Professional Documents

Culture Documents

Ten Years at A Glance: Standalone Operating Results 2005 - 2014

Ten Years at A Glance: Standalone Operating Results 2005 - 2014

Uploaded by

amanrachitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ten Years at A Glance: Standalone Operating Results 2005 - 2014

Ten Years at A Glance: Standalone Operating Results 2005 - 2014

Uploaded by

amanrachitCopyright:

Available Formats

Ten Years at a Glance

Standalone Operating Results 2005 - 2014

Year ending 31st March

GROSS INCOME

Excise Duties

Net Income

PBDIT

Depreciation

PBIT

PBT

Tax

PAT (Before Exceptional Items)

PAT

Dividends *

- Ordinary Dividend

- Special Dividend

Earnings Per Share on profit after tax

before exceptional items

Actual (`)**

Adjusted (`) @

Dividend Per Share

Actual - Ordinary (`)**

Actual - Special (`)**

Adjusted - Ordinary (`) @

Adjusted - Special (`) @

Market Capitalisation ***

Foreign Exchange Earnings

2005

13542

5667

7875

3028

313

2715

2673

836

1837

2191

883

883

2006

16448

6371

10077

3613

332

3281

3269

989

2280

2235

1135

1135

2007

19557

7056

12501

4293

363

3930

3927

1227

2700

2700

1365

1365

2008

21879

7320

14559

5015

439

4576

4572

1452

3120

3120

1543

1543

2009

23594

7447

16147

5393

549

4844

4826

1562

3264

3264

1634

1634

2010

26814

8046

18768

6689

609

6080

6015

1954

4061

4061

4453

2004

2449

2011

31399

9360

22039

7993

656

7337

7268

2280

4988

4988

4002

2518

1484

2012

36046

10073

25973

9674

699

8975

8898

2736

6162

6162

4089

4089

2013

43044

12204

30840

11566

795

10771

10684

3266

7418

7418

4853

4853

(` in Crores)

2014

48176

13830

34346

13562

900

12662

12659

3874

8785

8785

5583

5583

7.36

2.43

6.07

3.01

7.18

3.56

8.28

4.11

8.65

4.29

10.64

5.31

6.45

6.45

7.88

7.88

9.39

9.39

11.05

11.05

3.10

2.65

3.10

3.50

3.70

5.25

6.00

1.31

1.54

1.74

1.84

4.50

5.25

6.00

33433

1269

73207

1794

56583

2283

77765

2168

69751

2226

2.80

1.65

2.80

1.65

140408

2732

4.50

1.02

4.50

5.50

2.25

2.75

100476

2354

177360

2621

244245

3807

280708

4290

* Including Dividend Distribution Tax.

** Based on number of shares outstanding at the year end; reflects the impact of Corporate Actions and normalised for impact of 1:10 Stock Split effected in 2006.

*** Based on year end closing prices, quoted on the Bombay Stock Exchange.

@ To facilitate like to like comparison, adjusted for impact of Corporate Actions.

During the above 10 year period, the following Corporate Actions took place:

2006 1: 2 Bonus Issue

2011 1 :1 Bonus Issue

Standalone Equity, Liabilities and Assets 2005 - 2014

Year Ending 31st March

Equity

Share capital

Reserves and surplus

Shareholders funds

Non-current liabilities

Long-term borrowings

Deferred tax liabilities (Net)

Other Long-term liabilities

Current liabilities

Short-term borrowings

Proposed dividend (including tax)

Current liabilities (others)

Total Equity and Liabilities

Non-current assets

Fixed assets (Gross)

Accumulated Depreciation

Fixed Assets (Net)

Non-current investments

Long-term loans and advances

Current assets

Current investments

Cash and bank balances

Current assets (others)

Total Assets

Net Worth Per Share (`) *

2005

2006

2007

2008

2009

2010

2011

2012

2013

(` in Crores)

2014

249

7646

7895

375

8686

9061

376

10061

10437

377

11681

12058

378

13357

13735

382

13682

14064

774

15179

15953

782

18010

18792

790

21498

22288

795

25467

26262

76

376

50

86

325

50

94

473

86

91

545

90

91

867

95

92

785

45

87

802

115

77

873

120

66

1204

129

51

1297

115

169

882

2102

11550

26

1135

2401

13084

77

1364

2437

14968

92

1543

2830

17249

62

1634

3000

19484

4452

3567

23005

2

4002

4473

25434

2

4089

5035

28988

4853

5477

34017

...

