle East, and 21 from Western Hemisphere countries (including one regional

central bank).

34

Macroeconomic statistics (IMF)

The IMF is coordinating international efforts to improve the availability of macroeconomic data

essential for tracking financial and economic development. In late 2008, the Statistics

Department of the IMF created the Inter-Agency Group on Economic and Financial Statistics -

involving the Bank for International Settlements (BIS), the European Central Bank (ECB),

Eurostat, the Organization for Economic Co-operation and Development (OECD), the United

Nations (UN), and the World Bank (WB)- to address economic and financial data gaps needed to

monitor financial developments. One of the key outcomes of the Inter-Agency Group was the

launching of Principal Global Indicators Website (PGI website) in April 2009. The PGI website

brings together timely data available at participating international agencies covering financial,

governmental, external, and real sector data, with links to data at websites of international and

national agencies.

In December 2009 the website was revamped to allow presentation of its rich collection of data

in a more user-friendly fashion by shifting emphasis to cross-country indicators---currently over

forty indicators. Among the new additions include:

35

Additional cross-country tables of key indicators with more data transformation in harmonized

units of measurement to facilitate comparative analysis;

Longer runs of historical data via real-time access to the underlying PGI database;

On-line access to referential metadata which provide information on the data sources, economic

concepts, or national practices used in compiling the data; and

Visual display of key cross-country indicators.

Reports on Observance of Standards and Codes (ROSCs)

The IMF also conducts two - to three-week on-site missions to its member countries to assess the

quality of data and assist in their further development. The ROSC data module provides an

assessment of data quality in five areas of macroeconomic statistics - national accounts (NA),

prices (consumer and producer price indices), government finance, monetary, and balance of

payments (BOP) - based on the July 2003 Data Quality Assessment Framework (DQAF), as well

as an assessment of whether the data dissemination practices are in accordance with those

specified in the Special Data Dissemination Standard (SDDS).

The assessments are disseminated as data modules of the Reports on Observance of Standards

and Codes. As of December 2010, 124 data module ROSCs had been completed, including

updates and reassessments. These include - using the IMF's World Economic Outlook country

group classification - 27 from advanced economies, 27 from Africa, 9 from developing Asia, 20

from Central and Eastern Europe, 16 from the Commonwealth of Independent States (CIS), 4

from the Middle East, and 21 from Western Hemisphere countries (including one regional

central bank).

36

International trade and balance of payments (IMF)

International Trade:

The IMF participates in the development and promulgation of standards and methodology for

trade statistics compilation such as the UN's International Merchandise Trade Statistics. The IMF

has actively participated to the Intersecretariat Task Force on Merchandise Trade Statistics,

chaired by the World Trade Organization (WTO). The Task Force's initiatives include

developing international handbooks on concepts and compilation methods for merchandise trade

statistics and to reconcile merchandise trade data collected by the IMF, the United Nations, and

the WTO.

The IMF collects and maintains the monthly Direction of Trade Statistics database and

disseminates associated monthly electronic and quarterly/annual hardcopy publications Direction

of Trade Statistics, both quarterly and annual. Online version of the DOTS was released in

January 2007. The Direction of Trade Statistics Yearbook (DOTSY) database provides annual

bilateral trade data on the value of imports and exports of goods for 182 countries and major

37

regional groups. Exports and imports are based upon both country data and estimation

procedures designed to reduce gaps in reported values. The DOTS quarterly database is widely

used within the IMF for trade policy analysis. This quarterly publication presents data for 158

countries and major regional areas. It is supplemented by a monthly CD-ROM and online

database.

Balance of Payments and International Investment Position Statistics

The IMF's Statistics Department released the English version of the sixth edition of the Balance

of Payments and International Investment Position Manual (BPM6) at the end 2009 as an update

to BPM5. The release of the BPM6 represents the culmination of several years of work by the

Statistics Department under the auspices of the IMF Committee on Balance of Payments

Statistics (Committee) in collaboration with a range of interested parties such as data users,

national statistical compilers, specialized expert groups, and other international organizations.

The BPM6 retains the basic framework of the BPM5, and the revision was undertaken in parallel

with the update of the 2008 SNA, thereby enhancing the harmonization of macroeconomic

statistics.

The IMF provides technical assistance and training in external sector statistics to support

countries in implementing the BPM6.

