Professional Documents

Culture Documents

QUA05891 SepSalarySlipwithTaxDetails

Uploaded by

srajput66Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QUA05891 SepSalarySlipwithTaxDetails

Uploaded by

srajput66Copyright:

Available Formats

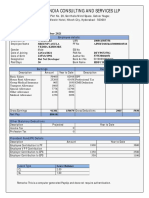

DOJ:12 Dec 2013 Payable Days:28.

00

Emp Code :QUA05891

Emp Name :SACHIN KUMAR

Department:Technical Solutions Group

Designation:SOLUTIONS ENGINEER

Grade :1A

DOB :10 Oct 1984

Location :GURGAON

Bank/MICR :110234004

Bank A/c No.:100026321043 (INDUSIND BANK LTD)

Cost Center :QBPO

PAN :BOSPK6982A

PF No. :HR/GGN/29073/5806

ESI No. :

UAN :100020614505

Description Rate Monthly Arrear Total

Deductions

Previous Employer Taxable Income 0.00

Previous Employer Professional Tax 0.00

Professional Tax 0.00

Under Chapter VI-A 13901.00

Any Other Income 0.00

Taxable Income 234977.00

Total Tax 0.00

Tax Rebate u/s 87a 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 1299.00

Tax to be Deducted 0.00

Tax/Month 0.00

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 0.00

QUATRRO GLOBAL SERVICES PRIVATE LIMITED

Basement, 24, C- Block, Community Centre, Janak Puri, DELHI -

110058

NEW DELHI

Pay Slip for the month of September 2014

All amounts in INR

Earnings Deductions

Description Amount

BASIC 12021.00 11220.00 0.00 11220.00

HRA 3844.00 3588.00 0.00 3588.00

CONV 800.00 747.00 0.00 747.00

CCA 750.00 700.00 0.00 700.00

CBPB(Bonus) 1245.00 1245.00 0.00 1245.00

MED ALL 600.00 560.00 0.00 560.00

PF 1346.00

ELWF 10.00

GROSS EARNINGS 19260.00 18060.00 0.00 18060.00 GROSS DEDUCTIONS 1356.00

Net Pay : 16704.00 (SIXTEEN THOUSAND SEVEN HUNDRED FOUR ONLY)

Income Tax Worksheet for the Period April 2014 - March 2015

Description Gross Exempt Taxable

BASIC 119877.00 0.00 119877.00

HRA 41264.00 0.00 41264.00

CONV 9444.00 9443.00 1.00

CCA 8853.00 0.00 8853.00

OTHALL 19777.00 0.00 19777.00

MEALAL 4384.00 0.00 4384.00

CBPB(Bonus) 13422.00 0.00 13422.00

MED ALL 7083.00 7083.00 0.00

EXTRA MILLER 41300.00 0.00 41300.00

Gross 265404.00 16526.00 248878.00

Deduction Under Chapter VI-A

Investments u/s 80C

Provident Fund 13901.00

Total Investments u/s 80C 13901.00

U/S 80C 13901.00

Total Ded Under Chapter VI-A13901.00

Total Any Other Income 0.00

Taxable HRA Calculation(Non-Metro)

Rent Paid 0.00

From 01/04/2014

To 31/03/2015

1. Actual HRA 41264.00

2. 40% or 50% of Basic 47951.00

3. Rent > 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 41264.00

TDS Deducted Monthly

Month Amount

April-2014 0.00

May-2014 242.00

June-2014 690.00

July-2014 367.00

August-2014 0.00

September-2014 0.00

Tax Deducted on Perq. 0.00

Total 1299.00

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarNo ratings yet

- Recoveries Earnings: Amount AmountDocument3 pagesRecoveries Earnings: Amount AmountVadamalai AdhimoolamNo ratings yet

- Salary Slip (30385759 May, 2018)Document1 pageSalary Slip (30385759 May, 2018)munafNo ratings yet

- Javed JuyDocument1 pageJaved JuyVikas JangidNo ratings yet

- Spice Mobile LimitedDocument1 pageSpice Mobile LimitedChristopher GarciaNo ratings yet

- Payslip For The Month of March 2015 Earnings DeductionsDocument1 pagePayslip For The Month of March 2015 Earnings Deductionsmadhusudhan N RNo ratings yet

- Nikita Pay SlipsDocument10 pagesNikita Pay SlipsdesignNo ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- Payslip Nov - Sailu1 fINALDocument2 pagesPayslip Nov - Sailu1 fINALChristine HallNo ratings yet

- Jan 2023 PDFDocument1 pageJan 2023 PDFBEPF 32 Sharma RohitNo ratings yet

- GI-Nov PayslipsDocument1 pageGI-Nov PayslipsmahendraNo ratings yet

- DDICGDIAP72DINOV22Document1 pageDDICGDIAP72DINOV22raghav bharadwajNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsachikant swainNo ratings yet

