Professional Documents

Culture Documents

Paystub 08:2004

Uploaded by

ReyAyala0 ratings0% found this document useful (0 votes)

60 views3 pagesWestern Business Solutions Payroll check number: 19129 3 2 7 2 8 3 1 0 E 11808 Miracle Hills Dr. Pay date: 08 / 20 / 2004 Omaha NE 68154 Taxable Marital Status: 1 Exemptions / Allowances: Reynaldo Ayala-Hernandez Federal: 3, $25 Additional Tax 420 16th St. Apt 4 State: 2 Sparks, NV. 89431 Local: 1 xxx-xx-5303 Earning

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWestern Business Solutions Payroll check number: 19129 3 2 7 2 8 3 1 0 E 11808 Miracle Hills Dr. Pay date: 08 / 20 / 2004 Omaha NE 68154 Taxable Marital Status: 1 Exemptions / Allowances: Reynaldo Ayala-Hernandez Federal: 3, $25 Additional Tax 420 16th St. Apt 4 State: 2 Sparks, NV. 89431 Local: 1 xxx-xx-5303 Earning

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views3 pagesPaystub 08:2004

Uploaded by

ReyAyalaWestern Business Solutions Payroll check number: 19129 3 2 7 2 8 3 1 0 E 11808 Miracle Hills Dr. Pay date: 08 / 20 / 2004 Omaha NE 68154 Taxable Marital Status: 1 Exemptions / Allowances: Reynaldo Ayala-Hernandez Federal: 3, $25 Additional Tax 420 16th St. Apt 4 State: 2 Sparks, NV. 89431 Local: 1 xxx-xx-5303 Earning

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

// total deduction this perio

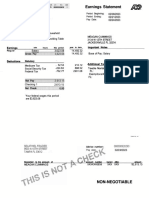

C O . FILE DEPT. CLOCK NUMBER

SBINC 526543 103216 9234519129 0

Earnings Statement

Western Business Solutions Period ending:

08/13/2004

11808 Miracle Hills Dr. Pay date:

08/20/2004

Omaha NE 68154

Taxable Marital Status: 1

Exemptions/Allowances:

Reynaldo Ayala-Hernandez

Federal: 3, $25 Additional Tax 420 16th St. Apt 4

State: 2

Sparks, NV. 89431

Local: 1

xxx-xx-5303

Earnings rate hours this period year to date Important Notes

Regular 9.00 80.00 720.00 720.00

PAY PERIOD - REGULAR - NON-EXEMPT

Overtime 13.50 0.00 0.00 0.00

Bonus -- -- 0.00 0.00

CURRENT PAY RATE IS: $9.00 PER HOUR.

-- -- 0.00 0.00

-- 0.00 0.00

Commission -- -- 0.00 0.00

REMEMBER OUR UNITED WAY FUND DRIVE

720.00

Deductions Statutory

Federal Income Tax - 91.27 91.27

Social Security Tax - 44.64 44.64

Medicare Tax - 10.44 10.44

State Income Tax - 0.00 0.00

Local Tax / SDI - 0.00 0.00

Other

401(k) - 0.00 0.00

Medical - 0.00 0.00

Garnish -0.00 0.00

Total Deductions -146.35 -146.35

573.65

* Excluded from federal taxable wages

Western Business Solutions Payroll check number: 19129

3 2 7 2 8 3 1 0 E

11808 Miracle Hills Dr. Pay date: 08/20/2004

Omaha 68154

Pay to the

order of:

Ayala-Hernandez Reynaldo

This amount:

573.65

NATIONAL BANK

AUTHORIZED SIGNATURE

STREET ADDRESS

VOID VOID VOID

CITY STATE ZIP

VOID AFTER 90 DAYS

001379 1220004964040110157

DIRECT DEPOSIT - DO NOT CASH - THIS IS NOT A CHECK

HOLD AT AN ANGLE TO VIEW WHEN CHECKING THE ENDORSEMENT.

