Professional Documents

Culture Documents

Balance Sheet Template

Balance Sheet Template

Uploaded by

ranjitd070 ratings0% found this document useful (0 votes)

20 views1 pageBalance Sheet

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBalance Sheet

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageBalance Sheet Template

Balance Sheet Template

Uploaded by

ranjitd07Balance Sheet

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

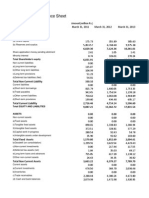

CONTOSO, LTD

Stated in 000s, for the period ending:

12/31/2013

Current Ratio [A/B] Working Capital [A-B]

0.45 ($58,750,000)

Quick Ratio [(A-C)/B] Debt-to-Equity Ratio [(G+H)/F]

0.29 0.42

Cash Ratio [D/B] Debt Ratio [(G+H)/E]

0.05 0.26

Assets % of Assets Liabilities & Owners' Equity % of Assets

Current Assets Current Liabilities

Cash and cash equivalents [D] $5,000 0.8% Loans payable and current portion long-term debt [H] $75,000 11.6%

Short-term investments $250 0.0% Accounts payable and accrued expenses $14,500 2.3%

Accounts receivable [I] $20,000 3.1% Income taxes payable $10,000 1.6%

Inventories [C] $18,000 2.8% Accrued retirement and profit-sharing contributions $8,000 1.2%

Deferred income taxes $3,500 0.5% Total [B] $107,500 16.7%

Prepaid expenses and other current assets $2,000 0.3%

Total [A] $48,750 7.6%

Fixed Assets Other Liabilities

Property, plant and equipment at cost 500,000 77.6% Long-term debt [G] $92,500 14.4%

Less accumulated depreciation 27,500 4.3% Accrued retirement costs $34,000 5.3%

Total 527,500 81.9% Deferred income taxes $6,000 0.9%

Deferred credits and other liabilities $4,000 0.6%

Total $136,500 21.2%

Other Assets

Long-term cash investments $8,000 1.2% Total Liabilities $244,000 37.9%

Equity investments $27,000 4.2%

Deferred income taxes $22,000 3.4%

Other assets $11,000 1.7%

Total $68,000 10.6%

Total Assets [E] $644,250 100.0%

Total Owner Equity [F] $400,250 62.1%

Total Liabilities + Owner Equity $644,250 100.0%

BALANCE SHEET

You might also like

- Balance Sheet - Publishing CompanyDocument2 pagesBalance Sheet - Publishing Companyapi-281323892No ratings yet

- Balance Sheet With Financial Ratios1Document1 pageBalance Sheet With Financial Ratios1api-281270178No ratings yet

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadNo ratings yet

- Contents of Balance SheetDocument8 pagesContents of Balance SheetJainBhupendraNo ratings yet

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- Financial Projections TemplateDocument17 pagesFinancial Projections Templatedeepscribd100% (1)

- NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014Document24 pagesNDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Balance Sheet With Ratios1Document1 pageBalance Sheet With Ratios1RioChristianGultomNo ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- 04 Module 4 Balance Sheet AnalysisDocument3 pages04 Module 4 Balance Sheet AnalysisSIDDHANT CHUGHNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Cma of HostelDocument128 pagesCma of HostelkolnureNo ratings yet

- INR Lakhs, Y/e March FY14 FY 13 FY 12: Titan Company: P&L StatementDocument6 pagesINR Lakhs, Y/e March FY14 FY 13 FY 12: Titan Company: P&L StatementHimanshu JhambNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- Consolidated Financial StatementsDocument40 pagesConsolidated Financial StatementsSandeep GunjanNo ratings yet

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- Ford Motor Co. Balance SheetDocument5 pagesFord Motor Co. Balance SheetJhonqNo ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- Chapter 3Document29 pagesChapter 3fentawmelaku1993No ratings yet

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333No ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDocument13 pagesLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123No ratings yet

- Ravi 786Document23 pagesRavi 786Tatiana HarrisNo ratings yet

- AAPLDocument6 pagesAAPLmangomikaNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementBharat AroraNo ratings yet

- Christ University Christ UniversityDocument6 pagesChrist University Christ UniversityMansiChauhanNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Fin Statement BDBL Dec2010Document46 pagesFin Statement BDBL Dec2010Saiful Islam JewelNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Income Statement (In Inr MN) Income: Asian PaintsDocument16 pagesIncome Statement (In Inr MN) Income: Asian Paintsavinashtiwari201745No ratings yet

- 132 QbalshtDocument1 page132 QbalshtAri BaagiiNo ratings yet

- Chapter 7 Cash Conversion Cycle YaDocument4 pagesChapter 7 Cash Conversion Cycle YajavierNo ratings yet

- Axis Bank Limited Group - Consolidated Profit & Loss AccountDocument66 pagesAxis Bank Limited Group - Consolidated Profit & Loss Accountshreyjain88No ratings yet

- Balance Sheet: Period EndingDocument2 pagesBalance Sheet: Period EndingRahul DevNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- FSA On Infy With InterpretationDocument22 pagesFSA On Infy With InterpretationayushNo ratings yet

- Fs Q2fy13crDocument4 pagesFs Q2fy13crAisha HusaainNo ratings yet

- Yahoo, Microsoft and Google Financial AnalysisDocument62 pagesYahoo, Microsoft and Google Financial AnalysisAnjana GummadivalliNo ratings yet

- TCS Condensed IndianGAAP Q3 12Document29 pagesTCS Condensed IndianGAAP Q3 12Neha SahaNo ratings yet

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsNo ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- Bajaj Auto LTD: Presented By: Hitesh RameshDocument15 pagesBajaj Auto LTD: Presented By: Hitesh RameshnancyagarwalNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Business Analytics End Term Project: Submitted by Submitted ToDocument15 pagesBusiness Analytics End Term Project: Submitted by Submitted ToVinayak ChaturvediNo ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberDocument2 pagesRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaNo ratings yet

- Asset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)Document12 pagesAsset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)kjmarts08No ratings yet

- Comman Size Analysis of Income StatementDocument11 pagesComman Size Analysis of Income Statement4 7No ratings yet

- BaluaDocument17 pagesBaluaUtkrista AcharyaNo ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Kansai Nerolac Balance SheetDocument19 pagesKansai Nerolac Balance SheetAlex KuriakoseNo ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Growing Npas in Banks: Efficacy of Ratings Accountability & Transparency of Credit Rating AgenciesDocument8 pagesGrowing Npas in Banks: Efficacy of Ratings Accountability & Transparency of Credit Rating AgenciesAnonymous AHW3sHNo ratings yet

- Present: Representatives of The ManagementDocument4 pagesPresent: Representatives of The ManagementAnonymous AHW3sHNo ratings yet

- Sarkar SirDocument2 pagesSarkar SirAnonymous AHW3sHNo ratings yet

- Bill LetterDocument1 pageBill LetterAnonymous AHW3sHNo ratings yet

- Monetary and Credit Information Review: Issue 10Document4 pagesMonetary and Credit Information Review: Issue 10Anonymous AHW3sHNo ratings yet

- BSC MML CommandsDocument19 pagesBSC MML CommandsAbderrahim Yahi50% (2)