- PayslipDocument1 pagePayslipAlec Paolo FabrosNo ratings yet

- Intex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020Document1 pageIntex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020rakeshsingh9811No ratings yet

- Awais Ahmed (UTL0477)Document1 pageAwais Ahmed (UTL0477)Awais AhmedNo ratings yet

- Fe96beed 7a5b 4d7b A5cc C38eecd2b38dDocument1 pageFe96beed 7a5b 4d7b A5cc C38eecd2b38dChandan ShahNo ratings yet

- Payslip Sep18Document1 pagePayslip Sep18csreddyatsapbiNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Allcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Document1 pageAllcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Shaik IrfanNo ratings yet

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Document2 pagesFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesNo ratings yet

- Ilovepdf - Merged - 2023-07-14T193418.587Document3 pagesIlovepdf - Merged - 2023-07-14T193418.587SRINIVASREDDY PIRAMALNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- Infinity Fincorp Solutions Private Limited: Payslip For The Month of March 2023Document1 pageInfinity Fincorp Solutions Private Limited: Payslip For The Month of March 2023venkata surendraNo ratings yet

- OfferLetter IGTDocument2 pagesOfferLetter IGTAnkit ShuklaNo ratings yet

- TarunDocument1 pageTarunUbed QureshiNo ratings yet

- Payslip For The Month of January 2018: Earnings DeductionsDocument1 pagePayslip For The Month of January 2018: Earnings DeductionsDevmalya ChandaNo ratings yet

- Huhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Document1 pageHuhtamaki PPL LTD (Hyderabadplant) : Payslip For The Month of August-2019Ashok SrinivasNo ratings yet

- Pay Slip For May 2013: Empno Gaurav Kumar 155281 NameDocument1 pagePay Slip For May 2013: Empno Gaurav Kumar 155281 NameashukundanNo ratings yet

- Date:27 12 2015Document1 pageDate:27 12 2015Anonymous pKsr5vNo ratings yet

- LW09560 SalarySlipwithTaxDetailsDocument1 pageLW09560 SalarySlipwithTaxDetailsshreyas kotiNo ratings yet

- Venus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020Document1 pageVenus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020pyNo ratings yet

- Salary Slip July 2023 - UnlockedDocument1 pageSalary Slip July 2023 - UnlockedPardeep AttriNo ratings yet

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWNo ratings yet

- Payslip Aug 2023Document1 pagePayslip Aug 2023paras rawatNo ratings yet

- SlipDocument5 pagesSlipHiten kaneshriyaNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Payslip Nov 2022Document1 pagePayslip Nov 2022Kiran PawarNo ratings yet

- H925 Payslip Gabriel Feb 2015 PDFDocument1 pageH925 Payslip Gabriel Feb 2015 PDFAnonymous ALI6GKILNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Oct PayslipDocument1 pageOct PayslipPandu RjNo ratings yet

- SR No. 13/ 4 A, Plot No. 14, Khandge Hospital Road, Shitole Nagar, Sangavi, Pune - 411027 Payslip For Jan-2020Document1 pageSR No. 13/ 4 A, Plot No. 14, Khandge Hospital Road, Shitole Nagar, Sangavi, Pune - 411027 Payslip For Jan-2020Rajesh NayakNo ratings yet

- Payslip Matrimony PDFDocument2 pagesPayslip Matrimony PDFPuneeth KumarNo ratings yet

- Salary Slip For The Month - Mar 2019: Earnings Amt. (INR) Deductions Amt. (INR)Document1 pageSalary Slip For The Month - Mar 2019: Earnings Amt. (INR) Deductions Amt. (INR)Shivpratap Singh RajawatNo ratings yet

- N2K Info Systems Private Limited: Payslip For The Month of April - 2019Document1 pageN2K Info Systems Private Limited: Payslip For The Month of April - 2019Munna ShaikNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Document1 pageTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNo ratings yet

- Powerweave Software Services Pvt. LTDDocument1 pagePowerweave Software Services Pvt. LTDSnehal ManeNo ratings yet

- PayslipDocument1 pagePayslipSk Samim AhamedNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Payslips 4Document1 pagePayslips 4Tech stackNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Earnings Entitled Amt. Earned Amt. Arrears Deductions AmountDocument5 pagesEarnings Entitled Amt. Earned Amt. Arrears Deductions AmountAditya PLNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctBhavesh MishraNo ratings yet

- Tax CalculaterDocument2 pagesTax CalculaterMahimaNo ratings yet

- Component Monthly Annual TaxableDocument3 pagesComponent Monthly Annual TaxableSachi SurbhiNo ratings yet