Trade in Services:

38

The IMF participates in the Inter-Agency Task Force on Statistics of International Trade in

Services (ITFSITS). The ITFSITS has revised the Manual on Statistics of International Trade in

Services (MSITS) in accordance with revisions to the 2008 SNA and the sixth edition of the

IMF's Balance of Payments and International Investment Position Manual (BPM6). The 2010

MSITS was approved by the United Nations Statistical Commission at its meeting in February

2010. The IMF promotes the development and improvement of data on international trade in

services as an integral part of its activities relating to the implementation of the BPM6. These

efforts include the organization of and participation in regional seminars on statistics of

international trade in services, in collaboration with other ITFSITS members.

Currency Composition of Official Foreign Exchange Reserves

The IMF has been collecting quarterly data on the currency composition of official foreign

exchange reserves (COFER) since the 1960s from individual countries on a strict confidentiality

basis, with dissemination limited to selected aggregates only. The database distinguishes official

reserves denominated in U.S. dollars, euros, pounds sterling, Japanese yen, Swiss francs, and

other currencies. In response to heightened policy and public interest, the IMF launched the

quarterly publication of aggregate COFER data on its website on December 21, 2005. Before this

launch, annual aggregate COFER data had only been published in the IMF's Annual Reports.

The published data are presented in aggregate form for each currency for three groupings: world,

advanced economies, and emerging and developing economies. The classification of countries

and the definition of foreign exchange reserves follow those currently used in the IMF's IFS.

External Debt Statistics

39

Under the aegis of the Inter-Agency Task Force on Finance Statistics (TFFS), chaired by the

IMF, the External Debt Statistics: Guide for Compilers and Users (EDS Guide) was published in

2003 to set the standards in this field of statistics. The TFFS agreed that work on the update of

the EDS Guide will be undertaken beginning in 2011 with the objective of having the next EDS

Guide ready by 2013. On the whole, the EDS Guide remains largely consistent with the updated

standards. A limited number of changes in the methodological treatments in the EDS Guide are

discussed in the paper: Update of the External Debt Guide on Issues Emerging from BPM6

(March 2009). The TFFS is hosted by the IMF and was launched in December 2008.

Government Finance Statistics (GFS)

Under the aegis of the Inter-Agency Task Force on Finance Statistics (TFFS) the IMF

developed a Public Sector Debt Statistics Guide for Compilers and Users. It is expected to be

disseminated in February 2011. In addition, the IMF and WB launched the Quarterly Public

Sector Debt Statistics Database in December 2010*. This covers currently 30 countries and will

be expanded.

The IMF's Government Finance Statistics Yearbook (GFSY) contains annual fiscal data for

'general government' plus subsectors for about 100 countries. It continues to be available in

hardcopy and CD-ROM format. Monthly, quarterly, and annual fiscal statistics are published in

the International Financial Statistics (IFS). The IFS includes high-frequency fiscal data for about

40

90 countries Particular attention is given to the availability and timeliness of fiscal data for G-20

economies.

The IMF provides technical assistance in GFS to member countries through a variety of

channels, including staff or expert missions to individual countries and long term advisors in the

field. Each year, the IMF organizes GFS courses at headquarters and at regional centers and

hands-on short workshops for high level officials (e.g. India, September 2010), and for mission

chiefs and fiscal economists in the IMF.

The IMF is phasing in the GFSM 2001 presentation for staff reports. The World Economic

Outlook adopted the GFSM 2001 presentation in December 2009, and staff assists fiscal

economists to adjust the fiscal sector files. Staff also participates in area department missions

focusing on fiscal data reporting to the IMF.

Work on updating the Government Finance Statistics Manual has begun. A Government

Finance Statistics Advisory Committee has been established and will be discussing the main

methodological areas for review, including the changes introduced in the 2008 System of

National Accounts. The first meeting is planned for February 2011. A GFSM discussion forum

for selected methodological issues is now available online.

With support from the U.K. DFID, staff is developing a Compilation Guide for Developing

Countries expected to be available for electronic distribution in 2011.

41

Cooperation with international organizations continues. The IMF, World Bank, OECD, ECB,

and Eurostat are developing a coordinated strategy for fiscal data presentation and collection.

Cooperation with the International Public Sector Accounting Board (IPSASB) continues.

