Professional Documents

Culture Documents

Finance

Finance

Uploaded by

dinnyseptiani0 ratings0% found this document useful (0 votes)

11 views3 pagesFinance involves the management of money and has two major areas. Financial services provide advice and financial products in areas like banking, investments, and insurance. Managerial finance oversees the financial operations within a business firm and requires understanding economics, using cost-benefit analysis for decisions, and interpreting accounting data for decision making. The overall goals of a firm include maximizing profit and shareholder wealth while satisfying stakeholders.

Original Description:

fainance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance involves the management of money and has two major areas. Financial services provide advice and financial products in areas like banking, investments, and insurance. Managerial finance oversees the financial operations within a business firm and requires understanding economics, using cost-benefit analysis for decisions, and interpreting accounting data for decision making. The overall goals of a firm include maximizing profit and shareholder wealth while satisfying stakeholders.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesFinance

Finance

Uploaded by

dinnyseptianiFinance involves the management of money and has two major areas. Financial services provide advice and financial products in areas like banking, investments, and insurance. Managerial finance oversees the financial operations within a business firm and requires understanding economics, using cost-benefit analysis for decisions, and interpreting accounting data for decision making. The overall goals of a firm include maximizing profit and shareholder wealth while satisfying stakeholders.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Finance art and science of managing money

Major areas and opportunities in finance

Financial services design and delivery of advice and financial products (banking, financial

planning, investment, real estate and insurance.

Managerial finance duties of financial managers in business firm.

The managerial finance function:

The size and importance of managerial finance depends on the size of the firm. Small firms

financial affairs could be dealt by the accounting department or the CEO.

Financial managers must understand the economic framework where they operate, to

anticipate or react to changes.

Marginal cost benefit analysis financial decisions should be implemented only when added

benefits exceeds costs.

Relationship with Accounting:

Finance Accounting

Present, Future Past

Cash Flow Accrual

Interpreting and Analyzing for Decision making Presentation

Goal of the firm:

Maximize profit

Maximize shareholders wealth

Satisfy stakeholders (employees, customers, suppliers, creditors, owners, etc)

Corporate Governance - the system of structures, rights, duties, and obligations by which corporations

are directed and controlled.

Investors:

Individual - purchase relatively small quantities of shares in order to earn a return on idle funds,

build a source of retirement income, or provide financial security.

Institutional - investment professionals who are paid to manage other peoples money. They

hold and trade large quantities of securities for individuals, businesses, and governments and

tend to have a much greater impact on corporate governance.

You might also like

- Lifting The VeilDocument19 pagesLifting The VeilHafizuddin Zaqi0% (1)

- Bionic Turtle FRM Practice Questions P1.T1. Foundations of Risk Chapter 1. The Building Blocks of Risk ManagementDocument17 pagesBionic Turtle FRM Practice Questions P1.T1. Foundations of Risk Chapter 1. The Building Blocks of Risk ManagementChristian Rey MagtibayNo ratings yet

- Public Protection Announcement 29 5 2018 Cease and Desist CTU 24Document3 pagesPublic Protection Announcement 29 5 2018 Cease and Desist CTU 24WORLD MEDIA & COMMUNICATIONS100% (1)

- Corporate Finance - MBA IIDocument80 pagesCorporate Finance - MBA IIAnmol Srivastava100% (1)

- Business ValuationsDocument14 pagesBusiness ValuationsInnocent MapaNo ratings yet

- Financial Management Class Notes Bba Iv Semester: Unit IDocument49 pagesFinancial Management Class Notes Bba Iv Semester: Unit IGauravs100% (1)

- Ppe 2Document13 pagesPpe 2Jerome BaluseroNo ratings yet

- Financial Management 1 Midterm ReviewerDocument7 pagesFinancial Management 1 Midterm Reviewerkurdapiaaa100% (1)

- Derivatives Model 1Document5 pagesDerivatives Model 1sbdhshrm146No ratings yet

- Principles of Managerial Finance HandoutsDocument2 pagesPrinciples of Managerial Finance HandoutsFatima Asprer100% (1)

- The Equity Millepede StoryDocument798 pagesThe Equity Millepede StoryNihal SinghNo ratings yet

- Unit 1 Introduction To Financial ManagementDocument2 pagesUnit 1 Introduction To Financial ManagementCarmina 'ria' de Jesus100% (3)

- CH 1Document41 pagesCH 1bjr_shagyounNo ratings yet

- Sbaa 3004Document71 pagesSbaa 3004mohanrajk879No ratings yet

- FINANCIAL MANAGEMENT Basic ConceptsDocument5 pagesFINANCIAL MANAGEMENT Basic ConceptsJhaydiel JacutanNo ratings yet