5583

5921

39229

5932

1796

4136

785

503

6470

2065

4405

784

568

8000

2390

5610

835

703

10087

2791

7296

846

859

11773

3287

8486

892

1117

12977

3825

9152

1357

882

14099

4421

9678

1563

1146

16421

5045

11376

1953

1196

18432

5735

12697

2001

1728

20841

6532

14309

2512

1480

3089

56

2981

11550

10.55

2733

856

3738

13084

12.07

2232

900

4688

14968

13.87

2089

570

5589

17249

16.00

1945

1031

6013

19484

18.20

4370

1126

6118

23005

18.42

3991

2243

6813

25434

20.62

4363

2819

7281

28988

24.04

5059

3615

8917

34017

28.21

6311

3289

11328

39229

33.02

* To facilitate like to like comparison, adjusted for 1:10 Stock Split, 1:2 Bonus Issue in 2006 and 1:1 Bonus Issue in 2011.

Equity includes impact of :

2006 1,21,27,470 Ordinary Shares of ` 1.00 each, fully paid, issued pursuant to Scheme of Amalgamation of erstwhile ITC Hotels Limited and Ansal Hotels Limited with the Company.

1 : 2 Bonus Issue (` 125 Crores).

2011 1 : 1 Bonus Issue (` 383 Crores).

Note : Figures for the periods prior to 2011 have been broadly re-classified/re-arranged/re-grouped, wherever material, as per revised Schedule VI to the Companies Act, 1956

in order to facilitate like to like comparison.

188

ITC Limited

REPORT AND ACCOUNTS 2014

You might also like

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- 22 Bollinger Band RulesDocument4 pages22 Bollinger Band Rulesravee100% (2)

- Sales 1477-1496Document4 pagesSales 1477-1496gapexceptionalNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- How To Determine When A Reversal Is Going To Take Place NewDocument34 pagesHow To Determine When A Reversal Is Going To Take Place NewGregory Drummond100% (1)

- Jetblue Airways Ipo ValuationDocument9 pagesJetblue Airways Ipo Valuationteddywmt100% (3)

- Square's Pitch DeckDocument20 pagesSquare's Pitch Deckapi-204718852100% (12)

- The Quant Cycle: David BlitzDocument27 pagesThe Quant Cycle: David Blitzwilcox99No ratings yet

- Strategic AssignmentDocument17 pagesStrategic AssignmentConnectNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- Balance Sheet: Lending To Financial InstitutionsDocument10 pagesBalance Sheet: Lending To Financial InstitutionsAlonewith BrokenheartNo ratings yet

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- 06 Financial HighlightsDocument1 page06 Financial HighlightsKhaira UmmatienNo ratings yet

- Exchequer Final Statement March 2012Document5 pagesExchequer Final Statement March 2012Politics.ieNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Annual Performance 2012Document3 pagesAnnual Performance 2012Anil ChandaliaNo ratings yet

- Office MaxDocument21 pagesOffice MaxBlerta GjergjiNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Information On Dena BankDocument17 pagesInformation On Dena BankPradip VishwakarmaNo ratings yet

- Copia de Analytical Information 30 Sep 2010Document12 pagesCopia de Analytical Information 30 Sep 2010Ivan Aguilar CabreraNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Financial Highlights: in This Annual Report $ Denotes US$Document2 pagesFinancial Highlights: in This Annual Report $ Denotes US$Harish PotnuriNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- Colgate's Summary Financial Data 2006 2005 2004 2003 2002Document4 pagesColgate's Summary Financial Data 2006 2005 2004 2003 2002dwi anitaNo ratings yet

- Rupees in '000 Rupees in '000: Balance Sheet 2008 2009Document22 pagesRupees in '000 Rupees in '000: Balance Sheet 2008 2009Ch Altaf HussainNo ratings yet

- Banking System of Japan Financial DataDocument44 pagesBanking System of Japan Financial Datapsu0168No ratings yet

- Analyst Mar 12Document36 pagesAnalyst Mar 12Abhinav WadhawanNo ratings yet

- MCB - Standlaone Accounts 2007Document83 pagesMCB - Standlaone Accounts 2007usmankhan9No ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Askri Bank Excel SheetDocument21 pagesAskri Bank Excel SheetraohasanNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Financial Analysis: P & L Statement of GE ShippingDocument4 pagesFinancial Analysis: P & L Statement of GE ShippingShashank ShrivastavaNo ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtNo ratings yet