The IMF collects and maintains the monthly Direction of Trade Statistics database and

disseminates associated monthly electronic and quarterly/annual hardcopy publications Direction

of Trade Statistics, both quarterly and annual. Online version of the DOTS was released in

January. The Direction of Trade Statistics Yearbook (DOTSY) database provides annual bilateral

trade data on the value of imports and exports of goods for 182 countries and major regional

groups. Exports and imports are based upon both country data and estimation procedures

designed to reduce gaps in reported values. The DOTS quarterly database is widely used within

the IMF for trade policy analysis. This quarterly publication presents data for 158 countries and

major regional areas. It is supplemented by a monthly CD-ROM and online database.

IMF Survey Magazine: IMF Research

Financial Crises Yield More Synchronized Economic Output:

Regional and global output see increased correlations during financial crises

Size of output spillovers depends on type of shock and strength of linkages with

originating economy

42

Financial globalization doesnt necessarily induce greater output synchronization across

countriestill crisis hits

The global panic set in motion by the 2008-09 financial crises generated an unprecedented output

collapse around the world that temporarily had countries moving in close lockstep, according to

a new study by the IMF.

The output performance of the worlds economies moved together during the peak of the global

financial crisis as never before in the recent history, according to a study published in the IMFs

October 2013 World Economic Outlook report. Correlations of various countries GDP growth

rates had been modest before the crisis but rose dramatically during 200709.

43

44

The increased correlation or co movement was not confined to the advanced economies

which suffered most from the crisisbut was observed across all geographic regions. As in past

episodes when output correlations spiked, the increase was temporary. In fact since 2010 output

co movements have returned close to precrisis levels despite continued economic turmoil in

Europe.

Lively debate persists on what caused the globally synchronized collapse and recovery and more

generally what makes countries economies move together.

Trade and financial linkages are the most likely explanation because they can transmit country-

specific shocks to other countries.

A second possibility is that greater co movements in output were induced by large, common

shocks simultaneously affecting many countries at approximately the same timesuch as a

sudden increase in financial uncertainty or a wake-up call that triggered a change in investors

perceptions of the world.

Finally, it could be that the nature of shocks changed. Shocks to countries financial sectors, such

as banking crises and liquidity freezes, were more prevalent during the global financial crisis.

These financial shocks might be transmitted to other countries in a more virulent manner during

crises than are the supply and demand shocksthat are more prevalent during normal times.

Global spikes :

45

Even though financial linkages may have played some role in pushing up co movements, the

study finds that big spikes in regional and global output correlations tend to occur during

financial crises, such as those in Latin America in the 1980s and in Asia in the 1990s. Moreover,

when the crisis occurs in an economy like the United Stateswhich is both large and a global

financial hubthe effects on global output synchronization are disproportionately large. U.S.

financial shocks generated spillover effects during the crisis years of 200709 that were about

quadruple that during other periods. In other words, the global financial crisis had a much

stronger impact on output than would have been predicted by the size of the underlying U.S.

financial shock.

Cross-country linkages:

The fact that co movements are now lower does not mean policymakers can ignore the effects of

external shocks, such as growth slowdowns or monetary and fiscal tightening in major

economies. But they need not worry equally about all potential shocks.

First, size matters. The United States still matters most from a global perspective, although the

euro area, China, and Japan are important sources of spillovers within their respective regions.

Second, the extent of the spillovers depends on the nature of the shock and the strength of

linkages with the economy where the shock originates.

46

Costs and benefits of financial integration:

47

The conventional wisdom that financial globalization necessarily induces greater output co

movement across countries is not true until a crisis hits. Financial linkages do transmit financial

stresses across borders, but in normal times when real supply and demand shocks are dominant,

financial linkages facilitate the efficient international allocation of capital. They shift capital

where it is most productive. The key is to preserve the benefits of increased financial integration

while minimizing the attendant risks through better oversight, including strengthened policy

coordination and collaboration.

The IMF supervised a modified gold standard system of pegged, or stable, currency exchange

rates. Each member declared a value for its currency relative to the U.S. dollar, and in turn the

U.S. Treasury tied the dollar to gold by agreeing to buy and sell gold to other governments at $35

per ounce. A countrys exchange rate could vary only 1 percent above or below its declared

value. Seeking to eliminate competitive devaluations, the IMF permitted exchange rate

movements greater than 1 percent only for countries in fundamental balance-of-payments

disequilibrium and only after consultation with and approval by, the fund. In August 1971 U.S.

President Richard Nixon ended this system of pegged exchange rates by refusing to sell gold to

other governments at the stipulated price. Since then each member has been permitted to choose

the method it uses to determine its exchange rate: a free float, in which the exchange rate for a

countrys currency is determined by the supply and demand of that currency on the international

currency markets.

Opportunities and Future Outlook for the IMF

48

The international community recognized that the IMFs financial resources were as important as

ever and were likely to be stretched thin before the crisis was over. With broad support from

creditor countries, the IMFs lending capacity tripled to around $750 billion. To use those funds

effectively, the IMF overhauled its lending policies. It created a flexible credit line for countries

with strong economic fundamentals and a track record of successful policy implementation.

Other reforms targeted low-income countries. These factors enabled the IMF to disburse very

large sums quickly; the disbursements were based on the needs of borrowing countries and were

not as tightly constrained by quotas as in the past.Globalization and the Crisis (2005Present),

International Monetary Fund, accessed July 26, 2010.

The founders of the Bretton Woods system had taken for granted that private capital flows would

never again resume the prominent role they had in the nineteenth and early twentieth centuries,

and the IMF had traditionally lent to members facing current account difficulties. The 2008

global crisis uncovered fragility in the advanced financial markets that soon led to the worst

global downturn since the Great Depression. Suddenly, the IMF was inundated with requests for

standby arrangements and other forms of financial and policy support.

The IMFs requirements are not always popular but are usually effective, which has led to its

expanding influence. The IMF has sought to correct some of the criticisms; according to a

Foreign Policy in Focus essay designed to stimulate dialogue on the IMF, the funds strengths

and opportunities include the following-

Flexibility and speed- In March 2009, the IMF created the Flexible Credit Line (FCL),

which is a fast-disbursing loan facility with low conditionality aimed at reassuring

49

investors by injecting liquidityTraditionally, IMF loan programs require the imposition

of austerity measures such as raising interest rates that can reduce foreign investmentIn

the case of the FCL, countries qualify for it not on the basis of their promises, but on the

basis of their history. Just as individual borrowers with good credit histories are eligible

for loans at lower interest rates than their risky counterparts

Cheerleading- The Fund is positioning itself to be less of an adversary and more of a

cheerleader to member countries. For some countries that need loans more for

reassurance than reform, these changes to the Fund toolkit are welcome.Martin S.

Edwards, The IMFs New Toolkit: New Opportunities, Old Challenges, Foreign Policy

in Focus, September 17, 2009, accessed June 28, 2010, this enables more domestic

political and economic stability.

Adaptability- Instead of providing the same medicine to all countries regardless of their

particular problems, the new loan facilities are intended to aid reform-minded

governments by providing short-term resources to reassure investors.

Transparency- The IMF has made efforts to improve its own transparency and continues

to encourage its member countries to do so. Supporters note that this creates a barrier to

any one or more countries that have more geopolitical influence in the organization. In

reality, the major economies continue to exert influence on policy and implementation.

CONCLUSION

50

The IMF also has an International Monetary and Financial Committee of 24 representatives of

the member-countries that meets twice yearly to provide advice on the international monetary

and financial system to the IMFs staff.

In simpler terms, the goals are to:

1. Facilitate the cooperation of countries on monetary policy, including providing the

necessary resources for both consultation and the establishment of monetary policy in

order to minimize the effects of international financial crises.

2. Assist the liberalization of international trade by helping countries increase their real

incomes while lowering unemployment.

3. Help to stabilize exchange rates between countries. Especially after the global depression

of the 1930s, it was considered vital to establish currencies that could hold their value,

serve as mediums of international exchange, and resist any speculative attacks.

4. Maintain a multilateral system of payments that eliminates foreign exchange restrictions.

Countries are thus free to trade with each other without worrying about the effects of

interest rates and currency depreciation on their payments.

5. Provide a safeguard to members of the IMF against balance of payments crises, i.e., when

governments cannot balance the money they have with the money they owe to other

countries. IMF members can have the confidence to adjust the imbalances in their

national accounts without resorting to painful measures that would hamper their

prosperity, such as devaluing their currency in relation to other countries.

BIBLIOGRAPHY

51

BOOKS REFERRED:

Models of IMF, by Peter Fuses.

IMF- Research Reports.

Views of IMF, by David Stowell.