- BA100FMREVIEWERDocument8 pagesBA100FMREVIEWERMadelyn GayolNo ratings yet

- Chapter One: Overview of Managerial FinanceDocument7 pagesChapter One: Overview of Managerial FinanceTsegay ArayaNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- 1.introduction To Finance Management - Jan 2012-1Document9 pages1.introduction To Finance Management - Jan 2012-1Moud KhalfaniNo ratings yet

- Business Studies - Finance Study NotesDocument29 pagesBusiness Studies - Finance Study NotesSamina Haider0% (1)

- HW #1 Financial ManagemenrDocument3 pagesHW #1 Financial ManagemenrHaidie DiazNo ratings yet

- Chapter 1Document7 pagesChapter 1Abd El-Rahman El-syeoufyNo ratings yet

- Introduction To Financial ManagementDocument4 pagesIntroduction To Financial ManagementJohn cookNo ratings yet

- Lecture 1Document39 pagesLecture 1rabiaNo ratings yet

- Define Finance: Debt Financing Equity FinancingDocument6 pagesDefine Finance: Debt Financing Equity FinancingJackie Lou SantosNo ratings yet

- Financial Management CompleteDocument17 pagesFinancial Management Completesphynx labradorNo ratings yet

- ReviewerDocument5 pagesReviewerJeline E LansanganNo ratings yet

- FNCE 545 Managerial Finance MBADocument417 pagesFNCE 545 Managerial Finance MBATarusengaNo ratings yet

- Chapter 1Document23 pagesChapter 1912304No ratings yet

- CH-1 Advanced Financial MGTDocument44 pagesCH-1 Advanced Financial MGTMusxii TemamNo ratings yet

- Introduction To Financial Management: Page 1 of 12Document12 pagesIntroduction To Financial Management: Page 1 of 12JP firmNo ratings yet

- FNCE 545 Managerial Finance MBA December 2012 SessionDocument415 pagesFNCE 545 Managerial Finance MBA December 2012 SessionTarusengaNo ratings yet

- Unit-I FMDocument31 pagesUnit-I FMAishvarya PujarNo ratings yet

- Bba FM Notes Unit IDocument15 pagesBba FM Notes Unit Iyashasvigupta.thesironaNo ratings yet

- Introduction To Financial ManagementDocument37 pagesIntroduction To Financial ManagementEftakharul Haque BappyNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementB112NITESH KUMAR SAHUNo ratings yet

- BAF c01pptDocument31 pagesBAF c01pptbisma9681No ratings yet

- Financial Management Unit 1 DR Ashok KumarDocument115 pagesFinancial Management Unit 1 DR Ashok KumarSulagna PalNo ratings yet

- Questions Mba - MidtermDocument6 pagesQuestions Mba - Midtermاماني محمدNo ratings yet

- Introduction To Financial ManagementDocument4 pagesIntroduction To Financial ManagementYuki ApacibleNo ratings yet

- CH 1Document30 pagesCH 1Muskaan KatariaNo ratings yet

- Unit-III Finance FunctionDocument8 pagesUnit-III Finance FunctiondaogafugNo ratings yet

- John Edward Pangilinan BS Accounting Information SystemDocument5 pagesJohn Edward Pangilinan BS Accounting Information SystemJohn Edward PangilinanNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementTrisha Kaira RodriguezNo ratings yet

- FM 1-3Document53 pagesFM 1-3zeleke fayeNo ratings yet

- Finance Chapter 1Document32 pagesFinance Chapter 1Tamzid Ahmed AnikNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceShamim Ahmed AshikNo ratings yet

- Chapter-4 Specialization - Ii FinanceDocument15 pagesChapter-4 Specialization - Ii FinanceRahul ThakurNo ratings yet

- Business Finance Chapter 1Document4 pagesBusiness Finance Chapter 1sn nNo ratings yet

- The Role and Environment of Corporate Finance: Dr. Doaa AymanDocument30 pagesThe Role and Environment of Corporate Finance: Dr. Doaa AymanMohamed HosnyNo ratings yet

- CH1 - Financial ManagementDocument10 pagesCH1 - Financial ManagementJohn LiamNo ratings yet

- Financial Management Entails Planning For The Future of A Person or A Business Enterprise To Ensure A Positive Cash FlowDocument7 pagesFinancial Management Entails Planning For The Future of A Person or A Business Enterprise To Ensure A Positive Cash Flowzeb_22No ratings yet

- Scope and Objective of Financial Management NewDocument3 pagesScope and Objective of Financial Management NewArafathNo ratings yet

- CHAPTER 1 Overview of Finance.1Document19 pagesCHAPTER 1 Overview of Finance.1jerainmallari12No ratings yet