- Cash Flow Statement: For The Year Ended March 31, 2013Document2 pagesCash Flow Statement: For The Year Ended March 31, 2013malynellaNo ratings yet

- MCB Financial AnalysisDocument28 pagesMCB Financial AnalysisSana KazmiNo ratings yet

- Final Final HDFCDocument46 pagesFinal Final HDFCJhonny BoyeeNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Consolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedDocument6 pagesConsolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedMbanga PennNo ratings yet

- Bluedart AnalysisDocument14 pagesBluedart AnalysisVenkat Sai Kumar KothalaNo ratings yet

- Pepsi Co - Calculations - FinalDocument46 pagesPepsi Co - Calculations - FinalMelissa HarringtonNo ratings yet

- MCB Annual Report 2008Document93 pagesMCB Annual Report 2008Umair NasirNo ratings yet

- Tiso Blackstar Annoucement (CL)Document2 pagesTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Financial Performance: 10 Year RecordDocument1 pageFinancial Performance: 10 Year RecordnitishNo ratings yet

- ABB Power Systems & Automation CompanyDocument13 pagesABB Power Systems & Automation CompanyMohamed SamehNo ratings yet

- Description Variable 2008: Financial Leverege (Nfo/cse)Document9 pagesDescription Variable 2008: Financial Leverege (Nfo/cse)Nizam Uddin MasudNo ratings yet

- Profit and Loss and Balance Sheet of Idbi BankDocument11 pagesProfit and Loss and Balance Sheet of Idbi BankHarjeet KaurNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- United States Court of Appeals, Third CircuitDocument31 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Lecture 4 - Insurance Company Operations (FULL)Document31 pagesLecture 4 - Insurance Company Operations (FULL)Ziyi YinNo ratings yet

- Current Affairs Monthly Issues - December-2021Document77 pagesCurrent Affairs Monthly Issues - December-2021tharuni maniNo ratings yet

- Branch AccountsDocument13 pagesBranch Accountstanuj_baruNo ratings yet

- Finmar Final Quiz Answer KeysDocument15 pagesFinmar Final Quiz Answer KeysGailee VinNo ratings yet

- The AuditorsDocument1 pageThe AuditorsHenry L BanaagNo ratings yet

- Prowessiq Data Dictionary PDFDocument5,313 pagesProwessiq Data Dictionary PDFUtkarsh SinhaNo ratings yet

- D14Document12 pagesD14YaniNo ratings yet

- Chapter 2 - Research MethodologyDocument42 pagesChapter 2 - Research MethodologyMotiram paudelNo ratings yet

- Stock - Book Debts CalculationDocument6 pagesStock - Book Debts CalculationAbhishekNo ratings yet

- BEP and CVP AnalysisDocument36 pagesBEP and CVP AnalysisCamae AtesNo ratings yet

- Taxation - Paper T5Document20 pagesTaxation - Paper T5Kabutu ChuungaNo ratings yet

- Compensation AssignmentDocument4 pagesCompensation AssignmentMehrehmat KohliNo ratings yet

- SVP Semi-Annual ReportDocument36 pagesSVP Semi-Annual ReportbarlieNo ratings yet

- Fundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...Document77 pagesFundamental Analysis of Iron and Steel Industry and Tata Steel (Indiabulls) ...chao sherpa100% (1)

- P3B Indonesia AustraliaDocument14 pagesP3B Indonesia AustraliaRickyNo ratings yet

- History of The Modern Middle East MidtermDocument4 pagesHistory of The Modern Middle East MidtermNadine FattalehNo ratings yet

- Alto 5 - Depreciation - Answer KeyDocument4 pagesAlto 5 - Depreciation - Answer KeyAlexa AbaryNo ratings yet

- Bureau of Internal RevenueDocument11 pagesBureau of Internal RevenueJerwhyne J. SaycoNo ratings yet

- Chap4 TheoryDocument2 pagesChap4 TheoryAnonymous LC5kFdtcNo ratings yet

- Chettinad Cement Corporation LTD 2008Document10 pagesChettinad Cement Corporation LTD 2008joosuganya8542No ratings yet

- Mergers, Acquisitions and Corporate Restructuring: Prasad G. GodboleDocument18 pagesMergers, Acquisitions and Corporate Restructuring: Prasad G. GodboleManan SuchakNo ratings yet

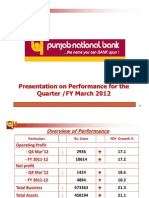

- Wts - Customs Entry PoaDocument1 pageWts - Customs Entry PoaAnonymous MP9r4Y0% (1)