WEBSITES REFERRED:

www.google.com

www.yahoo.com

www.Retailbanking.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Organizational Behaviour Notes ADM 2336Document44 pagesOrganizational Behaviour Notes ADM 2336Rodrigo MoranteNo ratings yet

- Affidavit of LossDocument7 pagesAffidavit of LossAlmarius Cadigal50% (2)

- Company Name Contact Person MobileDocument429 pagesCompany Name Contact Person MobileRitesh Sinha60% (10)

- Terence McKenna - Lectures On AlchemyDocument40 pagesTerence McKenna - Lectures On AlchemySipi SomOf100% (1)

- Depository Final ProjectDocument44 pagesDepository Final ProjectShweta Sawant100% (1)

- ICICI Lombard Project ReportDocument92 pagesICICI Lombard Project ReportShweta SawantNo ratings yet

- Mcom Derivatives.Document40 pagesMcom Derivatives.Shweta Sawant0% (1)

- Mergers and AmalgmationsDocument38 pagesMergers and AmalgmationsShweta SawantNo ratings yet

- Original Eco..Document37 pagesOriginal Eco..Shweta SawantNo ratings yet

- Study On Performace of Imf With Special Reference To Other International OrganizationDocument51 pagesStudy On Performace of Imf With Special Reference To Other International OrganizationShweta SawantNo ratings yet

- Poliomyelitis: By: Reema I. DabbasDocument35 pagesPoliomyelitis: By: Reema I. DabbasReema DabbasNo ratings yet

- Mira NSF Interview QuestionaireDocument3 pagesMira NSF Interview QuestionairelungilepchibiNo ratings yet

- Habit 2 Part 2 From The 7 Habits LargeDocument78 pagesHabit 2 Part 2 From The 7 Habits Largeabdul rehman100% (1)

- People Vs LaurenteDocument18 pagesPeople Vs LaurenteEj AquinoNo ratings yet

- Gonzales Vs AguinaldoDocument2 pagesGonzales Vs AguinaldoJaylordPataotao100% (2)

- Exegesis of MK 10.29-31Document13 pagesExegesis of MK 10.29-3131songofjoyNo ratings yet

- Book of Job SummaryDocument3 pagesBook of Job SummarynevrickNo ratings yet

- Erin Aitkin's Letter To The Lodi Unified School District BoardDocument4 pagesErin Aitkin's Letter To The Lodi Unified School District BoardlodinewsNo ratings yet

- City Limits Magazine, April 1989 IssueDocument24 pagesCity Limits Magazine, April 1989 IssueCity Limits (New York)No ratings yet

- The Tetragrammaton: in Her Book, in Awe of Thy Word, Gail Riplinger Highly Recommended Books by KabbalistsDocument16 pagesThe Tetragrammaton: in Her Book, in Awe of Thy Word, Gail Riplinger Highly Recommended Books by Kabbalistsgrace10000No ratings yet

- Creation Therapy TraingDocument1 pageCreation Therapy TraingKekeli Kwesi kwameNo ratings yet

- Zedbull ApplicationDocument4 pagesZedbull ApplicationFernando OliveiraNo ratings yet

- De Thi Trac Nghiem PDFDocument4 pagesDe Thi Trac Nghiem PDFPt Pt PhuongNo ratings yet

- 20140904Document24 pages20140904កំពូលបុរសឯកា100% (1)

- Remedial LawDocument59 pagesRemedial LawResIpsa LoquitorNo ratings yet

- Sample - Ethics Review Result FormDocument5 pagesSample - Ethics Review Result FormJenny Babe AriolaNo ratings yet

- Family Law OutlineDocument56 pagesFamily Law OutlineTianna GadbawNo ratings yet

- BCG EessDocument4 pagesBCG Eessnovianta.kuswandi1984No ratings yet

- Guru Ravidas Ayurved University, Punjab, HoshiarpurDocument6 pagesGuru Ravidas Ayurved University, Punjab, HoshiarpurGursimranNo ratings yet

- Diary of Anne FrankDocument14 pagesDiary of Anne Frankraj buildconjamNo ratings yet

- Accounting For Cash-receivables-InventoriesDocument12 pagesAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Article JisDocument2 pagesArticle Jisnatassya auliaNo ratings yet

- Myths and LegendsDocument98 pagesMyths and LegendsAránzazu García EscuredoNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Document5 pagesPamantasan NG Lungsod NG Valenzuela: Financial Accounting and Reporting I (FAR I)Mariane Manangan100% (2)

- Defendants' Motion To Strike Plaintiff's Motion To DefaultDocument52 pagesDefendants' Motion To Strike Plaintiff's Motion To DefaultNeil GillespieNo ratings yet

- CASS Identity FormationDocument2 pagesCASS Identity FormationDiana Teodora PiteiNo ratings yet