- Financial Management PGDM Study MaterialDocument152 pagesFinancial Management PGDM Study MaterialSimranNo ratings yet

- Basic Financial Mgt. ConceptsDocument10 pagesBasic Financial Mgt. ConceptsSaksham MathurNo ratings yet

- Introduction To Financial ManagementDocument28 pagesIntroduction To Financial ManagementNikiNo ratings yet

- RWJ Chapter 1 - EUDocument17 pagesRWJ Chapter 1 - EULokkhi BowNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceshaneemacasiNo ratings yet

- LT 3. Finacial Management - 1399-3!21!20-02Document72 pagesLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNo ratings yet

- FM8 Module 2Document5 pagesFM8 Module 2Kim HeidelynNo ratings yet

- Corporate Finance LernzettelDocument28 pagesCorporate Finance Lernzettelmirela.sejficNo ratings yet

- Unit 1 FINANCIAL MANAGEMENTDocument37 pagesUnit 1 FINANCIAL MANAGEMENTdhall.tushar2004No ratings yet

- Lesson 1: Overview of Financial ManagementDocument33 pagesLesson 1: Overview of Financial ManagementPhilip Denver NoromorNo ratings yet

- Synopsis - 01-IntroductionDocument7 pagesSynopsis - 01-IntroductionleyaketjnuNo ratings yet

- Business FinanceDocument16 pagesBusiness FinanceFat AjummaNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- Accounting Policy Changes and Accounting Estimates Made in 1984Document3 pagesAccounting Policy Changes and Accounting Estimates Made in 1984271703315Ra0% (1)

- Debenture TrusteeDocument6 pagesDebenture TrusteeRajesh GoelNo ratings yet

- SUPER17983Superannuation Standard Choice Form-1Document7 pagesSUPER17983Superannuation Standard Choice Form-1RomeoNo ratings yet

- CBSE SAMPLE PAPER 2 (Unsolved) Economics Class - XIIDocument3 pagesCBSE SAMPLE PAPER 2 (Unsolved) Economics Class - XIIVijay DhanakodiNo ratings yet

- Cash Flow Statement Exercise Compass Company Balance Sheet, March 31Document2 pagesCash Flow Statement Exercise Compass Company Balance Sheet, March 31Rajiv KumarNo ratings yet

- Tax 1 Midterms CasesDocument11 pagesTax 1 Midterms CasesJett LabillesNo ratings yet

- Exotic Options: - Digital and Chooser OptionsDocument8 pagesExotic Options: - Digital and Chooser OptionsKausahl PandeyNo ratings yet

- Tax Invoice: Exclusive DhotiesDocument1 pageTax Invoice: Exclusive DhotiesmsnsaikiranNo ratings yet

- House Property IncomeDocument4 pagesHouse Property IncomeOnkar BandichhodeNo ratings yet

- Money & Functions of Money: DEWETT 364/384Document24 pagesMoney & Functions of Money: DEWETT 364/384emmanuel JohnyNo ratings yet

- Tanzania 2010-2011 BudgetDocument55 pagesTanzania 2010-2011 BudgetSubiNo ratings yet

- FIN221 Chapter 3Document45 pagesFIN221 Chapter 3jojojoNo ratings yet

- Bihar Tax On Professions Trades Callings and Employments Act2011Document11 pagesBihar Tax On Professions Trades Callings and Employments Act2011Latest Laws TeamNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

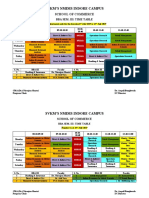

- Time-Table - BBA 3rd SemesterDocument2 pagesTime-Table - BBA 3rd SemesterSunny GoyalNo ratings yet

- Accounting Items - DefinitionDocument9 pagesAccounting Items - DefinitionAaron Pascual RiveraNo ratings yet

- Ch03 PDFDocument49 pagesCh03 PDFBich VietNo ratings yet

- Leader of The PackDocument2 pagesLeader of The PackNikken, Inc.No ratings yet

- Release of Imported GoodsDocument7 pagesRelease of Imported GoodsAlice Marie AlburoNo ratings yet

- Event Study-Impact of Result Announcement On Stock Price PDFDocument8 pagesEvent Study-Impact of Result Announcement On Stock Price PDFNamrataNo ratings yet

- Investment PortfolioDocument6 pagesInvestment PortfolioNorma BlancoNo ratings yet

- Midterm 2 Spring 2013Document9 pagesMidterm 2 Spring 2013Simreyna KangNo ratings yet

- Review of Research: A Review of Literature On Performance of Regional Rural Banks in IndiaDocument12 pagesReview of Research: A Review of Literature On Performance of Regional Rural Banks in IndiaaakritiNo ratings yet