Net Pay

Gross Pay

You might also like

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- PaystubDocument1 pagePaystubDorothy ShellNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

- E-Statement 20131018 00027Document1 pageE-Statement 20131018 00027Renee0430100% (1)

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFTwilliams SavgeeNo ratings yet

- Checkstub3 26 19Document1 pageCheckstub3 26 19Anonymous hFbpJzuBZM0% (1)

- Frazier0224 PDFDocument1 pageFrazier0224 PDFshani ChahalNo ratings yet

- J6Hooo009310710000r0313131DE64F521 PDFDocument1 pageJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNo ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- Paystub 10:2014Document3 pagesPaystub 10:2014ReyAyalaNo ratings yet

- View Paycheck: Employee InformationDocument4 pagesView Paycheck: Employee InformationJohn January0% (1)

- Justice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownDocument1 pageJustice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownLindsay SimmsNo ratings yet

- Paycheck 20201230 001387 Pravallika 202101241910Document1 pagePaycheck 20201230 001387 Pravallika 202101241910Prabhakar AenugaNo ratings yet

- CheckstubsDocument5 pagesCheckstubsAaron ThompsonNo ratings yet

- Advice of Deposit - Non-NegotiableDocument1 pageAdvice of Deposit - Non-NegotiableMolina VaneNo ratings yet

- The Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Document1 pageThe Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Dr. GigglesproutNo ratings yet

- Married 0: 401 14Th Street North, Kerkoven, MN 56252Document1 pageMarried 0: 401 14Th Street North, Kerkoven, MN 56252Scott DoeNo ratings yet

- Check StubDocument1 pageCheck StubBonnie GeneralNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Non-Negotiable: Nvidia CorporationDocument1 pageNon-Negotiable: Nvidia CorporationSteven LinNo ratings yet

- DirectDeposit 2021 08 31 1424Document1 pageDirectDeposit 2021 08 31 1424Holliday L RuffinNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableSrilatha YagniNo ratings yet

- Summit - Print Pay Check Information: InstructionsDocument4 pagesSummit - Print Pay Check Information: Instructionsjr83san100% (2)

- Lever Mcalilly LLC Paystubs 2015 06 30Document4 pagesLever Mcalilly LLC Paystubs 2015 06 30api-289189037No ratings yet

- Voucher Package - 0000177054 PDFDocument5 pagesVoucher Package - 0000177054 PDFNickMillerNo ratings yet

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonNo ratings yet

- Statement of Earnings: NON NegotiableDocument1 pageStatement of Earnings: NON NegotiableireneNo ratings yet

- Cook 4Document1 pageCook 4Renee MillerNo ratings yet

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDocument1 pageThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973No ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang Kim100% (1)

- Income Statement Template V3Document21 pagesIncome Statement Template V3Third WheelNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableanandsoggyNo ratings yet

- Easy PayAutomated Payroll / Timekeeping System Introduction and Project Status UpdateDocument28 pagesEasy PayAutomated Payroll / Timekeeping System Introduction and Project Status UpdateAkinuli OlaleyeNo ratings yet

- 2010 08 15 - BillDocument2 pages2010 08 15 - Billteporocho9No ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang KimNo ratings yet

- JF PaycheckDocument1 pageJF Paycheckapi-285511542No ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- MyfileDocument1 pageMyfileanon-302065No ratings yet

- Longoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020Document1 pageLongoria Inez (115) $999.25 Wed Oct 28 19 08 00 EDT 2020nelson menaNo ratings yet

- What Is Vacation Acc? What % of Gross Pay Is Federal Tax? What % Is EI?Document6 pagesWhat Is Vacation Acc? What % of Gross Pay Is Federal Tax? What % Is EI?barretteplett100% (1)

- C000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584Document2 pagesC000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584BrianNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- TX 1Document1 pageTX 1Humayon MalekNo ratings yet

- Pine Ridge Apartment Welcome LetterDocument2 pagesPine Ridge Apartment Welcome LetterKamil KowalskiNo ratings yet

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgNo ratings yet

- PaycheckDocument2 pagesPaycheckapi-373194232No ratings yet

- CCR 14-15 q4 Paystub ExampleDocument1 pageCCR 14-15 q4 Paystub Exampleapi-232724808No ratings yet

- f1040 Schedule C Expenses PDFDocument2 pagesf1040 Schedule C Expenses PDFVallery FisherNo ratings yet

- Actor TaxesDocument17 pagesActor TaxesMikah HornNo ratings yet

- Debit Account Transactions Date Description Type Amount Available Anson BasackerDocument3 pagesDebit Account Transactions Date Description Type Amount Available Anson BasackerClifton WilsonNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- Eusserlene Johnson - GCWooo005116430000r065AF579E5F521Document1 pageEusserlene Johnson - GCWooo005116430000r065AF579E5F521Jennifer Revelo VelascoNo ratings yet

- SunTrust StatDocument1 pageSunTrust StatIrakli IrakliNo ratings yet

- DescărcareDocument1 pageDescărcareDina SpinuNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet